Introduction

Research and Development (R&D) activities need more investment to make better progress in the current economic scenario. It has been determined that investment in R&D is fundamental for companies to survive. From one angle, R&D behaves as a major engine of economic and productivity growth. It has been noted that demand”pull emphasises demand-side factors, such as consumer demand for new products, and cost”reductions as primary drivers of R&D. On the other hand, supply”push holds that supply”side factors, such as differences in the technological environment and industry concentration, lead to variations in R&D expenditures (Tielemas, 2010).

Companies are interested in gaining benefit through in-house R&D or internal R&D due to the fact that they can recruit and train high-quality employees. Therefore, they will have better opportunity to gain control over the research process. In China, application of internal R&D is able to help the foreign side to win over beneficial policy measures from Chinese regulators who favour innovative R&D investments (Liu & Zou, 2008).

Chan and Daim (2011) in their study found that companies can reduce risks and cost. When multiple individuals agree to invest in a risky enterprise, a win-win situation has to occur with the concept of risk sharing. This will reduce the burden if only one entity is to cover if anything untoward happens. Collaboration and cooperation with additional parties will also reduce the amount of money to be paid in the investment. Situations like these will create a healthy environment to do research efficiently. It broadens up the company’s capacity, improve the flexibility, and lower the cost of fixed infrastructure.

Issues pertaining to intellectual property (IP) rights in Malaysia have gained serious attention in the Malaysian economic scenario. With the current development, the Malaysian government has appointed the Ministry of Trade and Consumer Affairs to accommodate the role of protecting property rights in various industries in Malaysia. Therefore, companies can rely on the effectiveness and efficiency of authorities under the supervision of this Ministry to protect their invention or creation. The governing body that deals with issues pertaining to IP in Malaysia is the Intellectual Property Corporation of Malaysia (MyIPO).

The Malaysian manufacturing industry has responded accordingly to the needs and wants of their global counterparts in strengthening their assets for protection. Therefore, the strong urge and force from the global community has been addressed consequently. This can be seen from the report by MyIPO revealing that registration from the manufacturing industry continues to grow from year to year.

Problem Statement

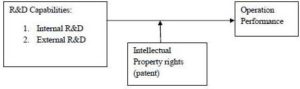

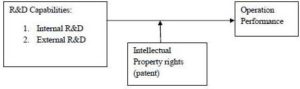

R&D is being regarded as a key element for a company’s survival in the global competition arena. When R&D activity is successful, it gives impact to the overall company performance. A product that is produced has better quality, reduced cost per product, increased product delivery, and the product has its own flexibility. Another important element where many companies forget to include is the implementation of intellectual property rights (IPR). In this case, IPR behaves as a moderating variable so that it helps to stimulate R&D toward achieving better operational performance.

Internal R&D has been practised by many corporations due to its less consuming funds to be allocated by the management. Therefore, it has become the most preferred choice by many corporations. Generally, companies understand that huge amounts of money are needed to be allocated for companies to perform R&D activity.

The decision whether to use in-house or external formal R&D for certain projects should be determined by the top management of the company. In the case of technological change and consequent competition between new entrants and established companies, applying protection of intellectual propery is very important to decide (Pisano, 1990).

Elements of IPR should be included in the company’s technology management practices, since it offers a wide range of benefits. Loopholes in company IPR policy are very crucial because they significantly impact on the overall performance of the company. Later on, as time goes by it creates a new approach to the way the company looks at it. This reflects on impact it has to the economic growth, product lifecycle, and issues pertinent to IPR are some of the new challenges that researchers want to look at.

In France, inventors were honoured due to the valuable property rights that they invented according to their patent system. Even though distributions of patent values were found to be highly distorted, this is still not the issue. The subsidy for R&D on average is between 15-25%, but it still provides good incentives to run R&D activities (Schankerman, 1998).

The mechanism underlying the importance of protecting invention as an outcome of effective R&D capability is through strong implementation of IPR. When companies aim to protect its intellectual capital by patents, trademarks, industrial designs, and many others, they are trying to protect their profits flowing from its innovation against its competitors. Later on, they can use it to finance their own future growth (Haned, 2009).

Therefore, a company’s wise decision to protect its invention should be seen as a long term investment to safeguard its own business. It is argued whether IPR can become a moderator for a relationship between R&D capability and operational performance of a company or it is just an element included in R&D capability. This is yet to be discovered in order to see how effective IPR can play its role to be a moderating variable in that relationship. To conclude, this study is important to know if it is possible to put a strong emphasis that IPR can play its role in becoming a moderating variable in that relationship.

Aims of the Paper

This study mainly focuses on R&D and IPR practices in Malaysian manufacturing industries. It studies the interrelationship between these two practices as well as the effect of these two practices on organisational performance. The operational performance is concerned with the organisational performance, since it is highly important in the manufacturing context as a driver of competitiveness. The way R&D and IPR practices are co-aligned with each other and the way these practices affect the organisations’ operational performance is the main focus of this study. More specifically, the main objectives of the study are:

- To study the relationship between internal R&D with company’s operational performance; and

- To investigate the relationship between internal R&D with company’s operations performance moderated by IPR.

