Introduction

During the last years, the world’s economy seems to have been revealing its limitations in what concerns its effectiveness and growth, as it has been confronted with significant slips caused both by its structural problems and by the controversial social, investment and financial policies applied in the states of the Globe. In the attempt to overcome the prolonged period of instability and to reestablish the ascending trend of economic growth, a detailed analysis of the triggers of this state of fact can be identified as necessary.

Initially started as a financial crisis, the current economic depression imposes, in order to find ways for comeback, a detailed analysis of the accumulation and distribution of the creation and compensation process of the financial resources used both in the private sector and especially in the public field. In order to limit the effects of the slip of the financial markets, numerous states have transferred the impediments in this area at the economic-social level. They have thus assumed major vulnerabilities of budgetary balances and significant limitations in what concerns future economic strategies, as well as the occurrence of a crisis of sovereign debt. Real economy has fully felt these effects, promptly reacting through a contradiction of the economic activity whose cause as well as effect is a diminution of consumption, with dramatic effects on economic growth and eventually on the standard of living of the population.

This paper aims to study the relationships established between the coverage of the necessary financial resources specific to national economies and their performance, reflected through the evolution of the GDP.

The Role of Financial Systems in Rendering National Economies More Effective

In this gloomy context, the states of the world have been affected differently by these slips of the entire spectrum through which economy can be regarded. A possible explanation of this situation can be provided by the manner in which the funding needs in the internal economies can be covered, respectively by the typology of the financial system owned. The financial system plays a crucial role in the accumulation and mediation of economies (savings), in reducing risks and in providing a safe distribution of these resources to the productive sector (Ang, 2008).

Concerns with proving this connection could have been met ever since the 1960s, when Goldsmith (1969) reveals, using variables specific to 35 countries in a comparative analysis, a positive relation between the financial sector and economic growth (Arestis, 2005). The 1990s provide a rich empirical literature that signals the importance of the development of the financial sector for economic growth (Rousseau & Wachtel, 2011). The benchmark in this area of the relation between economic growth and the financial sector is adjudicated by King & Levine (1993) who, based on a sample of 80 countries, establish a significant and positive relation between the initial financial conditions characteristic to them and the subsequent evolution of the gross domestic product per inhabitant. Confirmations of these relations are also provided by the studies performed by Atje & Jovanovic (1993), Demirguc-Kunt & Maksimovic (1998) and Levine & Zervos (1998).

The specificity of the financial systems, the dimensions and role of the various institutions that shape them, and their correlation with the evolution of the performance of economies have represented subjects of debate for numerous authors, such as Allen &Galle (2001), Beck & Levine (2002), Ergungor (2004), Levine (2002; 2005) and Champonnois (2006).

The characteristics of the financial system influence the development of the national economic process, providing various abilities of response and adaptation to the changes that occur within it. Therefore, a financial system based on banks can be considered rigid, because of its limited ability to meet the current demands of the economic space (the granted credits preserve their destinations for the entire duration of their action), as well as because of its capacity to meet the demands from entities that are in an intermediate state of development, and not of those in the launching phase, thus limiting their ability to renew and reinvent the economy. One of the advantages that can be stressed is the prudence signal transmitted by this significantly regulated system on the economy. Ang (2008) notices the tendency of this system to provide economic growth in a time interval correlated with the term for which banks grant loans. Gimet & Lagoarde-Segot (2011) state that when the financial system is based on the financial resources provided by banks, the financial policy must try to intensify the inter-banking competition, develop prudential measures at a macroeconomic level, and promote the development of the stock market. Actually, Halkos & Trigoni (2010), in their study of the relationship between the development of the financial systems and economic effectiveness, notice that an oversized banking system can have a negative effect on the economic results.

