Introduction

An entrepreneurial firm is perceived to have little understanding of business domain where trial and error strategic actions are commonplace (Green et. al, 2008). It adjusts it business practices and competitive tactics in response to the perceived efficacy of its strategic actions through a strong implementation of entrepreneurial management (EM) to improve the overall organizational performance in the small and medium-sized sectors (SMEs). Previous studies indicated positive relationships between strategic reactiveness and entrepreneurial orientation (Green et al., 2008).

Strategic reactiveness has been defined as a companies’ ability to change their business practices and competitive tactics in order to respond to the effectiveness of strategic actions (Green et al., 2008). In line with this suggestion, the authors intend to highlight that the strategic reactiveness is most important for correcting the wrong steps that inevitably occur in entrepreneurial firms. According to a Business Week 2007, Strategy Power Plays, the concept of strategy or strategic is that

Powerful strategy does not define what company produces, but also articulates a clear benefit for the customer-in this case, helping end user achieve ‘seem less mobility, far more effective than a laundry list of discrete initiatives, a compelling vision for success creates a stronger motivation; a set of shared goals. [Zander, 2004].

The point of view expressed in this definition is that strategy is something to do with long term prosperity in order to ensure that the entrepreneur’s business is still around in ten or twenty years’ time.

Following Gerry et al’s., (2006) arguments, strategy is the direction and scope of an organization over long term, which achieves advantage in changing environment through its configuration of resources and competence with the aim of fulfilling stakeholders’ expectations. It’s concerned with long-term growth, not short-term profit. By focusing on short term profitability, to the exclusion of explicit strategic consideration, leads organizations to make short-term opportunistic decision which, whilst financially rational in themselves, may lack consistency and thus lead to the business becoming widely diversified, highly complex and in the end unmanageable (Pearson, 1939).

As the twenty-first century unfolds, entrepreneurial actions are viewed as critical pathways to competitive advantage and improving performance in organizations of all types, sizes, and ages (Brown, Davidsson, and Wiklund, 2001; Covin, Slevin, and Heeley, 2000; Kuratko, Ireland, and Hornsby, 2001). There are many clear evidences to prove that entrepreneurship organizations that learn how to facilitate Strategic Reactiveness and Entrepreneurial Management in its various forms are more competitive and perform better than those that do not (Zahra and Covin, 1995). In fact, some even believe that the lack of attention focused on implementing entrepreneurial actions successfully in the fast-paced and complex economy will result in a failure (Zahra, 1999).

The strength of a firm’s entrepreneurial management (EM) can have a strong positive effect on organizational performance (Covin and Slevin 1986; Stevenson, 1999; Harms and Ehrmann 2003; Majid, 2006). Nevertheless, much can go wrong as firms engage in entrepreneurial activity; if entrepreneurial activity is inherently speculative (Bhidé, 2000; McGrath and MacMillan, 1995). Through the exhibition of a strong EM, firms place themselves in a novel and strategic position, which rarely happens in a poorly understood business domains where trial and error strategic actions are common. When the hoped-for results of entrepreneurial activity are not achieved, firms must re-think their actions in order to cut their losses and redirect their efforts through the exhibition of strategic reactiveness.

In this paper, attention is focused on strategic reactiveness in the SMEs that make up much of the Malaysia’s manufacturing and services sector. The research, which is based upon 200 SMEs, has three primary objectives:

i. To identify the critical relationship factor between Strategic Reactiveness and entrepreneurship inclination.

ii. To explore the strength of Strategic Reactiveness and Entrepreneurial Management in SMEs.

iii. To investigate the best predictors among the three elements of Strategic Reactiveness that are positively related to firm’s entrepreneurship inclination.

The next section of this paper provides a brief review of literature relating to strategic reactiveness and entrepreneurial management process in small and medium-sized sectors (SMEs) and the research framework of the study. The third section sets out the research methods of the study before looking at the demographic characteristics of the selected respondents, and finally the conclusion.

The Theory of Strategic Reactiveness

Strategic Reactiveness (SR) represents as a corrective action which entrepreneurial firms can apply to reduce the downside risk on their business practices. McGrath et al., (2000) and Morris et al., (2002) defines SR as the adjustments of strategy that enable the firms to reflect performance feedback and learning as they are engaged in their exploratory behaviors.

The capacity for rapid and informed action is a function of the goodness-of-fit that exists between a firm’s organizational structure attributes and the decision-making style employed by firm’s top managers. Certain organizational structure and decision making style combinations will likely facilitate a firm’s organizational response capability, thus, enabling those firms to be both strategically reactive and entrepreneurial.

Specifically, in this study SR is suggested to consist of three sub dimensions namely; Strategic Formulation, Technocratic Decision-Making and lastly Structural Organicity.

i. Strategic Formulation

According to Green et al., (2008), entrepreneurial actions often position firms in novel business domains where the outcomes of firm initiatives can be highly uncertain. Thus, strategic reactiveness and a firm’s EM level may be positively correlated in practice.

Judging from the literature, strategic formulation of a particular strategy can only be examined reactively, for example, by examining the strategy outcome after a period of time (Eden and Ackerman, 1993; Ramanujam et al., 1986). An upshot of this is that an effective strategic formulation process leads to a good strategy in business domain.

ii. Technocratic Decision-Making

A technocratic decision-making style exists at the high end of the technocracy dimension. This style actually, is heavily reliant on quantitative decision-making tools and characterized by research, systematic evaluation of alternatives, and formal reports. However, this label is a misnomer in as much as decisions based on intuition can also be made on rational bases (Khatri and Ng, 2000; Green et al., 2008).

The conceptualization of executive management’s decision-making style along the intuitive to-technocratic dimension (or, more concisely, the technocracy dimension) recognizes that decisions are variously grounded in experience and intuition versus formal analysis and explicit methods (Khandwalla, 1977; Schoemaker and Russo, 1993). An intuitive/experience-based decision-making style exists at the low end of the technocracy dimension. Decisions made in this style are heavily influenced by hunches and feelings that are often based on past experience. Intuitive/experience-based decisions are not likely to result from an explicit logic or to be justified in advance using objective data (Miller and Ireland, 2005).

iii. Structural Organicity

Green et al., (2008) argued that when organization structure and top management’s decision making style exist in theoretically congruent states, firms will develop an effective organizational response capability. In organically-structured firms, strategic reactiveness is most positively associated with EM when decisions are made intuitively because the boundary conditions that lead to the development of the effective use of intuition among decision makers are more likely to exist (Dane and Pratt, 2007).

In particular, the sensitive information processing capacities and open communications’ channels of organic structures can contribute to the depth and breadth of knowledge that senior executives consider as possible input to decisions.

The Theory of Entrepreneurial Management

It is commonly agreed that there is no universally-accepted definition of entrepreneur or entrepreneurship (Morris and Lewis 1995; Stearns and Hills 1996; Beaver and Jennings 2005). As remarked by Fiet (2000), recent efforts to develop entrepreneurship theory have tended to accumulate separate theories instead of building upon those that relate to each other and discarding those that are invalid and irrelevant. This is partly because of the dynamic nature of research and thinking in this area. New ideas from research forwarded by various scholars with similar interests over time contribute to the diversity in perspectives and approaches to the subject.

Shane and Venkataraman (2000) offered a contrasting view on entrepreneurship by suggesting the definition of entrepreneurship as the scholarly examination of how, by whom and with what effects and opportunities to create future goods and services are discovered, evaluated, and exploited. Their approach stresses the importance of opportunities in entrepreneurship study. This includes the study of sources of opportunities, the processes of discovery, evaluation and exploitation of opportunities, and the set of individuals who discover, evaluate and exploit them. It is rather clear that the main concern of this approach is to incorporate both central phenomenon in entrepreneurship, the presence of lucrative opportunities and the presence of enterprising individual (Shane and Venkataraman 2000).

The emphasis on these two phenomena has some similarity with Stevenson’s Entrepreneurial Management (EM) conceptualization of entrepreneurship as used in this study. Specifically, in this element of EM, it is suggested to consist of six subs dimensional namely Strategic Orientation (SO), Management Structure (MS), Growth Orientation (GO), Entrepreneurial Culture (EC), Resource Orientation (RO) and lastly, Reward Philosophy (RP).

i. Strategic Orientation

The ability to identify and commit oneself to new opportunities has been seen as key entrepreneurial feature of individuals (Eliasson et al., 2002; Casson, 1982; Kirzner 1973; Knight 1942; Schumpeter, 1934) and firm (Eliasson et al., 2002; Stevenson, 1983; Wiklund, 1998: Zahra, 1991). Stevenson’s suggests that entrepreneurial firms base their strategies solely on opportunities that exist in the environment, using opportunities as a starting point for developing strategies. Opportunities are used by an entrepreneurial firm as a starting point to develop their business strategies, while an administrative firm, on the other hand, is perceived to rely on the resources they already control when developing their business strategies (Majid., 2006).

ii. Management Structure

Stevenson (1983) suggests that the management structure of an entrepreneurial firm is organized with multiple informal networks while administrative firms are typically are organized as formalized hierarchies with clearly defined lines of authority (Stevenson & Gumpert, 1985). An entrepreneurial management structure is designed to access resources within the firm as well as through collaborative network relationships. It is suggested to be flexible and to create an environment where employees are free to create and seek new opportunities (Elliason et al., 2002; Stevenson, 1983).

iii. Growth Orientation

There are many arguments and debates in the literature on how growth is perceived and expected amongst entrepreneurs (Birley 1987; Davidsson 1989; Cassar 2005; Majid, 2006). However, as far as this research is concerned, growth orientation of a firm is referred to the suggestion made by the EM approach which assumes that it is normatively accepted throughout an entrepreneurial firm that growth is its top objective and rapid growth is very much intended.

iv. Entrepreneurial Culture

The culture of an organization is one of the key factors fostering entrepreneurial activities in organizations (Majid, 2006; Brown et al., 2001; Covin & Slevin, 1991; Zahra, 1993). It is an invisible aspect of an organization, which influences everything that people do (Covin & Slevin, 1991). By encouraging new ideas, experimentation and creativity, managers help to create an entrepreneurial culture with norms that support entrepreneurial behaviour (Covin & Slevin, 1991).

v. Resource Orientation

The traditional view of resources in entrepreneurship has been on resource ownership. For example, Vesper (1982) argues that building a new business requires resources. Covin and Slevin, 1991 and Elliason et al., 2002 have suggested that: “an organization’s entrepreneurial capacity will be, to some extent, limited by its resource base,” which implies that direct ownership of resources should stimulate entrepreneurial behaviour and financial performance. Previous research has also focused on the difficulty in obtaining resources and especially financial capital for future expansion (Sexton & Smilor, 1997). However, some research has started to emphasize that firms can gain flexibility by striving not to accumulate resources, since they may have a constraining effect on entrepreneurial activities (Stevenson, 1983).

vi. Reward Philosophy

Entrepreneurial firms tend to base rewards and compensations on value creation, while administrative firms base it on an individual’s position in the hierarchy (Stevenson & Gumpert, 1985). Schumpeter (1950) argued that it is extremely important to reward change by allowing the people who for example, create a new product or process to capture some of the benefits of their creations. Stevenson (1983) suggests that managers in administrative firms are getting rewarded according to how much responsibility (assets or resources they have under control) and their decisions are therefore often guided by the desire to protect their own positions and security. Because of that they tend to make smaller strategic experiments that show little result at the bottom line (Stevenson & Gumpert, 1985).

Research Framework

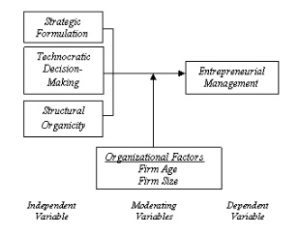

A research framework has been designed based on the perceived assumption that SR and EM tendencies are inter-related and have a positive relationship. Based on these notions and past studies, the authors enacted the following research framework.

Fig. 1: Research Framework

The authors used the dependent and independent variables for the research framework. The dependent variable is the entrepreneurial management for adopting Stevenson’s (1986) conceptualization. While the independent variables are strategic formulation, technocratic decision making and the structural organicity, the list of organizational factors such as firm size and firm age, are included as a moderating variable in this study. These two control variables are included in the theoretical framework as moderating variable. For each control variable, there are some theoretical bases that expecting the variable to have a systematic relationship with the independent variable, the dependent variable or both. Firm’s age is included in the analysis because of its potential influence upon entrepreneurial activities and financial performance (Zahra 1991; Becchetti and Trovato 2002; Majid et al., 2006). Many researchers found that the size of the firm plays a significant role in firm growth (Hall 1987; Acs and Audretsch 1987; Majid et al., 2006). The firm size is determined by the number of employees the firms have at the present time, inclusive of the owners who work for the company.

According to Fredrickson (1986), Powell (1992) and Green et al., (2008), the organizational factor are included in theanalysis because the larger and older firms often tend to be more technocratic in their decision-making style and more mechanistic in their firm’s structures. The degree of the three independent variables will explain the variance in the dependent variable.

Strategic formulation refers to strategy implementation process within entrepreneur’s business unit. Firms with low strategic reactiveness have a low score on Likert scale, while highly reactive firms have a high score on Likert scale. On the other hand, Technocratic decision-making is important to express the measure of technocratic decision-making concept in entrepreneur’s firm. A low score on this scale indicates that the decision-making style of entrepreneur’s firm is highly reliant on intuition and lessons generated through experience. A high score in Likert scale indicates a decision-making style that is technocratic.

Finally, Structural organicity describes the orientation of entrepreneur’s firm. Besides, it expresses the structural correlates of innovative behavior in a business unit. A high score in Likert scale represents an organic structure, while a low score indicates a mechanistic structure in entrepreneur’s firm.

Hypothesis Development

Based on the above discussion, the following hypotheses were articulated:-

- H1: Strategic Reactiveness with regard to Strategy Implementation is positively related to Entrepreneurial Management tendencies.

- H2: Strategic Reactiveness with regard to Technocratic Decision-Making is positively related to Entrepreneurial Management tendencies.

- H3: Strategic Reactiveness with regard to Structural Organicity is positively related to Entrepreneurial Management tendencies.

- H4: Strategic Reactiveness is positively related to Entrepreneurial Management tendencies.

Research Approach

Data Collection

Data collection involves a combination of primary data and secondary data whereby primary data will be collected through self-administered written questionnaire, which will be addressed to the respondents. Meanwhile the secondary data will be obtained from journals, articles and books to provide a firm foundation in structuring the underlying theory for the study.

Throughout the study, both primary and secondary data sources will be used. The primary data, directly relating to the purpose, will be collected through an empirical study. The empirical study will be made through conducting a survey using questionnaire on service quality. The secondary data, indirectly related to the study’s objectives, will be collected through a theoretical study.

Population and Sample

Manufacturing and Service sector SMEs from Malacca and Johor were targeted for the population of this study. A total of 200 companies were randomly selected from both states as a sampling (n) for this study.

