Introduction

The development of an economy depends on the level to which people interact and are interconnected. This interconnectedness is one of the main factors responsible for the volume of economic activities, which in turn fuels further interconnectedness (Janita and Miranda, 2013; Farhadi, Islam, and Moslehi, 2015). The advent of the internet led to the amplification of interconnectedness among people beyond geographical boundaries. This further strengthened the level of economic activities, which increased the volume of production, transactions, income and wealth (Bianchi and Matthews, 2015). However, it is not only people that are getting more interconnected as a result of the internet; products are also being exchanged and things are also getting more interconnected as a result of the internet. This interconnectedness of things is what is referred to as the internet of things (IoT).

IoT simply can be defined as the interconnectedness of physical objects as a result of their ability to sense and communicate by sending and receiving messages among themselves. There are many merits accrued to the IoT. It is expected to facilitate wealth creation and drive economics of resources to minimize waste and promote efficiency, the same way interconnectedness among people fuels economic activities, increases the volume of transactions and increases wealth (Manyika and Roxburgh, 2011; Michailidis, Partalidou, Nastis, Papadaki-Klavdianou, and Charatsari, 2011; Javalgi, Todd, Johnston, and Granot, 2012). The question is, how ready are developing economies to adopt the IoT? This is a question that requires attention, not because of the readiness to adopt IoT per se, but on how to identify and measure the readiness of developing economies to adopt IoT. This is vital because being able to measure the readiness of developing economies to adopt IoT exposes gaps that need to evolve policy options to bridge the gaps identified.

This study, therefore, aims to assess the IoT adoption readiness of African economies. This will be useful to guide policy makers, make governments more accountable as well as enlarge and exploit the economic opportunities of such economies.

Assessing the IoT Adoption Readiness of Sub-Saharan Africa

An overview of relevant factors to consider in order to examine IoT adoption readiness is presented in this section. This is done by using relevant indices that capture vital components of IoT. These elements include: ICT skills, ICT infrastructure, ICT education, favourable institutions, sophisticated markets, competitiveness and enabling environment. The indices used include Network Readiness Index, ICT Development Index, Global Innovation Index, Global Competitiveness Index and Knowledge Economic Index (KEI). A previous work (Atayero, 2015) established the direct correlation between KEI and ICT education. Using these indices, the regions of the world were examined, including Sub-Saharan Africa (SSA). The paper identifies the top ten performing countries in each region for each of the indices.

The assessment begins with the Network Ready Index (NRI) developed by the World Economic Forum (WEF). This index encapsulates ICT infrastructure, its affordability, availability of skills for its usage, its actual usage, the environment (institutional and economic) required to facilitate its operation as well as the overall impact on the society and the economy at large. Hence, from the index, we can deduce the level of readiness of countries to adopt the IoT. The NRI index is a good parameter for assessing the extent of IoT adoption readiness since, the IoT leverages on interconnectedness of things.

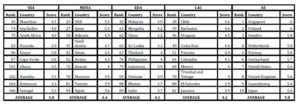

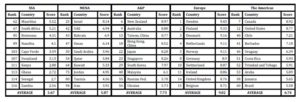

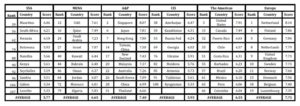

Table 1 captures the regions including Sub-Saharan Africa (SSA), Middle East and North Africa (MENA), Emerging and Developing Asia, Latin America and the Caribbean (LAC) and Advanced economies. Specifically, this study examines the readiness of SSA. Thus, the region is examined relatively by using other regions as benchmarks. The top ten network ready countries, globally, are categorized as advanced economies. These countries scored 5.75 points, on the average, out of 10 points. This clearly indicates a high degree of network readiness for such countries, making it conducive for IoT to be adopted in such countries. LAC, Emerging and Developing Asia, MENA and SSA, on the average scored, 4.24, 4.06, 4.42, and 3.77 points respectively. This shows that SSA is the least-performing region and the region least network ready. More so, it indicates that SSA is not as ready as other regions for the adoption of IoT.

Table 1: Top 10 Network Ready Countries per Region

Source: World Economic Forum (2015). Network Readiness Index

Note: “Average” connotes the average of the top ten per region.

SSA: Sub-Saharan Africa

MENA: Middle East and North Africa

EDA: Emerging and Developing Asia

LAC: Latin America and the Caribbean

AE: Advanced Economies

MENA, on the average, performed better than LAC and emerging and developing Asia.

