Introduction

In the early 80s, the financial world witnessed an unprecedented race in the search of key competitiveness means. Old economy companies were faced with a significant rise in new technologies. A situation which led to increased competition lead by companies operating in high-tech activities such as telephony, internet, etc…

This violent spurt of competitiveness and competition caused legal and financial experts to reflect on the issue of the financial products that could be adopted and adapted to this new world order.

Along the same lines, General Motors was the unique case in which a holding company had tried to outdistance its allies and create a new financial product in a form different from the classic forms, “Tracking Stocks.” This event gained momentum in the nineties. In turn, a large number of companies took the same path, with the goal of getting away from a situation of stagnation and finding an opening in a new economic world governed by new rules. This enthusiasm also originates in the tendency of financial markets to demand greater transparency in the management of diversified groups, the financial visibility of which is too often reduced. Such a demand for clarity is centre to the definition of “tracking stocks.”

Generally, “tracking stocks” means an equity security of the issuer, but the return of which reflects the performance of a specific activity practised within said issuer company or through one or more of its subsidiaries. Therefore, it is not based on the group in its entirety, but on a division or sector of activity. They are a sort of state within the state, sub-companies within the company. Their originality lies in the fact that they represent, just as any common share, a share of capital of the issuer in its entirety and not the subsidiary on which its return is founded1.

Tracking stock issuance has an important advantage for the issuer requiring to publicise on the market, the value of an activity having a high growth potential and to benefit from its high valuations, without resorting to a division of the company. The activity in question remains under the control of the parent company and does not benefit from any legal personality. As opposed to spin-offs and equity carve-outs, tracking stock issuance does not allow the company to be divided into two distinct entities: this issuance leaves the division as it is within the consolidated whole.

Currently, American companies continue to issue this financial instrument with the purpose of creating value and allowing them to avoid the limitations of spin-offs and equity carve-outs.

Seeking Value Creation: What Are the Key Factors?

Value creation remains a key concern for companies. To achieve this, the latter must take various factors into account in the decision leading to a restructuring. As a result of the theoretical analysis carried out, opting for a restructuring reveals other factors that are liable to influence the choice of managers who are tempted by a spin-off, an equity carve-out or tracking stock issuance.

Cross Subsidies Post and Pre-Restructuring

According to Lang and Stulz (1994), Berger and Ofek (1995), Comment and Jarrell (1995), Servaes (1996), diversified companies badly allot their investment capacity setting up cross subsidies that are value destroyers. This reflects the inefficiency of cross-subsidies. One may refer to two major models: the influence-cost model (Meyer, Milgrom and Roberts, 1992) and the power distortion model (Scharfstein and Stein, 2000) who clarified the possible distortions that a diversified company may face through its potential investments. Rajan, Servaes and Zingales (2000) note that diversified firms having, on average, great investment opportunities, tend to transfer resources of major divisions with good investment opportunities to small divisions with poor investment opportunities.

Certain authors maintain that the allocation of capital between different divisions of a conglomerate is more efficient than the allocation of capital by a financial market between different independent forms, as the conglomerate has better information than the market regarding the investment opportunities of the different divisions (Williamson 1975, Stein 1997). In this regard, this better capital allocation may allow a conglomerate to obtain more capital than various independent divisions (Stein, 1997).When the conglomerate includes divisions with different profitability levels, potential power struggles are strong and the profitable divisions choose inefficient but highly specific technologies, which help them better protect their resources. In order to avoid this problem, the conglomerate must assemble divisions which have similar profit opportunities.

D’Souza/Jacob (2000), Chemmanur and Paeglis (2001) noticed that resorting to tracking stocks is one of the most effective means for adjusting the levels of profitability and performance within the conglomerate. Recourse to this form of restructuring is a key motivation for managers of low profitability divisions, to match the parent company’s best-performing division. These studies have put the contribution of tracking stocks to the profit of the group without however evoking the impact on the state of cross subsidies. However, Wulf (2009) shows that the manager of a mature division may have an interest in manipulating internal information in order to prevent the growth of a new division.

Fluck and Lynch (1999) exhibit a model of moral hazard where the creation of a conglomerate allows obtaining more external financing. However, capital allocation within a conglomerate2 may cause a significant waste of resources and lead to important distortions especially when the conglomerate assembles divisions having very different levels of profitability. However, the theory suggests that to reduce the loss in value due to ineffective cross subsidies of diversified companies, it is expected that conglomerates decide to totally or partially break away from weak subsidiaries. Thus, they choose to opt for a spin-off or an equity carve-out (Scharfstein and Stein, 2000).

