Introduction

Malaysia economies are dominated by a large proportion of small and medium enterprises (SMEs). According to Census Report on SMEs 2011, there was a total of 645,136 SMEs operating their businesses in Malaysia representing 97.3% of the total of business establishments. The SMEs sectors are comprised of services sector (90 percent), manufacturing sector (5.9 percent), construction sector (3 percent), agriculture (1 percent) and mining and quarrying (0.1 percent) (Wayne Lim, 2011). Most of the SME establishments in Malaysia are based in Selangor (19.5%) and Kuala Lumpur (13.1%), followed by Johor (10.7%), Perak (9.3%) and Sarawak (6.8%). In 2014, SMEs contributed 65% of total employment and 17.8% of total exports. However, this contribution to the overall economy is relatively small when compared with the advanced and other high middle income countries (Department of Statistics Malaysia (DOSM) and SME Corp. Malaysia, 2014).

The early concept of the innovation of economic development and entrepreneurship has been popularized by Joseph Schumpeter, a German economist. Innovation, in his view, comprises the elements of creativity, research and development (R&D), new processes, new products or services and advance in technologies (Lumpkin and Dess, 2001). Normally a firm’s ability is evaluated based on its performance (Bonn, 2000). Firm performance is the outcome achieved in meeting internal and external goals of a firm (Lin et al., 2008).

This study is to investigate the relationship between the products, process, marketing and organizational innovations of SMEs with its innovative performance, operational performance and financial performance. The main contribution of this study is the comprehensively testing of innovation-performance analysis based on empirical data to uncover the effects of the different types of innovation on firm performance and the relationships among these variables. It is also expected to help the SMEs in the understanding of the key variables which influence their business and financial performance.

From the earliest work by Gunday et al. (2011) up to the recent work by Saunila (2014), the relationship between the innovation of firms and its performance is still debatable. Besides that, the nature of such research work is very important to the economy of a country. The total number of SMEs in Malaysia is estimated to grow to 1 million in 2012, accounting for up to 99.2% of total business establishments (SME Corp. Malaysia, 2014). Firms should be innovative irrespective of their firm size or sector in order to compete and survive in the market (Elci and Karatayli, 2009). Innovation contributes significantly to economic growth (Ahmed and Shepherd, 2010). Gunday et al. (2011), and Saunila and Ukko (2012, 2013) found that innovation and business performance are positively related. However, Saunila (2014) has reported a non-significant direct relationship of innovation with firm performance. Literature revealed that study in this area has been fragmented, lacks comprehensive reviews and findings were considered as inconsistent. Consequently, this research has been carried out to investigate the relationship between the SMEs innovation and its performance. Specifically, the research objectives are to investigate the level of SMEs firm innovation, the level of SMEs performance in Malaysia, and to determine whether SMEs innovation is related to the financial, operational and innovative performances.

Literature Review

According to SME International Malaysia (2013), the success of SMEs in some advanced economies is a fundamental component of their economies, comprising of over 98% of the total establishments and contributing to over 65% of employment as well as over 50% of the gross domestic product. Although, the numbers might be lower in Malaysia, SMEs have the potential to contribute substantially to the economy and can provide a strong foundation for the growth of new industries as well as strengthening the existing ones for Malaysia’s future development. Developing stronger SMEs requires major changes in the manufacturing sector, as SMEs make up over 90% of the Malaysia’s manufacturing sector.

Innovation at firm level refers to a firm’s receptivity and propensity to adopt new ideas that lead to the development and the launch of new products (Rubera and Kirca, 2012). The use of terms such as “new” or “improved” retains a degree of subjectivity in the notion of innovation. What is new to one firm is not necessarily new to another, therefore it is possible that the innovation in two different firms is not identical. This observation emphasizes the degree of complexity associated with the term. Product innovation has been defined as the creation of a new product from new materials (totally new product) or the alteration of existing products to meet customer satisfaction (improved version of existing products) (Gopalakrishnan and Damanpour, 1997; Langley et al., 2005). Process innovation is the implementation of a new or significantly improved production or delivery method. This includes significant changes in techniques, equipment and/or software (e.g. installation of new or improved manufacturing technology, such as automation equipment or real-time sensors that can adjust processes, computer-aided product development) (OECD and Eurostat, 2005).

Organizational innovation is the implementation of a new organizational method in the firm’s business practices, workplace organization or external relations (Gunday et al., 2011). Organizational innovations have a tendency to increase firm performance by reducing administrative and transaction costs, improving workplace satisfaction (and thus labor productivity), gaining access to non-tradable assets (such as non-codified external knowledge) or reducing costs of supplies (OECD Oslo Manual, 2005).

