Introduction

Microfinance is a development tool used to create access for the economically active poor to financial services at a sustainably affordable price. The issue of micro financing was hitherto understood only in terms of working capital. Akande (2012) found in his study that performance of women entrepreneurs did not improve significantly due to high interest rates and short repayment periods. The poor, fundamentally lack elementary skills and entrepreneurship ability to initiate and manage business concern. Micro financing includes various programmes and processes through which the productive capacity of the poor is improved. Sundry assistance and empowerment strategies for the poor include assistance giving to small firms, public investments in rural infrastructure, health facilities, schools and the like geared towards alleviating poverty may be regarded as essential aspects of microfinance, (Federal Government-CBN,2005). Human capital is the productive efforts of an organization workforce. Performance of employees helps implements the firm’s strategies.

Human capital training and development are basically the same. It takes human capital to organize and rationalize the contributions of other factors of production before a result oriented productive goal can be achieve in any industrial setting. Therefore human capital development is about supporting investing in human capital, coaching, training, internship and human capital management. Efforts to make human capital acceptable as costs in organization have not been totally recognized.

The human resources costs are usually written off to the profit and loss account and expenses in the books of the company rather than creating value for human capital and accounting for them in the balance sheet of the company as done in the case of physical assets like lands, machineries, equipments and financial assets like ordinary shares, treasury bills and debentures. The issue of who is responsible for the effective use of all other resources in the business (Akindele, 2007) has been on the front burner. Human resources being the traditional name for human skills used in the organization over the years have remained less valued and recognized in the literature of the accounting professions. To bring value to human resources is to redescribe it as human capital.

Human capital gives rise to Human Capital Assets whose value is significant to the organizations. Baker (2003), opined that, human capital asset (HCA) brings out the investment in human capital. How do will evaluate the value attributable to human capital? How do we evaluate and account for the total amount of human capital to be capitalized? There has always been the problem of huge human capital value, which is conventionally being applied in reducing the profit of Micro-Finance Bank (MFB) and by implication; result is huge loss to organizations. Most firms have had to cut down the cost of human capital to ensure survival; huge human capital cost is always a threat to the survival of firms and also a threat to the liquidity of banks and other businesses. Human capital development presupposes investments, activities and processes that produce vocational and technical education knowledge, skills, health or values that are embodied in people. It implies building an appropriate balance and critical mass of human resource base and providing an enabling environment for all individuals to be fully engaged and contribute to goals of an organization or a nation.

Wagner (2007) posited that human capital (people and teams) is one of the intangible assets that investors look for in valuing a company, along with structural capital (processes, information systems, patents) and relational capital (links with customers, suppliers, and other stakeholders). He concludes that annual reports now overemphasize the role of relationship capital in company performance and minimize the role of human capital, giving a skewed view of companies’ future performance. According to Tang (2005), HRA is basically an information system that tells management what changes are occurring over time to the human resources of the organization. It is an attempt to identify, quantify and report investment made in human resources of an organization that are not presently accounted for under conventional accounting practice.

Patra, Khatik and Kolhe (2003) examined the correlation between the total human resources and personnel expenses for their fitness and impact on production. They found that HRA valuation was important for decision making in order to achieve the organization’s objectives and improve output. Organizations invest in human development, only for the human capital to leave the organization for greener pastures within a short period. The economic loss to such firm impact negatively and heavily on its performance, survival and growth. The incessant turnover of trained and talented personnel of the firm that could have been retained by organization and represented in the balance sheet of firms cannot be overlooked. There is the problem of a one-time huge investment in human capital that brings Microfinance Banks (MFB) to long time loss if not treated adequately.

There is also the issue of concept compatibility through the practice of expending huge human capital cost and the growing idea of capitalizing human capital development as intangible asset. Performance is essentially what an employee does or does not do. Performances of employees affect the contributions to the organization in areas such as Quantity of output, Timeliness of output, Presence at work, Cooperativeness. Obviously other dimensions of performance might be appropriate in certain jobs, but those listed are common to most. Each job has criteria or job performance dimensions that identify the elements most important in that job. Jobs always have more than one job criterion or dimensions. In many other jobs, multiple job criteria are the rule rather than the exception, and it follows that a given employee might be better at one job criterion than at another. In some universities, a college professor’s teaching might be a bigger part of the job than research or service. In Financial services industry the performance of a banker may be measure by his ability to win high net worth customers to the bank.The investments by companies in human capital development are normally not reflected in their balance sheets but expensed in the profit and loss accounts (Okpala and Chidi, 2010; Micah, Ofurun and Ihendinihu, 2012). Some of the companies that have invested heavily in human resources and have applied human resources accounting in one way or the other in Nigeria include Unilever Plc, Nigeria Breweries, Guinness Nigeria Plc, Nestle Foods Nigeria Plc, Access Bank, Zenith Plc, Guaranty Trust Bank Plc, First Bank Plc, United Bank of Africa amongst others. The basic objective of this study is to evaluate the effects of Human Capital Development cost on the organization activities.

