Introduction

The current crisis entailed extensive political, scientific and civil debates about possible solutions. The views expressed are often very different, and their formulation starts from public financial economy “postulates”. An essential issue is thus overviewed, namely that there is no „universal crisis” as manifestation, only as effects. Thus, „universal” therapies must also be customized to each „patient”. It is imperative for the chosen solutions to be connected to the correctly identified causes, the “lessons” of the past being, in this respect, a first necessary landmark.

Conceived as a theoretical research grounded on statistical data, our work firstly aims at identifying the fiscal policy measures promoted by Romanian authorities prior to the crisis, in order to highlight their correlation with the depth and duration of the current crisis. Secondly, in this paper we intend to discuss on the relevance of the anti-crisis measures promoted in Romania since 2009, taking into consideration the results obtained so far and the potential factors of risk. From an analytical perspective, the paper seeks to answer the following questions:

- What was the fiscal behavior of Romanian authorities prior to the crisis?

- What significance did this behavior have for the future intervention to counter the crisis?

- Did structural deficiencies of the Romanian economy exist (were tolerated) prior to the crisis?

- Was Romanian authorities’ reaction to the crisis adequate both as content and time of occurrence?

- What lessons should be learnt from the pre-crisis and crisis period, in the event of a second recession?

As support for formulating and strengthening our conclusions, we will use data on budgetary revenues, expenditures, GDP, budget deficit, public debt, etc. provided by AMECO, Eurostat, the Romanian National Institute of Statistics, ECB, etc.

With respect to the crisis, the strategies applied and incident theoretical requirements, the literature is abundant. However, incident to the scope of our paper, the issue of fiscal vulnerability and of its implications in the event of a financial crisis is reflected within the works of J. Aizenman and G.K. Pasricha (2010) and R. Hemming, M. Kell and A. Schimmelpfennig (2003). As for the current crisis, the fiscal vulnerabilities accumulated prior to the crisis in emerging economies, especially from the Central and Eastern Europe, and their impact on governments’ ability to cope with the crisis’ effects are treated in the works of M. Eller et al. (2011), B.B. Bakker and L.E. Christiansen (2011), N. Leiner-Killinger (2011) or T. Jedrzejowicz (2011). Similar papers offer a proactive view over the issue, focusing on the restructuring of the financial systems so as to increase their ability to stabilize the economies, such as the work of N. Mates (2011).

For the particular case of Romania, the lack of fiscal discipline in the period before the crisis and its negative effects on economic growth is treated within the work of I. Dumitru and R. Stanca (2010). Other works deal with particular issues relevant for our study, such as the deficiencies of the pensions system (the works of M. Preda and V. Grigoras (2011) and M. Dragota and E. Miricescu (2009)) or the inter-administrative transfer system (the work of M.S. Dinca and G. Dinca (2009)).

The Pattern of Romanian Fiscal Policy Prior to the Crisis – Bad Actions in Good Times

Once the transition period overcame, Romania’s economy has seen, between 2004 and 2008, a period of “explosive” economic growth, the GDP growth rate exceeding by far the European average. This growth has resulted in an upward trend of public revenue and expenditure which, however, did not materialize, as would be natural, in budget deficit reductions. The data presented in Table 1 show that budgetary revenues increased by about 116% between 2004 -2008 which, correlated with a higher government expenditure growth (by approximately 146% over the same period of time) lead, even against the background of a consistent economic growth, to the increase of general government budget deficit from -1.2% in 2004 to -5.7% of GDP in 2008. Thus, debt reduction was of little consistency (from 18.7% of GDP in 2004 to 13.4% in 2008), being mainly driven by the GDP growth (Oprea, Bilan & Stoica, 2012).

