Introduction

The main motivation that lies at the basis of any economic activity resides in obtaining higher benefits than the efforts made in order to accomplish it. Companies fully abide by this reasoning, as they are constituted and governed in the direction of meeting the objectives of capitalizing upon the available funds, both by the shareholders and by the various creditors.

Therefore, the main objective can be identified, which rules the activity of all the economic entities, which is to insure economic and financial performance, expressed through profit, as a basis of internal economic growth. But the true challenge is not obtaining satisfactory stage economic results, but to preserve them over an as long as possible time horizon, thus insuring economic and financial internal stability, with noticeable influences on the socio-economic spectrum to which the entity belongs.

The company and the level of its results cannot be extracted from the national or regional area. Meeting the organizational desiderata depends on the specificity of the economic environment to which the entity is compared, respectively to its level of performance and to its perspectives of sustainable development. In this context, we can say that the economic entities insure a multi-annual maximization of their economic and financial performance only in economies simultaneously concerned with their economic side, as an element that generates welfare, and with the social and environmental implications of the development of the economic activity.

Thus, the pillars that support the concept of sustainable development are presented, a concept that has been a concern of, and that has accompanied the evolution of economy during the last decades, generating numerous debates concerning its structure, role, and the need to promote it. It is the reason why, in specialized literature, there are a multitude of definitions associated to the construct.

However, the majority of the opinions concerning the elements that define sustainable development converge towards the three major dimensions: economic, social, and environmental (Stead et al., 2004; Remillard & Wolff, 2009). Also, the concept of sustainable development must include elements related to the judicious and fair allocation of the available resources, from an intra and inter-generation perspective, so as to achieve a balance between anthropocentrism and ecocentrism (Milne et al., 2009; Mironiuc, 2009). In the opinion of Byrch et al. (2007), sustainable development is the evolution process that meets the needs of the present without compromising the possibility for future generations to cover their own needs.

Analyzing the antagonistic relation between the demand and offer of resources, Dinga (2009) states that the current criteria of economic optimization do not fit the dynamics of the basic resources. This fact, corroborated with the appearance of world-scale problems, determined by the globalization of the economic activities, has signaled the need for long-term approaches on the way in which economic resources of any kind are created and consumed. The author provides a definition of sustainable development, which in his opinion is “the ethical-economic reasoning that insures the preservation of the existential conditions of human society, over an undefined time horizon, at the level of the entire natural and social space accessible or possible to be accessed in the future”. We can thus notice an association between the moral side, as a complementary and necessary element in the definition and viability of the concept of sustainable development.

In order to study the effect of the economic growth on the socio-economic and natural environment, Uzawa (2005) suggests using the term common social capital. It includes, in the author’s opinion, natural capital (natural environment, resources), social infrastructure (roads, facilities), and institutional capital (the political system, the health system, the public administration, education, culture, etc.). In this context, sustainable development is “the process of inter-temporal allocation of private capital and common social capital, following which the value of the latter is supposed to remain at a constant level” (Uzawa, 2005).

Generated by the intense debates concerning the future of mankind, the concept of sustainable development is a synthesis of the concerns manifested at the various levels of socio-economic life. In this respect, Pesqueux (2009) notices four directions that have contributed to the coagulation of the mentioned term. He stresses a philosophical side, represented by the criticism brought to technical and scientific progress and its effects in the process of replacing the human factor, completed by the concerns generated by the impact of the economic activity on the environment (pollution, global warming). The concept also originates in ecological theories, according to which the planet is a self-regulating mechanism, and reaching certain limits may determine “self-defense” reactions, with dramatic effects on the human species. The crystallization of the concept also due to the ascension of the “green” political parties, which raised environmental protection to the rank of national and respectively international objective.

Irrespective of the origins of the term, of its role and structure, it becomes ever more obvious that, starting from the current economic climate, development may be achieved only in an integrated manner, achieving a dynamic balance between the objectives of wealth creation, as a fundament of the performance of any economic activity and the social and environmental conditions.

The Company — A Means of Implementation of Sustainable Development

The scope and importance of the objectives aimed through the implementation of the concept of sustainable development gives it a macroeconomic dimension, and the involvement of national and international decision factors is required.

However, starting from the principle according to which the efficiency of a system is determined by the involvement, viability, and performance of the factors that concur to its definition, any evolutionary and behavioral change must be made starting with the basic components, in this case, from the microeconomic dimension. Of course, the civil society, through its non-governmental institutions and governance organisms, through the development policies promulgated, consistently contributes to the implementation of a strategy for sustainable economic growth, but the real nucleus around which the fulfillment of all objectives gravitates is the company, as an exponent of the economic dimension involved in the mentioned process.

Companies include divergent characteristics in what concerns sustainable development. They generate difficulties for the environmental component, both through the required territorial extensions, and through the effects of pollution and irrational use of resources. For the social component, through the various relocations of the production capacity or through modernizations that gradually replace the use of labor force in the productive process, companies determine the occurrence of significant deficiencies concerning the aimed life standards. On the other hand, the economic entities are the main funding source for the mentioned complementary dimensions (social actions, environmental protection). This way, a complex inter-conditioning is identified, which must be cautiously analyzed and coordinated in order to obtain concrete results in the direction presented earlier.

The decisive role played by the economic factor in defining and implementing this development direction requires substance behavioral changes at the level of the operational strategies of the companies. For this reason, in our opinion, the translation of the term of sustainable development from the macro-economic field to microeconomic sector is fully justified.

