Introduction

The recent financial credit crisis started in the USA has affected almost the whole world at different degrees. As Kilmister (2008) states, firstly, it directly and immensely affected the banks in the USA where bad debt threatened the solvency of the banks. Secondly, the apparent change in Federal Reserve policy from the earlier rescue of Bear Sterns created a panic in the inter-bank lending market there. Thirdly, stock market investors also panicked sending bank shares into freefall. Since bank.

regulation is based on the idea that loans can only be a certain multiple of bank capital and since the decline in shares reduced capital significantly, this looked likely to lead to a massive decline in bank lending, which would have further threatened the stability of the system. While these problems first appeared in the US and UK, where housing booms and bank deregulation had been especially strong, it quickly became clear that banks from many countries particularly Continental Europe and other countries. The crisis also affected the price of currency (particularly the US dollar) when exchanged with other currencies. The author argue that the crisis which started in US banks, exposed investments in those banks by banks from the rest of the world into risk (e.g. investments by Emirate companies in US banks). In addition, it reduced to the minimal investments by US companies into other countries including the so-called developing countries (such as Egypt which was also badly affected by a drop in numbers of tourists visiting it due to the crisis). Furthermore, the shrinking ability of US and continental banks to give credit to companies due to the crisis may affect the demand for oil; the major source of national income in a country like UAE. These are some reasons for studying the case in Egypt and the UAE. Besides, the two countries belong to the developing nations which are rarely examined in the accounting literature and the UAE has an additional strong reason to be included; that is the massive effect of debts and financial problems of Dubai World company -belongs to Emirates of Dubai- that impacts many other businesses involved with it around the world.

Banks specifically in UAE were largely affected by the credit crisis in USA due to high exposure to US financial market. Woertz (2008) reports that only a limited number of Gulf banks have publicly admitted and quantified their exposure to the subprime crisis. Abu Dhabi Commercial Bank –is only an example- has announced an exposure of $272 million and has sued Morgan Stanley and other banks for wrong advice in the case of an ill-fated SIV deal. The UAE Central Bank has asked UAE banks to declare their exposure to Lehman in the wake of US bank bankruptcy, but no public announcement by banks about further exposure has resulted from this measure. Exposure could be in the form of bank bonds, derivative trades where Lehman has acted as counter party (e.g. credit default swaps) or structured investment products that were guaranteed by failed US bank investment. In mid September 2008, UAE’s Central Bank Governor Nasser Al-Suwaidi ruled out a systematic risk exposure of the UAE in the context of the financial crisis in the US. Three of the UAE’s largest banks state no or limited exposure to the Lehman bankruptcy, according to Reuters.

The real problem for the GCC banks lies in the indirect exposure to increased costs of funding amidst maturity mismatches and credit exposure to local consumer, project and real estate financing. A major reason for this distressed scenario is the deterioration of Dubai-related credit that constitutes a large part of the GCC bond market universe, as the emirate borrowed extensively to finance its development projects and Dubai Inc. companies were among the most prominent issuers in the GCC. The effects on stock markets were severely witnessed by the end of 2009, the Saudi stock exchange fell by 49%, Dubai’s by 72% and Egypt’s by 61%.

The losses of billions of dollars to individuals, companies and governments were surprisingly not anticipated or expected through academics or policy makers a fact which Dirk J Bezemer (2009) widely described as “No one saw this coming”. These financial scandals and collapses with dramatic influences triggered this research. The objective of this research is to investigate if accounting can contribute in corporate governance for better monitoring of management and other actions in order to provide better control on financial investments. The World Bank report about corporate governance in Egypt in 2004 states another reason particular to Egypt that increased the awareness of corporate governance that is, a number of banking scandals and the role of press in uncovering them.