The financial system based on obtaining financial resources mainly from the capital market corresponds to the economic spaces where the degree of business renewal is high and the investment risks are easy to accept. Tharavanij (2007) notes that the development of capital markets reduces the financial fragility of the economies, protecting them from any possible slips. This fact is due, on the one hand, to the superior maturity present at the level of financial brokerage provided by this space, and on the other hand, to the markets’ ability to insure increased liquidity of the assets and a decrease of any negative impact regarding price, generated by their sales. In the same direction, Wong & Zhou (2011) claim that the development of the economic market is a key factor that determines the generation of economic growth at a national level, irrespective of the type of financial system, the development stage, or the economic system.

However, the increased volatility of these markets, determined by the significant sensitiveness to any socio-economic stimulus, may cause incoherence at the level of the investment policies, both in the private and in the public area.

The debates concerning the effectiveness of the two financial systems in the generation of economic development have been treated in extended researches. Numerous empirical studies (Demirguc-Kunt & Maksimovic, 2002; Levine, 2002, etc.) made at an international level have shown the existence of a strong connection between the development of the financial system and economic growth, irrespective of whether the national financial system was oriented towards the banking branch or towards the capital markets (Ang, 2008).

An interesting analysis of the relationship between the financial structure and economic growth is made by Luintel et al. (2008), who examines this connection from the perspective of the theories confronted within the funding effort. They involve in the debate about, besides theoretical references concerning the orientation of the funding policies towards the capital market or towards banks, theories of financial services and of the degree of legal regulation.

Although the two major financial systems that characterize the funding process of the world’s economy imply covering a large array of risks generated by the specificity of the economic spaces they support, the occurrence of global financial crisis periods proves the existence of system problems in this field. Actually, the most important slips have been generated by the “prudential” banking sector helped by the “adaptable” capital markets.

Financial Integration – An Effect of the Globalization Process

With the extension of the globalization process, the free flow of capital in international markets has generated a significant integration of the accumulation and distribution instruments of the financial resources, determining a stumping of the characteristics of financial systems. This phenomenon increases the availability of funds for defective agents, relaxing the constraints concerning consumptions and investments, and provides the conditions improved by the capitalization of the resources placed by the investors. Private, public, economic or administrative entities may attract or place their financial resources both in national and in international markets.

The companies’ listing on several stock markets or accessing credits from financial-banking bodies outside the national area provides increased visibility and transparence, contributing to rendering their activities more effective and developed. Also, financial integration reduces the impact of regional shocks on domestic consumption and minimizes the risks on international and local markets (Fecht, Grüner, & Hartmann, 2008), thus contributing to making them more disciplined and to the elimination of the inefficient sectors. Due to the diversification and multiplication of the funding sources, public and private defective agents may benefit from a reduction in the cost of capital, as well as from a relaxation of the restrictions concerning guarantees and payability terms.

Financial integration plays an important role in encouraging institutional development, so that financial markets would be able to fulfill a crucial function, to deliver the capital to the most profitable users, which is the key to economic growth and to reducing poverty. However, although this phenomenon is an important way of creating goods, must be also mentioned its negative role, which consists in facilitating the transmission of shocks and of various categories of crises, because of the strong interconnections established at the level of national economies (Mishkin, 2007). Also, this liberalization of the capital flows may represent a restriction of the access to financial services, both for the poor population and for the middle class (Beck & Demirguc-Kunt, 2008), as financial resources are exclusively placed according to maximum effectiveness criteria.

Loayza & Ranciere (2006) notice the different meaning of the influences exerted by financial integration on economic growth. If, on the short run, the globalization of financial markets exerts a negative impact, on the long run it is an important factor for development.

In supporting the idea that economic growth depends on the development of the financial sector and not on the specificity of the financial system, there also come the concepts of the growth theory. It considers that the increase of the added value in economy is influenced by the financial area through two channels: that of capital accumulation and that of productivity. The former channel is focused on the ability of the financial sector to meet the need for financial resources by mobilizing the economies, and the latter channel is the qualitative dimension, of placing the funds into efficient investment projects that would generate economic growth (Ang, 2008).

