Introduction

In recent years, most organizations have facedrapid changes in their business environment. Management challenges have been intensified by the deregulation, in conjunction with the increasing global competition and reduction in product life cycles resulting from technological innovations (Abdel-Kader & Luther, 2008; Narong, 2009; Fei and Isa, 2010b). Emergence of advanced manufacturing technologies has resulted in greater automation and changes in the cost structure. The cost structure changes involved direct labor costs being replaced by indirect costs (Cooper, 1988). As a consequence, new management practices such as just-in-time management philosophy, total quality management practices and activity- based costing system have emerged.

Researchers, such as Abdel-Kader and Luther (2008) and Rasiah (2011), asserted that management accounting practices such as ABC is in crisis, because its implementation rate is still low. They also mentioned the significant innovation and the greatest interest in the area of activity-based costing (ABC). ABC emerged in the late 1980s as a mechanism for providing more accurate product/service cost information to support strategic decisions. During the 1990’s, it has been extended as a tool to control and manage costs more effectively.

However, the researchers have developed various interpretative perspectives to know and highlight the factors affecting ABC adoption and implementation (Shield, 1995; Swenson, 1995; Malami, 1999; Maelah & Ibrahim, 2006) and the stages of its implementation processes (Anderson, 1995; Krumwiede, 1998; Brown, Booth & Giacobbe, 2004). However, most of these studies arrived to ambiguous, different and divergent results. Different studies defined ABC implementation in different ways. Some defined it as actual ABC implementation; others defined it either as an actual implementation or a desire of implementing it (Sartorius, Eitzen & Kemala, 2007; Baird, Harrison, & Reeve, 2007). Furthermore, the basis for comparisons of factors influencing the implementation of ABC has differed in some studies. They compared companies implementing ABC with those not. Moreover, the adoption rate of ABC in a range of different countries varies widely: some countries were found increasing in the adoption rate of ABC, and other countries were found decreasing in the adoption rate. Researchers have even reported wide variations in the same country (Baird et al., 2004, 2007; Brown et al., 2004). So, it is difficult to evaluate the results from the different studies, particularly those relating to usage rates. It is also difficult for the ability of factors to discriminate between implementers and non-implementers, particularly when the term implementation had been subject to different definitions (Al-Omiri & Drury, 2007a).

Numerous studies stated that there is a need to segment ABC adoption to stages. This segmentation is necessary at the time of researching the success by examining ABC at sites maturity. The result of ABC implementation often is achieved after the using stage, especially in financial performance improvement (Krumweide, 1998; Baird et al., 2004; Liu & Pan, 2007; Fei and Isa, 2010a). Numbers of previous literature such as Baird et al. (2004) and Krumwiede (1998) have segmented the ABC implementation to stages. The number of stages was done differently by different researchers to suite the requirement of the study. More generally, this should be a consideration for any study examining a new system implementation (Fei and Isa, 2010). Therefore, in the current study, the researchers have segmented the adoption and implementation of ABC to several stages. These stages are: non-adoption, adoption, abandonment, implementation and usage stage.

Many researchers, such as Clarke, Hill and Stevens (1999) and Drury and Tayles (2005) and Al-Omiri and Drury (2007b), said that although there are many differences between sectors, previous studies tested factors affecting the adoption and implementation of ABC without separating the industrial and financial sectors. They also did not separate manufacturing industries from non-manufacturing in which ABC system has been adopted. This lack of separation may lead to ambiguous and vague results.

In this research, mixed methods were used. Firstly, a questionnaire survey was designed to include suitable control questions that allow the researcher to check respondents’ claims that their firms which are implementing ABC systems are really ABC adopters or operators. Secondly, face-to-face interviews were carried out with adopter firms for additional clarification and explanations about ABC system.

This study focuses on Jordan after the new changes in Jordanian business environment. Jordanian companies encountered globalization and strong competition because Jordan’s accession to the WTO resulted in more multinational companies establishing joint ventures or regional offices in Jordan, and this resulted in changes regarding management of accounting practices in Jordan. This modification is piloted by the need of Jordanian companies to implement cost accounting innovations for the purpose of having a competitive edge in the market (Hutaibat, 2005).

So far, little is known about the Jordanian manufacturing sector concerning the degree of ABC adoption and implementation, as well as the factors motivating, facilitating and creating barriers to implementation (Al-Khadash & Feridun, 2006). Thus, it is necessary to examine whether ABC could be successfully implemented and factors influencing ABC success in Jordan, Shields (1995) argues that a one successfully adopted technique in one country does not mean it also can be a success in another country, because ABC system success is determined by organizational and behavioral factors in developed countries.

Research Objectives

The aim of the present research is to contribute to and enhance the design of ABC implementation in Jordan. The objectives of this research are outlined below:

To examine the extent of ABC implementation system within the Jordanian manufacturing shareholding sector.

1. To identify the reasons for non-adopting ABC system.

2. To determine factors that prevents ABC implementation.

3. To determine the factors facilitating the process to implement ABC system.

4. To determine the main factors motivating the implementation of ABC system.

5. To identify the reason for implementing ABC.

6. To identify the problems faced in ABC implementation.

7. To ascertain the views of the user companies on the degree of success of ABC system and to encourage non-users for using this system.

