Introduction

In most developing nations of the world, the greatest majority of the populace is rural dwellers generally deprived of access to financial services, particularly credit facilities and savings as well as electricity and other essentials of life. These rural dwellers are predominantly subsistent farmers and artisans. They are largely poor old and young adults who depend on their employed relations in the cities for financial support to train their children and pay for other services. These rural dwellers seldom have access to banking services and are constantly in need of platforms for carrying out financial transactions. Carrying out banking services and money transfers for people who live in rural areas is somewhat challenging as a result of low accessibility to formal financial institutions. They have to travel several miles with high cost of transportation to reach the nearest bank branch. They also encounter the problem of spending several hours in banks to get the transactions done. Filling of application forms and completing the necessary documentations required by banks constitute a burden on them. Loan facilities are not easily accessible due to collateral and other stringent requirements. Hence, peasants have to borrow money from private money lenders at a very high interest rate (Collins et al., 2009; de Soto, 1989). Also, those in the urban areas rarely have convenient and secured means of sending money home to their relatives who have limited access to banking services (Noz et al., 2010). So the rural dwellers are practically almost excluded from the formal financial institutions which prevent them from crossing the poverty line.

Mobile money (m-Money) refers to a range of financial services delivered to the consumer via a mobile phone. The services include remittances, savings, credits and lodgings (Dolan, 2009 and OECD, 2006). It could be person-to-person transfer of funds either domestic or international remittances, or person-to-business payment for goods and services or mobile banking (Dolan, 2009). Remittances are a lynchpin between families and communities at home and economic migrants. Both formal and informal remittances play significant roles as a source of foreign exchange and enhancing human capital development by enabling families to meet meager financial needs (Desai, 2010; Porter, 2009).

Nigeria is known as the third fastest growing telecoms nation in the world and the fastest growing nation in Africa. Similarly, the growth of e-Payment instruments and e-Banking in Nigeria has attained a very encouraging dimension (Okereocha, 2010). The two categories of online payment are Account-based system and Electronic currency system. The account-based system includes: Credit Cards, Debit Cards, Mediatory Services, Mobile Payment and Telephone Account System and Payment via online banking; while the electronic currency system includes Smart Card system and online cash system (OECD, 2006). Presently, there are a total of 24 banks and 804 microfinance banks (MBIs) with several branches in towns and rural locations that will serve as part of the infrastructures involved in the framework in addition to the mobile telecoms operators (MTOs). Nigeria with a population of about 150 million has about 100 million mobile phone subscribers and all these put together will give credence to the system. ATM is the most prominent form of e-Payment system in Nigeria. It remained dominant over the years. The other media such as the Internet payment, POS and Mobile payments are gradually becoming popular (CBN Report, 2007; 2008; 2009).

The objective of this paper is to develop an effective framework for mobile money implementation in Nigeria that is secure, cost effective and reliable. The framework upon which this work is premised is a combination of account-based and electronic currency systems. Nigeria embarked on the national identity card project in the past without much success. However, efforts are ongoing to develop a national ID card that is biometric- based and would sort out all the gaps in the previous exercises. This card is proposed for use in this framework both for identification and payment instruments alike (Ayo, 2010).

The rest of the paper is arranged as follows: section 2 presents a review of related work, section 3 presents the design considerations and assumptions, while section 4 presents the model of the system and the benefits; the conclusion to the work is presented in section 5.

Review of Related Work

Ayo et al. (2007) presented the enormous opportunities for m-Commerce implementation in Nigeria based on the rate of diffusion of mobile devices. All the 25 banks that survived the “Recapitalization Exercise” of the Central bank of Nigeria actively apply ICT in service delivery across the various operations of the banks, which include e-Payment cards and Internet banking; but only 52% of the banks offer m-Banking services.

Similarly, Ayo and Ukpere (2010) designed a unified (single) smartcard-based ATM card with biometric cash dispenser to reduce the number of cards carried by each account owner as well as reduce the tide of identity theft that almost became an albatross to the ATM adoption in Nigeria. Ayo (2010) also designed a Unified Identity System where single electronic identity (eID) can be used across the various platforms of business transaction, banking and general identity. The system is such that the Nigerian national identity card doubles as a payment card. This model is recommended for this framework.

