Introduction

Migration can generate welfare gains for migrants whether international or internal migration although the former exceeds the latter in terms of benefits associated with it. The implications of migration are more in developing countries compared to developed nations due to the high level of poverty, extensive downsizing of organizations, ethno-religious conflicts, refugee movements, wide spread unemployment and rapid urbanization and its attendant patterns. The history of the human migration phenomenon in African continent started for a long time and it increases due to the dynamics of the societies. Several forms of migration exist, namely global migration, inter/intra-continental, regional migration and sub-regional migration. Migration may be voluntary, where people relocate to new areas based on discretion for better economic opportunities outside their original home countries, or forced migration, where people leave in response to conditions beyond their control such as wars, conflicts and environmental catastrophes.

Migrants’ economic remittance is an important and growing source of foreign funds for several developing countries. These inflows have increased in the recent past and constitute a large source of foreign income relative to other financial flows. According to the World Bank (2010), officially recorded remittances to developing countries reached $334 billion. Despite the global economic crisis that has impacted on private capital flows, remittance flows to developing countries have remained resilient, posting an estimated growth of 8 percent in 2011, (Word Bank, 2010).

The remittances of the diasporas, despite being a show of attachment to the country of origin, serve as a vehicle towards the economic growth of such country. In a study carried out on the impact of migrants’ remittances on economic growth in sub-Saharan Africa with special reference to Nigeria, Ghana and South Africa. Ikechi and Anayochukwu (2013)state that migrants’ remittances were found to have impacted positively on the economic growth of the economies studied, though with varying degree. Nigeria is the seventh biggest recipient of money remitted to the home country by her citizens living abroad according to Outlook for Remittance Flows 2012-14, (World Bank, 2010).

In fact the main objective of the paper is that diasporas remittances contribute to the economic growth of their country of origin. Diasporas remittances not only represent a source of relief for households in meeting basic needs but also facilitate the building of resources for increased human capital through both education and health care, increased physical and financial investments in residential real estate and starting up small businesses. No doubt some studies have been done on Nigerian diasporas, yet less attention has been focused on the contributions of Nigerian diasporas within the sub-region of West Africa to the economic growth of their country of origin.

Review of Literature

It may be true that African countries have lost a substantial proportion of their skilled through emigration or the “brain drain”, which is generally caused by a lack of economic opportunities and conflicts and other factors, but African countries also have benefitted from the African diasporas’ remittance for their economic growth.

In a study conducted on the impact of the workers’ remittances on economic growth in Nigeria, using a time series data, from 1970, Ukeje and Oiechina (2013) observe that workers’ remittances are significant and have positive impacts on economic growth. Remittances received by developing countries registered a sharp increase, overUS$300 billion of workers’ remittances were transferred worldwide through official channels, and it was likely that billions more were transferred through unofficial ones (World Bank 2009). In 2010, worldwide remittance flows were estimated to have exceeded US$440 billion. From that amount, developing countries received US$325 billion (World Bank, 2011), which represents a high proportion of 73.9%.

Several scholars have shown the existence of positive impact of workers’ remittances on economic growth (Adams and Page, 2005; Acosta et al, 2008; World Bank, 2008). They pointed out that migrant remittances impact positively on the balance of payments in many developing countries as well as enhance economic growth, via their direct implications for savings and investment in human and physical capital and, indirect effects through consumption. According to Ratha (2003), diasporas’ remittances increase the consumption level of rural households, which might have substantial multiplier effects, because they are more likely to be spent on domestically produced goods. Despite the positive opinions on the diasporas remittances with respect to economic growth, some other scholars perceived their impact in the contrary (Ahlburg 1991; Brown & Ahlburg 1999). They argued that remittances undermine productivity and growth in low-income countries as they are readily spent on consumption rather than on productive investments.

A noted trend that has gained recognition by the World Bank in recent times is the huge sum of money remitted by Nigerians living abroad. Nigeria has a strong and progressing diaspora community, in spite of the unpleasant socio-economic and political situation; Nigerians in the Diaspora have appeared unwavering in their commitment to the growth of their national economy with the quantum of their annual remittances to the country (Iheke, 2012; World Bank, 2008; The Nation, 2009). Remittances have been recognized as an important driver of the economy of most developing countries. They play vital roles in poverty reduction, income redistribution and economic development, especially in rural areas. According to Hernandez-Coss and Bun (2006), Nigeria is the largest recipient of remittances in Sub-Saharan Africa. They reported that the country receives nearly 65 percent of officially recorded remittance flows to the region and 2 percent of global flows. The Central Bank of Nigeria (CBN) reported approximately US$2.26 billion in remittances for 2004 (Iheke, 2012). The phenomenon of Nigerian emigrants, considered as an escape from hardship on the home front and a depletion of human capital is somehow paying off for the country. This is in view of the revelation that Nigerians abroad grew the economy by a whopping $7billion in the year 2008. (World Bank, 2008; The Nation, 2009).

Using Solow growth model, Rao and Hassan (2009) note that migrant remittances have positive but marginal effect on growth. Applying a four-sector medium scale macro model to study the relationship between remittances flows and the macro economy in Nigeria, Agu (2009) reveals a weak link between remittances and the real sector and components of aggregate demand. He pointed out that the existence of leakages of remittances proceeds through imports could be responsible for the weak nexus. Udah (2011) reiterates that remittances affect the economic performance in Nigeria, through its interaction with human capital and technology diffusion. In a related study of developing countries, using panel data, Natalia et al. (2006) investigate the impacts of remittances and economic growth, and found positive impact of remittances on economic growth.

Effects of Nigerian Diasporas’ Circular Migration on Nigeria’s Economic Growth

Nigerian diasporas in Ghana are engaged in circular migration as they move back and forth within the sub-region. Circular migration can have a number of positive impacts on both origin and destination countries. It enables the destination country to meet labour shortages in a flexible way and address shortages that are seasonal or short term for the origin country. It can be a notable strategy for relieving labour surplus. For with the growing population of Nigeria, it is beneficial for labour surplus relief. The circular migration of the Nigerian diasporas enhance their income, skills, experience and create opportunities for members of the family, and retain their valued cultural heritage.

Circular migration is beneficial to Nigeria’s economic growth because it reduces the risk of losing human capital permanently to brain drain, the differences between circular migration and permanent migration is that the human resources embodied in the migration are only partially lost after their migration from the origin country to the destination country.

It should be noted that one of the characteristics of West African diasporas is their back and forth movements within the sub-region. However, the greater commitment of the Nigerian diasporas in their country of origin shows that they are more engaged in the economic activities of Nigeria, their homeland.

Impact of Remittances on Economic Growth in the Developing Countries

According to the World Bank (2013), migrants’ remittances to the country of origin are growing fast with a total of $401 billion in 2012. These represent a major channel for reducing the severity of poverty in the developing countries. There is a projection that by 2015 this figure could grow by another $114 billion. Apart from the monetary benefits, remittances are also associated with continuous human development across a number of sectors which include health, education and gender mainstreaming. Remittances in money serve as facelift for the poor people and increase in income for the families and individuals in the societies. The positive spill-over effects are also noticeable in the expenditures and investments made by the remittance- receiving households which accrue to the entire communities.

However, in retrospect, migrants from the developing sent approximately three times more to their countries of origin than these countries received in official development assistance in 2011, and they sent an equal to about half foreign direct investment (FDI) in these countries. For example as noted by the World bank (2013), some countries which include Nigeria, India, china, Philippines and Mexico received the greatest amount of migrant remittances of all countries in the world in the year 2012. These constituted a combined $197 billion or nearly half of all monies remitted to the developing world in 2012. In essence, these remittances represent more than 20 percent of the gross domestic product (GDP) and in totality the actual amounts may be higher as the money remitted through informed channels may not be recorded.

Methodology

This study utilized the descriptive research design on the field survey carried on Nigerian diasporas in Ghana. The variables for the test of hypothesis were first examined under descriptive statistical analysis applying measures of central tendency and variability (mean, standard deviation, minimum maximum) derived from the responses generated through the Likert scaled questionnaire administered on the Nigerian emigrants which constitute the respondents of this study. The analysis of the study was conducted by employing both a non-parametric (chi-square) and a linear regression estimator. Chi-square analysis employs goodness of fit test to compare the observed and the expected frequencies in two or more categories of observation to test that all categories contain the same proportion of a value. A linear regression utilizes parameters that estimate the coefficients of the linear equation involving at least one independent variable (remittance to the place of origin and the amount remitted) that best describe the line of best fit for the dependent variable, predicting more accurately the value of the dependent variable. In this study, these dependent variables comprise of investment, charity support, community support and specific financial involvement in Nigeria which among others includes family/parents upkeep, community development projects, savings and projects execution at home. These factors constitute the different sub sectors that make up the entire real sector at the macro level.

Population: the population of the study entails all Nigerians diasporas who are of the workforce category (males and females) living in Ghana. These include those working, those not working but are looking for work, and those not working and not looking for work.

Sample and Sampling Technique: The selected sample for this study comprises of three hundred and twenty-six Nigerian adults who are within the age limit of 30 years up to 60 years and above. The respondents comprise of two hundred and eighty five (285) male diasporas and forty-one (41) female diasporas all living in Ghana. These were randomly selected for the survey and also interviewed. The samples were meticulously selected and utilized from the population study based on the purpose and aims intended to be achieved by the researcher.

Instrument: This mainly involves the use of questionnaires carefully constructed for the purpose of achieving the objectives outlined for this study. The questionnaire was designed in such a way as to gather the necessary information based on the responses of the Nigerian diasporas. It thus contains variables on the contributions of their financial remittances to Nigerian economic growth and development. Basic issues relating to savings and investments in Nigeria, charity support, community support and specific involvements as regards welfare and grass root development projects were also addressed. The ideas were derived from the contents of these variables.

Validity of Instrument: The questionnaire instrument was explicitly inspected and certified by the research personnel of the research and development arm of Covenant University, Ota. The essence of this evaluation exercise was necessitated by the need to ensure that the contents of the questionnaire are correctly structured and most importantly it captured what it is meant to measure as intended by the researcher within the scope of the study. This is to see that the objectives of the study are realized through the data generated from the research instrument- the questionnaire.

Reliability of the Instrument: Beside the research questionnaire, focus group discussion was carried out with the Nigerian diasporas in Ghana. This interactive aspect of the research was to facilitate further information concerning the reliability and authenticity of the responses in the questionnaire administered to the respondents.

The Null Research Hypotheses

- Nigerian diasporas in Ghana do not remit money to their country of origin

- There is no significant relationship between remittances and the economic growth of Nigeria.

- The remittances in money are not contributing to the economic growth of Nigeria.

The null hypotheses were framed to examine the contributory impact of the remittances from Nigerian diasporas in Ghana based on a two tail test statistics. The hypotheses were analyzed by employing chi-square and linear regression approach.

Results

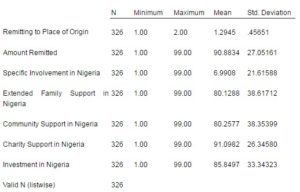

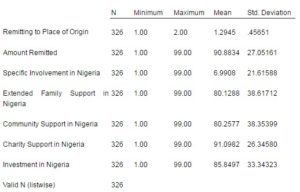

In the descriptive table 1, the minimum, maximum, means and the standard deviation of the cumulative responses of the three hundred and twenty-six (326) sampled observations to the questionnaire as they relate to the hypothesis are shown. The responses to the variables of the hypotheses had the highest mean score of 91.09 with the standard deviation of 26.34 while the minimum mean score of the responses exhibits the value 1.29 with the standard deviation of 0.45. A closer observation of the standard deviations showed that the responses revolve around the mean. Thus, on average the responses to the questions relating to the hypotheses were answered with a positive disposition by the respondents.

Table’ 1 Descriptive Statistics

Data Analysis

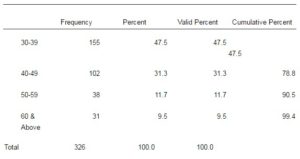

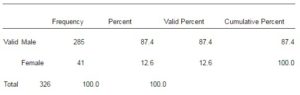

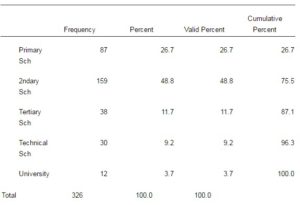

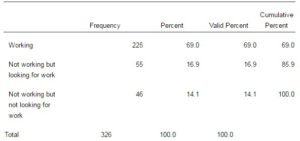

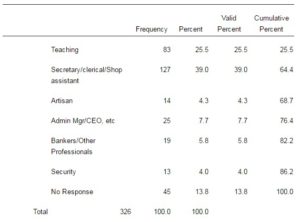

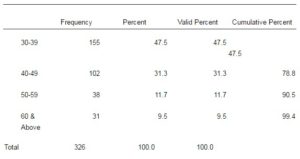

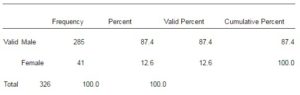

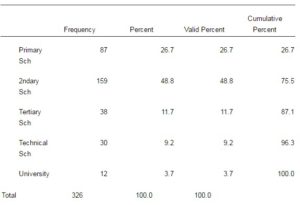

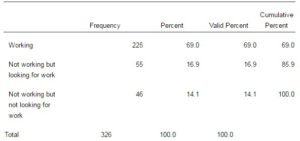

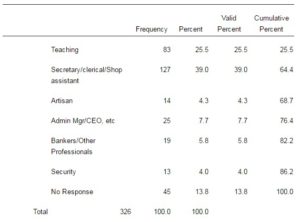

Tables2-6 show the composition and distribution of the sample statistics along the dimension of six demographic variables of age (30-39, 40-49, 50-59 and 60 and above); gender (male and female respondents); educational attainment (primary, secondary, technical education, tertiary) previous work experience (working, Not working but looking for work, Not working and not looking for work) and respondents occupation (teaching, secretary/clerical, shop assistant, artisan, admin manager/ CEO, Banks/other professionals, security, etc, ).

The results revealed that one hundred and fifty-five respondents which indicate 47.5% of the selected samples were between the age bracket of 30-39. One hundred and two of them, representing 31.3%, were within the age group 40-49, thirty-eight respondents representing 11.7% part of the sample were within the age boundaries of 50-59 and thirty-one representing 8.9% fall under the group of 60 years and above.

Two hundred and eighty-five of the respondents covering 87.4% of the sample size were male diasporas and the remaining forty-one were female diasporas which represent 12.6% of the respondents living in Ghana.

Within the sample, eighty-seven which represents 26.7% of the surveyed sample attained primary school, one hundred and fifty-nine with 48.8% distribution attained secondary school. Fifty of them, which represents 15.4 % distribution, attained tertiary institutions. However, thirty respondents which signify 9.2% of the total sample size were technical school graduates.

From the three hundred and twenty-six sample observation, two hundred and twenty-five indicating 69% were in the working class category, fifty-five representing 16.9% were not working although looking for work while forty-six capturing 14.1% were neither working nor looking for work.

Eighty-three of the total respondents which denote 25.5% were identified with the teaching profession, one hundred and twenty-seven with 39% distribution consists of the secretary, clerical and shop assistants. Fourteen which covers 4.3% of the sample were artisans, twenty-five signifying that 7.7% of the observations were made up of admin managers and CEO’s, nineteen with the percentage share of 5.8% were bankers and other professionals, thirteen which represents 4% were security agents and the last forty-five respondents representing 13.8% showed no response in regard to their occupational status.

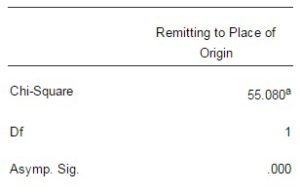

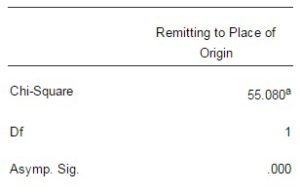

In table 7, the null hypothesis that verifies whether Nigerian diasporas in Ghana actually remit money to their country of origin (Nigeria) was tested using non-parametric chi-square (X2) normal distribution estimate. The chi-X2 result (55.08) with its probability value (Asymp. sig 0.000) given one degree of freedom, thus rejects the null hypothesis that Nigerian diasporas in Ghana send no remittances to their country of origin. The result established the fact that there is a significant remittance to Nigeria by the Nigerian diasporas residing in Ghana.

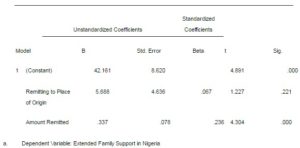

The remaining hypotheses which utilized the linear regression approach as earlier discussed in the methodology were analyzed (see tables 8-13).

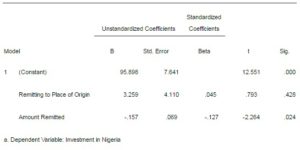

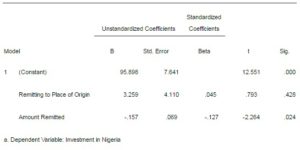

Table 8 shows the impact of remittances to the place of origin and the amount of remittances on investment in Nigeria. Remittances to the country of origin showed a positive relation with investment in Nigeria. The financial aspect of the remittances indicates a positive relationship between the remittances and the economic growth in the country of origin. This implies that some of these remittances are utilized and invested in the country.

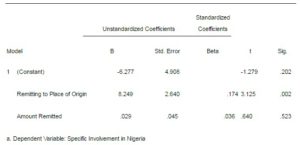

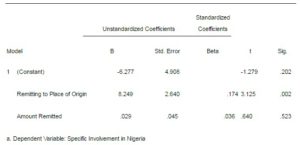

Table9 reveals that remittances generally have significant supported savings and investments in Nigeria, and charity organizations, community support projects and welfare development activities. The

financial remittances indicate a direct relationship with these specific factors. The result, therefore, suggests the need to increase financial remittances to the country for more meaningful impacts on specific project involvement that will further accelerate the economic growth in Nigeria.

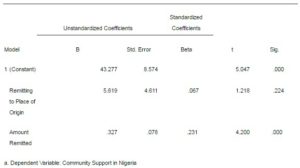

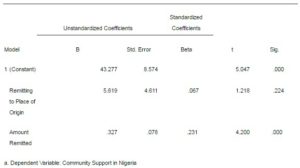

Table10 provides evidence that remittances to the country of origin (Nigeria) could serve as a means of providing community support projects to the place of origin. The amount of financial commitments showed a significant impact in accelerating the community-level developmental projects as it provides financial assistance and support to the beneficiary communities. This result further suggests that a percentage increase in the amount of remittances by the Nigerian diasporas in Ghana provides over 23 percent increase on community development and support programmes.

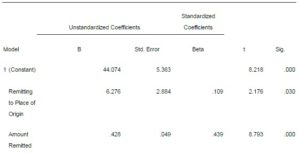

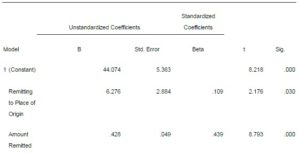

Table11 indicates that both general and financial remittances to the country of origin provide remarkable improvement to charity support activities in Nigeria. The estimated co efficient for both results implies a significant direct relationship in support for charity development activities in the country. Further investigation also suggests that general remittances and the financial aspect of the remittances from Nigerian diasporas in Ghana have accounted for over 10 percent and 43 percent increase in charity support in Nigeria. It could therefore be observed that remittances from the Nigerian diasporas in Ghana has provided a significant support for charity initiatives and could also serve as a good source of support for charitable organizations in Nigeria.

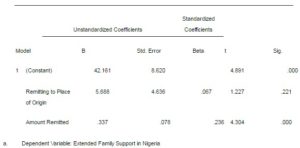

The result of table 12 implies that though remittances to the country of origin showed a positive relation with extended family support. The financial aspect showed a sufficient evidence of a significant impact on extended family support in Nigeria which among others includes family upkeep, parents’ upkeep, savings and developmental projects at the homeland.

Conclusion

The study was carried out empirically and data were analyzed by employing chi-square and linear regression approach. The results of the analysis indicate a positive relationship between remittances and economic growth in the country of origin. Furthermore, the results showed that remittances have significantly supported savings and investment activities in Nigeria. In addition, the analysis revealed the efficacy of financial remittances on the improvement of community development programmes and charitable activities in the country of origin.

Recommendations

From the above findings, Nigerian diasporas should be encouraged by the government of Nigeria with the policies that are favourable and attractive for investment in the homeland. These include reduction in the withholding tax by the Nigerian banks during money transfer and concessions on the establishment of cottage and small scale businesses in Nigeria. Therefore, the Nigerian government should create an investment climate that is alluring to Nigerians in the Diaspora.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1.Acosta, P., Calderón, C, Fajnzylber, P. & López, H. (2008). “What is the Impact of International Migrant Remittances on Poverty and Inequality in Latin America?,” World Development. vol.36, no. 1, pp.89-114.