Mironiuc (2009) considers companies as subjects with an important role in insuring sustainable development, as they are required to perform their activity so as to preserve the environment, the community, and the economic frame. Thus, a tight connection is created between the macroeconomic objectives for long-term development and the behavior of the economic entities. The involvement of the entities into this process makes them socially responsible companies, as exponents of the concept of corporate social responsibility-CSR). This term is a voluntary integration of the social and environmental concerns of the companies with their economic activity, as they are interested, besides fulfilling their legal obligations, in achieving investments into human capital and into the environment (Essid, 2009; Misani, 2010).

From this perspective, economic entities are encouraged to adopt balanced development strategies that constitute a valid premise for obtaining global performance. If, traditionally, the companies’ strategies were drawn, coordinated, and evaluated independently, with a focus on the economic aspect and only then on the socio-environmental one, the concepts of sustainable development and social responsibility come to signal the need to evaluate the company’s activity in an integrated, holistic manner. Moreover, Saulquin and Schier (2005), Saleh et al. (2011) and Orlitzky et al. (2003) notice, though their studies, significant positive connections between the three dimensions: economic, social, and environmental, stressing the dependencies existing between them. As a consequence, a vast management literature defines and supports the use of the concept of global performance. It is “the aggregation of economic, social, and environmental performance” (Germain & Trébucq, 2004), respectively “the contribution of the companies that have taken the objectives of sustainable development, involving the integration and balancing of the economic, social, and environmental objectives” (Quairel, 2006).

Adopting this role of instrument of sustainable development, the company thus becomes a nucleus of the demands and expectations of the entire social, economic, and political environment. The wide spectrum of subjects affected by the attitude adopted by the company requires a wide array of information concerning the activity and its results, which signals the need for an integrated information reporting system. Connected to the dimensions involved into the mentioned development strategy, it must include, besides the classical financial information, information on the social andenvironmental performance.

If financial reporting is strictly regulated by the International Financial Reporting Standards (IFRS), numerous lacks can be found in the process of communication to all the interested parties of the previously identified complementary information. A series of international bodies, such as: the World Business Council of Sustainable Development (WBCSD), International Standardization Organization (ISO), Global Reporting Initiative (GRI), Accounting for Sustainability Forum, militate for the adoption of integrated reporting, providing guidelines for drawing documents in this sense, but without being able to impose them as compulsory. GRI norms complete, in what concerns social and environmental reporting, ever since 1999, the IFRS referential, which remains exclusively focused on financial reporting (Trébucq, 2009). Independent solutions for the regulation of each complementary area have been issued at an international level. Therefore, from a social perspective, OHSAS 18001 (Occupational Health and Safety Standard) norms refer to labor health and safety, SA 8000 (Social Accountability) cover the scope concerning the compliance with the human rights by the companies using the labor force, while AA (AccountAbility) 1000 governs the process of information of all the interested parties about the involvement of the economic entities in the process of sustainable development (Wolff, 2009). The environmental side is subject to the regulations of EMAS (Environmental Management and Audit Schema) and ISO 14000. If EMAS defines the general frame for the voluntary adhesion of the companies to a community eco-management and environmental audit system, ISO 14000 regulates the minimum conditions that an organization must meet for certifying an environmental management system (Mironiuc, 2009).

In the conditions in which this diversity of norms aims at a better regulation of the informational communication of the company with all the interested parties, significant challenges appear for accounting as well. It remains incondite in what concerns the quantification, processing, and reporting of all the categories of information, either financial or non-financial, respectively in stressing, through distinct balance accounts, the efforts made for social and environmental protection.

Besides, from the viewpoint of the external communication of the information, the report presentation and the way in which they meet the users’ needs are still intensely debated topics in the accounting community, both professional and academic (Adams & Whelan, 2009; Cooper & Owen, 2007; Pratt, 2007). At the same time, the accounting profession must think of the manner of verifying and certifying this non-financial information, as they raise new problems concerning the manner of presentation and the responsibility for their publication (Wolff, 2009).

The evaluation and analysis of the global performance of the companies, mainly achieved based on the information generated by accounting impose identifying the most relevant method and of the most objective indicators, able to grasp in their own dimensions the set of characteristics that shape the three efficiency segments: economic, social, and environmental.

Indicators of the Global Performance of the Company

The extent to which the results of the economic activity meet the organizational objectives can be evaluated through a large array of indicators: profitability, solvency, liquidity, self-funding, etc. Drawn to the purpose of responding to the information need generated by the various parties interested in developing the economic entity, they grasp in the explanatory area different sides of the economic and financial activity, also having various degrees of pertinence and relevance.

One of the most complex indicators, which synthesizes in its own dimension the contributions of each level at which business is performed, is company value. It is the expression of economic performance, with information and motivational values for all the factors interested in the way in which the company performs its activity, be they shareholders, creditors, governmental institutions, employees, or potential investors. The relevance of the indicator depends, however, on the existence of a functional market economy, which justifies its use and provides, at the same time, the elements necessary for its estimation.

Company evaluation aims to provide a value dimension of the entity, and not establishing a price at which it can sell. If price is an objective value, resulted from the confrontation between demand and offer, value is identified as a subjective notion, conditioned by the influence of a large number of factors that determine the fate of a company. The International Valuation Standards — IVS define the value not as a fact, but as an opinion: either on the most probable price that could be paid for an asset (in an exchange), or on the economic benefits resulted from having it (IVSC, 2011).