Literature Review

The Underlying Theories

Diffusion of Innovations

Diffusion of Innovations can be defined as a theory of how, why and at what rate new ideas and technology spread through cultures (Rogers, 1962).

Management Accounting Change and Factors Influencing the Process of Change

The literature review shows the difference in the concept between innovation and change. Bradford and Kent (1977) argue that an innovation means the adoption of a new or a previous idea in a new circumstance or in a new setting. But change is not necessarily a new innovation or idea.

Despite the difference between these two concepts, the factors affecting the process of change in management accounting also are affecting the innovation adoption process. In their study of seven companies in the electronic sector, Innes and Mitchell (1990) found three types of factors influencing management accounting change process. These factors are facilitators, motivators and catalysts.

Empirical Literatures

The Reasons for Adoption of ABC

According to Cooper (1991), the growing costs and diversity of products is a major cause to adopt and implement the ABC. Chongruksut (2002) studied the adoption of ABC systems in different sectors in Thailand by survey method and found that the financial crisis of Thailand in 1995 and the economic recession played a major role in the ABC adoption.

Brown et al. (2004) found that technological factors, such as product customization and cost structure are not related to whether or not operating units considered ABC. Furthermore, they found insignificant effect of environmental factors, such as competition. Van Nuyen and Brooke (1997) argue that there is a positive association between the motivator’s factors such as change in cost structure, competition and ABC adoption. In this respect, Cooper (1988) and Booth and Giacobbe (1997) in their studiesalso found a positive association between the overhead level and ABC adoption.

Innes and Mitchell (1991), in their case study, found that the change in external environment, such as globalization and lower operating costs for competitors are the motivators for management accounting change. Brierley (2009) recommends future research in longitudinal approach to see when and how their consideration for ABC implementation has been complete. He also recommended future research to include the effect of organizational factor on ABC consideration.

In Iran, Ahmadzadeh et al. (2011) conducted a questionnaire survey in Iranian companies to examine whether the organizational factors such as organization size, industry type, cost structure, the importance of cost information and products and services diversity have a role in motivating the implementation of ABC. The results of this study found a positive association between cost structure, the importance of cost information, products and services and ABC implementation. It also found a negative association between the type of industry, organization size, product and services diversity and ABC implementation.

The review of literature above indicates that the researchers differentiated between two types of factors: catalysts which are associated directly with change? such as competitors using ABC, pressure from government or other regulatory authorities? and advice from parent or headquarters. However, Abrahamson (1991) classifies these factors to four perspectives: efficient choice, forced selection, fad and fashion. Another type is motivator’s factors which influence the change in general manner such as changes in cost structure, shortcomings of the existing cost system and change in business environment.

The Reasons for Non-Adoption of ABC

Despite the advantages of ABC over Traditional Accounting Systems, the adoption rate of ABC in different countries is still not very satisfactory (Askarany & Yazdifar, 2007). Many studies (such as Clarke et al., 1999; Pierce & Brown, 2004; Cohen, Venieris & Kaimenaki, 2005; Baird et al., 2007) describe the reasons for non- considering or non-adoption of ABC.

Pierce and Brown (2004) conducted a survey in different sectors in Ireland (manufacturing, service and financial sector organizations) to investigate the state of implementation of activity- based costing systems. The results of Pierce and Brown (2004) are divided into three parts. The first part is related to the factors that inhibit the implementation of the system. These include the lack of support, experience, training and resources, software support, human resource availability and perceived complexity. The second category is related to reasons for rejecting the system. These include the lack of significant difference in the product costs compared to the traditional systems, the current system will be deemed consequently as a better management tool, and the lack of relevance to the business. The findings also indicate that there is difficulty in establishing the key cost drivers and indeterminate benefits. The last category is related to reasons for never considering the system. These include satisfaction with the current system, lack of knowledge and experience, simplicity of the manufacturing process, small size of organization and the irrelevance of ABC to the nature of the business.

A study by Cobb, Innes, and Mitchell (1992) identifies the following issues: difficulty of collecting quantitative data on cost drivers, difficulty of linking cost drivers to individual product lines and other higher priorities. Furthermore, they indicate that those companies adopting ABC have faced some difficulties during the initial ABC implementation stage, including: the choice of activities, the selection of cost drivers as well as the uncertainty over using ABC for stock valuation for external financial reporting.

In Ireland, Clarke et al. (1999) also found that the major barriers to the adoption and implement ationof ABC were a lack of adequate resources and lack of experiences. Numerous studies (such as, Krumwiede, 1998; Innes et al., 2000; Chongruksut, 2002; Cohen et al., 2005) suggested that ABC is very complex, and there are many barriers such as internal resistance, lack of top management support, human resource availability, lack of knowledge, expressed satisfaction with current systems and a claimed lack of resources such as a qualified work force, time and effort.

ABC Success

Many studies suggested that worldwide ABC adoption rate is very low (Kennedy & Bull, 2000). Researchers gave many possible reasons to this rate. One reason could be ABC adopters not successful in delivering predictable net benefits. If ABC implementers find it unsuccessful, the low adoption rate could be justified (Byrne, Stower & Torry, 2009).