Furthermore, the principal-agent problem suggests that companies with risky debt may reject positive NPV as the earnings of these investments will increase the wealth of debt holders at the expense of shareholders. But if a division having investment opportunities with positive NPV becomes a detached company following a spin-off, these investments can be carried out, fully entitling the shareholders to the profit. According to Miles and Rosenfeld (1983), a spin-off announcement hence increases the value of the company by an amount equivalent to the NPV of these investment opportunities. Cross subsidies can be performed through the use of liquidity from the parent company to an unprofitable subsidiary and vice-versa from a profitable subsidiary to the parent company. For Daley, Mehrotra, and Sivakumar (1997), the spin-off has the same effects as issuing bonds, since once the operation has been carried out, the parent company and the detached company are two independent entities, both accountable to the capital market when issuing new equity.

Dittmar and Shivdasani (2001) like Gertner, Powers and Scharfstein (2002)3 studied the behavioral changes in terms of investment after the spin-off. They deduced that there was an improvement in the internal capital allocation. These studies corroborate those of Miles and Rosenfeld (1983) for whom a spin-off, by improving investment decisions through its initial public offering, will increase the value of the company. The spin-off reduces bad capital allocation for the parent company and eliminates any overlapping and superfluous services. It also helps improve investment decisions. As for the detached company, it no longer has access to the internal capital market and will thus, be able to optimise its investment decisions. Improving capital allocation is hence value creating for both the parent company and the spun-off company.

The literature as regards the cross subsidy issue within the context of equity carve-outs is abundant. Based on the assessment of Scharfstein and Stein (2000), it can be assumed that restructuring by equity carve-out bears the same advantages as spin-offs and we can ask ourselves whether companies should choose a spin-off or an equity carve-out at the expense of tracking stocks with the sole objective of optimizing capital allocation and limiting the negative effects of superfluous cross-subsidies.

The Impact of Tax in the Choice of a Restructuring

Several studies have developed an analysis of the value of a firm. Keen and Schiantarelli (1991) investigated the relationship between tax asymmetries and the maximization of firm value, Fama and French (1998) highlighted the effect of taxation upon the firm’s decisions and its value and Waegenaere et al. (2008), studied the evaluation while taking the deferred deficit into account.

The fiscal variable, by the multiplicity of effects that it causes influences the company and particularly its financial decisions. One of the measures characterizing the fiscal variable is the possibility of carrying out deferred deficit. For Cumming and Mallie (1999), the choice between the various restructuring operations is based on the fiscal and accounting requirements of the group. This indicator is defined as the part of current losses used to reduce taxable income of the following year. In other words, this tax carryforward makes it possible to reduce the loss realised one year by tax credit and decrease the tax to be paid the following year if the company has made profits4.

In the American tax system, there is mention of loss carry back. The deficit identified for a fiscal year by a company subjected to corporate tax may, optionally, be considered as an expense deductible from the profit of the antepenultimate fiscal year and if need be, that of the before last fiscal year and that of the one before. In this regard, in the case of spin-offs, or equity carve-outs, this debt to be paid by the tax authorities is transmitted by the transferring company to the receiving company when there is authorisation from the tax authorities.

If the latter refuses the authorization and if there is no liquidation of the company, it will be under no obligation to repay the debt when the 5-year period is not respected. Thus, preserving the activity tracked in the scope of the issuing company may have a significant tax incentive. This more favorable treatment is definitely not the reason why groups develop capital structures allowing them to make public the value of some activities5, however, potential tax advantage may bring leaders of such groups to prefer tracking stocks over other instruments which allow reaching such, an objective.

Given the U.S. capital gains tax system in connection with the assets contributed within a spin-off of activities, the issuance of tracking stocks is in principle more advantageous than subsidiary formation as it does not lead to publicise the assets in question. Such is the viewpoint of certain American tax specialists in the absence of positive interpretation on the part of the US administration and courts pertaining to this issue, making it possible to be certain that tracking stocks are exempt from taxation (Haas, 1999, p. 4) and D’Souza and Jacob (2000, p. 464). However, this state of affairs may well be only temporary.

Maintaining the tracked activity under the complete control of the issuing company allows writing off tax losses incurred by this activity on the group’s profit, or conversely if necessary (imputation of tax losses of the parent company to the tracked activity) (Chemmanur and Paeglis, 2000, p. 12). This advantage can be maintained by means of tax consolidation, when the tracked activity is converted to a subsidiary, in so far as the participation of the parent company remains equal to 95%6. In contrast, the opening up of share capital of this subsidiary in most cases translates as, especially if this opening is made through an IPO, participation lower than this threshold, the benefit of the tax consolidation plan thus being lost. However, the tax incentives of tracking stocks are conditioned by the tax loss carryforward scheme that can benefit spin-off and equity carve-out operations.

Following previous findings, it is expected that companies wishing to benefit from the tax loss carryforward scheme, opt for a restructuring by issuing tracking stocks instead of a spin-off or an equity carve-out.

