Introduction

Starting from the observation of the market behaviour of firms, from the complexity and dynamism of open economic systems, the present paper identifies other prospects in the revaluation of firm theories with the evolutionary perspective (Coase, 2002).

Formed according to the values promoted by the neoclassical school (along with his contemporaries Friedrich von Hayek and Milton Friedman), in 1940 Ludwig von Mises published his work “Human action” in which he argued that the economy is a social science (Mises, 1998). There were many reactions against this way of considering the economy and hence, it was called into question the entire neoclassical paradigm. In this context, the firm, the enterprise, is the form of human action, namely the creation of the entrepreneur. It is an integrative part of the market and should be integrated into the general theory of the market process and price formation. According to the neoclassical theory of perfect competition, the firm is to combine production factors in order to obtain a final product ( Nelson and Winter, 2005). Thus, the company combines production factors – labour and capital in order to maximize profits.

The marginality debate around the mid 1930s came after the publication of several studies which argued empirically that entrepreneurs apparently did not follow the marginal principle of maximizing profit and minimizing costs within companies, so that they questioned the relevance of profit maximizing to be found in the neoclassical theory of the firm (Foss, 2002). Ronald Coase identified, in an article published in 1937, several sources of the cost related to the market mechanism use, that determines the emergence of the firm as an institution. The most important reason to set up a firm seems to be that of identifying the relevant prices, along the cost of negotiation and conclusion of separate agreements for each transaction (Tavares and Teixeira, 2008).

In essence, the theory of the firm put forward by R.H. Coase is based on the generalization of organizational situations in an environment dominated by the market where transaction costs are significant ( Coase, 2002). Without deviating from the alternative coordination of resources, R. Coase examines in turn the natural reasons for the existence of the firm, as well as the implied contract costs, the law on transactions on the market, the costs of market use (Foss, 2002).

The evolutionary theory defines the firm as a set of essential skills, gained from its learning ability (Gould, 2002). The evolutionary approach adopts the concept of limited rationality, assuming that individuals and organizations have much to learn in a complex environment, characterized by uncertainty in the context of the knowledge economy.

Literature Review

Authors like O.E. Williamson (1971), S.G. Winter (1982), S. Ross (1973) H. Demsetz (1972), a.o., developed the approach initiated by R. Coase in 1937 discovered new areas for its application (Mises, 1998). Alchian and Demsetz (1972) argued that the neoclassical theory of the firm does not actually refer to firms, but to the industry (Jensen and Meckling, 2005). The analysis of the literature in the field on modern theories of the firm is based on noticing a deficiency consisting in the separation of the economic theory of the firm and the one of the entrepreneur. Individual firms will, in general, follow routines described by researchers, but in fact the industry is complying with the marginal principles. The industry tends towards the optimal decision, but not because of changes occurred in the behaviour of firms, where profit maximization is the result of an evolutionary process which took place in the industry (Coase, 2002).

Langlois (2003) shows that firms with identical production functions, transform homogeneous inputs into homogeneous outputs according to well known technical “plans” (Foss and Thomsen,2002). Machlup (1947) and Stigler (1947) also defended the marginal principle, as a reaction to these studies. Machlup argued that firms use established routines in decision making. Alchian and Demsetz (1972) argue that the hierarchical structure of the firm’s control does not minimize transaction costs, only monitoring costs [6]. The idea of the firm’s behaviour put forward by Demsetz and Alchain is not much different from the market behaviour, suggested by Jensen and Meckling (1976) who introduced the idea of agency costs as a source of the firm’s structure. In this regard the firm’s behaviour is similar to that of the market; it is the result of a complex balancing process. E. Fama (1980) stated that the separation of share ownership and their control can be explained as an effective form of economic organization in the perspective of the “set of contracts”. Every factor of production within the company is to be found in inputs, which put together can create final outputs. The contractual theories of the firm are based on the importance of property rights, asymmetric information and moral hazard (Foss, 2002).

Continuing the reflection of R. Coase, O. Williamson analyzes the situations in which the exchanges reflect a large opportunist potential. Using the sources of sustainable competitive advantage has renewed the resource-based firm theory (Gould, 2002). The resource-based firm theory explains performance differences between firms. Thus, the capabilities are the firm’s knowledge base (they belong to the firm and not to individual agents). From this perspective, the firms are heterogeneous, the competitive advantage is translated in terms of efficiency of annuities, and the sustainability is based on the difficulty for the competitors to imitate (Tavares and Teixeira, 2008). The need to integrate the two approaches to the theory of the firm – the contractual perspective and the one based on capabilities – is underlined by other theoreticians on this issue stating that for a better understanding of the firm, more attention should be given to the problem of distribution of knowledge / production knowledge among companies, and especially to their character (Jensen and Meckling, 2005). The corporation is not only a contractual entity, it is at the same time an entity that both learns and innovates, seeking competitive advantages from economies of scale and scope based on superior capabilities. Continuing the idea of coordinating knowledge, some authors (Cremer 1990, Radner 1992, 1996, Bolton and Dewatripont 1994) identified the firm with a network of communication set up to minimize both the cost of processing new information as well as its communication cost between agents (Mises, 1998).