The value of an economic entity may differ from its price as a response to the pressure exerted by: the objectives aimed in the transaction (going concern, dissolution, strategy changes), the existence of a brand, an increase in the market share, business consolidation with new activity segments, value of the human capital, social or emotional reasons, etc. These factors reflect on the notion of value a shade of relativity that eventually reduces it to an estimation unconditionally subject to change. The volatility of the concept may be related to the time perspective, as the established value quantum is practically valid only at the evaluation moment, as well as to the spatial, geographical perspective, to political, social, or human factors instability, the last having a significant impact in the quantification process.

The need to establish the value of companies becomes important in various moments of their evolution, thus marking their destinies. Providing a value level is requested in the case of property transfer to other shareholders, knowing that the interests of the parties involved into the transaction are divergent. The company’s quotation on the capital market is another moment that needs the value foundation of the firm’s dimension, since the investors are interested in a correctly estimated share price, which would provide them the possibility to obtain future gains.

Within reorganization operations, establishing the value of the company is the basic element that conditions the success of the approach, a process concerned with capitalizing upon the competitive advantages that may be offered by another form of organization of it. Evaluation, as notices Thauvron (2007), is a company management instrument that managers use to guide the operations performed fir meeting the fundamental objective of maximizing the value of the entity. Under these circumstances, the doctrine of economical and financial analysis is called to provide solutions to support the investment process to the purpose of its being performed objectively, providing useful benchmarks for the health of the general economic environment.

Mironiuc & Bedrule-Grigoruţă (2007) signal the fact that, at present, the role of companies has changed. Besides the traditional economic objectives, they have also taken on the responsibility for fulfilling socio-environmental objectives, such as: insuring labor safety, preserving and protecting the environment, developing the local community where the company is located. In this context, the integrated communication of organizational performance has stressed the need to draw indicators that grasp the company actions in each of its activity fields.

If the economic dimension is analyzed and presented to the users of information especially through financial indicators, the socio-environmental side mainly requires the use of non-financial indicators. Actually, intense efforts are being made in the direction of integrating the non-financial indicators into the great mass of financial measures, in order to reflect the global performance of the company. Berland (2007) claims that the purpose of this action is to move from a reporting system focused on informing the shareholders (financial reporting) to integrated communication (financial plus non-financial), oriented towards all the parties interested in the development of the entity. Essid (2009) indicated a series of reasons why non-financial information contributes to superior institutional reporting. In this sense, the author stresses: the awareness of the limitations of traditional accounting indicators in what concerns information; the intensification of the pressure from the competition, due to which all the information users require supplementary data on the company’s activity, the adoption of new management strategies (TQM – Total Quality Management), where the non-financial component is a main element.

These new forms of indicators, initially adopted for external reporting, may equally serve to control the internal behavior, as well as the “strategic piloting of the company” (Essid & Berland, 2011). But for their efficient use, the answers to a series of questions remain important, such as: How can they be defined? What are they/How are they quantified? What do they use for? What are their limitations?

Environmental indicators are classified in specialized literature according to numerous criteria, such as: nature, destination, form, etc. Essid (2009) groups these measures according to their nature, into: qualitative, which describe the actions taken by the company (policies, professional training, codes, etc.) and quantitative, which express the efforts made in this direction either financially (costs with environmental investments), or in physical terms (kg, kw).

Social performance is reflected in correlation with the efficient implementation of the personnel policies, as well as with the effects they generate on the company’s activity generate. On this line, Naro (2006) groups the social indicators into the following categories: economic and financial, structural (age, training, qualification. etc), related to recruiting, training, and skill management, payment, climate, and measuring professional risk.

In what concerns the company’s position in relation to its socio-environmental responsibility, Gillet (2010) identifies three variables that give substance to these concerns: the existence of a report dedicated to social and environmental information, the existence of a department that deals especially with these problems, and the presence of the company in a social responsibility index. The mentioned stock exchange indicator, ESG (Environmental, Social and Governance), was created by large international rating agencies, with concerns in this field, in order to classify the quoted companies according to the degree of social responsibility generated by their own activity. According to Déjean (2006), the presence of a company in computing such an indicator is a signal of visibility, which generates a positive institutional image, with an effect on the relations with the competition.

The publication on the reports on socio-environmental performance is a social evaluation criterion for the company (Garric et al., 2007). For the entity, this is a manner of managing its image and reputation, and to legitimize the continuity of the productive activity (D’Almeida, 2006). By publishing this information, companies show their social engagement, respectively their concern with meeting the objectives of all the interested parties (Capron & Quairel, 2009).

The socio-environmental indicators allow quantifying the companies’ commitment and actions on the environmental and social aspects, constituting performance actual control and evaluation, and contributing, together with the economic indicators, to meeting the strategic organizational objectives.

Research Methodology

Noticing the importance of recording a global performance of the company, as a support for its sustainable development, the present article aims to identify, analyze, and evaluate, at the level of Romanian economy, the connections established between the three dimensions corresponding to the mentioned principle (economic, social, and environmental). At the same time, an attempt is made to achieve a profile of the economic efficiency of the company according to its involvement into social and environmental protection actions. In the research approach, the analysis includes, as an explanatory variable, the funding policy adopted by the economic entities. It is a determinant factor that motivates and facilitates a management strategy based on the integration of the three targeted segments.