There has been few academic papers that examined corporate governance in the countries of concern. One study by Baydoun et,al., (2005) investigate corporate governance practices in five Arabian Gulf countries (Kuwait, Bahrain, the United Arab Emirates, Qatar and Oman). They compared between these countries based on OECD’s 2005 data and concluded that Oman is a leader in adopting corporate governance followed by Kuwait then the UAE while Bahrain and Qatar are the least. They suggest that a robust consistent regime of corporate governance in the region is still being developed and needs amendments in laws as well. Another exploratory study by Dahawy (2008) focused on presenting and analyzing disclosure of corporate governance practices among leading Egyptian companies especially under economic reform and consequences on capital market. The study depends on a checklist of 53 items developed by the United Nations to assess the level of disclosure of corporate governance practices. The research findings highlight a low level of corporate governance disclosure among the leading 30 companies, this might has been because of the novelty of the concept. Then Samaha and Dahawy (2011) published an empirical study about corporate governance structure and voluntary disclosure in volatile capital markets- the Egyptian experience. The results indicate that overall voluntary disclosure was low compared to other emerging capital markets. Multivariate results show audit committee presence as the most significant variable influencing voluntary disclosure followed by less significance of high ratio of independent non-executive directors. Factors that were not significant are government ownership aspects, number of shareholders, type of auditor, size, liquidity, leverage and industry type. The author might refer here to an excellent paper by Richardo Bebczuk (2005) on corporate governance and ownership applied on Argentina. It used quantitative measures on the quality of corporate governance and ownership structure in 65 companies’ information for 2003-2004. The results showed that Argentinean companies examined are poorly governed vis-à-vis international practices. In turn, ownership appears to be quite concentrated but separation of control and cash flow rights as an indicator to expropriate minority shareholders prevails in less than half of the companies. Results refer to a sizable and robust effect of corporate governance on performance.

This presentation of studies on Egypt and the UAE with regard to corporate governance shows a possible justification for doing this research on the ground that: a) it holds a comparison between the two countries which did not happen in a previous study. b) it examines variables and use measurements that have not been applied before on those countries. c) it focuses the discussion on banking sector which was affected most by the world financial crisis.

The rest of the paper is organized as follows: first, a discussion of corporate governance practices in the two countries and a statement of the reasons for choosing banks to investigate. Second, developing research hypotheses, variable measurements and data. Third, analyses, primary findings and conclusions.

Corporate Governance in Banks in Egypt and the UAE

Egypt was a pioneer in the region in developing domestic governance code, launched in 2005 while the UAE issued its code in 2007, both based on the OECD Principles of Corporate Governance. The launch of the Egyptian Institute of Directors and of the Hawkamah Institute of Corporate Governance (in the UAE) was as much a response to the existing demand for governance know-how, as it was to encourage a stronger application of corporate governance. Koldertsova (2010) recognizes two waves of corporate governance in the Middle East and North Africa region; the first was in 2005 and the second is as recent as 2010. Such codes were introduced as voluntary guidelines in the two countries, providing best-practice recommendations based on international standards, notably the OECD Principles of Corporate Governance and only recently, regulators attempted to introduce stricter requirements. In Egypt, board independence requirements first stipulated in the governance code were subsequently incorporated into the listing standards of the Egyptian Stock Exchange.

A survey in 2006 by the Egyptian Banking Institute about corporate governance in Egyptian banks reported the following findings:

- Banks have in place a good general framework for good corporate governance need to be better communicated.

- Banks have in place written policies regarding corporate governance and codes of ethics.

- Banks ensure to a large extent equitable treatment of shareholders.

- Banks enjoy a high level of disclosure of material information and financial transparency in line with international standards.

- More effort needs to be geared towards designing and implementing special training programs on corporate governance and internal control practice for employees.

- Banks have specialized committees for supervising and monitoring major business functions. Limited responses indicated the presence of specialized committees concerned with good governance and risk management.

- Banks have internal and independent persons in their Board; however independent directors do not have a majority presence in these Boards.

- Banks, in general, do not take into consideration the evaluation of clients’ corporate governance practices in their credit risk assessment systems.

Koldertsova (2010) report that the end of this decade marks the end of the first wave of corporate governance or “Hawkamah” in Arabic. The UAE introduced the code of practice to be compulsory for bank in 2007. The resistance to corporate governance as a concept –mainly by family-owned companies- has shifted from the centre to the periphery which is an evidence of successful awareness-raising campaigns. Moreover, during the past two years, regional regulators have been abolishing the voluntary nature of governance standards. These developments mark the beginning of a new wave of corporate governance in the region, focusing on implementation as opposed to awareness-raising. This second wave is being manifested through the revision of governance codes in order to clarify and tighten provisions. Hawkamah, the Institute for Corporate Governance in Abu Dhabi the capital of the UAE, is an independent international association established to efficiently coordinate and sequence the design, planning and implementation of corporate governance reforms and monitoring the outcome of corporate governance on the private sector level. Both Abu Dhabi and Dubai securities exchanges promote the adoption of best practices of corporate governance in the listed and to be listed companies. The author managed to get some corporate governance reports issued by Orascom Telecom company in Egypt and Mashreq bank, Dubai Holding and Abu Dhabi Ship Building Emirati companies. While comparing the content of these reports could be the subject of another research, the reports generally agree on providing information about the board of directors, remuneration, Committees along with risk management and internal audit. Some reports included information on shareholders communication, insider share dealing, corporate social responsibility, share movement and professional conduct.

