Introduction

Governance practices arise from agency and information asymmetry problems. To overcome these problems and to attract the attention of external investors, the company must carry out its mission by improving its governance through monitoring mechanisms.

This paper focuses on one of the essential components of corporate governance system (Charreaux, 1990) representing and defending the shareholders’ interest, ensuring the monitoring of managers (Fama, 1980, Fama and Jensen, 1983) and enhancing the performance of the firm; it is the board of directors.

Based on the literature, there are two main roles of the board: control and advice. The board of directors can exercise a strategic control and a financial control (Jarboui, 2008).

The control is illustrated through the practices of committees attached to the board of directors (Charreaux, 2000). The importance of these committees is also reflected in the role of an effective audit committee in ensuring good relations between the board of directors and the internal and external auditors, which contributes to improve the credibility of the committees and probably the company’s performance as well (Collier, 1997).

However, the disciplinary role of the board of directors is weakened in family firms (Charreaux and Pitol-Belin, 1990).

The board of directors helps the management team with advice and support in order to make the right decisions. Thus, the board of directors seeks to strike a balance between acting as a controller and an advisor to the management team (Anand et al, 2010).

Regarding the board structure-performance relationship, previous studies find inconclusive and mixed results (such as Fratini and Tettamanzi, 2015 and Darko et al, 2016). Furthermore, little attention is paid to the case of Tunisia, in spite of its place as an emerging economy where institutional arrangements are weak and fluid, and with a specific corporate governance model that needs more investigation to evaluate its development and effects. Turki and Ben Sedrine (2012) conclude that corporate governance in Tunisian firms needed to be more strengthened based on-board characteristics. The main range of board characteristics discussed in previous studies includes the board size, the role of independent directors and the CEO duality. It will be explicitly discussed later.

The board of directors, as an internal mechanism of governance, has been the subject of laws and texts in Tunisia and has also been the center of interest for organizations and associations.

The legal framework is essentially the CCC (2000)1. It gives companies large latitude in determining the characteristics of their boards.

The Tunisian Central Bank (TCB) issued the 2011-06 circular to financial institutions to impose the adoption of good governance practices. The publication of this circular is the result of the new vision of governance by the TCB following the mobilization of the image of the Tunisian context after the revolution of January 2011.

Also, the Tunisian Association of Business Administration Procedures, created in May 2009, aims to support directors and public authorities in the practice of good governance.

The purpose of this study is to reconcile some of the conflicting results of the board structure–firm performance relationship by investigating the effect of the board of directors’ characteristics on firm performance of Tunisian listed firms. It seems to evaluate the effectiveness and applicability of agency’s theory, as the major theoretical framework of corporate governance research, specifically that of the Tunisian corporate governance model.

This study can provide explanations and help the Tunisian firms in making decisions. In fact, it identifies the board of directors’ characteristics that play a key role in establishing good corporate governance and thus enhance the firm performance by mitigating most problems and making their company one of the most competitive ones.

Moreover, examining board structure–firm performance relationship provides a methodological contribution towards a better articulation of corporate governance-firm performance link in the context of an emerging market for which only a handful of studies have hitherto been conducted.

The remainder of the paper is organized as follows. Section 2 provides a review of the relevant literature and develops the study’s hypotheses. Section 3 describes the data set and empirical method. The core findings from the empirical study are outlined in Section 4, while Section 5 concludes the paper.

Theoretical background and hypotheses

Board size- Firm Performance Relationship

From an agency perspective, large boards of directors lead to manager’s dominance and conflict (Jensen, 1993). Thus, a limited board of director’s size seems desirable (Godard and Schatt, 2005). Jensen (1993). Considering that, the addition of one director increases the control capacity of the board. On the other hand, this benefit will be mitigated by the incremental cost of adding, in terms of communication problem and slow decision-making. This paradox is also discussed by Lipton and Lorsch (1992).

Also, the effectiveness of the small board size can be connected with higher information quality disclosed to the stakeholders (Klein, 2002) and lower managerial opportunism. Lawal (2012) argues that the stewardship theory also supports the need for a smaller board size, which helps achieve good performance.However, resource dependency theory presents arguments in favor of the large size of the board of directors. The more important the members of the board are, the more the firm will guarantee its survival by controlling its various resources and subsequently limit the managerial discretion and the company costs by taking advantage of the expertise and advice of the directors representing various resources.

Thus, a theoretical divergence is detected regarding the impact of board size on firm performance. This theoretical divergence is confirmed by empirical results. For example, Ciftci et al (2019) find that larger boards seem to make positive performance effects. However, Kao et al (2018) and Guest (2009) conclude a negative relationship between board size and firm performance. Merendino and Melville, (2019) find that board size has a positive effect on firm performance for lower levels of board size in the Italian context. An inverted U-shaped board size-firm performance relationship is also detected by Pérez de Toledo (2010). Also, Bennedsen et al (2004) conclude a nonlinear board size-performance relationship. In the Tunisian context, an insignificant linear relationship was concluded by Bouaziz and Triki (2012).

The above discussion leads to test two alternative hypotheses, formulated as follows:

H1a: There is a linear relationship between board size and firm performance.

H1b: There is a nonlinear relationship between board size and firm performance.

Board Independence-Firm Performance Relationship

Like most governance attributes, agency theory is considered an engine for analyzing the role of independent or external members in an effective monitoring of managerial opportunism. Thus, a strong participation of independent members allows them to decide without hesitation to dismiss an inefficient manager whose management generates a bad performance. Especially, the external directors play an important role in controlling the management of family businesses.