This study has an empirical nature and, based on mainly quantitative analyses, aims to validate the work hypotheses through a deductive-inductive process (Carp et al. 2012). This effort is made through the use of theoretical benchmarks and especially of the data analysis methods and techniques specific to financial analysis, accounting, mathematics, and statistics.

Tested Work Hypotheses

In order to meet the research objectives, in accordance with the current status of knowledge on the analyzed phenomenon, we suggest testing the following work hypotheses:

H1: It is possible to identify a profile of the economic performance of the company (quantified through the value variation index) according to its degree of involvement in socio-environmental actions (the level of work productivity and the existence/inexistence of an environmental report).

H2: The specificity of the socio-environmental policy, as well as that of the funding strategy (mainly through the issue of new shares or through bank credits) determines the value level of the company.

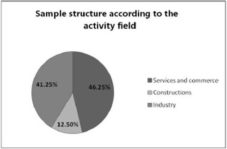

Data, Population, and Sample

The analyzed population is made up of the set of companies listed in the Bucharest Stock Exchange, and their selection in the sample was made in a stratified manner. In the selection of the studied elements, the benchmarks were the contribution of the activity field to which the company belongs to the gross domestic product (GDP), and the number of extracted companies is proportional to the weight of each field into the latter. The reference data used in the sampling were provided by the National Statistics Institute, respectively the Press Release no. 129 for the first trimester of 2012.

In the partial collectivities, the selection of the component units was made randomly simple. The study group is made up of 80 companies that perform their activity in the field of industry, constructions, respectively commerce and services.

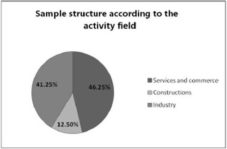

The distribution of the elements of the studied sample according to their activity field is reflected in Figure no.1.

(Source: Own Processing)

(Source: Own Processing)

Figure no. 1 Sample Structure according to the Companies’ Activity Field

The financial and non-financial information was collected from the reports of the analyzed companies, corresponding to the fiscal years 2009-2010 for the explanatory variables, and 2010-2011 for the result variables. The data were processed using the SPSS 19.0 software. The data sources were the organisms dedicated to their publishing, the Bucharest Stock Exchange, the National Bureau of the Registry of Commerce, and the organisms concerned with the analysis of the financial market, Capital Invest, International Business Promotion, etc.

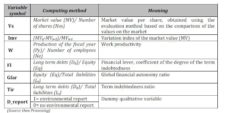

Used Variables and Data Analysis Methods

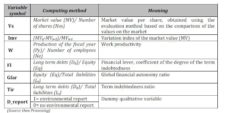

Obtaining a high degree of relevance of the analyses made on the identified phenomenon is possible only with a careful selection of the involved variables. Starting from this desideratum, the table below synthesizes the characteristics that have a significant explanatory power:

Table no. 1. Analyzed Variables

The category variables needed to identify the profile of the economic performance of the analyzed companies were obtained after the discretization of the initial measures (financial lever, the value variation index), using the information values provided by specialized literature. In the case of the W variable (work productivity), the mean (m) and the square mean deviation (σ) were taken into account. The intervals resulted from this process are:

– For Fl — funding mainly through the issue of new shares —Fl_Fea (0; 1);

— Funding mainly through credits — Fl_Fc [1; +∞).

– For Imv — value increase — Imv_positive [0; +∞);

— Value decrease — Imv_negative (-∞; 0).

– For W — low productivity — Prod_low (0; 116.35);

– Average productivity — Prod_average [116.35; 227.35);

– High productivity — Prod_high [ 227.35; +∞).

The identification and quantification of the connections established between a numeric dependent variable and “a mixture of quantitative and dummy (qualitative) variables as factor variables” (Jaba & Jemna, 2006) is made up through themultiple regression analysis with alternative variables. Also known in specialized literature under the name of covariance analysis model (ANCOVA), this type of analysis aims to test the influence of a qualitative variable (in this case, theexistence/inexistence of the environmental report) on the result variable (value per share) (Mironiuc et al, 2012). The application of this method requires transforming the nominal variable into a number of k new dummy variables (k = number of characteristics -1), by establishing a characteristic as reference field.

The general way of expressing the regression equation is (Gujarati, 2004):

Yi = β1 + β2 D2i + β3 D3i + β4 X i + ε where:

βi (i = 1 ,…, n) = coefficient of the regression model;

Di (i = 1 ,…, n-1)= 1 if the variable has the characteristic;

0 if the variable does not have the characteristic;

Xi (i = 1 ,…, n) = independent, exogenous variables;

Yj (j = 1 ,…, n) = dependent, endogenous variables;

εi = random variable, error.

The multiple correspondences factor, used in order to stress a profile of the economic efficiency of the company (quantified through the value variation index) according to its degree of involvement in socio-environmental actions (the level of work productivity and the existence/inexistence of an environmental report), is a method for analyzing the relations established between a series of category, nominal variables (Abdi & Valentin, 2007; Lebart, 2006). Jaba & Robu (2011) state that this method synthesizes the initial information by studying the associations between the variables stressed through a dispersion diagram built on a system of factor axes ranked in descending order, according to their importance in explaining the total variation in the point cloud.

Results Obtained and their Interpretation

The descriptive analysis, with which the empirical approach starts, facilitates an in-depth knowledge of the factors that concur to defining the studied phenomenon, providing a holistic image on the area where it occurs. The process also contributes to increasing the degree of appropriateness of the methods and techniques subsequently used in the inferential data analysis.

