Introduction

Many countries have experienced aging phenomenon. However, it seems to be a shocking trend for the world population as this issue would somehow affect the development process of the country. Poverty among the elderly has been a global concern, as stipulated in the Madrid International Plan of Action on Aging 2002 (United Nation, 2002). People in sub-Saharan Africa are among the poorest in the world, not only in terms of real income but also in terms of access to social services. Many people regard ‘absolute poverty’ as no longer existent in a Western European context. The EU Member States agreed on using poverty indicators, which are one-dimensional (monetary) and relative (based on a threshold defined in relation to the distribution of income within each country) (Eurostat, 2005). A poverty measure commonly used within the EU is to describe individuals as poor whose net equivalence income is less than 60 per cent of the median income in a given population (BMGS, 2005). Since the late 1980s/early 1990s, researchers and policymakers alike have increasingly acknowledged the multi-dimensional character of poverty. The key question for European, national, regional, and local policymakers concerned with the alleviation of poverty in old age is how to reduce the risk of poverty in the long run.

A general assessment of poverty in old age at provincial level reveals that the majority of the aged are poor due to unemployment/retrenchment (Madzingira, 1997). Carter and May (2001) further clarify that functional illiteracy is higher among the chronically poor, and other risk-reducing measures such as insurance and savings are important issues for poverty reduction. Issues such as the impact of unemployment and the prospect of early involuntary retirement should not be neglected. In the United Kingdom, aged population is projected to increase rapidly and a significant minority of people of pensionable age fully depends on state-based financial assistance. Besides due to the absence of money, causes of poverty are; intergenerational worklessness and economic dependency, family breakdown, serious personal debt, educational failure, and addiction to drugs and alcohol (McKee, 2009). The incidence of poverty among older persons is not only based on income, it also depends on factors such as health, education, and labor market opportunities. Thus, poverty is certainly a multidimensional issue.

Global Perspective on Causes of Poverty

One route for investigating the causes of poverty is to examine the dimensions highlighted by poor people. The basic ingredients for a review of the causes of poverty are much similar across countries in the region: low income, unemployment, no education/low level of education, no proper financial planning, spends too much money on the children, lack of support from children, inadequate pension program, and expensive health care. Some of the reasons could be due to low income and assets to attain basic necessities. Other relevant variables as education, health, housing, water, sanitation, and labor market opportunities also should not be ignored.

(i) Government support: In many non-western countries, there is considerable debate over how much government support should be provided for the care of the older population. The lack of comprehensive social security system in most developing countries including Malaysia increases vulnerability of the elderly to poverty especially among older women and the self-employed (Caraher, 2003). Whereas in the United Kingdom, aged population is projected to increase rapidly and a significant minority of people of pensionable age fully depends on state-based financial assistance. Aging Americans like other age groups are feeling the effect of challenges at old age poverty. Currently, 3.4 million senior ages 65 and older live below the poverty line and retirement income adequacy will decline due to insufficient amount of social security benefits and less certain income from employer pensions (Munnell and Soto, 2005). Although the government has increased the social security benefits to reduce elderly poverty, high medical cost can reduce the income available to meet the other needs (Cawthorne, 2008).

Echenberg (2009) identified four ways to reduce the elderly poverty by having income from investment at early age, income from work, income from government transfers such as providing incentives to participate in labor market, and support particular behavior or activities and non-monetary benefits such as affordable child care, social housing, and recyclable affordable used clothing. Canadian federal and provincial financial support programs provide the financial support to nearly all provinces (Ruggeri et.al,1994) and also ensured that there should not be any individual falls below the threshold (Sarlo, 2001). Feedbacks from retirees conclude that retiring Canadians have adequate financial resources, with the exception of those who retired involuntarily as a result of poor health (Alan et al., 2007). Unlike the U.S. system, which relies on the earnings-related pension component, Canada’s system offers a guaranteed income in the form of Old Age Security (OAS), regardless of past participation in the labour force. Thus, Canada Government has well designed an effective old age fund for its citizen (The Conference Board of Canada, 2016). Surprisingly, Australia has the higher rate of elderly poverty, and nearly 40 per cent of Australian seniors live in relative poverty. An OECD (2009) report notes that increase in elderly poverty in Australia is due to inefficient income-support payment program.

