Introduction

Financial irregularity and corruption are severe problems of concern globally. They are major concerns to developing nations. They are so endemic that their perpetration is gradually becoming a normal way of life. Although financial irregularities affect private and public sectors, the magnitude of public office fraud, together with the extent to which citizens are affected, calls for alarm. Internal fraud is a significant problem to the world economy of today. In Nigeria, the government parastatals are known for the increased and alarming rate of fraud, misappropriation and embezzlement of public funds used to run the public sector. Today, there is widespread growth in white-collar crimes, including both fraudulent financial reporting and misappropriation of asset schemes, which the government of any country wants to wipe out or erase from the society. Corruption and 419 also have important implications for forensic accountants. Racketeering and terrorist groups often rely on money laundering schemes to finance and disguise their activities. Representations are needed in the court to supply documentary evidence. The demand for forensic accountants and fraud investigators is growing. Federal, state, and local governmental agencies like Securities and Exchange Commission, Internal revenue service, The Independent Corrupt Practices Commission [ICPC], Nigerian Drugs Law Enforcement Agency (NDLEA), and Economic and Financial Crimes Commission (EFCC) all have a need for accountants and others with forensic investigation skills.

The public sector refers to all organizations that exist as part of government machinery for implementing policy decisions and delivering services that are of value to citizens. The public sector in Nigeria is made up of the following: (a) The civil service (b) The public bureaucracy- services of the state and national assemblies, the judiciary, the armed forces, the police and other security agencies, paramilitary services (immigration, customs, prisons, etc), parastatals and agencies including social service, commercially oriented agencies, regulatory agencies, educational institutions, research institution, etc. (Suleiman, 2009).

Nigeria has a large public sector running into millions of personnel. Their major function is to implement government policies and programs. While it is true that some governments did (do) not have any programs for the common good, the public sector has not successfully implemented the policies and programs of those that did. Many civil servants found it easier to align themselves with the government of the day and participate in treasury looting that has reduced Nigeria to an embarrassment among the comity of serious nations.

Though the Nigerian public service has undergone changes and transformation over the years, unfortunately, successive reforms have not made significant impact to reengineer the public sector. Public sector reforms have failed to achieve their fundamental goals. Even if the political leadership fails, it is the job of the public service to help steer the nation in the right direction (Suleiman, 2009; El-Rufa’I, 2006).

This paper posits that forensic accounting which is accounting that is suitable for legal review, offering the highest level of assurance and scientific deductions can play an invaluable role in making the Nigerian nation competitive globally via vision 2020 that integrates the forensic accounting profession. Forensic accounting is relevant to making economies globally competitive via a successful vision 2020 agenda because of the desire to have stable economic growth, crime free society, foreign direct investments and positive image both locally and internationally.

Statement of Research Problem

There is an alarming increase in the number of fraud and fraudulent activities in Nigeria. The perpetuation of financial irregularities is becoming the specialty of both private and public sector in Nigeria as individuals perpetrate fraud and corrupt practice according to the capacity of their office, requiring the visibility of forensic accounting services. The conception and attainment of vision 2020 for the nation will be futile if issues such as lack of a well-developed and implemented policy of corporate governance, lack of honesty and transparency in financial reporting, and an inefficient and ineffective system of internal controls, persist in the public sector.

Over the years, the drive of government in Nigeria has been towards attracting the needed foreign direct investment to further stimulate the economy. Thefts of heads of government parastatals and other economic crimes in the country have been a major hindrance. There is a general tendency to blame politicians for the poverty, underdevelopment, and colossal tragedy of the leadership that best describes Nigeria today. From military dictatorships to democratic government, all have conspired to reduce governance to the manipulation of public office to deceive and loot public funds for personal use. But the politicians and militicians can only be blamed to an extent because they come and go. The only permanent feature of government – whether under military or civilian dispensation is the civil service. This is why civil servants cannot escape responsibility for the rot that characterizes every aspect of the public sector in Nigeria (Modugu and Ayanduba, 2013).

Central to the point of public sector inefficiency are the following: outdated administrative machinery; poor capacity of the majority of civil servants, sometimes to the point of illiteracy; certificate forgery to gain entry and get promotions; age falsification to remain in service beyond the stipulated period/ age; corruption; policy reversals; primordial considerations like ethnicity at the expense of merit, etc.

