Introduction

Amidst the hot summer of 2008 in Cairo, Egypt, Mr. Sherif Samy, the CEO of CSC (Computer System Center) sat in his office in Heliopolis, when his sales manager, Mr. Maged Shawky, walked in exclaiming, “The days of the assembled PC are numbered my friend.” Reflecting on the statement Mr. Shawky nodded his head in agreement, but quickly added “The growth is declining but assembled PCs will be around for several years to come. Still, the notebook, and other electronic gadgets, will show tremendous growth.” Contemplating the sales trend of CSC over the past 3 years, Mr. Samy could clearly see that in this last year, the growth had flattened in comparison to the 2 previous years. As he recollected the events, it was clear that several factors had impacted their company’s growth. The explosion of computer malls all over Egypt greatly impacted the PC industry, as did the ‘PC for Every Home’ government led project. The shift in the market (from assembled PCs to the recently more affordable Laptops) also decreased PC sales, as well as the innovation of other electronic gadgets into the electronic market. From the flattening sales figures, it was clear that CSC‘s business model and its current strategies needed a quick intervention, in order to reverse the damage and re-energize the team. His yearly meeting with his sales team was planned in 2 weeks time, during which he would be expected to share his renewed company direction and core strategies.

CSC Company Background

CSC is a startup that has specialized in selling assembled PCs and laptops since the mid 90s, operating from an office in Heliopolis. Its objective is to assemble PCs, selling them to consumers and businesses. CSC uses international brand microprocessors, such as Intel and AMD, sourcing them from official distributors. Similarly, the company sources hard disks from key players (such as Western Digital and Seagate distributors), choosing to retrieve the less critical components (such as motherboards, display adapters and keyboards) from suppliers who imported components of Taiwanese and Chinese origin, so as to maintain price competitiveness within the market.

CSC’s product portfolio includes the full range of assembled PCs, from budget PCs all the way to the fastest, most sophisticated configurations. In recent years, CSC has expanded its portfolio to include Notebook computers and accessories, as well.

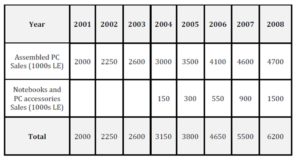

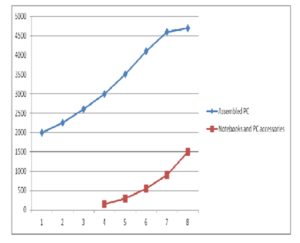

Between the years 2001 and 2006, CSC’s PC business grew by an optimistic average of 15% per year (see Exhibit A). Beginning in 2006, the PC business started to flatten, with the growth in 2008 reaching +2% in comparison to the previous year. In parallel, CSC witnessed a growth in the Notebooks category, which they had only added to their portfolio in 2004. The growth in Notebooks was most significant between 2006 and 2008, with the notebook business almost doubling in this period.

CSC organization structure

Since its inception, the CSC organization grew from a team of 10 members to an energetic team of 20 people, divided into the following functions:

• Marketing and sales: Responsible for selecting appropriate products as well as setting prices. They also prepare promotional material and advertisements. Telesales is also part of the department.

• Assembly and Maintenance: Responsible for the assembly, and later the maintenance and support of PCs and other devices, be it by telephone or on site.

• Administration: Responsible for general administration, logistics and accounting.

The fact that the organization is small in size presses for a level of flexibility, given that responsibilities are bound to overlap.

CSC Company Culture

Mr. Sherif Samy states that the CSC company culture is significantly customer focused. He has personally nourished a culture in which the team “goes out of their way to satisfy their clients.” It is a culture that is also characterized by a high level of agility/flexibility, which exists largely as a result of the relatively small size of their team. Their customer focused culture, and superior customer and maintenance support services, have helped fuel CSC’s growth over the past years. It has also given them a base of loyal consumers, leading to a high rate of repurchase among their clients.