Market innovation deals with the market mix and market selection in order to meet a customer’s buying preference (Johne, 1999). Continual market innovation needs to be done by a firm because of state-of-the-art marketing tools, particularly through the Internet, which makes it possible for other competitors to reach potential customers across the globe at the speed of light. Normally a firm’s ability is evaluated based on its performance (Bonn, 2000). According to Tangen (2005), performance is a term for all concepts that consider the success of a firm and its activities. In this research, performance refers to the outcomes. A firm’s performance is divided into three main areas: innovative performance, operational performance and financial performance. Financial performances refer to factors of sales value, sales growth and gross profit or profitability while; business performance can be classified in terms of financial and non-financial performance (Li, 2000). Particularly, four different performance dimensions are employed in the literature to represent firm performance (Hagedoorn and Cloodt, 2003; Yilmaz et al., 2005). These dimensions are innovative performance, production performance, market performance and financial performance.

The operational performance can also be referred to as productivity performance (Schreyer and Pilat, 2001). Productivity is commonly defined as a ratio of a volume measure of output to a volume measure of input use (Schreyer and Pilat, 2001) or in other words, how much of output which is obtained from a given set of inputs (Syverson, 2010). Productivity is a technical concept which measures the efficiency from the used factors of production. Higher productivity is likely to improve profitability and enhance a firm’s competitiveness relative to its rivals. Innovative performance is the combination of overall organizational achievements as a result of renewal and improvement efforts done via considering the various aspects of a firm innovativeness. Therefore, innovative performance is a composite construct (Hagedoorn and Cloodt, 2003) based on various performance indicators pertaining, for instance, to the new patents, new product announcements, new projects, new processes, and new organizational arrangements. Innovations can actually enhance the firm performance in several aspects.

Innovation has a considerable impact on corporate performance by producing an improved market position that conveys competitive advantage and superior performance (Walker, 2004). Studies focusing on the innovation-performance relationship provide a positive appraisal of higher innovativeness resulting in increased corporate performance (Hult and Ketchen, 2001; Du and Farley, 2001; Calantone et al., 2002; Garg et al., 2003; Wu et al., 2003). But these research works are generally conceptual in nature and/or focus only on a single type of innovation rather than considering all the four different types of innovation together to investigate its impact on the firm performance. Process and product innovations are the most common innovation types examined. The studies by Marcus (1988), Ittner and Larcker (1997), Whittington et al., (1999), Olson and Schwab (2000), Knott (2001) and Baer and Frese (2003) focus merely on process innovations while studies of Atuahene-Gima (1996), Subramanian and Nilakanta (1996), Han et al., (1998) and Li and Atuagene-Gima (2001) reported on product innovations. Many of these research studies embrace more or less a positive association between innovations and firm performance, but there are also some studies indicating a negative link or no link at all (Capon et al., 1990; Chandler and Hanks, 1994, Subramanian and Nilakanta, 1996).

Methodology

Firm performance has been central to strategy research through resource-based (RVB) approach. The key premise to RVB is how a firm competes basing on the resources capabilities and resources to sustain competitive advantage (Barney, 1986; Spanos and Lioukas, 2001; Peteraf and Bergen, 2003). Thus, the underlying approach used to formulate the research framework is based on RBV. Innovation which comprises of product innovation, process innovation, organizational innovation and marketing innovation is the independent variable while the firm performance measures comprising of the financial, operational, and innovative performances are the dependent variable.

The hypotheses that have been formulated for this research work are as follow:

H1: SMEs innovation is related to firm financial performance in SMEs.

H1A: Product innovation is related to firm financial performance in SMEs.

H1B: Process innovation is related to firm financial performance in SMEs.

H1C: Organizational innovation is related to firm financial performance in SMEs.

H1D: Marketing innovation is related to firm financial performance in SMEs.

H2: SMEs innovation is related to firm operational performance in SMEs.

H2A: Product innovation is related to firm operational performance in SMEs.

H2B: Process innovation is related to firm operational performance in SMEs.

H2C: Organizational innovation is related to firm operational performance in SMEs.

H2D: Marketing innovation is related to firm operational performance in SMEs.

H3: SMEs innovation is related to firm innovative performance in SMEs.

H3A: Product innovation is related to firm innovative performance in SMEs.

H3B: Process innovation is related to firm innovative performance in SMEs.

H3C: Organizational innovation is related to firm innovative performance in SMEs.

H3D: Marketing innovation is related to firm operational innovative performance in SMEs.