Human capital is the knowledge and know-how that can be converted into value. Human capital consists of know-how education, vocational qualifications, training, trading programs, union activity compensation plan and shares options scheme. Intellectual capital is classified items into three categories namely; internal, external and human capital. Internal capital is the knowledge that has been captured or institutionalized within the structure, processes and culture of the firm. Internal capital includes items such as patents, trademarks, and copyright. External capital is the perception of value obtained by a customer from doing business with a supplier of goods or services. External capital includes items such as brands, market shares, customer satisfaction and loyalty, business collaborations, franchising and licensing agreement while human capital gives rise to human capital assets.

The hypotheses to be tested in null form state that: (i) Human capital development value does not have positive effect on the Microfinance banks’ performances (ii) Staff training and development has no significant effects on the performance of microfinance banks. This study is justified because of failure of professional accountants to treat human resources as an asset reveals the non significance roles given to the managers of businesses. This also attracted the attention of the academics and societies generally that the concept of human resources accounting should be an important issue to be treated as assets in the books of organization by reflecting them in the balance sheet. Some of the research questions to be answered in this study are: What is the effect of human capital development value on the micro finance banks’ performances in Ogun State? What is the impact of human capital value on the return maximization effort of the Micro Finance Banks?

This study is carried out by a case study of Microfinance banks in Ogun state in Nigeria to empirically provide insights into investment in human capital and performance.The study is divided into five sections. Section one above presents the introduction. Section two reviews the existing literature. Section three shows methodology adopted for the study. Section four presents the data analysis and interpretation of results while Section five which is the last part deals with the finding, conclusion, and recommendations for policy decisions.

Literature Review

Weak financial capacities, poor understanding of the microfinance concept and the methodology for delivering MF services, Misfit Human Resources among others of microfinance banks have proved to be the major reason for early liquidation as evidenced by the closing down of the 103 Micro Finance Banks (MFBs) in 2009 (Federal Government, CBN Financial Report, 2009). The MFBs are faced with numerous challenges such as operating like deposit money banks with flamboyance, fleet of branded cars and high expenditure profile. In 2008/09, global financial turbulence revealed weak capitalization, poor corporate governance and insider abuse, incompetence and ineffective oversight of the board, poor risk management and internal controls, as well as dearth of on-lending/external funding among others (Federal Government, CBN Financial Report, 2009).

The CBN/NDIC Joint Target Examination carried out investigation on 820 MFBs in operation in 2009 to determine capital adequacy, liquidity, level of non-performing loans and general financial health of MFBs with the aim of forestalling the contagion, removing bad apples and avoiding total contamination of the industry. Two hundred and Twenty-Four (224) ‘Terminally Distressed’ and ‘Technically Insolvent’ MFBs had their licenses revoked. 121 MFBs that subsequently injected fresh capital were granted provisional approvals for new licenses, subject to meeting specified conditions within three months, while the remaining 103 MFBs were under liquidation. Consequently, the CBN establish the Microfinance Certification Programme (MCP) as a result of which 25 Microfinance Training Service (MTSPs) were accredited in 2009; 1,960 MFB operators were trained and were involved in the CIBN Certification Examination (Level I) in 2010 and later wrote Level II Training and Examinations. Investment in training of human resource in an organization is an activity that develops the worker’s capacity to improve efficiency and job quality, therefore, the enterprise increases its profitability. Training expenses are related to jobs and profession evolution, improvements in global services, and innovation or change in projects. Expenses derived from creative training are considered long-term because they increase the firm’s added value. In other words, with creative training, the firm-becomes more competitive and increases its income.

Investment in training human resource in an organization include increased job satisfaction and morale among employees, increased employee motivation, increased efficiencies in processes, resulting in financial gain, increased capacity to adopt new technologies and methods, increased innovation in strategies and products, reduced employee turnover, enhanced company image e.g. conducting ethics training, training, risk management e.g. training about sexual harassment, diversity training. A detailed exposition of human capital development practices in Singapore was undertaken by Lall (1999) and Kurvilla, Erickson and Hwang (2001). In Singapore the government has taken the initiative in human capital development, investing heavily in creating high-level skills to drive upgrade the industrial structure. The tertiary education system was expanded and directed towards the needs of national industrial policy. The government emphasized specialization at the tertiary level, changing focus from social studies to technology and science oriented fields. To achieve this, the government exercised tight control of curriculum content and quality, and ensured its relevance to national industrial objectives.