Okereocha (2010) presented the adoption of Quickteller services and other Internet platform that are spreading like wildfire in the Nigeria banking institutions. 9 out of the surviving 15 banks in Nigeria offer Quickteller services for airtime recharge, utility bill payment across ATM, Web portal and point of sales channels. Quickteller value-added service platform is being employed by most organizations in Nigeria to offer round-the-clock payment access to customers irrespective of bank branch or payment channels used. The other services still expected on this platform include bank-to-bank, bank-to-ATM, mobile-to-ATM and Internet bank transfers among others.

M”PESA was launched by Safaricom (Kenya’s largest mobile service provider) in March, 2007. It permits direct electronic transfer of money from one mobile telephone number to another with cash deposits and withdrawals made at corner shops that sell pre-paid mobile-phone credits (Medhi et al., 2009). It offers real”time transfers of e”money via the mobile phone for urban”to”rural remittances. It supports a wide variety of transactions, such as checking account balances, making deposits and withdrawals, transferring money and phone credit to other users and can be conducted on the account via the mobile phone.

GCash is an M-money application operated by Globe Telecom in the Philippines. It is also an instant money transfer via Short Message Service (SMS). All what is required to operate a Gcash account is a mobile phone and a SIM card. Users can make remote payments, pay bank loans with/without going to bank, pay bills without lining up, pay for food/services from anywhere and send remittances (Maniego-Eala, 2007).

Eko powered by HDFC (India) is an m-banking involving a no-frills savings account. The users register with an authorized “Customer Service Point” (CSP) in the area. The CSP are usually ordinary small enterprises (talktime vendors, pharmacists) running multiple businesses out of a single location (Medhi, et al., 2009). The service is available to the customers on all mobile phones including the most basic models. Customer Functionality is peer-to-peer money transfers, cash deposit/ withdrawal, wage and salary disbursements, micro-insurance, micro-credit and payments. Eko has been developed into a low-cost banking platform called “SimpliBank” which ensures real-time transactions and prepaid cash management systems to ensure transparency and traceability. The system has three-level security – the mobile phone, a “signature booklet” (patent pending) and the PIN (www.netsquared.org /projects/eko-indias-mobile-bank).

Other examples of mobile money includes: MTN Mobile Money in Uganda. It was launched in March 2009 and it is reported to have registered more than 1,000,000 customers, setup over 1,500 agents/outlets across the country and transferred more than UGX 590 billion (US$ 245 million) (Ndiwalana, et al., 2010). Zap launched by Zain’s (now Airtel) in July 2009 and M-Sente launched by Uganda Telecom (UTL) in March 2010 are other two M-money system operatives in Uganda (Ndiwalana et al., 2010). These three mobile money platforms allow registered users to load money into their accounts (cash-in), make transfers to other users (both registered or not), buy airtime (top-ups) as well as withdraw money (cash-out) with predetermined charge, which varies across offerings (Ndiwalana et al., 2010). Examples of other operational M-money system identified in literature include: WIZZIT (South Africa), Eazzy 24/7 (Kenya), and m-tranzact (Kenya).

Although the current implementation of mobile money in Kenya (M-PESA) and Philipine (Smart Padala and GCash) reveals that banks and post offices are not involved but informal carriers because of accessibility, speed and low-cost associated with the option (Porter, 2009 and Ngugi et al., 2006), the proposed model for Nigeria will be a combination of account-based and electronic currency systems.

Design Considerations

Baddeley (2004) opined that if e-Cash must survive as a true cash system, then the backing of trustworthy and stable institutions such as the central bank is a must.

In Nigeria, no mobile service operator has a constitutional right to act as a financial institution, which mobile money as developed in Kenya employs. Unless a constitutional framework evolves otherwise, banks will occupy a central stage of mobile money implementation in Nigeria. According to the Banks and Other Financial Institutions (BOFI) Act (1991) as amended, the Central Bank of Nigeria is charged with the responsibility of ensuring high standards of banking practice and financial stability through its surveillance activities, as well as the promotion of an efficient payment system (http://www.cenbank.org/AboutCBN/Coremandate.asp).

The design proposal for this framework is premised on the public and private partnership (PPP) initiative. That is, the influence of government will be reduced for effective and efficient implementation.

