Introduction

The influence of the board structure of a company on its performance has occupied scientists over the years resulting in numerous papers based on samples of both financial and non-financial firms. This issue has gained even greater importance in developed countries where the problem of board structure was tried to be solved through legislation. This is especially the case when it comes to gender diversity in the boards of firms, the issue which is dealt with by individuals, associations, governments etc.

Given the fact that most research on the board — performance relationship in the banking industry refers to the US market or other developed countries and, to a much lesser extent, to the European markets, especially for the Central and Eastern European countries where these are non-existent, the authors decided to find out evidence on the aforementioned relationship in the banking sector in Croatia.

In order to evaluate and consider how banks’ governance structure affects performance, it is important to understand the legislative framework regulating corporate governance in the banking sector in Croatia. As stipulated with the Credit Institutions Act (Official Gazette, No. 159/13), a credit institution must have a management board and a supervisory board. The members of the management board and of the supervisory board, respectively, must possess adequate collective knowledge, skills and experience required to direct and to supervise the business of the credit institution independently without undue influence from other persons, and in particular to understand the credit institution’s activities and the main risks. Moreover, management board members must ensure, among other things, that the credit institution operates in compliance with professional rules and standards, establishes and implements effective and sound governance arrangement meaning that the credit institution’s management board must adopt the business policy, approve and regularly review the credit institution’s strategic objectives and the strategies and policies for risk management, ensure the integrity of the accounting and financial reporting systems, regularly review the process of disclosure and communications and provide effective oversight of senior management.

Besides the duties and responsibilities relating the management board, almost an equal importance is also placed on the competences of the supervisory board. Specifically, it shall, among others, give opinions on the findings of the Croatian National Bank and other supervisory authorities relating to supervisory procedures, oversee the adequacy of procedures and effectiveness of internal audit activities, oversee the implementation and effectiveness of the credit institution’s governance arrangements, oversee the implementations of the credit institution’s business policy, strategic objectives and the strategies and policies for taking up and managing the risks.

Taking into account the role and importance of the supervisory board in the bank, the authors decided to analyse management board/supervisory board — performance relationship. We contribute to the literature relating this topic since, to the best of our knowledge, this is the first study that investigates not only the influence of the management board structure on bank’s performance but it also examines how the structure of the supervisory board affects bank’s performance.

In recent years, a significant number of studies analysing gender diversity as a corporate performance driver has arisen. Three well-established theories that refer to gender diversity and its implications should be taken into account in any study of the association between performance and gender diversity at different levels of decision-making in modern-day corporations: agency theory, the resource dependence theory and the resource-based view of the firm. The second and third theories are more easily applied to diversity in top management, whereas the agency theory is more directly linked to the presence of diversity on boards and stock ownership. Agency theory suggests that increased boardroom independence and better monitoring of managers will ensue as a consequence of higher gender diversity; therefore, diversity may strengthen existing control mechanisms over executives and managers (Gallego-Alvarez, Garcia-Sanchez and Rodrigues-Dominguez 2010).

At the present time, there is the ambiguous empirical evidence regarding this issue, i.e. some suggest corporate performance benefits from greater gender diversity at board level (e.g. Carter, Simkins and Simpson, 2003; Campbell and Minguez-Vera, 2007), while others suggest the contrary (e.g. Gallego-Alvarez, Garcia-Sanchez and Rodrigues-Dominguez, 2010; Adams and Ferreira, 2009). Pathan and Faff (2013) document both positive and negative influence depending on the time period being analysed.

Having in mind previous considerations, in this study we wanted to explore the role the women play in the Croatian banking sector that was traditionally dominated by men, i.e. to explore if there are performance benefits that banks gain from gender diversity. We would not debate this from the fairness and equality point of view but rather as a question of potential superior performance. The findings should be particularly interesting in the Croatian context since there is no advanced legislative framework promoting gender diversity in labour environments. Available statistical data, from 2013, show a worrisome low work activity rate of women in Croatian society which accounts for 39.1%. In addition, more than 60% of employable women in Croatia are completely outside the labour market and do not actively seek employment. This situation is likely to change since modern societies and organizations are increasingly becoming sensitive to cultural and other forms of discrimination at work and because of the increasing pressure that boards should be more represented by women.

