Introduction

There have been massive fraud and unethical practices within and among a number of organizations in Nigeria including Unilever Plc. Quadri (2010) posited that “the recent insider trading, massive and prevalent frauds, mandatory retirement of CEOs of banks, due to corrupt practices and inefficient rubber-stamped board, have combined to signal the absence of or failure of existing corporate governance structure”. In addition, the Companies and Allied Matters Act (CAMA) 2004 which was enacted to ensure that the relationship among the board, shareholders and the management including other stakeholders is balanced for healthy competition has not lived up to expectation both from the government and the public at large.

The events had serious devastating effect on stakeholders in terms of losses in their investments. The events also resulted in the loss of hundreds of jobs especially in the manufacturing sector and drastic drop in the share prices of most listed companies on the Nigerian Stock Exchange Market. The shock to the stakeholders and the public led to the yet unanswered question of ‘how’ such event could have happened when companies were declaring billions of Naira in profit. Therefore, the trust which investors had on the credibility and the quality of financial report presented by the management of companies could no longer be sustained as they were considered misleading. Hence, a higher need to protect stakeholders’ interest so as not to have another overwhelming shock becomes imperative. The cumulative effects of the ugly events led to the total overhaul of the Nigerian Code of Corporate Governance by the Securities and Exchange Commission (SEC) in 2011.

The overhaul was particularly instructive because the audit committees of companies were severely criticized because they are charged with the responsibility to oversee the financial and other reporting process of organization in order to enable them show credibility, integrity and transparency in their operations, including financial reporting. Oniwinde (2010) posits that the reported cases of poor and fraudulent financial reporting and governance experienced recently in Nigeria demonstrated the role the audit committee has to play either directly or indirectly as they are charged with overseeing financial reporting. The responsibilities bestowed on them due to information asymmetry between the management and the owners of the business was expected to ease the agency problems which would invariably lead to the reduction of agency cost when the substantial interests of the owners are aligned with the company’s interests (Yayah, Abdullah, Faudziah & Ebrahim, 2012). However, this objective seems not to have been realized in Nigeria.

In the light of the foregoing, various authors have studied the audit committee as an instrument of good corporate governance (Owolabi and Dada, 2011; Kumar and Singh, 2012) and also their influence on the financial reporting process for better performance. In their study, Mohiuddin and Karbhari (2010) found that an audit committee that will influence corporate financial reporting positively and effectively carry out their agency duties must possess certain attributes such as independence, financial expertise, membership mix, size and number of meetings. These are in line with the revised SEC Code of 2011.

Similar studies have also been carried out in the context of Nigeria (see Mohammed & Oladele, 2008; Uwuigbe, 2013). These studies have focused on corporate governance and the financial performance of firms in Nigeria. Thus, the question still remains: what is the impact of audit committee characteristics on the financial performance of firms in Nigeria? The objective of this study, therefore, is to examine the relationship between audit committee characteristics and firm performance in the context of Nigeria’s manufacturing companies. The audit committee characteristics are decomposed into: independence, financial expertise, meetings and size while performance is captured by Return on Equity (ROE), Return on Assets (ROA) and Return on Capital Employed (ROCE).

The rest of the paper is structured into four parts. Part 2 discusses the literature and hypotheses development and part 3 the methodology, part 4 discusses the analysis and implications of findings while part 5 is the conclusion and recommendations.

Literature Review and Hypotheses Development

Every public company in Nigeria is mandated under Section 359 (3) and (4) of the CAMA to establish an audit committee. It is the responsibility and the function of the Board to make sure that the committee is constituted according to the laid down policies which would make it able to effectively carry out its statutory duties and responsibilities. There are many indicators or variables that may form yardsticks by which audit committee can be measured in an organization. Some of these yardsticks which have earlier been identified are briefly discussed below.

Audit Committee Independence and Financial Performance

The independence of directors of companies has been widely discussed in the literature. Klein (2002) found that having outside directors on the board enhances and promotes corporate performance and the returns to shareholders. Similarly, independent directors are better monitors of management than are inside directors (DeFond and Francis, 2005). In like manner, the outside directors are seen as acting in the interest of shareholders which makes a significantly excess return follows the appointment of outside directors (Sanda, Garba & Mikailu, 2011). This is particularly true when independent directors are members of the audit committee. For instance, Anderson, Mansi and Reeb (2004) found that full independent audit committees brings about lower debt financing costs which indicates that all the members must be independent before there could be any significant impact. Based on the foregoing, the following hypothesis is proposed:

H1: A significant relationship does not exists between audit committee independence and Return on Equity, Return on Asset and Return on Capital Employed (ROCE) of listed manufacturing companies in Nigeria