In Indian, 70 percent of the population depends on rural income and agriculture, has brought to light the need to develop the competencies of the rural population to enhance their longevity, productivity and reduce poverty (Rao, 2004). Over the past 10 years, the share of employment in agriculture has been decreasing with rural-urban migration, while the service sector has experienced large employment gains. However, with the an estimated 12.8 million labor market entrants each year, employment growth in urban areas is insufficient to absorb the influx of largely unskilled workers (ILC, 2008). Investment by firms in human resources by acquisition and training will lead to anticipating a future generation of profits and services that will be produced by these assets. Investment in human capital is considered in the writing of Adams as the nature and causal aspects of industrial growth. Human resource accounting as an approach is designed to measure and communicate information about human resource in order to facilitate effective management within an organization. Likert (1967) argued that accountants have failed to deal with the human element in organizations as an asset and have consistently omitted it in corporate balance sheets as indicated by large difference between market values and book values of the owner equity in many corporations. He opined that managers take imprudent decision due to lack of information about human assets irrespective of laudable vision and mission statements, the underlining purpose of the organization is to make profit.

Empirical research cites several limitations imposed by traditional accounting system in reporting human and intellectual capital. This includes the writing off of intellectual and human assets to expenses in the income statement. (Backhuijs et al 1999, Lev et al 1999) have demonstrated that it leads to systematic under valuation and relatively adverse liquidity of firms. These weaknesses are responsible for giving rise to part of the gap between market value and the net book value. In South Africa, the existing system of training and education is fraught with divisions and inequalities as a result of the country’s history of apartheid (Christie, 1996). The origins of the skills policy is “intricately linked to our history as an Apartheid state, the legacy this presented in the labor market and the efforts of post-1994 to ameliorate the inequities of “Bantu” education” (Daniels, 2007: 1).

The training and workforce development system in South Africa has evolved to address acute shortages in professional and business skills, ignoring the importance of foundation and core skills of work to the development of human capital across ethnic and racial lines (Kraak, 2005). The transition from primary sector employment in 1994 (mining and agriculture) to the technologically driven tertiary (service) sector over the last 20 years has led directly to structural unemployment. Individuals, who worked in the primary sector, cannot obtain jobs in the new economic hub (service sector) because they lack required skills. Thus you have in South Africa a large demand for highly trained technologically savvy workers, coupled with an oversupply of unskilled and low-skilled workers. This has led to a mismatch between labor demand and supply characteristic of state-driven Human Capital Development (HCD) strategies (Daniels, 2007). The policy response to this skills crisis led to the enactment of the Skills Development Act (SDA) of 1998. Okafor (2009), Kumshe (2012) and Mohammed and Aminu (2012) argued that human resource should be expense in the financial statement but they contended that human resource is difficult to account for because of the different models of calculating human resource investment in an organization. Sveiby (1997) opined that companies acquire human resources to generate future revenues, and therefore human resources need to be considered as an asset and not as variable costs. Syed (2009) examined the relationship between corporate characteristics and human resources accounting disclosure and concluded that companies with higher profitability disclose more human accounting information. Enofe, Mgbame, Otuya and Ovie (2013) found that a positive relationship exists between the financial performance of a company and its level of Human Resource Accounting Disclosure.

The study also indicates that financial companies are disclosing human resources accounting information more than non financial companies and that company’s profitability influences companies to report the human resources accounting information in their annual report. Okpala and Chidi (2010) posit that corporate success depends on the ability and knowledge of human capital that are able to drive organization and adapt to technological changes leading to attainment of organization goals and objectives. Kirfi and Abdullahi (2012), opined that lack of human resource as an asset have significantly discouraged the use of any or a combination of measurement technique (s) in quantifying human resources let alone reporting it in Nigeria. In another perspective, Bassey and Tarpang (2012) investigated the influence of expensed human resourced cost (HRC) on corporate productivity and found that expensed human resources (remuneration, protection and dismissal/compensation) costs are important determinants of expensed human resources cost and does significantly influence corporate productivity.