Shields (1995) and Baird et al. (2007) said that the definition of success is problematic as the literature is not clear about what success means, and discussions with ABC experts during construction of the survey did not result in agreement about a tangible definition. The approach that Shields (1995) adopted was to allow the user to rate the degree of success with whatever definition they deemed applicable. He adopted a limited number of success measures. McGowan and Klammer (1997) criticized Shield’s study because he only adopted both management evaluation to overall success in addition to dollar improvement as a success measure, and he did not separate between ABC implementation stages.

Some studies such as Anderson (1995) and Krumwiede (1998) measured success as the attainment of a particular stage of implementation. However, this approach of measuring success received many criticisms by researchers such as Baird et al. (2004) since it measures success as the series of an organization from one stage of activity management implementation to the next.

In their study, Foster and Swenson (1997) used different attributes to measure the level of success in 166 sites of 132 companies. However, they did not segment adoption and implementation to stages. This means that they did not focus on the ABC maturity stage. The measures used were ABC information, decision actions, dollar improvement and management evaluation to the overall success of ABC. However, Foster and Swenson’s measure did not differentiate between different stages of ABC implementation. Several studies stated that there is a need to segment ABC adoption when researching success by examining ABC maturity.

Critical Success Factors (Factors Facilitates ABC Implementation)

A number of studies have been conducted to attempt to identify critical success factors (such as Shield, 1995; Krumwied, 1998; Maelah & Ibrahim, 2006; Brown et al., 2004). Shields (1995) found success to be strongly connected to behavioral and organizational variables such as top management support, adequate internal resources and training, but not to technical variables such as the type of software or the nature of the system. According to Anderson (1995), the factors influencing implementation are context- specific. His conclusion was the varying influence across the stage of implementation, of specific organization and technical factors, individual and task characteristics, and environmental factors on the implementation success.

Krumwied (1998) conducted a study on the U.S manufacturing firms investigating how various contextual and organizational factors influence the stages of the ABC implementation. The contextual factors include: the potential for cost distortion and size of firms. The organizational factors include: top management support, training or non – accounting ownership and education. He found different factors to influence various stages of ABC adoption and implementation. He also found that the degree of influence varies in different stages of implementation. Therefore, this study recommends taking organizational and contextual factors into account while considering or implementing ABC system.

In France, Rahmouni and Charaf (2010) conducted a study using mixed methods; data were collected through mail questionnaires and interviews with French financial controllers. The aims of Rahmouni and Charaf’s (2010) study was to know which organizational and technical factors are associated with the success of ABC implementation, to provide some answers to the ABC paradox and to improve a new measuring scale for the perceived complexity of the ABC project.

The results of the study show that the success of ABC implementation depends on two factors in French companies: training and perceived complexity of the information technology. Rahmouni & Charaf (2010) recommend for future research to take into account other important variables that have been ignored in their article but are likely to impact the success of ABC projects. However, Velmurugan and Nahar (2010) said there is no identification of common factors contributing to the successful implementation of ABC by those companies which have been using ABC for an extensive period of time.

Research Design and Methodology

Mixed method methodology was used in the current study, 92 surveys were distributed and the initial survey was adopted to evaluate the current state of ABC adoption and implementation as well as the level of ABC success. All of this is followed by semi-structured interviews conducted with financial managers / assistant financial managers and heads of accounting departments / heads of costing departments of companies within the Jordanian manufacturing companies. This study analyzes the data collected from interviews with representatives of four companies that have not yet adopted ABC in order to know the reasons for non-adoption of ABC. This is followed by interviews with three companies that have currently adopted ABC to know the reasons for not starting the implementation process. These interviews are followed by other interviews with six companies that have currently implemented ABC and currently using ABC information to identify reasons for implementation problems and factors relating to the implementation process. The analysis of the data was set by using both within company and cross-company analysis.

Data Analysis

Quantitative Data Analysis

The aim of the questionnaire is to know the implementation rate and the level of ABC success in the Jordanian manufacturing companies, and to overcome the problem of implementation definition. This process took place from 22th October to 9th December 2010. Ninety–two questionnaires were distributed and eighty-two questionnaires returned, thereby giving a response rate of 89%. A phone call and personal interviews were made afterwards to improve the response rate.

Adoption and Implementation Rate

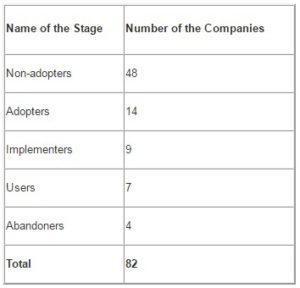

Based on the results of the questionnaire survey, companies are classified as follows:

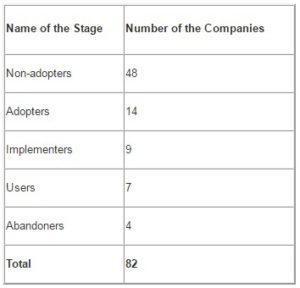

Table 1: Number of Companies in each Category of ABC Implementation

The first category includes 48 companies classified as non-adopters of ABC; companies in this group still use traditional costing system method to allocate overhead cost. The second category includes 14 companies classified as adopter companies. Here, the companies perceive the distortion of the existing cost system. They got approval from top management to implement and invest resources which are necessary to implement ABC system and the pilot project prepared in this stage.

The questionnaire results also show that 9 companies are classified as implementers. These companies are described as companies that have begun implementing ABC systems, and those that are in the process of forming a team of ABC implementation; determining project scope and objectives; designing training and workshops; collecting data and/or analyzing activities; cost drivers and organizational members’ commitment to use ABC.