Data used in this study were drawn from the annual reports published by the Croatian National Bank while the sample comprised all Croatian banks that were active during 2002-2013 period. More precisely, the sample consisted of credit institutions such as banks and savings banks which are all referred to as banks, while other credit institutions such as housing savings banks were not taken into consideration.

Employing Arellano-Bover (1995)/Blundell-Bond (1998) estimator, the authors try to find evidence of how supervisory board size as well as gender diversity of both management and supervisory board affect bank’s performance.

The rest of the paper is organised as follows. An overview of the previous studies and their findings relating to the content being analysed is provided in section 2. Section 3 presents variable description while section 4 gives insight into the sample description and econometric model including the empirical results. Section 5 presents concluding remarks.

Literature Review

Board structure – corporate performance relationship has been largely investigated in empirical corporate governance literature. Studies so far have shown a positive relation (e.g. Adams and Mehran, 2005), an insignificant relation (e.g. Wintoki, Linck and Netter, 2012) or even a negative relation (e.g. Pathan and Faff, 2013; Belkhir, 2009).

Adams and Mehran (2005) examine the relationship between banking firm board structure and performance focusing on two dimensions of board structure that have been studied most extensively: board composition and size. Their primary sample consisted of a random sample of 35 publicly traded bank holding companies (BHCs) which were amongst the 200 largest (in terms of book value of assets) top tier bank holding companies for each of the years 1986-1999. Later, they extended the data set for the period 1959-1985 on which they imposed no restrictions. Therefore, their analysis of the time period prior to 1986 served as a robustness check since the results are not driven by sample selection. The authors find that banking firms with larger boards do not underperform their peers in terms of Tobin’s Q defined as a ratio of the firm’s market value to its book value. They argue that mergers and acquisitions (M&A) activity and features of the bank holding company organizational form may make a larger board more desirable for these firms and document that board size is significantly related to the characteristics of firms’ structures. Even after accounting for the potential sources of endogeneity, they do not find a negative relationship between board size and Tobin’s Q. Moreover, they find that the proportion of outside members on the board is not significantly related to performance, as proxied by Tobin’s Q.

The increased scrutiny of board governance in banks following the global financial crisis motivated Pathan and Faff (2013) to investigate whether board structure including board size, independence and gender diversity affects performance. Moreover, the authors explore whether the introduction of the Sarbanes-Oxley Act of 2002 (SOX) or the financial market crisis have influenced the board structure-bank performance linkage since well-governed banks cannot only contribute to, but in fact be critical agents for the proper functioning of many non-financial sector firms and, thus, collectively promote a more efficient allocation of resources across the economy. Based on a sample of 212 large US BHCs over the period 1997-2011, using the generalised method of moments (GMM) estimation technique, the researchers document a strong negative relation between bank board size and performance. They also find evidence that banks in which boards have more independent directors perform worse. Their results show that gender diversity in the boardroom improves bank performance in the pre-SOX period (1997-2002), but it weakens in the post-SOX (2003-2006) and crisis periods (2007-2011). Finally, they present evidence that the impact of board structure on performance is prevalent particularly for banks with low market power, exposed to external takeovers and/or of smaller size.

The following literature review will show some of the works that introduce gender diversity as an important dimension that might affect corporate/bank performance. However, in the absence of the research relating to the banks, the emphasis is placed on those studies that deal with gender diversity in corporations.

Gallego-Alvarez, Garcia-Sanchez and Rodrigues-Dominguez (2010) focus on the effect of gender diversity on corporate performance. Specifically, their study focuses on the impact of the percentage of women on boards and in top management, and the percentage of female stockholders with significant shares in stock ownership, by using several measures of corporate returns, efficiency and market value. With a view to testing these hypotheses, the authors selected 117 Spanish corporations that were listed on the Madrid Stock Exchange over the period 2004-2006 as an objective population using several dependence models based on linear panel data regressions that were selected as the analytical technique. The findings show that companies with higher levels of gender diversity do not obviously outperform other companies with lower levels, in terms of several market and accounting measures. Therefore, their findings show no evidence for differences in corporate performance as a function of gender diversity.