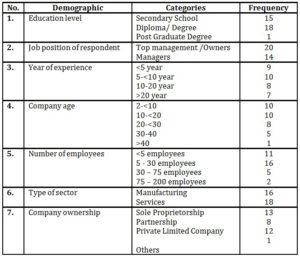

This is a quantitative research study. There are 68,874 SMEs listed in the SMEs Corp. Malaysia (2013) directory in the state of Johor. The sample size was determined based on Krejcie and Morgan (1970) sampling table. Survey questionnaires were e-mailed to the individual owner, director or manager who are knowledgeable of their respective business representing each SMEs from the total of 381 selected sampled innovative SMEs. Data were collected via email replied from the targeted respondents who are manager or owner of the respective SMEs over a period of 2.5 months. Follow-up phone calls were made to assist in getting the respondent’s response.

The questionnaire comprises of three sections. Section A is on general information of the respondents. Section B was divided into a few subsections, which include a) product innovation, b) process innovation, c) organizational innovation, and d) marketing innovation. Section C focuses on SMEs performance with innovative, financial and operational performance and in this section, respondents are required to compare their performance with that of their competitors.

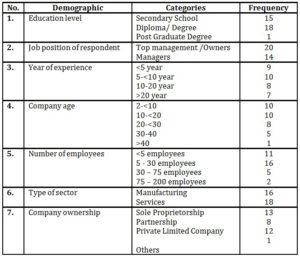

Section A comprises of eight questions where question 1 to question 3 are related to the highest education level of respondents, job position and year of experience in this job. Question 4 to question 8 asked about company background which included the number of employees in this company, company age, the number of years a firm has been in operation, company ownership and type of industry. Section B comprises of four sub-sections of marketing strategy with a total of 24 questions. Subsection a) consists of 5 questions on product innovation, sub-section b) consists of 5 questions which are process innovation, subsection c) consists of 9 questions on organizational innovation, and subsection d) consists of 5 questions on marketing innovation. Section C comprises of three sub-sections with a total of 8 questions. Subsection a) consists of 4 questions in financial performance, subsection b) consists of 4 questions on production performance and sub-section c) consists of 4 questions on innovative performance.

Pilot Study and Profile of Respondents

Ten respondents were chosen to answer the questionnaire for the purpose of the pilot study. This pilot test is to validate the validity of the measures of the variables as the respective questions of the measures. The research questions were adapted from various previous researchers and reviewed by two experts in the international marketing field. Cronbach’s Alpha has been used to test the reliability of the measures. The Cronbach’s Alpha result of product innovation is 0.822, process innovation is 0.829, organizational innovation is 0.859, marketing innovation is 0.858, financial performance is 0.772, operational performance is 0.682 and innovation performance is 0.860. The overall reliability Cronbach’s Alpha is 0.954. Cronbach’s Alpha value of ≥0.60 for all the variables indicated that all the measures in the questionnaire have good reliability. Thus, all the measures of variables are valid and reliable.

The reliability tests of the actual data collected were again tested using Cronbach’s Alpha. This is shown in Table 1. The Cronbach’s Alpha for product innovation is 0.704, process innovation is 0.707, organizational innovation is 0.870 and marketing innovation is 0.860. The Cronbach’s Alpha for the dependent variable of financial performance is 0.771, operational performance is 0.742 and innovation performance is 0.869. Thus, all the variables are reliable for further analyses.

Table 1: Reliability test of elements

Table 2 tabulated the profile of respondents and companies background.

Table 2: Profile of the respondents (N=34)

Findings and Discussion

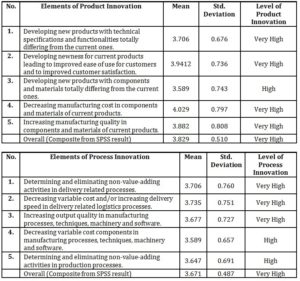

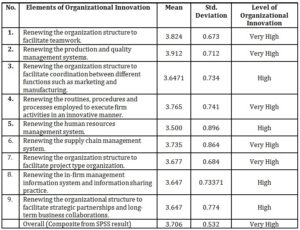

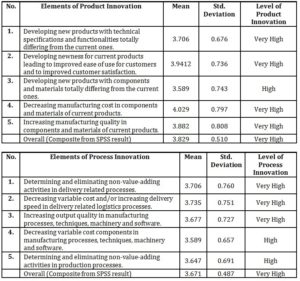

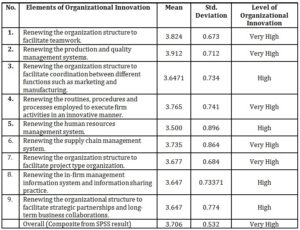

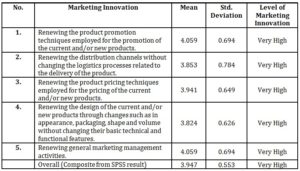

Level of innovation firm among SMEs

To answer the first research question of what is the level of innovation firm of SMEs in Malaysia, the descriptive statistic method was used. The results of the mean, its standard deviation and the levels of firm innovation for product innovation, process innovation, organizational innovation, and marketing innovation are tabulated in Table 3. As a summary, the SMEs in Johor are very high in their level of marketing innovation. However, it shows a mixture of very good and good levels of product innovation, process innovation, and organizational innovation. Thus, the objective of determining the level of innovation firm among SMEs has been determined.