The evolutionary perspective on the theories of the firm is linked to the research of authors such as Kirzner (1913), Williamson (1971), Winter (1982) and Littlechild (1986) who introduced the term of “evolutionary economics” (Nelson and Winter,2002). The approach of the theory of the firm from an evolutionary perspective had as starting point the work “An Evolutionary Theory of Economic Change” (1982), in which Nelson and Winter reconsidered the microeconomic analysis showing that excessive attention to market equilibrium was not needed, but rather the focus should be on the dynamic processes resulting from irreversible economic exchanges (Sirghi, Neamtu and Opris, 2012).

The Evolutionary Models of the Firms

In designing and testing models of evolution and revealing the firm’s performance in a competitive environment affected by risk and uncertainty can be used stochastic mathematical models (Tembine, Altman and El-Azouzi, 2007). Below we briefly present one of these models including finite stochastic differences, namely the Behrens – Feichtinger model (Tavares and Teixeira, 2008).

A number of “physical” models were developed as an extension of the nonlinear microeconomic Richardson model. These include the Behrens – Feichtinger model, which refers to two firms with asymmetrical investment strategies. The model refers to the sales’ evolution (x(n) and y(n)) of two competitive firms in the same market of goods, with asymmetric and active investment strategies for both companies(Sirghi, Neamtu and Opris, 2012).

If a firm does not invest in advertising, research, re-tech or development, the sales of the company are expected to drop exponentially, by a factor characterizing the actual situation on the firm’s market. Thus, every firm has the opportunity to invest in order to increase its sales and perhaps may make different investment strategies. The evolution of sales of the two firms can be described in a discrete time scale, x (n) representing the value of the firm X at the time n, by:

With a and b (0 < a, b < 1) being the time rates at which the sales of both firms decrease in the absence of investments (exponential decrease). The function f is:

Where parameter c characterizes the transition the slope from 0 to a for the function and measures the degree of nonlinearity.

This microeconomic model can be adapted to conditions of dynamic evolution as close to real conditions. For this purpose we introduce a series of changes that can cause the development of this mathematical model and the expanding of its application [10].

We suggest adding a random term for knowing the difference between the sales of two companies, as happens in reality, we do not always have the correct information about the sales of competitors, but only information with a certain degree of probability. The amount invested can also be variable, also modelled by a Gaussian distribution, even if the firm has an amount provided for investments, the value of this investment is not always the same, but may vary depending on the promotion and development strategy applied at the respective time, according to the current offer of the market, etc. We will change therefore the investment constant, a or b through:

The term B (Sigma) is equivalent with introducing a white noise (Wiener process) in the value of investments. The system is a chaotic system and the possibility of controlling the chaos is usually related to the stabilization of UPO’s (unstable periodic orbits).

This is done by controlling the dynamic system parameters and values so that all Lyapunov coefficients become negative and the trajectory of the system to become periodic. It is desired to keep the system in a dynamic which is unpredictable, chaotic, but the average variable of interest can be controlled so that firm profits can be improved. This can be done by analyzing the system’s dynamics and by changing the control parameters so that the centre “orbit” of the trajectory to move in a controlled way.

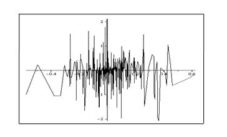

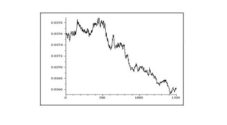

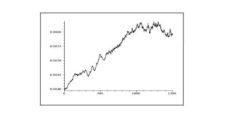

Thus, using a program in Maple 12, we get a series of orbits which can be stabilized (Fig. 1 in orbit (n, x1(n)) in Fig. 2 orbit (n, y(n)), and in Fig. 3 orbit (x (n), y (n))

Fig 1. Orbit (n, x1(n))

Fig 2. Orbit (n, y(n))

Fig 3. Orbit (x(n), y(n))

Next we describe the evolutionary model of the capital of a firm based on employee knowledge. In terms of the deterministic model, the firm has only one production process and production is used both for consumption and as investment. The labour noted with L = L (t) is considered to be formed by intellectuals L1=L1(t) and workers L2=L2(t). Suppose that L1= n1L, L2= n2L, where n1+n2 =1, n1, n2 are constant. Y represents the firm’s production. The consumption of an intellectual c1 Y/L, and a worker’s is c2Y/L, δ represents the capital depreciation rate.

The dynamics of the capital are given by the differential equation (5):

The dynamics of the capital are given by the differential equation (5):

Production is a function of number of workers L2, capital and the employees’ knowledge G. The model considers the production function as Y = f (G) Lα2 Kβ with f ‘(G)>0, α+β <1. In the following we consider f (G) = Gy.