Audit Committee Financial Expertise and Financial Performance

The issue of financial expertise for at-least one audit committee member was first recognized under Section 359 (3) and (4) of the CAMA. This was further re-echoed in the SEC code of 2011. And this has support in the literature. Carcello, Hollingsworth, Klein and Neal (2006) opined that having a member of an audit committee that possesses a financial expertise would likely reduce earnings management for firms where the corporate governance mechanisms are weak. Similarly, Qin (2007) found that firms with higher quality of earning are more associated with audit committee members who have financial expertise. This position has also been confirmed in more recent studies. Bouaziz (2012) found that “audit committee financial expertise has a significant impact on returns on equity and return on asset”. Based on the above evidence, a positive relationship between audit committee financial expertise and firm financial performance is expected. This study therefore hypothesized as follows:

H2: A significant relationship does not exists between audit committee financial expertise and Return on Equity, Return on Asset and Return on Capital Employed (ROCE) of listed manufacturing companies in Nigeria

Audit Committee Meeting and Financial Performance

The Code of best practice (2003) in Nigeria recommends that the audit committee meets not less than three times a year. Chen and Zhou (2004) noted that audit committee meetings serve as an important mechanism for improving and promoting corporate governance in firms. There is likeliness that financial fraud would be reduced if the audit committee meets frequently and carry out its duties as required (Stewart & Munro, 2007). The frequency of audit committee meetings has also been observed to have positive influence on return on equity (Azam, Hoque and Yeasmin, 2010). This paper therefore hypothesized that:

H3: A significant relationship does not exists between audit committee meetings and Return on Equity, Return on Asset and Return on Capital Employed (ROCE) of listed manufacturing companies in Nigeria

Audit Committee Size and Financial Performance

It is the requirements of some Stock Exchanges that the audit committee for the listed companies be made up of three members (Al –Sa’eed & Al-Mahamid, 2011). However, CAMA (1990) sec. 359 specifies the maximum number of audit committee members in Nigeria as six but did not specify the minimum. Bedard, Chtourou and Courteau (2004) have argued that when the audit committee is large, the control and oversight functions over the accounting and financial processes increase. In agreement to this Anderson, Mansi and Reeb (2004) found that large size audit committees with a large size has the potential to protect and control the process of accounting and finance by bringing in greater transparency. A very large audit committee can bring about dispersion of responsibility and process losses (Karamanou & Vafeas, 2005). This hypothesis is therefore drawn:

H4: A significant relationship does not exists between audit committee size and Return on Equity, Return on Asset and Return on Capital Employed (ROCE) of listed manufacturing companies in Nigeria

Research Methods

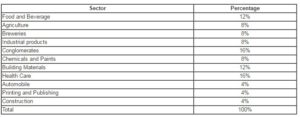

The focus of this study is on the manufacturing sector in Nigeria. According to the Nigerian Stock Exchange listings, the total number of manufacturing firms is 110. In obtaining the sample for this study, the judgmental non-probability sampling technique was employed. As a result, a sample size of 25 companies listed on the Nigerian Stock Exchange from 2004 to 2011 was selected based on the availability and accessibility of the financial report of the chosen companies. The sectors include: Agriculture, Food and Beverage, Conglomerates, Health care, Building material, Industrial goods, Printing and Publishing, Automobile, Breweries, Chemicals and paints and Construction/Real estate.

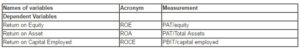

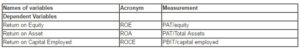

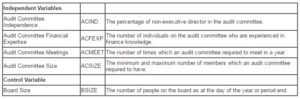

The firm performance was measured by Return on Equity (ROE), Return on Asset (ROA) and Return on Capital Employed (ROCE) as the dependent variables, while the independent variables were measured by four audit committee characteristics namely: audit committee independence (ACINDP), audit committee financial expertise (ACSFEXP) and one control variable, board size (BSIZE), audit committee meetings (ACMEET) and audit committee size (ACSIZE).

Table 3.1: Synopsis of Variables’ Measurement/Description

Summary of Variables Measurement/Description (continued)

Model Specification

However, the following mathematical model was developed to analyze the relationship that exists between financial performance and audit committee effectiveness as represented below:

Y= β0 + βX1 +µit……………………………………………………………………………………………………………………….. (1)

Where, Y represents the dependent variable. β0 is constant, β is the coefficient of the explanatory variable (audit committee effectiveness), βX1 is the independent variable and eit is the error term.