García-Meca, García-Sánchez, and Martínez-Ferrero (2015) analyse the effect of board diversity (gender and nationality) on performance in banks. By making use of a sample of 159 banks in nine countries (Canada, France, Germany, Italy, the Netherlands, Spain, Sweden, the United Kingdom, and the United States) during the period 2004—2010, their empirical evidence shows that gender diversity increases bank performance, while national diversity inhibits it. The authors also test whether board diversity matters more or less in countries accordingly their institutional characteristics. Given the importance of banks in the economy, it is crucial to understand which laws and regulations improve their governance. Therefore, it is interesting to test if the hypothesis based on the efficiency/inefficiency of a diverse board can be generalised further than the institutional differences among countries. Therefore, the moderating effect of investor protection and bank regulatory regime on the association between board diversity and performance is examined, analysing their substitution or complementary roles. Their results suggest that these institutional factors play a significant role in these effects. They show that in contexts of weaker regulatory and lower investor protection environments, board diversity has less influence on the performance of banks.

Francoeur, Labelle and Sinclair-Desgagne (2007) examine whether and how the participation of women in the firm’s board of directors and senior management enhances financial performance. The analysis is done on a sample of the 230 largest Canadian firms using the Fama and French (1992, 1993) valuation framework to take the level of risk into consideration, when comparing firm performances. The results indicate that better female representation, as measured either by the proportion of women sitting on the board of directors or by a score combining the relative presence of women as officers or directors, does not correlate with significant excess returns. Hence, although having more female directors may not have an impact on financial performance; firms with a higher proportion of women on their board are able to generate enough value to keep up with normal stock-market returns.

Adams and Ferreira (2009) in a sample of US firms try to find answers to the following questions: do measures of board inputs (director attendance and committee assignments) vary with gender diversity; does the gender composition of the board affect measures of governance, such as chief executive officer (CEO) turnover and compensation; and finally, does the effect of gender diversity on governance matter sufficiently to affect corporate performance? With all other answers being positive, the results suggest that, on average, firms perform worse the greater is the gender diversity of the board. The authors find that gender diversity has beneficial effects in companies with weak shareholder rights, where additional board monitoring could enhance firm value, but detrimental effects in companies with strong shareholder rights suggesting that firms should not add women to a board with the expectation that the presence of women automatically improves performance.

The paper by Campbell and Minguez-Vera (2007) investigates the link between the gender diversity of the board and firm financial performance in Spain, a country which historically has had minimal female participation in the workforce, but which has now introduced legislation to improve equality of opportunities. The authors investigate the topic using panel data analysis on a sample of 68 non-financial firms in the 1995-2000 period and find that gender diversity — as measured by the percentage of women on the board and by the Blau and Shannon indices — has a positive effect on firm value and that the opposite causal relationship is not significant. Their study suggests that investors in Spain do not penalise firms which increase their female board membership and that greater gender diversity may generate economic gains.

In the study examining the relationship between board diversity and firm value for publicly traded Fortune 1000 firms Carter, Simkins and Simpson (2003) defined board diversity as the percentage of women or minorities on the board of directors, whilst the firm value is measured by Tobin’s Q. They control for possible endogeneity between firm value and diversity using two-stage least squares analysis. Overall, the authors find a positive significant relationship between board diversity and firm value. This result holds after controlling size, industry, and other corporate governance measures.

Variables Description

In order to assess the influence of board structure on banks’ performance, a return on equity (ROE) as a dependent variable (i.e. measure of bank performance) was employed in the model.

Moreover, we use four measures of board structure as explanatory variables, specifically, gender of the president of the management board (GPMB), management board female members (MBFM), supervisory board size (SBS) and supervisory board female members (SBFM). Gender of the president of the management board (GPMB) is used as a dummy variable which equals 1 for females, and otherwise zero. The variable representing management board female members (MBFM) is calculated as the percentage of total members on the management board that are women. Supervisory board size (SBS) is represented by the number of members on the supervisory board whilst supervisory board female members (SBFM) variable is calculated as the percentage of total members on the supervisory board that are women.