Table 1: General Government Revenue, Expenditure, Deficit and Gross Debt Prior to the Crisis (2004-2008)

Source: realized by the authors, data from Eurostat and AMECO

Source: realized by the authors, data from Eurostat and AMECO

These findings indicate important issues to be taken into consideration for the subsequent manifestation of the crisis. Firstly, we must consider the relationship between the raised budgetary revenues and expenditures, the low tax collection rate having a strong negative impact on it and, thus, becoming a factor of vulnerability with budgetary implications, which should have been more firmly countered in times of growth. Secondly, it must be observed the lack of concern for reducing budget deficits faster and, eventually, creating some budgetary reserves. Economic cycles are not entirely a “big surprise”, they could have been anticipated. It is also objectionable that, against the background of a fragile, insufficiently consolidated economy, the “surplus” of budgetary revenues was rapidly oriented to consumption (either intermediate or final), and curbing public expenditures was not considered as an option, in order to achieve a prudent and appropriate fiscal margin of maneuver. The concern to reduce public debt was also a little consistent one, although there were prerequisites for firmer action. The destructive effects resulting from the absence of such concerns, with negative long-term implications in terms of the costs (sacrifices) to bear, are revealed by the recorded values of budget deficits and public debt, since 2009.

The explanatory factors of these developments are primarily psychological and electoral. Against the background of a difficult transition to a functioning market economy (14 years), the consistent economic growth recorded after 2004 materialized, in some way, a “desired fruit” for both public authorities and private agents. After a long period of economic problems and social instability, the recorded growth was interpreted as a well-deserved result, from which those who produced it could benefit. It is eloquent, in this respect, the statement of our finance officials who invoked, in 2008, as grounds for increasing wages and pensions by 50%, an equivalent increase in GDP. However, GDP growth was not a direct and singular result of the effort of public employees or of those covered by public insurance systems, and the idea of instantly consuming the resulted surplus is not a priori a productive one.

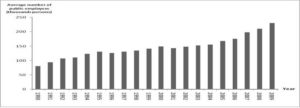

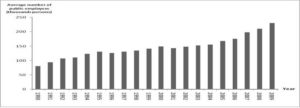

As the data in Figure 1 show, the theoretical possibility to support higher staff costs has actually resulted in new hires, the number of public employees rapidly increasing prior to the crisis.

Source: realized by the authors, data from the Romanian National Institute of Statistics’ Statistical Yearbook 2010

Source: realized by the authors, data from the Romanian National Institute of Statistics’ Statistical Yearbook 2010

Fig 1: The Number of Public Employees over the Period 1990-2009

On such a background, as shown in Table 2, current expenditure with public employees registered a sustained upward trend before the crisis, increasing by approximately 2.7 times in 2004-2008. A similar pattern can be found with respect to social benefits expenditure, which increased by 2.4 times over the same period of time.

Table 2: The Structure of General Government Expenditure Prior to the Crisis

(2004-2008)

Source: realized by the authors, data from AMECO

The data in Table 2 also show that Romanian authorities assumed high social spending, due to some irrationally performed social programs. Thus, in 2009 there were over 30 forms of social assistance in Romania, while the decision of “eligibility” for one of them did not take into account the prior award of others, which lead to unacceptable situations (people who earned, from social benefits, more than some public employees). Also, confusions were induced and perpetuated between social assistance and social insurance actions (including with reference to the financing budgets), with negative effects on the robustness and sustainability of public finance (e.g. the guaranteed minimum pension was financed out of the state budget and social assistance benefits were financed out of the social security budget). For the case of social security (pensions) budget, which should be designed in conjunction with the principle of contributiveness, it hasn’t been taken into consideration the correlation between resources and destinations. Thus, it became a mixed (social insurance and social assistance) budget, balanced by transfers from the state budget (Preda & Grigoras, 2011) and the real picture on its medium and long-term sustainability was diluted. This fueled serious vulnerabilities, severely exacerbated during the crisis.

Latent vulnerabilities can also be identified, before the crisis, with reference to budgetary revenues, relevant data on their main structural components as well as the implicit tax rates being presented in Table 3.

Table 3: The Main General Government Revenue and Implicit Tax Rates Prior to the Crisis (2004-2008)

Source: realized by the authors, data from AMECO and Fiscal Council, 2011

A first vulnerability is fiscal authorities’ low institutional capacity, reflected in very low implicit rates of taxation. At least for indirect taxes (VAT) and social contributions, Romania ranked worse than Bulgaria (Fiscal Council, 2011). Although economic prosperity was a fertile ground for fiscal discipline, increasing budgetary revenues pushed aside the concerns for diminishing tax evasion and increasing the efficiency of resources management and control. As we will see and could be expected, the emergence of the crisis became a catalyst for tax evasion.