The founders of agency theory, notably Fama (1980) and Fama and Jensen (1983), argue that the presence of outside directors in the board prevents the potential expropriation of wealth by managers and the majority of the shareholders. These directors add value to the company by providing expertise and control services. Thus, the participation of independent directors helps to reduce agency costs and consequently increases firm performance. The important role of independent directors is clearly reflected by defining their duties in corporate governance codes all over the world.

In addition to agency theory, other theories have been a field of analysis of the participation of independent directors. These are cognitive theories and resources dependency theories. According to Barredy (2007), under cognitive theories based on knowledge creation, the contribution of an external administrator lies in his knowledge, skills and ability to generate organizational learning. From a resource dependency theory perspective, external administrators play the role of network creators to help the company analyze the components of its environment and subsequently achieve its goals. Thus, we can theoretically conclude a positive relationship between the presence of independent directors and the company performance.

Several studies corroborate or conclude that firm performance is improved in the presence of independent directors in the board, such as Bouaziz and Triki (2012), Assenga et al (2018) and Uribe-Bohorquez et al (2018). In the same vein, Jeon and Ryoo (2013) argue that foreign investors push companies to increase the number of external directors in their boards. The authors find that the presence of this type of directors positively affects the firm performance.

However, external directors have limitations. Ang et al (1999) find that agency costs are important when the firm presents a board dominated by outside directors. Lawal (2012) adds that one of the most viable ways to ensure the effectiveness of the board and the variation of the performance is conditioned by the degree of dependence of the board of directors.

According to stewardship theory, the importance of outside directors is limited because managers can preserve the interests of the firm. They are also motivated to maximize the value of the firm (Davis et al, 1997). Furthermore, the weak power of independent directors can be explained by the contribution of entrenchment theory. According to this theoretical approach, the independent members in the board can’t limit the actions of opportunist managers.

Empirically, some studies conclude an inverse relationship between board independence and firm performance (Yermack, 1996; Agrawal and Knoeber, 1996; Klein, 2002; Kumar and Singh, 2013) and some other studies find no relationship between the two variables (Bhagat and Black, 2002; Dulewicz and Herbert, 2004; De Andres et al, 2005; Rashid, 2018; Allam, 2018).

The conflicting results are also justified by a fraction of empirical research that finds a nonlinear board independence-firm performance relationship. In the Italian context, Merendino and Melville (2019) conclude that independent directors do have a non-linear effect on performance. De Andres and Vallelado (2008) and Agoraki et al (2009) find an Inverted U-shaped relationship between the presence of independent directors and firm performance.

The above discussion leads to test two alternative hypotheses, formulated as follows:

H2a: There is a linear relationship between board independence and firm performance.

H2b: There is a nonlinear relationship between board independence and firm performance.

Board Gender Diversity-Firm Performance Relationship

Board gender diversity is an important issue related to board composition. Indeed, the gender diversity is the common element of codes of good governance in several countries (Ben Rejeb et al, 2019) especially in emerging ones like Tunisia where governmental measures were taken in order to encourage women’s entrepreneurship and to fight against the glass ceiling facing women, who are as educated and competent as men (Hachana et al, 2018). In Africa, the percentage of women in boards of listed companies varies greatly from a high of 19.8% in Kenya to a low of 5.1% in Cote d’Ivoire. In Tunisia, the percentage of women in boards is 7.9% (African Development Bank, 2015).

The women membership may improve boardperformance by bringing strategic knowledge and expertise, providing better counseling to managers and ensuring participative decision making (Bear et al, 2010; Nielsen and Huse, 2010). Female directors may try to reconcile CEO to shareholders (Lakhal et al, 2015),improve the monitoring process (Carter et al, 2003) prevent CEOs from focusing on short-term performance (Ben Rejeb et al, 2019) and focus on firm values (Nielsen & Huse, 2010; Isidro and Sobral, 2015).

They also play an important role in enhancing innovation. In this vein, Ben Rejeb et al (2019) find that the gender diversity positively moderates the link between ambidextrous innovation and board’s service role.

In line with previous board’s characteristics, a theoretical background and the empirical literature suggest mixed effects of gender diversity on the firm performance.

From the agency theory, women presence on the board of directors will make the board more independent and effective in monitoring managers (Carter et al, 2007). Moreover, board members of diverse genders may better avoid practices of earnings, smoothing and management, thus providing shareholders with more reliable figures of corporate performance (Gallego-Álvarez et al, 2010).

However, it should be noted that the agency theory does not provide a clear prediction of the link between the diversity of the board of directors and the performance of the firm (Mogbogu, 2016).

The resource dependency suggests that a more diverse board of directors will send a positive signal to the firm’s shareholders, customers and the government, that this board understands the importance of having a generally diverse workforce composition (Agrawal & Knoeber, 2001).

According to the human capital theory, the diversity of the board of directors may impact the firm’s performance. The sign could be positive or negative since it depends largely on the situation (Mogbogu, 2016). This is in line with the contingency theory in the sense that the value of the available human capital in one firm at some point of time, may not always remain the same at other given times or situations (Fiedler, 1967). However, Westphal and Milton (2000) used the social psychology theory to argue that women membership could lower social cohesion between groups, thus making it more difficult for female directors to have any positive impact on board’s performance and the overall firm’s performance as well (Mogbogu, 2016).

Empirically, Carter et al (2003) found a positive relationship between the presence of women in the board of directors and the firm’s value. Also, Campbell et al (2008) found that the diversity of the board of directors has a positive impact on the firm’s value. Recently, Boukattaya and Omri (2018) find a positive relationship between the percentage of women in boards and Tobin’s Q.

However, Farrell et al (2005) provide a negative impact of gender diversity on boards and performance. Adams et al (2009) found a negative relationship between the percentage of women in the board of directors and the financial performance of the firm. Minguez-Vera et al (2011) found a negative relationship between the presence of women in the board of directors and the firm performance. Mogbogu (2016) finds a small negative relationship between female directors and firm financial performance. Bouaziz and Triki (2012) confirm the expected negative sign of the diversity-performance relationship.

Kochan et al (2003), Rose (2007) and Carter et al (2010) find no significant relationship between the percentage of women in the board and financial performance. Similarly, Farrell and Hersch (2005) find no relationship between the addition of women to the board of directors and the return on assets. Recently, Ciftci et al (2019) conclude that women board membership is not significantly associated with firm performance.

Because of the above discussion, an alternative hypothesis is found as follows:

H3: There is a linear relationship between gender diversity and firm performance.

Chief Executive Officer Duality-Firm Performance Relationship

The board’s management structure can influence the roles played by the board of directors and subsequently several corporate parameters. The literature review led to conclude the existence of two divergent theories; the theory of stewardship favoring the Chief executive officer duality (whether the CEO serves as a board chairman simultaneously) and the agency theory favoring the CEO non-duality. According to the agency theory, merging the roles of board chairman and CEO can increase conflicts of interests within the firm and also agency costs (Gul and Wah, 2002).The pioneers of this theory argue that it causes the dysfunction of the board as a consequence of concentrated power in the hands of one leader. In fact, this power favors the holding of considerable latitude to initiate and implement projects that are directly profitable to them, which considerably influences the interests of the shareholders and damage firm performance (Li and Li, 2009). Hence, the separation between decisions and control functions, as a governance mechanism, enables the board of directors to carry out its mission by playing its roles of control and advice jointly and enhance its performance.

In line of the Enron affair, several governance codes haven’t proposed the dual-leadership structure within the board to guarantee independence between management and control (Krivogorsky, 2006).

In a similar vein, Serra et al. (2016) suggest that CEOs with specific expertise could negatively affect firm performance. Thus, a non-dual leadership structure may lead to a variety of skills and expertise between a CEO and a board chairman (Merendino and Melville, 2019).

Conversely to the previous logic, the duality of functions has advantages for the company by promoting its governance. This idea is theoretically defended by the theory of stewardship. The theory assumes that the interests of the principal and the agent are identical, thus the agency problems are reduced. In this vein, governance becomes a cooperative game and the logic of control gives way to the logic of advice (Depret et al, 2005).

Additionally, the non-contractual streams of organizational theory confirm that duality helps to strengthen the leadership of the organization. The informational power of the CEO-chairman helps him to ensure effective control and decisive decisions. Several studies, such as Brickley et al. (1997) and Tian and Lau (2001), agreed on improving the performance of companies opting for dual-leadership structure.

In line with the theoretical conflict, empirical tests of the CEO duality-firm performance relationship generate ambiguous results. Many studies, like Palmon and Wald (2002), Allegrini and Greco (2013) and Kao et al. (2018) find that CEO duality negatively affects firm performance. However, Zona (2014) and Bhatt and Bhatt (2017) find a positive relationship between the dual structure and firm performance.

Also, many studies, like Elsayed (2007), Rashid (2010), Rodriguez-Fernandez et al. (2014) Fratini and Tettamanzi (2015), Yasser and Al Mamun (2015), Allam (2018) and Ciftci et al. (2019) conclude a non significant effect of CEO duality on performance.

As a consequence of this theoretical discussion and findings of existing empirical studies, the present research seeks to reconcile some of the conflicting findings in prior studies of the CEO duality-firm performance relationship.

The fourth hypothesis is therefore, as follows:

H4. There is a significant linear relationship between CEO duality and firm performance.

Data, Variables, Models and Methods

Data and Sample Selection

The sample in this paper is drawn from 30 nonfinancial firms listed in the Tunisian stock exchange (TSE) between 2011 and 2017. These companies are compliant with AlphaMena database, from which the companies and the financial variables are extracted. The corporate governance mechanisms are drawn manually from both the annual stock guides provided by the Tunisian Stock exchange and AlphaMena databases. Overall, this sample consists of 210 firm-year observations

Variables Measurement

Dependent variable: Firm performance (ROA)

In the attempt to assess firm performance to board effectiveness, a performance measure is introduced as a return on assets. It is calculated by dividing the net income by the total assets. Several studies use this measure such as Makhlouf et al. (2018), and Rashid (2018).

Board Structure Variables

Board size is included as the logarithm of the total number of board members (Turki et al, 2012)

The theoretical divergence does not make it possible to decide the impact of board size on firm performance.

Thus, this hypothesis implies the existence of a significant relationship between board size and firm performance.

- Board independence (BIND)

Board independence is calculated by the percentage of independent directors on the board (Makhlouf et al, 2018).

The theoretical divergence does not make it possible to decide the impact of board independence on firm performance.

Thus, this hypothesis implies the existence of a significant relationship between board independence and firm performance.