Representing equation (1) above in an econometric model, equation (2, 3 &4) below therefore becomes:

ROAit= β0+β1ACINDit+ β2ACFEXPit+ β3ACMEET it+β4ACSIZEit + BSit +µit ……………….………… (2)

ROEit= β0+ β1ACINDit+ β2ACFEXPit+ β3ACMEET it+β4ACSIZEit + BSit + µit………………………………. (3)

ROCEit= β0+ β1ACINDit+ β2ACFEXPit+ β3ACMEET it+β4ACSIZEit + BSit + µit…………………………… (4)

Analysis and Presentation of Results

The data presented involved tables and figures which were used for the descriptive statistics and correlation analysis and regression analysis for the hypotheses testing.

Descriptive Statistics

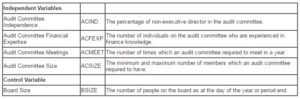

Table 4.1: Distribution of Samples

Table 4.1 shows the sample distribution of each sector in the manufacturing industry. While Conglomerates account for the highest as a result of the accessibility of the financial statements, the automobile, printing and publishing and construction came last. This was because the financial statement of these sectors is not easily assessable. But overall, all the sectors are fairly represented in the sample.

Table 4.2: Descriptive Statistics for all the selected Sectors (2004-2011)

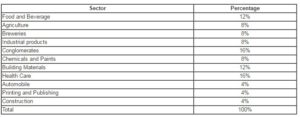

The result in table 4.2 showed on the average, that, there are two financial experts in the audit committee in the Nigerian manufacturing industry as denoted in the biographical information of members, but surprisingly they do not meet more than 2 times in a year as against minimum four times specified in the Securities and Exchange Commission Codes of 2011 in Nigeria. However, the industry maintained on the average a required six members that Company and Allied Matters Act (2004) stipulated, whereas the percentage of non-executive directors in the audit committee was not quite encouraging considering the figure. The table also shows a mean score of 11, 20 and 31 on ROA, ROE and ROCE respectively. These low figures could be as a result of the credit crunch suffered in the system during the financial meltdown, and also- infrastructural facilities lacking in Nigeria for example power (electricity) which has increased the cost of production in the country. However, with those attendant challenges, the industry was still able to generate relatively high return on capital employed when compared with ROA and ROE.

Correlation Analysis

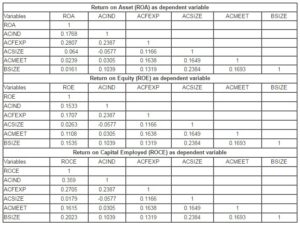

Pearson Moment Correlation was carried out on both the dependent and explanatory variables to check for multicollinearity and relationship between the various variables in the study. Gujarati and Porter (2009); Hair, Black, Babin and Anderson (2010) reasoned 0.8 as the threshold at which multicollinearity concerns can be harmful to the regression analysis and make the reliability or the positive power of the model as a whole to be reduced.

Table 4.3: Result of Pearson Correlation Analysis of independent variables and ROA, ROE and ROCE

The correlation matrix as shown in table 4.3 indicates that the assumption of multicollinearity has not been violated because none of the variables is greater than 0.7 and 0.8. All the variables were positively correlated to one another apart from the ACIND and ACSIZE which show a negative sign.

Multiple Linear Regression Analysis

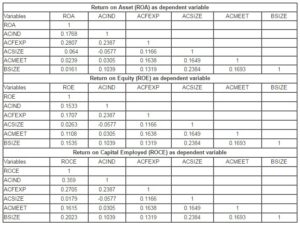

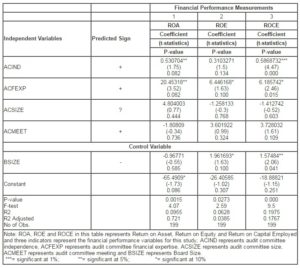

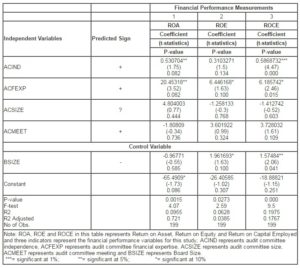

Table 4.4: Regression Results: Whole Sample

Note: Numbers in each cell are arranged in the following order-Coefficient, t-values (in parenthesis) and P-values.

