Introduction

It is known that return rates represent the most popular instruments of measuring the economic and financial performances of companies. If one follows the dictionary definition of the performance, one can find that this term refers to obtaining results in one specific area (Vâlceanu et al., 2004). However, in the economic field, this word is often referred to profitability, productivity and return (Vâlceanu et al., 2004).

As for the aspects noted above, if the return is a form of measuring the performances, one can say that two of the most popular return rates are: return on used resources and return on sales and these are calculated considering the profit and loss statements.

The objective of this work refers to analyzing the correlation between the two previously mentioned return rates.

The methodology used in order to achieve the specified goal refers to the correlation method and to the bibliographic research. The first is used when between the analyzed objective and the influencing factors there is at least one stochastic relationship (Vâlceanu et al., 2004). The second method is used for defining the area studied and is presented especially in the literature review chapter.

It is known that the empirical research or the method of correlation means to accomplish several stages: formulating the hypothesis, choosing the data sample, finding the best econometric model, estimating, testing and validating the model, obtaining and interpreting the results.

Overall, the proposed study comes to establish whether there is any correlation between the two mentioned rates, for Petrom and Zentiva companies, as these results are useful for both the literature in the area and for the two companies, which can assess their future strategies based on the results found. More than that, it is always useful to have a study from which further analyses could start, as no clear evidence on this issue is available as far as I know.

This study is structured as follows: a short review of the specific literature, the development of a hypothesis, the econometric study, the results and the conclusions.

Literature Review

The concept of economic and financial performance as of the existing specific literature refers to returns which usually take into consideration the results obtained based on inputs utilization, that are the elements presented in the profit and loss statement (Vâlceanu et al., 2004).

The return is defined as the ability of a company to obtain profits by inputs and capital utilizations (Vâlceanu et al., 2004). The return is a synthetic form of expressing the efficiency of a company’s activity, which is of all inputs used, bearing in mind all the economic cycle stages: supply, manufacture and sale (Vâlceanu et al., 2004).

In the specific literature, several researchers have analyzed the economic and financial performance through the return rates, especially using the return on assets and the return on equity for various situations or for different companies that have operations in a particular area. For example, Shim (2011) analyzes if the financial performances of companies measured using the return on assets and the return on equity increase or decrease in the specific case of a merger or acquisition of companies (Shim, 2011).

Another interesting study regarding the performance of merged companies is that of Hagendorff et al. (2009) that explore the operational strategies adopted by banks in the United States compared to those adopted in Europe, using accounting data for the comparison of long term performances of acquisition strategies (Hagendorff et al., 2009).

For examining the implications of merged banks profitability, there are put into discussion the changes of OPCFROA indicator (Hagendorff et al., 2009). This indicator refers to the cash flow before taxation related to the historical value of the assets, where the cash flow before taxation is computed as the sum of income before taxation and exceptional elements and loans expenses (Hagendorff et al., 2009). The OPCFROA indicator includes two types of interest expenses for banks: interest expenses that result from the financing decision and those from the financial mediation (for example the interest paid for deposits) (Hagendorff et al., 2009). By contrary, the accounting indicators that consider the earnings (for example the return on assets and the return on equity) include general interest expenses which are influenced by the merger accounting method and by the merger financing method (Hagendorff et al., 2009).

Considering the above aspects, the performance measurement using the accounting data as instrument is one of the most objective evaluation methods of the companies’ success. The researchers from this area have as an argument the business strategic scope of obtaining satisfactory returns (Papadakis et al., 2010).

Although the studies based on the accounting information have not just a few advantages, one can say that there are also disadvantages of using this method (Papadakis et al., 2010). First of all, the accounting profits represent the most limited performance measurement method due to the fact that they measure only the economic performance of a company (Papadakis et al., 2010). Furthermore, the performance measurement using accounting refers only to reflect the past performance of a company (Papadakis et al., 2010).

Two return rates less common for the specific literature are the return on used resources and the return on sales.

The return on used resources reflects the relationship between the profit corresponding to the turnover and the total costs of selling (Vâlceanu et al., 2004). Considering the reference to the operational activity, this rate is calculated by reporting the operational result to the operational expenses or by reporting the profit that corresponds to the net turnover to the expenses corresponding to the net turnover (Vâlceanu et al., 2004).

The return on sales shows the efficiency of a company’s commercial activity by expressing the liaison between the profit and turnover (Vâlceanu et al., 2004). This rate is calculated by reporting the profit (net, corresponding to the net turnover or operational) to the net turnover (Vâlceanu et al., 2004). The most important limit of this rate in defining the performance is generated by the fact that it is calculated on the basis of the accounting profit and in this way the rate will be influenced by the accounting politics and practices used by companies, that are the methods of depreciation of fixed assets, the methods of inventories evaluation, the supply politics, etc. (Vâlceanu et al., 2004).

Because there are no clear evidences of an analysis of the two rates in the specific literature, I propose a study of the possible correlation between these rates, starting from the fact that often in the specific literature the companies’ performances may be analyzed using the return indicators, that are calculated based on the accounting data, that information is from the profit and loss statement.