More directly referring to social security contributions, we must mention as objectionable the nonexistence of a legal regime for seasonal, daily and temporary workers. These people, not having the quality of subject (contributor) to the social insurance system, often appeared as social assistance beneficiaries. It is worse that these social benefits were granted from the Social Security Budget, functioning on the principle of contributiveness, and not from the state budget, where revenues are used depersonalized.

Also, the accumulated vulnerabilities directly correlate with the structure of the system of public budgets where these revenues were raised. At least until 2001, Romania practiced over 20 special funds, some of them functioning very disruptively. It is worth mentioning the case of the Special Fund for Petroleum Products, established in 2000, at which it is still raised the tax of 0.01 $ per l of fuel, in order to repay the debt of the former Romanian Oil Company (contracted in relation with Bancorex), debt that was unacceptably taken over to the state budget, for the reason that the company’s representatives have refused to sign the repayment agreement with the bank. For this fund there are no published data on its budget execution. Also, we can mention the Special Fund for Economic Reform, established in 1999, at which it was raised a tax that applied to economic operators of 0,2% of their investments, in exchange for a certificate that proved the permission to run an economic activity (although their legal constitution itself attested this right). It is unacceptable that this fund functioned for just a short period of time, after which all the amounts collected were refunded. This led to new administrative costs, producing a negative tax yield.

With reference to the yield of taxation, it is also objectionable that the functioning of a variety of special funds allowed for new institutional structures (which entrained more administrative expenses) (e.g. the State Office for Farmers Pensions Payment, although payments were actually made from the state budget, for which there already existed Public Finance Directions). Their subsequent dissolution entrained a “natural” opposition of the system, leading to their merging with the reasonably necessary structures and thus, the personnel unnecessarily increased.

An overall perspective points out that such revenue or expenditure-related vulnerabilities were strongly supported by the widespread legislative instability (e.g. the Special Fund for Economic Reform was enacted by a Government Emergency Ordinance in 1999, ordinance that was abrogated in the same year and rejected by the Parliament three years later).

Taking Steps towards Fiscal Soundness – How Appropriate was the Romanian Approach?

The transmission of the crisis benefited in Romania from a fertile ground due, among others, to public authorities’ euphoria. Under the pretext that Romanian banking system was free of toxic assets, in early 2009 it was still widespread the official conviction that Romania will be spared by the crisis. This shifting of policy-makers from the economic reality will later on affect their real possibilities to react to the crisis. Besides, the psychological factor knew particular manifestation in Romania, sometimes impossible to understand. It is worth mentioning, in this respect, that when the Government announced its plans to reduce public wages, subnational authorities immediately reacted by increasing them, as a measure of protection for their employees.

On such unstable ground, the emergence of the crisis entrained consistently negative effects, as shows the dynamics of some aggregate macroeconomic indicators, presented in Table 4. The data indicate a consistent contraction of GDP, from a real positive growth rate of 7.3% in 2008 to -6.6% in 2009 and -1.6% in 2010, correlated with an increase in unemployment from 5.8% in 2008 to 7.4% in 2011. The unemployment increase was mainly fueled by layoffs in the private sector of the economy, following the entry into insolvency or bankruptcy of many economic agents or the withdrawal of foreign investors (e.g. the case of Nokia that, in 2011, relocated in Moldova, which led to the dismissal of 2200 employees). Particularly for Romania, the trend can also explained by the return of some of the Romanians who used to work abroad and were fired in the respective countries and by the need to resize the public sector of the economy.