From table 4.4, the results showed that, the audit committee independence (ACIND) had positive signs in all the three equations (i.e. ROA, ROE and ROCE), but was significant in two of them i.e. ROA and ROCE at 10% and 1% level of significance respectively. Thus, the null hypothesis was rejected in favor of the alternative hypothesis with respect to ROA and ROCE. This indicates that, audit committee independence (i.e. number of non-executive directors in the audit committee) is good for firm financial performance. This result supports our early expectation of positive relationship and is in agreement with earlier studies such as Chan and Li (2008), whose result shows that a significant positive relationship between Tobin’s Q and independence of the audit committee exist. Mohiuddin and Karbhari (2010); Sanda, Garba & Mikailu (2011) also concluded in like manner that, outside directors are seen as acting in the interest of shareholders in that the appointment of outside directors is accompanied by significantly positive excess returns. However, this finding is in contrast with the submission of Hsu (2007) who failed to establish any relationship between audit committee independence and performance. Yayah, Abdullah, Faudziah and Ebrahim (2012) also found audit committee independence (ACIND) to be insignificantly related to performance.

With respect to audit committee financial expertise (ACFEXP), the result supports earlier expectation. It shows that audit committee financial expertise (ACFEXP) has positive impact on the financial performance (ROA, ROE and ROCE). The impact is also significant at the 10% and 5% respectively for ROA and ROCE. ROE is insignificant. The result partly supports the alternative hypothesis that audit committee financial expertise positively and significantly influences the firm’s financial performance. This result is consistent with prior studies (see Bouaziz, 2012).

In term of audit committee size (ACSIZE), the result shows a positive sign for ROA, ROE and ROCE but not significant. This indicates that audit committee size (ACSIZE) does not influence the financial performance of firms in Nigeria. Therefore, this study concludes that there is no relationship between audit committee size and the firm’s financial performance. Mere size may not be enough for financial performance. This study is in contrast with Yayah, Abdullah, Faudziah and Ebrahim (2012) who found a negative but significant relationship between audit committee independence and performance in Saudi Arabia’s firms.

Similarly, audit committee meeting shows positive sign with respect to ROA, ROE and ROCE but was not significant. The audit committee in the manufacturing sector in Nigeria meets on the average two times as seen in table 4.2 which indicates that, audit committee meeting does not influence the financial performance of firms in Nigeria. This result is in agreement with previous studies Yayah, Abdullah, Faudziah and Ebrahim (2012) who found that audit committee meeting (ACMEET) was insignificantly related to the performance of firms in Saudi Arabia. The audit committee could be meeting just to comply with the requirements of various governmental agencies (e.g. Central Bank of Nigeria and Securities and Exchange Commission’s) and not necessarily carrying out roles that can enhance the financial performance of firms.

Conclusion

This study investigated the relationship between audit committee effectiveness and the firm’s financial performance in Nigeria. The results showed that certain measures of audit committee effectiveness (such as audit committee independence, audit committee financial expertise and board size) have positive coefficients and significantly influence the firm’s financial performance. Although, the result showed that audit committee meeting had a significant positive relationship with return on capital employed (ROCE), but generally the result showed that audit committee size and audit committee meeting did not add value to the firm’s financial performance in Nigeria.

The results suggest important implications for practitioners and policy makers in Nigeria. One important and major implication is that, audit committee members with financial expertise do contribute significantly to the financial performance of firms and likewise the independence of the members. Therefore, Nigeria needs to strengthen policies by ensuring that the provision made in the Nigeria Securities and Exchange Commission Code of 2011 about the financial expertise of audit committee members is made compulsory particularly when new members are being considered. The particulars and biographical data of members of the audit committee with required experience and expertise should as a matter of compulsion, be disclosed in the annual financial report. In addition, the independence of audit committee members should be enhanced by ensuring that more of independent directors are introduced into the audit committee as against non-executive directors who still hold one form of interest or the other in the firm.

This study, like other previous studies, does have its limitations and therefore, the conclusions drawn should be interpreted with caution which would invariably serve as opportunities for further investigation in future research in this area. First, although this study captured the listed manufacturing sector in Nigeria, companies which operate in the financial sector are excluded since they have special practices and operations. Second, this study adopted the general definition of financial expertise; however, future research could consider the narrower definition. Also, the financial expertise was looked at generally without decomposing it into accounting, finance and supervisory expertise. This could help in future research. Third, only four characteristics of the audit committee were considered in the study. Hence, future study could investigate other audit committee characteristics that are not included in this study such as female members, state of origin of the members, and political connection(s) of the members.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Al-Mahamid M. A. and Al –Sa’eed S. M. (2011), ‘Features of an Effective Audit Committee, and its role in Strengthening the Financial Reporting: Evidence from Amman Stock Exchange’, Journal of Public Administration and Governance.

Google Scholar

2. Anderson, R. S. Mansi, D. and Reeb, (2004), ‘Board Characteristics, Accounting Report Integrity, and the Cost of Debt’, Journal of Accounting and Economics, 37(1), 315–42.