Characteristics of Banks in the Two Countries

There are features shared by banks in both countries:

- Banks include huge investments for governments and individuals and hence transaction there affect huge investments.

- Major banks in both countries are state-owned. In UAE, fifteen state-owned banks account for more than half of the sector’s total assets according to Index of Economic Freedom 2011 and the four biggest banks in Egypt are state-owned as well. Banks are generally moderate to high level of ownership concentration, due to the presence of family-controlled ownership in UAE especially.

- Banks are the major source of finance to other businesses in both countries as the Hawkama and OECD 2005 report state and their stability and success would affect the overall economy (as mentioned above the volume of losses from the financial crisis in the US).

- Commercial banks hold “significant” shares in listed and non-listed companies in both countries.

Banks in both countries differ in:

- Assets and resources

- Years providing services

- Exposure to international markets

- Country’s economic, political and cultural features including degree of corruption

Both the local bank scandals in Egypt before the world financial crisis and the latter’s effects on Egypt and the UAE feed the debate about the role of corporate governance in providing better informed about current and future earnings. Huge literature examined many aspects of corporate governance (including shareholder’s protection) from different levels (company’s level vs. country’s level) and via different perspectives. It is believed that the ownership of banks in Egypt and the UAE is dominated by the state –as mentioned above. Therefore, examining how to protect shareholders in that sector seems irrelevant. Rather, addressing the quality of accounting information and current and future earnings measurements that represents management choices would be more appropriate. Another research could address mechanisms and impacts of better shareholders’ protection that could improve performance in this sector.

Developing Research Hypotheses

In the earlier section about research background, some academic papers applied on the two countries of concern were reviewed, e.g. Baydoun et,al., (2005), Dahawy (2008), Samaha and Dahawy (2011), Bebczuk (2005). In this section, the researcher will develop the research hypotheses that make it different from other papers in the area.

The situation in the US was triggered by the high-profile downfalls of large corporations like Enron and WorldCom where investors lost millions of dollars. According to He et.al., (2008), the Public Company Accounting Reform and Investor Protection Act was signed in July 2002 to restore investors’ confidence. This act provides major changes to corporate governance and disclosure obligations. Among these changes are: 1) firm executives must certify the accuracy of financial reports 2) firm executives and auditors must certify the effectiveness of internal controls 3) firm executives and auditors are faced by tightened accountability and increased criminal penalties 4) corporate governance is more independent. All these changes indicate that firms are faced with a tightened business environment which seeks to provide greater protection to investors.

In the UAE, The Emirates Securities and Commodities Authority issued Decision No. (R/32 OF 2007) directed at listed companies to comply with specific regulations regarding board of directors, internal controls, remuneration, auditing and corporate governance. In 2009, The Central Bank of the UAE released a revised draft of its corporate governance guidelines regarding banks as mentioned by Walton et.al. (2009). The guidelines acknowledge the important role played by banks in the UAE economy and the vital role of good corporate governance in ensuring the long term success and security of banks. The guidelines emphasize disclosure, duties and responsibilities of directors, transparency and accountability and include model charters and policies. A notable requirement is that the Central Bank encourages directors not to accept more than one bank board appointment. The researcher points out that this point particularly will be among the measured items of corporate governance in the measure of transparency and disclosure in this study. Similarly, the World Bank report about corporate governance in Egypt in 2004 listed disclosure and transparency as one of the key corporate governance principles examined. If accounting could provide a level and quality of financial disclosure, this could enhance shareholder’s protection and improve their investment decisions. Siegel (2008) argues quality to be an important attribute of accounting information, although it is neither generally agreed upon nor measurable. However, Siegel (2008) described it via communication and considered the better the usefulness of financial information for decision making, the higher the quality of the information.