The fourth stage includes 7 companies that were using ABC; in this stage the companies have started using ABC information as a part of daily practices or integrating them with other systems. Finally, 4 companies were classified as the abandoners. In this category, ABC was abandoned after the decision to implement or use it in the company as a solution to the traditional costing system problems.

The previous studies used three criteria to determine the rate of ABC adoption and implementation; the first criterion was used by Maelah and Ibrahim (2006) to be acquainted with the adoption rate in Malaysian manufacturing companies. However, in their study, Maelah and Ibrahim (2006) do not segment ABC to stages. Based on these criteria, 30 companies out of 82 companies adopted ABC, which means that the adoption rate was around 36.5% in the Jordanian manufacturing companies.

The second and third criteria refer to Bjornenak’s (1997) study that used two methods to determine the implementation rate. The second criterion is based on usage and refers to full implementation and using ABC information for various purposes in the company (Bjornenak, 1997). Currently, 7 companies out of 82 are using ABC information as a part of daily practice or integrated with other systems. Accordingly, the rate of ABC implementation within the Jordanian manufacturing companies based on this criterion is about 8.5%. The rate of ABC implementation (8.5%) is less than the rates found in the previous studies. However, the usage rate was 10.7% in Al-Khadash and Feridun’s (2006) study. The definition of using was unclear as neither study segments ABC into stages.

The third criterion is based on implementation as a process rather than using ABC information as a part of daily practices or integrating ABC with other systems. Accordingly, the rate of ABC implementation within the Jordanian manufacturing companies based on this criterion is about 19.5% (7 companies used ABC; 9 companies were in the process of implementing).

Level of ABC Success

This section examines the research question: For companies that are currently using ABC, what is the degree of ABC success?

The current study used three success measurements of ABC implementation within manufacturing sector in Jordan. Considering observed ABC maturity and using stage, this measure comprises the overall success of ABC implementation, ABC information characteristic rating and satisfaction with ABC implementation. Most of the previous studies measured success at different stages and not based on ABC maturity.

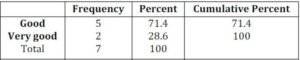

- The Overall Success of ABC Implementation

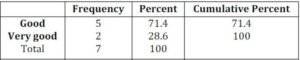

The first finding of the current study is about the level of ABC success. Users were asked to rate their perception of the success of ABC implementation in their companies. The level of ABC success was ranked on a five-point scale where 1= Poor and 5 = Very good. Table 2 below shows the perceptions of the success of implementing ABC by users. The majority of ABC users perceived the success level of implementing ABC as good (71.4%).

Table 2: Level of ABC Success among User Companies

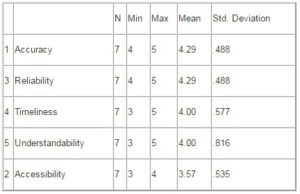

- ABC Information Characteristic Rating

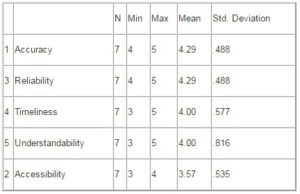

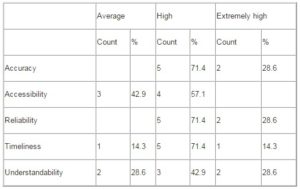

The second measurement of ABC success is based on the technical characteristics of ABC information. This ABC information characteristic rating comprises of accuracy, accessibility, reliability, timeliness and understandability. This measure was used by McGowan (1998) and Byrne et al. (2009) to compare between ABC information characteristic rating and TCS information characteristic rating. The current study assumes that the higher the ABC information characteristic rating, the more successful will be the implementation (Innes and Mitchell, 1995; Krumwiede, 1998). The respondents were asked to indicate on a five-point scale, from 1 = very low to 5 = extremely high, the frequency of ABC information characteristic rating for each of the five ABC information characteristics listed in the question. The findings are reported in Table 3 below.

Table 3: Frequency of ABC Information Characteristic

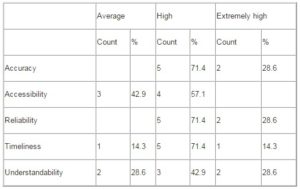

Table 3 shows that accuracy (mean score = 4.29) and reliability (mean score = 4.29) are the highest ABC information characteristic rating. This is followed by the timeliness (mean score = 4.00), understandability (mean score = 4.00) and accessibility (mean score = 3.57). Table4 below shows that the majority of users answered about ABC information characteristic rating in the following levels: average, high and extremely high.