In order to ascertain the IoT adoption readiness of African countries and to validate the postulations derived from the presentation from Table 1, the level of ICT development of some SSA countries was examined. This was done using the ICT Development Index (IDI) developed by the International Telecommunication Union (ITU). This index captures the readiness of economies to be ICT-driven as well as the intensity of ICT use. This is done by assessing available networked infrastructure and access to ICT. In addition, it assesses the level of skill capacity required to use ICT and the overall impact of the use, intensity and skill capacity for ICT. These are relevant measures that will help provide guidance for assessing the readiness for IoT adoption, particularly for developing economies.

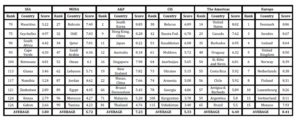

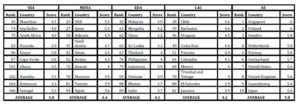

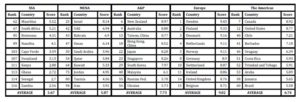

Table 2 presents the ICT development performance of various regions. This is done by capturing the top 10 performing countries in each region according to the index. Out of 10 points SSA, MENA, Asia and the Pacific, Commonwealth of Independent States (CIS), the Americas and Europe scored 3.80, 5.72, 7.23, 5.33, 6.40, and 8.41 points respectively. The scores reflect that Europe is the most ICT-developed region while SSA is the least ICT-developed region. All the regions, except SSA, exceeded the middle point of the total score. SSA’s performance, as revealed by the IDI, reveals that it is not as ready as the other regions for the adoption of IoT given the significant role ICT plays in facilitating IoT. Mauritius, however, exceeded the total average mark. Nigeria, the most populous nation in the region, also did not feature in among the top ten on the list. This is a warning signal for policy makers to investigate the quality, level and composition of human capital in the country. The non-appearance of the country among the top ten in SSA in Tables 1 and 2 could be as a result of the poor quality of the people, the process of human capital development as well as the few opportunities made available for freedom of enterprise and innovation. It also indicates the presence of unfavourable institutional environment.

Table 2: Top 10 ICT Developed Countries per Region

Source: International Telecommunication Union (2014). ICT Development Index

Note: “Average” connotes the average of the top ten per region.

SSA: Sub-Saharan Africa

MENA: Middle East and North Africa

A&P: Asia and the Pacific

CIS: Commonwealth of Independent States

The NRI and the IDI have validated that SSA is the least ready for the adoption of IoT out of all the regions. This assertion, however, may not be substantially adequate given that these two indices did not capture the level of innovation and competitiveness. The level of innovation will help reveal the creative capabilities of economies to proffer solutions; and such solutions could trigger the need to network readiness, ICT development and, ultimately, IoT adoption readiness. The level of competitiveness is also necessary to assess the aggressiveness of economies and find out whether they are factor-driven economies or innovation-driven economies. If an economy is mainly factor-driven, it suggests that they are still natural resource-driven and possibly still depend less on ICT to boost outcomes. On the other hand, an innovation-driven economy depends largely on highly-skilled human capital coupled with ICT for its growth and development. We, therefore, employed the Global Innovation Index (GII) and the Global Competitiveness Index for this examination.

The Global Innovation Index is an index that captures innovation outcomes as well as the enabling factors that facilitate the delivery of such outcomes. These enabling factors include the institutional environment for innovation to thrive, the level of human capital intensity, infrastructure, the degree of competition, freedom of enterprise, availability of and access to investment funds, and the extent to which businesses are knowledge-driven. This index will, therefore, grant an economic perspective to guide the process of judging IoT adoption readiness for developing economies, particularly SSA.

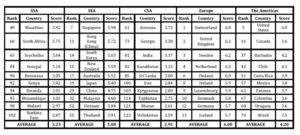

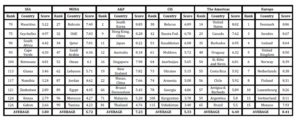

Table 3 shows the top 10 innovative countries per region according to the GII. On the average, SSA, South East Asia (SEA), Central and Southern Asia (CSA), Europe and the Americas ranked 3.23, 5.08, 2.91, 6.00, and 4.20 points respectively out of 10 points. The average ranking for the regions presented indicated that CSA is the least innovative region. SSA outperformed it by 0.32 point. This is not to conclude that SSA is competitive enough. The presentation in Table 3 shows that the region as well as the Americas scored below the average. Mauritius, which was ranked first in the SSA region, also scored below average. Moreover, Nigeria, which is termed one of the largest economies in the region as well as the most populous nation in the region, did not feature among the top 10 competitive nations in the region. Europe ranked as the most innovative region with a score of 6.00 points out of ten. Moreover, 80 percent of the top ten innovative countries in the world, according to the GII, are European countries. This is an indication of a high degree of innovation capacity in the region. SEA, made of some of Asian tigers, ranked the second best region. Economies such as South Korea and Singapore, which used to be developing economies are currently considered advanced and developed economies. The 1999 World Development Report shows that these two countries were economically at the same position as Nigeria in the early 1960s (World Bank, 1999). However, commitments to development endeavours have widened the gap between them.