The researcher emphasizes that the term transparency and the term disclosure are used interchangeably in this study without a distinction between the two. However, some studies in the literature (Bushman and Smith 2003) define corporate transparency by the availability of relevant, reliable information about period performance, financial position, investment opportunities, governance, value and risk of publicly traded companies and on that basis they define it by features of intensity, timeliness and credibility. The first feature “disclosure intensity” was ignored in this research because of lack of data to measure it. Bushman and Smith (2003) also report that previous studies in the literature suggest that those features are associated with differences in economic growth, efficient allocation of investment and sensitivity of investment to internal cash flow. The researcher argues that this is taken as the basis for the second hypothesis in this study as the features of transparency examined could enhance quality of information which in turn could improve shareholders’ monitoring and assessing of management decisions and performance in terms of growth, efficient use of resources and better control over cash flow. However, in order to maintain this study in focus, the last part of the debate –that is quality of accounting information and monitoring management’s performance or efficient investment or other managerial decision- will be assumed but not examined.

Calderón et. al (2005) from the World Bank identify exposure to be the integration of world goods and capital markets. A central dimension of globalization is the world trend toward larger financial and trade openness, observed in most industrial and developing economies. Financial openness has increased from a world median of 5% of GDP in 1970 to 45% of GDP in 2000 and trade openness has grown from a world median of 44% of GDP in 1970 to 70% of GDP in 2000.

The Central Bank of the UAE announced on its website in March 2011 that “Total banks’ loans and advances, net of provisions and interest in suspense, increased by 0.6 per cent, reaching Dh1.049 trillion, and the total banks’ assets increased by 1.8 per cent, reaching Dh1.66 trillion at the end of February this year,” The Central bank also discloses that the number of local commercial banks operating in the UAE are 23 in addition to branches of foreign banks. Also the Central bank reveals that in 2009, the majority of local commercial banks are owned by state (and Emirate) or a governmental authority of it, for example National Bank of Abu Dhabi is 70% owned by Abu Dhabi Investment Council, Emirates NBD is 56% owned by Investment Corporation of Dubai and 5% by Jumaa Al Majid (a major individual investor), Sharjah Islamic Bank is 31% owned by the government of Sharjaa, Commercial Bank of Dubai is 20% owned by Investment Corporation of Dubai, 10% by A. Al Futaim Private investor and 7% Ghobash Trading and 6% A. Al Rostmani investor.

The researcher develops a hypothesis based on these data that ownership is highly concentrated in UAE banks which could affect the production and disclosure of accounting information and corporate governance.

According to the Encyclopedia of the Nations, in 1999 there were 69 banks operating in Egypt: 4 state-owned commercial banks, 29 commercial banks, 33 investment banks, and 7 specialized banks; including 20 foreign bank branches. The 4 state-owned commercial banks-the National Bank of Egypt, the Bank of Alexandria, the Banque du Caire, and the Banque Misr-dominate the sector due to their size in terms of assets, deposit base and branches (an average of 200 branches each), accounting for 55% of the banking system’s total assets. The Central Bank of Egypt supervises all banks in Egypt except for Misr African International Bank, the Arab International Bank and the Egypt Export Development Bank. The national stronghold on the system becomes apparent when the public-sector banks’ shares in joint-venture banks are taken into account, which reveals the big four to be holders of over 90% of the total assets of commercial banks. The dominance of the public sector is heightened if the National Investment Bank (NIB) is included. Holding the long-term resources mobilized by the social security system, the NIB possesses roughly 25% of total bank deposits. Private sector ownership accounted for less than 30% of the banking sector in 2002, while the total assets of Egypt’s banks in the same year amounted to $72 billion. The official web site of the Central Bank of Egypt reveals in December 2010 that the Egyptian banking system consists of 5 public sector banks, 27 private and joint venture and 7 off-shore banks with total assets of banks in Egypt is USD .221 trillion (less than quarter a trillion).

The researcher draws up the following hypotheses based on these factual data about banks in the two countries. It is obvious that the size of banks’ assets in the UAE is bigger than those of Egypt, with more foreign operation and more concentration of ownership. There are two independent variables: transparency of accounting information and disclosure of corporate governance while the dependent variable is quality of accounting information. The proposed explanatory variables are foreign transactions or exposure, bank size and ownership concentration. The hypotheses will be formed to test three aspects. The independent variables group is examined: first, before and after the financial crisis in the two countries, second, it will be tested if there is a relationship between the independent variables group and the dependent variable, third, the independent variable will be compared in the two countries and whether the explanatory variables are valid to interpret differences or not.

