Introduction

The growth and development of any nation depend to a large extent, on the development of agriculture according to Iganiga and Unemhilin (2011). Most of the world active but poor people live in rural areas and are primarily engaged in agriculture. Nigeria is a vast agricultural country, endowed with substantial natural resources which include: 68 million hectares of arable land, fresh water resources covering about 12.6 million hectares, 960 km of coastline and an ecological diversity which enables the country to produce a wide variety of crops, livestock, forestry and fishery products. Bakare (2013) observed that despite the articulation of government policies, strategies and programmes and the commitment of Government and donors to the broader framework of sustainable agriculture and pro-poor rural development, the rural communities in Nigeria remain underdeveloped and many complex issues regarding the design, implementation, and monitoring and evaluation remain unresolved.

According to Nwankwu (1981) the role of agriculture in reforming both the social and economic framework of an economy cannot be over-emphasized. It is a source of food and raw materials for the industrial sector. It is also essential for the expansion of employment opportunity, for reduction of poverty and improvement of income contribution, for speeding up industrialization and easing the pressure on balance of payment. World Bank in a report (2014) concluded that in many developed and developing countries agriculture has been the main source of gainful employment, a source of basic food supply with which the nation can feed its teeming population, a regenerative source of foreign exchange earnings, means of providing the nation’s industries with local raw materials, and as a reliable source of government revenue. Generally, the agricultural sector contributes to the development of an economy in four major ways- product contribution, factor contribution, market contribution and foreign exchange contribution. In realization of this, the Nigerian government has formulated various policies and programmes aimed at strengthening the sector in order to continue to perform its roles.

Ehui and Tsigas (2013) mentioned that Nigeria has a highly diversified agro-ecological condition, which makes possible the production of a wide range of agricultural products. Hence, agriculture constitutes one of the most important sectors of the economy. Despite Nigeria’s rich agricultural resource endowment, the agricultural sector has been growing at a very low rate. Productivity is low and basically stagnant. Farming systems, which are mostly small in scale, are still predominantly subsistence-based and for the most part depend on the vagaries of the weather. Many agricultural policies have also been ineffective, either because they have been misguided, or because their impacts have been swamped by macro policies affecting inflation, exchange rates, and the cost of capital.

It is recognized that agricultural commercialization and investment are the key strategies for promoting accelerated modernization, sustainable growth and development hence, poverty reduction in the sector. However, to attract investment into agriculture, it is imperative therefore to examine the empirical relationship between agricultural output and economic growth in Nigeria and the policy concerns it engenders in Nigeria.

Literature Review

Literature is replete with the relationship between agriculture and economic growth in both developed and developing countries. Agriculture is the science or practice of farming, including cultivation of the soil for the growing of crops, the rearing of animals to provide food, and the preparation and marketing of agricultural and agro allied products. Agricultural output is the value of agricultural products which, free of intra-branch consumption, are produced during the accounting period and before processing, are available for export and consumption. Economic growth is the increase in the monetary value of goods and services produced in a country over a defined period of time usually a fiscal year. Many studies have examined the relationship between agriculture and economic growth. Findings from these studies are mix. While some studies established that agriculture exerts a negative impact on economic growth, other findings disapproved this position. This section reviews the findings on the relationship between agriculture and economic growth and also reviews the factors that account for the mixed findings.

Christiensen and Yee (1964) in a study on how improvement in agricultural productivity contributed to national economic growth of an imaginary country stated that increase in agricultural productivity comes from two sources: use of additional inputs, and increased productivity resulting from improved technology. They argued that Increases in agricultural productivity contribute to national economic development and growth in three major ways: supply of an economic surplus for consumption and production in agriculture or for capital formation; the release of labour and other resources for use in non-agricultural sectors; and the resulting increase in purchasing power of rural people, expand markets for industrial products, and structural changes needed for national economic growth. In a similar but more recent study Chang, Chen and Hsu (2006) in an extended model of Matsuyama that incorporated government taxation and infrastructure expenditure showed that, higher agricultural productivity creates a positive growth effect via the revenue generation that dominates the negative growth effect through the comparative advantage. On the contrary Patrick (1971) in a review paper on agriculture and economic growth: Japan’s experience, concluded that agriculture had a less propelling role in Japan’s economic development than earlier assumed. This he attributed to the slow change in people’s food consumption habits which held down the growth in demand for food.