Table 3: Top 10 Innovative Countries per Region

Source: Cornell University, INSEAD and World Intellectual Property Organization (2015). The Global Innovation Index

Note: “Average” connotes the average of the top ten per region.

SSA: Sub-Saharan Africa

SEA: South East Asia

CSA: Central and Southern Asia

IoT adoption demands that economies are innovation-driven for its easy adoption. The outcomes from the results give signals of the inadequacy of SSA’s preparedness to adopt IoT. Nonetheless, it is vital to assess the level of competitiveness so as to examine further economic capabilities of SSA in relation to other regions. The Global Competitive Index is used for this assessment.

The Global Competitive Index (GCI) is an index that captures the basic requirements for facilitating competitiveness, the factors that facilitate efficiency in competitiveness and innovation. The basic requirements for facilitating competitiveness include strong institutions that enable freedom of enterprise, competitiveness and protection of intellectual property rights. They also include infrastructure (physical and social) as well as sound macroeconomic environment. Factors that facilitate efficiency in competitiveness include higher levels of education coupled with market opportunities as well as technological readiness. Innovation as a component of the GCI is also relevant to encapsulate the degree of business and market sophistication. Hence, it is a comprehensive index for assessing the level of competitiveness, which is a guide for assessing the degree of IoT adoption readiness.

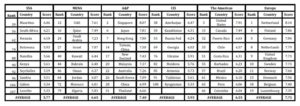

Table 4 shows the top 10 competitive economies per region represented in the table. On the average, SSA, MENA, Asia and Pacific, CIS, the Americas and Europe scored 5.77, 6.65, 7.40, 5.93, 6.55 and 7.71 points respectively out of 10 points. All the regions represented, thus, performed above the average of 5.00 points. However, SSA still ranked as the least competitive region. This indicates that it may be the least considered place to invest for the purpose of innovation, creativity and enterprise. Foreign investments into the region will mainly be driven by the size of the market rather than the availability of highly-skilled and competitive workforce.

Table 4: Top 10 Competitive Economies per Region

Source: World Economic Forum (2014). Global Competitive Index

Note: “Average” connotes the average of the top ten per region.

SSA: Sub-Saharan Africa

MENA: Middle East and North Africa

A&P: Asia and the Pacific

CIS: Commonwealth of Independent States

The performance of SSA examined so far indicates that SSA is short of the institutional strength and infrastructural capacity to adopt IoT. However, we chose not to be conclusive before examining the Knowledge economy status of SSA in relation to other economies. Checking this will give insight into what economies in the region are depending on for economic sustenance—innovation or resources. Knowledge economy is a concept that encapsulates the human capital capacity, innovation system, ICT infrastructure, institutional frameworks and economic incentives of an economy. In order to measure these, the World Bank (2008) has come up with the Knowledge Economy Index (KEI) in order to capture the knowledge economy capacity and readiness of economies. This index will, thus, be a pointer to the knowledge economy readiness of economies; it is also useful for validating previous findings as presented in Tables 1 to 4.

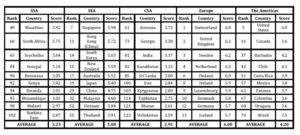

Table 5 is a presentation of the topmost knowledge-driven economies per region examined. SSA, MENA, Asia and Pacific, Europe and the Americas scored 3.67, 5.87, 7.73, 9.02, and 6.74 points respectively, on the average, out of 10 points. Europe ranked again as the best having seven countries on the top ten global KEI ranking. This is a reflection that the majority of economies in Europe are knowledge-driven economies, thus, are better prepared to adopt IoT as a means to engage their economy for greater prosperity. SSA ranked again as the least performing region indicating that it is less knowledge-driven compared to other regions. This is not far-fetched since most economies in the region still depend on trading unrefined products for economic sustainability. Lack of focus on manufacturing, R&D and innovation related enterprises have not enabled the economies in the region to consider significantly investing in highly-skilled human capital and engaging them optimally for the creation on highly competitive knowledge products. Nigeria did not also feature among the top ten countries in SSA in Table 5, despite its reputation for having the largest population and economy in the region.