The Internal Capital Market: An Alternative to External Capital Markets

According to Weston (1970), Lewellen (1971), Williamson (1975) and Stein (1997), a diversified firm has the advantage of creating an internal capital market, and thus, increases investment profitability.

The interest that companies have in sparking off internal capital markets lies in the possibility of overcoming an external market ineffectiveness or failure (Khanna and Palepu, (2000)) and investing in projects with positive net present value (NPV) which would not have been noticed by external investors. As opposed to spin-offs and equity carve-outs, issuing tracking stocks allows each group unit to constantly benefit from the internal capital market (Billet and Mauer, 2000). Besides, the modalities of issuing tracking stocks will lead to an important increase of liquidity allowing the whole group to take part within the framework of an expanded internal market.

Furthermore, leaders’ interest with respect to the internal capital market is justified by its reductive effect of liquidity risks relative to the weak entities of the company. The internal capital market would have as effect to generate cash flow that would be invested within sick units. As part of the contemporary theory of internal capital markets, Billet and Mauer (2003) have carried out a series of prediction tests regarding the efficiency of these markets and have noticed that financing constraints lead to a strong relationship between internal capital markets and firm value.

Based on these results, it is expected that firms choose to issue tracking stocks to be capable of preserving a buoyant internal capital market expanded by the liquidity provided by the tracked activity. This strategy aims to benefit from certain spin-off advantages while ensuring the control of the division.

Economic and Return On Equity of the Firm

The studies focusing on spin-off operations have shown a growth period, ranging between one year before and two years after the operation (Cusatis, Miles, and Woolridge, 1994) and a mean improvement of the global effectiveness of factories belonging to firms that have carried out a spin-off. (Chemmanur and Nandy, 2006). These assessments converge towards those pertaining to advantages of spin-off operations. The latter contribute in increasing the effectiveness of leaders, improving concentration in the core of the job and making it possible to reduce the cost of capital and improve internal capital allocation. Consequently, spin-offs improve both the performance of the parent company and the spun-off subsidiary (Chemmanur and Nandy, 2006).

As for equity carve-out operations Vijh (1999), Schipper and Smith (1986) maintain that these operations increase the value of the transferring company. Furthermore, Schipper and Smith (1986) make this assessment contrary to the effects of negative prices of the marketing of its own securities. They show that the increase in value reflects the potential benefits of managing restructured assets and opportunities for improving incentive-based contracts granted to the leaders (principal-agent problem). This hypothesis is partially based on the fact that subsidiary leaders receive remuneration aligned with the securities of disinvested subsidiaries (Allen, 1998). In the same vein, more effective contracts are liable to generate important operational improvements. Gaver and Gaver (1995), note that firms with increasing opportunities pay a large part of the remuneration in the form of securities and stock options. Their hypothesis also predicts that equity carve-outs can improve both the firm and its subsidiary’s operational performance.

The current theory regarding tracking stocks, did not examine the effect of such an operation would have on the economic and financial performance of the company initiating the restructuring. Subsequently, this issue undoubtedly converges towards the goal of shareholder wealth maximization. Moreover, through the characteristics of tracking stocks, spin-offs and equity carve-outs, the goal of creating economic value is real.

– A management effect favorable to issuing tracking stocks

The theories pertaining to tracking stocks and equity carve-outs have emphasized that the management of the group after announcement, weighs heavily on the future financial situation of both the group and the new or already-existing subsidiary. Contrary to equity carve-outs, management retains its composition and scope of activity after issuing tracking stocks. Furthermore, the management effect is taken into account by financial analysts and market players interested in the firm evaluation. This factor, requires the attention of the market through its influence on future economic and return on equity of the firm. After a restructuring announcement, observers focus on the future of the management, as such an operation causes the risk of having a dispersed or modified management as to its composition. This thesis was originally developed by Manne (1965), who supposes that these operations have a disciplinary nature.

In fact, when a firm is inefficiently managed or that the management team undergoes a modification, it registers a low performance with respect to the sector; the market value of the share drops below its real value. Thereby, equity carve-out operations cause the appearance of a new management within the division benefiting from the transfer.

Spin-off operations are also affected by the management effect. Such operations lead to a major risk of witnessing the division of the group’s management, part of the shareholders distancing themselves after a potential takeover bid of the spun-off entity. For tracking stocks however, management remains the same. In this case, the firms will opt for issuing tracking stocks in order to improve the firm’s performance.

The « Corporate Focus » Effect: An Alternative to Diversification

Refocusing on the core of the business is one of the objectives sought by enterprises that opt for restructuring. Concentrating more and more on one’s core business generates spin-off and equity carve-out operations. Reducing the size of the firm falls in line with a policy of cost reduction and optimization of the global financial situation while isolating a division with a low profitability level (Servaes 1996, Berger and Ofek, 1999). Desai and Jain (1999) deduced that spin-off operations increased concentration on the core of the business for firms. Vijh (1999) however, has shown that equity carve-outs would allow the parent company and its subsidiary to limit their activity. He assumes that the performance of both parties is linked to the extent of activities of which they are liable (corporate focus).