Although the findings on board gender diversity – bank corporate performance relation suggest that banks usually do not benefit from a higher participation of women on boards, the greater representation of women on board is often observed from positive perspective. As stated by Pathan and Faff (2013), women spend more effort on their tasks and, accordingly, could improve board effectiveness in terms of decision making and information flaw. A key factor, as documented by Fields and Keys (2003) in diversity’s successful impact on firm performance is the value found in the heterogeneity of ideas, experiences, and innovations that diverse individuals bring to the firm. Adams and Ferreira (2009) find, on a sample of U.S. firms, that female directors have better attendance records and gender diverse boards allocate more effort to monitoring. Focusing on the previous explanations, we predict a positive influence of gender diversity on board performance. Specifically, we expect the variables gender of the president of the management board (GPMB), management board female members (MBFM) and supervisory board female members (SBFM) to positively affect bank performance in the Croatian banking industry.

Although there are findings on both positive and negative relationship between board size and banks performance in the scientific literature, the authors usually expect negative relation. As reported by Lipton and Lorsch (1992), directors on large boards could face greater difficulties in expressing their opinions in the limited time available during board meetings. Moreover, Jensen (1993) emphasizes that when boards get beyond the optimal number of people, they are less likely to function effectively. Taking into account the previous arguments, we expect negative coefficient regarding the influence of supervisory board size (SBS) on bank’s corporate performance.

Finally, five control variables were introduced in the model including capital adequacy (CA) -obtained directly from Croatian National Bank publications, bank size (BS) calculated as a natural logarithm of bank’s assets and market share (MS) calculated as assets of an individual bank divided by the total assets of bank industry. Growth rate (GR) variable is calculated as follows, i.e. based on the assets, whilst loans to deposits ratio (LD) is calculated as loans given to deposits received ratio. We expect these variables to have positive impact on bank performance.

Sample description and econometric specification

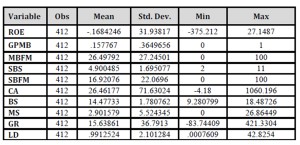

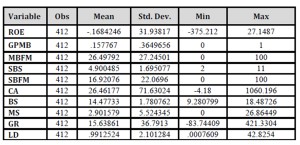

Our sample consisted of all Croatian banks that were active during the period from 2002 (46 banks) to 2013 (30 banks). Since the total number of analysed banks was changing over the years (as a result of the mergers, acquisitions and liquidations), our panel is unbalanced. On average, we were dealing with 34 banks per year. Table 1 reports descriptive statistics, while table 2 gives an insight into the Pearson pair-wise correlation matrix of all variables used in the research.

Table 1 Descriptive statistics

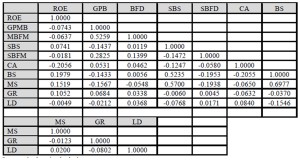

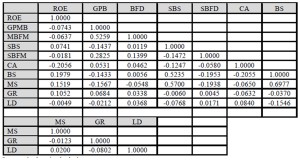

As it can be seen from table 2, multicollinearity among the regressors from our sample is not serious concern i.e. only one correlation coefficient (between banks’ size and banks’ market share) has a value close to 0.7. Additionally, contrary to our expectation, it seems that the correlation between our main variables of interest i.e. variables covering different segments of (supervisory) board characteristics, on one side, and ROE as a bank profitability measure, on the other side, is not high.

Table 2 Pair-wise correlation matrix

Source: Authors` calculations

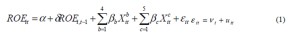

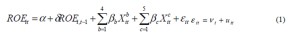

Given the dynamic nature of firm profitability, which is in Model 1 captured in a form of a lagged dependent variable standing as an explanatory variable, the estimators like ordinary least square (OLS), fixed effect (FE) and random effects (RE) become biased. In order to overcome this problem, we applied Arellano-Bover (1995)/Blundell-Bond (1998) estimator (that uses additional moment conditions in comparison to Arellano and Bond (1991)) on the following model:

where ROEit is the profitability of bank i at time t, with i=1, . . .,N, t=1, . . ., T; αis a constant term,ROEi,t-1 is the one-period lagged profitability, δ is the speed of adjustment to equilibrium, ’s are the explanatory variables (specifically, denotes (supervisory) board characteristics while stands for control variables), εit is the disturbance, with νi the unobserved bank-specific effect and uit the idiosyncratic error.