(ii) Financial planning- Causes of poverty in developing countries are due to lack of sufficient income and resources to live a full life. Some analysts view poverty as the outcome of personal decisions such as dropping out of school, having a child at early age, becoming addicts to drugs/alcohol or refusing to relocate the employment. Other analysts argue that poverty is a product of government programs that are not well structured. Meanwhile, limited financial resources, coupled with inability to manage financial resource, can lead to financial problems (Suwanrada, 2009). Today’s older Malaysians are unguarded to poverty due to forced retirement, lack of saving during younger years, limited social security coverage, and coupled with changing family structure and lifestyles, (Masud and Haron, 2014). Increased cost of living becomes another factor for the need to have good financial practices. Good financial planning and practices during younger years can be a factor to ensure financial security in old age since one of the recommended financial goals is savings for old age (Garman and Fougue, 2004).

Bardasi et al. (2002) suggest the importance of income and its effects of having low income on poverty at old age. In developed economic systems, those with high household income often consider themselves and their employers as the most important sources of retirement income whereas; households with lower incomes report the government and their families as most important (HSBC, 2008). Besides, retirement preparation among those employed influences income during old age. Moen et. al., (2006) discover that spouses’ decision making in the form of retirement planning tends to be positively related to lower poverty at old age.

(iii) Social demographic- Research evidence points to the crucial importance of education – the higher the level of education and, thus, the socio-economic status – of any individual (young or old); the less likely is s/he to be affected by poverty. These are the strongest determinants of health and quality of life in old age (Marmot & Wilkinson 1999). In the case of Latin America and the Caribbean, the incidence of poverty among older persons is not only based on income. It also depends on factors such as health, education, and labor market opportunities. Thus, poverty is certainly a multidimensional issue. Southeast Asian countries are sometimes grouped with East Asian “developmental stages” which maintained a low level of spending on welfare but with social policies being used in the overall pursuit of economic development (Kwan, 2005).The reason was due to the initial focus on contributory social insurance programs, household saving, and universal access to education. The policies of these countries have also been described as productivity in emphasizing investment in education and public health as underpinnings of economic development (Wood and Gough, 2006).

However, Zaidi and De Vos (2008) further argue that the employment record during working life is critical in many contexts, because entitlements to pensions in most schemes are accumulated with the help of the social insurance contributions deducted from wages. People accumulate wealth over their working lives to finance consumption after retirement (Friedman, 1957). Thus, longer employment period increases the amount of saving for their retirement. The occupation and type of job held also matters, because both levels of earnings and the likelihood of pension coverage in the employment sector affect the accumulation of pension entitlements. With lower level of educational attainment, older persons have limited economic opportunities and this eventually affects their ability to continue work, earned incomes and to some degree, savings and wealth (Jariah and Sharifah, 2008).

For many reasons, for most people the income potential diminishes after a certain age and then poverty is more likely to occur. Rake et al. (2000) discovered that women who had children, and for those who divorced and did not remarry has lower retirement incomes. These findings were supported by Ginn (2003), Walker et al. (2000), and Johnson and Favreault (2004), which showed a significant loss of pension entitlements among women who had children and who experienced marital disruptions. In apparent contrast to these studies, Bardasi and Jenkins (2004) and Sefton et al. (2008) found that marital history appeared to make no difference to pension income in old age once other factors were accounted for. On the other hand, past study reported that poverty among the elderly in rural areas is much higher than in urban areas (Masud & Haron, 2014).

Demey et al. (2013) argued that those mid-life men, who have not had children, have no educational qualifications, are not economically active and who live in rented housing were likely to be most at risk of needing a social and economic safety net in old age. Widowhood is one of the trigger events with adverse impacts on the financial well being of older persons (Emmerson and Muriel, 2008). Some have reported that there is no relationship between divorce and help given or received in old age (Pezzin and Schone 1999). Researcher such as Johnson and Favreault (2004) argued that there is a significant loss of pension entitlements among women who had children and who experienced marital disruptions. In the same vein, other research also has shown that marital disruptions over the life course may have adverse consequences for social support and connectedness at older ages.

(iv) Social support – In the United States where government provided substantial transfers to the elderly through social security and medicare, some non-western countries are trying to reinforce family support-networks (Da Vanzo, 1994,). In South Korea, families and close relatives provided the majority of financial support for the elderly. The government took advantage of this and did not prepare any extra measures to provide the elderly with pensions (Cook and Kim, 2010). The public pension scheme was only introduced in 1988, and retirees do not have accumulated pension entitlements in the new system when they retired in the mid-2000s. With modernization, tensions and gaps between generations will diminish the elderly roles in society and could lead to less responsibility for the younger generations to support the elderly. Thus, the root cause that contributes to the higher rate of elderly poverty in Korea is due to late preparation for proper pensions system for the citizens; secondly is due to the lack of support from families; thirdly the elderly do not save enough to sufficiently support themselves; and finally they have provided extensive support for their children (Lee, 2014).