Restructuring via tracking stocks meets the goals of managers seeking to reduce the risk of bankruptcy, by widening the firm’s scope of activity and thus increasing its size (Denis, Denis and Yost, 2002). This, in principle, allows us to suppose that firms will opt for a spin-off or equity carve-out in order to refocus on the core of the business.

Investigation into the Motivations of American Firms

The purpose of our empirical work is to identify the factors liable for justifying leaders’ choices in issuing tracking stocks.

The issue of the legal aspect of tracking stocks makes us think about the notion of asset transfer and the associated tax treatment. Restructuring by tracking stocks, via a motivation of firms for keeping total control over the tracked unit, directs us to the tax effect of such an operation on the selected choice. On the other hand, improving cross subsidies and reducing the associated losses seems to theoretically guide the choices of firms towards the forms of restructuring to opt for. The search for new sources of financing and performance possibly drives firms to arbitrate between the various restructuring choices that are on offer.

The methodological approach comprises two steps: a univariate analysis will be carried out using the Wilcoxon median difference test, followed by a multivariate analysis (logistic regression) within the same research context. This will provide information on the impact of spin-off, equity carve-out and tracking stock operations on the selected motivating factors and vice versa. This will allow us to reveal in principle the most affected factors and at the same time the most influential ones for each of the distinctly selected restructuring operations. A second multivariate analysis will present in the form of two multiple binary logistic regressions, the results pertaining to the choice of restructuring between tracking stocks/spin-off and tracking stocks/equity carve-out. The results which, are subject to interpretation, point us to the validation of the research hypotheses.

Research Sample: Origin and Composition of the Collected Data

Our study sample is composed of three subsamples. The first subsample is composed of 100 companies, issuers of tracking stocks on the American market between 2005 and the end of 2010. These data have been taken from the database of Thomson One Bankers specialised in mergers-acquisition operations. We then noticed that these data were retrieved from the Nasdaq-100 index. Reference is also made to the Lexis-Nexis database. This step is essential in being able to sort this sample according to the motivations for each of the tracking stock issuing operations. The second and third subsamples are composed of 220 complete announcements of spin-off operations and 120 complete equity carve-out operations. The collection of data has been the subject of the same steps as above. Furthermore, the Sdc-Platinum database has been referred to.

Three selection criteria were applied to our sample. Due to a lack of representativeness, we have retained companies that have two first identical digits of the SIC code (High-tech industry (48), business services (73). A second step eliminates the observations pertaining to spin-offs and equity carve-outs initiated for legal reasons or for being a part of the same equity carve-out – spin-off category. We have also eliminated the observations pertaining to tracking stock motivated for acquisition or an IPO. Our last step consists in eliminating the operations (spin-offs and equity carve-outs) that are not subjected to the tax consolidation regime.

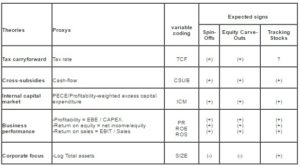

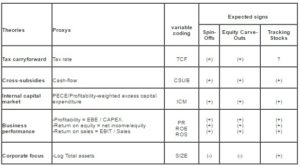

Our sample is only composed of 16 cases of equity carve-outs, 18 cases of spin-offs and 18 cases of tracking stock issuance between January 2005 and December 2010. However, the representativeness of our sample is consistent with the works of Hite and Owers (1983) regarding 123 spin-offs between 1963 and 1981, Billet and Mauer (2000) 23 tracking stock issuances carried out between 1963 and 1983. The variables used are listed in table 1.

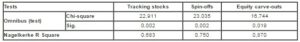

Table 1: The choice factors of restructuring, variables and expected signs

Effect of Restructuring Operations on Key Motivation Factors

Univariate analysis: Wilcoxon rank test:

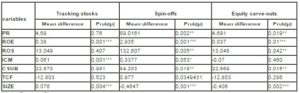

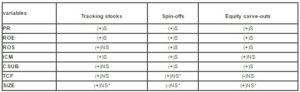

The first step comes in response to a first essential point: that of knowing if the explanatory variables have undergone a variation after the announcement date (2007). The study of this variation will allow us to verify whether the restructuring operations have really led to a change in the situations within the selected companies. It is important to study the signs and statistical significance of the obtained results. This approach will make it possible to detect, in principle, the nature of the impact of restructurings on the latter. The results are listed in table 2.