At a time when even the most powerful nations in the world are opting for younger, more energetic leaders, the Nigerian public sector is full of people who have passed the mandatory retirement age of 60 years or 35 years in service. These people have nothing new to offer, but continue to remain in the service courtesy of their ‘affidavit ages’. The public sector is full of people that lack the skills required to be efficient in this age. The absence of a secretary or typist to operate a typewriter or computer can truncate important assignments because the big “bosses” cannot do basic word processing. It is a fact that many workers in the public sector use fake or forged certificates. Indeed, if any serious verification of claimed qualifications is to be undertaken in the sector, many jobs would go. This is a true recipe for incompetence. The issue of corruption is also central to inefficiency in the public sector. Also, when policies and programs (like energy, for instance) keep getting reserved by every government with support of civil servants, little, if anything can be achieved, and when issues like ethnicity determine progress in the sector, efficiency becomes a mirage (Suleiman, 2009).

Significance of the Study

Weak implementation of strategic development initiatives and lack of political will to see development strategies through to the end have constrained Nigeria’s growth and development. Fixed medium-term development plans, National Rolling Plans, Structural Adjustment Programme, National Economic Empowerment and Development Strategy (NEEDS), the strategy for attaining the Millennium Development Goals (MDGs) and the 7-Point Agenda were all not effectively implemented as they recorded mixed results, modest success, underachievements, and failures (National Planning Commission, 2010). The public service is critical to the implementation and realization of the objectives of the 2020 vision. Therefore, the essence of public service reforms driven by forensic accounting applications to achieve an efficient and effective public service that is capable of implementing the 2020 vision cannot be over-emphasized.

This research paper shows how the forensic accountant is useful in resolving the problems faced by the Nigerian public sector. The forensic accountant through his investigative skill is able to detect problems and proffer solutions, and also help management authorities put proper controls in place to check the occurrence of corruption and fraud in the public service. The intention of the Nigerian government for vision 2020 is to curb the growing rate of crimes in the public sector and this research enables the government to recognize that forensic accounting helps and supports the investigation of criminal matters like: employee theft, securities fraud, Insurance fraud, embezzlement and proceeds of crime investigations.

There is a general expectation that forensic accounting will be able to stem the tide of financial malfeasance witnessed in the Nigerian public sector. This realization is a necessary prerequisite to Nigeria’s Vision 2020 goals of (i) planning development on a long-term basis in order to achieve structural transformation (ii) reducing the country’s overdependence on oil (iii) effectively transforming the lives of Nigerians in terms of significant improvements in their standards of living, and (iv) taking its rightful position among the nations of the world. This research provides an adequate emphasis, especially survey evidence on how forensic accounting can help curb financial crimes, boost the country’s global competitiveness, and by implication, enhance the achievement of vision 2020 goals beyond the several anecdotal views that abound.

Nigeria and Vision 2020

Nigeria’s vision 2020 is a long term development goal designed to propel the country to the league of the top 20 economies of the world by year 2020. This will enable it to achieve a high standard of living for the citizens. The vision integrates a thorough engagement process with all stakeholders across all levels of government and society. It places the country on a sustainable development path and transforms the country into a better modern society able to play competitively in the comity of nations. The vision has the two broad objectives of (1) Making efficient use of human and natural resources to achieve rapid economic growth and; (2) Translating the economic growth into equitable social development for all citizens. The development aspirations cut across four dimensions of (a) building a peaceful, equitable, harmonious and just society (social); (b) developing a globally competitive economy (economic); (c) having a stable and functional democracy (institutional); and (d) achieving a sustainable management of the nation’s natural resources (environmental) (National Planning Commission, 2010).