Table 3: Product, Process, Organizational and Marketing Innovations

Note: Range is based on Likert Scale of 1 to 5 where 1.00-2.33=Low; 2.3-3.66=High and 3.67-5.00 =Very High (Kim-Soon, 2015).

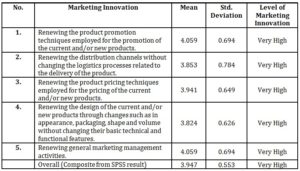

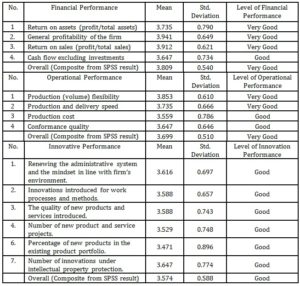

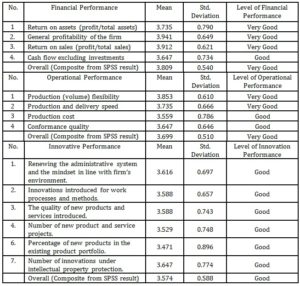

Level of SMEs performance

To answer the second research question of what is the level of SMEs performance in Malaysia, the descriptive statistic method was used to test the level of SMEs performance in Malaysia. The results of the mean, standard deviation and levels for financial performance, operational performance, and innovative performance are tabulated in Table 4. It indicates that SMEs Johor has good level innovation performance. There is a mixture of very good and good levels in financial performance and operational performance. Thus, the objective of determining the level of SMEs performance in Malaysia has been determined.

Table 4: Financial Performance

Note: Range is based on Likert Scale of 1 to 5 where 1.00-2.33=Not Good; 2.3-3.66=Good and 3.67-5.00=Very Good (Kim-Soon, 2015).

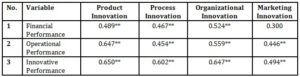

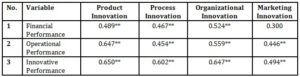

Relationship of innovation and SMEs performance in Malaysia

This section is to answer the third research question of whether there is a relationship between innovation and SMEs performance. The bivariate Pearson correlation analysis was used to determine the relationship of innovation and SMEs performance in terms of financial performance, operational performance and innovation performance. The results of analyses are tabulated in Table 5. It shows that product innovation, process innovation and organizational innovation has a strong positive relationship with financial performance as the R-value is between the ranges of 0.40 to 0.69. However, marketing innovation with a correlation coefficient of 0.30 is not significantly related to financial performance. On the other hand, all four firm’s innovation variables (product innovation, process innovation, organizational innovation and marketing innovation) are significantly related to firm operational performance at a p-value less than 0.01. These four innovation variables show a strong positive relationship with the firm operational performance at the correlation coefficient between the ranges of 0.40 to 0.69. It thus indicates that firm innovation has a positive relationship with operational performance. It follows that all the firm innovation variables have significant positive relationships with financial performance, operational performance and innovative performance. This is with the exception of marketing innovation which has no significant relationship with financial performance.

Normality Test

The normality test is to fulfill the linear regression assumption of the validity of linear regression analysis where the variables need to be normally distributed. The Kolmogorov-Smirnov Test has been used to test the normality of all the variables. The results of the one-sample Kolmogorov-Smirnov Tests are all not significant, ranging from the value of p<0.076 to p<0.200 indicating that all the respective variables are normally distributed.

Table 5: Correlation of SMEs innovations and the performance variables

** Correlation is significant at the 0.01 level; * Correlation is significant at the 0.05 level (2-tailed)

Hypotheses Testing

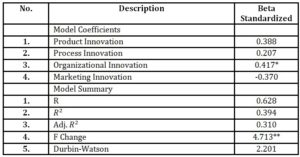

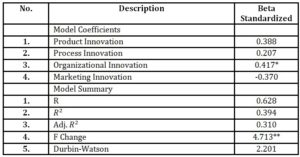

All the hypotheses have been tested with linear regression method and the results are shown in regression Table 6, 7 and 8.

H1: Innovation is related to firm financial performance in SMEs.

To examine this hypothesis, linear regression was used and the result of the independent variables with firm financial performance is shown in Table 6. The R value of 0.628 indicates a strong positive relationship to financial performance with significant F-change at p<0.01. The R Square change value of 0.394 means that 39.4% of firm financial performance is being explained by innovation firm. The Durbin Watson value of 2.201 of the model suggests that the result of the regression model is valid. Hence, this result supported the Hypothesis H1 of innovation firm is related to firm financial performance.

H1A: Product innovation is related to firm financial performance in SMEs.

Table 6 shows that Beta value of 0.388 is not significant for the relationship between product innovation with firm financial performance. Therefore, Hypothesis H1B is not supported.

H1B: Process innovation is related to firm financial performance in SMEs.

Table 6 shows that Beta value of 0.207 is not significant for the relationship between process innovation with firm financial performance. Therefore, Hypothesis H1B is not supported.

H1C: Organizational innovation is related to firm financial performance in SMEs.

Table 6 shows Beta value of 0.417 for the relationship between organizational innovation with firm financial performance is significantly related at p<0.05. Hence, Hypothesis H1C is supported.

H1D: Marketing innovation is related to firm financial performance in SMEs.

Table 6 shows that Beta value of -0.370 is not significant for the relationship between marketing innovation to firm financial performance. Therefore, Hypothesis H1D is not supported.

Table 6: Regression model for independent variables and firm financial performance

*** p<0.001 level; ** p< 0.01 level; * p< 0.05

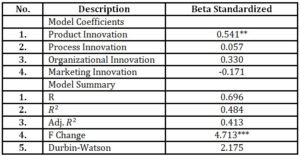

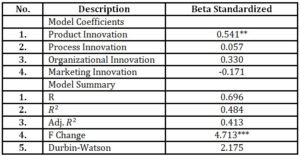

H2: Innovation is related to firm operational performance in SMEs.

To examine this hypothesis, linear regression was used and the result of the independent variables with firm operational performance is shown in Table 7. The R value of 0.696 indicates a strong positive relationship to operational performance at p<0.001. The R Square change value of 0.484 means that 48.4% of firm operational performance is being explained by innovation firm. The Durbin Watson value of 2.175 of the model suggests that the result of the regression model is valid. Hence, this result supported the Hypothesis H2 of “innovation firm is related to firm operational performance”.

H2A: Product innovation is related to firm operational performance in SMEs.

Table 7 shows Beta value of 0.541 for the relationship between product innovation to firm operational performance is significantly related at p<0.01. Hence, Hypothesis H2A is supported.

H2B: Process innovation is related to firm operational performance in SMEs.

Table 7 shows that Beta value of 0.057 is not significant for the relationship between process innovation to firm operational performance. Therefore, Hypothesis H2B is not supported.

H2C: Organizational innovation is related to firm operational performance in SMEs.

Table 7 shows that Beta value of 0.330 is not significant for the relationship between organizational innovation to firm operational performance. Therefore, Hypothesis H2C is not supported.

H2D: Marketing innovation is related to firm operational performance in SMEs.

Table 7 shows that Beta value of -0.171 is not significant for the relationship between marketing innovation to firm operational performance. Therefore, Hypothesis H2D is not supported.

Table 7: Regression model for independent variables and firm operational performance

*** p<0.001 level; ** p< 0.01 level; * p< 0.05

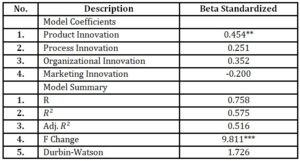

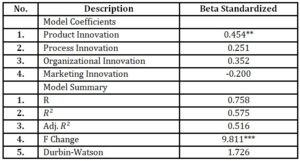

H3: Innovation firm is related to firm innovative performance in SMEs.

The result of the independent variables with innovative performance is shown in Table 8. The R value of 0.758 and the F-value is at p<0.001. Thus, it indicates that innovation firm is significantly related to firm innovative performance. The R Square change value of 0.575 means that 57.5% of firm innovative performance is explained by all independent variables. The Durbin Watson value of 1.726 suggests the regression result model is valid. Thus, Hypothesis H3 is supported; innovation firm is related to firm innovative performance.

H3A: Product innovation is related to firm innovative performance in SMEs.

Table 8 shows Beta value of 0.454 for the relationship between product innovation to firm innovative performance is significantly related at p<0.05. Hence, Hypothesis H3A is supported.

H3B: Process innovation is related to firm innovative performance in SMEs.

Table 14 shows that Beta value of 0.251 is not significant for the relationship between process innovative to firm innovation performance. Therefore, Hypothesis H3B is not supported.

H3C: Organizational innovation is related to firm innovative performance in SMEs.

Table 8 shows that Beta value of 0.352 is not significant for the relationship between organizational innovation to firm innovative performance. Therefore, Hypothesis H3C is not supported.

H3D: Marketing innovation is related to firm innovative performance in SMEs.