Table 4: The Dynamics of the Main Macroeconomic Indicators before and after the Emergence of the Crisis

* Forecasts

Source: realized by the authors, data from EUROSTAT and AMECO

Data also show that the main engine of Romanian economy prior to the crisis was the consumption, supported, among others, by banks’ chase after clients and clients’ chase after credits, on the backgrounds of a very relaxed consumer credit policy (e.g. “just with your ID” credit, “just for anything” credit). This engine slowed much after the awareness of crisis intervention, consumers choosing to be cautious. Also, the excessive share of bad loans forced NBR to reconsider its prudential rules, limiting the access to consumer credit. Overall, final consumption expenditure at 2005 prices fell by 7.3% in 2009 and 2.6% in 2010.

Unfortunately, the limited access to resources and the consumption decreases have strongly impacted on investments, for which the decrease was a more consistent one, of about 28% in 2009, trend also preserved in 2010. Although the upward trend resumed 2011, it cannot be considered satisfactory in terms of expected long-term effects. In addition, a significant problem for Romania is that some of these investments have a questionable real content (e.g. the already “famous” investments in transport infrastructure, materialized only in feasibility studies – many conducted by foreign companies, or expropriations).

A positive effect can however be noticed for the balance of payments, the negative value of the current account reducing from -58.8 billion RON in 2008 to -20.9 in the next year. Explanations mainly come from Romanian economy’s dependence on imports, affected by lower domestic consumption.

The shifts in real economy were also reflected in the state of public finance, a suggestive image on this connection being rendered by the data presented in Table 5. It can be noticed a surprisingly recover of budgetary revenues, which resumed the upward trend after 2009, when they decreases by nearly 10%. In connection with still growing public expenditures (by 1.9% in 2009 over 2008), either because they have been engaged prior to the crisis or because of the need to support for the real economy, the effect was a consistent general government budget balance deterioration (-9% in 2009 compared to -2.9% in 2007 and -5.7% in 2008). We must also emphasize that the unfavorable situation in 2008 was not a direct expression of the economic crisis but of the elections that took place this year, being recognized the correlation between the level of public expenditure and electoral cycle (Dima et. al., 2010).

Table 5: The Dynamics of General Government Revenue, Expenditure, Deficit and Gross Debt during the Crisis

* Forecasts

* Forecasts

Source: realized by the authors, data from EUROSTAT and AMECO

One obvious path for increasing public expenditure was that of the inter-administrative transfers (without objective grounds) and the use of the Intervention Fund at the disposal of the Government, for which it has full discretionary power ((Oprea & Bilan, 2011), (Dinca & Dinca, 2009)). They were accompanied by the legalized intention to increase professors’ wages by 50%, intention that did not materialize. However, trials with the state have been initiated and many of those trials have already been won, payments being scheduled for the next five years (which raises the question of the dimensions of the margin of maneuver Romanian authorities will dispose of in the near future).

Inevitably, the gap between public revenues and expenditures (correlated with the consistent reduction of GDP) passed on to public debt, which registered important increases since 2008, from 13.4% of GDP in 2008 to 23.6 % in 2009 and 34% in 2011. Although, by reference to the usual limit of 60% of GDP, Romania’s position seems, at least apparently, to be a comfortable one, in reality we appreciate that this situation involves important risks for its long term debt sustainability, as Romania’s real indebtedness capacity is much lower compared with that of the developed EU Member States.

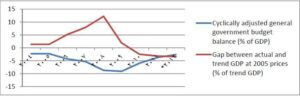

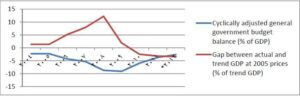

The highlighted developments have undoubtedly found their roots in the fiscal policy measures promoted prior to the crisis. Thus, economic theory stipulates that in times economic recession it is necessary to reduce taxes or increase public expenditure, and most EU Member States have reacted in accordance with these rational guidelines (van Riet, 2010). However, a general assessment shows that Romanian fiscal policy has been pro-cyclical, respecting the pattern of developing countries ((Ilzetzki & Vegh, 2008), (Alesina et. al., 2008)). This greatly diminished the margin of fiscal maneuver, when the crisis emerged. Thus, Romanian authorities were forced to adopt budget stabilization measures, in the absence of an adequate fiscal space allowing for fiscal stimulus measures, as the theory requires (for this see Figure 2).