Google Scholar

3. Azam, M.N., Hoque, M.Z. and Yeasmin, M. (2010), ‘Audit Committee and Equity Return: the case of Australian Firms’, International Review of Business Research Papers, 6(4), 202-208.

Google Scolar

4. Be´dard, J., Chtourou, S. M. and Courteau, L. (2004). ‘The Effect of Audit Committee Expertise, Independence and Activity on Aggressive Earnings Management’, Auditing: A Journal of Practice & Theory, 23(2), 13-35.

Publisher – Google Scholar

5. Bouaziz, Z. (2012), ‘The Impact of the Presence of Audit Committees on the Financial Performance of Tunisian Companies’, International Journal of Management & Business Studies, 2, 4.

Google Scolar

6. Carcello, J.V., Hollingsworth, C.W., Klein, A. and Neal, T.L. (2006), “Audit Committee Financial Expertise, Competing Corporate Governance Mechanisms and Earnings Management”. Retrieved 3/7/2013 from http://ssrn.com/abstract= 887512.

Google Scholar

7. Chan, K. C. and Li, J. (2008), ‘Audit Committee and Firm Value: Evidence of Outside Top Executives as Expert-Independent Directors’, Corporate Governance: An International Review, 16(1), 16-31.

Publisher – Google Scholar

8. DeFond, M. L. and Francis, J.R.(2005), ‘Audit research after Sarbanes-Oxley’, Auditing: A Journal of Practice & Theory, 24

Google Scolar

9. Gujarati, Damodar N. and Dawn C. P. (2009) Basic Econometrics. New York, NY: McGraw-Hill Irwin.

10. Hair, J.F. Jr., Black, W.C, Babin, B.J. and Anderson, R.E. (2010) Multivariate Data Analysis: A Global Perspective. (7th ed.). New Jersey: Pearson Education Inc.

11. Hsu, H. (2007) Boards of Directors and Audit Committees in Initial Public Offerings. DBA Dissertation. Nova Southeastern University

12. Karamanou, I. and Vafeas, N. (2005), ‘The Association between Corporate Boards, Audit Committees and Management Earnings Forecasts: An Empirical Analysis’, Journal of Accounting Research, 43(3)

Publisher – Google Scholar

13. Kumar, N. and Singh, J. P. (2012), ‘Audit Committee as Corporate Governance Mechanism; Myths and Realities. 9th Aims International Conference on Management.

14. Mohammed, K. and Oladele K. ( 2008), ‘Corporate Governance and Firm’s Performance in Nigeria’, KASU Journal of Management Sciences, 1(4)

15. Mohuiddin, Md. and Karbhari, Y. (2010), ‘Audit Committee Effectiveness: A Critical Literature Review’, Journal of Business and Economics, 9, 97-125.

16. Oniwinde, I. (2010), ‘Corporate Governance in Nigeria Manufacturing Industry Ogun: Covenant University. Unpublished (Bsc Degree Thesis), Covenant University.

17. Owolabi, S.A. and Dada, S.O., (2011), ‘Audit Committee: An Instrument of Effective Corporate Governance’, European Journal of Economics, Finance and Administrative Sciences, 35.

18. Quadri, A. H. ( 2010), ‘Conceptual Framework for Corporate Governance in Nigeria: Challenges and Panaceas’, PM World Today, Vol XII, Issue IX)

Google Scholar

19. Uwuigbe, O.R. (2013), ‘Corporate Governance and Share Price: Evidence from Listed Firms in Nigeria’, An International Multidisciplinary Journal, 7 (2), 129-143

Google Scholar

20. Sanda, A.U. Garba, T. and Mikailu, A.S. (2011), ‘Board Independence and Firm Financial Performance: Evidence from Nigeria’, AERC Research Paper 213 African Economic Research Consortium, Nairobi

21. Stewart, J. and Munro, L. (2007), ‘Auditor Perceptions of the Impact of Audit Committees and the Frequency of Audit Committee Meetings on the External Audit’, International Journal of Auditing’, 11(1), 51-69.

Publisher – Google Scholar

22. Yayah, A.A., Abdullah, K.A., Faudziah, H.B.F. and Ebrahim, M.A. (2012), ‘Board of Directors, Audit Committee Characteristics and Performance of Saudi Arabia Listed Companies’, International Review of Management and Marketing, 2(4), 241-251

Google Scholar

23. Zhou, J. and Chen, K. Y. (2004), ‘Audit Committee, Board Characteristics and Earnings Management by Commercial Banks. Working Paper. SUNY at Binghamton and National Cheng Kung University. Retrieved 20/8/2013 from www. ssrn.com