- Board gender diversity (GENDER)

Gender diversity is included as a dummy variable which takes the value of 1 if women are present in boards and null otherwise (Ciftci et al, 2019).

Empirical results are mixed about the effectiveness of gender diversity, however, this study predicts that Gender diversity is significantly related to the firm performance.

- Chief executive officer duality (DUALITY)

Dual CEO is used to measure board leadership. It is a dummy variable which takes the value of one if the CEO is also the chairman of the board and zero otherwise (Makhlouf et al, 2018). In line with the empirical conflict, CEO duality-firm performance relationship generates ambiguous results. Thus, there is a significant linear relationship between CEO duality and firm performance.

Control Variables

Firm size is measured by the logarithm of firms’ total assets (Ciftci et al, 2019; Makhlouf et al, 2018). Firm size could have a positive or a negative link to firm performance. The latter is explained by the agency cost. In fact, Su et al. (2008) argue that larger firms are more likely to have larger boards and hence larger agency cost. In contrast, according to Mura (2007), larger firms can benefit from economies of scale and have less expensive resources,thus, firm size has a positive impact on firm performance.

Financial leverage is reflecting financial risk related to the company’s business. This measure is measured by the ratio of the total debt divided by the firm’s total assets.

This control variable is used in several studies such as Ciftci et al, (2019). Firm leverage could have a positive or negative impact. In fact, it increases firm risk and the likelihood of bankruptcy. Thus, it has a negative effect on firm performance (Ciftci et al, 2019). In contrast, according to Jensen (1986), there is a positive effect of the two variables in the sense that debts decrease the agency cost.

Models Specification and Methodology

Various studies have focused on the endogeneity problem since it is one of the main econometric problems encountered in corporate governance studies (Devers et al, 2007).

The control of data endogeneity reports more efficient and robust estimates (Lemma, 2015).

Thus, a dynamic approach is used to estimate the models. The system Generalized Method of Moments (GMM) estimator of Arellano and Bover (1995) and Blundell and Bond (1998), is selected2.

To do so and in order to test the previously defined hypotheses and use the variables mentioned in the previous subsection, the regression models can be displayed as follows:

Results and Discussion

Descriptive Analysis

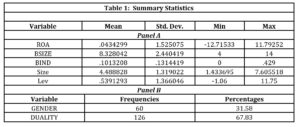

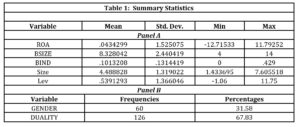

Table 1 reports summary statistics of all variables used in this model specifications. Because of the scarcity of information, unbalanced panel data will be used. Firm performance, measured by ROA, has a mean of 4%, with a minimum of -12% and a maximum of 11%, indicating that the Tunisian sampled firms are relatively profitable and have, in average, moderate or weak performances.

The Panel shows a mean BSIZE of roughly 9 members which indicates that boards in Tunisian firms are relatively large. Boards of directors are not fully independent. The average of independence is roughly 10% and is much lower than the required rate of 33%. This rate is judged to be artificial. Independent boards are only set to meet legal requirements and to calm down minorities.

About control variables, the table also indicates that this sample is made up of small and large firms reflected by a high spread of firm size with multivariate financial situations.

(Source: authors creation)

(Source: authors creation)

Concerning dummy variables, panel B of table 1 shows that Tunisian firms tend to have CEO duality which is a week governance mechanism. However, regarding gender diversity which is a veritable attribute of an effective board and good governance practices, Terjesen et al. (2009) advanced the fact that Tunisian firms became aware of the importance of developing women’s talent up to the board level.

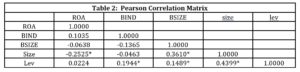

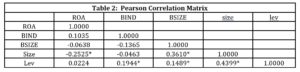

* indicate significance at the 5% levels.

(Source: authors creation)

As seen above, correlation coefficients for all the variables (except for dummy variables) are presented. They show no important correlations between them, which may provide support to their introduction in this model since they may have a significant impact on the firm performance.

Board Structure and Firm Performance: Linear Vs. Nonlinear Relationships

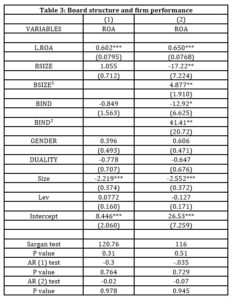

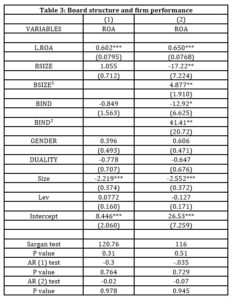

The consistency of the GMM estimator depends on the assumption that the lagged values of the corresponding variables are valid instruments and that the first differenced regression residuals are free from serial correlation. To check for the validity of the instruments, Sargan test is used for over identifying restrictions. Arellano-Bond test, AR (1) and AR (2) are used to examine the presence of first and second order serial correlation in the first differenced regression residuals.

Table 3 reports the results of the two specification tests. Thus, the two-step system GMM approach is accepted. The results found by estimating Equation (1) and (2) are reported in the table hereafter.

Table 3 indicates that past performance has an effect on actual performance and this significance is seen in both regressions.

Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1

Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1

(Source: authors creation)

Column (1) reports results relative to linear regression. Indeed, any interest variable is significant and explains firm performance. This makes it doubtful about the effectiveness of board structure variables, especially in a poor governed context like Tunisia. Moreover, total assets are negatively associated with firm performance indicating that large companies perform less compared to small companies. Large companies have achieved their maturities and are not able to extend further within the Tunisian context.