Methodology of the Research

In the context of financial integration, the present paper aims, first of all, to identify and analyze the connections established between the funding policy and the results of the national economic activity, reflected through the dynamics of the GDP. Second, it is the intention of this article to point out a profile of economic effectiveness according to the level of financial resources attracted through bank loans and the capital market, and according to the dimension of the investments made in economy. In order to compare the data, the analyzed variables have been related to the national dimension of the GDP.

This article assumes an empirical nature and uses mainly quantitative analyses in order to test the suggested work hypotheses through a deductive-inductive process.

Tested Work Hypotheses

In order to meet the research objectives and in accordance with the current stage of knowledge in the approached field, the researchers aim to test the following hypotheses:

H1: The specificity of the funding policy characteristic to European states (bank loans, market capitalization, private and public bond loans) and the level of the investments made determines the dynamics of the added value in economy (economic growth).

H2: It is possible to identify a profile of economic effectiveness according to the level of financial resources attracted through bank loans, of those drawn from the capital market, and to the dimension of the investments made in economy.

Target Population, Data and Work Methods

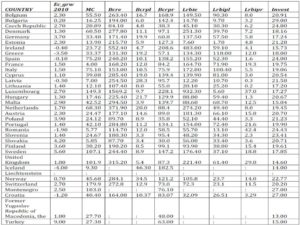

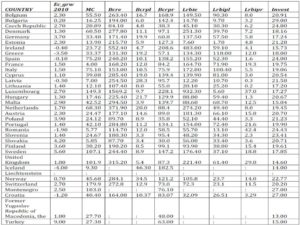

This study focuses on European economies, both within the EU and outside it. The data sources are represented by the international bodies largely involved in the evolution of the regional and global economy, respectively: EUROSTAT, OECD and WB. The economic information used comes from national reports and concerns the fiscal years 2008 – 2009, for the factor dimension of the analyses (the funding and investment policy), respectively 2009 – 2010 for the resulting policy (economic growth). The sample structure and the values associated to the analyzed variables are synthesized in Annex 1.

In the present research, data analysis methods specific to financial and statistic analysis, was used, such as: the ratio analysis, the multiple linear regression analysis and the multiple correspondences factor analysis.

Ratio analysis is an analysis method consisting in computing and interpreting indexes determined by reporting positions or aggregates in the financial statements corresponding to the same fiscal year (Mironiuc, 2009).

The multiple linear regression analysis is used to study the influence of the financial policies adopted by the European states to cover the funding needs generated by their own economies and of the dimension of the stable investments on economic growth. This method implies quantifying the mean variation of the predictive characteristic (Y) under the effect of the modification of the independent variables (Xi). The general mathematic expression is synthesized by the relation Y = β0 + β1X1 + …..+ βnXn + ε, where: Y is the dependent variable, Xi, i=1..n, are explanatory variables, β1 is a constant that expresses the mean value of Y when X1..Xn=0, and β1.. βn are the regression coefficients that show the mean variation of the predictor for a modification by a one unit of the independent variable (Gujarati, 2004).

In order to validate the work hypotheses, the researchers aim to test the following linear regression models:

- Economic growth2010 = f(Financial structure2009)

- Economic growth2010 = f(Stable investments2009)

- Economic growth2010 = f(Financial structure2009; Stable investments2009)

The multiple correspondences factor analysis used to point out a profile of economic effectiveness according to the level of financial resources attracted through bank loans to those drawn through the capital market and to the dimension of the investments made in economy is an analysis method of the relationships established in a series of category variables (Abdi & Valentin, 2007). Jaba & Robu (2011) state that this method synthesizes the initial information through the study of the associations between the variables stressed through a dispersion diagram built on a system of factor axes ranked in descending order, according to their importance in explaining the total variance of the point cloud.