Nevertheless, despite an increased need for social support for older people, there is evidence that the size of social networks generally decreases with age as a result of the loss of close friends and family members (Wrzus et. al., 2013) Available evidence suggests that social support makes an important contribution to health (Kendler et al., 2005) and a lack of social support may have negative effects on physical and mental health among general populations (Lakey & Cronin, 2008). Singapore is expected to experience rapid aging of its population in the next two decades. Therefore, old-age income security is increasingly becoming an important economic, social, and political issue. Citizen concerns are growing across a range of social issues, including: relative poverty; access, equity and affordability in health care; and retirement income provision. Both in Singapore and Malaysia, social protection relies primarily on personal savings and family support networks and the whole government support is channeled towards public provisions of health and education services (Cook and Pincus, 2014)

Elderly Living in Malaysia

Malaysia is a Southeast Asian nation and constitutes of two districts (Peninsular Malaysia and East Malaysia). The Malays, Chinese, and Indians are the main ethnic groups in Peninsular Malaysia, whereas indigenous people are concentrated in East Malaysia. Malaysian citizens consist of around 55% Malays, 24% Chinese, 7% Indians, 13% Indigenous people, and 1% of other ethnicity (Department of Statics Malaysia, 2010). According to the statistics from Malaysia’s Department of Statistics, the average life expectancy in Malaysia has increased to 75 years but most employees stop working at the age of 55 compared to Sweden where retirement age is 67 (Department of Statistics Malaysia, 2011). Malaysia is predicted to have 15% of elderly populations by 2030 and elderly Malaysians have experienced an alarming rate of poverty at 22.7 per cent (United Nation ESCAP Report, 2008). Most Malaysians do not have adequate saving when they get retired. Survey reported that average saving of people at the age of 54 years is $ 3,9750. The required amount for them to survive is $4, 7500 (EPF annual report, 2009). However, only about 23 per cent of the members at 55 have that amount (NST, 2015) and whereas 50% of retirees finished pension fund within 5 years, 70% of them finished their saving within 10 years, and 14% of them finished it within 3 years. These facts are alarming especially those who are still thinking to rely fully on their pension fund saving for the postretirement income. Rapid increase in the aged population, together with the longer life expectancy reflect that well planned personal financial planning turns out to be of utmost importance(Mohidin et. al., 2013).

According to Kim (2003), most of the people were not afraid to retire but they are not well prepared for retirement due to lack of money. More than 90% of Malaysians do not prepare for retirement and they do not take into account inflation rates and rising medical costs (Lai et al, 2009). The Government has always maintained that it is the responsibilities of children to provide care and support for their aging parents (Chan, 2005). Traditionally, it has been the norm and cultural practice of all ethnic groups for children to repay their parents (Yaacob, 2000). There is an increasing literature on the importance of culture for determining the effects of children to repay their parents (Ashraf et al., 2016), as well as the growing literature that examines the effects of gender-related cultural norms (Giuliano, 2014; Alesina et al., 2015). However, Malaysia has undergone rapid demographic transition, with continuing decline in fertility and increasing life expectancy over several decades. Since independence from the British rule in 1957, the total fertility rate has declined from 6.1 per woman to 2.1 in 2010 (Departmental Statistics of Malaysia, 2014). The increasing number of older persons with diminishing family size will put more stress on traditional family support systems. Previous findings in Malaysia revealed that older Malaysians, especially those living in rural areas, largely depend on financial support from their children (Tengku Aizan, H and Jariah, M, 2010). Family support for the elderly may be eroding due to social-demographic changes such as the trend towards delayed marriage and non-marriage, shrinking family size, out migration of the children, increased female labor force participation, and living in condominium (Department of Statistics Malaysia; 2014). Thus, the recent changes in the structure and functions of family may also have profound effects on the perception and provision of social support for older people (Abd Samad, 2013)