Table 2: Significant variables after Wilcoxon’s analysis

*** significant at 1%

** significant at 5%

In this vein, we refer to the Wilcoxon rank test for matched sample pertaining to the operations of tracking stocks, spin-offs and equity carve-outs. The results obtained will be subject to additional verification using a binary logistic regression. This step will help us determine the statistical significance of the estimate relating to the explanatory variables when the event occurs. The event being the occurrence of a pre- and post-announcement variation.

– Logistic Regression

This step consists in providing confirmation of the results obtained using the Wilcoxon rank test. We have chosen to carry out an additional verification by adopting a multiple binary logistic regression. Furthermore, after having identified the variables impacted by the restructuring operations, it is important to reassert the inverse relationship of this report. Furthermore, the question is to know if the related variables explained this relationship properly.

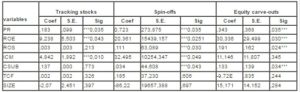

Consequently, the results obtained and listed in table 3 make it possible to identify whether or not the independent variables have significant prediction probabilities of the occurrence in a restructuring operation.

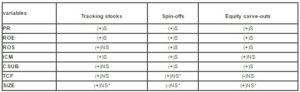

Table 3: Significant variables in the logistic regression (1)

*** significant at 1%

** significant at 5%

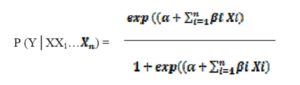

It is supposed that the event in which we are interested is the occurrence or not of a restructuring operation (tracking stocks, equity carve-out, spin-off). In the following, we will mark Y the variable to be predicted (explained variable), a Boolean variable having the value 1 if we notice the occurrence of the event and 0 if we do not. Then, we mark X= (RE, RF, ROS, MIC, CSUB, TCF, SIZE) predictor variables (explanatory variables).

We note the following probabilistic model:

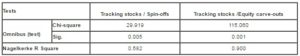

We will retain the Nagelkerke R Square indicator as representing the model as it is an adjusted version of the Cox &Snell test and hence our model encompasses 68,3% (tracking stocks), 75% (spin-off) and 87% (equity carve-out) from reality (table 4).

Table 4: Estimation of the regression models (1)

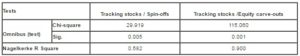

It is to be noted that our empirical analysis (Wilcoxon test and logistic regression) gives nearly the same results (table 5). Despite the significant results obtained by the Wilcoxon median difference test, variables SIZE, TCF have no exclusive impact on the occurrence of the event.

Table 5: Significant variables following the Wilcoxon tests and logistic regression

* Values rendered not significant by the logistic regression

We will mainly focus on the results drawn from the logistic regression as it allows detecting the factors which companies will be sensitive to for launching a restructuring operation. Consequently, the obtained results allow us to base the current theory pertaining to the impact of the above factors on the strategic restructuring choices. Remains to be determined the factors on which the selected companies would make their choice for a restructuring via tracking stocks at the expense of the other stated forms.

Identifying Motivation Factors By Means of Restructuring Pairs:

The discriminant analysis method has been criticised by several authors due to its restrictive assumptions (multivariate normal distribution, with constant covariance matrices between the groups) and limited implications (high precision estimations, but weak predictions in certain cases).

The logit analysis uses multiple regressions which use financial ratios as independent variables for predicting probability, P, that a firm issues tracking stocks as a preferred form of restructuring. The dependent variable (to be explained), Y, is a binary-coded Boolean variable, that is to say, the firm issues tracking stocks (Y=1) or another restructuring operation (Y=0). The logistic transformation P= [1 + exp (-Y)] – 1 guarantees that P is located between 0 and 1. More particularly, logistic regression will allow us to determine the impact of each of the factors chosen based on the different restructuring decisions.

The chosen regression will be a multiple binary logistic regression. Thus, two binary logit models will be established corresponding to arbitrage between restructuring pairs “tracking stocks/spin-off”, “tracking stocks/equity carve-out”. The choice of this model will allow us to separately analyse both forms while keeping the choice of tracking stock issuance as a reference restructuring. The logistic model is presented as follows:

P: probability of occurrence of a restructuring via tracking stocks in presence of the explanatory variables « PR, ROE, ROS, ICM, CSUB, TCF » and « SIZE ».

Whereby the estimated model is presented:

« Prob (choice of restructuring) = Logit (PR, ROE, ROS, ICM, CSUB, TCF, SIZE) »

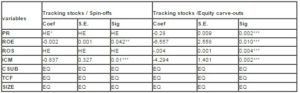

The Nagelkerke R Square representativeness indicator estimates the representativeness of logistic models pertaining to the chosen restructuring pairs, at 58% for the tracking stocks/spin-off pair and 90% for the tracking stocks/equity carve-out pair (table 6).