Evolution of the PC business

In 1981 IBM, the major player in the computer industry at the time introduced its first personal computer to the world. The first IBM PC had an Intel microprocessor and an operating system called DOS. During the 80s and 90s, other companies introduced high quality branded PCs as well. These companies were either established computer companies (such as HP), or new ventures (such as Compaq and Dell). Hence, initially the majority of the PC market share was dominated by Global brands including IBM, HP, Compaq, Dell and Acer. Another PC started to emerge along with these brands, taking a growing market share in the world wide market, namely “The Assembled PC” (or as some people refer to it, “The Clone”).

• The PC was built from the following main components:

• Microprocessor

• Mother Board

• Memory Modules

• Hard Disks

• Floppy Disk Drives

• Display Adapters

• Computer Case, Key Board, Mouse

• Monitor

Later, multimedia components, Fax modems and network adapters were introduced.

The clone was built using components manufactured by 2 types of companies: Large multinational companies for technologically demanding components, and Taiwanese, Chinese, and other East Asian countries, for all the other components. The components were imported by many local suppliers/distributors, and were assembled by local companies. The microprocessors were world known international brands, such as Intel and AMD, while Hard disks were from Seagate, Western Digital, Maxtor etc. On the other hand, the other components mostly came from numerous East Asian suppliers. In the greater majority of cases, the software used was initially DOS and later Microsoft windows.

The Clone PC opens up new horizons

The assembled PC led to a gradual shift in the PC market. It costs an average of 40 – 50% less than the price of the international brand PC, leading to a shift of consumers who did not need the PC for critical applications, rather mainly purchased it for home usage. Hence, users were inclined to transition to the more cost efficient assembled PC. Another impact of the assembled PC was that it opened the market to new consumers who no longer found the assembled PC to be prohibitively expensive, seeing as how it was almost half the price of most international PC brands. Medium and large Businesses were less open to adopting the assembled PCs, given that they were using PCs for mission critical applications that could impact the business processes. They therefore continued using the computers that they knew guaranteed higher reliability, despite their costly disadvantage.

IT market in Egypt

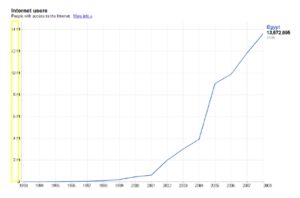

Hardware has always entailed the major fraction of the Egyptian IT sector, accounting for around 58% of the total market. The rates of PC penetration in Egypt are still relatively low, and around 1.5mm households in Egypt are said to own a computer at present. In 2006, Egypt spent around $507 million of its IT budget on hardware, driven by government led initiatives (such as the ‘PC For Every Home projects, which will be covered in depth in the case). The outlook for computer growth, therefore, is very positive, with room for significant growth in the next few years. The number of internet users is also expected to rise from the current 5mn users to 15 million users in 2011, thus providing room for growth for hardware vendors.

On the other hand, the overall spending on software remains quite low, and was estimated to be around $124 million back in 2006 (which accounted for around 14% of the total Egyptian IT spending). This reflects the immaturity of Egypt’s IT market. Piracy is another factor that contributes to the low spending on software, with more than 80% of IT software goods being a counterfeit. The software sector is expected to grow at a CAGR of around 6% between 2006 and 2011 (Egypt Information Technology report 2007).

PC Market dynamics in Egypt

As per the 2008 Egypt information technology report section of the Business Monitor international, Egypt’s IT sector is one of the most promising in the Middle East and Africa region. In 2007, Egypt accounted for more than 50% of the total computer sales of Arab Levant countries (Egypt Information Technology report 2007).

The report forecasts the Egyptian IT market to deliver strong growth over the next 5 years, in both the public and the private sectors, reflecting growth in consumption in house hold and business enterprises, despite the fact that still, “Computers remain a luxury item for many”. However, several factors are expected to fuel its growth. One of the most important factors is the increase in the affordability, and ultimately in the demand of notebooks, providing more opportunity for international vendors. The key constraint to the explosion in PC growth is the limited disposable income and wide economic inequalities.

Internet penetration is increasing at a pressing rate. In 2007 at 5 million households, it was forecasted to increase to 15 million in 2011, posing a major opportunity for Hardware vendors. Key growth drivers of the PC market consist of the rising need of PC’s in education, and the growth of small and medium enterprises. 20 – 25% of the PC sales are said to be made by households with almost 1.5million said to possess a computer in the present (Egypt Information Technology report 2007).

The Clone PC‘s Equity in the Egyptian Market

Worldwide, the Clone was initially received with some skepticism, and Egypt was no exception. It was perceived as a low quality device that was built from sub-standard components from Taiwan and China- countries that were not associated with quality products. Despite the initial skepticism, the attractiveness of the PC price being more than 40% less expensive than its international brand equivalent was the key trigger for the early adopters to purchase the clone and to initiate what became a strong trend both worldwide and in the Egyptian market.

As the trend grew, the quality perception of the Clone PC developed, positively driven by several key factors:

• Some of the suppliers of the components (such as mother boards, display adapters etc) developed and offered branded high grade components at a small premium of around 10%.

• Magazines and specialized periodicals such as PC Magazine were published regularly, grading PC essential components in terms of performance and reliability.

• Local Companies in Egypt leveraged these resources and built their own expertise as to the selection of high grade components that would satisfy their clientele.

• Local companies, who wanted to retain the loyalty of their customers, and to generate positive word of mouth, provided efficient and professional maintenance and support services.

The positive development of the Clone component quality improved the PC’s performance and positively impacted the equity of the Clone PC. All these factors contributed to the explosion of the Clone PC demand. In fact, the Clone PC trend grew so much that the technically oriented PC users became something of a cult.

Rising Trends in the Egyptian Market and Their Impact on CSC

Computer Malls Explosion

The rising trends of computer malls started in 2002, with the first computer mall opening in Heliopolis. The first mall was followed with several other new malls that opened in Mohandiseen and downtown- practically all over Cairo. Some malls had more than 60 stores, which were a mix between new, small businesses, start ups, and medium sized existing companies. Between 2004 and 2005, however, CSC began witnessing a gradual decline in the effectiveness of its prime marketing tool: the PC exhibitions. The rapid increase in computer malls had a negative influence on the reach of PC exhibitions, which CSC witnessed in the decline of exhibition traffic and therefore, in the number purchases. This rising computer mall trend also led to the “geographic purchasing trend” whereby residents of a certain area bought their PC from the nearest mall, ultimately limiting CSC to the clients in Nasr City and Heliopolis.

The rental costs of stores in the computer malls were relatively expensive, and would have cost CSC an extra 40% above its current overhead costs. Initially, CSC had not anticipated that malls would spread so vastly, especially given that some of the companies that started up in the malls were unable to sustain the high rental cost and closed down during the first year.

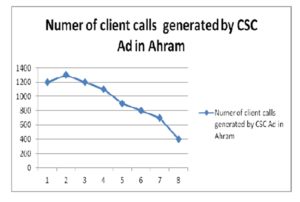

CSC tried to compensate for the decline in computer mall reach by investing disproportionately in newspaper advertising. The increased clutter in Newspaper advertising, mainly driven by mobile operators and hyper market Ads, had an impact in terms of number of calls. See Exhibit C.

PC for every Home Project

The rising trend of computer malls coincided with a mega government-led project named ‘PC for Every Home’. The project was led by the Ministry of Communication and Information Technology, in collaboration with 18 private sector computer manufacturers in a partnership between the public and private sectors. The initiative imported computer parts and assembled them in Egypt. The objective was to increase PC ownership from 1.5 million to 6.5 million in 5 years. The concept was to offer internet enabled PCs on installments with no collateral and no deposit required. Only a fixed telephone line was required, making the purchase of a PC both affordable and accessible to the average Egyptian family. In 2002, over 300,000 PCs were sold through the ‘PC for Every Home’ entity (ICT initiatives in Egypt). However, another factor that came into play is that the depreciation of the Egyptian pound in the last few years has raised the prices of the assembled PC parts, as initially foreseen by the project leaders. Though the program added new users, it took away a significant volume of business from the existing companies.

The mere fact that this government-funded project incorporated internet-enabled PC’s with no requirement for collateral had an impact on CSC. However, the success of the “PC for Every Home” project was not sustainable; due to the fact that many of the consumers who had bought PCs from the project on credit stated that using the telephone line as collateral was not sufficient to guarantee that customers will pay all their installments fully.