Publisher – Google Scholar

2.Adams, R. H. & Page, J. (2005). “Do International Migration and Remittances Reduce Poverty in Developing Countries?,” World Development vol. 33, no. 10, pp.1645-1669.

Publisher – Google Scholar

3.Agu, C. (2009). ‘Remittances for Growth: A Twofold Analysis of Feedback between Remittances, Financial Flows and the Real Economy in Nigeria,’ in African Econometric Conference, Nigeria.

Google Scholar

4.Ahlburg, D. A. (1991). ‘Remittances and their Impact: A Study of Tonga and Western Samoa,’ Pacific Policy. Paper No.7. Canberra: National Centre for Development Studies.

Google Scholar

5.Brown, R. P., & Ahlburg, D. A. (1999). “Remittances in the South Pacific,” International Journal of Socio-Economicsno. 26, pp. 325-344.

Publisher – Google Scholar

6.Fayomi, O. O. (2013). “The Diaspora and Nigeria-Ghana Relations (1979-2010),” Ph.D thesis, Covenant University, Ota.

Publisher – Google Scholar

7.Hernandez-Coss, R. and Bun, C. E. (2006). ‘The U.K. – Nigeria Remittance Corridor Challenges of Embracing Formal Transfer Systems in a Dual Financial Environment,’ Paper presented at the Second International Conference on Migrant Remittances, London.

Google Scholar

8.Iheke, O. R. (2012). “The Effect of Remittances on the Nigerian Economy.” International Journal of Development and Sustainability. vol. 1, no. 2, pp. 614–621.

Publisher – Google Scholar

9.Ikechi, K. S. & Anayochukwu, O. B. (2013). “Migrant’s Remittances and Economic Growth in Sub Saharan Africa: Evidence from Nigeria, Ghana and South Africa,” Interdisciplinary Journal of Contemporary Research in Business, vol. 4, no.10, pp.534-550.

Publisher – Google Scholar

10.Rao, B, & Hassan, G (2009). “Are the Direct and Indirect Growth Effects of Remittances Significant?,” MPRA Paper, 18641 Available from: .

Publisher – Google Scholar

11.Ratha, D. (2003). “Workers Remittances: An Important and Stable Source of External Development Finance,” Global Development Finance.Washington, World Bank).

Publisher – Google Scholar

12.The Nation (2009). “Nigerian Emigrants and Remittances,” The Nation Newspaper 13th September. p.2

13.Udah, E.B. (2011). “Remittances, Human Capital and Economic Performance in Nigeria,” Journal of Sustainable Development in Africa, vol.13, no.4.

Publisher – Google Scholar

14.Ukeje, E. U. & Obiechina, M. E. (2013). ‘Workers’ Remittances – Economic Growth Nexus: Evidence from Nigeria, Using an Error Correction Methodology,’ International Journal of Humanities and Social Science, vol. 3, no. 7, pp. 212-227

Google Scholar

15.World Bank (2008). ‘Global Monitoring Report 2008: MDGs and the Environment: Agenda for Inclusive and Sustainable Development,’ World Bank, Available from:<http://www.gtz.de/de/dokumente/en-global-monitoring-report-2008.pdf >[26/9/2013].

Google Scholar

16.World Bank (2009). ‘Country Indicators, Ghana,’ the World Bank, Available from: . [26th September, 2013].

17.World Bank (2009). ‘Migration and Remittances Fact Book 2008,’ World bank, Washington

18.World Bank (2011). ‘Migration and Remittances Fact Book 2011,’ 2nd edn, World bank, Washington

19.World Bank (2013). ‘Migration and Development Brief 20,’ World Bank Development Prospects Group, Migration and Remittances Unit, Available from: [22nd September, 2013]

Google Scholar

Appendix

Demographic Distribution of Respondents

Table2 Age of Respondent

Table3 Gender

Table4 Educational Attainment

Table5 Previous Working Experience

Table6 Respondent’s Occupation

Table7 Chi X2Test Statistics

Table8 Coefficients

Table9 Coefficients

Table10 Coefficients

Table11 Coefficients

Table12Coefficients

Source: Fayomi Oluyemi (2013). Unpublished Phd Dissertation, Department of Political Science and International Relations, School of Social Sciences, Covenant University, Ota, Nigeria