In order to analyze the data through the suggested methods, the work instrument used was the SPSS 19.00 software.

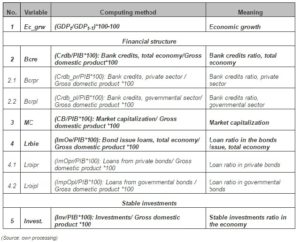

Analyzed Variables

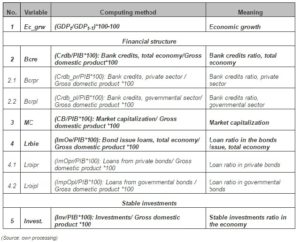

In the analysis of the considered phenomenon, in order to validate the work hypotheses and to meet the objectives of the research, a series of quantitative variables have been used, both of type result (predictor), and of type factor (independent). They are synthesized in Table no. 1.

Table No. 1. Analyzed Variables

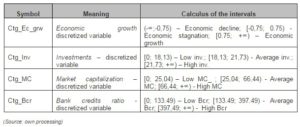

In order to obtain the category variables used to stress out the profile of the economic effectiveness, it is necessary to discretize the factors subject to the analysis (financial resources drawn through bank loans, those attracted through the capital market, and the dimension of the investments made in economy) (Jaba & Grama, 2004).

Table No. 2. Category Variables

In order to determine the specific intervals to the category variables for economic effectiveness, variables characteristic to its evolution have been taken into consideration, and in the case of complementary variables, the mean (m) and mean square deviation (σ) have been considered. The resulting category variables are presented in Table 2.

Obtained Results and Their Interpretation

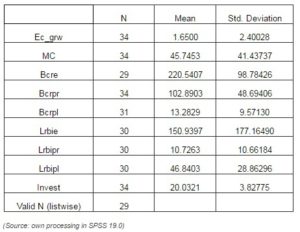

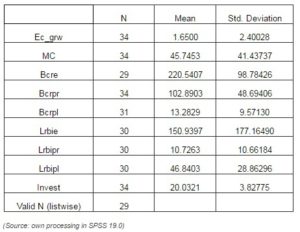

Meant to build a holistic image of the studied phenomenon, the descriptive analysis offers, in many situations, a consistent support in choosing and establishing the depth of the methods used in the research.

In this sense, from the data synthesized in Table 3 for 2010, noticed is a slight economic revival, reflected by the average dimension of economic growth at a European level (1.65%), a measure influenced, however, by the high degree of value dispersion (2.4%). This stresses a differentiated comeback of the European countries after the economic decline recorded in 2009.

Table No. 3. Descriptive Statistics

The funding needs recorded at the level of the regional economy are mainly covered through the borrowed resources. In relation to the size of the national GDP, the bank credits attracted represent 220.54%, loans from bonds emissions are 150.93% and only 45.74% corresponds to resources collected from the stock market. The researchers can therefore notice a low financial integration of the European financial market, as the features of the old continental financial system are still present. Actually, by analyzing the structure of the financial policy in depth, the researchers can note the distribution of the categories of the drawn financial resources according to the countries’ belonging to the traditional financial systems. Countries such as: Great Britain, Sweden, Switzerland, or Denmark, have a high rate of resources attracted from the capital market, a phenomenon characteristic to the Anglo-Saxon financial system, while Germany, Austria, or France remain faithful to the continental system, whose representatives prefer funding through bank loans. The structure of the funding sources of Central and Eastern European economies are specific to the continental system. This situation is generated, in the reseachers’ opinion, by the development stage of each country, as a developing economy finds it difficult to create a functional capital market, and it is hard for companies to meet the necessary conditions for being listed in stock exchanges, as well as because of the strong resistance to change and liberalization that characterizes these areas.

Although significant as average at a European level (150.93%), the ratio of loans from bond issues presents a significant dispersion of its values. This is mainly due to the various degree of development of the stock exchanges and to their unbalanced distribution in the studied geographical area.

