Introduction

An essential element of the management and, at the same time, a specific instrument is the decision. The decisions made and their degree of applicability shows the quality of the management of an entity. In order for a decision to be good, the knowledge of business is required, of management’s objectives, as well as the knowledge of staff who will attend the fleshing out of the decision. When we talk about the knowledge of staff we mean training and motivation, the interests and its qualitative potential.

At the same time, the managerial decisions are influenced by the type of accounting method used. What if, by analyzing the income and expenses of the economic entity, it is noticed that the entity has made profit, but posts the treasury deficit? The manager will review the cost bearers – phase, product, department, work point, etc. – and he will find that some centers of cost bring higher profit to the entity than other cost centers. Looking through the prism of the treasury, he will notice that what it was considered less profitable it bring the cash surplus, and what is considered profitable to bring the treasury deficit.

For the decision to be optimal there must be the “knowledge”. The manager must know and understand the economic information. “The economic information helps us to observe how to use the material and human resources, to realize and to examine critically the positive aspects but also the existence of deficiencies in order to take the needed measures. To manage an entity means, on the one hand, to know thoroughly the current task and to interfere with operative decisions in its management, and on the other hand, the supposed future evolution and elaboration of the forecasts to outline the directions of development in the perspective of that entity. “(Briciu Sorin, 2006, page. 9) The managers must be familiar with the information offered by the accounting method “accrual” and “cash accounting”; they must know and distinguish the treasury profits using those two methods.

Romanian accounting regulations provide the use of the accounting method “cash” only by taxpayers who obtain income from independent activities (Public Finance Minister Order No. 1040/2004) and, from the category of companies without patrimonial purpose, the religious entities and associations of owners (the Order of the Minister of Economy and Finance 1969/2007). The question arises whether the accounting method “cash” could be used in Romanian entities, or even just for those that meet certain conditions, would this lead to a recovery of the economy? The Romanian businessman would know that recognizing the expenses just at the time of payment; would he pay his debts according to the due dates? By recognizing the income only when he receives cash, would he be aware that he pays taxes on the profit actually realized?

In what follows, we will present a comparative study of the influence of the accounting methods “cash” and “accrual” in making decisions, comparing the results of the activity of the five entities, in five different areas of activity over a period of five years.

The Methodology of Research

Annual financial statements represent the mirror of an entity that allows an appreciation of the entity’s performance and of the financial position on the current period, but also compared with the previous period. “The main financial situation used for the interpretation of the performance of the entity is the profit and loss statement. It interprets the elements that contribute to the calculation of the profitability indicators, starting from the fundamental relationship: Income – Expenses =Results “(Liliana Feleagă, Niculae Feleagă, 2007, page 19).

In the research conducted for the elaboration of the present work, I started from the fundamental research to produce the theory through a reading of the scientific opinions expressed at this stage of knowledge. I have reviewed the literature and the annual financial reports of the five different entities: Transport of goods, Dental healthcare, Repair of computers and peripheral equipment, Maintenance and repair of motor vehicles, Repair of household appliances and home equipment.

As a support generator of the possible explanations and information, I used the descriptive research through the description of the main elements relating to the entity’s performance and managerial decisions taken as a result of accounting information. To identify differences and similarities between the entities, I resorted to comparative research by developing a comparative study of the activities of the five companies, in five different areas of activity over a period of five years.

At last, but not least, we have used the research for building the theory in the sense that this case study will be the basis of other studies of the indicators used in the financial and economic analysis of the entities mentioned. Here, we recall the length of rotation of stocks, receivables and payables and the influence they can have on managerial decisions when using the accounting method of “accrual” but also in accounting method “cash”.

The State of Knowledge

In the Romanian and European accounting, accrual accounting is based on the principle of delimitation in time of the revenue and expenditure or the principle of the independence of the fiscal year. According to this principle, revenues and profits, as well as costs associated with them are highlighted in the same fiscal year.

Accounting method “accrual” –accrual accounting – is a real aid for the management of the entities, as it presents a better knowledge of the financial situation at a time. Accrual accounting provides important information for a better control over the economic operations of the entity, as well as for the management of assets, debts and risks inherent in the activity of the multiannual perspective. Treasury accounting method-method “cash”- is defined as a key in the evaluation of the real estate of the entity because it seeks recognition of the main operations through the treasury, through the treasury understanding both liquidity and cash equivalents.

Putting face to face two accounting experts – one carrying an independent activity through an individual chartered cabinet, the other one through a limited liability company, with sole proprietor – we will find that in the same field of activity, about the same volume of revenue – the result differs significantly. And no thanks to spending.