Syed, Muhammad & Rana (2015) analyzed the impact of agricultural exports on the macroeconomic performance of Pakistan for the period 1972 to 2008. The study found a negative relationship between agricultural export and economic growth, while a non-agricultural export was found to have positive relationship with economic growth. On the basis of the empirical results, the study suggested that Pakistan has to embark on structural changes in agricultural exports by converting its agricultural exports into value added products. Converting agricultural exports into value added products is applicable to the Nigerian economy but their findings showing a negative relationship between agricultural export and economic growth are not applicable to the Nigerian economy.

Ideba, Iniobong, Otu & Itoro (2014) investigated the relationship between agricultural public capital expenditure and economic growth in Nigeria over the period 1961 to 2010 using annual data obtained from the Central Bank of Nigeria. The data were analysed using Augmented Dickey-Fuller test, Johansen maximum likelihood test and Granger Causality test. The result of the Johansen co-integration test showed that there exists a long run relationship between all the explanatory variables and the explained variable. The result of parsimonious error correction model showed that agricultural public capital expenditure had a positive impact on economic growth. Also, Granger Causality test showed a unidirectional relationship between agricultural public capital expenditure and agricultural economic growth. This means that agricultural economic growth does not cause expansion of agricultural public capital expenditure; rather it indicates that agricultural public capital expenditure raises the nation’s agricultural economic growth. This investigation dint makes emphasis on policy adjustment as a factor needed to promote economic growth.

Bakare (2013) examined the relationship between sustainable agriculture and rural development in Nigeria. Vector Auto Regression analytical technique (VAR) was employed for the empirical study. The a priori expectation is that sustainable agriculture will impact positively on rural development in Nigeria. The findings of the study show that the past values of agricultural output could be used to predict the future behaviour of rural development in Nigeria. The main conclusion of this study was that while agriculture remains dominant in the Nigerian economy, it is unsustainable; the food supply does not provide adequate nutrients at affordable prices for the average citizen and rural development is deteriorating. The findings and the conclusion of the study suggested the need for the policy makers to promote agriculture to a sustainable level by driving rural development.

Odetola & Etumnu (2013) investigated the contribution of the agriculture sector to the economic growth in Nigeria using the growth accounting framework and time series data from 1960 to 2011. The study found that the agricultural sector has contributed positively and consistently to the economic growth in Nigeria, reaffirming the sector’s importance in the economy. The contribution of agriculture to economic growth is further affirmed from a causality test which showed that agricultural growth Granger-causes GDP growth, however no reverse relationship was found. The resilient nature of the sector is evident in its ability to recover more quickly than other sectors from shocks resulting from disruptive events e.g. civil war (1967-70) and economic recession (1981-85) periods. The study also found that the crop production subsector contributes the most to agricultural sector growth and that growth in the agriculture sector is overly dependent on growth of the crop production subsector. This indicates the importance of this subsector and probably, lack of attention or investment to the other subsectors.

Aminu & Anono (2012) investigated the contribution of agricultural sector and petroleum sector to the economic growth and development (GDP) of the Nigerian economy between 1960 and 2010 through the application of Augmented Dickey-Fuller technique in testing the unit root property of the series; after which Chow breakpoint test was conducted to test the presence of structural break in the economy. The results of unit root test suggest that all the variables in the model are stationary at first difference and the results of Chow breakpoint test suggest that there is no structural break in the period under review. The results also revealed that agricultural sector is contributing higher than the petroleum sector, though they both possessed a positive impact on the economic growth and development of the economy. A good performance of an economy in terms of per capita growth may therefore be attributed to a well-developed agricultural sector.