Therefore the research hypotheses are:

H1: Disclosure of corporate governance and Transparency of accounting information in banks in both Egypt and the UAE is more after the financial crisis

H2: More Disclosure of corporate governance and Transparency in banks, increase quality of accounting information

H3: Disclosure of corporate governance and Transparency in banks in the UAE is more than in Egypt due to higher exposure to international markets, bigger size and more ownership concentration.

Measurements of Variables

Bushman and Smith (2003) introduced the following measurements that will be adopted in this study:

Quality of Accounting Information is Measured by Two Attributes:

Timeliness of disclosure: measured by:

- Number of specific accounting items disclosed in interim reports

- Consolidation in interim reports

- Reporting of subsequent eventsand Credibility of disclosure: measured by:

- Share of big 6-accounting firms in total value audited

- Financial statements available in English

- Degree of disclosure of important accounting policies

Corporate Transparency: Measured by Reporting the Following Items:

- Segment disclosure (product and geographic)

Governance Disclosure

- Identity of major shareholders

- Identity of board members and affiliations

- Remuneration of officers and directors

- Shares owned by directors and employees

Exposure to International Market

In this research exposure to international market will be measured by the value of operations in international market as expressed in the annual report of a company.

Ownership Concentration

It is measured as the percentage of shares owned by the largest shareholders (owners)

Bank Size

This is measured by total assets

Regarding the independent and dependent variables, following Bebczuk (2005), for each feature, the company is given a value 1 if the item is there (there is partial or total public information) and 0 otherwise.

Data and Analyses

While more analyses have to be undertaken on the data, this section will report only primary results that are obtained at date of submission, given that the total number of banks operating in Egypt is close to that operating in the UAE. Data are collected from a total of 26 banks in each country from the annual reports and web sites including all state-owned banks in both countries in addition to some private and joint venture ones. While banks in the UAE fully adopt the IFRS, banks in Egypt use the Egyptian Accounting Standards according to regulations of the Central Bank of Egypt which are based on the old IAS (International Accounting Standards) and the current IFRS. However, the World Bank within the economic reform taking place since 2003 in Egypt- requires that all companies there should comply with the IFRS and a draft of the Company’s Act is being prepared to include that. Thus, this point should not create a factor for differentiation at this stage. In order to maintain the research objective and compare between disclosure practices before and after the world financial crisis, the annual reports of the selected banks were examined over a period of four years: since the financial crisis began in the US in 2006, that year was avoided because annual reports of that year will reflect incredible shock and no sign of rather normal practice of business and of accounting practices will appear, therefore, the period of 2003, 2004 and 2005. Given that the financial crisis itself ended sometime between late-2008 and mid-2009. Therefore, the annual reports of 2009 and 2010 are used to represent the after crisis situation (with interim data for 2011). SPSS program was used to prepare descriptive and analytical tools for data. This means the study includes 26×6 data observations for every individual variable or measurement.

Findings

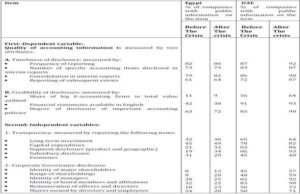

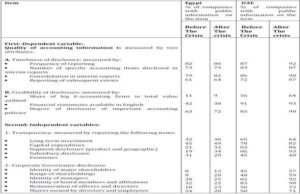

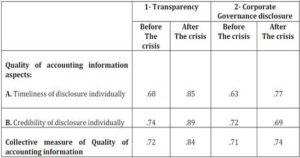

Firstly: analysis shows support for the first hypothesis in both countries with a higher score for the UAE as in table (1) below. The first part reveals the aggregate measure of accounting disclosure and transparency was higher in the after-crisis era (2009-2011) than the before-crisis (2003-2005).

