Introduction

The activation of innovation and investment initiatives is a necessary condition for a stable functioning and progressive development of the country’s economy. But in Russia, this problem has a pronounced regional content, due to the significant differentiation of territories in terms of the level of the gross municipal product, the rate of inflation, the balance of regional and municipal budgets, and the standard of living. As a result, the national economy’s transition to the stage of stable functioning and sustainable growth should be preceded by an institutional support for reducing the risks of the economic activity. In other words, only an investment mechanism of expanded reproduction that is effective in the regions of Russia can guarantee the national economy a way out of the recession and form the foundations of an innovative structure that makes it possible to take a leading position in the world and provide the population with a high quality of life.

Hypothesis 1. The innovation and investment potential is determined by a number of factors; it is necessary to determine the most significant of them.

Hypothesis 2. The types of the pursued social and economic policy predetermine the possibility of increasing the innovative and investment potential.

Methodology

One of the most important elements of the mechanism for financing the innovation and investment processes in municipalities of a region is the methods for assessing the potential of their innovative and investment development. State financial support for the territories in the process of innovative and investment development should be based on the creation and promotion of long-term competitive advantages. In this regard, the application of a model is proposed for assessing the potential of innovation and investment development of municipalities in the region using an integrated approach. It is based on a system of indicators, including an analysis of the dynamics of the social and economic development of the region, and an assessment of the resource potential for innovation and investment development.

The methodology proposed by the authors for assessing the innovation and investment potential of municipalities is based on an indicative analysis. This approach is often used in the economic literature to assess social and economic phenomena in regional economic systems (I. Gurban and A. Sudakova (2015), E. Vasilieva, A. Kuklin and I. Lykov (2014), E. Bartelsman, S. Scarpetta and F. Schivardi (2005), Ek. Kolmakova (2014), P. Pykhov and T. Kashin (2015), T. A. Shindina, Ek. M Kolmakova, G. A. Vlasova, N. A. Orlova and I. D. Kolmakova (2016), D. A. Maslennikov, S. N. Mityakov, L.Y. Kataeva and T. A. Fedoseeva (2019)).

The basis of this methodology is the method of identifying a set of indicators that characterize the level of the social and economic development of municipalities. These indicators are grouped according to the elements of the potential characterizing its individual components, forming blocks of indicators. For a more complete description of the situation in some areas, synthetic indicators are also used, which are a number of particular indicators. The application of this hierarchical structure and the corresponding set of indicators allow this study to analyze more deeply the conditions for the formation of an innovative and investment potential of a particular territory.

The assessment of a region’s innovation and investment potential includes a number of stages:

- Determining the score of the municipal entity in the region on the basis of the system of indicators for assessing the innovation and investment potential.

- Defining the potential of the innovative and investment development of the region for each group of indicators.

- Introducing a comprehensive assessment indicator of the innovation and investment potential of municipalities.

- Comparing the obtained integral indicator with a certain base.

- Drawing conclusions, making decisions.

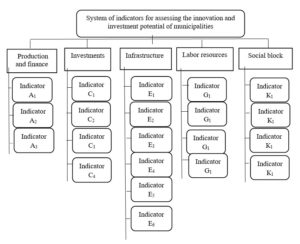

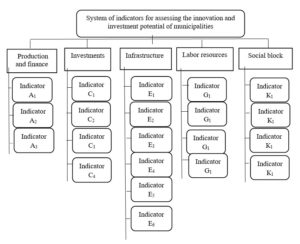

At the first stage, it is necessary to determine the sum of scores for each municipality in the region assessing the indicators which characterize its innovative and investment potential, which are presented in Fig 2.1.

Fig. 1: System of indicators for assessing the innovation and investment potential of municipalities

Indicators of the elements of block 1:

А1 – shipped goods of own production, performed works and services on their own (without small businesses) per capita, one thousand rubles;

А2 – fixed assets for urban districts and municipal areas (at the end of the year; at full cost; million rubles per 1 employee of organizations);

А3 – surplus (+), deficit (-) of the municipal budget (local budget), executed, thousand rubles, value of the indicator for 2016

Indicators of the elements of block 2:

С1 – volume of investment in fixed capital (except for budgetary funds) per 1 person, rubles, value of the indicator for the year.

С2 – number of sites open to the investor (according to the investment passports of the municipality on 22.12.2016).

