Introduction

The companies in general and more particularly, the small and medium-sized are confronted with several challenges. Indeed, each company tries to set up strategic orientations which enable it to outline the path to follow in order to guarantee its survival and even its performance.

At the level of the literature, we notice that the researchers work on several types of strategic orientations. We can quote for example, “the market orientation”, “the learning orientation”, “the technological orientation” and “the entrepreneurial orientation” (Hakala, 2010). In this study, we are interested in the entrepreneurial orientation (EO) as one among other key strategic orientations within the company. This entrepreneurial orientation makes it possible for the company to pro-actively seek new opportunities, to be offensive towards risk taking and to be constantly more innovative (Wales & al., 2013).

At the conceptual level, several authors are unanimous about the positive effects attributed to the entrepreneurial orientation (Gupta and Batra, 2016; Covin and Slevin, 1991; Miller, 1983.2011).

However, at the level of the former empirical studies, the obtained results of the consequences of the adoption of such orientation are paradoxical. The positive effects are not universal and it appears that this entrepreneurial orientation is contextual. For this reason, several approaches are involved for the study of the consequences of the entrepreneurial orientation.

There was a migration from the universal approach and the contingency approach; to the configurational approach. The field of organizational entrepreneurship has, therefore, made paramount growth. In fact, we study the EO according to this configurational approach and we propose a taxonomy which reflects the various profiles of the Tunisian industrial SME.

In order to achieve this, we shall proceed in our research in the following way. Initially, we are going to present the theoretical support within which the main approaches are pursued. Then, we shall expose the adopted methodology in the present study. Finally, we shall conclude with the discussion of the obtained results.

The Theoretical Framework of the Research

Entrepreneurial orientation concept (EO)

We notice during these last years that several business managers increasingly introduce the entrepreneurial activities into their companies in order to face the problems resulting from the intensification of the competition, the shortening of the life cycle of the products and even the companies. Alongside the practitioners, we acknowledge according to the abundant literature that the academicians increasingly recognize the importance of the entrepreneurial activities at the level of the company.

We similarly notice the popularity of the EO concept through the proliferation of the reviews and the scientific publications which are devoted to it. Moreover, the spirit of entrepreneurship is widespread everywhere in the world and it is diffused in the internal organization of the companies whether they are big, small, familiar or international.

Therefore, the concept of EO does not cease gathering momentum because of its importance in the renovation of the company products, due to its capacity to equip the company with a sense of speed in the detection of the opportunities and also its aptitude to change the attitude towards the risk, in order to encourage the companies to commit more in the adventure.

Moreover, Covin & al., (2006) highlight that at the level of the entrepreneurship and the studies in strategic management there exists major trend towards the examination of the EO concept theoretically and empirically. Moreover, it is unanimously admitted by a broad scientific community that the EO is a guarantee for the survival and the performance of the companies (Rauch & al., 2009).

Several definitions and denominations are devoted to the EO. In fact, we can affirm that the EO refers to the extent to which the strategic posture of a company reflects its entrepreneurial practices and behaviors (Anderson & al., 2009).

The EO is a concept which similarly reflects the entrepreneurial activities as well as the managerial activities. In the present research, we are looking at the study of the entrepreneurship according to an organizational approach, i.e. at the level of the company.

In spite of the recognized important boost of the entrepreneurial orientation concept, there remain debates as for the approaches mobilized in order to study it. Moreover, there is no universal definition which includes the various facets of the EO, to date.

Apart from that, similarly arises the problem of this concept dimensionality. With respect to this last point and to the literature, there exist two major different clans. On the one hand, we find the studies of Miller (1983) and Covin and Slevin (1986) who consider the entrepreneurial orientation as a unidimensional construct consisting of three dimensions which are the innovativity, the pro-activity and the risk taking. These three dimensions are interrelated and together constituting a “whole”.

On the other hand, a large number of research studies based on the works of Lumpkin and Dess (1996), which stipulate that EO is a multidimensional construct where each of these three dimensions, constitute an independent variable. These authors add to the three mentioned dimensions two other dimensions, named the autonomy and the competitive aggressiveness.