Pertaining to retirement financial planning, most working Malaysians are depending on monthly contribution to employee pensions fund (EPF). It has an average contribution rate of around 23% (i.e. employer 12% and employee – 11%) of their gross salary every month to their retirement savings with EPF (Ong and Lee, 2001). Malaysia’s EPF was established in 1951 and it is the oldest provident fund (PF) scheme in the world (Thillainathan, 2004). Compared to other East Asian countries, Malaysia is in higher rank with respect to the overall contribution rate to pension fund, however with respect to retirement age, it has only recently legislated to be increased to 60. Nowadays most Malaysians do not have enough saving when they get retired and they used up their pension fund within few years. Statistics shows that Malaysia’s pensions fund has higher contribution rate of total 23% to pensions fund compared to the United States which has 12.4%, even Japan as 23% and the U.K as 23.8%, however Malaysia retirees still do not have enough saving. Statistics further shows that Malaysia’s per capital income of $ 10,432, which is far lower than the United States with the amount of $ 51,749, the United Kingdom with the amount of $ 39,093 and Japan with the amount of $ 46,720. Whereas Singapore, which is a closer neighbor of Malaysia, has higher income capital $ 51,709 with the highest pension contribution rate with a total of 38% (Holzmann, 2015). Malaysian elderly are living longer which increases the percentage of the total population. Taking into consideration the normal retirement age as approximately 55 years, there is an urgent need to establish an adequate system that covers sufficient saving when they get retired. This raises the questions of:

- What are the causes of elderly poverty?

- What direction they should plan for the future retirement so that they can live comfortably at old age?

Therefore, the purpose of the study is to explore the causes of poverty at old age and also to recommend the action to reduce poverty at old age.

Proposed framework and hypothesis development

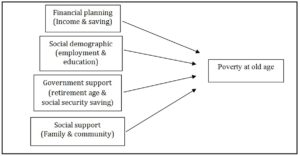

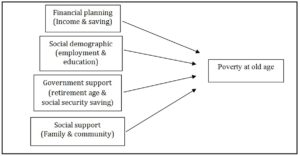

The absolute concept of poverty means one’s inability to obtain minimum necessities to maintain physical efficiency or to fulfill basic human needs (Jamilah, 1994). According to Deaton and Paxson (1998), poverty is a syndrome affecting people in situations characterized by malnutrition and poor health standard, low income, unemployment, unsafe housing, lack of education, inability to acquire modern necessities, insecure jobs, and a very negative outlook on life. Global Age Watch Index (2015) provides a good working framework to review the measures of vulnerability for older people. The framework identifies four domains of well being for older persons. These are 1) financial security, using indicators on the pension income beneficiaries ratio, older people’s incomes or consumption relative to the rest of the society, and poverty risk among older people, 2) health status, using healthy life expectancy at 60, and psychological well-being as indicators of physical health and mental well-being, 3) Employment and education among older people as a proxy for the coping attributes of older people, given that lacking these attributes makes them more vulnerable; and 4) Enabling environments, using indicators pertinent to enabling age friendly attributes of the societies in which older people live—they correspond to societal resilience. On the other hand, Glaser et al. (2009) suggest three domains of the well being of older persons as income, health, and social support to reduce the vulnerabilities of poverty in old age. Based on the review of past literature, this research suggests four main factors that cause elderly poverty. These are improper financial planning (income and saving), social-demographic factor (employment status and education), inadequate government support (retirement age, social security, and health) and lack of social support (family, community). Figure 1 shows the causes of poverty at old age.

Figure 1: Framework of causes of poverty at old age

Many elderly households do not have adequate savings for post-retirement expenses (Helman, R & Greenwald, 2013). Due to insufficient retirement funds, many elderly persons are confronted with serious financial problems (Gardyn, 2000). A survey on the elderly in public service shows that the elderly in Malaysia anticipate financial constraint to be the major challenge upon retirement (Merriam and Muhamad, 2000). Many of the elderly still need to work at retirement age as they do not have careful financial planning in earlier years. Based on this statement, the research proposes as follows.

Proposition 1: There is relationship between financial planning (income and saving) and elderly poverty.

Older people might be poorer just because they are less educated than the younger generations. Due to the lower education level, the elderly have less working capabilities and have limited sources of income (Mat & Taha, 2003). Therefore, this research proposes as follows.

Proposition 2: There is relationship between social-demographic (employment status & education) and elderly poverty.

The government’s ability to manage a social security system is important in determining the system best suited to a country. Many countries have had serious problems managing their social security systems and consequently lead to elderly poverty (OECD, 1998). Financial constraint is the major challenge upon retirement (Yaacob, and Nurdin. 2000.). Thus, the research proposes as follows.

Proposition 3: There is relationship between Government support (retirement age &, social security) and elderly poverty.