The Hypothesis Development, the Econometric Model and the Variables

As widely known, the return on used resources and the return on sales have the advantage of being calculated using only the profit and loss elements, without being necessary additional information as that from the management accounting (Vâlceanu et al., 2004). Considering the computing methods and the possible relationship between the two rates, I propose as a hypothesis the existence of a correlation between the return on used resources and the return on sales.

As far as I know, the approach of these two return rates is not common in the specific literature. Nevertheless, the two indicators have a particular relevance for the performance analysis.

The proposed econometric model is as follows:

Return on used resourcesi = a + b * return on salesi + xi, i = 1,…, n

where, Return on used resourcesi is the objective variable;

Return on salesi is the independent variable;

xi represents the residual variable;

n represents the number of considered quarters / semesters.

The above hypothesis refers to the fact that the return on used resources is correlated to the return on sales for the companies’ consideration in the data sample chapter.

Research Methodology

Data Sample

For testing the hypothesis previously defined, the selection of the companies was based on several criteria: the companies have been listed, they have had activity on the Romanian market and the accounting information has been available on the companies’ internet sites. Analyzing a couple of organizations, the ones that were considered as data sample are Petrom and Zentiva. Both companies have operated on the Romanian market: the gas and oil industry (Petrom) and the pharmaceutical industry (Zentiva).

Petrom has an interesting history. It has been established in 1991 as Regia Autonomă a Petrolului PETROM S.A. (Petrom, 2012). In 2004, the Austrian company OMV has acquired 51% of Petrom’s share capital and in January 2010, the company’s name was changed into OMV PETROM S.A., as a consequence of the General Meeting of Shareholders’ decision of 20th of October 2009 (Petrom, 2012). However, the name of the trade mark and logo of the company remained the same (Petrom, 2012).

The shareholders structure of Petrom is: 51,01% OMV AG (OMV Aktiengesellschaft), 20,64% the Romanian Ministry of Economy, 20,11% Fondul Proprietatea S.A., 2,03% EBRD (European Bank of Reconstruction and Development) and 6,21% private investors (Petrom, 2012). In 2001, Petrom was listed at the Bucharest Stock Exchange and the first date of shares trading was 3rd of September (Petrom, 2012).

Zentiva has a long history. The history has its roots in 1962 when it was established as a company of drugs manufacturing (Zentiva, 2011). This company was part of the state system which provided drugs to the internal market (Zentiva, 2011). Later, the company’s name changed into Bucharest Medicines Plant and in 1990 it was called Sicomed (Zentiva, 2011). In 1998, the company was listed at the Bucharest Stock Exchange, its shares being ones of the most sought after at that moment (Zentiva, 2011).

In 2005, Zentiva acquired Sicomed (Zentiva, 2011). In the first semester of 2006, Zentiva integrated the past activities of Zentiva group on the Romanian market with the existing ones of Sicomed (Zentiva, 2011). Zentiva becomes the leader on the Romanian market for general drugs (Zentiva, 2011).

The shareholders structure of Zentiva at 4th of June 2010 was: 50,9809% Venoma Holdings Limited, 23,9282% Zentiva NV, 6,6842% Sanofi-Aventis Europe, 9,6417% other legal persons, 8,7650% individuals (Zentiva, 2011).

The data selected for Petrom refers to the period between the second quarter of 2004 and the fourth quarter 2009 due to the fact that before the second quarter 2004 there was no available information on Petrom’s internet site. The data for the period after the fourth quarter 2009 was eliminated from the data sample because, starting with 2010, Petrom reports its quarterly consolidated results in accordance with the International Financial Reporting Standards (Petrom, 2012). Petrom’s statements of individual results are elaborated in accordance with the Romanian Accounting Standards, but starting with 2010 these are available only for semesters and annual periods of time (Petrom, 2012).

Information for Zentiva was selected for the period between the first semester 2004 and the first semester 2011. Although initially I considered quarterly periods of time, there was no sufficient available data for each quarter on Zentiva’s internet site. Also, the information previous to the first semester 2004 and after the first semester 2011 was not available on Zentiva’s internet page.

Considering the above, the data selected for the two companies from the profit and loss statements refer to: the net results, the operational expenses, the operational results and the net turnovers. The following indicators that represent the econometric model’s variables were calculated based on the above elements selected:

The return on used resources was calculated as:

Return on used resources = Operational result / Operational expenses *100

where, Return on used resources is for each quarter / semester;

Operational result and operational expenses refer to each quarter / semester.

Although this formula for the return on used resources could be argued as a method of computation less common due to the fact that there is a possibility for it to include elements that do not refer to the operational activity because some accounts included in the operational results or expenses could be of non-operational nature, I consider that, with all these, the formula is correct and fair enough for the purposes of this study.

The return on sales was calculated as follows:

Return on sales = Net result / Net turnover *100

where, Return on sales is for each quarter / semester;

Net result and net turnover refer to each quarter / semester.

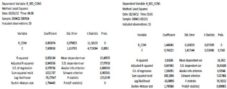

The Parameters Estimations and the Econometric Model’s Tests

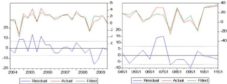

The correlation between the two variables of the model is described by the following graphics: