Introduction

The various financial misaapropriations all over the world and the collapse of companies shook investors’ confidence in the capital markets and the effectiveness of existing corporate governance practices in promoting transparency and accountability in companies (Kajola, 2008; Adegbite & Nakajima, 2011), the question on how good corporate governance can be entrenched into corporations across the globe has lingered on, as well as questions relating to the effect of corporate governance on firm performance, which led to a call for corporate governance reforms as well as improvement on existing codes of corporate governance in various countries (Reed, 2002).

Principal objective of most profit oriented private business entities is profit maximization, (Oyejide & Soyibo, 2001) while the investment objective of any investor is maximization of returns on investment, which can only be achieved when the company invested in makes enough profit, thus maximizing the assets employed through returns on assets. To achieve the objective of profit maximization, several factors must be put in place, with high emphasis on the quality of the management team as well as the board of directors. Companies inaugurate the board of directors, who are expected to represent the interest of the owners of the company, therefore the need for the composition of the board of directors to consist of executive and non executive directors (Security & Exchange Commission, 2003). The non executive directors are those directors that are not responsible for the day to day operations of the company.

It’s been suggested that Nigerian firms should adopt corporate governance mechanisms that will increase the level of independence of the board to enhance the financial performance of these companies, its been identified as an important mechanisms for aligning the interests of managers and other stakeholders of the firm (Ahmadu, et al., 2011). Board composition has been identified as a major ingredient of corporate governance (Bello, 2011). This concept evaluates the mix of the board members, with the executive directors not forming a major percentage of the entire board. This is seen as a major way of curtailing the execesses of the executive directors. The executive directors of companies because of their privileged information about the activities going on in the company as well as their ability to influence the direction of activities and events in the company are likely to make use this priviledged information for personal benefits at the detriment of the broad goals and objectives of the company. This sometimes may result into engagement in earnings management practices, which cannot be detected on the face of the report, but involves the adoption of some models to detect. To this end, however, what is the effect of board composition on the financial performance of Nigerian companies?

The Nigerian Company and Allied Matters Act (CAMA) 2004 as ammended, Section 359 (3&4) stipulates that all companies registered and operating in Nigeria should have an audit committee, with a mix of shareholders and directors. The Nigerian code of corporate governance of 2003 and 2011 respectively identified the need for companies to set up an audit committee with an objective of raising the corporate governance standards of the company (Security & Exchange Commission, 2003), which should not be influenced by any dorminant member of the board. This clause has been attributed to be an ingredient for good corporate governance. What is the effect of this clause on the financial performance of Nigerian companies?

Businesses solely owned by an individual have been aclaimed to perform better than companies owned by a group of people, as this has been identified as a loophole for inefficiency on the part of the management team, with little or no interest, with the opinion that he has nothing to loose except his salary in the event of liquidation or folding up of the company. Howbeit, this is not without its own challenges, but what is the effect of this on the financial performance of companies in Nigeria? To this end, this study examines the relationship that exist between board independence and financial performance of companies in Nigeria, also the study will determine the type of relationship that exists between ownership structure and financial performance of companies in Nigeria

In an attempt to achieve the above stated objectives, this study therefore profer the following research hypotheses, which are stated in null form:

H1: Board composition does not have a significant effect on the financial performance of Nigerian companies

H2: Ownership structure does not have a significant effect on the financial performance of Nigerian companies

H3: Audit committee composition does not have a significant effect on the financial performance of Nigerian companies

Review of Literature

Corporate Governance Mechanisms in Nigeria

Corporate governance, which can been defined as the system of effective internal control, as well as effective internal checks and control of power or governance from within (Rossouw, et al., 2002), has receieved a great attention in the last few years from all sectors and countries of the world. Its been seen as a tool for financial market stability, investment and economic growth(OECD, 2004). As a result of the financial scandals in times past, as well as other forms of mispresentation of financial reports by the managers of companies, which has caused the companies and the investors great fortune, researchers as well as managers and regulators therefore suggested the need to improve on the code of corporate governance structure (Adegbite, 2012). Taking a cue from the case of enron, which demonstrated the limits of the monitoring board, pointing the way to the stewardship model, in which the directors take responsibility for ensuring the sustainability of the assets of the companies (Deakin & Suzanne, 2004). The guiding assumption of the code of corporate governance is that the fall of Enron was as a result of the the conflicts of interest on the part of the senior managers and lack of oversight on the part of the board of directors of enron and its advisers (Deakin & Suzanne, 2004). This assumption however, is what premised the inclusion of the need for non-executive directors to be actively involved in the operations of the business, to carryout their oversight functions. The role of the board has been attributed to the need for developing countries to boost their ability to attract resources for investment in an increasingly competitive environment (Ahmadu, et al., 2011), while governance crisis has been linked to board of directors crisis, thus resolving that governance issues are central to the activities of the board of directors(Ayogu, 2001). Kajola (2008) noted that the supervision of managers, which is as a result of good corporate governance leads to higher stock prices or better long term performance, which results into the reduction of agency costs. Thus it is expected that a board with executive and non executive directors is able to carry out its oversight functions, which is expected to reduce wastages, curtail missapropriation of funds, reduce fraud and all forms of unethical practices in the compeny. As a result of this, it is expected that the financial objectives of the company is met, which is to minimize cost and maximize profit. A study conducted in Nigeria, it was concluded that there is need to strenghen board independence in developing countries like Nigeria with weak institutions (Adegbite, 2012) that need to attract foreign resources(Ahmadu, et al., 2011).

The Nigerian code of corporate governance, was first published in the year 2003 by the Security and Exchange Commission (SEC) and the Corporate Affairs Commission (CAC). The code was published as a result of the identification of the role corporate governance plays in enhancing national growth and development, as well as the realization of the need to align with the international best practices and the need to attract foreign investors (Security and Exchange Commission, 2003). Corporate governance, which is to enhance transparency as well as check the excesses of those charged with the responsibility of managing the business, is a topical issue and has been linked to several organizational behaviours.

The Nigerian code of corporate governance stipulates that board of directors should ensure that the company constantly improves its value creation as much as possible. This is a pointer to the fact that the success of the company is dependent on the efficiency level of the board of directors, thus membership of the board should not only be based on share ownership, but good understanding of the nature of the business and the environment in which the business operates.

The main target of the Nigerian code of corporate governance of 2003 was the board of directors, who are the leaders of corporate organizations as well as other stakeholders, ensuring that they all have a clear understanding of their roles in enhancing the governance structure of the company.

Companies have gained deeper understanding of how good corporate governance contribute to their competitiveness (Fodio, et al., 2013; Reed, 2002). Investors, especially collective investment institutions and pension fund managers who act in a fiduciary capacity have realised that they have a role to play in ensuring good corporate governance practices, which affects the value of their investments. Economies around the world are now interested in corporate governance, with the understanding that it goes beyond the interest of shareholders and the performance of individual companies, but the entire economy. Therefore corporate governance is important to broad and growing segments of the entire population. As companies play a pivotal role in the economic development (Mensah, et al., 2003) of countries and reliance on companies has increased, therefore the need for good corporate governance (OECD, 2004; Husted & Serrano, 2002).

The presence of an effective corporate governance system, within an individual company and across an economy as a whole, helps to provide a degree of confidence (Adegbite, 2012) that is necessary for the proper functioning of a market economy. As a result, the cost of capital is lower and firms are encouraged to use resources more efficiently, thereby corporate governance is one key element in improving economic efficiency and growth as well as enhancing investor confidence (Fodio, et al., 2013). Corporate governance involves a set of relationships between a company’s management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined. Good corporate governance should provide proper incentives for the board and management to pursue objectives that are in the interests of the company and its shareholders and should facilitate effective monitoring. underpinning growth (OECD, 2004).

As a result of the identified benefits of good corporate governance, developed and developing countries have promulgated several codes to resolve the corporate governance issues as a result of the identified challenges in companies. However there is no single model of good corporate governance but some common elements have been identified (OECD, 2004). Realizing the need to align with the International Best Practices, the Securities and Exchange Commission (SEC) in collaboration with the Corporate Affairs Commission inaugurated a seventeen (17) member Committee on June 15, 2000 in Nigeria, constituted a committee to look into the enactment of a code of corporate governance in line with the International expectation. The Committee, which was headed by Atedo Peterside was mandated to identify the weaknesses in the current corporate governance practice in Nigeria as at that date and fashion out the necessary changes that will improve the Nigerian corporate governance practices.