Table 4: ABC Information Characteristic Rating Among User Companies

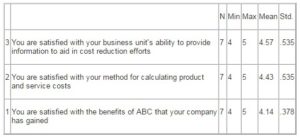

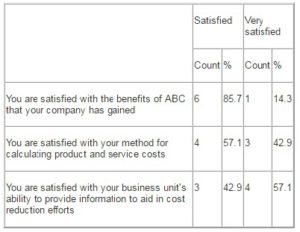

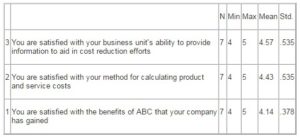

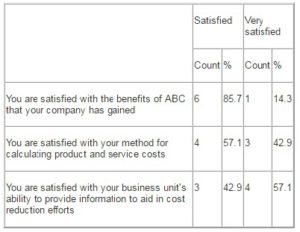

3. The Satisfaction with ABC Implementation

The third measurement of ABC success requested the respondents to give their opinion about their satisfaction in three areas they gained after implementing ABC. These areas are: calculating method, cost reduction and gained benefits. The respondents were asked to indicate on a scale where 1 = very unsatisfied and 5 = very satisfied. Table 5 shows that the majority of ABC users had a quite high level of satisfaction with the cost reduction efforts (mean scores = 4.57), calculating method (mean scores = 4.43) and satisfaction with the benefits of ABC that user companies have gained (mean scores = 4.14).

Table 5: Level of ABC Satisfaction among User Companies

Table 6 shows that most companies were satisfied and very satisfied with cost reduction effort, calculating method and satisfaction with the benefits of ABC that user companies has gained during the use of ABC in their companies. This finding is consistent with the previous finding of Swenson (1995), for example, who found that the degree of satisfaction with costing will be high after implementing ABC.

Table 6: The Degree of Satisfaction with ABC among User Companies

Qualitative Data Analysis

Data Analysis for Non-Adopter Companies

- Within-Company Analysis for Non-Adopter Companies

This section describes within-company analysis. It gives an overall picture of each company and the reasons for non-adoption of ABC.

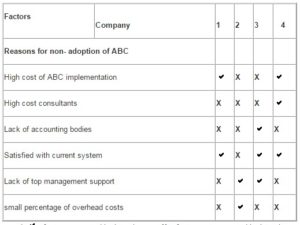

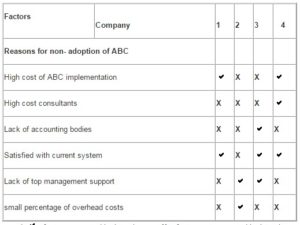

- Cross-company Analysis

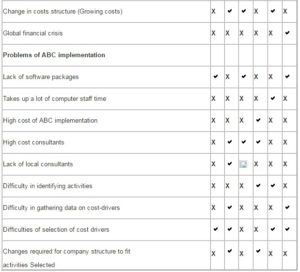

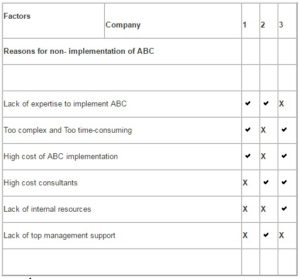

This section provides an outline of a cross-company analysis. It includes all barriers and problems identified by companies and their overall assessments in each individual company. To help arrive at an overall assessment of the important factors that impact the implementation of ABC within the Jordanian manufacturing companies, the analysis of the four companies has been summarized in Table 7 Qualitative analyses together with quantitative ratings were done to generate the summary.

Table 7: Summary of Cross-Company Analysis

Legend: = factors supported by interviewee X = factors not supported by interviewee

The four companies interviewed do not adopt ABC system because there are barriers to this adoption, but the most important reason is the fact that they are satisfied with the current system. The cross-company analysis shows that three companies out of four are satisfied with their traditional costing system. Two companies out of four said that the lack of top management support is an important reason for not adopting ABC system. In addition, two companies out of four said that the high cost of ABC implementation is a reason for not adopting ABC in their companies. These results are followed by the last two barriers which are high cost consulting services and small percentage of overhead costs.

Data Analysis for Non-Implementer Companies/Adopters

1. Within-Company Analysis for Non-Implementer Companies/Adopters

This section describes within-company analysis. Firstly, it provides a summary of background information which gives an overall picture of each company. It includes the universal background information, such as the type of sector and the number of employees of the company and its capital.

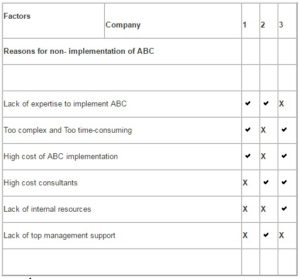

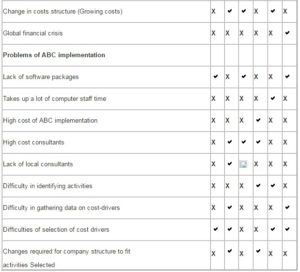

- Cross-company Analysis for Non-Implementing Companies

This section provides an outline of a cross-company analysis. It includes all barriers and problems identified by companies and their overall assessments in each individual company. To attain an overall assessment of the important factors that impact the implementation of ABC within the Jordanian manufacturing companies, the analysis of the three companies has been summarized in Table 8 Qualitative analyses together with quantitative ratings were done to generate the summary.

Table 8: Summary of Cross-Company Analysis

Legend: = factors supported by interviewee X = factors not supported by interviewee

The three companies interviewed have adopted the ABC system but have not implemented it yet because there are barriers to the implementation process. The cross-company analysis shows that two companies out of three faced four problems, most of them are related to ABC itself and not to behavior or organizational factors, These barriers are: too complex and too time-consuming, high cost of ABC implementation, high cost of consultants and lack of expertise to implement ABC. One company out of three said that lack of internal resources and Lack of top management support are the barriers they face, thereby resulting in delayed implementation process.