The individual cabinet, using the accounting method of “cash” recognizes income only upon receipt and expenditure just at the time of payment. Limited liability company using accounting method accrual-method “accrual”-recognizes income from professional activity at the time of the billing. This fact leads to the tax liability whether or not the money was received, which may destabilize the entity through a shortage of the treasury. These differences can be found in other areas of activity (production, services, etc.): company activity versus healthcare medical office, production company versus furniture carpenter –as individual, company for transport of goods versus individuals authorized to carry freight activity, etc. The list goes on.

In his doctoral thesis – “From accrual accounting to cash accounting in the management of controlled resources “ “– Mrs. Baban Cristina-Lucia (2010) presents accrual accounting as being generally accepted for recognition of economic transactions in the accounts when they occur and not when there is the time of payment or collection. The exception to this rule is the use of cash flows, which are based on the accounting method of cash. The managerial team, through its policies, must track the cash flow through the flows obtained from the basic activity and their use, the outcome of the cash to be done for investment and financing activities.

The international accounting standards council – IASB – through the general framework concerning the preparation and presentation of financial statements does not prohibit the use of the cash accounting, but requires the financial statements to be drawn up on the basis of accrual accounting for the effects of transactions and events to be reported in the financial statements for the period in which they occurred.

Financial practice, as well as theory on the financial side of an entity, indicates an interest of users of the information provided by the financial statements of an entity, in the formulation of decisions taking into account the entity’s ability to generate cash flows in the period ahead. Statements of cash flows provide information about how the company generates and uses the liquidity and cash equivalents.

The European Commission, through the Guide on the new financial reporting system of the EU: “The upgrading of EU accounts – a better management of the information and increased transparency” available at the web address of http://ec.europa.eu/budget/library/biblio/publications/modern_accounts/modernising_EUaccounts_ro.pdf, presents information about reform ABAC (Accrual Based Accounting – accounting of commitments), whose goal was to steer the general accounting towards an accrual accounting system since 2005. In January 2005, the new accounting system became operational, and a new series of accounting standards enter into force.

Case Study

For the elaboration of the case study, excerpts from the annual financial statements of five entities in different areas of activity are presented: road transport, dental care, repair of computers and peripheral equipment, maintenance and repair of motor vehicles and the repair of household appliances and equipment for the home.

In our opinion, what makes the subject of the current research is the result set after subtracting the expenses from income and the result set after the deduction from the receipts of the gross payments. Starting from the result determined by accrual accounting, through adjustments, we will calculate the result determined by the accounting method of cash. The support for the case study is the balance sheet and the profit and loss statement.

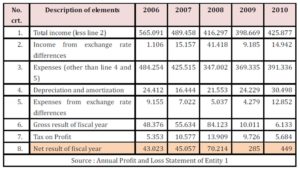

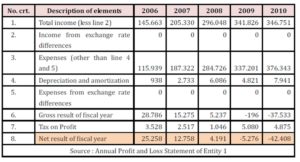

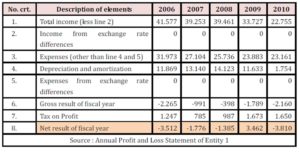

Entity 1: Limited Liability Company with a capital of 200 RON that has as main activity the road transport of goods. Extracts from the annual profit and loss statement of the entity in question are presented in Table 1.

Table 1: Extract from the Profit and Loss Statement of Entity 1

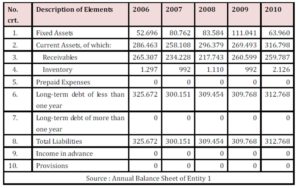

Extracts from the annual balance sheets of the analyzed entity are presented in Table 2.

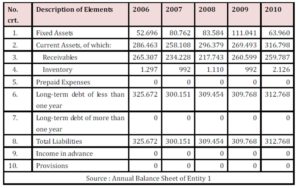

Table 2: Extract from Annual Balance Sheet of Entity 1.

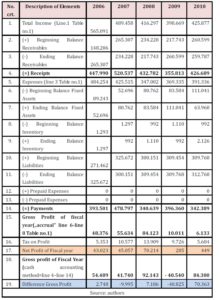

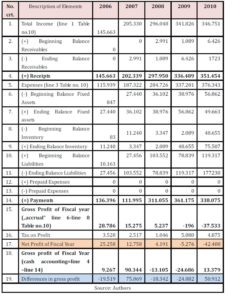

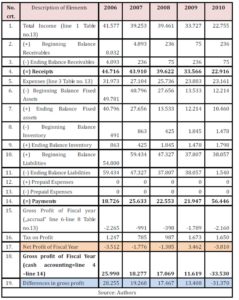

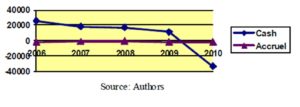

We will make the necessary adjustments to reflect the accounting method of cash during the period 2006-2010. These adjustments and the calculation mode are presented in Table3, and the graph of evolution is represented in Graph 1.