Table 6: Estimated of the regression models (2)

As regards the “tracking stocks/spin-off” pair, it is noted in table 7 that our logistic model has made it possible to use two motivation factors to significantly predict at the threshold of 5% a restructuring by tracking stocks, namely, the internal capital market (ICM) (p = 0.01) and return on equity (ROE) (p = 0.042).

Table 7: Significant variables in the logistic regression (2)

*** signifiant at 1%

** significant at 5%

* excluded from equation

These results come as a confirmation to the works of Billet and Mauer (2000), D’Souza and Jacob (2000) and Chemmanur and Paeglis (2001). The probability of proceeding with a restructuring by tracking stocks instead of a spin-off operation is motivated on the one hand, by the improvement of return on equity generated by externalization on the market of a tracked activity with a high growth potential. The strategy set by the issuer amounts to benefiting from the announcement effect and the signals sent to potential investors pertaining to the will to publicise the tracked activity. The results of such an operation generate an increased market capitalization and a possibility of concealing the less efficient results of the other entities of the same group. On the other hand, the search for a promising and less costly funding market (ICM) is a key ambition in the choice of a tracking stock restructuring, opposite to a spin-off where the company seeks to improve the capacity of its internal capital market by separating the entities with low profitability.

It is worth noting that the logistic model of the “tracking stocks/equity carve-out” pair has only retained four motivation factors which are significant and which allow us to deduce the probability of choosing a restructuring by tracking stock issuance instead of an equity carve-out: return on equity (ROE) (p=0,01), profitability (PR) (p=0,002), return on sales(ROS) (p=0,004) and the internal capital market (ICM) (p=0,002). However, the factors pertaining to cross subsidies (CSUB), to tax losses carried forward (TCF) and to the size (SIZE) are insignificant and have very low probability levels for being able to predict a restructuring by tracking stocks. The same assessments have been found by Vijh (1999), Scharfstein and Stein (2000). Hence, the probability to proceed with a restructuring by tracking stocks is motivated on the one hand, by the search for performance while benefiting from the potential growth of the tracked activity (D’Souza and Jacob, 2000). The compensatory effect sought by the parent company in favour of the rest of the group seems a better means to meet the requirements of the aimed strategy through its issuances. The internal capital market research appears to motivate enterprises to which additional funding sources seem necessary and less costly than resorting to external markets. Furthermore, externalizing an activity with a high growth potential will definitely attract investors who have been offered dividend rights higher than those provided by rival enterprises operating in the same sector of activity.

It is possible to interpret the coefficients pertaining to the significant variables as a simple regression where the coefficients would represent the impact of an additional unit on the log of odds (probability ratio). It is noted that the coefficients corresponding to variables ICM (-4.294), ROE (-6.557), ROS (-0.028) and ROS (-0,004) are significantly negative at the threshold of 5% (Wald test). Hence, an inverse relationship between the actual variables and the probability of event occurrence is deduced. Consequently, the less the capital market is profitable, the lower the performance and hence the higher the probability of issuing tracking stocks (Billet and Mauer, 2000). Moreover, the tax loss carryforward scheme would benefit transferring companies wishing to benefit from this privilege while avoiding to lose control over the entity that is beneficiary of the transfer as in the case of a spin-off. Consequently, the variable SIZE appears to be a motivation factor for an equity carve-out opening up the possibility for the transferring company to keep a predominant degree of control on the targeted entity by the transfer. The result obtained points us to the works of Desai and Jain, 1999. Besides, a restructuring by equity carve-out allows transferring companies and beneficiary subsidiaries to refocus themselves on the core of the business. The purpose is to improve the performance of the subsidiary with respect to external market players. Moreover, the transferring companies do not lose sight of their subsidiary while keeping a sufficient degree of control to generate positive cash flow returns related to subsidiary performance (Vijh 1999).

Conclusion

Tracking stock issuance does not constitute a substitute to a complete separation of tracked activities, but an operation of a different nature meeting the objectives that are in part identical. The group within which is practiced the activity to be externalised will engage in an arbitrage between maintaining control over this activity and maximizing the amounts liable to be generated7 from this externalization. However, this arbitrage will be particularly oriented towards the forms of issuance (issuing new stocks, conversion of common stock, etc) and will constitute a dominating character in identifying the risks and advantages connecting them.

Moreover, tracking stocks are liable to be of interest to an issuer, considering that they offer the possibility of externalizing the value of an activity without losing control over it. In the US, their appeal also lies in the freedom left in defining the characteristics of issued securities. The attraction of these securities for certain potential issuers, particularly for French case “Alcatel”, has raised the issue of transposing this instrument into French law.

Currently, most American companies use “tracking stocks” as part of a financial blackmail also called “GREENMAIL8”; a defensive strategy adopted by the parent company with the purpose of keeping its interests in its subsidiary and aiming to repurchase its securities from investors in possession of more than 5% of its capital at a nominal value higher than that of the market. This strategy prevents the parent company from any foreign participation in the capital of its subsidiary (tracked activity) which could lead as is often the case to a takeover bid.