Column (2) reports the nonlinearity relationship between firm performance and board structure variables. As it has seen that dual CEO and gender diversity variables remained insignificant suggesting that these mechanisms are ineffective and are not tied to firm performance. The results join those of other previous studies such as Kochan et al. (2003), Rose (2007) and Carter et a.l (2010). Recently, Ciftci et al. (2019) conclude that women board membership is not significantly associated with firm performance. Although gender diversity is the common element of codes of good governance in several countries (Ben Rejeb et al, 2019) especially in emerging ones, women jobs and roles are not well pronounced within the Tunisian context. Authorities are taking governmental measures in order to encourage women’s entrepreneurship and to fight against the glass ceiling facing women who are as educated and competent as men (Hachana et al, 2018). As for duality, the results are consistent with those of Allam (2018) and Ciftci et al, (2019). Duality is a common practice seen as a week governance mechanism and cannot be relied on for examining firm performance.

The nonlinear relationship between board size and firm performance is convex with a threshold level of 6. Thus, for low levels, firm performance is poor and firms do not appear to be particularly inclined to apply good governance practices.

Larger boards are effective enough to boost firm performance proving that smaller ones show less engagement and commitment to increase firm performance. This is in line with dependence resource theory. This U-shaped board size-firm performance relationship is also detected by Hidayat and Utama (2016) in the Indonesian context. Therefore, H1b is supported.

The quadratic model regression also indicates a presence of U-shaped relationship between board independence and ROA. The nonlinear relationship between these variables is also confirmed by Merendino and Melville (2019), within the Italian context. The board independence effect is positive on firm performance after achieving the threshold of 15%. Thus, results are in line with resource dependency theory and supported H2b.

Robustness Check

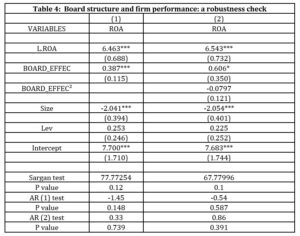

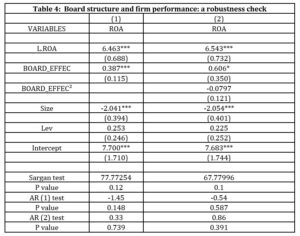

After analyzing the effect of individual board structure measures, there is an attempt to test the robustness of the results for a couple of reasons. Firstly, each individual governance mechanism may have its limitations which may not meet the requirements of the changing environment. Thus, corporate governance mechanisms should be evaluated in a comprehensive way by using an aggregate measure (Guo, 2011). Secondly, the individual mechanism may give contradictory effects and divergent results. So, the composite measure gives a more accurate evaluation of the Board’s effectiveness (Ali, 2013). Thirdly, the effectiveness of one mechanism of board of directors’ characteristics depends on the effectiveness of other mechanisms. So, it’s better to adopt a composite measure to evaluate the join effect of board characteristics (Hashim and Amrah, 2016).

Following Makhlouf et al. (2018), the composite measure includes the independent variables such as board size, board independence, gender diversity and duality. To do so, a score is constructed (BOARD_EFFEC). For non-dummy variables, these will be converted into dummies. In fact, a value of one is given to variables equal to or above the median of the sample and null otherwise. Concerning the dummies, a one is given for nondual CEO and gender presence and null otherwise. Overall, the score, noted as BOARD_EFFEC, ranges from 1 to 4 and a higher score indicates higher board effectiveness.

Standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1

(Source: authors creation)

Table 4 reports results of robustness check. It highlights that the governance index has a positive and significant effect on firm performance. This is maintained when adding the square value of governance score. Even though the non-linearity is highly proven above, it is suggested that putting structure variables together strengthen the linearity link and consequently suggest the role of effective governance mechanisms to enhance firms’ performance.

As for control variables, firm leverage is insignificant and has no effect on firm performance, whereas firm size is significant and negative. The result contradicts those of Ciftci et al. (2019). However, the negative sign joins the result of Su et al. (2008) and the agency cost theory. In fact, larger firms are more likely to have larger boards and hence larger agency cost to cover. Within the Tunisian context, firms are more likely to be large which complies with the findings in this paper.

Conclusion

This study examines the relationship between board of directors’ attributes and firm performance. The scope of previous studies is extended concerning the corporate governance and performance by considering the Tunisian environment, which is characterized by poor governance mechanisms and its ineffectiveness.

The empirical results reveal that board independence and board size have a nonlinear relationship with ROA. A board size below 6 members and an independence rate below 15% are seen to affect firm performance negatively. In fact, the effectiveness of large board size can be attributed with higher information quality disclosed to the stakeholders (Klein, 2002) and lower managerial opportunism. Moreover, external directors are important in improving firm performance.

With the aim to examine the join effect of all board characteristics, the linear relationship between board effectiveness score and firm performance is proven.

This research presents a methodological interest because the empirical analyses are based on a dynamic approach to avoid endogeneity bias.

Regarding practical contribution, this research can help managers of Tunisian companies to put a good governance system in place based on the main role of board of directors in order to help the firm devise strategies leading to a higher performance.

Despite previous contributions, this work has limits. The first one is the small sample size which can be enlarged by extending the period. Second, the scarcity of data regarding board structure which obliges the study to include few board variables because other variables like board meeting is not available and hence not used.