The paper proceeds as follows: firstly, the researchers provide the literature review pertaining to R&D activities in Malaysia and its relation to the current practices of R&D companies. Thereafter, the concept of internal R&D and operational performance is elaborated followed by a description of IPR. Later on, it continues with a description of the sample and method used in this study. The paper ends with a discussion and suggestions for companies to practice the concept elaborated in the discussion.

Literature Review

R&D capability is defined as the ability to restructure the current knowledge and produce new knowledge (Fleming 2001; Henderson & Cockburn 1994; Kogut & Zander 1992). It also has been determined as a prime competence to differentiate between successful and unsuccessful company performance. There are five core elements of R&D capabilities, which are R&D planning, internal R&D practices, external cooperative R&D activities, coordination between internal and external activities, and IPR management.

To discuss this matter further, research and development (R&D) terms should be clearly defined. R&D is famously defined in the Malaysian context as “research and development that comprises creative work undertaken on a systematic basis in order to increase the stock of knowledge, and the use of this stock of knowledge could be used to devise new applications”. According to this definition, R&D includes the following areas of activities:

- Design, construction and operation of prototypes where the main objective is technical testing or to make further improvements.

- Construction and operation of pilot plants not operated as commercial units.

- Research and development into and original development (or substantial modification) of computer software, such as new programming languages and new operating systems.

- Feedback directed at solving problems occurring beyond the R&D phase, for example technical problems arising during initial production runs.

- Research work in the biological, physical and social sciences and humanities.

- Social science research including economic, cultural, educational and sociological research.

- If the primary objective is to make further technical improvements then the work comes within the definition of R&D (Ministry of Science, Technology and the Environment of Malaysia, MOSTE, 2002).

R&D capabilities have been identified as one of the crucial elements for the survival of company operations. Performance of a company is proven to have a direct relationship with strong R&D capabilities. When a company manages to produce good products as an outcome of R&D success, this will help to increase the revenue of a company. As a result to company revenue, economic growth of a company and its market share will also increase. Since many people keep on talking about the advantages that can be generated from IPR, this study tries to include IPR as a stimulus for the betterment of R&D toward operational performance.

In addition, it has been identified that entrepreneurs and companies can commercialise new technology discoveries with the help of patents. This will later on manage to secure their financial gains using IPR protection, especially by patents. It is claimed that the future gains are very great when protection is given to new inventions/products (Featherstone & Specht, 2004).

In fact, companies belonging to this industry devoted a high percentage of their total revenue to R&D (generally, R&D investments are more than 30% of the total sales). In this aspect, the recent study of Hopkins et al. (2007), according to which the biotechnology revolution may be simply a ‘myth’, seemed to be a little exaggerated in its conclusions, since it does not consider the huge amount of research projects still in their nascent stages.

Griffith et al. (2004) pointed out the existence of “two faces of R&D”. The first face of R&D is a situation when R&D produces innovations. This innovation can be novel or new which has the ability to gain IPR recognition or it can improve innovation. At the same time, it can break the record to get patent reward. The second face of R&D is when it gives better maintenance in making sure that companies fit in to compete in the level playing field. This means that the company has its own strengths in producing the “best practice” technology and “state-of-the-art” design through the process of adapting and learning from others. Therefore, the company has the potential to gain benefit from within and outside economy if it performs R&D even if they cannot compete to become major innovator. From this scenario, it can be summed up that patent and R&D can complement each other in an incentive policy. R&D may also cover a wider range of socially beneficial activity that contributes to the well-being of the nation.

Even it can be seen that the combination between patents and R&D subsidy will have different outcomes to the various parties involved. This happens due to the impact on economic situation pertaining to the activity on innovation. Patent is very limited, being filed by the company in the service sector and less in classified R&D. On the other hand, application from service sector on trademarks is improving significantly (Greenhalgh & Rogers, 2006). This shows that implementation of IP protection is very much reflected on which purposes fit their business needs.

There is a reason why companies divide their R&D spending activities which merely can be seen from the perspective of: to identify which one is performing well compared to the other one. In the case of companies separating their registration on trademark and patent accounts, they want to see which one is more productive (Greenhalgh & Longland, 2002).

Caputo, Cucchiella, Fratocchi, Pelagagge, and Scacchia (2002) highlighted that few factors had been identified which contribute to the major constraint to innovation and technology transfer to small companies. It can be divided into three major categories according to their approach in dealing with innovation:

a) Technology developers, can be distinguished through its technological leadership, coming from internal R&D investments;

b) Leading technology, can be seen when they adjust externally developed technologies to match specific internal requirements; and

c) Technology follower can be described when they adopt technology which has been developed by their competitors (more than 75 percent).

