Introduction

Bowen (1953) has outlined the ‘modern debate’ regarding corporate social responsibility (CSR), stating that businessmen have ‘the obligations to pursue those policies, to make those decisions, or to follow those lines of action which are desirable in terms of the objectives and values of our society’. Business operates according to society’s orientations based on the existence of a social contract, as a set of rights and obligations, similar to the governmental system. The specificity of the contract could be changed in relation to changes in society, but generally the contract remains always the source of business legitimacy (Donaldson, 1982).

The social contract represents the means by which business ethics are congruent with society’s objectives. According to The Committee for Economic Development (1971), social contracts are not convenient for the companies, being instead necessary from a moral point of view, at the same time stimulating the companies to adopt a vision towards the members of the society. However, the social activities will diminish the costs related to stakeholders which request an equitable atitude of the company related to the rights and profit distribution (Sen, 1997; Swanson, 1995). As a consequence, a company that honors this contract will gather implicitly social harmony and will reduce the costs for maintenance of good relationships with the stakeholders (Jones, 1995). Otherwise, the non-compliance with contractual terms will determine the rise of the business operating costs.

Based on Wartick & Cochran’s (1985) definition, Wood (1991) defined corporate social performance as ‘a business organization’s configuration of principles of social responsibility, processes of social responsiveness, and policies, programs, and observable outcomes as they relate to the firm’s societal relationships’. According to Frederick (1994), social responsibility is fundamented on moral and ethical concepts, whereas social responsiveness deals with managerial processes related to the response (planning, social forecasting, organizing for social answers, control of social activities, social decision processes, corporate social policies), thus having a problematic character. Besides, Carroll (1979) and Sethi (1979) have considered that social responsiveness cannot replace social responsibility, because companies could be very receptive to social pressures or environmental conditions, but it could act irresponsible or unethical. As well, Wartick & Cochran (1985) emphasized that responsiveness completes, but does not replace the responsibility. Branco & Rodrigues (2007) highlighted the fact that firms are perceived from the perspective of their obligation to take into consideration social needs and long term society’s desires, which implies that they engage in activities which promote benefits for the society and minimize the negative effects related to the employed actions, as long as the society is not harmed by such activities.

The aim of this study is to research the relationship between corporate social responsibility proxied by Corporate Social Responsibility Index (CSRI), reported by Boston College Center for Corporate Citizenship and Reputation Institute, and firm value, by using a sample of U.S. companies listed on the New York Stock Exchange (NYSE) and NASDAQ Stock Market, over 2008-2011. The study is structured as follows. The second section highlights previous research results regarding corporate social responsibility and companies’ value and develops the research hypothesis. The third section describes the database, the variables, and the quantitative models to be used. The fourth section presents the results of the empirical research. The last section concludes the paper.

Literature Review and Hypothesis Development

By considering the relationship between social/environmental performance (CSP) and corporate financial performance (CFP), Orlitzky, Schmidt & Rynes (2003) have introduced several hypotheses: a positive relationship between corporate social performance and financial performance across a wide variety of industry and study contexts; a bidirectional causality between corporate social performance and financial performance; corporate social performance is positively correlated with corporate financial performance because CSP increases managerial competencies, contributes to organizational knowledge about the firm’s market, social, political, technological, and other environments, and thus enhances organizational efficiency; furthermore, CSP is positively correlated with CFP since CSP helps the company to develop a positive reputation and goodwill with its external stakeholders. By employing a meta-analysis of 52 studies, Orlitzky, Schmidt & Rynes (2003) found that CSP appears to be more highly correlated with accounting-based measures of CFP (return on assets, return on equity) than with market-based indicators, whilst CSP reputation indices were more highly correlated with CFP than were other indicators of CSP.

According to Orlitzky (2013), the organizational signals related to corporate social responsibility may have a harmful impact on equity markets seeing that corporate social responsibility is not systematically correlated with the companies’ economic fundamentals, withal opportunistic managers are incentivized to distort the information provided to market participants as regards their firms’ corporate social responsibility. Thus, there could be acknowledged the hardship faced by market participants in order to interpret the information about corporate social responsibility accurately. In fact, the greater noise showed within financial markets typically entails more noise trading, which in turn leads to excess market volatility among all publicly traded firms and, in a particular context of social-institutional processes and structures, to excess market valuations of firms that are widely perceived as socially responsible.