Abogan, Akinola, & Baruwa (2014) investigated the impact of non-oil export on economic growth in Nigeria between 1980 and 2010, and employed the co integration approach. The study reveals that the variables are co integrated which confirms the existence of long-run equilibrium relationship between the variables. Thus, this suggests that all the variables tend to move together in the long run. The impact of non-oil export on economic growth was moderate as a unit increase in non-oil export raised the productive capacity of the economy by 26%.

The review of the literature shows that the relationship between agriculture and economic growth is inconclusive and an empirical issue that should be further investigated. Previous studies made use of disaggregated variables to study the contribution of agriculture to economic growth. This study is therefore different from previous studies as the total value of agricultural output will be used to capture the contribution of agriculture to economic growth, also the study period is more recent.

Methodology and Sources Of Data

This study makes use of secondary data in the analysis. The different annual time series data sets of observation were collected from the Central Bank of Nigeria, National Bureau of statistics, International Monetary Fund and World Bank Development Index. The data cover a period of thirty three years from 1981 to 2014.

Model Specification

The baseline model estimated for this study is presented as follows:

RGDPt= f(AGPO, INTR,INFL, EXR) ______________________________ (1)

This baseline equation is an extension of the national income equation in which national output (RGDP) is a function of consumption, investment, government expenditure and net export. These variables interest rate, inflation, and exchange rate also influence national output.

The function in equation (1) is transformed to natural logarithms as follows

logRGDPit= β0+β1logAGPOt+β2logINTRt+ β3logINFLt + β4logEXRt + Ut ______(2)

Where:

RGDP= Economic growth given by real GDP (naira)

AGPO= Agricultural Output

INTR= Interest rate (per cent)

EXR= Exchange rate (naira per US dollar)

INFL= Inflation rate (per cent)

β0 = constant,

β0, β1. . . β 4 = the coefficients of the regression equation.

‘t’= is the time trend, and

Ut= Stochastic error term.

Model Estimation Technique

In terms of econometric methodology, the multivariate cointegration approach offers useful insights towards testing for causal relationship. In principle, two or more variables are adjudged to be cointegrated when they share a common trend. Hence, the existence of cointegration implies that causality runs in at least one direction (Okodua and Ewetan, 2013; Akinlo and Egbetunde, 2010; Granger, 1988). However there could be exceptions to this expectation. The cointegration and error correction methodology is extensively used and well documented in literature (Banerjee, et al. 1993; Johansen and Juselius, 1990; Johansen, 1988; Engle and Granger, 1987).

Empirical Results and Discussions

This study examines time series data from 1981 to 2014. The econometric analysis involves three basic steps. First, the unit root test examines the stationarity of the data. Second the Johansen co integration test investigates the long-run relationship between the variables. Third, the Vector Error Correction Model is used to determine the speed of adjustment of the variables i.e. how errors generated in the short run are corrected in the long run equilibrium path. The following sections present and discuss the result obtained from the analysis.

Stationarity Tests

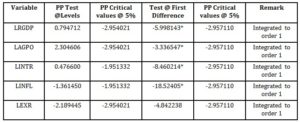

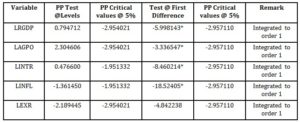

Table 1: Phillip Perron (PP) Unit root results

*, **, Represents stationary trend at 1% and 5% level of significance respectively

Due to the stochastic trend process associated with most time series data, it is important that these series are tested for the presence of unit root. The result of the unit root stationarity test in table 1 was conducted using Phillip Perron (PP). The result of the PP test shows that all the variables were not stationary at level. Therefore the entire series were subjected to further test at first differencing. It is evident that all the variables achieved a stationary trend process after the first differencing for the Phillip Perron test. Hence the null hypothesis of unit root could no longer be accepted for the variables at this level. This means that the series are integrated in order order 1.