According to Jommi and Paruzzolo (2007), the current literature in the Italian case does not provide a thorough analysis of all variables potentially influencing the localisation of R&D in the pharmaceutical and biotechnology industries. This study focuses on two variables in R&D capabilities, namely internal R&D and external R&D.

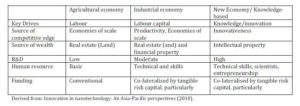

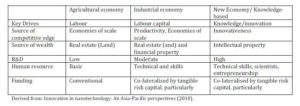

In one case, Singh (2008) mentioned that there is a negative relationship between the impact of geographic dispersion and company’s R&D innovative output. It was concluded that geographically distributed R&D alone cannot guarantee that it will increase the quality of a company’s innovations. Therefore, R&D capabilities have its personal impact on the operational performance of a company. Table 1 below shows how the evolution of economic ecosystem moves by stages that significantly highlight the seriousness of effective implementation of R&D capabilities.

Table 1.0: Differing Requirements for Stages in Economic Ecosystem

Table 1 above highlights that, R&D, IP, and source of competitive advantage are interrelated in this modern new economy or in a catch-phrase, “knowledge-based economy”. Its interdependencies show that each and every individual party need to work hand in hand for them to climb up further in the most challenging value chain atmosphere. In the Malaysian scenario, the manufacturing industry alone contributes 11.4 per cent to the national economy.

It has been noted that the global economy rebounded in 2010 recently after the worldwide financial crisis and economic downturn in 2009. Most countries in the world received better economic growth including countries in the Asian region. Due to that, Malaysia gained positive growth of 7.2 per cent in the year 2010, while only 5.6 per cent in the year 2009. Contribution of this strong economic growth came from Services Sector (6.8 per cent) and Manufacturing Sector (11.4 per cent) (http://www.statistics.gov.my/).

Figure 1.0: Percentage Distribution of GDP Based on Economic Activity for the Year 2010

(Percentages Sourced from http://www.statistics.gov.my/).

In the Malaysian economic scenario, the Gross Domestic Product (GDP) has stretched by 5.3 per cent growth in the third quarter of 2010. For the supply side, all economic sectors carry on to produce positive growth with the exception of the mining and quarrying sector. The services and manufacturing sectors remained as the main drivers to the growth. As for the demand side, the growth was headed by the Private Final Consumption Expenditure and Gross Fixed Capital Formation. The growth momentum in the first three quarters of 2010 rebounded to 8.0 per cent from negative 3.7 per cent in the same period last year (http://www.statistics.gov.my/ ).

The situation for manufacturing sector favours positive remarks when it grows, at a modest rate of 7.5 per cent as compared to 16.0 per cent in the previous quarter. The leading sector is electrical & electronic with 8.7 per cent, followed by petroleum, chemical, rubber & plastic products with 5.7 per cent. Later on, transport equipment & other manufactures with 9.3 per cent. Sub-sectors were the main contributors for the growth.

Internal R&D

Internal R&D or in-house R&D (IRD) is defined as an activity of the company whereby it sets up and fulfils a research project within itself. Nakamura and Odagiri (2005) mentioned that this can be done by employing important resources, such as researchers, research materials and equipment. It may also procure a part of the R&D activity from outside Audretsch et al. (1996) and Bonte (2003) often used the terms “internal R&D” and “external R&D” replacing “in-house R&D” and “procured R&D”.

Internal R&D as mentioned by Cassiman and Veugelers (2002) has several dimensions that contribute to the full function of it. This includes its ability to scan the environment for existing technology, ability to evaluate the technology, integrate the technology, leverage the productivity of R&D activities (Veugelers, 1997), appropriation capacity, and prior knowledge to effectively absorb external know-how (Cohen & Levinthal, 1990).

Meanwhile, Cassiman and Veugelers (2002) pointed out that the advantages of implementing internal R&D include: increasing the complexity of the new product/process, establishing a lead time, gaining appropriate returns to innovation strategy (Teese, 1986), and making an important source of itself. Sufficient support by the internal network is one of the examples where simultaneous interaction occurs. It is crucial because this support will directly affect important external network linkage. From another perspective, properly managed external network linkages offer inputs to R&D sources for the internal network.

By implementing internal R&D, it allows the company to better scan the environment for existing technology. The current technology which is based internally will help the process of equipping R&D capabilities to evaluate the built-in technology (Cassiman & Veugelers, 2002). In the long run, it will give better returns to the company. Internal R&D can also behave as an appropriation capacity. For example, internal R&D can improve the complexity of the new product/process or by creating a lead time.

The same scenario applies for the company conducting in-house research, which relies on the public research associations set up after World War 1 in the UK. The research association’s primary role is to provide the company with support on technical matters. Therefore, this drives companies to conduct internal R&D with received support from research associations that provide scientific and technical information for the company.