Corporate Governance Variables / Index

Literature has shown that several variables can be used in the measurement of the strenght of corporate governance in a company. The impact of the various variables and their effect of the organisations have been explored in literature and conclusions reached thereby. This study however will be considering some of these variables as reviewed in literature and their informed effect on the governance structure of any company and financial performance.

Audit Committee Composition

The Board of Directors of companies are expected to establish an audit committee of at least three non-executive directors with written terms of reference, which deal clearly with its authority and duties, Audit Committees should be established in accordance with CAMA Section 359 (3 & 4), with not more than one executive on them. A majority of the non-executives serving on the committee should be independent of the company (i.e. independent of management and free from any business or other relationship, which could materially interfere with the exercise of their independent judgment as committee members). The Chairman of the Audit Committee should be a Non Executive Director, to be nominated by the members of the Audit Committee, while membership of the audit committee should be for a fixed tenure. However, any member of the committee should be eligible for re-election after his tenure. The Secretary of the Audit Committee should be the Company Secretary, Auditor or such other person nominated by the Committee. Members of the Committee should understand basic financial statements, and should be capable of making valuable contributions to the Committee. Considering some of the qualifications expected of the members of the audit committee, with relation to their literacy in accounting, this qualification is expected to enhance the delivery of their services as a committee that is in charge of moderating the financial excesses of the managers and the boards as it relates to earnings management and instituting good corporate governance in an organisation.

Audit committee, may have a more direct role in controlling earnings management, with the function of monitoring firm’s financial performance and financial reporting (Biao, Davidson, & DaDalt, 2003). Regulators around the world have acknowledged the important function of audit committees in financial reporting even before financial scandals occurred at the end of the last decade (Murya, 2010).

The Nigerian code of corporate governance emphasised the need for audit committee independence from managers. The audit committee has an overseeing and monitoring function of managers’ discretion over the accounting policy. An effective audit committee adds to the quality of the audit process at two levels. First, by overseeing the financial reporting process and examining major accounting measurement and choices, and this enables the committee to mitigate earnings management practices. Secondly, by coordinating the internal and external audits and, above all, assuring external auditors’ independence and freedom from managerial pressure (Murya, 2010).

According to Duztas (2008), boards are important boundary spanners, as they can be used as a mechanism to form links with the external environment, achieve inter-organisational linkages, such as the appointment of outside directors and board interlocks, which can be used to manage environmental contingencies. Directors who are prestigious in their professions and communities can be a source of timely information for executives and also used as channels of marketing the brand of the company. Also with the inclusion of external non executive directors, individuals with good managerial skills can be brought on board, which may enhance the oversight functions of the board as a whole.

Duality of Position of Chairman and Chief Executive Officer of Companies

Duality occurs when the same person occupies both the CEO and chairman positions on the board. Past studies test the chairman’s independence and the concentration of power on the board. It is argued in the governance literature that the objectivity and quality of board oversight may suffer if the CEO also chairs the board. Duality of position is envisaged to cause centralisation of power in a company, which can result in the CEO being able to exercise excessive influence over the board by setting board agendas, managing meetings and controlling the flow of information to its members (Murya, 2010). The Nigerian code of corporate governance stipulates that the Board of a company should not be dominated by an individual, while responsibilities at the top of a company should be well defined. It further emphasized that the position of the Chairman and Chief Executive Officer should ideally be separated and held by different persons with a note that the combination of the two positions in an individual represents an undue concentration of power. The code however gave a clause to the expectation by stating that “In exceptional circumstances where the position of the Chairman and Chief Executive Officer are combined in one individual, there should be a strong non-executive independent director as Vice Chairman of the Board” (SEC, 2003).

Board Composition in Companies

Research on board composition and board leadership structure has also been dominated by a focus on company performance (Dally & Dalton, 1999), which is consistent with the institutional investment community’s demands for more independent board structures. The general notion is that boards with higher proportion of non executive/independence directors are generally objective and independent in its monitoring function (Bello, 2011). The Nigerian code of corporate governance stipulates some requirements for the composition of board members in companies. The code stipulates that the board should be composed in such a way as to ensure diversity of experience without compromising compatibility, integrity, availability, and independence. It states that the board should comprise of a mix of Executive and Non-Executive Directors, to be headed by a Chairman of the Board. Members of the Board should be individuals with upright personal characteristics and relevant core competences, preferably with a record of tangible achievement, knowledge on board matters, a sense of accountability, integrity, commitment to the task of corporate governance and institution building, while also having an entrepreneurial bias.