С3 – share of innovative goods, works and services in the total volume of goods shipped, works performed and services of industrial production

С4 – number of patents for inventions per population of the municipality

Indicators of the elements of block 3:

Е1 – length of motor roads per unit area of the territory under consideration (km/km2)

Е2 – area of municipality per capita as of January 1, 2015, km2

Е3 – share of the territory influenced by the megapolis from the total area of the territory under consideration

Е4 – volume of ore mines (thousand tons)

Е5 – volume of nonmetallic minerals (thousand m3)

Е6 – volume of rare-earth minerals (kg)

Indicators of the elements of block 4:

G1 – dynamics of the population in municipalities (the analysis period of 3 years)

G2 – average annual number of employees of organizations in % of the total population

G3 – level of registered unemployment in % of the economically active population

G4 – characteristics of the territory by the number of scientific personnel per capita

Indicators of the elements of block 4:

К1 – ratio between fertility and mortality (coefficient of vitality).

К2 – level of average wages of the population (thousand rubles per month).

К3 – total area of residential premises, an average for one inhabitant (m2/person).

К4 – consumer price index

The method was tested in 12 urban districts within the Chelyabinsk region. The study provides a comparative analysis of the innovative and investment potential of urban districts in the Chelyabinsk region for 2011-2013 (I period) and for 2014-2016 (II period). Criteria for evaluating the innovation and investment potential of municipalities are given in table 2.1

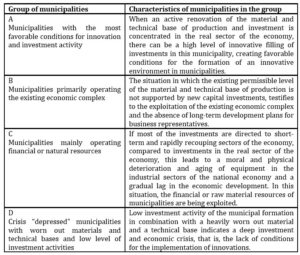

Table 2.1: Criteria for assessing the innovation and investment potential of municipalities (fragment)

Then, the indicator of the innovative and investment potential of the municipality is determined for each block of the indicators according to the formula:

where:

Mfi – actual sum of points for each block of indicators;

Mni – minimum set sum of points for each block of indicators.

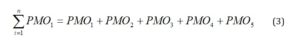

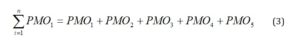

At the next stage, a complex indicator of the innovative and investment potential of the territory is defined by the formula:

where n is a number of indicators of the innovation and investment potential of the municipality.

The fourth stage involves comparing the obtained integral indicator (KAP) with the base, which is used as integral indicators; the average for the region.

The final stage involves drawing conclusions and making decisions.

Results

To illustrate the application of the proposed methodology, it was tested on the example of municipalities within the Chelyabinsk region of the Russian Federation.

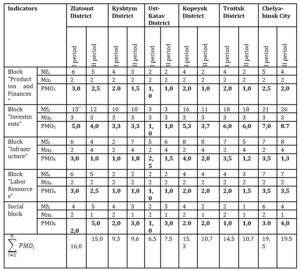

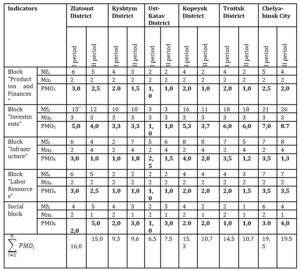

Table 3.1. presents a fragment of calculating the score for each municipality in the context of the blocks of indicators proposed by the study before (Table 2.1). The scoring for each block of indicators is based on the analysis and evaluation of statistical data according to Table 2.2.

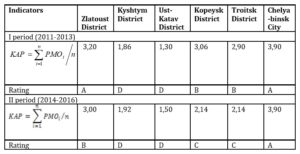

Table 3.1 presents the score for each municipality in the context of the groups of indicators presented in Table 1 for 2011-2013 (I period) and for 2014-2016 (II period).

Table 3.1: Score of municipalities on the basis of indicators of the innovation and investment potential (fragment)

The scoring for each group of indicators is based on the analysis and evaluation of

statistical data (economic, social and other indicators) according to Table 2.2.

For each group of indicators, the value of the smallest sum of points gained by any municipality becomes the base (Mni) for calculating the indicator of the innovation and investment potential of the municipality for each group of the indicator system (PMOi). Next, it is necessary to define a comprehensive indicator of the innovative and investment potential of each municipality. For example, for the first municipality:

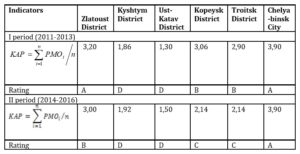

Similarly, the comprehensive indicator of the innovation and investment potential of other municipalities was determined. The results of the calculation of comprehensive indicators of evaluating the innovation and investment potential of municipalities of the Chelyabinsk region (fragment) are presented in Table 3.2.

Table 3.2: Rating of the innovation and investment potential of municipalities on the basis of integrated indicators (fragment)

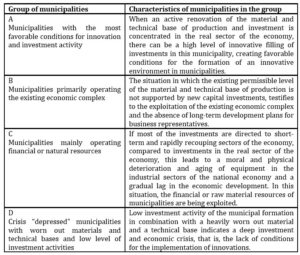

As it can be seen from the table, the greatest innovation and investment potential is that of Chelyabinsk City, which is followed by Zlatoust District. Kopeysk District and Troitsk district had rating B in the first period and fell to a lower position in the ranking in the second period. Kyshtym and Ust-Katav districts are in group D. Out of the 12 studied city districts in the Chelyabinsk region in the second rating period, 3 municipalities are rated as A, 4 – as B, 3 are rated as C and 2 municipalities are rated as D. At the same time, three municipalities ( Zlatoust, Kopeysk and Troitsk) have worsened their positions in the ranking. The reason for this situation was that in these municipalities, there was no process of active updating of fixed assets of production; the level of investment was insufficient for innovation. Thus, the social and economic policy implemented in the municipalities directly affects the level of the innovation and investment potential of the municipalities. The characteristics of municipalities in terms of innovation and investment potential are given in Table 3.3.