The affordability theory emphasizes that only those companies registering an adequate performance could afford the costs of social responsible actions. However, this assumption is in accordance with the corporate social responsibility model developed by Carroll (1979) which stated that managers will firstly complete economic obligations, then juridical ones, and eventually the discretionary responsibilities. Additionally, the slack resources theory conceived by Cyert & March (1963) underlines the fact that firms do not operate within an exclusively efficient manner, excess resources representing the proper means through which unpredicted events could be solved or programatic measures could be taken. McGuire, Sundgren & Schneeweiss (1988) and McGuire, Schneeweiss & Branch (1990) stressed the appearence of a high level of financial performance if excess resources are allocated to social field.

According to Servaes & Tamayo (2013), corporate social responsibility activities could enhance firm value for firms with high public awareness, as proxied by advertising intensity. Nevertheless, firms with high public awareness are also penalized more when there are corporate social responsibility concerns. Likewise, for firms with low public awareness, the impact of corporate social responsibility activities on firm value is either insignificant or negative. As well, advertising has a negative impact on the relationship between corporate social responsibility and firm value if there is an inconsistency between the firm’s efforts as regards CSR and the company’s overall reputation. Furthermore, after considering firm fixed effects, Servaes & Tamayo (2013) concluded that there is no direct relation between corporate social responsibility and firm value.

By using the scores provided by Credit Lyonnais Securities (Asia) over 2001-2004, Cheung, Tan, Ahn & Zhang (2010) identified a positive relationship between corporate social responsibility and market valuation, moreover CSR being positively related to the market valuation of the subsequent year thus present CSR actions reflecting into future firm value. Jo & Harjoto (2011) established a positive association between the implication in social responsibility actions and Tobin’s Q ratio, based on Kinder, Lydenberg, and Domini’s (KLD’s) Stats database. Nelling & Webb (2009) used KLD Socrates Database in order to measure corporate social responsibility and found a weak relationship between CSR and corporate performance after using a time series fixed effects approach. From a different perspective, Belal & Cooper (2011) focused on the absence of CSR reporting within a developing country such as Bangladesh. There was examined the lack of disclosure on three particular eco-justice issues as follows: child labor, equal opportunities, and poverty alleviation. Thereupon, the findings of 23 semi-structured interviews which were undertaken with senior corporate managers suggest that the main reasons for non-disclosure include the lack of resources, the profit imperative, lack of legal requirements, lack of knowledge/awareness, poor performance, and the fear of bad publicity.

Given these findings, we consider the following hypothesis: Corporate social responsibility actions positively influence firm value.

Data and Estimation Framework

Sample Selection and Description of Variables

Initially, the database consisted of 56 U.S. companies, over 2008-2011. Further, four companies were dropped from the sample due to their non-listing on the New York Stock Exchange or NASDAQ Stock Market. Therefore, our final sample comprised 52 companies having the following distribution: 38 companies in 2008, 46 companies in 2009, 39 companies in 2010, respectively 32 companies in 2011, summing up 155 statistical observations. The membership to activity sector as regards the selected companies is varied, as follows: consumer cyclical, consumer defensive, consumer goods, financial services, healthcare, industrials, services, technology.

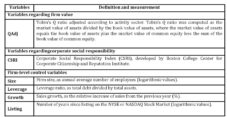

Table 1 provides the definition and measurement of all the variables employed within empirical research. To measure firm value, we will employ Tobin’s Q ratio according to Kaplan & Zingales (1997), Gompers, Ishii & Metrick (2003), and Bebchuk, Cohen & Ferrell (2009). After computing Tobin’s Q ratio for each company, we adjusted it according to activity sector, due to the large spread of companies in different sectors of activity, using the methodology described by Eisenberg, Sundgren & Wells (1998). Thus, the difference between Tobin’s Q ratio for a certain company and the median of the ratio in that activity sector represents ∆TobinQ, whereas the adjusted ratio, TobinQadj, is defined as follows: TobinQadj= sign(∆TobinQ)*sqrt(|∆TobinQ), where sign(∆TobinQ) is the sign of the difference between Tobin’s Q ratio for each company and the median in that activity sector. There was used the median instead of the average because the data were not following a normal distribution. The source of financial data was represented by the companies’ annual reports. All the data were hand-collected.