*Forecasts for 2012

Source: realized by the authors, data from AMECO

Fig 2: The Dynamics of Cyclically Adjusted Budget Deficit and GDP Gap over the Period 2004-2012*

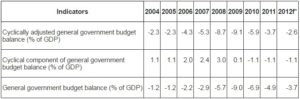

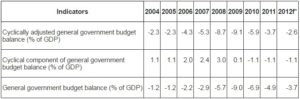

In this context, we believe it to be absolutely objectionable public policies grounding on the overall budget deficit, deficit that we consider to be “artificial”, and not on the cyclical component and cyclically adjusted budget balance. The deficit we call “artificial” is the simple result of the difference between budgetary expenses and revenues, deficit for which the Romanian experience shows how easy it can be “adjusted” (e.g. in 2009 it was decided to roll over payments on public wages for the beginning of 2010). An overall view on budget deficits reality, as reflected in Table 6, would have been a serious anchor to guide public financial policies, if it was properly used.

Table 6: Structural and Cyclical Budget Balance in Romania

* Forecasts

Source: realized by the authors, data from AMECO

The data in Table 6 indicate that Romanian authorities tolerated, before the crisis, inadmissibly large and growing structural budget deficits, in the shade of some absolutely satisfying values for the overall budget deficit, by reference to the European limit of 3% of GDP. From this point of view, concealing Romania’s actual deficit (kept below 3% until 2007) may be associated with the political goal of EU accession, in terms of the specific rules established by the Treaty of Maastricht and the Stability and Growth Pact.

Basically, the data highlight the existence of some structural deficiencies of the Romanian economy, raising questions if overcoming the crisis will also solve the problem of the structural deficit. Public authorities’ preoccupations, often focused on a 1 to 2 years horizon, must imperatively be substituted with long-term ones. Also, the narrow vision, focusing on the volume and growth rate of public expenditures and revenues, must be surpassed by the vision focusing on the restructuring of the real economy. In addition, addressing issues only by reference to the crisis may distract attention from problems independent of it but with similar effects (such as the pressure that demographic changes exert on public expenditure, especially current ones).

The Romanian austerity package mainly consisted in measures such as the dismissal of public employees, cuts and unification of public sector wages or cuts in pension expenditures. Moreover, employment was blocked (in the case of education) or delayed (in the case of police school graduates). The targeted reductions were of 25% for public wages and of 15% for pensions. Also, the so called “special” pensions were recalculated (Dragota & Miricescu, 2009). Although the austerity measures were clearly aimed, their implementation and compliance with the existing legal system distorted the expected effects and delayed their occurrence. For example, although in 2010 personnel expenditures were scheduled to decrease by almost 9% compared to 2009, in execution the value was exceeded by 800 million lei. Blamed for this were local authorities, which have consistently avoided such austerity measures, as a result of a poor control (Fiscal Council, 2011).

In these conditions, an apparently consistent reduction of ¼ of public wages, together with public wages resizing and public employees dismissal, had only feeble effects, personnel expenditures reducing (as shown in Table 7) by 5.8 billion RON over the period 2008-2011, and continuing to be, even today, well above their 2007 level.

The data in Table 7 also indicate a critical situation in the case of interest expenditures. Against the background of the need to raise important resources to fund maturing liabilities (including current expenses), the increase in the amount of debt resources combined with high interest rates on new loans have led to an increase in interest expenditures by over 150% in 2008-2011. Considering Romania’s public debt structure (mostly external debt), domestic market could not take great advantage of these expenditures, naturally-oriented as transfers towards the foreign sector (Oprea, Bilan & Stoica, 2012).

Table 7: Changes in General Government Expenditure during the Crisis

* Forecasts

Source: realized by the authors, data from AMECO

The analysis of government gross fixed capital formation data reveal crucial issues for the premises and effectiveness of the policy conducted by Romanian public authorities in order to counter the effects of the crisis. The recorded values are at least unsatisfactory by reference to the importance of these expenditures, the emergency for increasing and rationalizing them and, paradoxically, even to the statements of public policy makers who consistently asserted the need to increase investments. Although, at least as intent, Romanian authorities chose the same path preferred by most European countries, its materialization did not by far measure up to the performance of other countries. In fact, such expenditures were consistently lower in Romania in 2009-2011 compared to their 2008 level. Government investment expenditures also fell in Romania as a share of GDP, from 6.6% in 2008 to 5.9% in 2009 and 5.8% in 2010. Meanwhile, government investment expenditures increased, over the same period (2008-2010) by 0.3% of GDP in Denmark, 1% of GDP in Poland, 0.7% in Cyprus and 0.5% in Hungary (Eurostat).