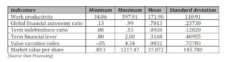

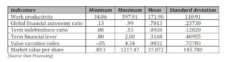

In this sense, table no. 2 shows the extreme values, the mean and standard deviation recorded by the characteristics of the units that compose the study group.

Work productivity is the indicator that, through its own dimension, stresses the extent to which companies include social actions into their strategy. This fact considers the effectiveness of the personnel policy, implemented through: superior conditions of labor safety, continuous training of the employees, motivating salary, organizational culture, etc. All these measures eventually determine an increase in the degree of personal satisfaction, which has a positive effect on the result of the employees’ activity.

For the analyzed sample, we can see a mean of 171.90 thousand lei production achieved annually by each employee. The significant dispersion of the factor value signals the existence of major differences in what concerns the companies’ involvement in social activities concerning their own staff. However, the standard deviation of 110.91 thousand lei reflects a mean concentration of 68% of the population in the interval 71.9 — 271.9 thousand lei, showing an optimistic trend in the concern of Romanian companies with developing in this direction.

The social performance of the companies through work productivity must be evaluated under the reserve of the volatility of the indicator. In its analysis, it is necessary to take into account the influences exerted by a series of complementary factors, such as: the activity field, the degree of machine renewal, the degree of work externalization, etc.

Table no. 2. Descriptive Statistics

From the analysis of the funding policy of the companies that compose the extracted sample, we can notice their penchant towards meeting the necessary to be funded based on an increase in equity (issuing new shares and self-funding), 70.13% (Gfar = 0.7013) of the total funds being attracted this way. On the average, only 9.20% (Tir = 0.092) of the resources necessary for performing the activity are attracted through credits, which gives the economic entities increased financial and decision-making independence.

Reporting long-term debts to the dimension of the equity, the financial lever reflects the degree of indebtedness of the companies, signaling at the same time the size of the insolvency risk to which they are exposed. The mean level of Fl of 0.31 units, very remote from the maximum limit 1, indicates that this type of risk does not occur in the analyzed sample. However, the major value dispersion, stressed by the standard deviation of 0.40 units, shows that in some punctual cases the presence of financial risk may be taken into account.

A high dispersion around the mean (m=8%; σ=72.78%) is identified in the case of the market value variation index (Imv). Recorded in an unfavorable period for the economic activity, the evolution of the value of the entities confirms, however, the rules of the stock exchange market. According to them, under the influence of the multitude of factors that support the investment decision, the course of shares follows specific trends.

A particular situation concerning the mean and standard deviation analysis of the distribution of some variables is signaled in relation to the market value per share (Vs). Showing a mean value of 37.81 lei/share and a standard deviation of 145.78 lei/share, the indicator is influenced by the various policies of share issuing: the value level allocated to each title, splitting operations, the manner of increasing capital (by issuing new titles or increasing the nominal value), etc. For this reason, the usefulness of this measure can mainly be seen in inferential analyses.

(Source: Own Processing in SPSS 19.0)

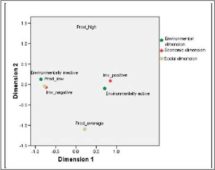

Figure no.2. Economic Performance Profile in the Context of Sustainable Development

The identification of the profile of economic efficiency, to be achieved by validating hypothesis H1, is based on the study of the associations between the category variables corresponding to the three dimensions (economic, social, and environmental), which contribute to the sustainable development of the companies. To this purpose, economic performance is reflected through the value variation index (positive or negative), while the effect of the social actions is quantified by the level of work productivity (low, average, high). The indicator corresponding to the environmental dimension is the existence or absence of reporting on the activity of environmental protection (environmentally active/inactive companies). Data processing through the multiple correspondences factor analysis allowed drawing the diagrams presented in figures 2 and 3.

Analyzing the interactions between the three mentioned dimensions, we can notice an increase of the company’s value (Imv positive), in the case of companies concerned with the voluntary or imposed implementation of the environmental protection norms (environmentally active). This category is also characterized by an average level of work productivity, a possible explanation in this respect being the fact that, often, the application of various International norms in ecology imposes restrictions in performing the production process. We can thus identify a possible conflict between the two sides, and a significant effort to harmonize them is necessary. However, we can see an association of social performance (average productivity) to the maximization of the business value.

Unlike this side, much more evident is the deterministic connection through which the negative economic results (Imv negative) are recorded in case the companies do not obtain environmental or social performance (environmentally inactive, low productivity).

(Source: Own Processing in SPSS 19.0)

(Source: Own Processing in SPSS 19.0)

Figure no. 3. Global Performance Profile in Relation to the Funding Policy

In figure no. 3, the analysis includes the financial lever (Fl), as an indicator of the financial structure, and the ratio dimension stresses the typology of the adopted funding policy (based on credits or on share issuing). From the analysis of the diagram, we can notice a significant association between funding by share issuing (Lf_Fea) and the group of category variables that express the performance of the three dimensions. On this basis, we can state that companies that attract their financial resources from the capital market are concerned with the competitive advantages provided by them in socio-environmental activities, and the adopted integrated development policy contributes to increasing the stock quotations.

By validating hypothesis H2, the aim is to draw econometric models that quantify the influences generated by the social and environmental dimension, through representative indicators, on the economic side of the companies’ activity. The latter is both a result variable and a support factor, lying at the basis of socio-environmental activities, thus signaling a reciprocal dependency relation (circular causality).