In our study, we are aligned with the works of Miller (1983) and Covin and Slevin (1988, 1989) in order to consider the EO as a unidimensional variable constituting a continuum, wherein on the first end there are the non-entrepreneurial companies, with a small degree of EO and on the other end, the entrepreneurial companies with a higher degree of EO.

In fact, the entrepreneurial company is defined as being “The company which engages in the innovativity of the product and/or the market, which commits to taking risk and finally which remains pro-active in launching innovations, beating by this their competitors in the market” (Miller, 1983).

Always according to Miller (1983), so that it is entrepreneurial, the company must have a high score of EO. This consequently implies raised scores for the three latent dimensions of innovativity, pro-activity and risk taking. Moreover, Covin and Slevin (1988, 1989) and starting from the works of Miller stipulate that the company can have different degrees of EO throughout this continuum and can consequently position on intermediate levels. Starting from this idea, Miller has revised his article dated 1983 and has announced in later research the importance of studying the EO according to a configurational approach (Miller, 2011).

Thereby, our study is registered within this theoretical framework in order to propose the taxonomy of the Tunisian industrial SMEs according to the degrees of their entrepreneurial orientation.

We shall present in what follows the three constitutive dimensions of EO of our study.

Dimensions of EO

In the present study, we are going to discuss only three dimensions which are innovativeness, proactiveness and risk-taking. In fact, two other dimensions, namely autonomy and competitive aggressiveness are not included in this study.

Innovativeness

Entrepreneurship, which is studied either at the individual or at the organizational level, has introduced the concepts of innovation and creation.

Innovativeness means the propensity of the company to commit to the creativity; the experimentation (Rauch & al., 2009), and the generation of new ideas which are reflected in new products and services.

Proactiveness

This dimension is defined as being the tendency of the company to act the first and not to be satisfied to follow and imitate. It is the capacity to precede the competitors while being the first to grasp the market opportunities and the first to propose innovations. With this proactive orientation, the company can obtain a great capacity for anticipation and consequently, it can even change the environment in its favor (Miller and Friesen, 1978). In other words, it can practice competitive prices and enter in new market segments.

Risk-taking

According to Miller and Friesen (1978), risk taking reflects the degree of the business managers’ will to commit enormous resources in risky projects. This behavior is adopted with the aim of a higher profitability. Risk taking is also defined as the will to make decisions and to act courageously in situations of uncertainty.

In this study, we follow the idea of Covin and Slevin (1991) considering the EO as an aggregation of the three abovementioned dimensions. Thereby, the company which shows higher degrees of commitment in behaviors of innovativeness, proactiveness and risk-taking is a company which is characterized by a strong EO. On the other hand, the companies which record lower levels in the abovementioned behaviors are characterized by a weak Entrepreneurial Orientation. Similarly Stam and Elfring (2008) describe the EO as a simultaneous exhibition of innovativeness, proactiveness and risk-taking.

In fact, our attention is brought to the concept of Entrepreneurial Orientation, while being particularly interested in the explanation of its impact on the performance. We, thereby, study in the following paragraph the benefits of the EO, especially its relationship with the performance and the approaches likely to solve the complexity of this relation.

Entrepreneurial orientation and performance

At the conceptual level, and according to a meta-analysis realized by Rauch & al. (2009), it was admitted that the EO has positive consequences on the performance. Thus, the company having a strong Entrepreneurial Orientation is considered as the most powerful. Indeed, at the empirical level, this relation is marked by controversies. It proves that the EO is contextual and is not always beneficial; this is why several approaches are mobilized to study it. Thereby, there exist multiplicities of approaches which are all plausible but different according to the objectives expected from the conducted study. We can thus quote the universalistic, the contingency and the configurational approaches.

Universalistic approach

The essence of this approach is that the EO is the best orientation which all the companies must adopt in order to maximize their performance. In other words, it is the axiom of “Best One Way”. This means that the linear relation between the two variables is universal and positive for all the companies and in all the contexts (Delery and Doty, 1996).

In fact, several studies are carried out according to this approach and a significant body of research both theoretical and empirical has marked the field of the EO (Andersen, 2010; Gupta and Gupta, 2015; Wolf & al., 2015). These researchers admit the existence of a linear and positive relation between the EO and the performance.

Only when this relation has been studied in various contexts and having obtained different results, the researchers were convinced that this orientation is contextual. From there we have started to consider the specificities of the context of the studies devoted to the Entrepreneurial Orientation. The EO will have thereby to be aligned henceforth with the internal and the external context of the company in order to achieve higher levels of performance (Lumpkin and Dess, 1996; Wiklund and Shepherd, 2005).

Moreover, we can say that at the empirical level, the studies’ results of the EO and the performance relation are mitigated. A group of researchers succeeded in finding a significant positive relation (Zahra and Covin, 1995). Other researchers did not find any significant relation between the two concepts (Becherer and Maurer, 1997). A third group has found a negative impact (Hart, 1992).

In fact, starting from these empirical reports which the researchers suggest; the EO is the Source of the increase in the variance of the performance levels between the companies. This is due to the fact that this orientation leads certain companies towards performance, whereas it has a negative impact on other companies.

Contingency approach

Following the call of Lumpkin and Dess (1996), the study of the EO according to the contingency approach has expanded. According to these authors, it is primordial to consider the exogenous and the endogenous variables while studying this relation.

Thereby, this approach is based on the non linearity between the EO and the performance. It is the alignment of the EO and the contextual variables which takes precedence over the study of the linear relation.

Configurational approach

Authors, such as Kreiser and Davis (2010), Andersén (2012) and Randeson & al. (2014) plead in favor of the EO study according to the configurational approach. The researchers use either of the theoretical configurations and we mean here the companies typologies, or, the empirical configurations, in this case, we find ourselves within the framework of a taxonomic approach. Our study thus fits in this last approach.

Within the framework of this approach, it is about classifying the companies in configurations in order to achieve a better comprehension of the differences in performance noted between the companies.

Measures

Here, it’s a question of converting our study variables into measurable indicators. While basing ourselves on the conceptual literature as well as the former empirical works, we choose measurement scales for the EO variable and similarly for the performance.

Entrepreneurial orientation

As we have before indicated, there exist two points of view for the conceptualization of the EO, either, multidimensionally or unidimensionally. In this study, we have chosen the second position and we have chosen the measurement scale of Miller (1983) which was developed thereafter by Covin and Slevin (1991). It is a semantic differential scale at 5 points which contains 9 items and which answers the unidimensionality criterion.

The latent variables of innovativeness, proactiveness and risk-taking together shape the variable of the EO. It is thereby a question of calculating a score of EO.

Performance

In the present study, the performance is subjectively measured (Wiklund and Shepherd, 2005).The respondent expresses his perception regarding the growth of the sales turnover, the growth of the market share and similarly the growth of the cash-flow in comparison with his competitors. We calculate an aggregate index of performance starting from these indicators. Indeed, these three information types are regarded as confidential by the entrepreneurs who can only provide orders of magnitude.

We have checked the unidimensionnality of the measurement scales. Thereby, whenever, the principal component analysis only extracts one factor. Moreover, with a Cronbach’s Alpha superior to 0.7, we have guaranteed the reliability of our two measurement scales.

The Methodological Framework of the Research

In the present study, we have adopted the configurational approach in order to study the EO while inspiring from Miller, (2011). Our objective is thus to explain the heterogeneity of the performance levels conducted by the Tunisian companies. We consequently try to generate profiles of the companies according to their Entrepreneurial Orientation.

Data collection

The survey is the tool used in this research in order to collect the essential information for our statistical analyses. We have administered a well established survey near 110 Tunisian industrial SMEs. We have chosen the face-to-face survey mode in order to increase the answers rate and to guarantee the reliability of the obtained answers. The business managers of the various companies were questioned for their perception degree regarding the EO and the performance.

Sample

Our sample is subdivided in two groups, the small companies having a workforce lower than 50 people and the medium companies having a workforce between 50 and 200 people (NIS – Tunis, 2011). We have similarly distributed our sample according to the age criterion which includes the young companies (age lower than 10 years) and the more mature (age superior to 10 years). With regard to the branch of industry, the companies of our sample operate in nine different branches of industry (API – Tunis, 2016).

Results

Cluster analysis

In order to quantitatively obtain our empirical taxonomy, we have conducted a cluster analysis according to the EO of the various companies. This analysis is realized in SPSS 21, while following a hierarchical procedure of classification based on method “Ward” and a non hierarchical classification or even “k-means”.

At the conclusion of this analysis, three configurations were generated.

– Cluster 1: 43 SME (39.1 %)

– Cluster 2: 56 SME (50.9 %)

– Cluster 3: 11 SME (10 %)

Description of cluster

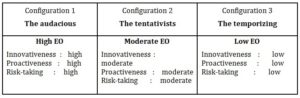

Table 1: Cluster of SME

We have interpreted the various clusters based on the average scores of the EO, the median values, and the percentiles.

We are in the conceptual perspective of Miller’s continuum (1983), where appears at an end, the type of the entrepreneurial company and at the other end, the conservative company which is without any entrepreneurial orientation. Moreover, we could release an intermediate configuration with median levels of EO.

In the same way as for the EO variable, we have interpreted the performance on the basis of average scores values as well as the median values and the percentiles. In fact, the reading of the average scores performance of each cluster enables us to have an idea on the trend of its performance.

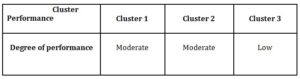

The results are in the table below:

Table 2 : Interprétation of average scores performance

In fact, the interpretation of the average scores performance of each cluster does not reveal any cluster which was able to achieve a high performance. As well as cluster 1 and cluster 2 which record moderate levels of performance. However cluster 3 is not performing. We believe that these results are closely related to the current situation of social and economic crisis in the country.

Interpretations of configurations

Configuration 1: the “audacious”

This cluster includes the companies which account for 39.1% of our sample of study. The specificity of these companies is that they have high degrees of innovativeness. They accord importance to the creativity and the generation of the new ideas. This strong commitment towards innovativeness conducts these companies to introduce new products and services.

Likewise, these companies are committed to high levels of risk taking, which makes them adventurous. They have an audacious behavior and they adopt a favorable attitude towards risk taking, in order to maximize profitability.

Moreover, the proactiveness enables them to precede their competitors and to develop a capacity to act on the future needs of the customers and to anticipate opportunities. Thereby, they are the first to get into the market, which guarantees to them the profits of the first entrant.

Configuration 2: the “tentativists”

These companies account for 50,9 % of the sample, they are characterized by average EO. Innovativeness, proactiveness and risk taking record moderate levels in this cluster.

These companies are characterized by their commitment towards the entrepreneurial activities, however moderately. They innovate little and introduce some improvements in case of necessity. They do not have an audacious behavior but these companies can be characterized by their reactivity towards the response to the environment and the customer requirements. Regarding risk taking, this cluster is risk averse and only commits in projects with a guaranteed anticipated profitability.

This cluster with moderate entrepreneurial orientation records moderate performance levels.

Configuration 3: the “temporizing”

These companies account for 10 % of the sample, they are the least representative cluster and they are characterized by a low EO. Innovativeness, proactiveness and risk-taking are absent in this profile. These companies do not have any commitment in the introduction of new products or services. The capacity to exploit opportunities is absent. It is the passivity which is paramount in these companies. The positive attitude towards risk taking is synonymous with the bankruptcy risk, and there is no will to commit in risky projects.

Obviously, these companies are not performing. They are satisfied to function under stabilized conditions even if these conditions are minimal.

We summarize in this paragraph the results of this study while basing ourselves on the specificity of the Tunisian context.

With respect to the “audacious” companies, this cluster reflects the type of the entrepreneurial companies. In spite of the economic and the social crisis, these companies have chosen the orientation towards the entrepreneurial dynamics. Certainly, despite all the deployed effort, these companies could only achieve average levels of performance.

As for the “tentativists” companies, they are very demanding. In this situation of economic crisis, the companies of this cluster choose the guarantee of a certain balance between the activities of exploitation and those of exploration. Their moderate commitment to the EO guarantees for them an average level of performance, close to the average level achieved by the “audacious” companies.

Finally, for the “temporizing” companies, we have noted that these companies do not have a strong commitment degree in the EO because of the current situation of social and economic crisis which reigns in the country. It seems that these companies are waiting until the crisis is dissipated in order to commit to the EO and to improve their performance.

Conclusion

The taxonomy empirically generated according to the data extracted from an exhaustive survey covering 110 Tunisian industrial SMEs enabled us to release three business configurations and to draw the profile of each cluster. We notice that cluster 1 and cluster 2 are both characterized by moderate degree of performance. This result is approaching the studies which plead in favor of the EO profits.

The obtained result, with respect to the display of the average performance degrees and the absence of the high levels in spite of the commitment of the Tunisian industrial SMEs in entrepreneurial dynamics, may be assigned to the social and the economic crisis experienced by these companies during these last years and that its consequences still persist. In a similar situation, it is difficult to display high levels of performance. In fact, these companies have appreciated the importance of the EO at least for the guarantee of their survival and they still need time to reflect the recorded levels of EO in high levels of performance.

Moreover, the business managers of the Tunisian industrial SMEs must appreciate and pay attention to other internal and external factors beside their entrepreneurial commitment in order to overcome the consequences of the economic and the social crisis and to set out the path towards performance.

Thereby, the present research could make contributions at the theoretical, empirical and managerial level as well. At the theoretical level, we add further insights into the OE study on the conceptual continuum, where figure two types of companies, the conservative and the entrepreneurial. This conceptual framework guides us towards the empirical contribution of this study in terms of the mobilization of the configurational approach and the constitution of an empirical taxonomy of the Tunisian industrial SMEs, listed on the above mentioned conceptual continuum. At the managerial level, the business managers of the Tunisian companies will find in this study a schematization of the various profiles of the companies, from which they will be able to position their companies according to the EO level which they consider adequate.

Certainly, this study has some limitations, particularly regarding the nature of the mobilized measurement scales and which are generally designed and applied in the context of the United Sates and the Western countries. Indeed, the remarks of Knight, (1997) affirm that the EO variable varies according to the culture and the differences in contexts.

In spite of these limitations, our study opens the path towards future works. It would be interesting to introduce other variables for the constitution of various configurations. Likewise, it remains important to, independently explore the demonstrations of each EO dimension.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Anderson, BS., Covin, JG., and Slevin, DP. (2009), “Understanding the relationship between entrepreneurial orientation and strategic learning capability: An empirical investigation”, Strategic Entrepreneurship Journal, 3(3), 218–240.

- Andersen, J. (2010), “A Critical Examination of the EO-Performance Relationship”, International Journal of Entrepreneurial Behaviour & Research, 16(4), 309-328.

Google Scholar

- Andersen, J. (2012), “A resource-based taxonomy of manufacturing SMEs”, International Journal of Entrepreneurial Behaviour and Research, 18 (1), 98-122.

Google Scholar

- Becherer, RC. and Maurer, JG. (1997), “The Moderating Effect of Environmental Variables on the Entrepreneurial and Marketing Orientation of Entrepreneurial-led Firms”, Entrepreneurship Theory and Practice, 22: 47-58.

Google Scholar

- Covin, JG. And Slevin, DP. (1986), “The development and testing of an organization level entrepreneurship scale”. Frontiers of Entrepreneurship Research , 626-639.

- Covin, JG. And Slevin, DP. (1988), “The influence of organization structure on the utility of an entrepreneurial top management style”, Journal of Management Studies, 25(3), 217-234.

- Covin, JG. And Slevin, DP. (1989), “Strategic management of small firms in hostile and benign environments”, Strategic Management Journal, 10(1), 75–87.

Google Scholar

- Covin, JG. And Slevin, DP. (1991), “A Conceptual Model of Entrepreneurship as Firm Behavior”, Entrepreneurship Theory and Practice, 16(1), 7-25.