By analyzing sequentially, under the perspective of the appellants of financial resources, the researchers can notice a preference of the private sector (non-financial companies) for bank credits (102.89%), while bonds issue is a solution mainly used by the governmental sector (46.84%). This is probably the effect of the numerous bonds issues made by the European countries, during the last years, in order to cover budgetary deficits. In what concerns the destination of the resources attracted into the economy, the study reveals that the investments in fixed capital are 20.03% of the mean value of the European GDP, and this is the most normally distributed variable around the mean. It is still imperative We still have to analyze the usefulness of these investments and the effectiveness of their capitalization in the effort to increase the added value in the economy.

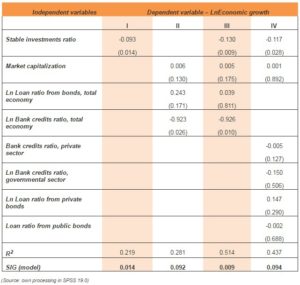

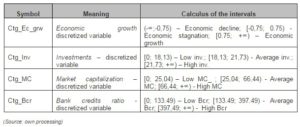

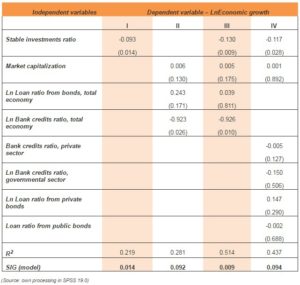

In order to test H1, the study details, through the regression analysis, the connections and influences established between economic growth and the various sets of independent variables that characterize the funding and investment policies of the European states. In this sense, the first model (I) studies the influence of stable investments on the considered predictor, and the second mathematical relation (II) shows the effect of the financial policy, at the level of the economy, on the former. Then, the two dimensions are introduced simultaneously into the analysis, followed by a detailed analysis through the involvement of the factors that reflect the funding of the private and governmental sectors (III; IV). The results synthesized in Table 4 reflect various connections and influences between the variables subject to research.

Table No. 4 Multiple Regression Analysis of the Economic Growth Relation – Funding Policy and Resource Destination

Note: Regression coefficients are presented with the associated sig. values in parentheses. The independent variables are expressed as ratios in the dimension of the GDP. In processing the data, a risk of 5% was taken into account, concerning the degree of significance of the results.

Therefore, in case I, it can be noticed that 21.9% of the mean economic growth is due to the influence of the ratio of stable investments, and the difference is represented by the contribution of random factors. For an increase by one percentage unit of the factor, economic growth will diminish on the average by 0.093%. This intriguing situation, from the point of view of economic doctrine, can be accounted by unproductive investments made at a European level, which do not actually contribute to creating added value. Model II explains 28.1% of the variance of the predictor through the structure of the financial resources in European economies. This points out the fact that if the other factors remain constant, an increase by one unit of market capitalization will determine an average increase of economic effectiveness of 0.006%. In the same conditions of stability of the complementary variables and a degree of certainty of 82.9%, an increase by one unit of the ratio of loans from bonds generates an increase of the dependent variable, on the average, by 0.243%. Accepting a risk of 5%, it can be stated that an increase by one unit of the bank credit ratio will generate a mean decrease of economic effectiveness of 0.923%. From this mathematical relation, noticed is the opportunity to attract financial resources from the capital markets (low costs and risks) and the negative effect of increasing the volume of bank credits on the performance of economies.

Model III analyzes the simultaneous influence of the two dimensions, the financial and the investment one, justifying the fact that economic results depend on their combined action. The obtained results support, with a confidence of 95% (sig. 0.009), that the model adjusts the real data and the existence of a significant connection between its variables. The relation explains to a higher extent the variance of the economic growth (51.4%), and the sense of the influences of the factor variables is the same as in the partial models.