Table 1: Definition and Measurement of Variables

Source: Authors’ processing.

Corporate social responsibility is proxied by Corporate Social Responsibility Index (CSRI), the data being collected from Boston College Center for Corporate Citizenship and Reputation Institute. This index evaluates from the social implication point of view the following three dimensions: citizenship (responsible involvement in the community and in the environment issues), governance (performing the activities in a fair and transparent manner and the evaluation of the way on which stakeholders associate the company with high ethical standards), workplace (adopting a fair behaviour towards the employees, assuring a decent salary, investments in developing employees’ abilities, and offering career opportunities).

Additionally, we include a set of firm-level control variables which could influence companies’ value. Thus, for evaluating companies’ size, the annual average number of employees will be used (logarithmic values), similar to Arlow & Gannon (1982), Ullmann (1985), Griffin & Mahon (1997), Waddock & Graves (1997a), Husted & Allen (2007). The size influences the capacity to initiate social responsibility actions, because smaller firms have a reduced potential to sustain these activities in contrast to larger companies which have a solid infrastructure and high levels of cash flows. As the company develops, it becomes more visible and responsible regarding stakeholders’ requests. According to Roberts (1992), stakeholders’ wealth is influenced by the existence of financial difficulties. The gearing and debt level will be measured as the ratio between total debt and total assets, a company with a solid orientation towards stakeholder interests being considered well-managed and less risky. As well, we will consider the growth opportunities, because there could be suggested the improvement of employees and customer satisfaction through rising the turnover. We will include the age of the company measured through the number of years since it has been listed on the NYSE or NASDAQ Stock Market (logarithmic values).

Empirical Design

In order to empirically investigate the relationship between Corporate Social Responsibility Index (CSRI) and firm value we will estimate several multivariate panel data regression models, unbalanced, both without cross-sectional effects and with fixed effects, by considering the following general specification:

Companies_valueit= α + βXit + γZit + uit i = 1, …, N; t =1, …, T (1)

where for the company i in year t, we consider as dependent variable the Tobin’s Q ratio adjusted according to activity sector, Xit being the vector of independent variables representing corporate social responsibility actions proxied by CSRI conceived by Boston College Center for Corporate Citizenship and Reputation Institute, and Zit is the vector of firm-level control variables. According to Baltagi (2005), models with only one component for the error are used frequently, as follows:

uit = μi + υit (2)

μi showing the specific individual effect, unobservable and Ï…it representing the remaining error. In the context of fixed effects models, the component from error parameter μi could be correlated with the explicative variables Xit, but with the maintenance for the hypothesis of uncorrelation between Xit and random error’s component Ï…it.

Empirical Findings

Descriptive Statistics and Correlation Analysis

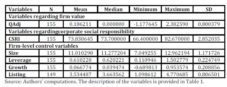

Table 2 shows descriptive statistics related to all the variables employed within empirical research. We emphasize the following tiers as regards the scores related to Corporate Social Responsibility Index (CSRI), according to Boston College Center for Corporate Citizenship and Reputation Institute: below 45 (poor/lowest tier), 45-55 (weak/vulnerable), 56-65 (average/moderate), 66-75 (strong/robust), and above 75 (excellent/top tier). Therefore, the mean score (73.83) of Corporate Social Responsibility Index (CSRI) reveals the fact that the selected companies are strong/robust towards citizenship, governance, and workplace.

Table 2: Descriptive Statistics

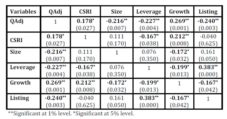

Table 3 provides the Pearson correlations coefficient matrix. Thus, we acknowledge that the values of correlation coefficients are not high. Besides, we underline a positive correlation (r = 0.178), statistically significant (prob. = 0.027), between Corporate Social Responsibility Index (CSRI) and firm value.

