Introduction

Financial management crisis around the world has proven that risk management practices are indispensable for organisations that aim at sustaining customer and shareholder patronage. Before now, risk management was not seen as a central component to the operations of most organisations in Nigeria; rather, it was relegated to an office space at the corporate headquarters. Sanusi (2011) expressed the fusion of risk management and corporate governance flaws as a major factor responsible for the financial crisis in Nigeria. He further opined that:

“The surge in capital put pressure on… risk management frameworks. This led to the recent experience with margin loans and other high risk investments. Consequently, when the capital market’s bubble burst, the balance sheet of banks became eroded to the extent that some of them remained for some time on ‘life support’ from the CBN”.

In furtherance of the consequence of risk management, the Chairman of the Federal Reserve of US, Alan Greenspan, stated in a lecture delivered at Stern Business School that:

“Inevitably, risk management failures occur, and in two instances – the highly publicized cases of Barings and long term capital management – they proved destabilizing. … deficiencies in risk management will result in wide spread failures or that the failure of a very large derivative participant will impose heavy credit losses on its counterparties and yield a chain of failures.”

Thus this study intends to investigate the effects of risk management on the performance of financial institutions in Nigeria.

Research Hypothesis

H0: There is no relationship between risk management and financial performance of banks

Scope of Study

This study basically investigates the relationship between risk management and bank’s financial performance. In achieving this objective, the corporate annual reports for the period 2006 – 2012 were analyzed. Furthermore, the study considered a total of 14 listed banks in Nigeria. The choice of the banking sector is based on the pivotal role of the banking industry in triggering a financial crisis.

Literature

The retention of public confidence, through the enthronement of good corporate governance and the establishment of a well-structured risk management system remains of utmost importance to the players and drivers in the financial industry, given the role of the industry in the mobilization of funds, the allocation of credit to the needy sectors of the economy, the payment and settlement system and the implementation of monetary policy (Central Bank of Nigeria, 2006). Financial institutions are business organizations that act as mobilisers and depositories of savings, and as purveyors of credit or finance (Bhole 2004). They render services such as resource mobilization and allocation, financial intermediation and facilitation of foreign exchange transactions to enhance international trade (Merna, and Al thani 2008). The financial institution can be broadly classified into banking and non-banking financial institution. However, this study aligned its investigation towards the banking sector.

Banks and banking activities hold a pivotal role in the economy of any nation, especially in a developing country like Nigeria; their importance serves the following purposes as opined by (Levine 2004, Khalid and Hanif 2005).

1. They aid industrial expansion, efficient mobilization and allocation of fund

2. They boost capital formation

3. They stimulate productivity and growth

4. They provide finance for commercial enterprises

5. They provide basic financial services and access to payment systems to a broad segment of the population

6. They provide several lines of credit for their various customers.

The Nigerian Banking Situation

The Nigerian banking system has undergone remarkable changes over the years, in terms of the number of institutions, ownership structure, as well as depth and breadth of operations. These changes have been influenced largely by challenges posed by deregulation of the financial sector, globalization of operations, technological innovations and adoption of supervisory and prudential requirements that conform to international standards (Ogunleye, 2005).

More specifically, the banking institution has been plaque by several challenges as highlighted by the Central Bank of Nigeria, such as, Disagreements between Board and Management giving rise to Board squabbles, Ineffective Board oversight functions. Fraudulent and self-serving practices among members of the board, management and staff, overbearing influence of chairman or MD/CEO, especially in family-controlled banks, Weak internal controls, Non- compliance with laid down internal controls and operation procedures, ignorance of and non- compliance with rules, laws and regulations guiding banking business , poor risk management practices resulting in large quantum of non – performing credits including insider -related credits, succumbing to pressure from other stakeholders e.g. shareholder’s appetite for high dividend and depositors quest for high interest on deposits, gross undercapitalization in relation to the level and character of business, low earnings resulting in huge operational loss, weak management as reflected by poor asset quality, insider abuse, inadequate internal controls, unprofessional conduct. This has led to the declining state of the industry. (Central Bank of Nigeria, 2006, Ajie, Ezi, Akekere, and Ewubare, 2006, Adekanye, 2010)

Furthermore, the following issues arise from the special and peculiar nature of banks and banking operations, such as 1. The inability of depositors in protecting their interest (deposits), due to information asymmetry, 2. The nature of bank assets is usually opaque and lacking in transparency, 3. Bank instability will lead to a contagion effect, which would affect a class of banks or even the entire financial system of the economy, 4. Banks play a dominant role in developing economic financial systems and are important engines of economic growth (Arun and Turner, 2003). This institution cannot be handled negligently because of its overbearing importance to the economy. Thus, critical issues such as risk which threaten the core of their existence should be investigated.

Why Risk Management

The importance of risk management has become heightened in today’s competitive economic world. These cannot be underemphasized as the practice of risk management minimizes financial losses to the firm. In a study carried out by Ashby and Diacon (1994), as cited in Gerald Mars (2000), it was discovered that the practice of risk management in commerce stems largely from the need to avoid contractual, tortuous or statutory liability which has the capacity to dent the image of the organization. The danger of capital misallocation and imprudent risk taking has become the leading source of problem in the banking industry,; this has crippled many banks, thus, there is need to identify, measure, monitor and control all inherent risk in their day to day business transactions.