Table 3.3: Characteristics of municipalities in the level of innovation

and investment potential

Municipal formations belonging to group A, thus, have a fairly stable innovation and investment potential, municipalities belonging to groups B and C are medium-stable, and those in group D have an innovative investment potential with low sustainability.

From the above, it can be concluded that the sustainable municipal development can be interpreted as a dynamic and complex state of the system based on a balanced set of social, economic, ecological, political and other interrelated processes implemented on the basis of a rational use of all resources of the territory, not exceeding the maximum permissible loads for the environment, and enabling to consistently increase the potential of the municipality to improve the quality of life and the needs of citizens residing in its territory.

Thus, it can be concluded that the administrative and territorial units of the Chelyabinsk region are quite differentiated, despite the fact that, on the whole, the region has the status of an industrial region specializing in metallurgy.

Conclusion

Determining the level of development of the innovation and investment potential allows this study to take measures to ensure the growth of new technologies, innovative goods, works and services, increasing the investment attractiveness of the municipal formation, not only in the foreseeable future, but also in the strategic perspective. Coro, G. and Micelli, S.(2007); Parrilli, M. D., Curbelo, J. L. and Cooke, P. (2012); López-Estornell, M., Tomás-Miquel, J.-V. and Expósito-Langa, M. (2014); Tsertseil, J. S., Kookueva, V. V., Gryzunova, N. V. and Khashchuluun, C. (2017) noted the correlation between the sustainable territory’s development and the magnitude of innovation and investment. This study also reveals this dependence.

The results of territory ranking by the innovative and investment potential allow this study to determine the most problematic areas in levels and criteria necessary for taking measures for ensuring the innovation and investment development of a given territory. Besides, the results obtained on the basis of potential opportunities of the territory (fossils, energy, recreational zones, etc.), make it possible to develop program measures to increase the investment attractiveness of a particular territory.

Municipalities in Groups C and D (for example, Kyshtym and Troitsk Districts), respectively demonstrate a decline in the population for the analyzed period. The potential for labor resources is low.

The financial basis for the development of the regional economy and its constituent municipalities in terms of financing the public sector are territorial budgets. The municipalities from group A demonstrate high positive dynamics in the formation of the financial result of the activity. They demonstrate the highest indicators of the budgetary security.

The obvious lag of most municipalities is observed in terms of indicators of the “Infrastructure” block, which is a confirmation of hypothesis 1. This confirms the conclusions of C. V. Sylvie Demurger (2001), A. Kumar, D. Gray, M. Hoskote , S.von Klaudy and J. Ruster (1997), H. Kelejian and D. Robinson (1997). A. Munnell (1992) and Doloreux, D. (2002) on the importance of this factor in the development of the territory.

Assessing the development level of the innovation and investment potential of the municipality results in the identification of potential investment objects. This greatly facilitates the work of the investor in the search for sources of investment, as well as reduces the risk of non-return of the funds invested by them.

Prospective directions of investing in the economy of territories belonging to the first group can be:

– Development of innovative activities. For the development of the municipal education as an economic center, it is necessary to pursue a policy of advancing development of science and technology in relation to other branches and spheres of activity in the municipality;

– Construction of international logistics centers.

Prospective directions of investing in the economy of territories belonging to the second group can be:

– Construction of large and small electric power facilities.

Prospective directions for investing in the economy of territories belonging to the third group can be:

– Development of the tourism and recreation industry;

– Organization of economic activities that reduces the negative impact on the environment and the health of the population, and preserves the biological and landscape diversity of the territory;

– Diversification of economy in single cities.

Prospective directions for investing in the economy of the territories belonging to the fourth group can be:

– Realization of “breakthrough” investment projects and importing substituting technologies;

– Introduction of energy and resource saving;

– Maximum use of natural, infrastructure and human capital opportunities of small towns and rural areas within the framework of comprehensive programs of social and economic development.

In the conditions of uneven development of municipalities within the social and economic space of the region, it is possible to single out, in this study’s opinion, the following types of social and economic policy conducted by municipalities:

– Stimulating municipal policy. The municipal authorities actively search for investors and use all the means at their disposal to accelerate the economic development by stimulating the introduction of innovations, the development of modern industries (as well as the curtailment of old ones), through infrastructure and information preparation of the territory (Chelyabinsk City and Magnitogorsk City).