Data Analysis for Implementer and User Companies

1. Within-Company Analysis for Implementer and User CompaniesCross-company

This part describes within-company analysis. Firstly, it provides a summary of background information which gives an overall picture of each company.

- Analysis for Implementers and Users

The current section provides an outline of a cross-company analysis. It includes all factors and problems identified by companies and their overall assessments in each individual company. To help in arriving at an overall assessment of the important factors that impact the implementation of ABC within the Jordanian manufacturing companies, the analysis of the six implementers and user companies has been summarized in Table 9 Qualitative analyses together with quantitative ratings were used to generate the summary.

Table 9: Summary of Cross-Company Analysis

Legend: = factors supported by interviewee X = factors not supported by interviewee

The six companies interviewed gradually moved to implementing or using ABC system. The length of time required to implement the ABC system varied across the companies. In all companies, there is strong evidence that the fashion and the fad perspectives are the most important reasons for ABC implementation within the Jordanian manufacturing sector. One out of six companies said that efficiency choice is the reason for ABC implementation, and at the same time one out of six companies said that force decision is the reason for their implementation. The finding from the interviews shows the reasons for implementing ABC system in Jordanian manufacturing companies, including all Abrahamson four perspectives which are Fashion, Fad, Efficiency choice and Forced decision.

Top management support is the most important factor to influence ABC implementation. According to the findings from the qualitative data, five out of six companies agreed that top management completely support, are committed to and concerned with the process of ABC implementation. This result is consistent with the more general result that states that almost all successful innovations need the support of top management. Top management should focus on resources, goals and strategies in the implementation of ABC. They must show a promise to ABC by using it as a basis for decision-making. To support the use of ABC information, top management must use ABC information in communications and agreement with other workers.

Two out of six companies agreed that training was the most important factor to facilitate their decision to implement ABC. Training in designing, implementing and using the ABC system leads workers to appreciate, accept and take into heart the use of ABC.

Moreover, two out of six companies agreed that non-accounting ownership was the most important factor to facilitate their decision to implement ABC. Maelah and Ibrahim (2006) argue that if non-accounting employees could take part in the early stage of ABC implementation, ABC can be implemented more effectively. Non-accountants will support and promote ABC and be committed to its use and success. When ABC is owned by accountants, there is danger that it might be used only to satisfy their needs, which are often related to status within the accounting profession and external reporting.

Two out of six companies agreed that higher information technology was the most important factor to facilitate their decision to implement ABC. Anderson (1995) said that the level of information technology has important effects on the costing system design. For instance, the measurement cost associated with using additional cost drivers depends on whether the data required by that driver is already available, or has to be specifically determined. IT can also give detailed data related to cost driver information which is needed to implement ABC.

One company agreed that education is the most important factor to facilitate its decision to implement ABC, and another company agreed that sufficiency of internal recourses is the most important factor to facilitate its decision to implement ABC.

The shortcoming of the existing system, such as allocation problems and inability of the traditional cost systems to provide relevant information in the new business environment, are the major factors that motivate ABC implementation. Four companies out of six indicated that the shortcoming of the existing system motivated their decision to implement ABC. They also indicated that ABC system generates more detailed and accurate accounting information. The information is useful in assisting management in making various decisions.

Most of the respondents from the participating companies (five companies out of six) said that globalization and increase of competition motivated their decision to implement ABC. Companies operating in a more competitive environment have a greater need for advanced costing systems, such as ABC that more accurately assign costs to cost products. This is because competitors are more likely to take advantage of any errors from managers having relied on inaccurate cost information to make decisions.

During ABC implementation process, the company could be faced with problems related to changing implementation in practice. Thus, barriers to change could make the change process slower, hinder it and even prevent change. The difficulties in the selection of cost drivers have also been noted as a barrier followed by lack of software packages. Three companies mentioned that lack of software packages is a problem faced by them during the implementation process (see Table 5.3 for more details).

Conclusions

This paper collected the data from questionnaires and interviews with representatives of four companies that have not yet adopted ABC, in order to know the reasons for non-adoption of ABC. This is followed by interviews with three companies that have currently adopted ABC to know the reasons for not starting the implementation process. These interviews are followed by others with six companies that have currently implemented ABC and currently using ABC information for different purposes. The analysis of the data was set by using both within company and cross-company analysis. The questionnaire data analysis shows three types of adoption rates based on the previous studies and this hopefully will help to overcome the problem of ABC implementation definition used by previous studies. Three measures are used in the current study to know the level of ABC success. Firstly, the Jordanian Manufacturing Sector assesses the degree of ABC success as good and very good. Secondly, the data analysis shows that the users perceived that ABC information characteristic rating is average, high and extremely high. Finally, the greater part of ABC users had quite a high level of satisfaction with their unit’s ability to provide information to aid in cost reduction efforts, calculating method and gain benefits. The interviews finding shows that behavioral and organizational factors rather than technical factors influence ABC adoption and implementation, and this does not agree with some of the previous studies which said that only behavioral and organizational factors influence ABC adoption and implementation. However, future studies should segment ABC adoption and implementation to stages, and they must measure the level of ABC success at site of ABC maturity stage. Furthermore, it is recommended that future study should adopt case study with users companies to know the relation between using ABC system and the improvement in their financial performance.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Abdel-Kader, M. & Luther, R. (2008). “The Impact of Firm Characteristics on Management Accounting Practices: A UK-Based Empirical Analysis,” The British Accounting Review, 40(1), 2-27.