Model IV details this study. It reflects the established connections and quantifies the influences exerted by the independent variables, considered at the level of the private sector, and respectively at the governmental sector. A positive influence on economic growth is exerted by an increase by one unit of the ratio of loans from private bonds (0.147%) and the market capitalization ratio (0.001%). In the opposite direction, the action is performed by the increase by one unit of the investments (0.117%), the bank credit ratio both in the private sector (0.005%) and in the governmental sector (0.150%), and the ratio of loans from the public bonds (0.002%). This reflects a saturation of the indebtedness of the European public sector and the need to apply policies that would support the development of the private sector based on the financial resources drawn from the stock market. As a space that matches the closest conditions of a perfect market, the stock market provides optimal conditions for the formation of the price of the titles involved in transactions, as well as minimum levels of the associated costs, thus eliminating the multiple restrictions generated by the banking sector. This field is the area that generated the current financial crisis, determining the degradation of economies, and the attempt of European countries to capitalize banks, transforming them into a consolidation of the economic downfall. This is a possible explanation of the need for an improved integration of the European financial system, of the need to increase the weight of the financial resources attracted from the capital markets in order to create the optimal conditions for economic development and growth.

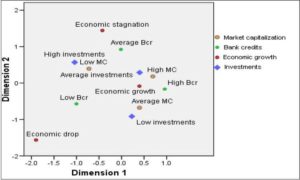

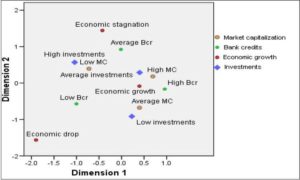

Because of the dispersion of the economic activity results and of the traits of the national financial systems, in order to validate H2, this study aims to identify profiles of economic effectiveness that would provide information on the current situation at the European level, the causes for its occurrence and the solutions for improvement.

In this respect, Figure no. 1 shows the dimension of the factors that lie at the basis of a certain level of economic performance. The economies that recorded an economic growth in 2010 covered their funding needs by resorting, in 2009, to a high extent, to bank credits (high Bcr) and to the resources on the capital market (high MC), thus signaling the role of financial integration in their development. From the perspective of the use of these funds, the economies in this performance group have an average dimension of the investments in fixed capital, reflecting the prudence that needs to be considered in allocating financial resources. The influence of this factor depends, however, on the stage of development or modernization of the countries subject to analysis, some of them having to make substantial investments in order to eliminate the inter-regional gaps, sacrificing, for some time, their economic growth.

(Source: own processing in SPSS 19.0)

Figure No. 1. Economic Effectiveness Profile at the European Level

Taking into account the influences of the same category variables, it is obvious that economic stagnation is generated in the presence of an average bank credits ratio, of low market capitalization, and high investment expenses. This situation is characteristic to Central and Eastern European countries (Bulgaria, Latvia, Lithuania), which are more dependent on banks, have less developed capital markets, and where the effectiveness of investments is low. The countries whose economies recorded an economic drop are characterized, in what concerns funding, by a low credit ratio and by an average market capitalization. This situation signals the need to create a balanced mix of funding sources, as the advantages and restrictions they generate contribute to the creation of an appropriate environment for economic development. The low level of the stable investments ratio shows the vulnerability of these economies and the need to consolidate the productive sector as a source that generates economic growth.

Conclusions

The consolidation and increase of the effectiveness of economies is, nowadays, an important objective, both at the world level, and especially at a European level. Meeting this objective depends, however, on the nature, size, and direction of the influences generated by a whole set of factors. Nevertheless, significant restrictions and advantages come from the manner in which financial resources are attracted and used in national economies.

The present paper attempts to reveal, analyze and quantify the existence of this connection. In this respect, through the descriptive analysis made on the variables involved in the study, observed is a weak integration of the European financial system, the national specificity, in what concerns funding and the use of acquired resources, which have a significant impact on economic growth. This is reflected by the standard deviation value corresponding to the analyzed measures, which shows an important degree of dispersion of the values of the characteristics of the studied sample. It can therefore be noticed the lack of a strategy or common solutions in the European area that would constitute the support for generating economic growth in this region.