In supporting these statements, the value of the correlation coefficients, synthesized in table no. 3 are used, which are obtained by applying the correlation analysis on the available data. We can notice the strong connection (0.701; 0.821) between the mentioned independent variables and the result variable. Used in order to reflect the influence of the funding policy on the company’s value, in the context of sustainable development, the global financial autonomy ratio and the term indebtedness ratio are strongly connected (Gfar — 0.848), respectively moderate (Tir — 0.477), compared to the market value per share.

Table no. 3. Correlation Coefficients Concerning the Analyzed Variables

Testing the collinearity of the independent variables provides minimum values of the correlation coefficients (0.036; -0.039; 0.096, etc.), thus excluding the existence of significant influences between them, justifying their subsequent use in the multiple linear regression analysis.

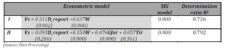

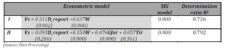

After the regression analysis, it is possible to confirm, with a confidence of 95% (SIG — 0.000) that the econometric models reflected in table no. 4 adjust real data. Also, the values of the determination ratios R2 claim that: for the first model, the independent variables taken into account explain 72.6% of the variation of the predictor, and for model II, 79.20% of the variation of the value per share is explained by the factor variables, the difference being accounted by random factors.

Table no. 4. Equations of the Regression Models

The associated regression equations were computed based on the regression coefficients, estimated with various confidence levels, between 64% and 95%. The econometric models do not take into account the contribution of the constant because of the nature of the analyzed phenomena and of the purpose for which they are made. They do not play a role in the predictive calculus of the company’s value. The first relation follows the effect of environmental reporting, respectively the influence of the variation of work productivity on the value per share. The second model starts form the idea that, in the lack of funding, no economic activity can occur.

Referring to model I, we can state, with a risk of 5%, that, in the conditions of constant work productivity, the value per share is, on the average, 0.311 lei/share higher in the case of companies that draw environmental reports, compared to those that are not involved in environmental protection actions. Also, an increase by 1000 lei/employee of the work productivity determines a mean increase of 0.637 lei/share.

Introducing into the analysis, through model II, the funding policy (the proportion taken by each major funding source, respectively the capital market and the banking market), the direction of the influences exerted on the dependent variable is preserved. The increase in the explanatory ability of the model (R2 = 79.20%) is accompanied by a reduction of the regression coefficients and of the confidence degree taken in their estimation. Thus, if the other factors remain constant, an increase by 1% of the global financial autonomy ratio (Gfar) generates a mean increase by 0.476 lei/share, while the increase by the same percentage of the term indebtedness ratio (Tir) determines a mean value evolution per share of only 0.057 lei/share.

We can thus identify, at the level of the Romanian stock exchange market, the investors’ preference for the companies with increased financial independence, and the financial risk generated by the dependence of the entities on banking institutions is little tolerated. This attitude may be explained as a reaction to the instability of the interest rate level for the attracted credits, as well as to the inconsistency of the economic results of the companies, as a source of refund of the costs corresponding to these resources. The shareholders, considered residual creditors, thus see their chances of remuneration of the invested capital minimized, eventually preferring to share the company’s benefit with a high number of co-owners.

Conclusions

The acknowledgement of the negative effects generated by economic growth on the socio-environmental dimension determined, over the last decades, deep behavioral changes at the level of the economic enterprises. From this point of view, companies are the nucleus around which gravitate all the interests and means to meet them, which characterize human society in this evolutionary moment.

The change in the attitude towards the natural environment and the acknowledgement of the benefits provided by the new personnel policies, focused on the respect, emancipation, and higher training of the employees, has lead to significant corrections of the development strategies of the companies, deviating from the strict focus on obtaining profit, irrespective of the consequences, towards the integration of this desideratum with the objectives of rendering the social and environmental protection activities more efficient.

On this basis, the present article analyzes, for the BSE quoted companies, the extent to which socio-environmental actions are present, and their effect on value.

The validation of hypothesis H1 has allowed identifying economic performance profiles, expressed through the increase/decrease index of the entity value (Imv), according to the degree of association of this objective with the results of performing socio-environmental actions, reflected through work productivity and to the extent to which the entities make reports on the environmental protection activities. We noticed that an increase of the company’s value (Imv positive) was recorded for the companies concerned with the implementation of environmental norms (environmentally active) and that achieve an average level of work productivity (Prod_average), as a result of the adopted personnel policies. Involving the funding policy into the analysis, it was noticed that the entities that obtain global performance mainly draw their financial resources from the capital market, which suggests that a higher level of the share price depends on the existence of sustainable development strategies.

The stressed connections do not express exhaustive causalities, but signal the correlations between the three dimensions of the global performance of the company, motivating the opinions according to which their sustainable development can only be achieved by integrating into their own strategy the objectives concerning economic, social, and environmental efficiency.

The quantification of the influences exerted by the complementary dimensions to the economic side of the companies’ activities on the market value per share, aimed to be achieved by validating hypothesis H2, reveals important dependencies directly proportional (positive regression coefficients) between them. Thus, the entities that draw environmental reports benefit, according to the two econometric models, from a value surplus of the share price. Also, the increase by 1000 lei/employee of work productivity, as an effect of social actions, produces a share value increase (0.637 lei/share, respectively 0.354 lei/share).

Both analysis methods used, the multiple correspondences factor analysis and the multiple regression analysis with alternative variables stress the positive impact on the value of Romanian companies generated by their involvement into environmental protection and personnel policy improvement actions. This fact supports the opinion according to which the company’s government by global performance is a need and not a sterile, obsolete, or useless objective.