– Adapting municipal policy. The municipal authorities use their available resources to mitigate the negative consequences associated with the lack of funds in the local development budget. Such a policy is also oriented at receiving subsidies, subventions and benefits from higher-level budgets for the performance of assigned powers (for example, Kyshtym District, Karabash District and Troitsk District).

– Compensatory municipal policy. The municipal authorities promote the adaptation of more mobile and manageable components of municipal development to inertia and less manageable ones; they use the resources at their disposal to mitigate the negative consequences associated with the lack of resources in the local development budget. This policy is also associated with obtaining subsidies, subventions and benefits from budgets of a higher level, but for the purpose of transitioning to a new type of production related to development (Ust-Katavsk District and Chebarkul District).

One of the ways to increase the innovation and investment potential of municipalities is their entry into the composition of agglomerations and territories of advanced social and economic development.

«The work was supported by Act 211 Government of the Russian Federation, contract № 02.A03.21.0011»

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Bartelsman, E., Scarpetta, S. and Schivardi, F. (2005) ‘Comparative analysis of firm demographics and survival: Evidence from micro-level sources in OECD countries,’ Industrial and Corporate Change, 14 (3), pp. 365-391.

- Coro, G. and Micelli, S. (2007) ‘The industrial districts as local innovation systems: Leader firms and new competitive advantages in Italian industry,’ Review of Economic Conditions in Italy, 1, 41-67.

- Demurger, S. (2001) ‘Infrastructure Development and Economic Growth: An Explanation for Regional Disparities in China,’ Journal of Comparative Economics, 29, 195-217.

- Doloreux, D. (2002) ‘What we should know about regional systems of innovation,’ Technology in society, 24(3), 243-263.

- Gurban, I. and Sudakova, A. (2015) ‘An Assessment Methodology for the Development of Higher Education in Russia.’ Mediterranean Journal of Social Sciences, 6(5), 197-210.

- Kelejian, H. and Robinson, D. (1997) ‘Infrastructure Productivity Estimations and Its Underlying Economic Specifications: A Sensitivity Analysis,’ Papers in Regional Science 76, 115-131.

- Kolmakova, Ek M. (2014) ‘Potential and limitations of the spatial-investment-innovation model of the region’s growth,’ Bulletin of the Chelyabinsk State University. Economics, Issue 47, 21 (350), 82-86.

- Kumar, A., Gray, D., Hoskote, M., von Klaudy, S. and Ruster, J. (1997) Mobilizing Domestic Capital Markets for Infrastructure Financing: International Experience and Lessons for China. World Bank Discussion. Washington, DC: World Bank, 377.

- López-Estornell, M., Tomás-Miquel, J.-V.and Expósito-Langa, M. (2014) ‘Knowledge and district effect in innovative firms. A study in the region of Valencia,’ Revista de Estudios Regionales, 101, 189-216.

- Maslennikov, D. A. Mityakov, S. N, Kataeva, L.Yu. and Fedoseeva T. A. (2019) ‘Identification of the Characteristics of the Regional Strategic Development Based on the Indicators’ Statistical Analysis,’ Economy of the region, 15(3), 707-719.

- Munnell, A. (1992) ‘Policy Watch: Infrastructure Investment and Economic Growth.’ Journal of Economic Perspectives, 6, 189-198.

- Parrilli, M.D., Curbelo, J.L., and Cooke, P. (2012) Innovation, Global Change and Territorial Resilience Innovation, Global Change and Territorial Resilience, Edward Elgar Publishing Ltd.

- Pykhov, P A. and Kashina, T O. (2015) ‘Infrastructural security of the UrFD regions: assessment methodology and diagnostic results,’ Economy of the region, 3, 66-77.

- Shindina, T A., Kolmakova, Ek M., Vlasova, G A., Orlova, N. A. and Kolmakova, I D. (2016) ‘Labour and social relations as the economical category and the efficiency of the regional system of labour and social relations (on the example of the constituent parts of Ural federal okrug of Russian Federation),’ Journal of Applied Economic Sciences. Volume XI, Issue 4(42), 779-78.

- Tsertseil, J.S., Kookueva, V.V., Gryzunova, N.V. and Khashchuluun, C. (2017) ‘Analysis and prospects of infrastructure development of innovation regional clusters in Russia through the example of specific economic zones of industrial production and technology innovation types, ’ Journal of Applied Economic Sciences, Volume 12, Issue 7,1896-1905.

- Vasilieva, E V., Kuklin, A A., Lykov, I A. (2014) ‘Program of complex diagnostics of the quality of life in the region. Functional characteristics and possibilities of its application,’ Living standards of the population of Russian regions, 1, 18-123.