Third, this study limits corporate governance attributes and financial performance measure. Thus, other governance variables, such as ownership structure variables or performance proxies, especially market ones, can be added to the model in order to test the effect of large corporate governance attributes on firm performance proxies. These limitations can extend this research to new avenues of future research.

Acknowledgment

Appreciation is extended to all anonymous reviewers for their helpful comments. This research was not funded by any organization or institution.

Endnotes

1Commercial Compagnies Code.

2Dynamic GMM panel models attempt to deal with the possibility of reverse causality between board structure variables and firm performance. Following Wintoki et al (2012), a one-year lagged dependent variable (ROA t-1) is employed as an explanatory variable to control the dynamic nature of the tested relationship.

References

- Adams, R.B. and Ferreira, D. (2009), ‘Women in the boardroom and their impact on governance and performance’, Journal of financial economics’, 94(2), 291-309.

- Agoraki, M.K., Delis, M.D. and Pasiouras, F., (2009), ‘Regulations, competition and bank risk taking in transition countries’, Journal of Financial Stability, 7(1):38-48.

- Agrawal, A. and Knoeber, R. (1996), ‘Firm performance and mechanisms to control agency problems between managers and shareholders’, Journal of Financial and Quantitative Analysis, 31(3), 377-397.

- Agrawal, A. and Knoeber, C. (2001), ‘Do Some Outside Directors Play a Political Role?’, The Journal of Law and Economics, 44(1), 179-198.

- Allam, B.S. (2018), ‘The impact of board characteristics and ownership identity on agency costs and firm performance: UK evidence’, Corporate Governance: The International Journal of Business in Society, 18(6), 1147-1176.

- Allegrini, M. and Greco, G. (2013), ‘Corporate boards, audit committees and voluntary disclosure: Evidence from Italian listed companies’, Journal of Management and Governance, 17(1), 187-216.

- Ali, M.A.S. (2013), ‘Equity Compensation Incentives, Earnings Management, And Corporate Governance: The Uk Evidence’, (PhD thesis), University of Surrey.

- Anand, A., Milne, F. and Purda, L., (2010), ‘Monitoring to Reduce Agency Costs: Examining the Behavior of Independent and Non-Independent Boards’, working Paper, N° 1243, Queen’s University.

- Ang, J.S., Rebela. C. and James W.L. (1999), ‘Agency Costs and Ownership Structure’, The Journal of Finance, 55(1), 81-108.

- Arellano, M. and Bover O., (1995), ‘Another Look at the Instrumental Variable Estimation of Error-Components Models’, Journal of Econometrics, 68, 29-51.

- Assenga, M.P., Aly, D. and Hussainey, K. (2018), ‘The impact of board characteristics on the financial performance of Tanzanian firms’, Corporate Governance: The International Journal of Business in Society, 18(6), 1089-1106.

- Barredy, C., (2007), ‘ Réflexion théorique sur l’intérêt des administrateurs externes dans les entreprises familiales cotées’, International Conference of Strategic Management, Montréal.

- Bear, S., Rahman, N. and Post, C. (2010), ‘The impact of board diversity and gender composition on corporate social responsibility and firm reputation’, Journal of Business Ethics, 97, 207-221.

- Bennedsen, M. Kongsted, H.C. and Nielsen, K.M. (2004), ‘Board size effects in closely held corporations’, Centre for Applied Microeconometrics, Institute of Economics, University of Copenhagen, paper no. 25.

- Bhagat, S. and Black, B.S. (2002), ‘The Non-Correlation between Board Independence and Long-Term Firm Performance’, Journal of Corporation Law, 27, 231-273.

- Bhatt, P.R. and Bhatt, R.R. (2017), ‘Corporate governance and firm performance in Malaysia’, Corporate Governance, 17 (5), 896-912.

- Blundell, R. and Bond, S. (1998), ‘Initial Conditions and Moment Restrictions in Dynamic Panel Data Models’, Journal of Econometrics, 87, 115-143.

- Bouaziz Z. and Triki M., (2012), ‘The impact of the board of directors on the financial performance of Tunisian companies’, Universal Journal of Marketing and Business Research, 1(2), 56-71.

- Brickley, J.A., Coles, J.L. and Jarrell, G. (1997), ‘Leadership structure: separating the CEO and chairman of the board’, Journal of Corporate Finance, (3),189-220.

- Campbell, K., and Minguez-Vera, A. (2008), ‘Gender diversity in the boardroom and firm financial performance’, Journal of business ethics, 83(3), 435-451.

- Carter, D. A., D’souza, F., Simkins, B. J. and Simpson, W. G. (2010), ‘The Gender and Ethnic Diversity of US Boards and Board Committees and Firm Financial Performance’, Corporate Governance: An International Review, 18(5), 396-414.

- Carter, D. A., Simkins, B. J. and Simpson, W. G. (2003), ‘Corporate Governance, Board Diversity, and Firm Value’, the Financial Review, 38(1), 33-53.

- Carter, D. A., Souza, F. D., Simkins, B. J. and Simpson, W. G. (2007), ‘The Diversity of Corporate Board Committees and Firm Financial Performance’, SSRN Electronic Journal, 1–40.

- Charreaux G. and Pitol-Belin J.P. (1990). Le conseil d’administration, Vuibert.

- Charreaux G. (1990). La théorie des transactions informelles: une synthèse, Économies et Sociétés, Série Sciences de Gestion, N° 15, 137-161.