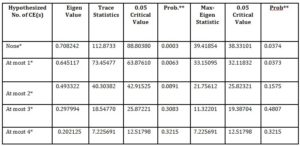

Johansen Co Integration Test

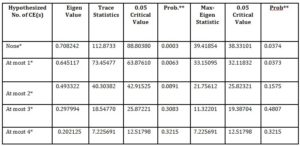

Table 2: Co-integration Result

Source: Authors computation from E-views 7.1

Having established that all the variables are integrated in order one, this study employed the Johansen and Jesulius (1992) co-integration approach to determine whether there is a co integrating relationship between agricultural output, interest rate, inflation rate, exchange rate and real economic growth of Nigeria. This method utilized both the trace and maximum Eigen statistic in determining the significance or otherwise of the co integrated series as suggested by the unit root results. In ascertaining the existence or non-existence of a co integrated series, the calculated trace and max Eigen statistic was compared to their critical values at 5 percent significance. A higher value for the trace and max Eigen statistic in relation to their critical values suggests the existence of co integrated equation in that rank order. Evidence from the trace statistic as shown in the upper part of table 2 revealed two co integrated equations in “at most 1” rank level for the trace and maximum Eigen value statistic. The existence of a co integrated series from the result above thus implies the existence of possible long run relationship among the variables over time.

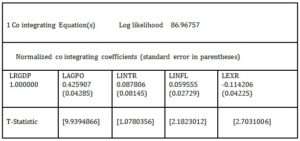

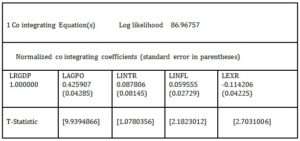

Table 3: Normalized co integrating coefficients

Source: Authors computation from E-view 7.1

The result in table 3 above shows the long run estimated parameters for agricultural output, inflation rate and exchange rate indicate statistically significant relationship with economic growth over the period covered in this study. However, interest rate does not have a significant relationship with economic growth. Given the long run estimates of the normalized co integrated results for the economic growth model, the interpretations of the long run co efficient are based on the elasticity of the estimated results.

The coefficient of the long run agricultural output (LAGPO) is negative indicating a negative relationship between agricultural output and economic growth which does not conform to a priori expectation. The coefficient is 0.426 which is less than one which means that agricultural output is inelastic in relation to economic growth (LRGDP) indicating that a change in agricultural output leads to less proportionate change in economic growth. The negative relationship with economic growth means that a 1 percent increase in agricultural output will bring about 0.423 decrease in economic growth and vice versa, and it is statistically significant at 1 percent level of significance. The coefficients of interest rate and inflation rate are negative while that of exchange rate is positive which conform with the a priori expectations. Also the coefficients are less than one which means that interest rate, inflation rate and exchange rate are inelastic in relation to economic growth indicating a change in interest rate, inflation rate and exchange rate will lead to less than proportionate change in economic growth.

Vector Error Correction Model (Vecm)

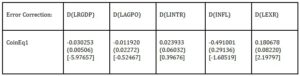

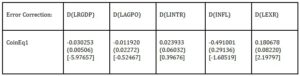

Table 4: Error Correction Model

Source: Authors computation from E-view 7.1

The VECM coefficient is the speed of adjustment factor, which tells us how fast the system adjusts in order to restore equilibrium. It also shows the reconciliation of the variables over time right from the disequilibrium position to the period where equilibrium is restored. The result of the vector error correction model (VECM) is indicated above.