Google Scholar

- Covin, JG., Green, KM. and Slevin, DP. (2006), “Strategic Process Effects on the Entrepreneurial Orientation–Sales Growth Rate Relationship”, Entrepreneurship theory and practice, 30 (1), 57-81.

Google Scholar

- Delery, JE. and Doty, DH. (1996), “Modes of Theorizing in Strategic Human Resource Management: Test of Universalistic, Contingency and Configurational Performance Predictions”, Academy of Management Journal, 39(4), 802-835.

Google Scholar

- Gupta, V. and Gupta, A. (2015), “The concept of entrepreneurial orientation”, Foundations and Trends in Entrepreneurship, 11(2), 55-137.

Google Scholar

- Gupta, VK and Batra, S. (2016), “Entrepreneurial orientation and firm performance in Indian SMEs: Universal and contingency perspectives”, International Small Business Journal, 34(5), 660-682.

Google Scholar

- Hart, S.L. (1992), “An integrative framework for strategy-making processes”, Academy of Management Review, 17(2), 327-351.

Google Scholar

- Hakala, H. (2010). Configuring out strategic orientation. Finland: University of Vassa.

- Kreiser, PM. and Davis, J. (2010), “Entrepreneurial Orientation and Firm Performance: The Unique Impact of Innovativeness, Proactiveness, and Risk-taking”. Journal of Small Business & Entrepreneurship, 23(1), 39-51.

Google Scholar

- Knight, G. (1997), “Cross-cultural reliability and validity of a scale to measure firm entrepreneurial orientation”, Journal of Business Venturing, 12: 213-225.

Google Scholar

- Lumpkin, GT. and Dess, GG. (1996), “Clarifying the entrepreneurial orientation construct and linking it to performance”, Academy of Management, 21(1), 135-173.

Google Scholar

- Miller, D. (1983), “The correlates of entrepreneurship in three types of firms”, Management science, 29(7), 770-791.

Google Scholar

- Miller, D. (2011), “Miller (1983) revisited: A reflection on EO research and some suggestions for the future”, Entrepreneurship Theory and Practice, 35(5), 873-894.

Google Scholar

- Miller, D. and Friesen, P.H. (1978), “Archetypes of Strategy Formulation”, Management Science, 24 (9), 921-933.

Google Scholar

- Randerson, K., Bettinelli C. andFayolle A. (2014), “A configurational approach to entrepreneurial orientation”. In: R. Blackburn, Delmar, F., Fayolle, A., Welter, F., (ed.) Entrepreneurship, People and Organisations: Frontiers in European Entrepreneurship Research 51-73. Cheltenham UK: Edward Elgar.

- Rauch, A., Wiklund, J., Lumpkin, G., andFrese, M. (2009), “Entrepreneurial orientation and business performance: An assessment of past research and suggestions for the future”. Entrepreneurship Theory and Practice, 33 (3), 761–787.

Google Scholar

- Stam, W. and Elfring, T. (2008), “Entrepreneurial orientation and new venture performance: The moderating role of intra- and extra- industry social capital”, Academy of Management Journal, 51(1), 97-111.

Google Scholar

- Wales, WJ., Gupta, VK. And Mousa, F-T. (2013), “Empirical research on entrepreneurial orientation: An assessment and suggestions for future research”. International Small Business Journal, 31(4), 357–383.

Google Scholar

- Wiklund, J., and Shepherd, D. (2005), “Entrepreneurial orientation and small business performance: A configurational approach”. Journal of Business Venturing, 20, 71–91.

Google Scholar

- Wolff, JA., Pett, TL. and Ring, JK. (2015), “Small firm growth as a function of both learning orientation and entrepreneurial orientation: an empirical analysis”, International Journal of Behavior and Research, 21(5), 709-730.

Google Scholar

- Zahra, SA., and Covin, JG. (1995), “Contextual Influences on the Corporate Entrepreneurship-performance Relationship: A Longitudinal Analysis”, Journal of Business Venturing, 10(1), 43-58.

Google Scholar