With respect to public revenues, the measures undertaken by Romanian public authorities prove the lack of direct concern for economic stimulation. Moreover, under the impact of cyclical pressures, their actions were opposite (instead of achieving fiscal relaxation, fiscal pressure increased). In fact, the only consistent measure that can be identified in this direction is the 5% VAT increase in 2010, when pension cuts were blocked by the Romanian Constitutional Court. We emphasize that the increase in VAT rate, contradictory to accepted economic theories, appears to be irrational by reference to that moment’s development needs. It reduced consumption and, in conjunction with a more limited access to credit resources (NBR legalizing a maximum private indebtedness ratio), diminished aggregate demand. Or, the financial policy reaction to a crisis like the one in question should have been oriented towards stimulating demand, which is considered as a growth “engine”.

At the beginning of the crisis (2009), Romania ranked last in EU with respect to the general government revenue ratio to GDP (32.4% of GDP for fiscal and non-fiscal revenues). A similar rank was registered for fiscal revenues (27.1% vs. Bulgaria – 28.9% and Hungary – 39.5%) (Fiscal Council, 2011).

Instead, as shown in Table 8, as a result of increasing the VAT rate, Romania comes forward when it comes to the share of indirect taxes. They accounted for 12.1% of GDP in 2010 and 12.5% in 2011, compared to a much lower share of direct taxes, of only 6.2% in 2010 and 6.5% in 2011.

Although we admit that the VAT rate increase in times of crisis, an absolutely irrational measure, seemed to be an advantageous option in terms of the rapidity of raising revenues and of satisfying creditors’ demands (we should, however, say that the IMF did not expressly imposed this condition to Romania), we intend to think that the alternatives were at least generous. But their effectiveness is conditioned by the capacity of strengthening and fast reaction of fiscal institutions, which we do not consider to be a chapter in which Romania excels.

Table 8: Changes in Main General Government Revenue during the Crisis

* Forecasts

Source: realized by the authors, data from AMECO

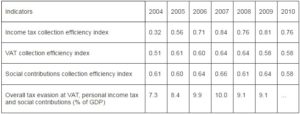

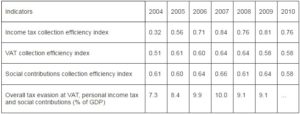

Thus, we must firstly raise the issue of taxation efficiency, an old problem for Romania, problem that the introduction of the flat tax in 2004 concealed until 2008 (see Table 9). It should be noted the situation of personal income tax (collection efficiency index of 0.81 in 2009 and 0.76 in 2010), VAT (0.58) and social contributions (0.64 in 2009 and only 0.58 in 2010 ). Particular to VAT, the tax rate increase in 2010 was offset by the reduction of the tax collection rate, thus little progress was registered in 2010 over the previous year.

Table 9: Tax Collection Efficiency* and Tax Evasion in Romania (2004-2010)

* The efficiency is assessed by the tax collection efficiency index, determined as the ratio between the implicit tax rate and the legally enforced one

* The efficiency is assessed by the tax collection efficiency index, determined as the ratio between the implicit tax rate and the legally enforced one

Source: realized by the authors, data from the Fiscal Council, 2011 and the National Institute of Statistics

Regarding social security contributions, the incapacity of the fiscal institutional system to impose discipline on economic agents and to obtain a higher degree of tax compliance, resulted in at least paradoxical outcomes: the budgetary revenues (9.6% of GDP in 2009) were smaller than for countries with similar (Czech Republic – 15.4% of GDP) or lower (Estonia – 13.1%) social security contributions rates (Fiscal Council, 2011).