Table 8 shows that Beta value of -0.200 is not significant for the relationship between marketing innovation to firm innovative performance. Therefore, Hypothesis H3D is not supported.

Table 8: Regression Model among Independent Variables and Firm Innovation Performance

*** p<0.001 level; ** p< 0.01 level; * p< 0.05

Discussion, Conclusion and Recommendation

This section is on discussion, conclusion and recommendations. The discussion covers the research objectives, literature review, hypotheses and analysis of results. Recommendations for business and further studies are provided.

Discussion

This study investigated whether SMEs innovation is related to its performance. Previous international innovation study’s researchers have indicated that innovation firm is a major element in the SMEs performance. The elements of innovation firm include the product innovation, process innovation, organizational innovation and marketing innovation (Gunday et al., 2011). It is clear from the findings in this study that Johor SMEs are innovative to achieve their objectives and goal.

This study is also aimed to determine whether there is a relationship between innovation and SMEs performance. Literature related to the innovation of firm indicates that most of the studies show innovation firms have a significance relationship with SMEs performance. This study found that the innovation of SMEs is significantly related to its financial, operational and innovative performance.

Roxes et al. (2014) reported that product innovation is significantly related to firm performance. However, this study shows that product innovation has a moderate positive relationship with firm operational and innovative performance but not significantly related to firm financial performance.

Gunday et al. (2011) found process innovation is significantly correlated to innovative performance, and it influences it through product innovation. However, this study shows that process innovation is not significantly related to financial, operational and innovative performance.

The findings of Damanpour et al. (2009) revealed that distinctive competencies, organizational capabilities outcomes can be attained with the help of certain innovation types. However, this study shows that organizational innovation has a moderate positive relationship with the firm financial performance but not significantly related to firm operational and innovative performance.

Gunday et al. (2011) found marketing innovations have both direct and indirect effects on innovative performance. Conversely, this study shows that marketing innovation is not significantly related to financial, operational and innovative performance.

Conclusion

It was found that Johor SMEs are innovative in their product innovation, process innovation, organizational innovation, and marketing innovation as their firm innovation which is translated into their firm performance. This is evident by the strong positive relationship between firm innovation and firm performance at p<0.001 level. The standardized beta of the regression analyses shows that organizational innovation is significantly related to financial performance and that product innovation is significantly related to the operational performance and innovative performance. These findings imply that to enhance financial business performance, SMEs need to modify the organizational and their management system. They should be renewing the production and quality management systems. They should be renewing the organization structure to facilitate teamwork. They should be renewing the routines, procedures and processes employed to execute firm activities in an innovative manner.

These findings imply that to enhance operational and innovative performance, SMEs need to be effective in their manufacturing cost especially on the elements and materials of their current products. New products development should enhance the ease of use for customers and customer satisfaction. Enhancing the manufacturing quality of components and materials will help in improving their current products.

Recommendation

It is obvious that SMEs should focus more on organizational innovation to increase the firm financial performance as these two variables are strongly and significantly found to be related. They should be prepared to adapt and adopt organization structure that facilitates teamwork and it is important for them to use better production and quality management systems. SMEs that focus on product innovation are able to enhance innovative performance. They can achieve it by enhancing technical specification and functionalities totally differing from their current products, improving ease of use, competitive cost and quality of components and materials for customers and enhancing customer satisfaction.

Acknowledgments

This work has been supported in part by Universiti Tun Hussein Onn Malaysia under Grant No. MDR 1322 to Dr. Ng Kim Soon.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Amara, N., & Landry, R. (2005). Sources of information as determinants of the novelty of innovation in manufacturing firms: evidence from the 1999 statistics Canada innovation survey. Technovation, 25(3), 245-259. DOI: 10.1016/S0166-4972(03)00113-5

- Arokiasamy, L., & Ismail, M. (2009). The Background and Challenges Faced by the Small Medium Enterprises. A Human Resource Development Perspective. International Journal of Business and Management, 4(10), p95. DOI: http://dx.doi.org/10.5539/ijbm.v4n10p95

- Atalay, M., Anafarta, N., & Sarvan, F. (2013). The relationship between innovation and firm performance: An empirical evidence from Turkish automotive supplier industry. Procedia-Social and Behavioral Sciences, 75, 226-235. DOI: 10.1016/j.sbspro.2013.04.026

- Bartel, C. A., & Garud, R. (2009). The role of narratives in sustaining organizational innovation. Organization Science, 20(1), 107-117.

- Bell, G. G. (2005). Research notes and commentaries: Clusters, networks, and firm innovativeness. Strategic Management Journal, 26(3), 287-295. DOI: 10.1287/orsc.1080.0372

- Brouwer, M. (1991). Schumpeterian puzzles: technological competition and economic evolution. University of Michigan Press.