Table (1) Frequencies of Companies with Public Information about Timeliness, Credibility, Transparency and Disclosure

Details show that banks reveal more details about their long term investments, geographic segments and subsidiaries. These included financial investments by banks in each country and abroad. As the world financial crisis hit banks in the UAE more than Egypt, the UAE regulatory bodies encouraged more adoption of reporting practices especially with relation to deposits abroad, operations overseas and disclosing events subsequent to closure of the fiscal year. Whereas banks in Egypt before and after the crisis are tightly controlled from the Central Bank of Egypt by limited deposits in a foreign bank abroad (no more than 10% of deposits) and the vast majority of that amount is in form of secured bonds of the US government, to avoid bankruptcy and not more than 5% are used in mortgagee activities. Some local issues are could be noted. For example, it is a common practice by Emirati companies in transparency to prepare their annual reports in both English and Arabic while this is very limited in Egypt. Also, in Egypt, all companies owned by the state including banks should be audited by a national independent organization “The Central Agency for Accounts”. This fact minimized the appearance of big 6 firms in Egyptian data.

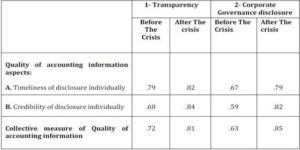

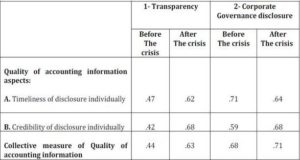

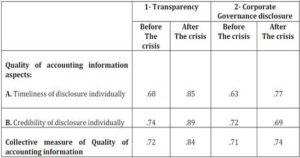

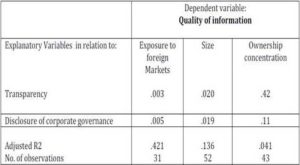

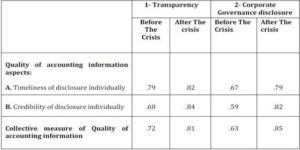

Secondly, the second hypothesis reads that more disclosure and transparency could increase quality of accounting information. The correlations in tables (2,3 and 4) below show the associations between measurements of disclosure on one hand and measurements of quality on the other as suggested in this research.

Table (2) Correlation between Independent Variables (Transparency and Disclosure) and the Dependent Variable (quality of information) for the Whole Data:

Table (3) Correlation between Independent Variables (Transparency and Disclosure) and the Dependent Variable (Quality of Information) for Egypt Data:

Table (4) Correlation between Independent variables (Transparency and Disclosure) and the dependent variable (quality of information) for the Emirati data:

It reveals a positive relationship between quality of disclosure and corporate governance in both eras. The relationship is stronger for the after financial crisis period in both countries. During the period of 2009-2011, banks in the UAE released more relevant and timely financial information to users in different ways and on more frequent basis. The amount of details given by UAE banks in terms of financial statements, plans, projects, follow-up review announced about the financial operation and the open discussion in the media about some business decisions such as take-over decisions were much witnessed in the UAE bank environment than in Egypt. Only to name a few: The information about Dubai Islamic bank offer to buy a controlling stake in 2011appeared in UAE Interact official site as well as various banks when issue bonds. Also the news that First Gulf Bank pulls the plug on Libyan operations in 2011 was reported in UAE Interact official site and similarly National bank of Abu Dhabi operations in Oman.

Thus, the two dimensions measured for quality were found collectively positively correlated to the measurement of disclosure in both countries with the association stronger for the UAE during the period of 2009-2011 compared to the period of 2003-2005 and compared to banks in Egypt during the first period. In terms of details of information, the reporting of accounting policies is much more than that of banks in Egypt along with a consistent reporting of members of board of directors, key managers and their remuneration. The Egyptian banking environment does not see the importance of these information yet, hence, few cases reveal that to readers.

In the UAE there is a big-6 accounting firms involvement issuing the financial statements available in both Arabic and English compared to Egypt and more accounting policies are disclosed in a more systematic way. This finding may have resulted from the fact that there is more involvement of international market by banks in the UAE than in Egypt and the IFRS has been adopted almost in full for a longer period of time. In conclusion, the second hypothesis is supported. It is notable that UAE banks score higher than Egypt in governance disclosure in terms of releasing information about directors, their affiliations and remuneration. This practice is still thin in Egyptian environment.