In order to quantify the influences generated by the policy of covering the funding needs of European economies, this article examines the causal relations established between the dependent variable and its associated factors, both at the level of the entire economy and at that of its defining segments, the private and the governmental sector. The analysis was detailed, in order to better explain the variance of economic growth, by including in the study the investments in fixed capital as destination of the attracted resources, and an evaluation of their influence was made, both independently and complementary to the financial policy.

The mathematical models obtained reflect an average explanatory power of the considered factors regarding the variance of the effectiveness of economies (R2 is between 21.9% and 51.4%), and it could be noticed, at the same time, the occurrence of variables whose influence is not significant, such as: market capitalization (in model IV), Ln ratio of loans from bonds, total economy (in model III). This situation corresponds to the opinion of Rousseau & Wachtel (2011), according to whom the intensity of the relationship between the financial structure and economic growth is declining compared to the beginning of the 1990s. A decrease in the intensity of the connection between the funding policy and the evolution of the economic results obtained can be explained by the increase of the influences of other factors, such as: the degree of social protection, the level of customs taxes, the legal inconsequence, etc.

The validation of the second hypothesis reveals the profile of the effectiveness of European economies through the association of the involved category variables, respectively market capitalization, attracted bank credits and investments. The graphical representation made in the system of two factor axes shows the need for an optimal mix between the specificity of financial resources and the level of investments made in economy. Low investments and minimum bank funding, even in the conditions of an average market capitalization, is associated, in a European context, with economic decline. High investments, completed by an average level of bank loans and by a low market capitalization, can only generate a stagnation of economic effectiveness. The performance of economies can only be increased if financial resources ratios are high, coming both from the stock market and from credits, and if the investments level is average, as a higher immobilization of the funds is not an optimal solution in this period.

This study incorporates into the analysis only the influences of quantitative factors, and does not quantify the impact of qualitative variables. Considering the latter and using analysis methods with a higher explanatory power would be future directions for research.

Acknowledgements

This work was supported by the European Social Fund in Romania, under the responsibility of the Managing Authority for the Sectoral Operational Programme for Human Resources Development 2007-2013 [grant POSDRU/CPP 107/DMI 1.5/S/78342]

(adsbygoogle = window.adsbygoogle || []).push({});

References

Abdi, H. & Valentin, D. (2007). ‘Multiple Factor Analysis, Encyclopedia of Measurement and Statistics,’ Sage Publications, Thousand Oaks.

Allen, F. & Gale, D. (2001). “Comparing Financial Systems,” MIT Press, London.

Publisher – Google Scholar

Ang, J. B. (2008). “A Survey of Recent Developments in the Literature of Finance and Growth,” Journal of Economic Surveys, 22 (3), 536–576.

Publisher – Google Scholar – British Library Direct

Arestis, P., Luintel, A. D. & Luintel, K. B. (2005). “Financial Structure and Economic Growth,” CEPP Working Paper, 6, 1-31.

Publisher – Google Scholar

Atje, R. & Jovanovic, B. (1993). “Stock Markets and Development,” European Economic Review, 37, 632–640.

Publisher – Google Scholar

Beck, T. & Demirguc-Kunt, A. (2008). “Access to Finance: An Unfinished Agenda,” The World Bank Economic Review,22 (3), 383–396.

Publisher – Google Scholar

Beck, T. & Levine, R. (2002). “Industry Growth and Capital Allocation: Does Having a Market- or Bank-Based System Matter?,” Journal of Financial Economics, 64, 147–180.

Publisher – Google Scholar – British Library Direct

Champonnois, S. (2006). “Comparing Financial Systems. A Structural Analysis,” European Central Bank Working Paper Series, 702, 1-55.