Table 3: Adjustments Made for Entity 1

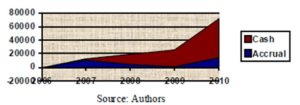

Graph 1. Evolution of Gross Profit Entity 1

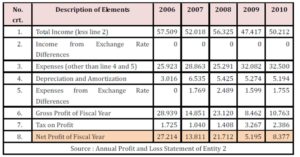

Entity 2: Limited Liability Company with a capital of 200 RON that has as main activity dental healthcare. Extracts from the annual profit and loss statements of this entity are presented in Table 4.

Table 4: Extract from Profit and Loss Statement of Entity 2

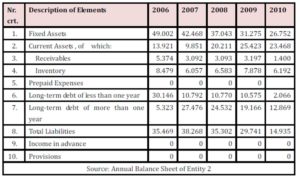

Extracts from the annual balance sheets of the company analyzed are presented in Table 5.

Table 5: Extract from Annual Balance Sheet of Entity 2

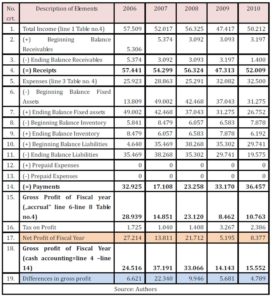

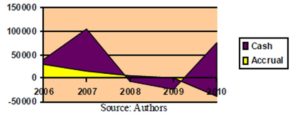

We will make the necessary adjustments to reflect the cash accounting method during the period 2006-2010. These adjustments and the calculation mode are presented in Table 6 and its evolution is represented in Graph 2.

Table 6: Adjustments made for Entity 2

Graph 2.Evolution of Gross Profit of Entity 2

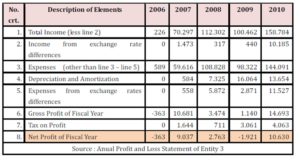

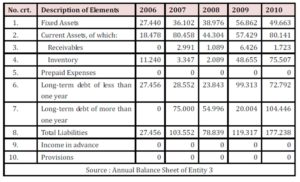

Entity 3: Limited Liability Company with a capital of 200 RON, that has as main activity the repair of computers and peripheral equipment. Extracts from the annual profit and loss statements of this society are presented in Table 7.

Table 7: Extract from Profit and Loss Statement of Entity 3

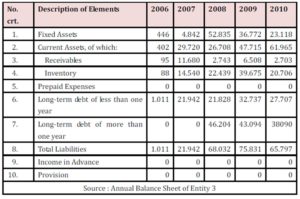

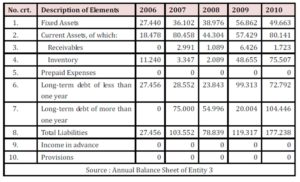

Extracts from the annual balance sheets of the company analyzed are presented in Table 8.

Table 8: Extract from annual balance sheet of Entity 3

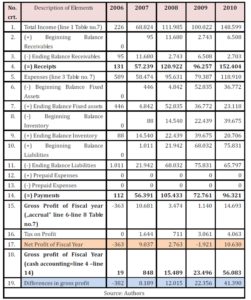

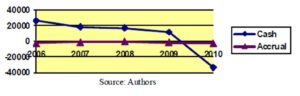

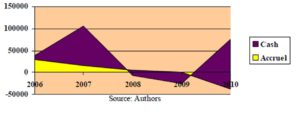

We will make the necessary adjustments to reflect the cash accounting method during the period 2006-2010. These adjustments and the calculation mode are presented in Table 9, and its evolution is represented in Graph 3.

Table 9: Adjustments Made for Entity 3

Graph 3: Evolution of Gross Profit Entity 3

Entity 4: Limited Liability Company with a capital of 200 lei, that has as main activity the maintenance and repair of motor vehicles. Extracts from the annual profit accounts of this society are presented in Table 10.

Table 10: Extract from the Profit and Loss Statement of Entity 4

Extracts from the annual balance sheets of the company analyzed are presented in Table 11.

Table 11: Extract from Annual Balance Sheet of Entity 4

We will make the necessary adjustments to reflect the cash accounting method during the period 2006-2010. These adjustments and the calculation mode are presented in Table 12, and its evolution is represented in Graph 4.