In 1984, American companies spent around 3.5 billion dollars to finally repurchase their securities at a market value estimated at 600 million dollars namely 5 times the price. This method has been criticised for its abuse with respect to tracking stock holders, thus causing a conflict of interest between shareholders who mostly feel deprived of the earnings of their shares whereas investors realise enormous profits after repurchasing their shares by the parent company. In November 1983, investors realised around 400 million dollars in profit solely through a repurchasing operation by the issuing company.

The existence of tracking stocks can significantly weigh down the management of the issuing company. Determining the results of the tracked activity requires setting up an especially complex accounting system, particularly when the tracked activity is not practiced through a subsidiary9.

Notes

1- L. Faugerolas and E. Boursican, les actions « reflet », (“tracking” stocks) (1st part), Option Finance n°622,18 december. 2000.

2- Lamont (1997) established that, during the 1986 oil crisis, diversified oil companies had also reduced capital expenditure even for the non-oil divisions in which investment opportunities were not connected to the drop in oil prices. The opposite is also true and conglomerates badly allot their investment capacity by subsidizing underperforming divisions.

3- Sample of 160 spin-offs between 1982 and 1996.

4- Future tax assets: tax savings which will be possibly realized, deductible temporary differences or unused deductible tax loss amount able to be carried forward

5- J. L. Dahlberg and J. D. Perry, Tracking Stock: Virtual Equity, Virtual Entities, and Virtual Mergers and Acquisitions, Tax and Law practice, Practicing Law Institute, oct.-nov. 2000.

6- Art. 223 of the Code Général des Impôts français (French General taxation code).

7- J. J. HAAS, How Quantum, DLJ and Ziff-Davis Are Keeping on Track with « Tracking Stock »: part I, op. cit., note 18, and C. DANIEL and R. MINDER, Alcatel Eyes Optics Buy, Financial Times, 21 mars 2001.

8- The Harvard Law Review Association, Vol. 98, No. 5, Mar., 1985.

9- The proxy statement of Tele-communications presenting the tracking stock issuance project was long by 479, of which an important part was constituted of separate accounts for each tracked activity and accounts combining the various activities of the conglomerate (J.J.HAAS, How Quantum, DLJ and Ziff-Davis Are Keeping on Track with « Tracking Stock » Part II, opt.cit., note 26).

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Allen, J. (1998), “Capital markets and corporate structure: the equity carve-outs of Thermo Electron“, Journal of Financial Economics 48, 99-124.

Publisher – Google Scholar

2. Aron, D. J., (1991), “Using the Capital Market as a Monitor: Corporate Spin-Offs in an Agency Framework”, Journal of Economics, 22, 505-518.

3. Berger, P. G., et Ofek, E. (1995), “Diversification’s Effect on Firm Value“, Journal of Financial Economics, 37, 39-65.

Publisher – Google Scholar

4. Berger, P. G., et Ofek, E. (1999), “Causes and Effects of Corporate Refocusing Programs“, Review of Financial Studies, 12, 311-345.

Publisher – Google Scholar

5. Billet M., Mauer D., (2000), “Diversification and the value of internal capital markets: the case of tracking stock. Journal of Banking and Finance 24, 1457-1490.

Publisher – Google Scholar

6. Chemmanur, T., et Nandy, D., (2006), How do Spin-offs Increase Efficiency?, Document de travail, Carroll School of Management et Schulich School of Business.

7. Chemmanur, T., Jordan, B., Liu, M., et Wu, Q., (2007), Anti-Takeover Provisions in Corporate Spin-Offs, Working paper.

8. Comment R, Jarrell G. (1995), “Corporate focus and stock returns”, Journal of Financial Economics 37, 67-87.

9. Cumming, J., et Mallie, T. Y., (1999), “Accounting for Divestitures : A Comparison of Sell-Offs, Spin-Offs, Split-Offs, and Split-Ups”, Issues in Accounting Education,14, 1, 75-97.

Publisher – Google Scholar

10. Cusatis, P., Miles, J., Woolridge, J., (1993), “Restructuring through spin-offs: The stock market evidence“, Journal of Financial Economics, 33, 293-311.

Publisher – Google Scholar

11. Cusatis, P. J., Miles, J. A., et Woolridge, J. R. (1994), “Some New Evidence that Spin-offs Create Value”, Journal of Applied Corporate Finance, 7, 100-107.

Publisher – Google Scholar

12. Dahlberg, J. L., Perry, J. D., (2000), “Tracking Stock : Virtual equity, Virtual entities, and Virtual Mergers and Acquisitions”, Tax and Law Practice”, Practicing Law Institute.