It has been found that there is evidence showing that the ability of the executive management to translate corporate strategy into a sourcing strategy is a must. It is vital for the company to face the challenging business environment. Positive impact will occur once the implementation of the R&D strategy of the organisation is executed through a properly coordinated sourcing strategy. Trends to start commercialising output within an R&D company need to be implemented while developing new capabilities, both should also work concurrently (Brook & Plugge, 2011).

Arora and Gambardella (1994) derived two effects from internal know-how. The first effect is that internal know-how provides important aspects in screening available projects. The second effect is they claimed that internal know-how plays a major role in maximising its capability of evaluating external know-how. To conclude, both perspectives create a positive outlook that internal R&D/know-how can do for the betterment of the company.

When internal R&D becomes the company business strategy, this would allow the company to avoid the outflows of important information to other competing companies. This will also prevent innovating companies from gaining reward or even recover the costs of R&D. Benefits can be obtained if companies decide to combine internal and external R&D (Den Hertog & Thurik, 1993). Therefore, issues pertaining to limited financial resources can be overcome through the wise decision of the top management of the company.

It was determined that lack of skilled personnel would contribute to internal rigidities based on the dynamic of innovation. From the perspective of adequate innovation, combination of skilled workforce and properly managed organisation are the main ingredients for successful innovation to take place (Galia & Legros, 2004). In line with the internal R&D element, lack of skilled R&D personnel has a big impact that contributes to the gain of reward resulting from R&D output.

Bayona, Marco, and Huerta (2001), who studied Spanish companies, reported that lack of infrastructure, information technology and innovatory potentials impact negatively on the coefficient reinforcement that move the company away from instigating cooperative relationships. Consequently, lack of infrastructure for R&D is also one of the crucial elements in facilitating internal R&D of a company.

Lack of commitment by top management (Ramanathan, 2008), excessive top management involvement in process detail (MASTIC, 1998), delays in making decisions by the management (Berkovitz, 2005), lack of R&D management know-how (Cassiman, 2005), lack of proven analytical techniques (Gima & Patterson, 1993), and inadequate market research (Green, 1996) are other elements that contribute to the implementation of internal R&D of a company.

Intellectual Property Rights

Intellectual property rights is a concept of protecting one’s own effort in creating new inventions or products that has long been practised by the world community since 1867. The establishment of the world body that coordinates and becomes the centre of reference for issues pertaining to IPR, namely the WIPO (World Intellectual Property Organisation), shows how deep is the appreciation of the international community toward IP.

The history of patents was promoted by the royal grants from Queen Elizabeth I (1558-1603) when Her Majesty bestowed it for monopoly privileges. This shows that IP was not started by patent inventions. 200 years just about the end of the Queen’s reign, it has been mentioned that a patent represents one’s legal rights. This legal right awarded to an inventor for the purpose of owning exclusive control over the production and sale of his mechanical or scientific invention. Later on, this continues by demonstrating the evolution of patents from royal prerogative to common-law doctrine (Mossoff, 2001).

According to the current development in Malaysian industry, it can be concluded that there is still long distance to go in creating the culture and platform to drive innovation. The low level of Malaysian ownership of patents and its low sensitivity toward applying protection of IP speaks of the low level of awareness. Interest among Malaysians and Malaysian-owned companies in creating original products and original designs does not show a positive signal to a healthy environment of IPR.

A point to ponder, IBM which is the top corporate innovator in the world, has more than 40,000 patents in their worldwide portfolio. IBM had 4186 U.S Patents at one time and the number of patents it has almost triple the combined patents of Microsoft, Hewlett-Packard, Oracle, Apple, EMC, Accenture and Google (http://www.ibm.com/news/us/en/ 2009/01/14/e714183t64858z03.html).

The simple reason for companies like IBM to safeguard their new invention or products is the fact that this invention or product would have the ability to become a long term investment for the company or a new source of income for them. The secret behind IP is its function as a measure of a country’s or company’s ability to create wealth. The creation of wealth is continuous from year to year and covers the protection world-wide. Therefore, it is not weird why most of the patents are controlled by the developed nations. They know the importance and advantages that can be garnered out of it.

For IBM itself, the notion to increased protection of property rights will be reflected on by the improvement in publishing new inventions that will cultivate and produce better infrastructure. This also works hand in hand in order not to claim certain patent rights in open source software, health care, education, environment and software interoperability

(http://www.ibm.com/news/us/en/2009/01/14/e714183t64858z03.html).

Lim (2009) noted that the situation in Malaysia differs from that in the developed countries, because they treat IP merely as a means of protection of their new invention or product. They hardly see IP as a new mechanism for them to create wealth and generate long term return on investment. They are only concerned with ways to gain profit from investment through traditional ways of doing it, such as making money from landed property, manufacturing, and the stock market. This traditional thinking to make money from traditional way should be shifted since the world is facing new challenges especially from the emerging technology and new industries.