Most of Malaysian elderly depend on their adult child to support them but those whose children do not have enough money to support them, have serious problem to manage their living costs (Merriam and Mohamad, 2000). Although allowances from children significantly reduce elderly poverty, it is not clear whether this practice does indeed last in the long run. Thus, the research proposes as follows.

Proposition 4: There is relationship between social support (family, community) and elderly poverty.

Future Directions for Retirement Plan

Old-age financial protection has become a key focus of policy interest and research efforts in South-East Asia, including Malaysia. In developed countries the combination of strong social security systems, well-developed capital markets, and small households contribute to higher living standards for the elderly. Due to demographic, social and economic changes, there is a need for an effective system in income provision for the elderly. Reliance on traditional means of family support combined with individual savings may not reduce poverty at old age. To prevent such a scenario, action needs to be taken to ensure that all workers are covered by a system that offers a minimum guaranteed income through periodical payments. However, any such reforms are dependent upon the political will of government to address such concerns.

The government should provide assistance through effective public policy to protect the welfare of the elderly, involve private entities through corporate social responsibility, encourage both formal and informal sectors for voluntary savings, ensure the adequacy of savings to support post-retirement living, and create the awareness of the benefits of savings from the young through early education in schools and parental guidance (Suhaimi, 2013). Indeed, most developed countries have introduced policies and organizational practices that target older workers, including: reducing incentives for workers to take early retirement, encouraging later retirement and flexible retirement, passing legislation to counter age discrimination and helping older workers find and keep jobs (The conference board of Canada, 2016). As the number of the elderly grows annually, their demand for healthcare also relatively increases. Hence, in the future, Malaysia government should build more hospitals and clinics especially in the rural area to cater for the huge healthcare demand from the elderly.

Lifelong learning has an important potential contribution to poverty reduction. Individuals engaged in lifelong learning are more likely to improve their livelihoods through better employment opportunities, higher income, broader understanding of financial markets, better health and healthier behaviors, access to health services, knowledge of health conditions, among others. Therefore, the government must work hand in hand with private sectors to ensure maintaining the skills of the current workforce; upgrading the skills of those with the greatest needs to increase their employability; and allowing adults to re-skill to find employment in other areas (Sabates, 2008).

It is important for one to have sufficient financial knowledge, as it would help in understanding one’s own financial status. Those who have financial knowledge can have well prepared financial planning for the future (Joo, S.H., & Grable, J.E. (2005) and thus can avoid poverty at old age. Thus, the government should establish a government-linked institution body to create awareness throughout the country and provide professional advice to the citizens. In addition, the government should make it compulsory for higher education learners to take the financial planning as a required subject or co-curricular activities. Besides that, both public and private companies should provide training on financial planning for the working people. The practice will not only help them to prepare for better future financial planning but also it indirectly helps to country economy growth.

Children in Asia were generally positive and responsible towards their elderly parents. These elderly parents are being cared for not only financially, but also in the form of food preparation, purchase of daily necessities, housekeeping, doing laundry and transportation to visit relatives/hospital/clinic (Chor & DaVanzo, 1999). In many other regions, such as Singapore, China, the United States and Canada, adult children are required by law to support their elderly parents. Legislation of parental support explicitly states that it is the responsibility of the family, rather than the government, to care for their elderly parents. This legislation of parental support and practices should also be applied in other Asian countries like Malaysia where the culture still value the closed knitted family. That will help the elderly to have comfortable life with people surrounding them. In addition, every community in the region also must play a role in ensuring that the elderly are well taken care of.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Abd Samad, S. (2013). “Population ageing and social protection in Malaysia”. Journal of Economic Studies, 50(2): 139-156.

- Alan, Sule, K. Atalay, and T. F. Crossley. (2007). “Adequacy of retirement Savings: Subjective Survey Reports by Retired Canadians”. Social and Economic Dimensions of an Aging Population Working Paper #199. McMaster University,Hamilton, ON.

- Alesina, A; Benedetta, B, and Eliana, L. F (2015). “Violence Against Women: A Cross-cultural Analysis for Africa,”Working Paper, 2015.

- N; Natalie. B, Nathan. N, and Alessandra. V. (2016). “Bride Price and Female Education,”Working Paper, 2016.

- Bardasi, E., Jenkins, S.P. and Rigg, J.A. (2002). ‘Retirement and the income of older people: a British perspective’, Ageing and Society, vol 22.