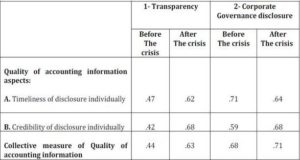

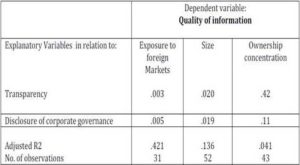

Thirdly, Primary Analysis including descriptive and regression in table (5) below indicates that disclosure and transparency of accounting information by banks in the UAE is more than in Egypt due to the former’s more involvement in international trade and markets.

Table (5) the Regression between Transparency and Disclosure as Independent Variables and quality of Information as Independent Variable under Foreign Exposure, Size and Ownership Concentration as Explanatory Variables

It is mentioned earlier that there are restrictions on commercial banks in Egypt by the Central bank regarding the amount of deposits that can be put abroad and this reduced the impact of the financial crisis in Egypt. In other words, the same reasons worked on imposing more regulation on the UAE banks after the world financial crisis. However, the bigger resources of UAE banks comparing to Egypt along with the state’s full guarantee of all deposits has been supported, for the banking sector absorbed the negative effects of the international credit crisis effects in spite of the huge losses which UAE banks experienced. The higher ownership concentration in the UAE worked against mangers’ willingness to disclose information. More concentration of ownership might mean more powerful owners, but the huge resources invested in the business and the separation of management from business increases the probability of losing control. In UAE case, few cases for managers’ manipulation were revealed because often businesses are owned by families and run by members of the family. While more banks in the UAE are owned by families and prestigious figures (Al Mashreq bank and National Union Bank are examples), this feature exists far less in Egypt’s case (only for some foreign banks operating in Egypt e.g. Ouda Lebanese Bank) where banks specifically are different from other sectors in the economy where mostly are state-owned.

Given that this is still a working paper, the author wishes to make this note a reservation. Also, no previous studies were found in this area with empirical tests to compare results with. The study of Bushman and Smith (2003) while sharing the research arguments and questions, it did not test arguments on real data. Baydoun et. al., (2005) report in a more like content analysis the corporate governance practices in five Arabian Gulf (only) countries. Our findings agree with Baydoun et. al., (2005) in that, the UAE scores more than other Arab countries (in their case Gulf countries and in our case Egypt) in adopting and reporting on corporate governance. This study findings seem incomparable with Bebczuk (2005) which investigates corporate governance and ownership impact on performance while effects on performance are not targeted or examined in this research. However, this study’s results regarding Egypt agree with those reported by Dahawy (2008) where he found the level of disclosure in Egypt is low and that non conformity to corporate governance code may be because companies are not convinced of the needs and benefits of corporate governance.

Conclusion and Future Expansion of Research

This study examines the disclosure and transparency of accounting information revealed by banks to different users and the relationship between this and a potential improvement in corporate governance and quality of information. The research starts by justifying the choice of banks to be the focus of examination. Banks in Arab countries and around the world suffered huge losses due to the credit crisis in the UAE in 2006, some of the money lost belonged to states rather than individual. Therefore it was worthwhile to discuss how those and other users of accounting information can be better informed about decisions and performance. The world financial crisis all over the world and some bank scandals in Egypt fed the desire to provide higher quality accounting information that are more, timely and credible. Data collected from the financial reports of banks in both countries and other sources are analyzed. Primary findings show support for the research hypotheses. Splitting data to before the world financial crisis and after, show more disclosure about financial items, operations abroad, directors and their remuneration in both countries (higher for the UAE which was hit larger by the crisis). It is also found a positive association between disclosure and quality of information in terms of the timeliness and credibility (with higher scores for the UAE). The differences between the two countries could be referred to more exposure to international market (financial and trade) in the UAE when compared to Egypt. Other reasons for the differences are relatively more ownership concentration and bigger bank resources in the UAE when compared to Egypt. This research could be expanded further by examining the effects of the variables that make the change between banks’ environment in the two countries and each of corporate governance practices and accounting disclosure. The analysis may extend to examine the effects of each of the following factors: years of service and size of operations in one hand and accounting disclosure and transparency or quality of accounting information on the other hand. It could also examine effects on specific corporate governance items such as shareholders’ protection industries which have enough shareholding (no ownership concentration) to examine.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Baydoun, N., Ryan, N. & Willett, R. (2005). “Corporate Governance in Five Arabian Gulf Countries,” [Feb. 2, 2011],Http://Apira2010.Econ.Usyd.Edu.Au/Conference_Proceedings/APIRA-2010-281-Willet-Corporate-Governance-In-Five- Arabian-Gulf-Countries.Pdf.