Nigeria’s vision 2020 aims to stamp out corruption and improve the country’s ranking on the Corruption Perception Index (CPI) to 60 by 2015 and 40 by 2020. The Vision aims to minimize corruption by creating wealth and employment opportunities; reducing poverty and ensuring the social security of Nigerians. In fighting corruption, there will be political and financial freedom for anti-corruption agencies, severe punishment for corrupt officials and promotion of transparency and accountability in the management of public finances. The parameters to measure the attainment of Nigeria’s vision 2020 goals would include a sound, stable and globally competitive economy with a GDP of not less than $900bn and a per capita income of not less than $4,000 per annum (Adedokun, 2013). Nigeria is currently one of the most corrupt nations in the world with a ranking of 121 out of 180 countries on the Corruption Perception Index (CPI).

Nigeria and Global Competitiveness

Global competitiveness refers to the ability of an economy to produce and distribute a set of goods in sufficient quantity, quality and at competitive prices for the domestic, and or the international market. Corruption has been implicated in Nigeria’s economic underdevelopment (Ehwarieme, 2010). Nigeria ranks as one of the least competitive economies in the world, being 99th out of 133 countries on the Global Competitiveness Index and 125th out of 183 countries on the Ease of Doing Business Index. The knowledge of forensic accounting is essential to a vision 2020 driven public sector that will promote an open, efficient, effective and globally competitive business environment in order to facilitate the growth of businesses and investments. This knowledge supports the introduction of economic reforms and market-friendly policies that will attract foreign and domestic investment. Institutions such as Immigration Service, Nigeria Police, Corporate Affairs Commission, rail and air transportation management agencies, etc that are currently controlled exclusively by the federal government will become decentralized to ensure more effective and efficient delivery of services to the public. The government will also reduce the business registration time to a maximum of 48 hours as well as harmonize all tax systems and payments channels to reduce multiple taxation.

The overall goal of vision 2020 is to improve Nigeria’s ranking on each of the six governance indicators, namely: Voice and Accountability, Political Stability, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption. As a result, key strategies being adopted include: establishing a transparent and accountable government that gives voice to the people and guarantees their welfare, instituting economic policy that guarantees the financial sustainability of each tier of government, rewarding internal revenue generating efforts and promoting co-operation and co-ordination among the tiers of government, and pursuing comprehensive electoral reforms that encourage participatory and development-oriented governance at all levels to promote trust and confidence between the leaders and the citizenry. The Nigerian government literally declared war on economic and financial crimes when it established the Economic and Financial Crimes Commission (EFCC) with the function of investigating all financial crimes including advance fee fraud, money laundering, counterfeiting, illegal charge transfer, commodity future market fraud, fraudulent encashment of negotiable instruments, computer credit card fraud, contract scam and terrorism. The Federal Government demonstrated its resolve to improve Nigeria’s global competitiveness rating and revitalize the economy when it inaugurated the Board of the National Competitiveness Council of Nigeria (Subair, 2013).

The Concept of Forensic Accounting

Forensic accounting is investigative accounting that is about the application of financial skills and investigative mentality to unresolved issues, conducted within the context of the rules of evidence. It is a discipline that encompasses anti-fraud knowledge, financial expertise, a sound understanding of business reality, and the working of the legal system. Forensic accounting is defined as a science dealing with the application of accounting facts gathered through auditing methods and procedures to resolve legal problems. It requires the integration of investigative, accounting, and auditing skills. Forensic accountants draw conclusions, calculate values and identify irregular patterns or suspicious transactions by critically analyzing the financial data. It provides accounting analysis or explanations to the court for dispute resolution. Forensic accounting is a discipline that trains accountants to be anti-corruption vanguards, anti-corporate governance abuses checkmating experts, financial manipulation detectives, and predictors of going concern and fraudulent reporting issues. Forensic accounting is being provided as a course by many educational institutions in different countries of the world (Koh, Arokiasamy, and Suat, 2009; Crumbley, 2008).

Forensic accountants are the detectives of the finance world and they help in investigating fraud and other financial misrepresentations. Forensic accountants enable lawyers, insurance companies and other clients to resolve disputes. They have the ability to communicate financial information clearly and concisely in the courtroom. They are trained to look beyond the numbers and deal with the business realities of situations. Analysis, interpretation, summarization and the presentation of complex financial and business related issues are prominent features of the profession. They possess skills such as problem solving abilities, interpersonal and communication skills, a logical, analytical approach, and the ability to relate legislation to a variety of different situations. Forensic accountants are familiar with legal concepts and procedures. Public practice or insurance companies, banks, police forces and government agencies are the common employers of forensic accountants (Institute of Chartered Accountants of England and Wales, n.d.(a)).