- Bardasi, E. & Jenkins, S. P. (2004). “The Gender Gap in Private Pensions”. ISER Working Paper 2004-29, Institute for Social & Economic Research, University of Essex,Colchester.

- Bundesministerium für Gesundheit und soziale Sicherung (BMGS) [Federal Ministry for Health and Social Security] (2005): Lebenslagen in Deutschland. Der zweite Armuts- und Reichtumsbericht der Bundesregierung [Circumstances in Germany. “The Second Poverty and Affluence Report of the German Government”. Berlin: Bundesministerium für Gesundheit und soziale Sicherung.

- Caraher, K, (2003). Malaysia: Approaches to Income Security in Old Age. Social Policy and Society, 2, 295-304

- Carter, M and May, J (2001). “One kind of freedom: poverty dynamics in Post-Apartheid South Africa”. World Development, 29(12), 198-206.

- Cawthorne, A. (2008). “Elderly Poverty: The Challenge Before Us”. Center for American Progress.

- Chan, A. (2005). “Aging in Southeast and East Asia: issues and policy directions”. Journal of Cross-Cultural Gerontology, 20 (4), pp. 269–284. View at Publisher · View at Google Scholar · View at Scopus

- Chor S. N. & DaVanzo, J. (1999). “Parentchild co-residence and quasi co-residence in Peninsular Malaysia”. Southeast Asian Journal of Social Science, 27(2), (pp.43-64)

- Cook, P.J and Kim, E.H (2010). “Response of family elder support to changes in the income of the elderly in Korea”. Annual Meeting of the Population Association of America, 2010.

- Cook, S and Pincus, J. (2014). “Poverty, Inequality and Social Protection in Southeast Asia”. An Introduction. Journal of Southeast Asian Economies, 31(1), pp. 1–17

- Da Vanzo,J. (1994). “Living Arrangements of Older Malaysians — Who Coresides with Their Adult Children?” Forthcoming in Demography. Department of Sociology, Haines Hall.

- Deaton, A.S. and C. Paxson. (1998). “Measuring poverty among the elderly. In D. A. Wise (Ed.) Inquiries in the economics of Aging”. University of Chicago Press: 169-204.

- Demey, D., A.Berrington, M.Evandrou and J.Falkingham. (2013).“Living alone and psychological health in mid-life: the role of partnership history and parenthood ”Paper presented at the XXVII IUSSP, International Population Conference, Busan, Republic of Korea.

- Department of Statistics Malaysia (2011). “Population Distribution, and Basic Demographic Characteristics, 2010”. Department of Statistics Malaysia, Putrajaya, Malaysia, 2011.

- Department of Statistics Malaysia, Malaysia @ a Glance 2010–2013, (2014). Putrajaya, Malaysia. “Employees’ Provided Fund (EPF) – Annual Report 2009”.

- Echenberg, H. (2009). “The Poverty Prism: Causes of Poverty”. PRB 09-14E. Parliamentary Information and Research Service, Library of Parliament, Ottawa, 28 September 2009.

- Emmerson, C.,and A.Muriel. (2008). “Financial resources and well-being.” In J. Banks, E.Breeze, C. Lessof and J. Nazroo, eds.,Living in the 21st Century: Older People in England. The 2006 English Longitudinal Study of Ageing Wave 3: 118 –149. London :Institute for Fiscal Studies.

- Eurostat (2005). “Population and social conditions: Sustainable development indicators. Ageing Society” http://epp.eurostat.cec.int/portal/Tables / Ageing Society (30/01/2006).

- Friedman, M. (1957). “A Theory of the Consumption Function”. Princeton University Press, Princeton.

- Gardyn, R. (2000). “Retirement redefined.” American Demographics, 22 (11), 52-5

- Garman, T. E., & Forgue, R. E. (2004). “Personal finance”. New York: Houghton Mifflin Company.

- Ginn, J. (2003). “Gender, pensions and the life course”. The Policy Press, Bristo.

- Giuliano, P. (2014). The Role of Women in Society: from Preindustrial to Modern Times,”CESifo Economic Studies, 2014, p. ifu019.

- Glaser, K., D. Price,R.Willis, R. Stuchbury and M.Nicholls. (2009).“ Life course influences and well-being in later life: a review.”London:Institute of Gerontology, King’s College London; Department for Work and Pensions: Equality and Human Rights Commission; Age Concerns and Help the Aged.

- Glaser, K., Stuchbury, R., Tomassini, C., Askham, J. (2008). “The long-term consequences of partnership disruption for support in later life in the United Kingdom”. Ageing & Society, 28,329-351.