Methodology

The study was carried out in Ogun State. The state was created in 1976 with the capital in Abeokuta. Ogun State is located in the South West of Nigeria with a population of Three million seven hundred and twenty eight thousand and ninety eight citizens (3,728,098), (National bureau of statistics 2006 national population census). This population is expected to have grown to (4,218,001) as at 2011, given the annual growth rate of twenty five percent (25%). The state has 20 Local Government Areas and predominantly populated by the Yorubas with the Eguns in the minority. The state is broadly classified along four ethnic/ dialect nationalities namely: The Egbas, Ijebus, Remos and Yewas. The total population for this study consists of the forty eight (48) Micro Finance banks that are spread across the state. In order to achieve the research objective and ensures the collection of representative data, the state was divided into four, namely Egba, Ijebu Remo and Yewa Divisions. Structured questionnaires was used elicit information from respondents. Four microfinance banks were sampled in each of the four divisions using judgmental sampling technique based on the possibility of being able to collect the required data from the chosen microfinance bank. The researcher however, ensured a wide geographical spread of the selected microfinance banks within each of the division to ensure that collection of a representative sample. This produced a total sample of 16 banks chosen out of a total of 48 microfinance banks in the state. Krejcie & Morgan (1970) in Amadi (2005) agrees with the sample as they proposed the population proportion of 0.05 as adequate to provide the maximum sample size required for generalization. A total of 350 questionnaires were distributed among the 16 selected banks cutting across the top executives, middle level managers, lower level workers; the directors and the shareholders. A total of 320 questionnaires were finally adjudged good enough for the purpose of analysis after evaluating the quality of responses of the respondents to the questionnaires. Secondary data were collected from already published works, collated figures and facts from Central Bank, financial journals, newspaper articles relating to micro finance banks, and annual reports of concerned micro finance banks and the internet. The validity for this research instrument was confirmed by subjecting the Questionnaire to expert review and constructive opinion. The experts selected included academics and professionals in the field. The reliability this research was confirmed by testing and retesting the questionnaires.

Data Presentation, Analysis and Interpretation

The study employed both parametric and non-parametric technique. The parametric statistics enable the researcher to generalize the outcome of the research through the sample parameter. The Non-Parametric method include simple percentages, ratios and averages while the parametric statistic used the simple regression analysis for the purpose of generalizing the result obtained from the sixteen (16) microfinance banks used for the study.

Distribution of Respondents

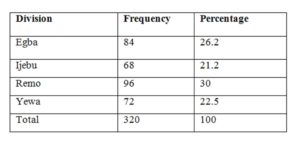

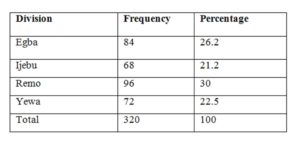

Table 4-1 presents the distribution of the respondents by divisions. Out of the 350 questionnaires administered 320 were selected for final analysis. This represents about 91.42 percent of the total questionnaire distributed. A total of 84 (26.2%) were from Egba, 68 (21.2%) from Ijebu, 96 (30.0%) from Remo and 72 (22.5%) from Yewa divisions of Ogun State.

Table 4-1: Distribution of Respondents by Divisions

Source: Field Survey, 2012

Source: Field Survey, 2012

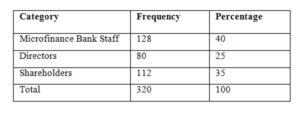

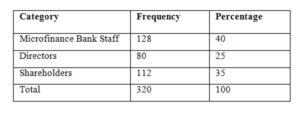

Distributions by Respondents Category

Table 4-2 shows the distribution of the different categories of the respondents used in the survey. The table shows that 128 (40%) were microfinance bank staff, 80(25%) were directors of microfinance bank while 112 (35%) were microfinance bank shareholders.

Table 4-2: Distributions by Respondents Categor

Source: Field Survey, 2012

Socio-Demographic Characteristics of the Respondents

The results in Table 4-3 show the socio-demographic characteristics of the respondents. The essence of these variables is that they are meant to provide insights into the background of the respondents which is assumed to have influence on their opinions and perception of human resource accounting issues and performance of the organization. Their age distribution shows that 30 (9.3%) of the respondents were below 25 years of age, 164 (51.2%) between 26 — 35 years, 47 (14.7%) between 36 — 45 years, 56 (17.5%) between 46 — 55 years, 19 (5.9%) between 56 — 59 years and 4 (1.2%) were 60 years and above. This indicates that majority of the respondents were between the age of 26 – 35 years old. The distribution of the respondents by gender according to the table shows that 144 (45.0%) of the respondents were male while 161 (50.3%) were females. This shows an equitable gender distribution of respondents to the study. The distribution of respondents by educational qualifications indicates that 5 (15%) were educated up to Primary School, 26 (8.1%) up to Secondary school, 219 (68.4%) were graduates, 67 (20.9%) had Professional Qualifications and 3 (0.9%) had other qualifications. The table also presents the distribution of respondents by marital status. From the table 4-3, it can be seen that 62 (19.4%) of the respondents were single, 238 (74.4%) were married, 15 (4.7%) divorced and 2 (0.6%) are widow/widower.

Table 4-3: Respondents’ Distribution by Socio-Demographic Variables

Source: Field Survey, 2012

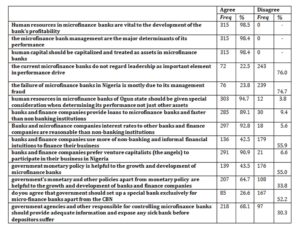

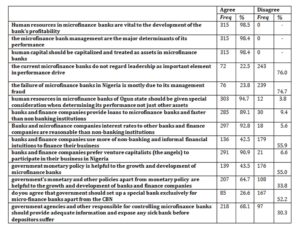

General Appraisal of Human capital Accounting and MFBs Performance

Table 4-4 below presents the general appraisal of the human capital accounting and other general matters on MFBs performance. The table shows that the 98.5% respondents agreed that human resources in microfinance banks are vital to the development of the bank’s profitability, 98.4% of respondents confirmed that the microfinance bank management are the major determinants of its performance and 98.4% of the respondents agreed that human capital should be capitalized and treated as assets in microfinance banks. 94.7% respondents agreed that human resources in microfinance banks of Ogun state should be given special consideration when determining its performance. From the study 92.8% agreed that Banks and microfinance companies interest rates are reasonable than non-banking financial institutions; 90.9% agreed that banks and finance companies prefer venture capitalists (the angels) to participate in their business in Nigeria; 64.7 % agreed that governments monetary are helpful to the growth and development of banks and finance companies while 68.1% confirmed that government agencies and other responsible for controlling microfinance banks should provide adequate information and expose any financial unhealthy bank before depositors suffer.

Table 4-4: General Appraisal of Human capital Accounting and MFBs Performance

Source: Field Survey, 2012

The result shows that 76% disagreed that the current microfinance banks do not regard leadership as important element in performance while 74.7% confirmed that the failure of microfinance banks in Nigeria is mostly due to its management fraud.

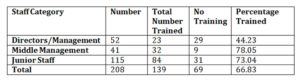

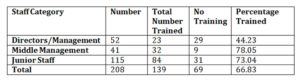

Staff Training Attendance

Presented in table 4-5 is the distribution of different categories of management and staff of MFBs in terms of training attendance. Analysis of the respondents indicates that the selected sample consists of 208 management and employees representing 65% of the sample. It shows that majority (66.83%) of the staff of MBFs have attended different training programmes in recent times. This actually cut across different categories of employees including the directors, management staff and junior staff.

Table 4-5: Distribution of Staff by Training Attendance

Source: Field Survey, 2012

Source: Field Survey, 2012

It can be concluded here that the allocation of training expenditure has been fairly distributed among the different categories of staff of MBFs in Nigeria.

Microfinance Bank and Reporting of Expenses on Human Capital Expenditure

In order to further evaluate the level of importance that microfinance banks (MFBs) placed on human capital value, the study went further by carrying out a content analysis of the annual reports and financial statements of the sampled MFBs. The content analysis can be summarized under the following headings.

Staff Training: From the survey conducted all the Micro Finance Bank reported that:

(i) Their banks recognized human resources as the most important assets of the organization.

(ii) Staff was allowed to attend seminars and courses especially those organized by Central Bank of Nigeria (CBN) and other Training Institutions

(iii) The distribution of training attendance cut across all cadre of staff- managing directors, Company Secretary, Internal Auditors, other Senior staff and Junior staff

(iv) In-house courses were also organized for staff especially the junior staff.

However, none of the MBFs reported on the actual amount expended on staff training and development.

Staff Salary and Staff Strength

(i) The average expenditure on stall salaries and wages the MFBs was N11, 045, 453 per annum.

(ii) The average staff strength was eighteen (18). It therefore implies that that an average MBF in Ogun State invested an average of N613, 636.28 per employee in terms of salaries and wages.

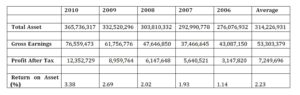

Financial Performance of Microfinance Banks in Ogun State

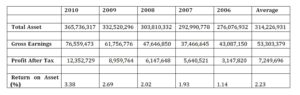

Table 4.6 presents the average financial performance of the microfinance banks whose staff was included in the survey. The analysis was based on the summary of the average total assets, gross earnings, and profit after tax and return on assets of the MFBs.

Average Total Assets

The result shows that the MFBs have consistently shown improvements in terms of their yearly average performances from 2006 to 2010. The total assets of the MFBs have improved from N276.08million in 2006 to N365.74million in 2010 with an annual average of N314.33million. This suggests growth of 32.48% over the five- year period in the banks’ total assets.

Average Gross Earnings

The average total earnings /turnover of the MBFs have also improved consistently. The average gross earnings grew from N43. 08 million in 2006 to 76.56million in 2010. This indicates a growth rate of 77.68% over the five-year period. The average gross earnings of the MBFs was N53.30million

Table 4.6 Average Financial Performance of Microfinance Banks (2006- 2010)

Source: Annual Reports of 16 MBFs , 2010

Source: Annual Reports of 16 MBFs , 2010

Testing of Hypotheses

Hypothesis one states human capital development value does not have significant effect on the Microfinance banks’ performance

P = f (HCDV) Equation …………………………… 4.1

P = 4.138E7 + 0.228S + 0.034 T Equation. …………… 4.2

(16.839) (4.167)* ( 0.034) Adj. R2 = 0.046

Note: t-values in parentheses; *: significant at 1 percent level; F-value: 8.876 (sig :000).

The estimated model to evaluate the relationship between human resources value and performance of microfinance banks in presented in equation 4.2. Accounting for human capital development value (HCDV) has been evaluated based on payment of good salaries (S) and staff training (T) and inclusion of expenses as assets built into the workforce. The result shows human resource value has a significant effect on MFBs performance especially the Salary bill component. As expected, payment of good salaries contributes significantly and positively to the overall performance of MFBs and also contributes in enhancing the revenue/earnings generation capacity of the banks and the profitability of the MFBs.

Investments in human assets /capital development has an adjusted R2 value of 0.046 implying that human resource value contributes 4.6% to the earnings of MFBs in Nigeria. Therefore, the null hypothesis that human capital development value does not have effect on microfinance banks’ performance is hereby rejected while the alternative is accepted. The study shows that accounting for human resource value has a significant effect on MFBs performance.

Hypothesis two of this study investigated if Staff training and development has no significant effects on the performance of microfinance banks. This was evaluated by testing the hypothesis that:

MR = f (HCDV) Equation ……………..4.3

Investment in human capital development value is linearly decomposed into Salaries (S) and Training (T). The dependent variable is Maximization of Return (MR).

Equation 4.3 was evaluated by asking the respondents if they have sent their staff on training in recent time and if such training expenditure had contributed to maximization of profit/ return or otherwise? The estimated regression model is presented in equation 4.4 below:

MR = 2.893E7 – 0.013S + 0.162T Equation ………………4.4

(41.014) (- 0.228) (2.921)* Adj. R2 = 0.020

Note: t-values in parentheses; *: significant at 1 percent level; F-value:4.271 (sig :015)

The result presented in equation 4.4 indicates that investment in staff training and development has positive and significant influence on the profit and return maximization of microfinance banks in Ogun state. The null hypothesis that staff training and development has no significant effects on the performance of microfinance banks is therefore rejected. The study concludes that staff training and development has significant influence on the efforts of microfinance banks to maximize their profit and returns. Investment in human capital development especially payment of good salaries both in terms of amount, regularity and promptness of payment and investment in staff training have significant influence on the aggregate performance of microfinance banks in Ogun state.

Conclusion, Findings and Recommendations

Conclusion

The failure of professional accountants to treat human resources as assets just like physical and financial assets led to the emergence of Human Resources Accounting (HRA) – Eddie and Peter, 2002. Human Resources accounting advocates the measurement and reporting of the cost and value of people and their capitalization in organization resources rather than writing them off to profit and loss account. The value of human resource component of all organizations are treated in the conventional financial statement by writing off expenditures on human capital development to the profit and loss account rather than being capitalized and shown in the balance sheet.

Findings

Investments in human assets /capital development has an adjusted R2 value of 0.046 implying that human resource value contributes 4.6% to the earnings of MFBs in Nigeria. The study shows that accounting for human resource value has a significant effect on MFBs performance. Investment in human capital development especially payment of good salaries both in terms of amount, regularity and promptness of payment and investment in staff training have significant influence on the aggregate performance of microfinance banks in Ogun state.