- Camisón-Zornoza, C., Lapiedra-Alcamí, R., Segarra-Ciprés, M., & Boronat-Navarro, M. (2004). A meta-analysis of innovation and organizational size. Organization Studies, 25(3), 331-361. DOI: 10.1177/0170840604040039

- Chen Goh, P., & Pheng Lim, K. (2004). Disclosing intellectual capital in company annual reports: evidence from Malaysia. Journal of Intellectual Capital, 5(3), 500-510. DOI: 10.1108/14691930410550426

- Cho, H. J., & Pucik, V. (2005). The relationship between innovativeness, quality, growth, profitability, and market value. Strategic Management Journal, 26(6), 555-575. DOI: 10.1002/smj.461

- Damanpour, F. (1991). Organizational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34(3), 555-590. DOI: 10.2307/256406

- Damanpour, F. (1996). Organizational complexity and innovation: developing and testing multiple contingency models. Management Science, 42(5), 693-716. DOI: 10.1287/mnsc.42.5.693

- Dewar, R. D., & Dutton, J. E. (1986). The adoption of radical and incremental innovations: An empirical analysis. Management Science, 32(11), 1422-1433. DOI: 10.1287/mnsc.32.11.1422

- Gopalakrishnan, S., & Damanpour, F. (1997). A review of innovation research in economics, sociology and technology management. Omega, 25(1), 15-28. DOI: 10.1016/S0305-0483(96)00043-6

- Gunday, G., Ulusoy, G., Kilic, K., & Alpkan, L. (2011). Effects of innovation types on firm performance. International Journal of Production Economics, 133(2), 662-676. DOI: 10.1016/j.ijpe.2011.05.014

- Hajar, I. The Effect of Business Strategy on Innovation and Firm Performance in the Small Industrial Sector.

- Hashim, M. K. (2000). Business strategy and performance in Malaysian SMEs: A recent survey. Malaysian Management Review, 35(2), 1-10.

- Higgins, J. M. (1995). Innovation: the core competence. Planning Review, 23(6), 32-36. DOI: http://dx.doi.org/10.1108/eb054532

- Hin, C. W., Kadir, K. A., & Bohari, A. M. (2013). The strategic planning of SMEs in Malaysia: types of strategies in the aftermath of an economic downturn. Asian Journal of Business and Management Sciences, 2(8), 51-59.

- Huiban, J. P., & Bouhsina, Z. (1998). Innovation and the quality of labor factor: an empirical investigation in the French food industry. Small Business Economics, 10(4), 389-400. DOI: 10.1023/A:1007967415716

- Hurley, R. F., & Hult, G. T. M. (1998). Innovation, market orientation, and organizational learning: an integration and empirical examination. The Journal of Marketing, 42-54. DOI: 10.2307/1251742

- Li, L. (2000). An analysis of sources of competitiveness and performance of Chinese manufacturers. International Journal of Operations & Production Management, 299-315. http://dx.doi.org/10.1108/01443570010294307

- Jiménez-Jiménez, D., & Sanz-Valle, R. (2011). Innovation, organizational learning, and performance. Journal of Business Research, 64(4), 408-417. DOI: 10.1016/j.jbusres.2010.09.010

- Johannessen, J. A. (2008). Organisational innovation as part of knowledge management. International Journal of Information Management, 28(5), 403-412. DOI: 10.1016/j.ijinfomgt.2008.04.007

- Johne, A. (1999). Successful Market Innovation, European Journal of Innovation Management, 2 (1), 6-11.

- Khalique, M., Isa, A. H. B. M., Shaari, N., & Abdul, J. (2011). Challenges for Pakistani SMEs in a Knowledge-Based Economy. Indus Journal of Management & Social Sciences, 5(2).

- Krejcie, R. V., & Morgan, D. W. (1970). Table for determining sample size from a given population. Educational and Psychological Measurement, 30(3), 607-610.

- Mumford, M. D., & Licuanan, B. (2004). Leading for innovation: Conclusions, issues, and directions. The leadership quarterly, 15(1), 163-171. DOI: 10.1016/j.leaqua.2003.12.010

- Kim-Soon, N., Ibrahim, M.A., Abd Rahman Ahmad, A.R & Sirisa. (2015). The Use of Smartphone to Enhance Learning, Advanced Science Letters, Vol. 21(7), 1936-7317.

- Noudoostbeni, A., Yasin, N. M., & Jenatabadi, H. S. (2009, April). To investigate the success and failure factors of ERP implementation within Malaysian small and medium enterprises. In Information Management and Engineering, 2009. ICIME’09. (pp. 157-160). IEEE. DOI: 10.1109/ICIME.2009.66

- Radam, A., Abu, M. L., & Abdullah, A. M. (2008). Technical efficiency of small and medium enterprise in Malaysia: A stochastic frontier production model. International Journal of Economics and Management, 2(2), 395-408.