The VECM result shows that the coefficient of the error correction model for our dependent variable LRGDP has a negative sign, is between zero and one and from the t-statistic, it is statistically significant. From our result, the significance of the error correction model indicates that there is a steady long run equilibrium state between Real GDP and the independent variables. The adjustment speed is -0.030253. In addition, the coefficient lies between 0 and 1 and the t-Statistic is -5.97657 which is greater than 2 in absolute value; therefore, it is statistically significant observing the rule of thumb. Thus, this implies that about 3.03 percent of the errors in the current period would be corrected in subsequent periods. This further shows that the system has the ability of converging during instances of external shocks.

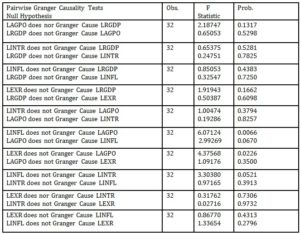

Granger Causality Analysis

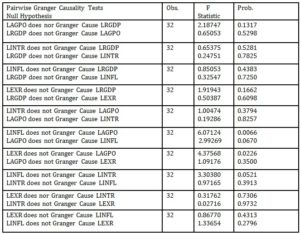

Table 5: Pairwise Granger Causality Tests

Source: Authors computation from E-view 7.1

There is no directional causality between agricultural output and real economic growth. Real economic growth does not granger causes interest rate while interest rate also does not granger causes real economic growth. The null hypothesis of no granger causality cannot be rejected for the relationship between inflation and real economic growth for both directions. It is observed to be the same for the relationship between interest rate and economic growth and between exchange rate and economic growth.

The analysis of the granger causality test in table 5 reveals bidirectional causality between inflation rate and agricultural output at 1 percent and 10 percent significance level. This further implies that inflation rate does granger causes agricultural output and agricultural output does granger causes inflation rate though at 10 percent. Hence, the null hypothesis that LINFL does not Granger Cause LAGPO and that LAGPO does not Granger Cause LINFL is hereby rejected in this study.

There is a unidirectional causality between exchange rate and agricultural output at 5 percent significance level such that exchange rate does granger causes agricultural output while agricultural output does not granger causes exchange rate

Interest rate does not granger cause agricultural output and agricultural output does not granger cause interest rate

Inflation rate does granger causes interest rate at 5 percent significance level while interest rate does not granger causes inflation rate. Hence the null hypothesis of no granger causality is accepted for interest rate while being rejected for inflation rate.

Further evidence from the study shows no directional causality from exchange rate and interest rate. This shows that exchange rate does not granger causes interest rate and interest rate does not granger cause exchange rate at 5 percent significance level. Thus the null hypothesis that LINFL does not Granger Cause LINTR and LINTR does not Grange causes LINFL can be accepted in this study. Also exchange rate and inflation reveals no granger causality in both directions.

Conclusion and Policy Implication

In conclusion, the key to resuscitation of agricultural output is to make the farm sector more productive through better and efficient policies so as to reverse the negative relationship between agricultural output and economic growth in Nigeria as revealed by the finding of this study. The study reveals a significant long run relationship between agricultural output and economic growth. This being the general objective of the study, it is necessary to emphasize how agricultural production in Nigeria can be improved which in turn will increase the level of economic growth. Therefore the monoculture nature of the Nigerian economy which basically relies on oil proceeds should no longer be allowed. This study suggests the need for government to diversify the economy away from its major dependency on oil by promoting the development of the agricultural sector. This will no doubt create more employment opportunities for the teaming unemployed population, provide more investment opportunities, increase non-oil export, improved technology, external reserve leading to favourable foreign exchange conditions and improved economic growth for the country.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Abogan, O P., Akinola, E., and Baruwa, O. (2014), ‘Non-oil export and Economic growth in Nigeria,’ Journal of Research in Economics and International Finance, 3(1), 1-11.

- Akinlo, A E., and Egbetunde, T. (2010), ‘Financial Development and Economic Growth: The Experiences of 10 Sub-Saharan African Countries Revisited,’ The Review of Finance and Banking, 2(1), 17-28.

- Alfred, T G., and Oliver, R. (2003), The Nature of Mediterranean Europe: An Ecological History, Yale University Press.