Respondents

A pilot study will be carried on experienced managers using the developed questionnaire. Based on the feedback of this pilot study, further refinement will be made to the questionnaire. The final questionnaire will be posted to the respondents such as CEOs, Owner Manager, and Entrepreneur of each company taken from the sample frame according to SME Corporation Malaysia List of Company within the state of state Melaka and Johor. The target respondents will be requested to complete and return the questionnaire in a pre-paid envelope. A covering letter requesting the questionnaire completed by the CEOs, Owner Manager and Entrepreneur are attached together with the questionnaire. The survey will be proceeding in January, 2010. A follow-up letter will also be distributed in an attempt to improve response rate. For non-response SMEs firms, the researcher contacts them to ascertain the reasons for not responding and kindly persuade them to answer the questionnaire.

Questionnaire Design

The level of entrepreneurship inclination is based on the EM construct and will be measured in two sections. First, the 14-items scale developed by Dean and Thibodeaux’s (1994) and Khandwalla (1976/1977) and subsequently adapted by Green et al., (2008) is used. Here, subjects indicated their agreement or disagreement responses based on an eight-point Likert scale where a series of statement characterizes the extent to which top management’s decision making style, orientation of the company and finally the previous action of company’s strategy formulation and implementation process.

Secondly, a 20-items scale based on Stevenson’s (1986) contrast of opportunity seeking behaviour of promoter-type firm that pursue and exploit opportunities regardless of resources controlled with trustee-type firm that focused on efficiently using resources controlled. This survey concept has been adapted and widely used by other scholars (e.g Fox, 2008, Majid, 2006 and Brown et.al, 2001). The 20 items are based on eight-point Likert scales that represent the decision of respondents that varies from point 1 for ‘Strongly Disagree’ to point 8 for ‘Strongly Agree’ with pairs of opposite statements. To avoid response set contamination, the questions were arranged so that the entrepreneurial and non-entrepreneurial statements appeared on both the right and the left sides.

Analysis

As explained in the earlier section of this paper, this section will deal mainly with demographic characteristics of the firms, in terms of their age, size, business activities and ownership structure. This section will start with a brief explanation of the respondents’ population followed by the items that has been described earlier.

Demographic Characteristics

Population of Respondents

Based on the SME Corporation Malaysia progress updates released at the time of this research (24 November 2009) in the SME Corporation Malaysia’s official website at http://www.smecorp.gov.my/node/19, there are 1313 total population companies in Malacca and 2811 total populations SME companies in Johor that have been registered under SME Corporation Malaysia. Table 1 shows the statistic of the population that was last updated in November, 2009.

Table 1. Statistic of Population Small and Medium-Sized Industry

Source: SME Corporation Malaysia Official Website,

“The SME Company List 2009”, retrieved on November 24th, 2009, from http://www.smecorp.gov.my/node/19

The information provided in this directory enabled the researchers to randomly select 200 respondents form both the manufacturing and service sectors. After finalizing the selected respondents, series of mails containing the research questionnaires were sent to them. A final number of 178 firms agreed to participate in this study. Based on the information solicited from these respondents, an early analysis was undertaken and for this paper, the researchers decided to present the demographic characteristics of the firms before proceeding further with the analysis.

Table 2 provides a brief demographic profile of the firms. It can be said that more than half of the firms (62.9%) are at the initial and second stage of their operations. This shows that they are at a stage where they are most active because of their need to grow and survive before reaching a more stable phase. Due to this, the need for them to be strategic and innovative is one of the utmost important tasks they have to undertake and this augurs well for this research because it can provide this study with relevant data that this research intended to do.

In terms of size, the firms are more or less concentrated between small and medium size firms (87.6%) and their firms’ activities are distributed in several business areas. These firms are mostly private limited firms (75.3%) with only a small percentage of them being open to public ownership (2.2%). This shows that in terms of opening up their businesses to other potential investors, there is still reluctance on the part of the entrepreneurs.

Table 2. Demographic Profiles of the Firm’s Characteristic

While table 2 looks at the firms’ characteristics, table 3 presents brief information about the entrepreneurs themselves. Male entrepreneurs dominated both sectors (73.6%) and most of them are Malays (73%). Most of those who participated in this study were from top management team (64.6%) followed by senior managers (20.2%).

Table 3. Summary of the Entrepreneur’s Characteristic

Conclusion

Being entrepreneurial can be instrumental to achieving firm success. However, the exhibition of an entrepreneurial management (EM) – as reflected in its various sub-dimensions; management structure, strategic orientation, entrepreneurial culture, growth orientation, reward philosophy, and entrepreneurial culture – will place firms in positions of potentially great uncertainty and vulnerability as a function of the inherently exploratory nature of entrepreneurship. Because entrepreneurial firms’ actions result in their entry into novel and sometimes poorly understood business domains, these firms will commonly experience strategic “missteps.” That is, intended outcomes will not materialize due to, for example, unanticipated competitive response, miscalculated market demand, or underestimation of a new product’s technological challenges. When such missteps are made, entrepreneurial firms must take corrective action by realigning their strategies with the realities of their environments. The realignment of strategy with environmental exigencies occurs via strategic reactiveness, herein defined as a firm’s ability to adjust its business practices and competitive tactics in response to the perceived efficacy of its strategic actions. In short, strategic reactiveness represents a corrective mechanism through which entrepreneurial firms can minimize the downside risks inherent to their operations.

Acknowledgment

The authors would like to thank Universiti Teknikal Malaysia Melaka (UTeM) for funding this research project under PJP/2009/FPTT(4F)S619 short term research grant.

(adsbygoogle = window.adsbygoogle || []).push({});

References

Acs, ZJ. and Audretsch, DB. (1987) ‘Innovation, market structure and firm size’, Review of Economics and Statistic, 6 (4), 567-575.

Publisher – Google Scholar

Beaver, G. and Jennings, P. (2005) ‘Competitive advantage and entrepreneurial power: The dark side of entrepreneurship‘, Journal of Small Business and Enterprise Development, 12 (1), 9-26.

Publisher – Google Scholar

Becchetti, L. and Trovato, G. (2002) ‘The determinants of growth for small and medium sized firms. The role of availability of external finance‘, Small Business Economic, 19 (4), 291-306.

Publisher – Google Scholar – British Library Direct

Bhide, AV. (2000) The origin and Evolution of New Business, Oxford University Press, New York.

Google Scholar

Brown, TE., Davidsson, P. and Wiklund, J. (2001) ‘An operationalization of Stevenson’s conceptualization of entrepreneurship as opportunity-based firm behavior‘,Strategic Management Journal, 22, 953-968.

Publisher – Google Scholar – British Library Direct

Covin, JG., Green, KM. and Slevin, D.P. (2006) ‘Strategic Process Effects on the Entrepreneurial Orientation’Entrepreneurship Theory and Practice,’ 30 (1), 57-82.

Publisher – Google Scholar – British Library Direct

Croclett, RO. (2004), Business Week of Strategy Power Play: How the World’s Most Strategic Minds Reach the Top of Their Game, Mc Graw-Hill.

De Toni, A. and Tonchia, S. (2003) ‘Strategic planning and firms’ competencies: Traditional approaches and new perspectives’, International Journal of Operations & Production Management, 23 (9), 946-976.

Publisher – Google Scholar – British Library Direct

Dean,CC. and Thibodeaux, MS. (1994), ‘Corporate entrepreneurship: U.S firms operating in the middle east and the Arab world’, Advances in International Comparative Management, 9, 193-222.

Google Scholar

Dincer, M., Tatoglu, E. and Glaister, KW. (2006) ‘The strategic planning process: evidence from Turkish firms’, Management Research News, 29 (4), 206-219.

Publisher – Google Scholar – British Library Direct

Eliasson, E. and Davidsson, P. (2003) ‘Entrepreneurial Management, Corporate Venturing, and a Finance Performance’, Frontiers of Entrepreneurship Research, 461-470.