According to Duztas (2008), boards are important boundary spanners, as they can be used as a mechanism to form links with the external environment, achieve inter-organisational linkages, such as the appointment of outside directors and board interlocks, which can be used to manage environmental contingencies. Directors who are prestigious in their professions and communities can be a source of timely information for executives and also used as channels of marketing the brand of the company. Also with the inclusion of external non executive directors, individuals with good managerial skills can be brought on board, which may enhance the oversight functions of the board as a whole and enhance the performance of the company.

The code of corporate governance in an attempt to ensure that the executive directors do not use their power to run the affairs of the company in a way that is not to the advantage of other stakeholders in the company. A board of directors with more executive directors than the non executive directors is seen as an overbearing board with the assumption that the executive directors will lord major decisions on the entire board, which may boost insider dealings and unethical practices in the company. However the code states that a an equal mix of executive and independent non executive directors is expected to have an independent board (Security and Exchange Commission, 2010).

The Nigerian code of corporate governance stipulates that the board of Nigerian companies should comprise of a mix of Executive and Non-Executive Directors, which is a factor that informs the degree of independence in a company. Wu, Lin, Lin, & Lai (2010) concluded that there is a positive significant relationship between board independence and firm performance. Independent boards are more likely to remove poorly performing CEOs from office, which leads to improved shareholder value(Masulis, 2013). Prior study on board independence and firm financial performance in Nigeria adopted the use of fixed-effects regression on 89 sampled companies in Nigeria for the period 1996-2004(Ahmadu, et al., 2011).

Ownership Structure of Companies

The code of corporate governance in an attempt to reduce the overbearing control the board of directors have on the company stipulates that equal information must be made available to both minority and majority shareholders. It also stipulate that the shareholdings of the members of the board should be disclosed in the financial reports as published. The Nigerian code of best practices and corporate governance of 2003 also states that there must be a representative of the minority shareholders on the board of directors. This is to ensure that the operations of the board and the decision making process is not left in the hands of a few individuals. The ownership structure of companies has been identified as a major tool in ensuring good corporate governance (Murya, 2010; OECD, 2004).

Research Methods

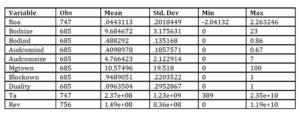

This study adopts the use of the fixed-effect regression method to determine the type of relationship that exists between board independence, ownership structure and firm financial performance of Nigerian companies. The fixed effects regression was adopted because of the missing data of some of the sampled companies. This study adopted the use of panel data for 137 companies for the period 2003 to 2010. This data was subjected to the heteroscedasticity test, which shows that the data was heteroscedastic, thus the need to apply weight on company basis. The heteroscedasticity of the data is as a result of the varying sizes of companies in the sample as well as the performance. However, the study used return on assets (ROA) of the sampled companies as a proxy for measuring performance, the proportion of non-executive directors on the board was used to determine the board independence of the sampled companies, while the percentage of management shares to total share capital of the sampled companies was used to determine the ownership structure, for the period of study.

Model Specification

The model of the study at hand is as presented below:

ROAit = β0 + β1BODSIZEit+ β2BODINDit + β3AUDCOMINDit + β4AUDCOMSIZEit + β5MGTOWNit + β6BLOCKOWNit + β7DUALITYit + TAit+ REVit + eit…… Equation (1)

Where:

ROAit is Return on Assets for company i in year t

BODSIZEit is Board Size of company i in year t

BODINDit is Board Independence of company i in year t

AUDCOMINDit is Audit Committee Independence of company i in year t

AUDCOMSIZEit is Audit Committee Size of company i in year t

MGTOWNit is Management Ownership of company i in year t

BLOCKOWNit is Block Ownership of company i in year t

DUALITYit is Dualisation of Chairman and CEO position of company i in year t

TAit is Total Asset of company i in year t

REVit is Turnover of company i in year t

e is residual of the equation

Data Analyses

Table 1: Descriptive Statistics

Correlation Matrix

roa bdsiz bdcm adcd adcsz mgtn blkw dual ta rev

roa 1.0000

bdsiz 0.0727 1.0000

bdcm 0.0020 0.2037 1.0000

adcd 0.0621 0.0535 -0.0772 1.0000

adcsz 0.1203 0.1889 -0.0374 0.8921 1.0000

mgtn 0.0574 -0.0454 -0.1626 0.0911 0.0923 1.0000

blkw -0.1218 -0.0620 0.1367 -0.0562 -0.0638 0.1191 1.0000

dual -0.0083 -0.1046 -0.0958 -0.0158 0.0386 0.1928 0.0757 1.0000

ta 0.0168 0.0032 -0.0646 0.0794 0.0825 0.0844 -0.0871 -0.0347 1.0000

rev 0.0476 -0.0127 -0.0785 0.0756 0.0722 0.0800 -0.0027 -0.0363 0.7767 1.0000

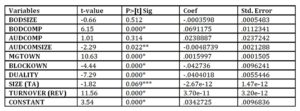

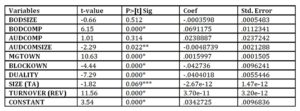

Table 2: Summary of Data Analyses

Source: Research (2013) * Significant at 1% significant level ** Significant at 5% significant level *** Significant at 10% significant level

Findings

With reference to the data analyses presented in the previous section, this study has identified that there is a significant positive relationship between board independence and financial performance of Nigerian companies. This finding however, shows that companies with high level of board composition of mixture of non executive to executive directors are likely to perform better than companies with low level of board composition. This however can be said to be as a result of the non-execurive directors ability to carry out their oversight functions of checkmating the executive directors and influencing the activities of the executive directors to ensure they engage in profitable ventures.

This study further revealed that there is a significant positive relationship between the management ownership structure of Nigerian companies and their financial performance. This therefore connotes that companies in which the board of directors have ample percentage of the shareholdings are likely to perform better than companies that the directors have little or no investment. This further buttresses the fact that where a man’s treasure is, there his heart will be. This is true of the Nigerian environment that directors are likely to guard their investment jealously to avoid illiquidity, which they know will affect them at the long run as well as affect their returns on investment. Also there is a negative and significant relationship between audit commitee size and financial performance of Nigerian companies. This shows that there is need for close monitoring of the audit committee size and its effect on the agency cost, which will have an effect on the profitability of companies.

There is a negative significant relationship between block ownership and financial performance of Nigerian companies. This means the higher the block ownership, the lower the financial performance of Nigerian companies. This however is a pointer to the fact that block ownership may result into insider trading, which may be detrimental to the interest of the other stakeholders in the business. Furthermore, there is a negative and significant relationship between dualisation of chairman and ceo position and financial performance of Nigerian companies. This shows that the higher the duality, the lower the performance, which is a pointer to the fact that dualisation of ceo and chairman position results into concentration of power in the hands of a few individuals, which may affect the operational efficiency of the company.

Worthy of note is the fact that there is a negative but insignificant relationship between board size and financial performance of Nigerian companies. This means the higher the board size the lower the performance, which may be as a result of the agency cost, thus a need for close evaluation of the adequate board size, which will not be to the detriment of the profitability of the company. Also, there is a positive and insignificant relationship between audit committee independence and financial performance of Nigerian companies. This shows that the higher the audit committee independence, the better the financial performance of Nigerian companies.

Conclusion

With respect to the various analyses conducted, this study therefore concludes that corporate governance mechanisms such as has a significant impact on the financial performance of companies in Nigeria. Therefore a thorough evaluation of the direct impact of the corporate governance indices is what determines the type of relationship that exists between firm performance and the corporate governance indices. Board composition and size should be managed in such a way that it does not increase the agency cost of operation which may later affect the performance of companies on the longrun. Furthermore, this study concludes that audit committee size and composition should also be closely monitored in order to avoid its adverseeffect on the financial performance of the companies. Worthy of note also is the need to state that ownership structure as well as the dualisation of chairman and ceo position are major corporate governance issues, which if not adequately monitored will have an adverse effect on the performance of companies in Nigeria.