- Aminu, U. and Anono, A. (2012), ‘An Empirical Analysis of the Contribution of Agriculture and Petroleum Sector to the Growth and Development of the Nigerian Economy,’ International Journal of Social Science and Education, 2(4), 1-11.

- Bakare, A S. (2013) ‘An econometric analysis of sustainable agriculture and rural development in Nigeria: A Vector Autoregressive Approach (VAR). Journal of Agricultural Economics and Development,’ 2(5), 184-193.

- Banerjee, A., Dolado, J., Galbraith, J., and Hendry, D. (1993), Co-integration, Error-Correction, and the Econometric Analysis of Non-Stationary Data. Oxford: Oxford University Press.

- Chang, J J., Chen, B., and Hsu, M. (2006), ‘Agricultural Productivity and Economic Growth: Role of Tax Revenues and Infrastructures,’ Southern Economic Journal, 72(4), 891-914.

- Christiensen, R P., and Yee, Y. (1964), ‘The Mechanics of Agricultural Productivity and Economic Growth,’ Journal of Farm Economics, 46(5), 1051-1061.

- Ehui, S. and Tsigas, M. (2009), ‘The Role of Agriculture in Nigeria’s Economic Growth: A General Equilibrium Analysis,’ International Association of Agricultural Economists, August 16-22 August 2009, Beijing, China.

- Engle, R F., and Granger, C. (1987), ‘Co-integration and Error Correction: Representation, Estimation and Testing,’ Econometrica, 55, 251-276.

- Engle, R F., Granger, C., and Hallman, J. (1988),’ Merging Short-and Long-run Forecasts: An Application of Seasonal Co-integration to Monthly Electricity Sales Forecasting,’ Journal of Econometrics, 40, 45-62.

- Ewetan, O O., and Okodua, H. (2013), ‘Econometric Analysis of Exports and Economic growth in Nigeria,’ Journal of Business Management and Applied Economics, 2(3), 1-14.

- Ideba, E E., Iniobong, E., Otu., W. and Itoro, N. (2014), ‘Analysis of Agricultural Public Capital Expenditure and Agricultural Economic Growth in Nigeria,’ American Journal of Experimental Agriculture, 4(4), 443-456.

- Iganiga, B O., and Unemhilin, D. (2011), ‘The Impact of Federal Government Agricultural Expenditure on Agricultural Output in Nigeria,’ Journal of Economics, 2(2), 81-88.

- Johansen, S. (1988), ‘Statistical Analysis of Cointegration Vectors,’ Journal of Economic Dynamics and Control, 12, 231 254.

- Johansen, S. (1990). ‘Maximum Likelihood Estimation and Inference on Cointegration with Application to Demand for Money,’ Oxford Bulletin of Economics and Statistics, 52, 169-210.

- Nwankwu, O O. (1981), ‘Analysis of the contribution of Agricultural sector on the the Nigerian Economic Development,’ World Review of Business Research, 1(1), 191-200.

- Odetola, T. and Etumnu, C. (2013), ‘Contribution of Agriculture to Economic Growth in Nigeria, International Food Policy Research Institute (IFPRI), Abuja, Nigeria,’ Proceedings of The 18th Annual African Econometric Society (AES), 2013, at the session organized by the Association for the Advancement of African Women Economists (AAAWE), Accra, Ghana

- Patrick, H T. (1971), ‘Review of Agriculture and Economic Growth: Japan’s Experience,’ The Journal of Asian Studies, 30(2), 463-464.

- Syed, W A, Muhammad, A., and Rana, M. (2015), ‘Agricultural Export and Economic Growth: A Case Study of Pakistan,’ International Journal of African and Asian Studies, 13, 1-10.

- Todaro, M P., & Smith, S. (2003). Economic development (8th ed.). Singapore: Pearson Education.

- World Bank, (2014). World Bank Development Report.