Risk Management and Performance

A major objective of bank management is to increase shareholders’ return signifying performance. The objective often comes at the cost of increasing risk. The banks motivation for risk management comes from those risks which can lead to banks underperformance

In Nigeria, a pioneer study carried out in this area of research i.e. risk management and performance was done by Akindele (2012), the study examined the effect of risk management and corporate governance on bank performance. The study revealed that there is a positive relationship between risk management and bank performance; furthermore, the study affirms that effective risk management enhance bank profitability and bank performances depends largely on risk management and corporate governance being enshrined into the organization. In carrying out the study, the researcher administered four hundred and eighty (480) questionnaires to employees of Wema Bank Plc and extracted data from the annual reports of the bank for the year 2008 and 2009 using financial ratios. The data gathered were analysed using a non-parametric statistics test named Chi-square. Similarly, a study carried out in Indonesia by Eduardus et al (2007) which served as a spring board for the study carried out by Akindele (2012), also affirms that risk management has a significant effect on bank performance. However, the research utilizes both primary data and secondary data analyses. The study analysed using Generalized Methods of Moments (GMM), for secondary data and bootstrap method, factor analysis, and 3-state least squares (3SLS) for primary data. This study also finds that the relationships between corporate governance and risk management and between corporate governance and bank performance are sensitive to the type of bank ownership.

Research Methodology

To accomplish the objective of this research, the study obtained data from the corporate annual reports of banks listed on the floor of the Nigerian Stock Exchange. The use of banks as a representative of the financial institution is based on the pivotal role that this industry occupies in the financial sector in Nigeria. Statistically in Nigeria the banking industry accounts for 65% of the total population that makes up the financial sector. This is consistent with minimum sample size as suggested by Krejice & Morgan (1970). In assessing the effect of risk management on bank’s financial performance this study made use of the regression analysis.

Model Specification

ROEit = f (NPLRit,CRit,LTDit RDISCit)

In a broader sense, this can be rewritten as:

ROEit = α + β1NPLRit + β2CRit + β3LTDit + RDISCit + εit

Where:

ROE: Return on Equity

NPLR: Non performing loan ratio

CR: Capital Ratio

LTD: Loan to Total Deposit

RDISC: Risk Disclosure

ι: represents the 14 banks in the sample

t: time period involved

β: Parameter of explanatory variable

α: Intercept

ε: Error term

Analysis of Results

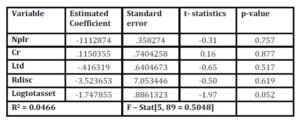

The coefficient of non-performing loan, loan to deposit, risk disclosure, and total asset show that there is an inverse non-significant relationship with return on equity. This implies that as return on asset decreases by one naira the non-performing loan increases by .11 naira, similarly, the loan to deposit increases by .41naira, disclosure of risk in the financial statement likewise, increases and the total asset is depleted by 1.75%. However, the capital risk shows a positive insignificant relationship with the return on equity, therefore, implying that as return on equity increases by one naira the capital risk measure will likewise increase by .115 naira non-significantly.

Thus, we accept the null hypothesis which states that there is no significant relationship between risk management and financial performance of banks in Nigeria.

The F-statistics further asserts the insignificance of this relationship between the proxies of risk management and financial performance of banks in Nigeria as used in this study, this is so because the F- statistics calculated figure is 0.504 which is far above the confidence interval.

Table 1: Regression table for hypothesis 1 (ROE)

Conclusion

This paper examined the relationship between risk management and financial performance of banks of 14listed banks in the financial sector of the Nigerian economy over a period of 6years (2006-2012). The findings revealed that management of risk does not often translate to positive financial performance of banks. Although effective risk management in financial institutions reduces the occurrence of systemic and economic breakdown, but this does not guarantee increase in the returns on equity. This paper concludes by stating that the increased drive for the management of risk poses a limit on the earning capacity of Nigerian banks.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Adel, B., & Shorouq, T. (2012), ‘Corporate governance and bank performance evidence from Jordanian banking industry’ Jordan journal of business administration.

Google Scholar

2. Adekanye, F, (2010). The elements of banking in Nigeria. Offa, FazBurn publishers. Lagos

3. Ajie, H., Ezi, C., Akekere, J., & Ewubare, D. (2006), Financial institutions, markets and contemporary issue, Port Harcourt, Pearl publishers.

4. Alo. (2003), Issues in Corporate governance, Apapa, Lagoe, Financial institution training center.

5. Akindele, R, (2012). ‘Risk management and cooperate governance performance – empirical evidence from Nigerian banking sector’, Ife psychologIA, 106.

6. Basel committee on banking supervision. (1999). Enhancing corporate governance for banking organisation.

7. Bhole, L. (2006), Finanacial institutions and markets structure, growth and innovations, New Delhi: Tata Mc Graw Hill.