Table 3: Correlation Matrix

Regression Results Towards the Influence of Corporate Social Responsibility Index (CSRI) on Firm Value

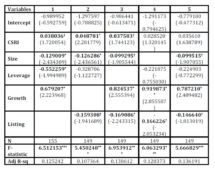

We have estimated five econometric models, for both the models without cross-sectional effects and with fixed effects, in order to catch the robustness of the relationship between corporate social responsibility and firm value.

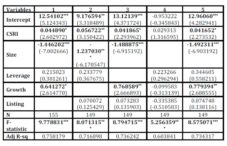

Table 4 reveals the results of panel data regression models, unbalanced, without cross-sectional effects as regards the influence of Corporate Social Responsibility Index (CSRI) on firm value. Thus, the index related to corporate social responsibility positively influences the value of U.S. listed companies (models 1, 2, and 3). By considering the impact of firm-level control variables on Tobin’s Q ratio adjusted according to activity sector, the results provided support for a negative influence of firm size, as annual average number of employees, on firm value (models 1, 2, 3, and 5). Besides, there was established a negative relationship between leverage ratio, as total debt to total assets and firm value (model 1), likewise between the number of years since listing on the New York Stock Exchange or NASDAQ Stock Market (logarithmic values) and firm value (models 2, 3, 4, and 5). On the contrary, sales growth, as the relative increase of sales from the previous year, positively influences Tobin’s Q ratio adjusted according to activity sector (models 1, 3, 4, and 5).

Table 4: Results of the Estimations Regarding the Influence of Corporate Social Responsibility Index (CSRI) on Firm Value (Without Cross-Sectional Effects)

” p < 0.10. *p < 0.05. **p < 0.01. ***p < 0.001. The t-statistic for each coefficient is reported in parentheses. The description of the variables is provided in Table 1. Source: Authors’ computations.

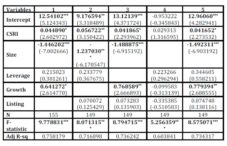

Table 5 provides the results of the estimations with fixed effects, regarding the influence of Corporate Social Responsibility Index (CSRI) on firm value. Therefore, the positive relationship between Corporate Social Responsibility Index (CSRI) and firm value was confirmed (models 1, 2, 3, and 5). Furthermore, there was underlined a negative impact related to firm size on Tobin’s Q ratio adjusted according to activity sector (models 1, 2, 3, and 5), respectively, a positive impact of the relative increase of sales from the previous year on firm value (models 1, 3, and 5).

Visibility in CSR policies reflected through CSRI is understood to be related to value creation. To the extent that stakeholders and customers are perceived to remark companies’ corporate social responsibility activity, they are able to reward the firm for its participation. A greater presence of CSR programs engenders a favorable firm image that has a positive impact on the ability of the firm to generate value through increased customer loyalty and development of new products and markets. The increase in sales (partially acquired through customer awareness of the good image created by the instrumentality of CSR involvement) also was evidenced to have a positive impact on firm value.

Table 5: Results of the Estimations Regarding the Influence of Corporate Social Responsibility Index (CSRI) on Firm Value (With Fixed Effects)

” p < 0.10. *p < 0.05. **p < 0.01. ***p < 0.001. The t-statistic for each coefficient is reported in parentheses. The description of the variables is provided in Table 1. Source: Authors’ computations.

The negative correlation between firm size and Tobin’s Q ratio adjusted according to activity sector could be explained in the case of large listed companies through the allocation of resources, thus having many employees is leading to an increase in the labour cost and from a certain level restrict the usage of resources available to use for the achievement of an increase in firm value. The evidence provided on the negative relationship between the gearing level and firm value (in the models without cross-sectional effects) is consistent with other authors’ findings (Roberts, 1992) because the leverage measures the risk level and a highly valued corporation having orientation towards stakeholders’ interests is considered less risky and has lower levels of indebtedness.

In both panel data regression models, without cross-sectional effects and with fixed effects, the same relationship between CSRI and Tobin’s Q ratio adjusted according to activity sector expressing firm value was proved. Thereby, the hypothesis of the current research, according to which the undertakings related to corporate social responsibility positively influence firm value, is statistically validated.

