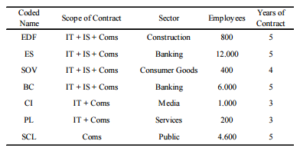

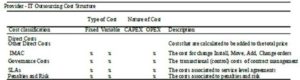

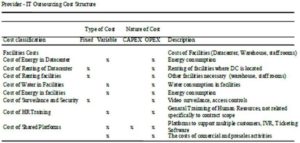

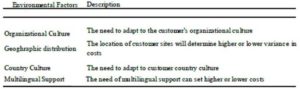

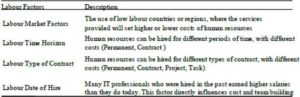

Summarizing the information gathered, the authors identified three main groups with impact on costs: First, the IT Outsourcing configuration group (Cullen, Seddon, & Willcocks, 2005), based on the scope showed in Tables 2, 4, 5, 6 and in assets ownership…

Second, Hidden costs group in Table 3,which can be divided into three sub-groups, transactional costs associated with contract governance that include monitoring paperwork reporting requirements. These costs are often assigned to overhead accounts, rather than allocated to products departments directly. Contingent costs associated to penalties, fines and future liabilities are costs that may or may not be incurred at some point in the future. They can only be estimated in probabilistic terms. Examples of this are penalties for underperformed service level agreements and future remediation costs. Intangible costs, like corporate image, community and consumer relations, are difficult to estimate and are associated with maintaining corporate image, good relationships with investors, employees and customers, among others.

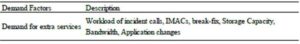

Demand costs group, in Table 7, is presented as a factor with impact on costs and revenue. The provider needs to answer market demand and to do that, a supply chain needs to be prepared.

Findings

In order to obtain the answers to the aforementioned questions, the authors mapped the results with literature review. The results are shown in the following paragraphs.

Discussion of Research Question 1

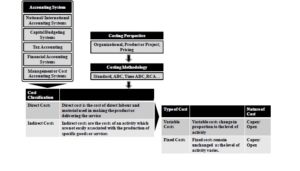

(RQ1): What are the cost lines and cost methodologies used to manage an IT Outsourcing contract?

In order to take full advantage of IT Outsourcing services, customers need to know their objectives, systems and know-how to manage IT services in order to decide what to outsource, how to outsource, in what degree and for how long.

For the provider, each IT Outsourcing contract has unique aspects that are difficult to measure and price. Some customers keep their own on-site staff, equipment ownership and responsibility for part of the services so as to support organization business (Cullen, Seddon, & Willcocks, 2005), while others totally rely on the provider. Given the range of possibilities, it is not usually simple to identify the exact cost structure and which cost drivers must be measured during the Outsourcing life cycle in order to have standard performance indicators across different IT Outsourcing contracts.

The analysed cases showed that approximate costs are calculated for the full contract duration at market prices when the provider intends to sign the contract, allocating the resources to answer customer requirements and using the same approach described by Brealey (2004) for investment projects.

In this study, the comparison between contracts shows that IT Outsourcing contracts have a common cost structure grounded on direct and indirect costs that are adapted for every contract based on scope, but the concept of cost driver is not used.

The authors identified that cost allocation is driven by the requirements of financial cost reporting. This fact limits the provider’s ability to identify and manage the contract’s costs. For instance, the account department needs to know the cost of each server, but a service manager who wants to reduce variance also needs to know the time each server spends on each incident and the financial metrics fail to detect these costs’ details.

The present research shows that cost methodology is based on standard costing with the identification of direct costs in labour and assets, which tends to be the most significant cost category in service organizations, also stated by Horngren (2000). In addition, there is the use of overhead costs, which are then divided arithmetically by the number of tickets per contract.

This approach with aggregated standard costing connected with financial statements should be limited in favour of using costing methodologies that focus on closer connections to operational realities in terms of cause-and-effect relationships that convert its inputs into outputs and outcomes, and which are essential to the effective use of costing to support business decisions (IFAC, 2009).