Migration to Laptops

Another key trend was taking place in the PC market in parallel. Laptop prices were declining and getting closer to PC prices, driving consumers to purchase trendy laptops versus the traditional PC. CSC, among others, responded by offering a portfolio of laptops that met the diverse consumer needs. The growth of the laptop segment strengthened the position of international vendors, given that they had an advantage over assembled PCs, dominated by Local Players (Business Monitor report). In 2006, Laptop growth was more than 100% in Egypt, whereas desktop growth was in singles digits. Despite the fact that Desktop sales were still dominating the majority of the market in absolute figures, it was clear that a growing trend to the advantage of laptops was heading their way.

The laptop growth trend was an indicator that there would be an increased influence of international players. For example, Dell announced that it is planning to open its own site in Egypt in 2007. In the past years, Dell was represented by Local Companies: Raya and Quest and revealed that Egypt’s sales increased by 80% in 2006, reaching 12.9% of the market share, with HP being the market leader (followed by Dell and Acer who are at PAR). In total, all 3 vendors accounted for around 40% of revenues in 2006 (Egypt Information Technology report 2007).There were several international brands playing in the laptop market, most important of which were HP, Dell, Compaq, Toshiba and Acer.

All in all, the heightened innovation of mobile phones (expected to reach 70% penetration in 2010) and other internet devices is gradually amounting to the decrease in the PC market’s potential.

Explosion of Mobile phones

The vast innovation of mobile penetration in Egypt represented another major trend. The mobile market review explains that Egypt is by far the biggest telecom market in North Africa (Mobile Market Review). It is projected that by 2010, mobile phone penetration is expected to reach 70%- far above the PC penetration levels. The explosion in mobile consumption diverted consumer expenditure from PCs to mobile phones, which were becoming an increasing need rather than a mere luxury among Egyptian consumers.

The Used PC

In the early 2000s, a new player entered the market: “The used PC”. Many small companies began importing container loads of used international brand PCs, mainly from the United States or Europe. Most of these PCs were functioning, but with relatively outdated hindering them from running the most up to date software programs. However, for many consumers this was a bargain. They were suddenly able to purchase a functioning PC between 500 LE and 1000LE. Some Computer malls became specialized in selling these used PCs, given the large potential of this low end market in Egypt.

This trend highly expanded the market to classes that previously found the assembled PC to be prohibitively expensive. It also negatively impacted the low end PC market (the assembled PCs that were being sold at around 2000 LE were declining).

The CSC Business Model

The Core of CSC’s proposition

Catching the early trend of assembled PCs, CSC built a solid business. The company started with a team of 10 people, formulating the core functions of Sales, Maintenance/assembly, and administration. The team identified several key pillars that would differentiate it from its competitors:

• Buying from reputable PC Component Suppliers: CSC bought its components from reputable suppliers, ensuring the purchase of the PC’s critical components (such as its microprocessors and hard disks) from international brands, while purchasing other components from key suppliers who imported Chinese and Taiwanese components. This provided consumers with a reliable PC at a competitive price.

• Superior Maintenance Service: In addition, it offered its consumers an excellent maintenance service, which was a key business driver, enriching the consumers’ after purchase experience and ensuring the spread of their word of mouth. CSC provided a warranty service, including spare part replacement for 1 year, and general support services for several years after. The strong maintenance service was one of the key differentiating elements, having a positive impact on CSC’s reputation in the assembled PC market.

• Competitive Pricing: CSC also ensures that it remains competitive in its pricing by sourcing its components from 5 suppliers, thus ensuring that it maintains a strong bargaining power with its suppliers, and that it sustains the most competitive prices on the market.

• Efficient Inventory Management: More over CSC followed a “Just-in-time” inventory management system, which enabled it to operate with a high level of agility, hence allowing it to source its components from the most competitive suppliers, and to leverage promotional opportunities, taking advantage of the ever declining prices of PC components.

CSC’s Segmentation Strategy

The assembled PC market consisted of several consumer profiles. Initially, the early adopters were the ones who started buying and experimenting with the Clone PC. Gradually, more consumers started joining the trend. CSC segmented the market into the following categories:

• The Aspiration Family: who perceived the PC as being an essential part of their children’s development. This was made for the most sizeable segment of the assembled PC market. To them, learning “English and PC skills” were critical to the future success of their children. The investment the family was willing to make varied, depending on where in the social spectrum they stood. But generally they calculated the price, PC reliability and longevity.

• The Techie: who retained a wide knowledge on PC components and specifications, and was willing to invest more in relation to the other target segments.

• The Gamer: who bought the PC to play the latest and ever more advanced computer games. Their investment was driven by a desire for high speed and graphic performance.

• The Professional: Engineers, Graphic designers, Accountants. They were looking for adequate performance and reliability.

Mr. Shawky, the CSC marketing Manager, estimates that despite some overlap among the consumer segments, they are split into the following categories: the asp rational Family is the biggest and fastest growing segment accounting for around 60% of the PC consumer market by the professionals that account for around 20%. The techies and the gamers account for around 10% each, investing least in the assembled PC market.

Mr. Shawky adds that the pricing sensitivity of the different PC market consumer segments varied over time. However, for more than a decade in the 1990s, 3000 LE was the magic price range that most consumers wanted to maintain. This price range was highly influenced by the needs of the “Aspiration Family”, due to the fact that they were the most sizeable segments. Of course, some families with lower cash outlay were leaning towards purchasing a PC around 2000 LE. On the other hand, the other segments: The Techie, Gamer and Professionals, were in some cases willing to pay well over the market price average of 3000 LE, in line with their superior performance requirements and expectations from the PC.

At a minimum, the PC and internet penetration was estimated to be around 14 million users in Egypt, and it is expected that within the next few years, families will continue to be the fastest growing segment. Due to the diverse PC/laptop applications, the assembled PC is used by almost all family members as an educational tool in schools and universities, entertainment for music, videos and games, as well as for social networking.

CSC’s targeting strategy

CSC’s sales strategy primarily focused on consumers, who accounted for around 80% of their business, followed by the small business sector (which accounted for around 20% of their business). CSC targeted its proposition to all the consumer segments by offering different PC configurations that require different cash outlay levels, and by tailoring the communication of their sales team depending on which segment the customer belonged to. For example, to the Techie they focused on specs and performance, to the gamer they stressed on speed and graphics performance, and to the aspiration family they focus on reliability, price and longevity.

The Aspiration Family, or what the CSC team internally called “The Happy Family segment”, was the most sizeable of their segments and was a key driver of CSC’s growth. The other 20% was mainly driven by businesses and professionals.

CSC’s Communication Strategy

According to the research carried out by CSC, the following were the most effective marketing strategies through which consumers were reached:

• Word of mouth: was a critical source of information. Consumers trusted what they heard about the purchase experiences of families and friends.

• Computer Exhibitions: were a new trend that emerged with the growth of the assembled PC market. Several exhibitions were held at different times of the year, through which the consumers were able to compare the offerings, and get a firsthand experience of the different assembled PC companies in the Egyptian market.

• Newspaper Ads and specialized publications: were also checked by PC shoppers, who then called the companies to ask the intricate questions regarding prices and available PC configurations before paying a visit.

Based on the consumer insights, CSC developed a detailed communication plan which constituted the below elements:

• Computer Exhibitions:

CSC mainly relied on PC exhibitions organized by El Ahram (Egypt’s national newspaper) and by other computer societies. CSC managed to utilize these largely exposed channels in order to reach their target consumers with the latest technologies that they had to offer. Two major exhibitions were held annually in the 1990s: Al Ahram exhibition was organized by El Ahram, and was held around February, and the Compuknowledge exhibition was held around September, and was organized by a computer society. Two other exhibitions were held in June and November, also organized by a private company. Universities, professional syndicates (Neqabat) held exhibitions throughout the year as well.

Exhibitions were a key tool through which potential consumers met and interacted with the CSC Team, evaluated both the products and the team members. Thus, CSC strove to maintain a professional, high quality image in the exhibitions through its displays and quality brochures. Exhibitions generated immediate business and managed to positively impact CSC product sales, long term. In order to maximize the immediate business generated by the exhibitions, CSC offered discount and gift premiums for consumers who purchased products during the exhibition period.