The framework is described below:

- The parties involved are:

- Mobile Telecoms Operators (MTO): all the mobile telecoms operators in Nigeria

- Financial Institutions (FI): all the banks and microfinance banks in Nigeria

- Delivery Agents (DA): the delivery agents at the rural locations

- The instruments involved are:

- ATM cards (National ID cards)

- The procedures involved

a. Sender

Ø Sends text (SMS) to bank or visits the bank to fill a form containing:

- Telephone number of recipient

b. Recipient

- Receives SMS notification

- Presents message and ATM card for processing

- Cash dispensed via ATM at rural location

c. Bank

- Credits recipient’s ATM card

- Bank sends notification to recipient

- E-Cash sent for clearing and delivery

Assumptions

The following assumptions were made:

- All Nigerians have a national ID card that doubles as the ATM card in this case,

- ATMs are located at public places all over the federation (banks, microfinance banks, post offices/postal agencies),

- Both SMS and the ATM card serve a 2-factor authentication, for security against identity theft,

- ATMs are manned by Das to validate identity,

- Services are not for much profit, only the sender pays commission,

- The recipient pays nothing for delivery,

- Power supply at remote locations through Solar energy,

- Infrastructure provided via PPP as part of corporate social responsibility, which attracts reduced tax from government.

Mobile Money Model

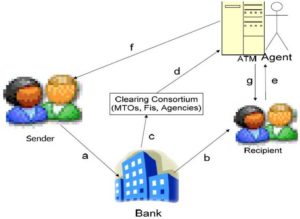

The model has seven (7) activities labeled a, b, c, d, e, f, and g.

Activity a: The Sender sends money by filling a prescribed form on his phone and sends the same to his banker.

Activity b: The Banker verifies the details of the account and if satisfactory notifies the Recipient via SMS of the transfer and the sender’s account debited.

Activity c: The Bank also notifies the consortium (Clearing house) of the transfer. The clearing house serves as the link between the various participating banks and MTOs in Nigeria.

Activity d: The consortium sends notification to the agents at the rural locations so that adequate fund can be made available for disbursement.

Activity e: The Recipient proceeds to the nearest ATM in the rural location for disbursement under the supervision of the Agent to authenticate the Recipient.

Activity f & g: The ATM sends notifications to the sender and Recipient respectively of the transfer.

Figure 1: Mobile Money Implementation Model

The benefits of this model include:

Improved financial inclusion across the country,

- Improved quality of life: education, health, etc. through availability of funds,

- Improved e-Inclusion, the level of use of ICT is further enhanced,

- Improved knowledge of e-Banking,

- A viable system for poverty alleviation.

Conclusion

We have developed a framework for mobile money implementation in Nigeria based on the PPP initiative and the peculiarity of the Nigerian environment. The system is secure because of the 2-factor authentication required (Phone and ATM card). The recipient’s ATM card is required to disburse funds in addition to the SMS on the phone. The wide spread location of banks, microfinance banks, post offices and postal agencies in Nigeria will virtually place the service at the doorstep of all and sundry.

The justification for this model in Nigeria is that the mobile telecoms operators have no constitutional right to engage in financial transaction and the issue of fraud which may be a deterrent to the platform if not well handled. Finally, the model will help jumpstart the implementation of bank-to-ATM, ATM-to-bank and mobile-to-ATM funds transfer in Nigeria among others. The benefits of the system are enormous but typical among them is its ability to reduce poverty.

Further work on successful implementation of this framework should consider establishing a successful agent’s network. Also, to fully realize the potential of branchless banking in Nigeria, there is a need for regulations that enable innovation and protect the consumers.

Furthermore, an empirical evaluation of the factors that can influence the successful adoption of mobile money implementation should be carried out given the myriads of challenges the Nigerian banking institutions are currently faced with.

References

Ayo, C. K. (2010). “Designing a Framework for a Unified Electronic Identity System: Nigeria a Case Study,” Global Journal of Pure and Applied Sciences, 16(2), 269-275.

Publisher – Google Scholar

Ayo, C. K., Adebiyi, A. A., Fatudimu, I. T & Uyinomen O. E. (2008). “A Framework for e-Commerce Implementation: Nigeria a Case Study,” Journal of Internet Banking and Commerce, 13(2), Available at: http://www.arraydev.com/commerce/JIBC/2008-08/AYO.asp]

Publisher – Google Scholar

Ayo, C. K. & Ukpere, W. I. (2010). “Design of a Secure Unified e-Payment System: in Nigeria a Case Study,” African Journal of Business Management , 4(9), 1753-1760. [Online] http://www.academicjournals.org/AJBM, ISSN 1993-8233 ©2010 Academic Journals.