Summary and Concluding Remarks

By using a sample of companies listed on the New York Stock Exchange and NASDAQ Stock Market, over 2008-2011, the results provide support for a positive influence of corporate social responsibility measured through Corporate Social Responsibility Index (CSRI) developed by Boston College Center for Corporate Citizenship and Reputation Institute, on firm value, proxied by Tobin’s Q ratio adjusted according to activity sector. CSRI was chosen for the completeness of information regarding CSR, since its computation comprising citizenship, governance, and workplace matters. The adjustment related to the activity sector was performed in order to ensure the comparability of the variables for the companies in each industry. The positive relationship is supported by the instrumental stakeholder theory, according to Jones (1995), the companies involved in corporate social responsibility undertakings use in a more effective way the resources in order to satisfy the manifold needs related to stakeholders (Waddock & Graves, 1997b). The aforementioned theory is instrumental since it suggests the use of corporate social responsibility in order to register a better performance (Jones, 1995; McGuire, Sundgren & Schneeweiss, 1988). Furthermore, the image on the market for a company with high social involvement and good disclosure of corporate social responsibility undertakings is reflected in the rise of its number of customers and sales. It has been also demostrated that the annual growth of sales leads to an increase in firm value, reflected through Tobin’s Q ratio adjusted according to activity sector.

In addition to the variables of theoretical interest, CSR researchers have emphasized the need to control the impact of firm size, risk, and industry. Similar to other studies (Husted & Allen, 2007), our research highlighted that firm size measured by the annual average number of employees has a slightly negative effect on firm value. Likewise, firm size has a positive correlation with CSRI, thereby companies with a large number of employees have a higher potential to sustain CSR activities with a solid infrastructure and high levels of cash flows.

The limits of current research emerge from the reduced number of statistical observations. As future research avenues, we consider the elaboration of a corporate social responsibility index according to a self-developed methodology for computing a score that takes into consideration more CSR related factors, and as well the research of its impact on firm value, by using data from several countries in order to compare the effects of corporate social responsibility on performance disclosed in the context of different corporate governance systems.

References

1. Arlow, P. and Gannon, M. J. (1982) ‘Social responsiveness, corporate structure, and economic performance’, Academy of Management Review, 7 (2), 235-241.

Publisher – Google Scholar

2. Baltagi, B. H. (2005) Econometric analysis of panel data, Third Edition, West Sussex, England: John Wiley & Sons Ltd.

3. Bebchuk, L., Cohen, A. & Ferrell, A. (2009) ‘What matters in corporate governance?’, The Review of Financial Studies, 22 (2), 783-827.

Publisher – Google Scholar

4. Belal, A. R. and Cooper, S. (2011) ‘The absence of corporate social responsibility reporting in Bangladesh’, Critical Perspectives on Accounting, 22 (7), 654-667.

Publisher – Google Scholar

5. Bowen, H. R. (1953) Social responsibilities of the businessman, New York: Harper.

6. Branco, M. C. and Rodrigues, L. L. (2007) ‘Positioning stakeholder theory within the debate on corporate social responsibility’, Electronic Journal of Business Ethics and Organization Studies, 12 (1), 5-15.

Google Scholar

7. Carroll, A. B. (1979) ‘A three-dimensional conceptual model of corporate performance’, Academy of Management Review, 4 (4), 497-505.

Publisher – Google Scholar

8. Cheung, Y. L., Tan, W., Ahn, H.-J. and Zhang, Z. (2010) ‘Does corporate social responsibility matter in Asian emerging markets?’, Journal of Business Ethics, 92 (3), 401-413.

Publisher – Google Scholar

9. Cyert, R. M. and March, J. G. (1963) A behavioral theory of the firm, Englewood Cliffs: Prentice-Hall.

Google Scholar

10. Donaldson, T. (1982) Corporations and morality, Englewood Cliffs, New Jersey: Prentice-Hall.

Google Scholar

11. Eisenberg, T., Sundgren, S. and Wells, M. T. (1998) ‘Larger board size and decreasing firm value in small firms’,Journal of Financial Economics, 48 (1), 35-54.