Forensic accounting is a merger of forensic science (application of the laws of nature to the laws of man) and accounting. It is a specialized field of accounting that describes engagements that result from actual or anticipated disputes or litigation. The activities of forensic accountants involve: investigating and analyzing financial evidence; developing computerized applications to assist in the analysis and presentation of financial evidence; communicating their findings in the form of reports, exhibits and collections of documents; and assisting in legal proceedings, including testifying in courts as an expert witness and preparing visual aids to support trial evidence. The increasing sophistication of financial fraud requires that forensic accounting be added to the tools necessary to bring about the successful investigation and prosecution of those individuals involved in criminal activities (Modugu and Ayanduba, 2013).

Typical assignments in forensic accounting border on: Business valuations, Computer forensics. Criminal investigations, Shareholders and partnership disputes, Personal injury claims, Business interruptions and other type of insurance claims e.g. policy reviews, loss calculations, Business/employee fraud investigations which can involve fraud tracing, asset identification and recovery, forensic intelligence gathering and due diligence review, Matrimonial dispute involving the tracing, locating and evaluation of asset, Business economic losses, Professional negligence, to ascertain the breach and quantify the loss involved, and Mediation and arbitration, as a form of alternative dispute resolution (Sadiq, 2007).

A forensic accountant can be of assistance in various ways, including:

Investigative Accounting: Review of the factual situation and provision of suggestions regarding possible courses of action; Assistance with the protection and recovery of assets; Co-ordination of other experts, including: Private investigators, Forensic document examiners, and Consulting engineers; Assistance with the recovery of assets by way of civil action or criminal prosecution.

Litigation Support: Assistance in obtaining documentation necessary to support or refute a claim; Review of the relevant documentation to form an initial assessment of the case and identify areas of loss; Assistance with Examination for Discovery including the formulation of questions to be asked regarding the financial evidence; Attendance at the Examination for Discovery to review the testimony, assist with understanding the financial issues and to formulate additional questions to be asked; Review of the opposing expert’s damages report and reporting on both the strengths and weaknesses of the positions taken; Assistance with settlement discussions and negotiations; and attendance at trial to hear the testimony of the opposing expert and to provide assistance with cross-examination.

Each forensic accounting assignment is unique. So, the actual approach adopted and the procedures performed will be specific to it. However, in general, a typical forensic accounting assignment will include the following steps: Meeting with the client, Performing a conflict check, Performing an initial investigation, Developing an action plan, Obtaining the relevant evidence, Performing the analysis (the actual analysis performed will be dependent upon the nature of the assignment and may involve: calculating economic damages; summarizing a large number of transactions; performing a tracing of assets; performing present value calculations utilizing appropriate discount rates; performing a regression or sensitivity analysis; utilizing a computerized application such as a spread sheet, data base or computer model; and utilizing charts and graphics to explain the analysis) and Preparing the report (Zysman 2004)

Role of Forensic Accountants in Vision 2020 Actualisation via Public Sector Competitiveness

In positioning Nigeria for global competitiveness in the delivery of its vision 2020 goals, the country needs forensic accountants who are able to: investigate and analyze financial evidence; develop computerized applications to assist in the analysis and presentation of financial evidence; communicate their findings in the form of reports, exhibits and collections of documents; assist in legal proceedings, including testifying in court as an expert witness and preparing visual aids to support trial evidence (Institute of Chartered Accountants of England and Wales, n.d.(a)).

For public sector effectiveness and efficiency, accountants are needed to carry out the tasks of: creating financial records and preparing and interpreting statements such as annual reports, managing and communicating financial management information to senior stakeholders, developing profit projections and cash-flow forecasts, and formulating accounting and reporting policies. Due to the fact that accountants are people developed in abilities such as: numerical and analytical skills, excellent communication skills, team-working skills, time management skills, and interpersonal skills, they are always of immense value in making governments and organizations successful in goals delivery (Institute of Chartered Accountants of England and Wales, n.d. (b)).

Forensic accounting offers a solution to the challenge of difficulty in monitoring transactions through manual audit processes which in turn makes the control utility of auditing ineffective. The increasing need for forensic and investigative accounting in Nigeria’s economy e.g. the banking sector, results from the complexities of modern day banking with large volume of complex data. Virtually all the weaknesses and challenges identified in the banking industry in Nigeria’s post-consolidation, and criminal investigations and prosecutions arising from them, are issues for forensic accounting. Forensic accountants are trained to adapt information technology tools to their tasks.

Forensic accounting could be used to reverse the leakages that cause corporate failures in the public sector because a proactive forensic accounting practice seeks out errors, operational vagaries and deviant transactions before they crystallize into fraud. Nigeria’s ability to realize its potentials and emerge as one of the 20 leading global economies in the world by 2020 will require forensic accounting enforcements. Specifically, forensic accountants will be valuable in urgently and immediately addressing the most serious domestic and external constraints to the country’s growth and competitiveness. These constraints that would be addressed include: poor and decaying infrastructure; epileptic power supply; weak fiscal and monetary policy co-ordination; fiscal dominance and its implications for inflation and private sector financing; pervasive rent-seeking behaviour by private and public agents, including corruption; weak institutions and regulatory deficit; policy reversals and lack of follow-through; inordinate dependence on the oil sector for government revenue/expenditure; disconnect between the financial sector and the real sector; high population growth which places undue stress on basic life-sustaining resources and eventually results in diminished well-being and quality of life; insecurity of lives and property; threats of climate change, especially in relation to food production; and vulnerabilities in the global economic environment, in particular, the global economic crisis and disturbances in the international oil market (National Planning Commission, 2010).

If the public sector is free from the clogs of financial fraud, wastefulness, inefficiency, and corruption via forensic accounting policy drives, Nigeria will be able to aggressively pursue a structural transformation of the economy from a mono-product to a diversified and industrialized economy. It will also be able to invest in human capital to transform Nigerian people into active agents for growth and national development. It will also have enough to invest in infrastructure to create an enabling environment for growth, industrial competitiveness and sustainable development. The reality is that all the parameters in the entire Vision 2020 can be achievable by one single agenda of eradicating corruption from Nigeria’s national life (Ekanem, 2009). As long as it is business as usual and the law goes to sleep, and protects those who apply the resources of the nation for private use, Nigeria cannot overcome the traps of poverty and underdevelopment for its people.

Forensic accounting is vital to developing efficient, accountable, transparent and participatory governance, and establishing a competitive business environment characterized by sustained macro-economic stability. Forensic accounting enhances national security and improves the administration of justice. The increasing sophistication of financial fraud requires that forensic accounting be added to the tools necessary to bring about the successful investigation and prosecution of those individuals involved in criminal activities. Forensic accountants are whistle blowers, solution providers to money laundry and cybercrime challenges, as well as catalysts to the growth of inflows in foreign direct investments. Their skills can be relied on for developing a consistent system of Corporate Governance, disseminating such information within and outside institutions, ensuring that governance policies and objectives are interwoven into the internal control system, setting up fraud prevention systems, and investigating any existing fraud. (Shah, 2009; Modugu and Ayanduba, 2013)

Forensic accounting is a catalyst to creating strong, efficient and effective public service institutions. Its entrenchment will create a world-class, professional and incorruptible public service that emphasizes value for money, excellence, discipline, integrity, transparency and loyalty. It will improve public service delivery and promote good governance. Forensic accounting initiatives would strengthen the Nigerian Public Service at all levels in the states of the Federation. Merit will be adopted as the cardinal policy for recruitment and promotion in the public service. Public enterprises such as refineries, power, steel industries, and railways will be privatized while a code of values and ethics for public servants will be introduced to improve morality and conduct in the public service.

Forensic accounting education is a tool to ensuring national security and improving the administration of justice. Internal security has remained a big challenge in Nigeria, as internal conflicts, such as religious, ethnic and economic crises have negatively impacted national development. As vision 2020 seeks to develop a constitutionally independent judicial system that ensures respect for the rule of law and equal access to justice, entrenching forensic accountants as part of law enforcement agencies will improve the ability of law enforcement agencies to respond to national security emergencies will be improved. Thus, all discriminatory laws, policies and practices will be amended to promote a culture of respect for human rights. Forensic accounting will also promote prompt settlement of disputes and ensure timeliness in the trials of criminals.

Forensic accountants are important for driving the legal requirements of vision 2020. The legal requirements are in two areas namely constitutional and legislative. Successful implementation of vision 2020 requires an amendment to the constitution, especially in the areas of Appropriation Framework, and Exclusive and Concurrent lists, while legislative actions will be in the areas of amendment to a number of existing laws that are crucial to the actualization of the policy thrusts of the vision, passage of the pending legislations and enactment of new legislations enabling implementation.

Methodology

A combination of primary and secondary data was used in this work. The research adopted is the survey research design. The survey research design is one in which the sample subjects and the variables that are being studied are simply being observed as they are without making an attempt to control or manipulate them. Primary data were generated from copies of a five-likert scale questionnaire which were distributed to civil servants and their management members i.e. commissioners and permanent secretaries. Secondary data were generated from the internet, books, and journals. The population of study constitutes of various senior and lower level civil servants in the ministries and local government councils in Nigeria. The sampling technique used is the accidental or convenience non-probabilistic sampling method whereby elements are drawn into sample on first come first served basis. This is usually employed where the population size is unknown and is impossible or difficult to determine with accuracy (Ebohon, 2007). The sample size of research is taken from some federal and state ministries and local government councils in Bayelsa state.

Data Analyses

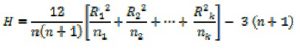

A combination of both qualitative and quantitative descriptive analysis was engaged in this research. Kruskal Wallis, a statistical non-parametric test of whether more than two independent groups differ, was adopted. The procedures for applying Kruskal Wallis involve the formula:

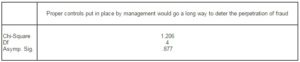

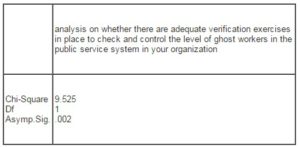

a Kruskal Wallis Test

b Grouping Variable: Analysis of respondents on whether there are ghost workers in the Ministries.

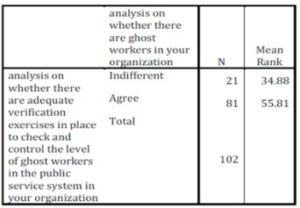

Analysis: Using a level of significance of 0.05 (5%), at a degree of freedom 1, the computed value of the test statistic is 9.525; using the chi-square table, the critical value is 3.84. The result shows that the null hypothesis (H0) should be rejected since the computed value of the test statistic is greater than the critical value. This implies that there are adequate verification exercises in place to check and control the level of ghost workers in the public service.

Findings

From this research, the following findings have been made:

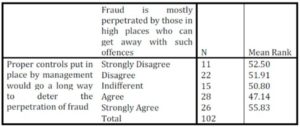

(a)Proper controls put in place by civil service management will go a long way to deter the perpetration of fraud in the various ministries.

(b) Fraud is mostly perpetrated by those in high places who can get away with such offences.

© Proper orientation program was not being administered to civil servants to correct their wrong mentality about the government of the day’s business.

(d) Disciplinary measures taken against those found wanting in the discharge of their duties will serve as a proper deterrence.

(e) There are adequate verification exercises in place to check and control the level of ghost workers in the public service system of respondents’ organizations. This implies that the newly introduced biometric system is efficient and effective.

(f) Regular staff audit conducted from time to time is desirable in the public service.

(g) Staffs are recruited often in the public service organizations.

(h) Regularly exercised staff training and capacity building are desirable in public service institutions.

(i) Concluded biometric exercises will properly deal with the challenge of ghost workers in public sector institutions.

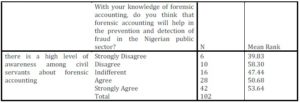

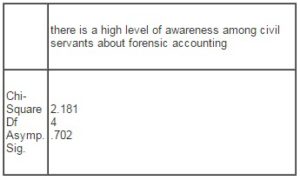

(j) There is a low level of awareness among civil servants about forensic accounting.

(k) There are ghost workers in the civil service sector institutions.