- The average expenditure on stall salaries and wages the MFBs was N11, 045, 453 per annum and the average staff strength was eighteen (18). It therefore implies that that an average MBF in Ogun State invested an average of N613, 636.28 per employee in terms of salaries and wages. While the MFBs reported on their staff training activities, they have failed to reveal the amount expended on staff training and development.

- The study also shows that human capital development has positive and significant impact on overall performance of MFBs in Ogun State. Specifically, employees’ compensation in terms of salaries, wages and staff training and development has positive and significant impact on the survival and overall performance of MFBs in Ogun State.

- The study revealed that majority 315 (98.5%) confirmed human resource team is vital to the overall performance of MFBs. 314 (98.4%) of the respondents agreed that human resources expenditures should be capitalized and treated as assets. 313 (98.4%) of the respondents revealed that the management of MFBs is the major determinants of MFBs performance in Ogun State.

Recommendations

- Microfinance banks should create a framework in the balance sheet to recognize treatment of human resources and appropriate value to be attached based on the inherent qualities of human capital.

- Recognizing human capital in financial statement would show accuracy in profit declaration.

- The study recommends that firms can significantly improve on their performance by investing in their employees and seeing to the payment of salaries and training cost as investment expenditures for the development of human asset towards enhancing the productivity of human asset. Human capital expenditures should be perceived as investment costs that can be capitalized and included in the balance sheet rather mere operational cost to be written off to the profit and loss account.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Akindele, R.I. (2007): Fundamentals of Human Resources: Nigeria, Cedar Production, Ile-Ife. ISBN – 978-38468-8-4. pp. 379-385.

- Amadi, V.L. (2005): “An Investigation into the Role of Private Sector in Nigeria Higher Institution: A Study of the University of Abuja”, International Journal of Research in Education, Vol.2, No1 & 2

- American Accounting Association (1970): A statement of Basic Accounting Theory: Evanston,

LIL: AAA, revised pp. 35.

- Backhuijs, J.B (1973): Reporting on intangible assets, OECD Symposium on Measuring and Reporting of Intellectual Capital, Amsterdam (June 9 -11)

- Baker, G.M.N.(2003) “The feasibility and Utility of HRA” California: Managing Review, Summer 1794, 1733.

- Bassey, B.E & Tapang, A.T (2012): “Expensed Human Resources Cost and Its influence on

Corporate Productivity: A Study of Selected Companies in Nigeria”, Global Journal of Management and Business Research, 12(5), 3-8

- Christie, P.(1996): Globalization and the Curriculum: Proposals for the Integration of Education and Training in South Africa, International Journal of Educational Development, Vol.16, No.4, pp.407-416

- Daniels, R.C. (2007): Skills Shortages in South Africa: A Literature Review. Development Policy Research Unit, Working Paper 07/121http/ww.commerce.uct.ac.za/researchunits/dpru/workingpapers/pdf_files/wp-0 7-121.pdf

- Dobija, M.(1998): “How to place Human Resources into the Balance Sheet”, Journal of International Business and Cultural Studies.

- Eddie Maclaney and Atrill, Peter (2002): Accounting — An Introduction, England Pears Education Limited, Edinburg Gate Harlow Essex, pp. 140-143.

- Enofe, A. O, Mgbame, S.O & Ovie, C. (2013): “Human Resources Accounting Disclosures in

Nigeria Quoted Firms”, Research Journal of Finance and Accounting, Vol. 4, No. 13 pp. 7-11.

- Federal Government of Nigeria (2003): National Bureau of statistics.

- Federal Government of Nigeria (2009): CBN Annual Report National Bureau of statistics.

- Flamholtz, E. G , Kannan-Narasimhan, R., & Bullen, M.L.(2004): “Human Resource

- Accounting today: Contributions, controversies and conclusions”, Journal of Human

Resource Costing & Accounting, 8 (2), pp.23-37.

- Imeokparia, L.A (2009): “Human Resource Accounting and Intellectual Capital Reporting in Developing Countries: An Empirical Study of Nigeria”, Journal of Management and Entrepreneur, Rosefet Academic Publication, Vol.2, No.1 p.1

- International Labour Office (2008): Skills development through Community Based Rehabilitation: A good Practice Guide — International Labour Office.

- Kaplan, R. and Norton, D (1992): “The Balance Sheet Scorecard — Measures that drive Performance”, Harvard Business Review, Vol.70, No.1.

- Kirkpatrick, D.H (1994): Evaluating training programs, The Four Levels, San Francisco

- Kirfi, M.M & Abdullahi, A (2012): Human Capital Accounting: Assessing Possibilities for

Domestication of Practice in Nigeria, Research Journal of Finance and Accounting, 3 (10), 57-63.