- Charreaux G. (2000). Le conseil d’administration dans les théories de la gouvernance, Revue du Financier, N° 127, 6-17.

- Ciftcia I., Tatoglub E., Woodc G., Demirbagc M. and Zaimd S. (2019), ‘Corporate governance and firm performance in emerging markets: Evidence from Turkey’, International Business Review, 28, 90-103.

- Darko, J., Aribi, Z.A., Uzonwanne, G.C., Eweje, G. and Eweje, G. (2016), ‘ Corporate governance: The impact of director and board structure, ownership structure and corporate control on the performance of listed companies on the Ghana stock exchange’, Corporate Governance: The International Journal of Business in Society, 16(2), 259-277.

- De Andres, P. and Vallelado, E. (2008), ‘Corporate governance in banking: the role of the board of

directors’, Journal of Banking and Finance, 32(12), 2570-2580.

- De Andres, P., Azofra, V. and Lopez, F. (2005), ‘Corporate boards in OECD countries: size, composition, compensation, functioning and effectiveness’, Corporate Governance: An International Review, 13(2), 197-210.

- Depret, M. H., Finet, A., Hamdouch, A., Labie, M., Missonier-Piera, F. and Piot, C. (2005), ‘Gouvernement d’entreprise : enjeux managériaux et financiers. Brussels: De Boeck.

- Devers, C.E., Cannella, A.A., Reilly, G.P. and Yoder, M.E. (2007), ‘Executive Compensation: A Multidisciplinary Review of Recent Developments’, Journal of Management, 33(6), 1016–1072.

- Dulewicz, V. and Herbert, P. (2004),’ Does the Composition and Practice of Boards of Directors Bear Any Relationship to the Performance of their Companies?’, Corporate governance: An International Review, 12 (3), 263-280.

- Elsayed, K. (2007), ‘Does CEO duality really affect corporate performance?’, Corporate Governance: An International Review, 15(6), 1203-1214.

- Fama E. F. and Jensen M. C. (1983), ‘Separation of Ownership and Control’, Journal of Law and Economics, 26(2), 301-325.

- Fama E. F. (1980), ‘Agency problems and theory of the firm’, Journal of Political Economy, 88(2), 288-307.

- Farrell, K. A. and Hersch, P.L. (2005), ‘Additions to corporate boards: The effect of gender’, Journal of Corporate Finance,11(1-2), 85-106.

- Fiedler, F.E. (1967). A theory of leadership effectiveness. New York: McGraw-Hill.

- Fratini, F. and Tettamanzi, P. (2015), ‘Corporate governance and performance: evidence from Italian

companies’, Open Journal of Business and Management, 3(2), 199-218.

- Gallego-Alvarez, I., Garcia-Sanchez, I.M. and Rodriguez-Dominguez, L. (2010), ‘The influence of gender diversity on corporate performance’, Spanish Accounting Review, 13(1), 53-88.

- García-Sanchez, I.M., Rodríguez-Domínguez, L. and Gallego-Álvarez, I. (2011), ‘Corporate governance and strategic information on the internet’, Accounting, Auditing & Accountability Journal, 24(4), 471-501.

- Godard, L. and Schatt A. (2005), ‘Caractéristiques et Fonctionnement des Conseils d’administration Français : Un état des lieux’, Revue française de gestion, 5, 69-87.

- Guest, P.M. (2009), ‘The impact of board size on firm performance: evidence from the UK’, European Journal of Finance, 15(4), 385-404.

- Guo, L. (2011), ‘The Moderating Impact Of Directors’ Demographic Characteristics On The Relationship Between Corporate Governance And Firm Performance In China’s Listed Companies’, (Ph.D thesis), Lincoln University.

- Hachana, R., Berraies, S. and Ftiti, Z. (2018), ‘Identifying personality traits associated with entrepreneurial success: does gender matter?’, Journal of Innovation Economics and Management, 27(3), 169-193.

- Hidayat, A.A. and Utama, S. (2016), ‘Board Characteristics and Firm Performance: Evidence from Indonesia’, International Research Journal of Business Studies, 8(3), 137-154.

- Jarboui, A. (2008), ‘ Impact des mécanismes de gouvernance sur la stratégie de diversification des groupes tunisiens’, Management & Avenir, (17), 83-104.

- Jensen, M.C. (1993), ‘The modern industrial revolution, exit and the failure of internal control Systems’, Journal of Finance, 48(3), 831-880.

- Jeon, J. and Ryoo, J. (2013), ‘How do foreign investors affect corporate policy: Evidence from Korea’, International Review of Economics and Finance, 25, 52-65.

- Kao, M.F., Hodgkinson, L. and Jaafar, A. (2018), ‘Ownership structure, board of directors and firm performance: evidence from Taiwan’, Corporate Governance: The International Journal of Business in Society, 19(1), 189-216.

- Klein, A. (2002), ‘Audit Committee, Board of Director Characteristics, and Earnings Management’, Journal of Accounting and Economics, 33(3), 375-400.

- Kochan, T., Bezrukova, K., Ely, R., Jackson, S., Joshi, A.K.J. and Thomas, D.(2003), ‘ The effects of diversity on business performance: Report of the diversity research network’, Human Resource Management, 42(1), 3-21.

- Krivogorsky, V. (2006), ‘Ownership, board structure, and performance in continental Europe’,

International Journal of Accounting, 41(2), 176-196.