It is however remarkable that, against the risk of a second recession in Eurozone, the Romanian authorities initiated in the first quarter of 2012 the debating and documenting on the possibility of reducing social security contributions. This measure is undoubtedly necessary, leading the reduction of labor force costs, a stimulus that Romania desperately needs. In addition, it would be very appropriate for the current economic position, supporting for the efforts to eliminate Romanian economy’s deficiencies among which, as shown in Table 9, tax evasion is a priority.

Conclusions

The main conclusion of this paper confirms our assumption that economic growth periods are conducive to the relaxation of public decision-makers, when it comes to public finance robustness. Romania showed such a behavior during 2004-2008, by increasing public spending and relaxing taxation. This pro-cyclical fiscal policy has limited the room for fiscal maneuver at the emergence of the crisis and created favorable conditions for a deep and long crisis. Basically, Romanian authorities were forced to act contrary to the rational need for fiscal stimulus, building an anti-crisis package focused on expenditure reductions and tax increases. Although the strategy was quite ambitious and firm, the results are not fully satisfactory, as they were diluted by the already existing deficiencies of Romanian economy, among which the fiscal institutional system’s failures, the lack of fiscal discipline, the incoherent legal system, etc.

It is objectionable that, while at declarative level, public sector resizing, reshaping social spending and higher public investments were the pillars of the growth strategy, the figures do not confirm a reorientation of the required consistency. The explanation is that Romanian authorities mainly and directly focused on the immediate consolidation of budgetary revenues and expenditures and were less concerned about eliminating the structural deficiencies of our economy. From this point of view, we think that Romania’s exit from the crisis will not singularly solve the structural deficit issue, evidenced throughout this paper. Thus, it would require a more careful long-range “purification” of the processes of the real economy.

From a global perspective, we consider that Romania’s anti-crisis strategy was an ambitious and firm one, this largely offsetting the inconsistencies emphasized throughout this paper. It is, however, essential that the firmness of pursuing this strategy is not eroded by the exuberance of the minimum growth associated with the exit from the crisis. In the light of past experiences, we believe that 2012 carries additional risks, being an election year. It remains to be seen if it will not incite to the diversion of the assumed measures, the risk of a second recession thus being potentiated.

Acknowledgment

This work was supported by the project “Post-Doctoral Studies in Economics: training program for elite researchers – SPODE” co-funded from the European Social Fund through the Development of Human Resources Operational Programme 2007-2013, contract no. POSDRU/89/1.5/S/61755.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Aizenman, J. & Pasricha, G. K. (2010). “Fiscal Fragility: What the Past May Say about the Future,” NBER Working Paper no. 16478. [Online], NBER, [Retrieved February 25, 2012], http://www.nber.org/papers/w16478.

Publisher

Alesina, A., Campante, F. R. & Tabellini, G. (2008). “Why Is Fiscal Policy Often Procyclical?,” Journal of European Economic Association, 6(5), 1006-1036.

Publisher – Google Scholar – British Library Direct

Bakker, B. B. & Christiansen, L. E. (2011). “Crisis and Consolidation – Fiscal Challenges in Emerging Europe,” Proceedings of the Oenb Workshops „Limited Fiscal Space in CESEE: Needs and Options for Post-Crisis Reforms”February 28 2012, Vienna, Austria, 25-40.

Publisher – Google Scholar

Dima, B., Moldovan, N. & Lobont, O. (2010). “Correlation between Electoral Cycle and Fiscal Policy Decisions in Romania,” Euroeconomica, 24(1), 48-55.

Publisher – Google Scholar

Dinca, M. S. & Dinca, G. (2009). “Fiscal Decentralization in Romania – Present State and Perspectives,” The Scientific Annals of „Al. I. Cuza” University of Iasi, Economic Sciences Series, Tome LVI, 56, 103-116.

Publisher

Dragota, M. & Miricescu, E. (2009). “Deficiencies of the Public Pension System in Romania: Some Reform Measures Derived from the EU Experience,” Theoretical and Applied Economics, 11, 3-14.