Discussion of Research Question 2

(RQ2): How the management of an IT Outsourcing contract copes with cost reduction in opposition to the need of revenue increase?

A recurrent theme in this research is the provider’s difficulty in managing flexible demand from IT services. According to Fitzsimmons & Fitzsimmons (1998), service demand management can be done in several ways. However, the authors focus on partitioning demand through appointment scheduling; publication of pricing incentives and promoting off-peak demand through service catalogue and request management, also referred to by Addy (2007, p. 81- 103); and the use of a knowledge base and service desk to identify sources of demand and problems. Some problems can be solved by better training, better products, better innovation and automated-response systems while others depend on shaping the behavior of customers (for instance, by offering tools and guidance to help them solve problems themselves, like an IT knowledge base (Addy, 2007, p. 155).

On the opposite side of demand, the provider needs to manage supply in order to be able to execute cost optimization. For that, it is necessary to distinguish between value-added costs and non-value-added costs in task execution. On the one hand, a value-added cost is the cost of an activity that cannot be eliminated without affecting a service value to the customer. On the other hand, non-value added costs need to be minimized, since there are costs that can be eliminated without affecting the service value to the customer. An example of an approach to eliminate non-value added costs is a just-in-time (JIT) or activity-based costing (ABC), initially developed for products, but also applicable to services.

Nowadays, providers and customers are moving to outsourcing cloud services (Tramacere, 2011) to allow standardization of operating environments.

Standardization can be done on several dimensions: increasing customer participation through service catalogue and self-care platforms (Addy, 2007, pp. 81-103); and sharing infrastructure capacity, like cloud offering. The provider mentioned that the type of cloud used in IT Outsourcing contracts is mainly based on a private cloud, also stated by Lageschulte et al., 2011. By cross training employees, the work force becomes more flexible because people can be transferred with less retraining. Likewise, scheduling work shifts will help integrate with partitioning demand (Fitzsimmons & Fitzsimmons, 1998).

Service level agreements (SLAs) also contribute to cost variance because they vary among contracts, and customers tend to demand more responsiveness from the provider, even with service levels agreed and contracted.

Finally, market analysis (Kotler & Armstrong, 2009)is always necessary to estimate capacity so as to analyze the evolution of the customer’s business and to evaluate the demand for IT services since, generally, projects are designed to meet the demand, reaching a maximum value of its productive capacity after some time (Brealey, Myers, & Marcus, 2004).

Conclusion

IT Outsourcing contracts need specific metrics and cost drivers to be consistent throughout the entire life cycle. As shown above, every contract is different. This difference results from the contract configuration (Cullen, Seddon, & Willcocks, 2005), the underneath cost structure and cost values (monetary cost per item),which vary from contract to another.

The sources of difference are: scope, scale, geographic distribution, workload, use of capital, ownership of equipment (owned or leased by the provider or by the customer (Cullen, Seddon, & Willcocks, 2005, p. 374); diversity of SLA types, governance and relationship complexity; duration of contract; labour costs; and an additional factor that contributes to variance which is market behaviour that will influence most other dimensions.

Also, the high cost of serving an IT Outsourcing contract should encourage providers to use more efficient costing methodologies. Traditionally, high performance costing methodologies (like ABC and RCA) are used in industry organizations in order to optimize production, cope and avoid material and labour waste, whereas in service companies these methodologies are essentially based on labour hours (Horngren, Foster, & Datar, 2000). If control mechanisms are not in place, the necessary tasks can be done with extra labour not accounted or billed to customer, as identified earlier in the research.

The findings strongly establish the importance of understanding the different types of factors that contribute to variance in IT Outsourcing contracts, since each customer’s environment has unique aspects that are difficult to measure and standardize. Thus, to minimize cost variance, providers should work on three major groups.

Firstly, cost allocation and management. Selecting the most appropriate methodology (IFAC, 2009) will allow the provider to manage resources identifiable and measurable; charge policies and procedures; link to service level agreement; and automate reporting. In addition, providers must consider that the primary emphasis of a cost system should be to provide relevant and reliable information for management decision making, rather than focusing only on financial reporting requirements.

Secondly, collaborative and innovation actions between parties is binding in order to keep trust and technology enhancement, because if failed, the result will be a loss of competitive advantage for the buying organization (Evans & Wolf, 2006, p. 218).

Thirdly, managing flexible demand with appropriate indicators (historic and predictive) could allow a better preparation of supply infrastructure, since services are produced and consumed simultaneously. As a result, time is an important dimension to consider in the production of services.

Finally, managing demand and supply; providers can standardize environments in order to more effectively optimize and manage human and technical resources. Albeit knowing that IT Outsourcing contracts are in the spectrum of high cost to serve with highly customized services, providers must find a set of common processes between contracts to allow the optimization of operations.

Study Limitations and Future Research

The work developed so far would benefit from a broad empirical study with more providers so as to test and enrich the findings.

In the future, it would be interesting to do a longitudinal study in a set of providers to analyse the evolution of cost accounting systems (like ABC or RCA) and the use of IT frameworks in an adverse market, such as in recessions like what is currently happening today in Portugal, Spain and other countries in Europe.

Another interesting research theme would be to analyse the evolution of standardization offer in IT services (Tramacere, 2011) and the acceptance from IT Outsourcing customers, since the main driver for customization are the customer needs. Additionally, it would be interesting to analyse the level of hidden costs supported by labour force in IT Outsourcing contracts.

References

Addy, R. (2007). “Effective IT Service Management: To ITIL and Beyond,” Berlin: Springer.

Publisher – Google Scholar

Ang, S. & Straub, D. (2002). ‘Costs, Transaction-Specific Investments and Vendor Dominance of the Marketplace: The Economics of IS Outsourcing,’ In R. Hirschheim, A. Heinzl, & J. Dibbern, Information Systems Outsourcing, Enduring Themes,Emergent Patterns,and Future Directions (pp. 48-74). Berlim: Springer Verlag.

Google Scholar

Brealey, R. A., Myers, S. C. & Marcus, A. J. (2004). ‘Fundamentals of Corporate Finance,’ (4th ed.). New York: Mcgraw Hill.

Google Scholar

Brown, D. & Wilson, S. (2005). The Black Book of Outsourcing. How to Manage the Changes, Challenges and Opportunities, New Jersey, USA: John Wiley & Sons Inc.

Publisher – Google Scholar

Bryman, A. & Bell, E. (2007). Business Research Methods, New York: Oxford University Press.

Publisher – Google Scholar

Burke, J. & Christensen, L. (2012). Educational Research: Quantitative, Qualitative, and Mixed Approaches, (4th ed.). Thousand Oaks, CA, USA: SAGE Publications Inc.

Publisher

Clark, T. D., Zmud, R. W. & McCray, G. E. (1995). “The Outsourcing of Information Services: Transforming the Nature of Business in the Information Industry,” Journal of Information Technology, 10, 221-237.

Publisher – Google Scholar – British Library Direct

Cronin, B. (1992). “When is a Problem a Research Problem?,” In S. Estabrook, Applying Research to Practice: How to use data collection and research to Improve Library Management Decision Making (pp. 128-129). Illinois: Univ. Illinois Graduate School.

Publisher – Google Scholar

Cullen, S. (2009). The Contract Scorecard: Successful Outsourcing by Design, England, UK: Gower Publishing Limited.

Publisher – Google Scholar

Cullen, S., Seddon, P. B. & Willcocks, L. P. (2005). “IT Outsourcing Configuration: Research into Defining and Designing Outsourcing Arrangements,” The Journal of Strategic Information Systems, 14(4), 357-387.

Publisher – Google Scholar

Dibbern, J., Goles, T., Hirschheim, R. & Jayatilaka, B.(2004). “Information Systems Outsourcing: A Survey and Analysis of the Literature,” Database for Advances in Information Systems, 35(nº4).

Publisher – Google Scholar – British Library Direct

Earl, M. J. (1996). “The Risks of Outsourcing IT,” Sloan Management Review, 37(3), 26-32.

Publisher – Google Scholar – British Library Direct

Eisenhardt, K. M. (1989). “Agency Theory: An Assessment and Review,” The Academy of Management Review, 14(1), 57-74.

Publisher – Google Scholar

Eisenhardt, K. M. (1989). “Building Theories from Case Study Research,” Academy of Management Review, 14(4), 532-550.

Publisher – Google Scholar

Evans, P. & Wolf, B. (2006). “Richer Sourcing,” In C. &. Stern, The Boston Consulting Group on Strategy, classic concepts and new perspectives (2nd ed.). USA: John Wiley & Sons Inc.

Fitzsimmons, J. A. & Fitzsimmons, M. J. (1998). “Service Management: Operations, Strategy, and Information Technology,” (2nd ed.). Singapore: McGraw-Hill.

Publisher – Google Scholar

Goo, J., Kishore, R., Rao, H. R. & Nam, K. (2009). “The Role of Service Level Agreements in Relational Management of Information Technology Outsourcing: An Empirical Study,” MIS Quarterly, 33(1), 1-28.

Publisher – Google Scholar

Gorman, G. E., Clayton, P. & Shep, S. J. (2005). “Qualitative Research for the Information Professional,” (2nd ed.). London, UK: Facet Publishing.

Publisher – Google Scholar

Hammond, J., Keeney, R. & Raiffa, H. (2001). ‘The Hidden Traps in Decision Making,’ Boston: Harvard Business School Publishing Corporation.

Google Scholar

Hancox, M. & Hackney, R. (2000). “IT Outsourcing: Frameworks for Conceptualizing Practice and Perception,”Information Systems Journal, 10(3), 217-237.

Publisher – Google Scholar – British Library Direct

Hirschheim, R., George, B. & Wong, S. F. (2004). “Information Technology Outsourcing. The Move towards Offshoring,”Indian Journal of Economics and Business.

Google Scholar

Horngren, C. T., Foster, G. & Datar, S. M. (2000). “Cost Accounting a Managerial Emphasis,” (International Edition 6th ed.). USA: Prentice-Hall International, Inc.

Publisher – Google Scholar

IBM. (2009). “Transformation Chaos to Cadence: Transforming Sales, Organizations to Win in the Global Economy,” New York: IBM Global Business Services.

Publisher

IFAC. (2009). “Evaluating and Improving Costing in Organizations. International Good Practice Guidance,” New York:IFAC.

Publisher

IFAC. (2009). “Evaluating the Costing Journey: A Costing Levels Continuum Maturity Model,” New York: IFAC – International Federation of Accountants.

Publisher

ITGI. (2005). ‘Control Objectives for Information and Related Technology (Cobit) Version 4.0,” Rolling Meadows. USA: IT Governance Institute.

Jensen, M. C. & Meckling, W. H. (1976). “Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure,” Journal of Financial Economics, 3(4), 305-360.

Publisher – Google Scholar

Jick, T. D. (1979). “Mixing Qualitative and Quantitative Methods: Triangulation in Accumulation,” Administrative Science Quarterly, 24, 602-611.

Publisher – Google Scholar

Kaplan, R. S. & Cooper, R. (1998). “Cost & Effect, Using Integrated Cost Systems to Drive Profitability and Performance,” Boston: Harvard Business School Press.

Publisher – Google Scholar

Kotler, P. & Armstrong, G. (2009). ‘Principles of Marketing,’ (13rd ed.). Englewood clifs, USA: Prentice-Hall Inc.

KPMG. (2012). “Sourcing Advisory 2012 Legal Pulse Survey,” Equaterra. KPMG.

Publisher

Lacity, M. C. & Hirschheim, R. A. (1993). “Information Systems Outsourcing: Myths, Metaphors and Realities,” Chichester, USA: Wiley.