(l) Policies, practices, procedures, reports and other mechanisms developed to monitor activities and safeguard assets, particularly in high-risk areas exist and they are necessary in the civil service.

(m) Forensic accounting will help in the prevention and detection of fraud in the Nigerian public sector.

(n) There are no proper controls put in place by management to deter the perpetration of fraud in the various ministries. This means that if at all there are controls, they are not effective neither are they efficient.

Conclusion and Recommendations

This work has focused on the role of forensic accounting in shaping up Nigeria’s public service sector for global competitiveness towards the implementation and attainment of vision 2020. Most fraud situations are well hidden under the veneer of apparent compliance with procedure and adherence to controls. The public service system has an ineffective due process. Due Process Office is to ensure full compliance with laid down guidelines and procedures for the procurement of capital and minor capital projects as well associated goods and services. Proponents of the idea that government has no business engaging in enterprises outside core governance often hinge their arguments on the fact that, in many public enterprises, it is usually at top management level that loopholes are deliberately created, through which the system could be defrauded. Recent corporate accounting scandals and the resultant outcry for improving transparency and honesty in financial reporting have given rise to two disparate yet logical outcomes. First, forensic accounting skills have become very crucial in untangling the complicated accounting maneuvers that have obfuscated financial statements. Second, public demand for change and subsequent regulatory actions, both in the developed and developing countries, has transformed Corporate Governance scenario. Therefore, the number of corporate officers and directors, who are coming under ethical and legal scrutiny, are increasing year after year. In order for the Nigerian public sector to be able to respond to new development challenges of vision 2020 which require alternative innovative strategies of managing the public service and redefining the role of the state in the development paradigm, the following recommendations have become essential: .

(i)The government should ensure that public sector management puts in place sound controls, enforced by forensic accountants, to deter the perpetration of fraud in the various ministries, departments, and parastatals.

(ii) The Nigerian government should employ or engage, through the expertise of forensic accountants, competent persons who are trained regularly for knowledge expansion and skills development towards vision 2020 successful implementation.

(iii) The government should strengthen the use of forensic accounting institutions and the utilization of their services in public sector. These institutions e.g. EFCC, NDLEA, etc should not only be empowered but be made independent and reputable.

(iv) Civil servants and politicians should be compelled to disclose any conflict of interest resulting or that can result in personal gains. Aligning with the code of ethics and governance in the public sector should be enforced without fear or favour.

(v) Internal control as a process should be properly defined and effected by the management and other personnel in the public sector. Controls should be designed to provide reasonable assurance regarding the achievement of vision 2020 objectives. Those controls should promote efficiency, reduce the risk of asset loss, prevent loopholes for bribery, and ensure the reliability and timeliness of financial statements and compliance with relevant laws and regulations.

(vi) The machinery of government at all levels should be strengthened with forensic accounting equipments desirable to ensure that all tiers of government have the ability to carry out the programmes and projects contained in the vision 2020 agenda.

(vii) More specifically, forensic accountants should be engaged in: translating vision 2020 objectives and outcomes into specific programmes and projects to which adequate resources will be allocated; measuring implementation and evaluating regularly against the vision 2020 goals to ensure that the desired objectives are being achieved; setting priorities – making sure that the most important things are done first; setting targets – deciding on the things that needs to be achieved and when they would be achieved; monitoring of the programmes and projects and generating reports made available to the public on a regular basis for further inputs.

(viii) The Institute of Chartered Accountants of Nigeria, Association of National Accountants of Nigeria, the National Universities Commission, and other educational/professional bodies should encourage formalization and specialization in the field of forensic accounting education in Nigeria.

(ix) The government should stimulate interest in forensic accounting for the monitoring and investigation of suspected corruption cases as they could derail vision 2020 attainment. The legal system should be strengthened with forensic accountants and special courts.

(x) Critical policy priorities of Nigeria’s vision 2020 should be vigorously pursued with forensic accounting emphasis in the public sector.

(xi) Forensic accounting education should be promoted amongst the populace in order to remove

apathetic, uninterested or gullible spirits that make the populace fail to give adequate attention to

political processes.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Adedokun, N. (2013), The Mirage Called Vision 2020. [Online]. [Retrieved September 13, 2013],

http://odili.net/news/source/2013/sep/13/819.html

2. Andy, F.(2005). Discovering Statistics Using SPSS. Second Edition. London EC1Y 1SP: Sage

Publication Ltd.