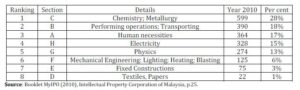

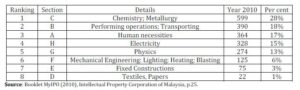

Table 2 below shows the patent classification granted in the year 2010. As can be seen from this table, the Malaysian overall industry that managed to be granted a patent is dominated by the chemical and metallurgy companies with 28%. The second rank is by performing operations and transporting with 18%, followed by the third place for the human necessities category with 17%. Later on, fourth placing goes to electricity category with 15%, and physics category is ranked fifth with 13%. Mechanical engineering secured sixth position with 6%, while number seven is awarded to fixed constructions with 3% and finally textiles and paper industry is the last category with 1%. It can be concluded that the overall industry had made tremendous efforts to obtain patent recognition. This should not stop here because there is still a long way to go in the current challenging business environment.

Table 2: Sorted Patent Granted by Class 2010

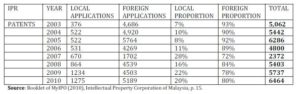

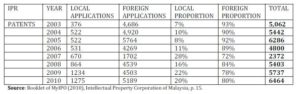

Table 3 below shows patent application by local versus foreign recorded by MyIPO.

Table 3: Patents Application by Local versus Foreign.

It should be noted that different elements of IP have different characteristics. It is also important to know which IP element that really gives better protection according to the product that one has. Even companies need to pay some amount of money for the protection; this can be considered a long term investment for the product to give it returns, which one would never know how much those inventions are worth. In Malaysia, there are several types of IP protection including patent, copyright, trademark, layout design of integrated circuit, industrial design, geographical indication, and traditional knowledge. Each IP element has its own characteristics which need to be evaluated to suit the company’s business strategy. It is important because it should go parallel with the company’s vision and mission.

Operational Performance

Companies operating in different competitive environments may have different performance objectives and that the competitive strategy must fit the specific needs of the company and its customers. Stable environment consists of reutilised operations focused on building efficient and lean operation flows. Their operations are dedicated to functional products with long life cycles and a low degree of innovation, such as in stable consumer goods industries.

Their performance priorities start with cost, followed by delivery and quality. Companies in dynamic environments should focus on agility and market-responsiveness. They enable the production of innovative products with short life cycles, such as in emergent industries with rapid technological change (Da Silveira & Cagliano, 2006). Therefore, their major performance objective is flexibility, followed by quality and delivery.

Considering these facts, for assessing the operations performance of organisations, researchers used the following as the major variables (Da Silveira & Cagliano, 2006): (1) cost; (2) quality; (3) delivery and (4) flexibility. Cost is determined by the scale of economies, capacity utilisation and inventory turnover. Delivery involves performance in lead times and supply reliability. Quality may involve both conformance and performance issues, appearing to suggest that stable operations system is aimed at quality “sustainability” (conformance) levels, which might not be as high as the quality “supremacy” (performance) levels of the system (Da Silveira & Cagliano, 2006).

Cost, quality, delivery/dependability and flexibility have become widely used as indicators of the competitive dimensions of manufacturing. In each market where the company operates, it should identify those criteria that win orders against the competition (Voss, 1995).

Once the understanding of the operations capabilities of the provider company is achieved, this will enable successful service delivery as per the pre-set performance requirements (quality, speed, flexibility, or cost leadership). It is proved that most world-class operations strive to deliver high performance in all four of these performance requirements, but in any performance-based service contract, this is very hard to quantify and maintain as there are many uncertainties involved (Datta & Roy, 2010).

Discussion

Companies would be involved in multiple technological trajectories, speeded-up research direction development, and effective external skills performance. At the same time, direct contact with corresponding R&D activities that is done externally can also be utilised. As a result, it will increase effects to the internal R&D performance (Belderbos, Carree, & Lokshin, 2006; Cassiman & Veugelers, 2006).

Even though internal R&D would be able to perform successfully accompanied by external R&D and knowledge sourcing, the empirical literature came out with various interpretations. A few papers that cross-checked internal R&D and external technology sourcing in multiple scenarios concluded that there was no complimentary relationship between the two. Some even suggested that these strategies are substitutes.

Medium and low technology companies apply internal and external R&D as an alternative in their business strategy, but not for high technology companies, as reported by Audretsch, Menkveld, and Thurik (1996). Meanwhile, according to Fernandez Bagues (2004), it was observed that there were positive impacts for certain R&D projects which were done in-house and gained support from outsourcing agreement in a pharmaceutical company. It was concluded that “make” and “buy” relationship was a negative relationship.

On the other hand, Blonigen and Taylor (2000) found out that in high technology industries, an inverse relationship occurs between R&D intensity and technology acquisition. In this case, companies may choose between decision strategy to “make” or “buy”. A study on estimation of simultaneous impact of internal R&D and technology purchases on their productivity was done by Basant and Fikkert (1996).