- Global AgeWatch Index (2015). “Insight report”. HelpAge International. Global Network.

- Helman,R. (2010). “The 2010 Retirement Confidence Survey: Confidence Stabilizing, But Preparations Continue to Erode”. A research report from the EBRI Education and Research Fund © 2010 Employee Benefit Research Institute. Accessed at https://www.ebri.org/pdf/briefspdf/ebri_ib_03-2010_no340_rcs.pdf.

- Helman, R & Greenwald, M (2013). The 2013 Retirement Confidence Survey: Perceived Saving Needs Outpace Reality for Many. EBRI Issue Brief, No. 384.

- HSBC, (2008). “The future Retirement: The power of planning”. Global report.

- Helman, R & Greenwald, M (2013). The 2013 Retirement Confidence Survey: Perceived Saving Needs Outpace Reality for Many. EBRI Issue Brief, No. 384.

- Holzmann, R. (2015). “Old-Age Financial Protection in Malaysia: Challenges and Options”. IZA Policy Paper No. 96.

- Jamilah, A. (1994). “Poverty: Conceptual underpinnings, trends and patterns in Malaysia and literature review”, in Jamilah, A (Ed.) Poverty amidst plenty. Pelanduk Publications. Petaling Jaya, Selangor.

- Jariah, M and A.H. Sharifah. (2008). “Income differences among elderly in Malaysia: A regional comparison”. International Journal of Consumer Studies 32, 335-340.

- Joo, S.H., & Grable, J.E. (2005). Employee education and the likelihood of having a retirement savings program. Financial Counseling and Planning, 16(1). 37-49.

- Johnson, R. W.,and M. M. Favreault (2004).“Economic status in later life among women who raised children outside of marriage.” Journals of Gerontology Series B – Psychological Sciences and Social Sciences, 59: S315–S323.

- Kendler, KS, Myers, J and Prescott, CA (2005), “Sex differences in the relationship between social support and risk for major depression: A longitudinal study of opposite-sex twinpairs”, The American Journal of Psychiatry.162 (2):250-256.

- Kim, V. K. G. (2003). “An empirical study of older workers’ attitudes towards the retirement experience”. Employee Relation.25 (4):330-346.

- Kwan, H-J. (2005). “Transforming the Developmental Welfare State in East Asia”. Social Policy and Development Programme Paper Number 22, September 2005. United Nations Research Institute for Social Development.

- Lakey, B and Cronin, A (2008), “Low social support and major depression: Research, theory and methodological issues”, in KS, Dobson & D, Dozois (eds.), Risk factors for depression, Academic Press, San Diego, CA, pp. 385.

- Lai, M. M., Lai, M. L., & Lau, S. H. (2009). “Managing money and retirement planning: Academics’ perspectives.” Pensions: An International Journal, 14 (4), 282-292.

- Lee, S. J. (2014). “Poverty amongst the Elderly in South Korea: The Perception, Prevalence, and Causes and Solutions”. International Journal of Social Science and Humanity, 4 (3).

- Marmot, M. & Wilkinson, R. (eds.) (1999). “Social Determinants of Health”. Oxford: Oxford University Press.

47. Masud, J & Haron, S.A. (2014). “Income Disparity among Older Malaysians”. Research in Applied Economics, 6(2).

- Mat, R. & Taha, H.M. (2003). “Socio-economic characteristics of elderly in Malaysia”. Department of Statistic, Malaysia

- McKee, M (2009). “How can health systems respond to population aging?” European Observatory on Health Systems and Policies. World Health organization, Europe.

- Merriam, S.B., & Mohamad, M. (2000). “How cultural values shape learning in older 123 adulthood: The case of Malaysia.” Adult Education Quarterly, 51(1), 45-64.

- Moen, P., Huang, Q., Plassmann, V., & Dentinger, E. (2006). “Deciding the future: Do dual-earner couples plan together for retirement?” American Behavioral Scientist, 49, 1422-1443. http://dx.doi.org/10.1177/0002764206286563.

52. Mohidin, R; Abd Jamal, A.A; Geet, C; Sang, L.T and Abd Karim, M.R. (2013). “Revisiting the relationship between attitudes and retirement planning behavior: A study on personal financial planning”, International Journal of Multidisciplinary Thought. 3(2):449–461.