3. Crumbley, D. L (2008). Forensic and Investigative Accounting. [Online]. [Retrieved September 11,

2013], http://www.rtedwards.com/journal/JFA/students

4. Ebohon, A. F. (2007). Business Research and Techniques for Data Analysis. Lagos, Iju – Ishaga,

Agege:Adextech Nig. Ltd.

5. Ekanem, E. (2009), Eradicating Corruption can make Vision 2020 Realizable-Cleric. [Online]. [Retrieved September 12, 2013], http://www.vanguardngr.com/2009/10/eradicating-corruption-can-make-vision-2020-realisable-cleric/#sthash.vzFtXDH4.

dpuf

6. Ehwarieme, W. (2010), Politics and the Competitiveness of the Nigerian Economy. [Online]. [Retrieved September 12, 2013], http://www.krepublishers.com/02-Journals/JSS/JSS-23-0-000-10-Web/JSS-23-1-000-10-Abst-PDF/JSS-23-1-039-10-934-

Ehwarieme-W/JSS-23-1-039-10-934-Ehwarieme-W-Tt.pdf

Google Scholar

7. El-Rufa’i M. N. A. (2006), The Public Service Nigeria Needs. [Online]. [Retrieved September 10, 2013], http//:www.bpsr.gov.ng/cnt/publications

8. Institute of Chartered Accountants of England and Wales (n.d.(a)), A Career in Forensic Accounting. [Online]. [Retrieved September 11, 2013], http://careers.icaew.com/university-students-graduates/careers-and-salary/forensic-accounting

9. Institute of Chartered Accountants of England and Wales (n.d. (b)), A Career in the Public Sector. [Online]. [Retrieved September 11, 2013], http://careers.icaew.com/university-studentsgraduates/careers-and-salary/Public-sector

10. Koh, A.N. Arokiasamy, L. and Suat, C.L. (2009), ‘Forensic Accounting: Public Acceptance Towards Occurrence of Fraud Detection’. International Journal of Business and Management, Vol 4, No 11, November. [Online]. [Retrieved September 13, 2013], www.ccsenet.org/journal.html

11. Modugu, K.P. and Ayanduba, J.O. (2013), ‘Forensic Accounting and Financial Fraud in Nigeria: An Empirical Approach’. International Journal of Business and Social Science, Vol 4, No 7, July. [Online].

[Retrieved September 14, 2013],

http://www.ijbssnet.com/journals/Vol_4_No_8_Special_Issue_July_2013/28.pdf

Google Scholar

12. National Planning Commission (2010), Nigeria Vision 20:2020. [Online]. [Retrieved September 13, 2013], http://www.npc.gov.ng/vault/Abridged_Version_of_Vision2020.pdf

13. Sadiq, K.A. (2007), The Relevance of Forensic Accounting to Financial Crimes in Private and

Public Sectors of Third World Economies: A Study from Nigeria. [Online]. [Retrieved September 03, 2013], http://unilorin.edu.ng/publications/kasumas/Forensic%20Accounting%20pdf.pdf

14. Shah, N. P. (2009), Corporate Governance and Role of the Forensic Accountants. [Online].

[Retrieved September 03, 2013], http://www.lawyersclubindia.com/articles

15. Subair, G. (2013), Federal Government set to boost Global Competitiveness in Nigeria. [Online]. [Retrieved September 11, 2013], http://tribune.com.ng/news2013/index.php/en/businesspackage/2012-10-29-11-35-35/tribune-business/item/4684-

fg-set-to-boost-global-competitiveness-in-nigeria.html

16. Suleiman, S. (2009), Nigeria: Why the Public Sector is Inefficient. [Online]. [Retrieved September 04, 2013], http://www.nigeriavillagesquare.com/articles/salisusuleiman

17. Zysman, A. (2004). ‘Forensic Accounting Demystified’. World Investigators Network. [Online].

[Retrieved September 04, 2013], http://www.forengtvfbsicaccounting.com