Companies that merge “make” and “buy” strategies are considered as being innovative, but the implementation of both strategies need to be considered as separate practices (Cassiman & Veugelers, 2006). A company’s patent application would improve greatly when contracting R&D is applied. Its performance will only increase when it is shared together with internal R&D (Beneito, 2006).

This happens when business R&D expenditures are high, based on the results obtained by Grifï¬th, Redding, and van Reenen (2003) who examined productivity growth at the industry level across the panel of Organisation for Economic Cooperation and Development (OECD) countries. This phenomenon is said to be on the minimum level of absorptive capacity that corresponds to business R&D expenditures (Lokshin, Belderbos, & Carree, 2008).

The proposed framework is as follows:

Conclusion

The importance of internal R&D can be seen in three major perspectives:

- Its ability to develop and grow critical human resource,

- Active involvement in the corporate R&D programme, and

- Its ability to connect information-wise (Vereecke et al., 2002).

The three major perspectives above show the degree of strengths that binds together in the internal R&D organisation. This also can be seen as a sign of the relationship that exists between other internal R&D sites alongside the R&D headquarters. However, there are two major limitations existing in this interaction. Firstly, to avoid dispersion and information leakage in the external network linkage by sustaining optimal balance between the two networks in order. Secondly, other R&D sites in the network linkage are under too much supervision by the headquarters (Helble & Chong, 2004).

To conclude, past literature recommends that absorptive capacity is able to play important roles to make sure that companies make more profit from technological knowledge obtained elsewhere. On the other hand, the literature is not convincing about the linking between internal and external technology sourcing. Therefore, the researchers will explore the two variables by examining the impact of internal and external R&D on operational performance moderated by IPR, particularly in companies that are actively involved in patenting their products or processes in Malaysian manufacturing companies. Further research should be focusing more on the interdependency of internal R&D with other factors, such as external R&D or any other factor in the R&D capability component.

Acknowledgements

The author would like to acknowledge the support from Ministry of Higher Education of Malaysia (MOHE) and Universiti Utara Malaysia (UUM) particularly School Technology Management and Logistics (STML) for helping the authors to conduct this study. The appropriate support especially in terms of financial support really helps in ensuring the success of this study. Thanks are due to the anonymous referees for their many insightful comments and suggestions.

References

Arora, A. & Gambardella, A. (1994). “The Changing Technology of Technical Change: General and Abstract Knowledge and the Division of Innovative Labour,” Research Policy, 23, 523-532.

Publisher – Google Scholar

Atuahene-Gima, K. & Patterson, P. (1993). “Managerial Perceptions of Technology Licensing as an Alternative to Internal R&D in New Product Development: An Empirical Investigation,” R&D Management, (23), 327—336.

Publisher – Google Scholar – British Library Direct

Audretsch, D. B., Menkveld, A. J. & Thurik, A. R. (1996). “The Decision between Internal and External R&D,” Journal of Institutional and Theoretical Economics, 152, 519—530.

Publisher – Google Scholar – British Library Direct

Basant, R. & Fikkert, B. (1996). “The Effects of R&D, Foreign Technology Purchase, and Domestic and International Spill-Overs on Productivity in Indian Firms,” Review of Economics & Statistics, 78, 187—199.

Publisher – Google Scholar

Bayona, C., Marco, T. G. & Huerta, E. (2001). “Firm’s Motivations for Cooperative R&D: An Empirical Analysis of Spanish Companies,” Research Policy (30), 1289—1307.

Publisher – Google Scholar

Belderbos, R., Carree, M. & Lokshin, B. (2006). “Complementarity in R&D Cooperation Strategies,” Review of Industrial Organisation, 28, 401—426.

Publisher – Google Scholar – British Library Direct

Beneito, P. (2006). “The Innovative Performance of In-House and Contracted R&D in Terms of Patents and Utility Models,” Research Policy, 35, 502—517.

Publisher – Google Scholar

Berkovitz, J. & Feldman, M. (2005). “Fishing Upstream: Firm Innovation Strategy and University Research Alliances, Dynamics of Industry and Innovation: Organisations, Networks and Systems,” Paper to be presented at the DRUID Tenth Anniversary Summer Conference 2005 on Copenhagen, Denmark, June 27-29, 2005, 1-46.

Publisher – Google Scholar

Blonigen, B. A. & Taylor, C. T. (2000). “R&D Intensity and Acquisitions in High-Technology Industries: Evidence from the US Electronic and Electrical Equipment Industries,” The Journal of Industrial Economics, 48, 47—70.

Publisher – Google Scholar – British Library Direct

Bonte, W. (2003). “R&D and Productivity: Internal vs. External R&D – Evidence from West German Manufacturing Industries,” Economics of Innovation and New Technology, 12(4), 343—360.

Publisher – Google Scholar – British Library Direct

Booklet MyIPO (2010). ‘Intellectual Property Corporation of Malaysia,’

Brook, J. W. & Plugge, A. (2011). “Strategic Sourcing of R&D: The Determinants of Success,” Working Paper No. 2011/06,1-35.