Publisher – Google Scholar

Lacity, M. C., Khan, S. A. & Willcocks, L. P. (2009). “A Review of the IT Outsourcing Literature: Insights for Practice,”Journal of Strategic Information Systems, 130-146.

Publisher – Google Scholar

Lacity, M. C. & Willcocks, L. P. (1998). Strategic Sourcing of Information Systems: Perspectives and Practices, Chichester, UK: John Wiley & Sons Inc.

Publisher – Google Scholar

Lageschulte, P. J. & al, e. (2011). ‘IT Control Objectives for Cloud Computing Controls and Assurance in the Cloud,’ Rolling Meadows, USA: ISACA.

Lee, A. S. (1991). “Integrating Positivism and Interpretative Approaches to Organizational Research,” Organization Science, 2(4), 342-365.

Publisher – Google Scholar

Luecke, R. & Collis, D. (2005). Harvard Business Essentials. ‘Strategy Create and Implement the Best Strategy for Your Business,’ Boston, USA: Harvard Business Press.

Google Scholar

Miranda, S. & Kim, Y.- M. (2006, September). “Professional versus Political Contexts: Institucional Mitigation and the Transaction Cost Heuristic in Information Systems Outsourcing,” MIS Quarterly, 30(3), 725-753.

Publisher – Google Scholar – British Library Direct

Morden, T. (2007). Principles of Strategic Management, (3rd ed.). Hampshire: Ashgate Publishing Limited.

Publisher – Google Scholar

Poppo, L. & Zenger, T. (2002). “Do Formal Contracts and Relational Governance Function as Substitutes or Complements?,” Strategic Management Journal, 23, 707-725.

Publisher – Google Scholar – British Library Direct

Porter, M. E. (2008). “The Five Competitive Forces that Shape Strategy,” Harvard Business Review.

Publisher

Quinn, J. B. & Hilmer, F. G. (1994). “Strategic Outsourcing,” Sloan Management Review, 43-45.

Publisher – Google Scholar – British Library Direct

Tramacere, G. (2011). “Key Issues for Infrastructure Services, 2011,” Stamford: Gartner Group Inc.

Publisher

Ward, J. & Griffits, P. (1996). Strategic Planning for Information Systems, (2nd ed.). London: John Wiley & Sons Inc.

Publisher – Google Scholar

Welsch, G. A. (1988). Budgeting: Profit Planning and Control, (5th ed.). Prentice Hall.

Publisher – Google Scholar

Willcocks, L. & Lacity, M. (1998). ‘The Sourcing and Outsourcing of IS: Shock of the New,’ In L. Willcocks, & M. Lacity, Strategic Sourcing of Information Technology: Perspectives and Practices (pp. 1-41). Chichester: Wiley.

Google Scholar

Willcocks, L. P., Cullen, S. & Craig, A. (2010). The Outsourcing Enterprise: From Cost Management to Collaborative Innovation, (Technology, Work and Globalization). Palgrave.

Publisher – Google Scholar

Williamson, O. E. (1979). “Transaction-cost Economics: The Governance of Contractual Relations,” Journal of Law and Economics, 22(2), 233-261.

Publisher – Google Scholar

Williamson, O. E. (1985). ‘The Economic Institutions of Capitalism,’ New York: Free Press.

Google Scholar

Wullenweber, K., Beimborn, D., Weitzel, T. & Konig, W. (2008). “The Impact of Process Standardization on Business Process Outsourcing Success,” Information Systems Frontiers, 10(2), 211-224.

Publisher – Google Scholar – British Library Direct

Yin, R. K. (2003). “Case Study Research: Design and Methods,” Thousand Oaks: Sage Publications Inc.

Publisher – Google Scholar

Yin, R. K. (2008). ‘Case Study Research: Design and Methods (Applied Social Research Methods),’ (4th ed.). Thousand Oaks, CA, USA: SAGE Publications Inc.

Google Scholar