The limitations of the study lay in the inclusion, in the analyzed sample, only of the companies quoted in the Bucharest Stock Exchange and in considering a restrained number of explanatory variables concerning the analyzed phenomenon. Removing these problems and applying more relevant data processing methods constitute future research directions.

Acknowledgements

This work was supported by the European Social Fund in Romania, under the responsibility of the Managing Authority for the Sectoral Operational Programme for Human Resources Development 2007-2013 [grant POSDRU/CPP 107/DMI 1.5/S/78342]

References

Abdi, H. & Valentin, D. (2007). “Multiple Factor Analysis,” Encyclopedia of Measurement and Statistics, Sage Publications, Thousand Oaks

Publisher

Adams, C. A. & Whelan, G. (2009). “Conceptualising Future Change in Corporate Sustainability Reporting,” Accounting, Auditing & Accountability Journal, Vol. 22, No. 1, pp.118-143.

Publisher – Google Scholar

Berland, N. (2007). “A Quoi Servent les Indicateurs de la RSE? Limites et Modalités d’usage,” Les enjeux du développement durable, pp. 41-64, available at: http://hal archi ves-ouvertes.fr/docs/00/34/04/30/PDF/Article_Mendes_France.pdf, accessed on: 06.08.2012

Publisher – Google Scholar

Byrch, C., Kearins, K., Milne, M. & Morgan, R. (2007). “Sustainable “What”? A Cognitive Approach to Understanding Sustainable Development,” Qualitative Research in Accounting & Management, Vol. 4 No. 1, pp. 26 — 52

Publisher – Google Scholar – British Library Direct

Capron, M. & Quairel, F. (2009). “Le Rapportage du développement Durable: Volontariat ou Obligation?,” Revue de l’Organisation Responsible, Vol. 4, No. 2, pp. 19-29

Publisher – Google Scholar

Carp, M., Mironiuc, M., Robu, I. B. & Chersan, I. C. (2012). “Empirical Study on the Efficiency of the Companies Financing Process through Statistical Analysis,” Communications of the IBIMA, Vol. 2012, pp. 1-19

Publisher – Google Scholar

Cooper, S. M. & Owen, D. L. (2007). “Corporate Social Reporting and Stakeholder Accountability: The Missing Link,”Accounting, Organizations and Society, Vol. 32, pp. 649-667

Publisher – Google Scholar

D’Almeida, N. (2006). ‘La Perspective Narratologique en Organizations,’ in Responsabilité sociale: vers une nouvelle communication des entreprises?, Lille: Septentrion, pp. 27-38, available at: http://books.google.ro/books?id= DMsCuCmmFtcC&pg=PA27&lpg=PA27&dq=La+perspective+narratologique+en+organizations&source=bl&ots=ah02, accessed on: 06.08.2012

Déjean, F. (2006). “L’émergence de l’investissement Socialement Responsable en France : Le Rôle des Sociétés de Gestion,” Revue de l’organisation responsible, Vol. 1, pp. 18-29

Publisher – Google Scholar

Dinga, E. (2009). ‘Studii de Economie: Contributii de Analiza Logica, Epistemologica si Metodologica,’ Bucuresti: Economica

Google Scholar

Essid, M. (2009). “Les Mecanismes de Controle de la Performance Globale: Le Cas des Indicateurs non Financiers de la RSE,” Doctoral thesis, Paris: Université Paris-Sud-Faculté Jean Monnet, available at: http://tel.archives-ouvertes.fr/docs/00/47/37/94/PDF/These_Moez_Essid.pdf, accessed on: 07.07.2012

Publisher

Essid, M. & Berland, N. (2011). “Les Impacts de la RSE sur les Systèmes de Contrôle,” Comptabilité-Contrôle-Audit, Vol. 17, No. 2, pp. 59-88, available at: http://hal.archives-ouvertes.fr/docs/00/63/76/33/PDF/CCA_2010_Essid_et_Berland_Version_Finale_2.pdf, accessed on: 06.08.2011

Publisher

Garric, N., Léglise, I. & Point, S. (2006). “Le Rapport RSE, Outil de Légitimation? Le Cas Total à la Lumière d’une Analyse du Discours,” Revue de l’Organisation Responsible, Vol. 2, No. 1, pp. 5-19, available at: http://hal.archives-ouvertes.fr/docs/00/29/22/68/PDF/2006-Garric-Leglise-Point-RSE.pdf, accessed on: 06.08.2012

Publisher

Germain, C. & Trébucq, S. (2004). “La Performance Globale de l’entreprise et son Pilotage: Quelques Réflexions,”Semaine sociale Lamy, pp. 35-41., available at: http://trebucq.u-bordeaux4.fr/1186-germain-trebucq.pdf, accessed on: 07.07.2012

Publisher

Gillet, C. (2010). “L’étude des Déterminants de la Vérification des Informations Sociétales dans le Contexte Français,”Doctiral thesis, Paris: Université Toulouse, available at: http://tel.archives-ouvertes.fr/docs/00/55/10/17/PDF/GILLET.pdf, accessed on: 07.07 2012

Publisher

Gujarati, D. (2004). ‘Basic Econometrics,’ New York: The McGraw-Hill Companies

International Valuation Standards Council (2011). ‘International Valuation Standards,’ London: IVSC