Publisher – Google Scholar

Caputo, A. C., Cucchiella, F., Fratocchi, L., Pelagagge, P. M. & Scacchia, F. (2002). “A Methodological Framework for Innovation Transfer to SMEs,” Industrial Management & Data System, 102 (5), 271-283.

Publisher – Google Scholar – British Library Direct

Cassiman, B. & Veugelers, R. (2002). “R&D Cooperation and Spillovers: Some Empirical Evidence from Belgium, American Economic Review,” American Economic Association, 92(4), 1169-1184.

Publisher – Google Scholar – British Library Direct

Cassiman, B. & Veugelers, R. (2006). “In Search of Complementarity in Innovation Strategy: Internal R&D, Cooperation in R&D and External Technology Acquisition,” Management Science, 52, 68—82.

Publisher – Google Scholar – British Library Direct

Chan, L. & Daim, T. U. (2011). “Technology Transfer in China: Literature Review and Policy Implications,” Journal of Science and Technology Policy, 2(2), 122-145.

Publisher – Google Scholar

Cohen, W. M. & Levinthal, D. A. (1990). “Absorptive Capacity: A New Perspective on Learning and Innovation,” Admin. Sci. Quart. 35, 128—152.

Publisher – Google Scholar

Da Silveira, G. J. C. & Cagliano, R. (2006). “The Relationship between Interorganisational Information Systems and Operations Performance,” International Journal of Operations and Production Management, 26 (3), 232-253.

Publisher – Google Scholar – British Library Direct

Datta, P. P. & Roy, R. (2011). “Operations Strategy for the Effective Delivery of Integrated Industrial Product-Service Offerings, Two Exploratory Defense Industry Case Studies,” International Journal of Operations & Production Management, 31( 5), 579-603.

Publisher – Google Scholar

Den Hertog, R. G. J. & Thurik, A. R. (1993). “Determinants of Internal and External R&D: Some Dutch Evidence,” De Economist, 141(2), 279-290.

Publisher – Google Scholar

Featherstone, D. & Specht, M. (2004). ‘Nanotechnology Patents: A Snapshot of Nanotechnology Patenting through an Analysis of 10 Top Nanotech Patents,’ Intellectual Property Technology Law Journal, 16(12), 19-24.

Google Scholar

Fernandez-Bagues, M. (2004). ‘Complementarity in Innovation Strategies: Evidence from Pharmaceutical Dynamic Panel Data,’ Paper Presented at the 30th EARIE Conference, Helsinki, Finland.

Google Scholar

Fleming, L. (2001). “Recombinant Uncertainty in Technological Search,” Management Science, 47(1).

Publisher – Google Scholar – British Library Direct

Galia, F. & Legros, D. (2004). “Complementarities between Obstacles to Innovation: Evidence from France”, Research Policy , (33), 1185—1199.

Publisher – Google Scholar

Greenhalgh, C. & Longland, M. (2002). “Running to Stand Still? – Intellectual Property and Value Added in Innovating Companies,” Economics Series Working Papers 134, University of Oxford, Department of Economics.

Publisher – Google Scholar

Greenhalgh, C. & Rogers, M. (2006). “Intellectual Property Activity by Service Sector and Manufacturing Companies in the UK, 1996-2000,” Melbourne Institute Working Paper Serieswp2006n03, Melbourne Institute of Applied Economic and Social Research, The University of Melbourne.

Publisher

Green, J. P., Stark, A. W. & Thomas, H. M. (1996). “UK Evidence on the Market Valuation of Research and Development Expenditures,” Journal of Business Finance and Accounting, 23(2), 191-216.

Publisher – Google Scholar – British Library Direct

Grifï¬th, R., Redding, S. & van Reenen, J. (2003). “R&D and Absorptive Capacity: Theory and Empirical Evidence,”Scandinavian Journal of Economics, 105, 99—118.

Publisher – Google Scholar – British Library Direct

Griffith, R., Redding, S. & van Reenen, J. (2004). “Mapping the Two Faces of R&D: Productivity Growth in a Panel of OECD Industries,” The Review of Economics and Statistics, MIT Press, 86(4), 883-895.

Publisher – Google Scholar – British Library Direct

Haned, N. (2009). ‘Economic Returns to Innovation: Between Efficiency and Effectiveness,’ Proceedings of the 4th European Conference on Entrepreneurship and Innovation (ECEI), Belgium, 10-11 September 2009.

Helble, Y. & Chong, L. C. (2004). “The Importance of Internal and External R&D Network Linkages for R&D Organisations: Evidence from Singapore,” R&D Management , 34, (5), 605-612.

Publisher – Google Scholar – British Library Direct

Henderson, R. & Cockburn, I. (1994). “Measuring Competence? Exploring Company Effects in Pharmaceutical Research,” Strategic Management Journal, (15), 63-84.