Recommendations

With respect to the findings of this study and the conclusions therefrom, this study therefore recommends that the regulators of companies in Nigeria monitor closely the various corporate governance indices and their respective effect on the financial performance of the companies, as well as the expertees of those appointed as directors of companies in the area of operations of the business. It is also recommended that potential investors should consider the percentage interest of the directors, both executive and non-executive before investing in any company, as this will determine the extent at which the directors will pursue the investment objective of maximizing shareholders return on investment, which can only be done when the company makes enough profit to be redistributed. Also potential investors should be careful enough to avoid companies with the chairman dualising as the chief executive officer.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Adegbite, E., & Nakajima, C. (2011). Corporate governance and responsibility in Nigeria. International Journal of Disclosure and Governance. 8(3), 252-271.

Google Scholar

- Adegbite, E. (2012). Corporate governance in the Nigerian banking industry: towards governmental engagement. International Journal of Business Governance and Ethics. 7 (3), 209-231.

Google Scholar

- Adegbite, E. (2012). Corporate governance regulation in Nigeria. Corporate Governance., 12 (2), 257-276.

Google Scholar

- Ahmadu, U. S., Tukur, G. and Aminu, S. M., (2011), ‘Board Independence and Firm Financial Performance: Evidence from Nigeria.’ African Economic Research Consortium, Nairobi, 213.

Google Scholar

- Alzoubi, E. S. S. and Selamat, M. H., (2012), ‘The Effectiveness of Corporate Governance Mechanisms on Constraining Earning Management: Literature Review and Proposed Framework.’ International Journal of Global Business, 5 (1), 17-35.

- Ayogu, D. M., (2001), ‘Corporate Governance in Africa: The Record and Policies for Good Corporate Governance.’ African Development Bank, Blackwell Publishers, 308-330.

Google Scholar

- Bello, A., (2011), Corporate Governance and Accounting Ethics in Nigeria. 1591-1608.

- Biao, X., Davidson, N. W. and DaDalt, P. J. D., (2003), ‘Earnings management and corporate governance: the role of the board and the audit committee.’ Journal of Corporate Finance, 295-316.

Google Scholar

- Dally, C. M. and Dalton, R. D., (1999), ‘Corporate Governance Digest.’ Business Horizons, May/June.

Google Scholar

- Deakin, S. and Suzanne, J. K., (2004), ‘Learning from Enron.’ Corporate Governance: An International Review, Vol 12, Issue 2, 134-142.

Google Scholar

- Duztas, S., (2008), ‘Corporate Governance: The Effects Of Board Characteristics, Information Technology Maturity And Transparency On Company Performance,’ Istanbul: Graduate Institute of Social Sciences.

Google Scholar

- Fodio, M. I., Ibikunle, J. & Oba, V. C., (2013), ‘Corporate Governance Mechanisms and Reported Earnings Quality in Listed Nigerian Insurance Firms.’ International Journal of Finance and Accounting, 279-286.

Google Scholar

- Kajola, S. O., (2008), ‘Corporate Governance and Firm Performance: A Case of Nigerian Listed Firms.’ European Journal of Economics, Finance and Administrative Sciences, 16-28.

Google Scholar

- Masulis, R., (2013), No Social Ties: How Independent Boards Improve Firm Performance. Knowledge@Australian School of Business, 23 July, pp. 1-3.

- Murya, H., (2010), The Effectiveness of Corporate Governance and External Audit on Constraining Earnings Management Practice in the UK., Durham: Durham University.

Google Scholar

- OECD, (2004), Principles of Corporate Governance, Paris Cedex 16, France: Organisation for Economic Co-oporation and Development.

- Oyejide, T. A. & Soyibo, A., (2001), Corporate Governance in Nigeria. Accra, Ghana, pp. 1-35.

- SEC, (2003), ‘Code of Best Practices on Corporate Governance in Nigeria,’ Nigeria: Nigerian Securities and Exchange Commission; Corporate Affairs Commission.

- Security and Exchange Commission, (2010), ‘Nigerian Capital Market Statistical Bulletin,’ Garki, Abuja: Office of the Chief Economist and Research Division of the Research and Planning Department, Securities and Exchange Commision.

- Wu, M.-C., Lin, H.-C., Lin, I.-C. & Lai, C.-F., (2010), ‘The Effects of Corporate Governance on Firm Performance’.