Publisher – Google Scholar

Abrahamson, E. (1991).” Managerial Fads and Fashions: The Diffusion and Rejection of Innovations“ The Academy of Management Review, 16(3), 586-612.

Publisher – Google Scholar

Ahamadzadeh, T., Etemadi, H. & Pifeh, A. (2011).”Exploration of Factors Influencing on Choice the Activity-Based Costing System in Iranian Organizations,” International Journal of Business Administration, 2(1), p61.

Publisher – Google Scholar

Al-Omiri, M. & Drury, C. (2007a).”Organizational and Behavioral Factors Influencing the Adoption and Success of ABC in the UK,” Journal of Cost Management, 21(6), 38-48.

Publisher – Google Scholar – British Library Direct

Al-Omiri, M. & Drury, C. (2007b). “A Survey of Factors Influencing the Choice of Product Costing Systems in UK Organizations,” Management Accounting Research, 18(4), 399-424.

Publisher – Google Scholar

Anderson, S. W. (1995). “A framework for Assessing Cost Management System Changes: The Case of Activity Based costing Implementation at General Motors,1986-1993,” Journal of Management Accounting Research, 7(1), 1-51.

Publisher – Google Scholar

Askarany, D. & Yazdifar, H. (2007).” Why ABC is Not Widely Implemented?” International Journal of Business, 7(1).

Publisher – Google Scholar

Baird, K., Harrison, G. & Reeve, R. (2007). “Success of Activity Management Practices: the Influence of Organizational and Cultural Factors,” Accounting & Finance, 47(1), 47-67.

Publisher – Google Scholar – British Library Direct

Baird, K. M., Harrison, G. L. & Reeve, R. C. (2004).” Adoption of Activity Management practices: a Note on the Extent of Adoption and the Influence of Organizational and Cultural factors,” Management Accounting Research, 15(4), 383-399.

Publisher – Google Scholar

Bjornenak, T. (1997). “Diffusion and Accounting: the Case of ABC in Norway,“ Management Accounting Research,” 8(1), 3-17.

Publisher – Google Scholar – British Library Direct

Booth, P. & Giacobbe, F. (1997).’ Activity-Based Costing in Australia Manufacturing firms: Key Survey Findings. Management Accounting Issues Report,’ Management Accounting Centre of Excellence of ASCPA, No.5, March 1997, pp.1-6.

Bradford, M. G. & Kent, W. A. (1977).Human Geography: Theories and their Applications, Oxford: Oxford University Press.

Publisher – Google Scholar

Brierley, J. A. (2009). “An Examination of the Factors Influencing the Level of Consideration for Activity-based Costing,” International Journal of Business and Management, 3(8), P58.

Publisher – Google Scholar

Brown, D. A., Booth, P. & Giacobbe, F. (2004). “Technological and Organizational Influences on the Adoption of Activity Based Costing in Australia,” Accounting & Finance, 44(3), 329-356.

Publisher – Google Scholar – British Library Direct

Brown, R. & Pierce, B. (2004).”An Empirical Study of Activity-Based Systems in Ireland,” The Irish Accounting Review, 11(1), 55–61.

Publisher – Google Scholar

Byrne, S., Stower, E. & Torry, P. (2009).’Is ABC Adoption a Success in Australia?’ The Journal of Applied Management Accounting Research, 7(1), 37-51.

Google Scholar

Chongruksut, W. (2002).”The Adoption of Activity-Based Costing in Thailand,” VictoriaUniversity.

Publisher – Google Scholar

Clarke, P. J., Thorley Hill, N. & Stevens, K. (1999).” Activity-Based Costing in Ireland: Barriers to, and Opportunities for Change,” Critical Perspectives on Accounting, 10(4), 443-468.

Publisher – Google Scholar – British Library Direct

Cobb, I., Innes, J. & Mitchell, F. (1992).’ Activity Based Costing: Problems and Practice,’ Chartered Institute of Management Accountants, U.K.

Google Scholar

Cohen, S., Venieris, G. & Kaimenaki, E. (2005).” ABC: Adopters, Supporters, Deniers and Unawares,” Managerial Auditing Journal, 20(9), 981-1000.

Publisher – Google Scholar – British Library Direct

Cooper, R. (1988—1990).’ The Rise of Activity-based Costing: Parts 1, 2, 3 & 4,’ Journal of Cost Management

Google Scholar

Cooper, R. (1991). ‘A Structured Approach to Implementing ABC,’ Accountancy (UK), June, pp. 78-80.

Google Scholar

Drury, C. & Tayles, M. (2005).”Explicating the Design of Overhead Absorption Procedures in UK Organizations,” The British Accounting Review, 37(1), 47-84.

Publisher – Google Scholar

Fei, Z. Y. & Isa, C. R. (2010).”Behavioral and Organizational Variables Affecting the Success of ABC Success in China,” African Journal of Business Management, 4(11), 2302-2308.

Publisher – Google Scholar

Fei, Z. Y. & Isa, C. R. (2010). “Factors Influencing Activity-Based Costing Success: A Research Framework” 023X.