Publisher – Google Scholar

12. Frederick, W. C. (1994) ‘From CSR1 to CSR2. The maturing of business-and-society thought’, Business & Society, 33 (2), 150-164.

Publisher – Google Scholar

13. Gompers, P., Ishii, J. and Metrick, A. (2003) ‘Corporate governance and equity prices’, Quarterly Journal of Economics, 118 (1), 107-156.

Publisher – Google Scholar

14. Husted, B. W. and Allen, D. B. (2007) ‘Strategic corporate social responsibility and value creation among large firms: lessons from the Spanish experience’, Long Range Planning, 40 (6), 594-610.

Publisher – Google Scholar

15. Jo, H. and Harjoto, M. A. (2011) ‘Corporate Governance and firm value: The impact of corporate social responsibility’, Journal of Business Ethics, 103 (3), 351-383.

Publisher – Google Scholar

16. Jones, T. M. (1995) ‘Instrumental stakeholder theory: A synthesis of ethics and economics’, Academy of Management Review, 20 (2), 404-437.

Publisher – Google Scholar

17. Kaplan, S. and Zingales, L. (1997) ‘Do investment-cash flow sensitivities provide useful measures of financing constraints?’, Quarterly Journal of Economics, 112 (1), 169-216.

Publisher – Google Scholar

18. McGuire, J. B., Schneeweiss, T. and Branch, B. (1990) ‘Perceptions of firm quality: A cause or result of firm performance’, Journal of Management, 16 (1), 167-180.

19. McGuire, J. B., Sundgren, A. and Schneeweiss, T. (1988) ‘Corporate social responsibility and firm financial performance’, Academy of Management Journal, 31 (4), 854-872.

Publisher – Google Scholar

20. Nelling, E. and Webb, E. (2009) ‘Corporate social responsibility and financial performance: The “virtuous circle”revisited’, Review of Quantitative Finance and Accounting, 32 (2), 197-209.

Publisher – Google Scholar

21. Orlitzky, M. (2013) ‘Corporate social responsibility, noise, and stock market volatility’, Academy of Management Perspectives, 27 (3), 238-254.

Publisher – Google Scholar

22. Orlitzky, M., Schmidt, F. L. and Rynes, S. L. (2003) ‘Corporate social and financial performance: A meta-analysis’, Organization Studies, 24 (3), 403-441.

Publisher – Google Scholar

23. Roberts, R. (1992) ‘Determinants of corporate social responsibility disclosure’, Accounting, Organizations and Society, 17 (6), 595-612.

Publisher – Google Scholar

24. Sen, A. (1997) ‘Economics, business principles and moral sentiments’, Business Ethics Quarterly, 7 (3), 5-15.

Publisher – Google Scholar

25. Servaes, H. and Tamayo, A. (2013) ‘The impact of corporate social responsibility on firm value: The role of customer awareness’, Management Science, 59 (5), 1045-1061.

Publisher – Google Scholar

26. Sethi, S. P. (1979) ‘A conceptual framework for environmental analysis of social issues and evaluation of business response patterns’, Academy of Management Review, 4 (1), 63-74.

Publisher – Google Scholar

27. Swanson, D. L. (1995) ‘Addressing a theoretical problem by reorienting the corporate social performance model’, Academy of Management Review, 20 (1), 43-64.

Publisher – Google Scholar

28. Ullmann, A. A. (1985) ‘Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of U.S. firms’, Academy of Management Review, 10 (3), 540-557.

Publisher – Google Scholar

29. Waddock, S. A. and Graves, S. B. (1997a) ‘The corporate social performance-financial performance link’, Strategic Management Journal, 18 (4), 303-319.

Publisher – Google Scholar

30. Waddock, S. A. and Graves, S. B. (1997b) ‘Quality of management and quality of stakeholder relations’, Business & Society, 36 (3), 250-279.

Publisher – Google Scholar

31. Wartick, S. L. and Cochran, P. L. (1985) ‘The evolution of the corporate social performance model’, Academy of Management Review, 10 (4), 758-769.

Publisher – Google Scholar