- Munnell, Alicia H., and Mauricio Soto. (2005). “The House and Living Standards in Retirement”. Issue Brief No. 39. Chestnut Hill, MA: Center for Retirement Research at Boston College.

- Muhamad, M. and Kamis, M. (1999). Programs for learning for older people in Malaysia. Paper presented at the Asia-Soth Pasific Bureau for Adult Education. Singapore. November, 6- 8.

- News Straits Times (NST) (2015). “Educating Malaysians on retirement savings”. Accessed at http://www.nst.com.my/news/2015/11/112190/educating-malaysians-retirement-savings

56. Ong, A. & Lee, B.K. (2001). “Personal financial planning in Malaysia: your blueprint to financial success”. Citibank, N.Y.Singapore : AFPJ.

- OECD (2009), “Australia: Highlights from OECD Pensions at a Glance 2009” (Paris: OECD, 2009).

- Pezzin, L. E., Schone, B. S. (1999). “Parental marital disruption and intergenerational transfers: An analysis of lone elderly parents and their children”. Demography, 36,287-297.

- Rake,K., Davies,H.,Joshi,H.andAlami,R.(2000). “Women’s Incomes over the Lifetime”. A Report to the Women’s Unit, Cabinet Office, London: HMSO.

- Ruggeri, G.C., Howard, R., and K. Bluck. (1994). “The Incidence of Low Income among the Elderly.” Canadian Public Policy, 20(2): 138-151.

- Sabates, R. (2008). “The Impact of Lifelong Learning on Poverty Reduction”. IFLL Public Value Paper 1. Accessed at http://shop.niace.org.uk/media/catalog/product/P/u/Public-value-paper-1.pdf

- Suhaimi A. S. (2013). “Population Aging and Social Protection in Malaysia”. Malaysian Journal of Economic Studies 50(2): 139:156.

- Sarlo, C. ( 2001 ). “Measuring poverty in Canada. Critical issues bulletin.” Vancouver, British Columbia, Canada: The Fraser Institute .

- Sefton, T., Evandrou, M. & Falkingham, J. (2008). “Family ties: Women’s work and family histories and their association with incomes in later life in the UK”. Case Paper 135, Centre for the Analysis of Social Exclusion, London School of Economics, London.

- Suwanrada, W. (2009). “Poverty and Financial Security of the Elderly in Thailand”. Aging International, 33, 50–61.

66. Tengku Aizan, H and Jariah, M. (2010). “Financial well being of older Malaysians,” in International Seminar on Social Security Organized by The Employees Provident Fund, Kuala Lumpur, Malaysia, 2010.

- The Conference Board of Canada, (2016). “Elderly Poverty”. Accessed at http://www.conferenceboard.ca/hcp/details/society/elderly-poverty.aspx.

- Thillainathan, R. (2004). “Malaysia: Pension & Financial Market Reforms and Key Issues on Government”. Paper Presented at the Conference on Pension in Asia organized by Hitotsubashi University in Tokyo.

- United Nations (2002). “Political Declaration and Madrid International Plan of Action on Aging”. Second World Assembly on Aging, Madrid, Spain.

- United Nation ESCAP (2008). “Country report population and poverty in Malaysia”. Asia Pacific Population Journal. 1-35.

- Walker, R., Heaver, C. & McKay, S. (2000). “Building up pension rights”. DWP, Research Report No. 114, Department for Work and Pensions, London.

- Wrzus, C, Hänel, M, Wagner, J and Neyer, FJ (2013), “Social network changes and life events across the life span: A meta-analysis”, Psychological Bulletin, 139(1):53-80.

- Wood, G. and I. Gough (2006). “A comparative welfare regimes approach to global social Policy”. World Development, 34(10), 1696–712.

- Yaacob, M.F. (2000). “Formal old age financial security schemes in Malaysia,” in Social Welfare East and West: Britain and Malaysia, J. Doling and R. Omar, Eds., pp. 71–79, Ashgate, Aldershot, UK, 2000. View at Google Scholar.

- Yaacob, M. F. and M.F. Nurdin. (2000). “Old-age financial support schemes in Malaysia.” In Issues and Challenges of Social Policy East and West, ed. R. Omar and J. Doling, pp. 155. Kuala Lumpur:University of Malaya Press.

- Zaidi, A.,and K.De Vos.(2008).“ Income Mobility of the Elderly in Great Britain and the Netherlands: A Comparative Investigation.” In A. Zaidi,ed.,Well-being of Older People in Ageing Societies:237–287.Aldershot:Ashgate Publishing Limited.