Publisher – Google Scholar

Ayo, C. K., Uyinomen, O. E., Fatudimu, I. T. & Adebiyi, A. A. (2007). ‘M-Commerce Implementation in Nigeria: Trends and Issues,’ Journal of Internet Banking and Commerce, 12(2), Available at: http://www.arraydev.com/commerce/JIBC/2007-08/AyofinalPDF%20Ready.pdf

Google Scholar

Baddeley, M. (2004). “Using e-Cash in the New Economy: an Economic Analysis of Micropayment Systems,” Journal of Electronic Research, 5(7), 239-253

Publisher – Google Scholar

CBN Report (2007). “CBN Annual Report for the Year 2007,” Access date: June 2009, Available at:http://www.cenbank.org/documents/annualreports.asp

Publisher

CBN Report (2008). “CBN Annual Report for the Year 2008,” Access date: June 2009, Available at:http://www.cenbank.org/documents/annualreports.asp

Publisher

CBN Report (2009). “CBN Annual Report for the Year 2009,” Access date: June 2009, Available at:http://www.cenbank.org/documents/annualreports.asp

Publisher

Collins, D., Morduch, J., Rutherford, S. & Ruthven, O. (2009). Portfolios of the Poor: How the World’s Poor Live on $2 a Day. Princeton University Press.

Publisher – Google Scholar

Desai, K. (2010). “Can Mobile Payments Deliver Financial inclusion as well as Returns?,” Development and finance Journal, 3(4), 6-27.

Publisher

Dolan, J. (2009). “Accelerating the Development of Mobile Money Ecosystem,” Washington, DC: IFC and the Harvard Kennedy School, available at:http://www.hks.harvard.edu/mrcbg/CSRI/publications/report_39_mobile_money_january_09.pdf

Publisher

Eko India’s Mobile Bank (2010). [Retrived August 20, 2011], http://www.netsquared.org/projects/eko-indias-mobile-bank. accessed 2011-08-22

Publisher

Gbolahan, D. (2005). ‘Banking Sector Consolidation – Integration of IT applications is key,’ Financial Standard, 6(11), 24.

ManiegoEala R. (2007). ‘Telcos Extending Financial Access to the Unbanked: the Philippine Experience Siteresources,’ [Online], [Retrived August 18, 2011], worldbank.org/FSLP/…/RizzaManiegoEala_DeliveryChannels

Medhi, I., Ratan, A. & Toyama, K. (2009). “Mobile-Banking Adoption and Usage by Low-Literate, Low-Income Users in the Developing World,” Lecture Notes in Computer Science, Vol. 5623, pp 485-494.

Publisher – Google Scholar

Ndiwalana, A., Morawczynski, O. & Popov, O. (2010). “Mobile Money Use in Uganda: a Preliminary Study” [Online], [Retrived August 20, 2011], http://scholar.mak.ac.ug/andiwalana/files/m4d-mobilemoney.pdf

Publisher – Google Scholar

Ngugi, B., Pelowski, M. & Ogembo, J. G. (2010). “M-PESA: a Case Study of the Critical Early Adopters’ Role in the Rapid Adoption of Mobile Money Banking in Kenya,” EJISDC, 43(3), 1-16.

Publisher – Google Scholar

Noz, A., Azzi, J., & Coppens, T. (2010). “Bringing financial services to the Unbanked with Mobile Money Services,” [Online], [Retrieved August 20, 2011], available at: www.alcatel-lucent.com/search

Publisher

Nwachukwo, C. (2005). ‘Recapitalization: Bank Workers endorse categorization,’ access date: 2005, Available at: http://allafrica.com/stories/200504010318.htm

OECD (2006) “Online payment systems for e-Commerce,” DSTI/ICCP/IE/(2004)18/FINAL (unclassified), [online] available at: http://www.oecd.org/dataoecd/37/19/36736056.pdf

Publisher

Okereocha, C. (2010). ‘The Broadband Revolution,’ Broad Street Journal, 29(47), 46-54.

Porter, S. (2009).”Mobile Remittances: a study of the Philippines and Tonga,” [online], available at:http://www.microfinance-pasifika.org/assets/files/News/2010/January/Mobile-remittances.pdf

Publisher – Google Scholar

Soto, H. D. The Other Path: the Invisible Revolution in the Third World. Harper & Row Publishers, New York, 1989, p. 162.

Publisher – Google Scholar