Table 12: Adjustments Made for Entity 4

Graph. 4: Evolution of Gross Profit Entity 4

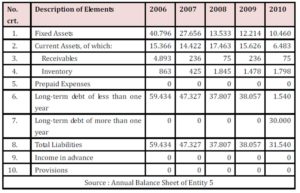

Entity 5: Limited Liability Company with a capital of 200 RON that has as main activity to repair household appliances and equipment for the home. Extracts from the annual profit and loss statements of this society are presented in Table 13.

Table 13: Extract from the Profit and Loss Statement of Entity 5

Extracts from the annual balance sheets of the company analyzed are presented in Table 14.

Table 14: Extract from Annual Balance Sheet of Entity 5

We will make the necessary adjustments to reflect the cash accounting method during the period 2006-2010. These adjustments and the calculation mode are presented in Table 15, and its evolution is represented in Graph 5.

Table 15: Adjustments Made for Entity 5

Graph 5: Evolution of Gross Profit Entity 5

Conclusions and Proposals

As noted in the case study presented, significant differences between gross results set by the method of “accrual” accounting are present in each entity examined.

Conclusions regarding the net result cannot be stated because on the period analyzed for determining the tax payable, the entities were applied with different rules to determine the tax liability (corporate tax, income tax, minimum tax). The managerial decision about achieving net profit may be affected by the type of the tax on the profit realized. If the tax on the result is the nature of tax on profit, the manager will make decisions mainly regarding expenditure of the entity; in the case of income tax , the trend of tracking the expenses is much diminished by the taxable result if not affected.

An influence on management decisions has the modality and the deadlines for receivables and payables. The decisions of realization of revenue cannot be influenced by accounting model “cash” because only a reduction of the period of liquidation of receivables can offer a different image of the entity. The same reasoning applies to payments. The period of settlement of receivables and payables is very important also in terms of fiscal influence, as it is less, so the result determined by accrual accounting method is approaching those determined by the method of “cash accounting”. If the results are close, the tax due on the result has similar values and the managerial decision is not influenced by the accounting method chosen, or is influenced only in small degree.

Having regard to the limitations of this case study, our objective is to continue the research in terms of economic and financial analysis of activity of the analyzed entities and the establishment of results in terms of indicators of efficiency – the rotation speed of the fixed assets, inventories, receivables and payables.

By this we believe that we will be able to identify the essential elements that help, on the one hand, the manager in making decisions, and on the other hand, the auditor in the evaluation of the managerial process, the risks associated with it, and also in the appreciation of the way in which the alternative accounting treatments were selected, the estimates, the methods applied in determining the results, in achievement of the targeted management objectives. (Dănescu Tatiana, 2007, p. 103).

The accounting treatments used influence the image of the entity’s annual financial statements, but this image must be analyzed also in terms of the factors that may affect the user in retrieving information required. Its purposes include: type of organization of entity, periods of settlement of receivables and payables, taxation of the result obtained, etc.

We conclude that there are differences of image by using different accounting models “cash” or “accrual”, but the one who makes the best difference is the manager of the entity through his decisions.

Acknowledgment

This paper has been financially supported within the project entitled “SOCERT. Knowledge society, dynamism through research”, contract number POSDRU/159/1.5/S/132406. This project is co-financed by European Social Fund through Sectoral Operational Programme for Human Resources Development 2007-2013. Investing in people!

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Briciu Sorin (2006). Contabilitatea managerială – Aspecte teoretice şi practice, Economica (Ed),9

2. Dănescu Tatiana (2007). Audit financiar. Convergenţe între teorie şi practică., Irecson (Ed.), 103

3. Feleagă Liliana & Feleagă Niculae (2007). Contabilitatea financiară. O abordare europeană şi internaţională, ediţia a II-a, Volumul 2 Contabilitate financiară aprofundată. Elemente de inginerie contabilă în contextul referenţialului internaţional, Economica (Ed.), 19

4. Baban Cristina-Lucia, Doctoral thesis„De la contabilitatea de angajamente la contabilitatea de trezorerie în managementul resurselor controlate”, Bucureşti, 2010, disponibilă la adresa http://www.biblioteca.ase.ro/resurse/resurse_electronice/teza_capitole.php?tid=1613&qs=sort%3Dtitlu%26dir%3Dup%26

pagina%3D13

5. OMFP nr. 1040 din 08/07/2004, published in Monitorul Oficial, Partea I nr. 642 din 16/07/2004

6. OMEF nr. 1969 din 09/11/2007, published in Monitorul Oficial, Partea I nr. 846 din 10/12/2007

7. http://ec.europa.eu