Publisher – Google Scholar

8. Cadbury, A. (1992), Report of the committee of the financial aspect of corporate governance, London, Gee Gee limited.

9. Central Bank of Nigeria. (2006), Code of corporate governance for banks in Nigeria post consolidation.

10. Cendrowski, H, & Mair, W. (2009), Enterprise risk management and COSO: a guide for directors, executives and practitioners, New Jersey and Sons.

Google Scholar

11. Chatterjee, S. (2009), ‘Does increased equity ownership lead to more strategically involved board’, Journal of business ethics, 268.

Google Scholar

12. Choi, S. (2011), Towards an operational model of corporate governance, International journal of technology management and sustainable development , 168.

Google Scholar

13. Chong-En Bai, Qiao Liu, Joe Lu, Song, F. M., & and Zhang, J. (2002), Corporate governance and firm valuation in China.

14. Coles, J., Williams, M., & Sen, N. (2001), ‘An examination of the relationship of governance mechanisms to performance’, journal of management , 23-50.

Google Scholar

15. Conger, J. A., Finegold, D., & Lawler, E. (1998), Appraising boardroom performance, Harvard business review, 136-148.

Google Scholar

16. Daliton, D., Daily, C., Ellstrand, A., & Johnson, J. (1998) ‘Meta – analytic reviews of board composition,leadership structure and financial performance’, Strategic management journal, 269 – 290.

Publisher – Google Scholar

17. Donaldson, L., & Davis, J. (1991), ‘Agency theory or stewardship theory: CEO governance and shareholder returns’, journal of management , 49-64.

Google Scholar

18. Eduardus, T., Hermeindito, K., Putu, A., & Supriyatna. (2007) ‘Corporate governance ,risk management and bank performance’.

19. Forbes, D., & Milliken, F. (1999) ‘Cognition and corporate governance understanding board of director as strategic decision making groups’, Academy of management review , 489-505.

Publisher – Google Scholar

20. Feizizadeh, A. (2012), ‘Corporate governance Frameworks’, Indian Journal of Science and Technology, 33-54.

Google Scholar

21. Ituwe, C. (1996), Bank Management, Lagos: P-Numoda.

22. Jensen, M. (1993) ‘The modern industrial revolution exit and the failure of internal control system’. Journal of finance , 48.

Google Scholar

23. Jill, S. (2004) Corporate governance and accountability, West Sussex: John Wiley.

Google Scholar

24. Kaen, F., Frenkel, M., Hommel, U., & Rudolf, M. (2005) Risk Management: challenges and opportunity, Springer .

25. Karaca, S., & Eksi, H. (2012) ‘The relationship between ownership structure and firm performance: an empirical analysis of Istanbul stock exchange listed companies’, International business research, 172-181.

26. Kim,K.,& Nofsinger, J. (2007) Corporate governance, New Jersey, Pearson Prentice Hall.

27. Kim,P., & Rasiah, D (2010) ‘The relationship corporate governance and bank performance in Malaysia during the pre and post Asian financial crisis’ European journal of economics, finance and administrative sciences.

28. Krejice & Morgan D.W (1970) ‘Determining sample size for research activities’ educational and psychological measurements.

Google Scholar

29. Lee, C., Rosenstein, S., Rangan, N., & Davidson, W. (1992), ‘Board composition and shareholder wealth: the case of management buy outs’ financial management , 58-72.

Google Scholar

30. Levine, R. (2004), The corporate governance of banks: a concise discussion of concepts and evidence. World bank.

Publisher – Google Scholar

31. Lipton, M., & Lorsch, J. (1992), ‘A modest proposal for improved corporate governance’ business lawyer, 59-77.

Google Scholar

32. Longman Dictionary. (1998) Longman active study, England, Yorkshire.

33. Mülbert, P. (2009) ‘Corporate Governance of Banks’ European business organization law review, 414.

Google Scholar

34. Ogunleye, G. (2005). Regulatory Challenges in a consolidated banking system – NDIC perspective.

35. Okoye, A. E., Josiah, M., & Adediran, O. S. (2013) ‘Accounting standards in Nigeria, the journey so far’ Research Journal of Business Management and accounting, 4-5.

36. Organization for economic cooperation and development . (2004). OECD, Principles of Corporate Governance.

37. Reddy, K., Locke, S., & Scrimgeour, F. (2010) ‘The efficacy of principle based corporate governance practices and firm financial performance: an empirical investigation’ international journal of managerial finance , 190-219.

Google Scholar

38. Sanusi, L.S.(2011, March 7), ‘Banks in Nigeria and national economic development: a critical review.

Google Scholar

39. Sanusi,L.S (2012, February 17). Banking reform and its impacts on the Nigerian economy.

40. Uwuigbe, U., & Olusanmi, O. (2012). ‘An empirical examination of the relationship between ownership structure and the performance of firms in Nigeria’ International business research, 208-215.

Google Scholar

41. Yermack, D. (1996). ‘Higher market valuation of companies with a smaller board of directors’. Journal of financial economics , 185-211.

Publisher – Google Scholar