Publisher

Bebczuk, R. N. (2005). “Corporate Governance and Ownership: Measurement and Impact on Corporate Performance in Argentina,” Inter-American Development Bank, Research Network Working Paper #R-516.

Publisher – Google Scholar

Bezemer, (2009). “No One Saw This Coming: Understanding Financial Crisis through Accounting Models,” MPRA Munich Personal Repec Archive, [As In April 22, 2011], Http://Mpra.Ub.Uni-Muenchen.De/15892/.

Publisher

Bushman, R. M. & Smith, A. J. (2003). “Transparency, Financial Accounting Information and Corporate Governance,” 0FRBNY Economic Policy Review, 65-87.

Publisher – Google Scholar

Calderón, C. A., Loayza, N. & Schmidt-Hebbel, K. (2005). “Does Openness Imply Greater Exposure?,” [April 11, 2011] Http://Www.Cnb.Cz/Miranda2/Export/Sites/Www.Cnb.Cz/En/Research/Seminars_Workshops/2006/ 2006_02-21_Schmidt-Hebbel_B.Pdf.

Publisher – Google Scholar

Dahawy, K. (2008). “Developing Nations and Corporate Governance: the Story of Egypt,” [May 11, 2011],Http://Www.Ifc.Org/Ifcext/Cgf.Nsf/Attachmentsbytitle/Paperkhaleddahawy/$FILE/Dahawy_Kahled4.Pdf.

Publisher

Egyptian Banking Institute (July 2006). “Survey Results: Corporate Governance Survey of the Egyptian Banking Sector,”

Publisher

Hawkama and OECD (2005). Report on Brief Policy on Corporate Governance of Banks- Building Blocks.

Publisher

He, H., El Masry, EL.- H. & Wu, Y. (2008). “Accounting Conservatism of Cross-Listing Firms in the Pre and Post Sarbanes Oxley Periods,” Advances in Accounting, 24 (2), 237-242.

Publisher – Google Scholar

Kilmister, A. (2008). “The Economic Crisis and its Effects,” the View from Britain, IV Online Magazine, 407, [May, 28, 2011, Http://Www.Internationalviewpoint.Org/Spip.Php?Article1581.

Publisher

Koldertsova, A. (2010). “The Second Corporate Governance Wave in the Middle East and North Africa,” OECD Journal: The Financial Market Trends, Issue 2.

Publisher – Google Scholar

Samaha, K. & Dahawy, K. (2011). “An Empirical Study of Corporate Governance Structures and Voluntary Corporate Disclosure in Volatile Capital Markets: the Egyptian Experience,” International Journal of Accounting, Auditing and Performance Evaluation, 7 (1-2), 61-93.

Publisher – Google Scholar

Siegel, J. (2008). ‘The Quality of Earnings Concept- A Survey,’ Financial Analysts Journal.

The Central Bank of Egypt, [April 11, 2011], Http://Www.Cbe.Org.Eg/.

Publisher

The Central Bank of the UAE, [March 12, 2011], Http://Www.Centralbank.Ae/En/Index.Php.

The Encyclopedia of The Nations. “Egypt- Banking And Securities,” [March 11, 2011],Http://Www.Nationsencyclopedia.Com/Africa/Egypt-BANKING-AND-SECURITIES.Html.

Publisher

UAE Interact: Dubai Islamic Bank Buys US$102m Stake in Tamweel Posted On 04/04/2011,

Http://Www.Uaeinteract.Com/Russian/News/Default.Asp?ID=141http://Www.Uaeinteract.Com/Russian/News/ Default.Asp?ID=141

Publisher

Walton, H. & Merali, Z. (2009). “Corporate Governance Regulations in the Arabian Gulf,” Clyde and Co., [April 28, 2011], Http://Www.Clydeco.Com/Knowledge/Articles/ Corporate Governance Regulations in the Arabian Gulf.

Publisher

Woertz, E. (2008). “Impact of the US Financial Crisis on GCC Countries” Gulf Research Center Report.

Publisher – Google Scholar

World Bank Report (2004). Report On The Observance of Standards and Codes (ROSC)– Corporate Governance Country Assessment- Egypt.

Publisher

2011 Index of Economic Freedom, The Heritage Foundation and Wall Street Journal.