Falshaw, JR., Glaister, KW. and Tatoglu, E. (2006) ‘Evidence on formal strategic planning and company performance’, Management Decision, 44 (1) 9-30.

Publisher – Google Scholar – British Library Direct

Green, KM, Covin, JG. and Slevin, DP. (2008) ‘Exploring the Relationship between Strategic Reactiveness and Entrepreneurial Orientation‘, The role of structure-style fit,’ Business Venturing Journal, 23, 356-383.

Publisher – Google Scholar

Harrison, EF. (1995) ‘Strategic planning maturities: Shows the dynamic interrelationship between planning horizons and strategic planning maturities’, Management Decision, 33 (2), 48-55.

Publisher – Google Scholar – British Library Direct

Majid, I.A., and Ismail, K. (2009) “Entrepreneurial Management and Technology-Based Firm Performance: Malaysian Multimedia Super Corridor”, Lambert Academic Publishing, Koln.

Majid, I.A., Cooper, S., Levie, J. and Ismail, K. (2008) ‘Entrepreneurial Management and Technology-Based Firm Performance’, Journal of Advanced Manufacturing Technology, 2 (1), 79-98.

Publisher – Google Scholar

Majid, IA. (2006) ‘Entrepreneurial Management and the Performance of Firms in the Malaysian Multimedia Super Corridor’, unpublished PhD thesis, Glasgow, University of Strathclyde, Hunter Centre for Entrepreneurship.

Morris, M.H and Lewis, P.S. (1995) ‘The determinants of entrepreneurial activity: Implications for marketing’, European Journal of Marketing, 29 (7), 31-48.

Publisher – Google Scholar – British Library Direct

O’ Regan, N. and Ghobadian, A. (2002) ‘Effective strategic planning in small and medium-sized firms’, Management Decision, 40 (7), 663-671.

Publisher – Google Scholar – British Library Direct

Pallant, J. (2005). SPSS Survival Manual; A step by step guide to data analysis using SPSS Version 12, 2nd ed., Sydney, Open University Press.

Publisher – Google Scholar

Rudd, JM., Greenley, GE., Beatson, AT. and Lings, IN. (2008) ‘Strategic Planning and performance: Extending the debate’, Business Research Journal, 61, 99-108.

Publisher – Google Scholar

Shane, S. and Venkataraman, S. (2000) ‘The promise of entrepreneurship as a field of research’, Academy of Management Review, 25 (1), 217-226.

Publisher – Google Scholar – British Library Direct

Stonehouse, G. and Pemberton, J. (2002) ‘Strategic planning in SMEs: Some empirical findings’, Management Decision, 40 (9), 853-861.

Publisher – Google Scholar – British Library Direct

Thomson, AJr., Strickland, AJ. and Gamble, JE. (2007) Crafting and Executing Strategy, 15th edition, Mc Graw Hill/Irwin.

Timmons, J.A and Spinelli S. (2003) New Venture Creation: Entrepreneurship for the 21st century,” 6th ed., Mc Graw Hill/Irwin, Singapore.

Publisher – Google Scholar

Venkatraman, N. (1989) ‘Strategic Orientation of Business Enterprise: The construct, dimensionality, and measurement’, Management Science, 35 (8), 942-962.

Publisher – Google Scholar

Wilson, TB. (1999) ‘Reward That Drives High Performance; Success Stories from Leading Organization’, American Compensation Association.

Yip, GS. (1982) ‘Gateway to Entry’, Harvard Business Review, 60 (5), 85-93.

Zahra, S.A., Jennings, D.F and Kuratko, D.K. (1999) ‘The antecedents and consequences of firm-level entrepreneurship: The state of the field’, Entrepreneurship Theory and Practice, 24 (2), 45-46.

Publisher – Google Scholar – British Library Direct