Publisher – Google Scholar

Feridun, M. & Al-Khadash, H. (2006). “Impact of Strategic Initiatives in Management Accounting on Corporate Financial Performance: Evidence from Amman Stock Exchange,” Managing Global Transitions, 4(4), pp. 299 -313.

Publisher – Google Scholar

Foster, G. & D. Swenson (1997).’ Measuring the Success of Activity-Based Costing Management and its Determinants,’ Journal of Management Accounting Research, 9, 109-141.

Greene, A. H. & Flentov, P. (1991). ‘Managing Performance: Maximizing the Benefit of Activity-Based Costing,’ Emerging Practices in Cost Management, J5-1.

Google Scholar

Gunasekaran, A. (1999). “A Framework for the Design and Audit of an Activity-Based Costing System,” Managerial Auditing Journal, 14(3), 118-127.

Publisher – Google Scholar – British Library Direct

Hutaibat, K. A. (2005).’ Management Accounting Practices in Jordan: A Contingency Approach,’ University of Bristol.

Google Scholar

Innes, J. & Mitchell, F. (1990).” The Process of Change in Management Accounting: Some Field Study Evidence,”Management Accounting Research, 1(1), 3-19.

Publisher – Google Scholar

Innes, J. & Mitchell, F. (1995). ‘ABC: a Survey of CIMA Members,’ Management Accounting, 69(9), 28-30.

Innes, J., Mitchell, F. & Sinclair, D. (2000). “Activity-based Costing in the UK’s largest Companies: A Comparison of 1994 and 1999 Survey Sesults,” Management Accounting Research, 11(3), pp. 349-362.

Publisher – Google Scholar – British Library Direct

Kennedy, T. & Bull, R. (2000).”The Great Debate.Management Accounting (British),” 78(5), 32-33.

Publisher

Krumwiede, K. R. (1998). “The Implementation Stages of Activity-Based Costing and the Impact of Contextual and Organizational Factors,” Journal of Management Accounting Research 10.

Publisher

Liu, L. Y. J. & Pan, F. (2007). ” The Implementation of Activity-Based Costing in China: An Innovation Action Research Approach,” The British Accounting Review, 39(3), 249-264.

Publisher – Google Scholar

Maelah, R. & Ibrahim, D. N. (2006). “Activity-Based Costing (ABC): Adoption Among Manufacturing Organizations–The Case of Malaysia,” International Journal of Business and Society, 7(1), 70-101.

Publisher – Google Scholar

Malami, T. (1997). “Towards Explaining Activity-Based Costing Failure: Accounting and Control in a Decentralized Organization,” Management Accounting Research, 8, 459-480.

Publisher – Google Scholar – British Library Direct

Malami, T. (1999).” Activity-based Costing Diffusion Across Organizations: an Exploratory Empirical Analysis of Finnish Firms,” Accounting, Organizations and Society, 24, pp 649-672.

Publisher – Google Scholar – British Library Direct

McGowan, A. S. (1998).” Perceived Benefits of ABCM Implementation,” Accounting Horizons, 12, 31-50.

Publisher – Google Scholar – British Library Direct

McGowan, A. S. & Klammer, T. P. (1997).’ Satisfaction with Activity-based Cost Management Implementation,’ Journal of Management Accounting Research, 9, 217-238.

Google Scholar

Morakul, S. & Wu, F. H. (2001).” Cultural Influences on the ABC Implementation in Thailand’s Environment,” Journal of Managerial Psychology, 16(2), 142-156.

Publisher – Google Scholar – British Library Direct

Narong, D. K. (2009).”Activity-Based Costing and Management Solutions to Traditional Shortcomings of Cost Accounting,” Cost Engineering, 51(8), 11-22.

Publisher – Google Scholar

Rahmouni, A. F.- A. & Charaf, K. (2010). “Success of Activity-Based Costing Projects in French Companies: The Influence of Organizational and Technical Factors,” Retrieved from 2010 from http://ssrn.com/abstract=1686246.

Publisher

Rasiah, D. (2011).’ Why Activity Based Costing (ABC) is Still Lagging Behind the Traditional Costing in Malaysia ? ‘Journal of Applied Finance & Banking 1(1), 83-106.

Rogers, E. M. (1962). “Diffusion of Innovations,” New York, NY: Free Pr.

Publisher – Google Scholar

Sartorius, K., Eitzen, C. & Kamala, P. (2007).” The Design and Implementation of Activity Based Costing (ABC): a South African survey,” Meditari Accountancy Research, 15(2), 1–21.

Publisher – Google Scholar

Shields, M. D. (1995).’ An Empirical Analysis of Firms’ Implementation Experiences with Activity-based Costing,’ Journal of Management Accounting Research, 7(1), 148–165.

Google Scholar

Swenson, D. (1995). ‘The Benefits of Activity-Based Cost Management to the Manufacturing Industry,’ Journal of Management Accounting Research, 7, 167-180.

Google Scholar

Van Nguyen, H. & Brooks, A. (1997). “An Empirical Investigation of Adoption Issues Relating to Activity-based Costing,” Asian Review of Accounting, 5(1), 1-18.

Publisher – Google Scholar

Velmurugan, M. S. & Nahar, W. N. A. B. W. (2010).’ Factors Determining the Success or Failure of ABC Implementation,’ Cost Management, 24(5), 35.

Google Scholar