Publisher – Google Scholar

Dumitru, I. & Stanca, R. (2010). “Fiscal Discipline and Economic Growth – The Case of Romania,” MPRA Paper no. 27300, [Online], University Library of Munich, [Retrieved February 20, 2012], http://mpra.ub.uni-muenchen.de/27300/.

Publisher

Eller, M., Mooslechner, P. & Ritzberg-Grunwald, D. (2011). “Limited Fiscal Space in CESEE: The Issue, Underlying Economic Conditions, Related Implications and Policy Options,” Proceedings of the Oenb Workshops „Limited Fiscal Space in CESEE: Needs and Options for Post-Crisis Reforms. February 28 2012, Vienna, Austria, 7-24.

Publisher – Google Scholar

Fiscal Council (2011). ‘Fiscal Council Annual Report,’ [Online], [Retrieved March 10, 2012], http://revista.eadr.ro/conferintadepresa-7apr2011.pdf.

Hemming, R., Kell, M. & Schimmelpfennig, A. (2003). Fiscal Vulnerability and Financial Crises in Emerging Market Economies, International Monetary Fund Occasional Paper no. 218, IMF.

Publisher – Google Scholar – British Library Direct

Ilzetzki, E. & Vegh, C. A. (2008). “Procyclical Fiscal Policy in Developing Countries: Truth or Fiction,” NBER Working Paper no. 14191. [Online], NBER, [Retrieved February 18, 2012], http://www.nber.org/papers/w14191.pdf.

Publisher

Jedrzejowicz, T. (2011). “Fiscal Space in CESEE Countries: Lessons from the Crisis with a Special Focus on Poland,” Proceedings of the OeNB Workshops „Limited Fiscal Space in CESEE: Needs and Options for Post-Crisis Reforms. February 28 2012, Vienna, Austria, 78-88.

Publisher – Google Scholar

Leiner-Killinger, N. (2011). “Fiscal Vulnerabilities in the CESEE Countries: The Role of Fiscal Policy Structures and Budgetary Discipline,” Proceedings of the OeNB Workshops „Limited Fiscal Space in CESEE: Needs and Options for Post-Crisis Reforms. February 28 2012, Vienna, Austria, 61-77.

Publisher

Mates, N. (2011). “How to Make CESEE’s Public Finance Systems More Crisis-Resilient and Improve their Macroeconomic Stabilization Capacity?,” Proceedings of the OeNB Workshops „Limited Fiscal Space in CESEE: Needs and Options for Post-Crisis Reforms. February 28 2012, Vienna, Austria, 99-110.

Publisher – Google Scholar

OECD (2011). “OECD Factbook 2011-2012. Economic, Environmental and Social Statistics,” [Online], [Retrieved February 23, 2012], http://www.oecd-ilibrary.org/economics/oecd-factbook-2011-2012_factbook-2011-en.

Publisher

Oprea, F. & Bilan, I. (2011). ‘The Inter-Administrative Transfers System in Romania – A Critical Approach,’ The Proceedings of the International Conference „Globalization and Higher Education in Economics and Business Administration”, “Al. I Cuza” University Publishing House, Iasi.

Oprea, F., Bilan, I. & Stoica, O. (2012). “Public Debt Policy in Romania – A Critical Review,” Models and Methods in Applied Sciences – Proceedings of the 2nd International Conference on Environment, Economics, Energy, Devices, Systems, Communications, Computers, Mathematics (EDSCM’12), WSEAS Press.

Publisher

Preda, M. & Grigoras, V. (2011). “The Public Pension System in Romania: Myths and Facts,” Transylvanian Review of Administrative Sciences, 32, 235-251.

Publisher – Google Scholar

Radulescu, M. (2010). “International Financial Crisis and Policy Responses to This New Challenge in Emerging Europe,” The Annals of Tibiscus University of Timisoara, Economic Sciences Series, 16, 47-54.

Publisher

Van Riet, A. (2010). “Euro Area Fiscal Policies and the Crisis,” ECB Occasional Paper Series no. 109. [Online], ECB, [Retrieved February 23, 2012], www.ecb.int/pub/pdf/scpops/ecbocp109.pdf.

Publisher