Table 5: Top 10 Knowledge-Driven Economies per Region

Source: World Bank (2012). Knowledge Economy Index

Note: “Average” connotes the average of the top ten per region.

SSA: Sub-Saharan Africa

MENA: Middle East and North Africa

A&P: Asia and the Pacific

Given the outcomes of these results, is SSA ready to adopt IoT? It is pertinent to ask this question given the extent to which SSA economies are utilizing ICT infrastructure and using it to deliver basic and essential services inclusively and affordably. In addition, SSA was discovered to be the fastest growing in terms of mobile-broadband penetration (International Telecommunication Union, 2014). The region enjoyed broadband growth up to 20 percent in 2014 from 2 percent in 2010. These are other signals that need to be considered to explore more deeply SSA’s IoT adoption readiness. Moreover, the indices used for the assessments in this study may not be adequate enough to conclude that SSA is not ready to adopt IoT. This is why the advancement stage of this study aims at developing an index that effectively captures the IoT readiness of developing economies, particularly those in SSA.

Conclusion

This study has helped to assess the IoT adoption readiness of SSA using NRI, IDI, GII, GCI and KEI. This was done by examining the top ten performing countries in SSA in relation to the top ten in other regions for each of the indices. Overall, the SSA region is seen to be lagging behind in all the indices used except for GII. It is also observed that Nigeria, which is reputed to be the largest economy and the most populous in the region, did not feature among the top ten performing countries in SSA for all the indices employed in this study. This clearly indicates that the region demands strong institutions that can drive the increase in high level human capital, installation of adequate ICT infrastructure, innovations that facilitate the delivery of affordable services and a market that promotes competitiveness.

This study, however, is not conclusive. An index that better captures, holistically, the IoT readiness of SSA countries needs to be developed. Given that SSA has been discovered to be the fastest growing market for mobile technology, there is a need to ascertain where the region is headed. This is why an index that puts this, and other relevant factors, into consideration is suggested.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Atayero, A. (2015). The Relationship Between ICT Education and Knowledge Economy in Africa. Proc. 2nd ICADI, DOI: 10.13140/RG.2.1.4536.3367, http://bit.ly/1WHB4d7

Google Scholar

2. Bianchi, C., & Matthews, S. (2015). Internet Marketing and Export Market Growth in Chile. Journal of Business Research, doi:10.1016/j.jbusres.2015.06.048.

3. Cornell University, INSEAD and WIPO. (2015). The Global Innovation Index. Geneva: World Intellectual Property Organization.

4. Farhadi, M., Islam, R., & Moslehi, S. (2015). Economic Freedom and Productivity Growth in Resource-rich Economies. World Development, 72: 109-126.

Publisher – Google Scholar

5. International Telecommunication Union. (2014). ICT Facts and Figures. Geneva: International Telecommunication Union.

6. International Telecommunication Union. (2014). Measuring the Information Society Report. Geneva: ITU.

7. Janita, S. M., & Miranda, J. F. (2013). The Antecedents of Client Loyalty in Business to Business (B@B) Electronic Marketplaces. Industrial Marketing Management, 42(5): 814-823.

Publisher – Google Scholar

8. Javalgi, R. G., Todd, P. R., Johnston, W. J., & Granot, E. (2012). Entrepreneurship, Muddling through, and Indian Internet-enabled SMEs. Journal of Business Research, 65(6): 740-744.

Publisher – Google Scholar

9. Manyika, J., & Roxburgh, C. (2011). The Great Transformer: The Impact of the Internet on Economic Growth and Prosperity. McKinsey Global Institute.

Google scholar

10. Michailidis, A., Partalidou, M., Nastis, S., Papadaki-Klavdianou, A., & Charatsari, C. (2011). Who goes Online? Evidence of Internet Use Patterns from Rural Greece. Telecommunications Policy, 35(4): 333-343.

Publisher – Google Scholar

11. World Bank. (1999). Knowledge for Development. World Bank.

12. World Bank. (2008). Knowledge Economy index. Washington D.C.: World Bank Knowledge Assessment Methodology.

World Bank. (2012). Knowledge Economy Index Ranking. http://siteresources.worldbank.org/INTUNIKAM/Resources/2012.pdf: World Bank.

14. World Economic Forum. (2014). The Global Competitiveness Report. Geneva: World Economic Forum.

15. World Economic Forum. (2015). The Global Information Technology Report. Geneva: WEF-INSEAD.