- Kraak, A. (2005): Human Resources Development and the Skills Crisis in South Africa: The used for a Multipronged Strategy, Journal of Education and work,18, No.1, pp.57-83

- Krejcie, R. V; & Morgan, D.W. (1970): “Determining Sample Size for Research Activities”, Educational and Psychological Measurement, 30, 607-610.

- Kumshe, A.M (2012): Human Resources Accounting in Nigeria: An analysis of its practicability, A Ph.D thesis submitted to Postgraduate School Usman Danfodiyo University, Sokoto, Nigeria.

- Kuruvilla, A, & Shrader, E (1999): Social Capital Assessment tool Conference on Social Capital and Poverty Reduction, World Bank.

- Lall, S.(1999):“Competing with Labour: Skills and Competitiveness in Developing Countries, Developing Policies Department, International Labour Office, Discussion Paper 31

- Likert, R. M. (1967): “The Human Organization: Its Management and Value”, (New York: McGraw-Hill Book Company. Journal of International Business and Cultural Studies.

- Micah, L.C, Ofurum, C.O & Ihendinnhu, J.U (2012): “Firms Financial Performance and Human

- Resources Accounting Disclosure in Nigeria”, International Journal of Business and Management; 7 (14), 67-75.

- Mohammed, Musa Kirfi and Aminu Abdullahi (2012): “Human Capital Accounting: Assessing Possibilities for Domestication of Practice in Nigeria”, Research Journal of Finance and Accounting, Vol. 3, No.10, p.1

- Moore, R. (2007): “Measuring how ‘human capital’ appreciates in value over time”, Plant Engineering 61 (4), pp.29.

- Okafor, G.O (2009): “Disclosure of Human Capital in the Annual Reports of Firms: The Nigerian Accountant’s View”, Certfied National Accountant, July-September.

- Okpala, P.O & Chidi, O.C (2010): Human Capital Accounting and its Relevance to Stock Investment Decisions in Nigeria, European Journal of Economics, Finance and Administrative Sciences (21). Retrieved 23rd January, 2013 from http;//www.eurojournals.com

- Olsson, B. (1999): “Measuring personnel through human resource accounting reports: A procedure for management of learning. The hospital sector in Northwest Stockholm”, Journal of Human Resource Costing and Accounting, 4 (1), pp.49-56.

- Olsson, B. (2001: “Annual reporting practices: information about human resources in corporate annual reports in major Swedish companies”, Journal of Human Resource Costing and Accounting, 5 (1).

- Patra R., Khatik, S.K., & Kolhe, M. (2003): Human resource accounting policies and practices: A case study of Bharat Heavy Electricals Limited, Phopal, India”, International Journal of Human Resources Development and Management, 3 (4), pp.285.

- Rao, T.V (2004): “Human Resources Development as National Policy in India”, Advances in Developing Human Resources, Vol. 6, No.3, pp.288-296.

- Schwarz, J.L., & Murphy, R. E. (2008): “Human capital metrics: An approach to teaching using data and metrics to design and evaluate management practices”, Journal of Management Education 32 (2), pp.164.

- Sveiby (1997): The New Organization wealth, San Francisco: Berrett-Koehler

- Syed (2009): “Human Resource Accounting Disclosure of Bangladeshi companies and its

Association with Corporate Characteristics”, BRAC University Journal, 1(1), 35-43.

- Tang, T. (2005): “Human Resource Replacement Cost Measures and Usefulness”, Cost engineering, 47(8), pp.70.

- Turner, G. (1996): “Human resource accounting — Whim or wisdom”, Journal of Human Resource Costing and Accounting, 1 (1), pp.63-73.

- Vuontisjarvi, T. (2006): “Corporate social reporting in the European context and human resource disclosures: An analysis of Finnish companies”, Journal of Business Ethics, 69, pp.331-354.

- Wagner, C.G (2007): “Valuing a company’s innovators”, The Futurist,41 (5),7

- Weber, M. (1947): The Theory of Social and Economic Organization, New York, and Oxford University Press.

- Wood .F. (1987): Business Accounting I. London: W.C.2E 9AN Pitman Publishing, 128 Long Acre.

- Yesufu, T.M. (2000): The Human Factor in National Development, University of Benin Press and Spectrum Books Ltd.

- hrfolks.com. “Valuation of Human Capital”, JBIMSRetrieved from http://www.sec.gov/rules/proposed/2008/33-8982.pdf.Journal of International Business and Cultural Studies.