Jaba, E. & Jemna, D. (2006). ‘Econometrie,’ Iaşi: Sedcom Libris

Jaba, E. & Robu, I.- B. (2011). “Explorarea Statistica a Pietei de Audit în Scopul Aprecierii Independentei Auditorului,”Audit Financiar, Vol. 9, No. 6, pp. 28-36

Publisher

Lebart, L., Piron, M. & Morineau, A. (2006). Statistique Exploratoire Multidimensionnelle. Visualisation et Inférences en Fouille de Données, 4th edition, Dunod, Paris

Publisher

Milne, M., Tregidga, H. & Walton, S. (2009). “Words Not Actions! The Ideological Role of Sustainable Development Reporting,” Accounting, Auditing & Accountability Journal, Vol. 22, No. 8, pp. 1211 — 1257

Publisher – Google Scholar

Mironiuc, M. (2009). “Sisteme de Managementul Mediului: Metodologia de Proiectare si Implementare,” Iasi: Alexandru Ioan Cuza

Publisher

Mironiuc, M. & Bedrule-Grigoruta, M. V. (2007). “Performance in the Economical and Financial Communication of the Entity: Cognitive Potential and Limitations, Colloque International,” À la recherche de la performance: Un concept de gestionnaire essentiel à l’entreprise”, February 1 and 2 2007, l’ESC Bretagne Brest, France, available at:http://papers.ssrn.com/sol3/papers.cfm?Abstract_id=965107, accessed on: 05.08.2012

Publisher

Mironiuc, M., Carp, M., Chersan, I. C. & Robu, I. B. (2012). “The Evaluation of the Investment Opportunity by Analyzing the Financial Structure Influence on Company Value,” Communications of the IBIMA, Volume 2012, pp. 1-16

Publisher – Google Scholar

Misani, N. (2010). “The Convergence of Corporate Social Responsibility Practices,” Management Research Review, Vol. 33, No. 7, pp. 734 — 748

Publisher – Google Scholar

Naro, G. (2006). “Les Indicateurs Sociaux: Du Contrôle de Gestion aux Développements Récents du Pilotage et du Reporting,” in Management et gestion des ressources humaines : stratégies, acteurs et pratiques, Paris: EduSCOL

Publisher – Google Scholar

Orlitzky, M., Schmidt, F. L. & Rynes, S. L. (2003). “Corporate Social and Financial Performance: A Meta-Analysis,”Organization Studies, Vol. 24, No. 3, pp. 403-441.

Publisher – Google Scholar – British Library Direct

Pesqueux, Y. (2009). “Sustainable Development: A Vague and Ambiguous “Theory”,” Society and Business Review, Vol. 4, No. 3, pp. 231 — 245

Publisher – Google Scholar

Pratt, L. (2007). “Sustainability Reporting,” CGA Magazine, Vol. 41, No 5, pp. 18-35

Publisher

Quairel, F. (2006). “Contrôle de la Performance Globale et Responsabilité Sociale de L’entreprise (RSE),” Lucrare sustinuta la: Congrès de l’Association Francophone de Comptabilité, Tunis, pp. 1-22, available at: http://halshs.archives-ouvertes.fr/halshs-00548050/en/, accessed on: 07.07.2012

Publisher

Remillard, D. & Wolff, D. (2009). “Le Développement Durable: L’émergence d’une Nouvelle Convention?,” Revue Française de Gestion, Vol.35, No. 194, pp. 29-43.

Publisher – Google Scholar

Saleh, M., Zulkifli, N. & Muhamad, R. (2011). “Looking for Evidence of the Relationship between Corporate Social Responsibility and Corporate Financial Performance in an Emerging Market,” Asia-Pacific Journal of Business Administration, Vol. 3, No. 2, pp. 165 — 190

Publisher – Google Scholar

Saulquin, J. Y. & Schier, G. (2005). “La RSE Comme Obligation/Occasion de Revisiter le Concept de Performance?,”lucrare prezentata la Congrès Grefige NANCY, available at: http://ddata.over-blog.com/xxxyyy/0/32/13/25/performance-la-rse-et-le-concept-de-performance.pdf, accessed on: 07.07.2012

Publisher

Stead, W. E., Stead, J. G. & Starik, M. (2004). Sustainable Strategic Management, New York: ME Sharpe, available at: http://www.google.ro/books?hl=ro&lr=&id=c1mF3vx_-4C&oi=fnd&pg=PR11&dq=Sustainable+Strategic+Management, accessed on: 10.06.2012

Publisher – Google Scholar

Thauvron, A. (2007). ‘Evaluation d’Entreprise,’ Paris: Economica

Trébucq, S. (2009). “Cartographie Stratégique des Actions de Développement Durable: Le Cas de PME Françaises,”lucrare sustinuta la: Congrès de l’Association francophone de comptabilité, Strasbourg, pp. 1-28, available at:http://halshs.archives-ouvertes.fr/docs/00/46/06/40/PDF/p178.pdf., accessed on: 08.07.2012

Publisher

Uzawa, H. (2005). Economic Analysis of Social Common Capital, New York: Cambridge University Press

Publisher – Google Scholar

Wolff, D., Roy, C. & Berthelot, S. (2009). “Projet d’intégration du Développement Durable au Tableau de Bord des PME par une Adaptation du SD 21000,” Paper presented at: Congrès de l’Association francophone de comptabilité, pp. 1-19, available at: http://halshs.archives-ouvertes.fr/docs/00/45/94/19/PDF/p100.pdf, accessed on: 07.07.2012

Publisher