- Lakhal, F., Aguir, A., Lakhal, N. and Malek A. (2015), ‘Do Women on Boards and in top Management reduce earnings management? Evidence in France’, Journal of Applied Business Research, 31(3),1107.

- Lawal, B. (2012), ‘Board Dynamics and Corporate Performance: Review of Literature and Empirical Challenges’, International Journal of Economics and Finance, 4(1), 22-35.

- Lemma, T.T. (2015), ‘Corruption, debt financing and corporate ownership’, Journal of Economic Studies, 42(3), 433-461.

- Li, H., and Li, J. (2009), ‘Top management team conflict and entrepreneurial strategy making in China’, Asia Pacific Journal of Management, 26, 263-283.

- Lipton, L. and Lorsch, J. (1992), ‘A modest proposal for improved corporate governance’, The Business Lawyer, 48(1), 59-77.

- Mayer, R.C., Davis, J.H. and Schoorman, F.D. (1995), ‘An integrative model of organizational trust’, Academy of Management Review, 20, 709-734.

- Merendino, A. and Melville, R. (2019), ‘The Board of Directors and Firm Performance: Empirical Evidence from Listed Companies’, Corporate Governance, 19(3), 508-551.

- Minguez-Vera, A. and Martin, A. (2011), ‘Gender and management on Spanish SMEs: An empirical analysis’, The International Journal of Human Resource Management, 22(14), 2852-2873.

- Mogbogu, O. (2016), ‘Women On The Board Of Directors And Their Impact On The Financial Performance Of A Firm: An Empirical Investigation Of Female Directors In The United States Technology Sector’, (Doctoral dissertation), Illinois State University.

- Makhlouf, M.H., Laili N.H., Ramli, N.A., Al-Sufy, F. and Basah, M.Y. (2018), ‘Board of Directors, Firm Performance and the Moderating Role of Family Control in Jordan’, Academy of Accounting and Financial Studies Journal, 22(5), 1-15.

- Mura, R. (2007), ‘Firm performance: Do non-executive directors have a mind of their own?

Evidence from UK panel data’, Financial Management, 36(3), 81-112.

- Nielsen, S. and Morten, H. (2010), ‘The Contribution of Women on Boards of Directors: Going Beyond the Surface’, Corporate Governance: An International Review, 18(2), 136-148.

- Palmon, O. and Wald, J.K. (2002), ‘Are two heads better than one? The impact of changes in

management structure on performance by firm size’, Journal of Corporate Finance, 8 (3), 213-226.

- Pérez de Toledo, E. (2010), ‘The relationship between corporate governance and firm value: A simultaneous equations approach for analyzing the case of Spain’, CAAA Annual Conference.

- Rashid, A. (2010), ‘CEO Duality and firm performance: Evidence from developing country’, Corporate Ownership & Control, 8(1), 163-175.

- Rashid, A. (2018), ‘Board independence and firm performance: evidence from Bangladesh’, Future

Business Journal, 4 (1), 34-49.

- Rodriguez-Fernandez, M., Fernandez-Alonso, S. and Rodriguez-Rodriguez, J. (2014), ‘Board

characteristics and firm performance in Spain’, Corporate Governance: The International Journal of Business in Society, 14 (4),485 -503.

- Rose, C. (2007), ‘Does female board representation influence firm performance? The Danish evidence’, Corporate Governance: An International Review, 15(2), 404-413.

- Serra Fernando, R., Três, G. and Ferreira, M.P. (2016), ‘The ‘CEO’ effect on the performance of Brazilian companies: an empirical study using measurable characteristics’, European Management Review,13(3), 193 -205.

- Su, Y., Xu, D. and Phan, P.H. (2008), ‘Principal-Principal conflict in the governance of the Chinese public corporation’, Management and Organization Review, 4(1),17-38.

- Terjesen, S. Sealy, R. and Singh, V. (2009), ‘Women Directors on Corporate Boards: A Review and Research Agenda’, Corporate Governance: An International Review, 17(3), 320-337.

- Tian, J. J. and Lau, C. (2001), ‘Board Composition, Leadership Structures and Performance of Chinese Shareholding Companies’, Asia Pacific Journal of Management, 18, 245-263.

- Turki, A. and Ben Sedrine, N. (2012), ‘Ownership Structure, Board Characteristics and Corporate Performance in Tunisia’, International Journal of Business and Management, 7(4), 121-132.

- Uribe-Bohorquez, M.V., Martı´nez-Ferrero, J. and Garcı´a-Sa´nchez, I.M., (2018), ‘Board independence and firm performance: the moderating effect of institutional context’, Journal of Business Research, 88, 28-43.

- Westphal, J.D. and Milton, L.P. (2000), ‘How Experience and Network Ties Affect the Influence of Demographic Minorities on Corporate Boards’, Administrative Science Quarterly, 45(2), 366-398.

- Wintoki, B.M., Linck, J.S. and Netter, J.M. (2012), ‘Endogeneity and the dynamics of internal corporate governance’, Journal of Financial Economics, 105(3), 581-606.

- Yasser, Q.R. and Al Mamun, A. (2015), ‘The impact of CEO duality attributes on earnings management in the East’, Corporate Governance: The International Journal of Business in Society,15(5),706-718.

- Zona, F. (2014), ‘Board leadership structure and diversity over CEO time in office: a test of the evolutionary perspective on Italian firms’, European Management Journal, 32(4), 672-681.