13. Daley, L., Mehrotra, V., et Sivakumar, R., (1997), “Corporate focus and value creation : Evidence from spinoffs“, Journal of Financial Economics, 45, 257-281.

Publisher – Google Scholar

14. Denis, D. J., Denis D. K., et Yost K., (2002), “Global diversification, industrial diversification, and firm value“, Journal of Finance, 57, 1951-1979.

Publisher – Google Scholar

15. Desai, H. et Jain, P.C., (1999), “Firm performance and focus: long-run stock market performance following spinoffs”, Journal of Financial Economics, 54, 75-101.

Publisher – Google Scholar

16. D’Souza, J. et J. Jacob., (2000), “Why Firms Issue Targeted Stock,” Journal of Financial Economics 56, 459-483.

Publisher – Google Scholar

17. Faugerolas, L et Boursican, E.,(2000), ” les actions « reflet », (1ème partie) “, Option Finance n°622.

18. Fluck, Lynch , (1999), “Why do Þrms merge and then divest? A theory of Þnancial synergy“,Journal of Business.

Publisher – Google Scholar

19. Gertner, R., Powers. E., et Scharfstein, D., (2002), “Learning about Internal Capital Markets from Corporate“, The Journal of Finance, Vol. 57, 2479-2506.

Publisher – Google Scholar

20. Haas, J., (1999), “How Quantum, DLJ, and Ziff-Davis are Keeping on Track with Tracking Stock:’ Part I,” New York Law School Working Paper.

21. Henry, G., Manne (1965), “Mergers and the market for corporate control”, George Washington University Law School Working paper.

22. Hulbert, H.J.Miles et Wooldridge., (2002), “value creation from equity carve outs”, financial management, 31, 83-100.

23. Khanna, T., et Palepu, K., (2000), “Is group affiliation profitable in emerging markets? An analysis of diversified Indian business groups”, Journal of Finance, 55, 867-891.

Publisher – Google Scholar

24. Lamont, O., (1997), “Cash flow and investment: Evidence from internal capital markets“, Journal of Finance, 52, 83-109.

Publisher – Google Scholar

25. Lang L.H.P et Stulz R.M. (1994), ” Contagion and Competitive Intra-Industry Effects of Bankruptcy Announcements : An Empirical Analysis “, Journal of Financial Economics, Volume 32, Issue 1, August 1992, P. 45-60.

26. Lewellen, W., (1971), “A pure financial rationale for the conglomerate merger“, Journal of Finance, 26, 521-537.

Publisher – Google Scholar

27. M. Keen and F. Schiantarelli, (1991), “Corporate Tax Asymmetries and Optimal Financial Policy”, Oxford Economic Papers, 43, pp. 280-291.

28. Meyer, Michael., Paul Milgrom, and John Roberts, (1992), “Organizational prospects, influence costs, and ownership changes”,Journal of Financial Economics, volume 37, Issue 1, January 1995, Pages 67-87.

Google Scholar

29. Rajan, R., H. Servaes, and L. Zingales., (2000), “The Cost of Diversity: The Diversification Discount and Inefficient Investment,” Journal of Finance, 55, 35-80.

Publisher – Google Scholar

30. Scharstein, D., et Stein, J., (2000), “The dark side of internal capital markets: Divisional rent-seeking and inefficient investment“, Journal of Finance, 55, 2537-2564.

Publisher – Google Scholar

31. Schipper K., Smith, A., (1983), “Effects of recontracting on shareholder wealth: the case of voluntary spin-offs“, Journal of Financial Economics 12, 437-467.

Publisher – Google Scholar

32. Servaes H. (1996), “The Value of Diversification During the Conglomerate Merger Wave“, Journal of Finance 51, 1201-25.

Publisher – Google Scholar

33. Stein, Jeremy C, (1997), ” Internal Capital Markets and the Competition for Corporate Resources,” Journal of Finance, American Finance Association, vol. 52(1), pages 111-33, March.

Google Scholar

34. Thomas J. Chemmanur & Imants Paeglis, (2001), “Why Issue Tracking Stock? Insights From A Comparison With Spin-Offs And Carve-Outs,” Journal of Applied Corporate Finance, Morgan Stanley, vol. 14(2), pages 102-114.

Publisher – Google Scholar

35. Waegenaere et al, (2008), “Dynamic Tax Depreciation Strategies”, Tilburg University Center for Economic Research (CentER) and VU University Amsterdam paper, October 13.

Google Scholar

36. Weston, J. F., (1970), “The nature and significance of conglomerate firms”, St. John’s Law Review, 44, 66-80.

37. Williamson, Oliver, Afarkets and Hienxrchies, (1975), “Analysis and Antitrust Implications: A Study in the Economics of Internal Organization”, (New York, NY).