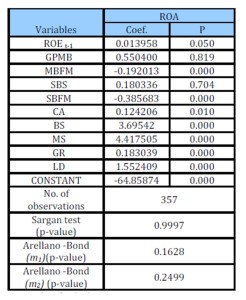

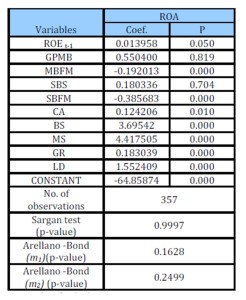

The empirical results for Model 1 are presented in table 3 from which it is clear that the model is well fitted i.e. the results indicate statistically insignificant test statistics for both first and second order autocorrelation coefficients. Likewise, Sargan test, which checks for the overall validity of instruments, shows no evidence of over-identifying restrictions.

Table 3: Parameter estimates of dynamic panel model

Source: Authors` calculations

The dynamic character of the model specification is confirmed with the statistically significant influence of lagged profitability variable (ROE t-1) on current banks’ profitability. Regarding the governance variables (GPMB, MBFM, SBS, SBFM), i.e. variables representing different aspects of management and supervisory board characteristics, it can be stated that the gender of the president of the management board (GPMB) has no influence on the bank profitability. The same is true for the number of members in the supervisory board (SBS). Although the authors, similar to other researchers, assumed a positive relationship between gender diversity and bank performance, the research results showed evidence for negative influence on bank performance as a function of gender diversity. However, this result is in line with previous findings in the academic literature (e.g. Gallego-Alvarez, Garcia-Sanchez and Rodrigues-Dominguez, 2010; Francoeur, Labelle and Sinclair-Desgagne, 2007; Adams and Ferreira, 2009). The percentage of both, total management board (MBFM) and total supervisory board members that are women (SBFM) variables have statistically significant and negative influence on bank performance. This could be explained, as documented by Pathan and Faff (2013), that the inclusion of female directors beyond a certain point could limit the possibility of including more effective male directors. Moreover, as explained by Gallego-Alvarez, Garcia-Sanchez and Rodrigues-Dominguez (2010) diversity also implies a potential source of conflicts, as well as a slow decision-making process, which could be especially negative in competitive environments where the speed in making decisions may be crucial.

The influence of all control variables is positive and statistically significant.

Conclusion

An important place in the scientific literature is occupied by papers dealing with the influence of board structures on corporate financial performance. The present study is particularly interesting since the authors try to find out the impact of supervisory board size as well as of both management and supervisory board gender diversity on corporate financial performance in the banking sector in Croatia, which is still highly dominated by men.

Based on a sample of Croatian banks operating in the 2002-2013 period, the authors documented no influence of the gender of the president of the management board on bank performance as well as no influence of the size of supervisory board on bank performance. Moreover, conducted analysis provided evidence on the negative influence of gender diversity on bank performance. Specifically, an increase of the representation of women on the management and supervisory boards negatively affects bank performance.

Following our findings that gender diversity negatively influences bank performance and taking into account the increasing pressure imposed by the general public and different regulatory authorities for an increase in the representation of women in decision-making bodies, we can consequently conclude that the requirements of increasing gender diversity may not necessarily be derived from performance drivers but these requirements probably rely more on factors of a sociological nature as pointed by Gallego-Alvarez, Garcia-Sanchez and Rodrigues-Dominguez (2010).

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Adams, R. B. and Ferreira, D. (2009), ‘Women in the boardroom and their impact on governance and performance’, Journal of Financial Economics, 94 (2), 291—309.

Publisher – GoogleScholar

- Adams, R. B. and Mehran, H. (2005), ‘Corporate Performance, Board Structure and its Determinants in the Banking Industry’, [Online], [Retrieved January 15, 2015], http://papers.ssrn.com/Sol3/papers.cfm?abstract_id=302593

GoogleScholar

- Arellano, M., and S. Bond. (1991), ‘Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations’, Review of Economic Studies, 58, 277—297.