• Newspaper Advertising:

In addition to PC exhibitions, CSC published regular newspaper advertisements during Exhibition seasons and to generate business in times of high demand (such as the summer season and the beginning of the school year). CSC mainly advertised in El Ahram newspaper, the highest distribution newspaper in Egypt, though in some cases the company also advertised in Akhbar el Yom, published every Saturday.

In order to maximize the return on the investments being made in advertising, CSC set up a simplified call center made up of a trained telesales team, equipped to answer all customer inquiries. The team also followed up on any outstanding customer issue.

• Mail Shots:

CSC leveraged its customer base and exhibition visitor information to build a list of potential customers to whom they sent regular mail shots. The mail shots included the company’s updated offers and special promotions, timed to be delivered right before the high seasons mentioned above.

CSC Competition

Despite CSC’s early innovation into the assembled PC market in Egypt, it was soon faced with intense competition due to the growing potential of the assembled PC market, as well as the low startup capital cost of the operation leading to low barriers to entry. In a typical exhibition, over 100 companies participated with diverse contributions, including international brands, assembled PCs, and even companies who sold PC supplies. Nonetheless, CSC’s retained a positive reputation as a result of its very reasonable prices, its ongoing maintenance service, and its continuous marketing activities. As a result, the company managed to stand firm despite the rising competition.

During the second half of the 90s, there were several attempts by local companies to brand their PC i.e. sell it under a local brand name with preset configurations and model names. Their prices were set at a premium higher than the price of the assembled PC, but lower than the prices of international brand names, thus promoting the fact that they have better quality control and that they use standardized components. Unlike what these local companies might have hoped for, customers did not buy into this concept due to the fact that the premium companies offered neither product nor service and maintenance security in comparison to the assembled PC companies. Finally, the preset configurations did not offer sufficient flexibility to meet the demands of the different user profiles that we referred to earlier. Their main customer was of the business and government sector. On the long run, however, due to the low demand and high overhead costs of their organization, premium companies suffered extreme instability.

The Future of CSC

Sherif Samy looked at CSC’s latest sales results and thought, “It seems that we need to come up with alternative plans in order to reverse the flattening trend. Otherwise or we will simply continue to lose shares”. The PC assembly business is gradually declining and the trend is moving in the opposite direction. Sherif had several options to consider: should CSC merely focus on Laptops, or should they expand to offer other electronic gadgets such as mobile phones and game consoles? And how will they differentiate their contribution in categories where price was becoming the main differentiating factor? Should they leverage the CSC brand when expanding to the gadget business, or would this dilute their equity as a professional Laptop and PC company among its existing clients? Finally how should they adapt their distribution model so that it lines up with their portfolio expansion, fueling the growth of their current base business?

His yearly meeting with his sales team was planned in 2 weeks time, during which he would have to share his renewed company direction and core strategies.

Exhibit A

Table 1: CSC Sales Progression Table 2001 -2008

Exhibit B

Figure1: CSC Sales Progression Chart 2001 -2008

Exhibit C

Figure2: Customer Calls generated from Same Size Ad – progression (2001 – 2008)

Number of client calls received in a week from the date of publishing the Ad

Exhibit D

Figure3: Internet Penetration growth in Egypt

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Corder, Rob. November 15th 2010. “Egypt plans to put a PC in every home.” Arabian Business.com. http://www.arabianbusiness.com/egypt-plans-put-pc-in-every-home-149431.html

2. “Egypt Information Technology Report (Q3 2007).”Business Monitor International, 6, 7.

3. Farag, Soni. CSC Customer Service Manager. November 5th 2010, Personal Interview.

4. Ibrahim, Hani. CSC General Manager. November 5th 2010 Personal interview.

5. “ICT Initiatives in Egypt.” Arab Development. Retrieved November 17th 2010 http://www.arabdev.org/node/add/book/parent/90

6. Magdy, Sameh. CSC Sales Manager. November 6th 2010 Personal interview.

7. “Mobile Market Review Egypt 2009.” Consultant Value Added.

8. “PC in Every Home.” November 28th 2010. Ministry of communication and Information Technology. http://www.mcit.gov.eg/PressreleaseDetailes.aspx?id=O3JjqP/4lJI=.