Publisher – Google Scholar – British Library Direct

Hopkins, M. M., Martin, P. A., Nightingale, P., Kraf, A. & Mahdi, S. (2007). “The Myth of the Biotech Revolution: An Assessment of Technological, Clinical and Organisational Change,” Research Policy, 36(4), 566-589.

Publisher – Google Scholar

http://www.ibm.com/news/us/en/2009/01/14/e714183t64858z03.html retrieved from IBM news on April 30, 2012.

http://www.statistics.gov.my/ retrieved from Department of Statistics Malaysia on Dec 12, 2011.

Innovation in nanotechnology: An Asia-Pacific perspectives (2010). ‘Innovation in Nanotechnology: An Asia Pacific Perspective 2010,’ Proceedings and papers presented at the consultative workshop on promoting innovation in nanotechnology and fostering industrial application: An Asia Pacific perspective, International Economics, Washington, D.C

Jommi C. & Paruzzolo, S. (2007). “Public Administration and R&D Localisation by Pharmaceutical and Biotech Companies: A Theoretical Framework and the Italian Case Study,” Health Policy, 81(1), 117-130.

Publisher – Google Scholar

Kogut, B. & Zander, U. (1992). “Knowledge of the Company, Combinative Capabilities, and the Replication of Technology,” Organisation Science, 3(3), 383-397.

Publisher – Google Scholar

Lim, K. W. (2009). 27.08.2009. “Let’s Innovate Malaysia Now,” 2009, [online blog] Retrieved on November 20, 2010 from (http://founder.limkokwing.net/blog/lets _innovate_malaysia_now/)

Publisher

Liu, X. & Zou, H. (2008). “The Impact of Greenfield FDI and Mergers and Acquisitions on Innovation in Chinese High-Tech Industries,” Journal of World Business, 43, 352-364.

Publisher – Google Scholar

Lokshin, B., Belderbos, R. & Carree, M. (2008). “The Productivity Effects of Internal And External R&D: Evidence from a Dynamic Panel Data Model,” Oxford Bulletin of Economics and Statistics, 70(3), 399-413.

Publisher – Google Scholar – British Library Direct

MASTIC (1998). Retrieved on April 30, 2011 from

(http://www.mastic.gov.my/portals/ mastic/publications/R_DSurvey/98/ack.pdf)

Publisher

Mossoff, A. (2001). “Rethinking the Development of Patents: An Intellectual History 1550-1800,” Hastings Law Journal, 52, 1255-1273.

Publisher – Google Scholar – British Library Direct

MOSTE (2002). Ministry of Science, Technology and Environment of Malaysia.

Nakamura, K. & Odagiri, H. (2005). “R&D Boundaries of the Company: An Estimation of the Double-Hurdle Model on Commissioned R&D, Joint R&D, and Licensing in Japan,” Economic Innovation New Technology, 14(7), 583-615.

Publisher – Google Scholar

Pisano, G. P. (1990). “The R&D Boundaries of the Company: An Empirical Analysis,” Administrative Science Quarterly, 35, 153—176.

Publisher – Google Scholar

Ramanathan (2008). “An Overview of Technology Transfer and Technology Transfer Models,” retrieved on April 30, 2011 from (http://www.business-asia.net/Pdf_Pages/Guidebook%20on%20Technology%20Transfer%20Mechanisms/

An%20overview%20of%20TT%20and%20TT%20Models.pdf)

Publisher

Schankerman, M. (1998), “How Valuable is Patent Protection? Estimates by Technology Field,” RAND Journal of Economics, 29, 77—107.

Publisher – Google Scholar – British Library Direct

Singh, J. (2008). “Distributed R&D, Cross Regional Knowledge Integration and Quality of Innovative Output,” Research Policy, 37(1), 77-96.

Publisher – Google Scholar

Sobel, R. S., & Dutta, N. & Roy, S. (2010). “Does Cultural Diversity Increase the Rate of Entrepreneurship?,” The Review of Austrian Economics, 23(3), 269-286.

Publisher – Google Scholar

Teese, D. J. (1986). “Profiting from Technological Innovation: Implications for Integration, Collaboration, Licensing, and Public Policy,” Research Policy, 15(6), 285-305.

Publisher – Google Scholar

Tielemas, S. (2010). ‘Analysis of the Eurelectric Survey Questionnaire on the Role of R&D in Power Companies,’ A EURELECTRIC Survey Report May 2010, 1-23.

Vereecke, A., Van Dierdonck, R. & De Meyer, A. (2002). A Typology of Plants in Global Manufacturing Networks,INSEAD Working Paper.

Publisher – Google Scholar

Veugelers, R. (1997). “Internal R&D Expenditures and External Technology Sourcing,” Research Policy, 26(3), 303-315.

Publisher – Google Scholar

Voss, C. A. (1995). “Alternative Paradigms for Manufacturing Strategy,” International Journal of Operations & Production Management, 15, (4), 5-16.

Publisher – Google Scholar – British Library Direct