- Arellano, M., and O. Bover. (1995), ‘Another look at the instrumental variable estimation of error-components models’, Journal of Econometrics, 68, 29—51.

GoogleScholar

- Blundell, R., and S. Bond. (1998), ‘Initial conditions and moment restrictions in dynamic panel data models’, Journal of Econometrics, 87, 115—143.

- Belkhir, M. (2009), ‘Board structure, ownership structure and firm performance: evidence from banking’, Applied Financial Economics, 19, 1581—1593.

Publisher – GoogleScholar

- Campbell, K. and Minguez-Vera, A. (2007), ‘Gender Diversity in the Boardroom and Firm Financial Performance’, Journal of Business Ethics, 83, 435—451.

- Carter, D. A., Simkins, B. J. and Simpson, W. G. (2003), ‘Corporate Governance, Board Diversity, and Firm Value’, The Financial Review, 38 (1), 33-53.

Publisher – GoogleScholar

- Credit Institutions Act (Official Gazette, No. 159/13), [Online], [Retrieved January 15, 2015], http://www.hnb.hr/propisi/zakoni-htm-pdf/e-zakon-o-kreditnim-institucijama-159-2013.pdf

- Croatian National Bank, Banks Bulletin, No. 1-27, Zagreb, 2001-2014, [Online], [Retrieved December 1, 2014], http://www.hnb.hr/publikac/hpublikac.htm

- European Commission, Strategy for equality between women and men 2010-2015, [Online], [Retrieved February 18, 2015], http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=COM:2010:0491:FIN:en:PDF

- Fields, M. A. and Keys, P. Y. (2003), ‘The Emergence of Corporate Governance from Wall St. to Main St.: Outside Directors, Board Diversity, Earnings Management, and Managerial Incentives to Bear Risk’, The Financial Review, 38 (1), 1–24.

Publisher – GoogleScholar

- Francoeur, C., Labelle, R. and Sinclair-Desgagne, B. (2007), ‘Gender Diversity in Corporate Governance and Top Management’, Journal of Business Ethics, 81, 83—95.

- Gallego-Alvarez, I., Garcia-Sanchez, I. M. and Rodrigues-Dominguez, L. (2010), ‘The influence of gender diversity on corporate performance’, Revista de Contabilidad, 13 (1), 53—88.

Publisher – GoogleScholar

- García-Meca, García-Sánchez, I. and Martínez-Ferrero, J. (2015), ‘Board diversity and its effects on bank performance: An international analysis’, Journal of Banking & Finance, 53, 202-214.

- Jensen, M. C. (1993), ‘The Modern Industrial Revolution, Exit, and the Failure of Internal Control Systems’, Journal of Finance, 48 (3), 831-880.

Publisher – GoogleScholar

- Labour Act (Official Gazette, No. 93/14) [Online], [Retrieved January 15, 2015], http://www.zakon.hr/z/307/Zakon-o-radu

- Lipton, M. and Lorsch, J. (1992), ‘A modest proposal for improved corporate governance’, Business Lawyer, 48, 59—77.

GoogleScholar

- National policy for gender equality 2011-2015, Government of the Republic of Croatia, Office for Gender Equality, [Online], [Retrieved February 18, 2015], http://www.ured-ravnopravnost.hr/site/images/pdf/kb%20strategija%20za%20ravnopravnost%20spolova%20knjizica%20eng.pdf

- Ombudsperson for Gender Equality, Annual report 2013, [Online], [Retrieved February 15, 2015], http://www.prs.hr/attachments/article/1492/Annual%20Report%202013.pdf

- Pathan, S. and Faff, R. (2013), ‘Does board structure in banks really affect their performance?’, Journal of Banking & Finance, 37 (5), 1573—1589.

Publisher – GoogleScholar

- The Act on mailto:jenny_marfe@usal.esGender Equality Act (Official Gazette, No. 82/08), [Online], [Retrieved January 15, 2015], http://www.ured-ravnopravnost.hr/site/the-act-on-gender-equality-nn-8208.html

- Wintoki, M. B., Linck, J. S. and Netter, J. M. (2012), ‘Endogeneity and the dynamics of internal corporate governance’, Journal of Financial Economics, 105(3), 581-606.

Publisher – GoogleScholar