Publisher – Google Scholar

Demirguc-Kunt, A. & Maksimovic, V. (1998). “Law, Finance, and Firm Growth,” Journal of Finance, 53 (6), 2107–2137.

Publisher – Google Scholar – British Library Direct

Fecht, F., Grüner, H. P. & Hartmann, P. (2008). “Financial Integration, Specialization and Systemic Risk,” Discussion Paper, Series 1: Economic Studies, 23, 1-56.

Publisher – Google Scholar

Gimet, C. & Lagoarde-Segot, T. (2011). “Financial Sector Development and Access to Finance. Does Size Say It All?,” Emerging Markets Review, Available at http://www.sciencedirect.com/science/article/pii/s1566014111000665, Accessed on 18.02.2012.

Publisher

Gujarati, D. (2004). ‘Basic Econometrics,’ The Mcgraw-Hill Companies, New York.

Halkos, G. E. & Trigoni, M. K. (2010). “Financial Development and Economic Growth: Evidence from the European Union,” Managerial Finance, 36 (11), 949-957.

Publisher – Google Scholar

Jaba, E. & Grama, A. (2004). ‘Analiza Statistică Cu SPSS Sub Windows,’ Polirom, Iaşi.

Google Scholar

Jaba, E. & Robu, I. B. (2011). “Obtinerea Probelor de Audit Pentru Testarea “Going Concern”, Folosind Metode Statistice Avansate În Analiza Influentei Factorilor Asupra Ratei Îndatorarii Globale,” Audit Financiar, 9 (2), 37-46.

Publisher

King, R. G. & Levine, R. (1993). “Finance and Growth: Schumpeter Might Be Right,” Quarterly Journal of Economics, 108, 717–737.

Publisher – Google Scholar – British Library Direct

Levine, R. (2002). “Bank-Based or Market-Based Financial Systems: Which Is Better?,” Journal of Financial Intermediation, 11, 398–428.

Publisher – Google Scholar – British Library Direct

Levine, R. (2005). “Finance and Growth: Theory and Evidence,” Handbook of Economic Growth, 1 A, 865–934.

Publisher – Google Scholar – British Library Direct

Levine, R. & Zervos, S. (1998). “Stock Markets, Banks, and Economic Growth,” American Economic Review, 88 (3), 537–558.

Publisher – Google Scholar – British Library Direct

Loayza, N. V. & Ranciere, R. (2006). “Financial Development, Financial Fragility, and Growth,” Journal of Money, Credit, and Banking, 38 (4), 1051–1076.

Publisher – Google Scholar – British Library Direct

Luintel, K. B., Khan, M., Arestis, P. & Theodoridis, K. (2008). “Financial Structure and Economic Growth,” Journal of Development Economics, 86, 181–200.

Publisher – Google Scholar

Mironiuc, M. (2009). ‘Analiză Economico-Financiară,’ Univ. “Al. I. Cuza”, Iaşi.

Mishkin, F. S. (2007). “Is Financial Globalization Beneficial?,” Journal of Money, Credit and Banking, 39 (2-3), 259-294.

Publisher – Google Scholar – British Library Direct

Rousseau, P. & Wachtel, P. (2011). “What Is Happening to the Impact of Financial Deepening on Economic Growth?,” Economic Inquiry, 49 (1), 276-288.

Publisher – Google Scholar

Tharavanij, P. (2007). “Capital Market, Severity of Business Cycle, and Probability of an Economic Downturn,” Working Paper, Available at http://mpra.ub.uni-muenchen.de/5189/, Accessed on 10.02.2012.

Publisher

Wong, A. & Zhou, X. (2011). “Development of Financial Market and Economic Growth: Review of Hong Kong, China, Japan, the United States and the United Kingdom,” International Journal of Economics and Finance, 3 (2), 111 – 114.

Publisher – Google Scholar

Annex 1. The Sample Structure and the Analyzed Variables

Source: Eurostat, OECD, WB