Thus, production becomes:

The knowledge dynamics are assumed to take the form

Here p is the workers’ efficiency in increasing knowledge, h is the function of intellectuals’ contribution to the increase of knowledge, is the knowledge depreciation rate. The function h is given by:

Where k=K/L (capital per employee), g=G/L (knowledge per employee), y=Y/L (production per employee).

The deterministic differential system [9]:

The stochastic model is given by the stochastic equation system (10):

Where (k0, g0) is the stationary solution of the deterministic system and B1(t), B2(t) are Wiener processes.

For the numerical simulation the following values were considered

c1=0.8

The steady state is k0 = 0.082, g0 = 0.035.

We notice that this state is asymptotically stable. Considering σ1=0.3, σ2=0.2, the orbits (t, k(t,ω)), (t, g(t,ω)), (k(t,ω)), g(t,ω )) are provided in Fig 4, Fig 5 and Fig 6

Fig 4. Orbit (t, k(t, ))

Fig 5. Orbit (t, g(t, ))

Fig 6. Orbit (k(t, ), g(t, ))

Conclusions

According to the neoclassical theory of perfect competition, the firm exists to combine factors of production in order to obtain a final product. Thus, the firm combines inputs – labour and capital in order to maximize profits (Zhang, 2005). The marginality debates which empirically argued that entrepreneurs did not apparently follow the marginality principle of maximizing the profit and minimizing costs within firms, questioned the relevance of profit maximizing in the neoclassical theory of the firm.

In essence, the theory of the firm is based on the generalization of organizational situations in an environment dominated by the market where transaction costs are significant (Coase, 2002). In the economic processes, we do not always obtain accurate information, so we need to add a random term described by a Winner process (Sirghi, Neamtu and Opris, 2012).

Using the numerical simulations we can notice that the steady states are mean square stable. The analysis of a firm’s model considering the physical capital and the quality of the human capital is analyzed in (Zhang, 2005). In this paragraph a random model was built taking into account that the economic processes have a high degree of uncertainty. The graphs described in the present paper show that the state variables are asymptotically stable in probability.

The research results can be summarized as follows: the accomplishing of a critical study on the theories of the firm; the refining of the theories of the firm in terms of evolutionary perspectives, discussing the existing empirical evidence supporting the evolutionary paradigm of the firm and the simulation of company development based on evolutionary games.

To conclude, we highlight the importance of stochastic mathematical models for designing and testing models of evolution and revealing the firm’s performance in a competitive environment affected by risk and uncertainty.

Acknowledgement

The author is grateful for the support from POSDRU/90/2.1/S/63442 project, entitled „Real Acces to the Labour Market through Simulated Enterprise”, Beneficiary: „Ovidius” University Constanţa, Partner 3: West University of Timişoara.

References

Coase, R. (2002) ‘The Nature of the Firm. Alternative Theories of the Firm’, Edward Elgar, Publishing Limited, Cheltenham, SUA.

Foss N. J. (2002), ‘Capabilities and the Theory of the Firm. Alternative Theories of the Firm’, Edward Elgar Publishing Limited, Cheltenham, SUA.

Foss, N.J., Lando, H., Thomsen, S. (2002), ’The theory of the firm’, Journal of Economic Perspectives-vol. 16, Nr. 2-Spring, 23-46.

Gould, S., J. (2002), The Structure of Evolutionary Theory, Belknap Press, Harvard University Press

Jensen, M., Meckling, W. (2005), ’Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure’, Journal of Economics, SUA, 300-306.

Ludwig von Mises (1998), Human action. A treatise of economic theory, Nemira Publishing House, Bucharest.

Nelson, R. R., Winter, S.G. (2002),’ Evolutionary Theory in Economics’, Journal of Economics Perspectives, vol. 16, nr. 2, Spring , 23-46.

Publisher – Google Scholar

Sîrghi, N., Neamțu M., Opriș, D., (2012), ’Dynamical evolutionary games with delay’, Proceedings of the 13th WSEAS Int. Conf. on Mathematics and Computers in Business and Economics (MCBE’12),ISBN: 978-1-61804-098-5, Iasi, june 13-15, 170-176.

Tavares, S., Teixeira, A. (2008), ’Economics of the firm and economic growth: a hybrid theoretical framework of analysis’, Journal of organisational Transformation and Social Change, vol. 2, nr. 3, 255-269.

Tembine, H., Altman, E., El-Azouzi R, (2007), ’Asymmetric delay in evolutionary games’ Proceeding Value Tools’, Proceedings of the 2nd international conference on Performance evaluation methodologies and tools, ISBN: 978-963-9799-00-4, Article No. 36, 42.

Publisher

Zhang W. B. (2005), Capital and knowledge, Springer, Berlin.