- Rose, R. C., Kumar, N., & Yen, L. L. (2006). Entrepreneurs success factors and escalation of small and medium-sized enterprises in Malaysia. Journal of Social Sciences, 2(3), 74-80.

- Rosenbusch, N., Brinckmann, J., & Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. Journal of business Venturing, 26(4), 441-457.

- Roxas, B., Battisti, M., & Deakins, D. (2014). Learning, innovation and firm performance: knowledge management in small firms. Knowledge Management Research & Practice, 12(4), 443-453. DOI: 10.1057/kmrp.2012.66

- Rubera, G., & Kirca, A. H. (2012). Firm innovativeness and its performance outcomes: A meta-analytic review and theoretical integration. Journal of Marketing, 76(3), 130-147. DOI: http://dx.doi.org/10.1509/jm.10.0494

- Saleh, A. S., & Ndubisi, N. O. (2006). An evaluation of SME development in Malaysia. International Review of Business Research Papers, 2(1), 1-14.

- Saunila, M. (2014). Innovation capability for SME success: perspectives of financial and operational performance. Journal of Advances in Management Research, 11(2), 163-175. DOI: http://dx.doi.org/10.1108/JAMR-11-2013-0063

- Saunila, M., & Ukko, J. (2012). A conceptual framework for the measurement of innovation capability and its effects. Baltic Journal of Management, 7(4), 355-375. DOI: http://dx.doi.org/10.1108/17465261211272139

- Saunila, M., & Ukko, J. (2013). Facilitating innovation capability through performance measurement: A study of Finnish SMEs. Management Research Review, 36(10), 991-1010. DOI: http://dx.doi.org/10.1108/MRR-11-2011-0252

- Sim, A. B. (1991). Turnaround for small businesses-a synthesis of determinants for action research, with reference to Malaysia. Malaysian management review, 26(3), 15-22.

- Sim, A. B., & Yap, T. H. (1997). Strategy types in Malaysian industrial companies. Malaysian Management Review, 32(4), 1-10.

- SME Annual Report Malaysia (2011/2012).SME Corp. Malaysia, (2013), [Online] Available: http://www.smecorp.gov.my/vn2/node/37

- SME Corp. Malaysia, (2014), [Online] Available: http://www.smecorp.gov.my/vn2/

SME Corp. Malaysia, (2014), [Online] Available: http://www.smeinfo.com.my/index.php?option=com_content&view=article&id=1415&Itemid=1312&lang=enSME International Malaysia, (2013), [Online] Available: http://smeinternational.org/sme-information/developing-malaysian-smes.

- SMEDA, (2013), [Online] Available: http://www.smeda.org/index.php?option=com_content&view=article&id=2&Itemid=10.

SMEDA, (2013), [Online] Available: http://www.smeda.org/index.php?option=com_fsf&view=faq&catid=3&faqid=48.

- Standing, C., & Kiniti, S. (2011). How can organizations use wikis for innovation? Technovation, 31(7), 287-295. DOI: 10.1016/j.technovation.2011.02.005

- Therrien, P., Doloreux, D., & Chamberlin, T. (2011). Innovation novelty and (commercial) performance in the service sector: a Canadian firm-level analysis. Technovation, 31(12), 655-665. DOI: 10.1016/j.technovation.2011.07.007

- Ul Hassan, M., Shaukat, S., Nawaz, M. S., & Naz, S. (2013). Effects of Innovation Types on Firm Performance: An Empirical Study on Pakistan’s Manufacturing Sector. Pakistan Journal of Commerce & Social Sciences, 7(2).

- Vyas, V. (2009). Innovation and New Product Development by SMEs an Investigation of Scottish Food and Drinks Industry: An Investigation of Scottish Food and Drinks Industry (Doctoral dissertation, Edinburgh Napier University).

- Wolfe, R. A. (1994). Organizational innovation: Review, critique and suggested research directions*. Journal of Management Studies, 31(3), 405-431.

- Yasin, G., Nawab, S., Bhatti, K. K., & Nazir, T. (2014). Relationship of intellectual stimulation, innovations and SMEs performance: Transformational leadership a source of competitive advantage in SMEs. Middle-East Journal of Scientific Research, 19(1), 74-81. DOI: 10.5829/idosi.mejsr.2014.19.1.12458

- Zulkifli-Muhammad, M., Char, A. K., bin Yasoa, M. R., & Hassan, Z. (2009). Small and medium enterprises (SMEs) competing in the global business environment: A case of Malaysia. International Business Research, 3(1), p66. DOI: http://dx.doi.org/10.5539/ibr.v3n1p66