Introduction

This study arose from the need to understand the application and integration of Accounting Information System (AIS) in Thailand’s banking sector, especially with the increasing technological improvements, business developments, growth of the current contemporary business environment and the intensive competitive business environment, which has made managers consider more advanced management techniques in the finance sector. AIS is a system that supports firms and businesses in the assemblage and chronicling of data and information about occurrences that have economic implications on the firm. It assists in the preservation, processing and transmission of such information to investors, shareholders, and other interested parties (Ganyam & Ivungu, 2013). The techniques in the applications of AIS are geared towards improving the processes of problem solving and decision making, as well as business sustainability in the era of turbulent technological advancements, fluctuating customers’ preferences and demands, as well as increased business awareness. Among these strategies is the adoption and application of the information systems within the operations of business organizations (Davoren, 2019). Before the IT revolution between the mid-1990s and early 2000s, most banking operations required physical presence of individuals in banking halls. Today, however, most banking operations have scaled geographical barriers, and can be conducted anywhere and at any time without restrictions in most cases thanks to improvements in IT and information systems.

The benefits of AIS adoption for organizations include increased functionality where the timeliness of providing AIS is significantly improved, enhanced accuracy of internal checks and balances, the system ensures that accounts are properly balanced and with efficient processing times, providing an improved external reporting interface. Records such as financial statements and performance reviews are digitized by AIS allowing investors and shareholders to easily determine how good their investments are performing under market conditions. These investors can be utilized for equity financing during expansion of the organization (Tilahun, 2019; Szczepańska-Woszczyna, 2018). Al-Dalaien, and Dalayeen (2018) infer that information systems implies the process of organizing firms’ resources such as data, processes, policies, protocol, skills software, hardware and other components which together enhance the capabilities and functionalities of a firm. From the foregone, it is explicitly expected that AIS should be related to the quality of management in an organization, and more importantly, the management performance. The accounting activities conducted in a particular organization could explain what is inherent in the performance management, since most of the activities are conducted under the accounting procedures. In theory, it is generally expected that with the increase in the investment in AIS, there is a wide range of benefits that accrue to the concerned organization as a whole in the long run. These benefits emanate from AIS increased processing power, generation of vital information and reports on timely manner, as well as reduction of associated operational costs. More importantly, AIS reduces the human interference with the financial and other transactional records, hence improving the credibility and reliability of the results generated.

Some of the factors that influence the adoption of AIS to any business according to Tilahun (2019) include perceived usefulness and perceived ease of use, CEO’s motivation, innovativeness, management commitment, perceived difficulty, and government support. There is the assumption that the behavioral intention to use any system increases when the system is perceived as not being cumbersome (Muangmee, et al. 2021; Kot et al. 2020; Chaveesuk et al. 2020; Chaiyasoonthorn et al., 2020;), this has been validated to have a significant effect on the intention of users to adopt information system (Azmi & Sri, 2015; Nasri & Charfeddine, 2012). Management commitment is crucial towards the adoption of AIS by any business firm. They are expected to authorize the budget for the upscaling, this includes approving purchase of hardware and software that would aid adoption and implementation of AIS, recruitment of personnel who are experts in AIS, approving training courses for staff on AIS, and creating an enabling environment that supports and enhances AIS within organization (Komala, 2012; Schwalbe, 2006). The department of human resources has been established to have a positive relationship with the adoption of AIS (Ahmad et al., 2013; ALshbiel, and Al-Awaqleh, 2011), the quality of accounting team is also an important factor (Zhou, 2010).

Data showing the application of AIS in Thailand’s banking sector is lacking, hence, the objective of this study was to investigate the interrelationship among the quality measures of AIS such as total assets, operating assets, total liabilities, earnings after tax and return on equity of banks in Thailand from their published financial statements. Doing this will highlight the position of the banks to their shareholders, stakeholders in the Thai financial sector and researchers interested in data on Thailand’s banking sector and how they apply AIS in their operations. The contributions of the banking sector to any nation’s GDP cannot be understated; this study captured the performance of the selected Thai banks based on their performance over the operational periods captured in this study to understand the effects of AIS on performance management. Transparency is key to the growth of any industry and the ability to bring in investors both domestic and international is dependent on the availability of reliable and verifiable data. Without an effective AIS that highlights key performance indices, this would be herculean and can lead to the decline of that sector, these bring to the fore some of the motivations for this study.

This research is hinged on the Resource-Based View (RVB) Theory; it is suitable for this study because it is one of the foremost theories on information system (Ganyam & Ivungu, 2013). It was proposed by Wernerfelt (1984) and improved on by Barney (1991) who inferred that the source of sustainable advantage in business emanates from executing initiatives in superior manner by adopting superior capabilities and deploying superior resources. The main argument of RBV is that the performance of a business is influenced by the resources at its disposal. Thus, this infers that based on the RBV Theory, the resources at the disposal of a firm positioned to it to have a competitive edge to similar firms. From our study arguments, we can allude that the AIS variables present in the financial statement of firms such Total Assets, Operating Assets, Total Liabilities, Earnings after Tax and Return on Equity a firm holds give it a competitive advantage. For all the variables listed except total liabilities, the higher they are, the higher the profit for the shareholders, while the lower the total liabilities, the greater the flexibility for the firm towards achieving a sustainable competitive edge (Liang, You & Liu, 2010).

The RVB model asserts that not all resources are of equal prominence, or the potential to become a key index in affording the business with a sustainable competitive edge. There are three subdivisions of the RVB Theory, and they include Capability, Competence and Skills (Cragg et al., 2011). Capability refers to the ability of the business organization to manage its resources; competence deals with how businesses manage their resources; while skills involve the technical, managerial, and general management skills needed to make the business a sustainable business entity. In this regard, AIS is part of the resources available to businesses to deploy in advanced organizational goals and objectives. Situating this in the context of our study, performance denotes that businesses appropriately and satisfactorily manage AIS by utilizing their capability, competence and skills for an improved performance that aligns with the set objectives. A number of studies relating to the application of information technology in organizational performance are inconclusive on its impact, while some studies have questioned the uncertain relationship between information technology investment and performance (Li and Ye, 1999; Ravichandran et al., 2009; Ray et al., 2005; Wang et al., 2006).

Literature Review

According to Hall (2008), AIS is made up of four major sub-systems; the transaction processing system, which supports the organization’s daily business operations with messages and documents generated to help various information users throughout the organization; the management reporting system, which generates special purpose reports and information to enable the internal management to make vital decisions such as budgets; the general ledger reporting system, which generates the traditional financial reports like the balance sheets, tax return statements, cash flow statements, income statements, and other documents mandated by the law; and the fixed asset reporting system, which processes the transactions pertaining to acquisition, maintenance, and disposal of fixed assets within the organization. Traditionally, AISs were mainly paper-based systems and could therefore not fit or work well in today’s rapidly changing business environment. The invention and advancement of information technology (IT) has revolutionized and transformed the nature of business operations, including the AISs. The diffusion of IT in AISs has enhanced financial performance and maintenance of transparency within the organization (Ginevičius et al., 2021; Swanepoel, 2019; Veeken, and Wouters, 2002).

The relationship between the AIS and performance management has been demonstrated in many studies (Al-Delawi, Ramo, 2020; Saithong et al., 2019; Sori, 2009). Most of these studies have indeed enumerated a significant relationship between AIS and performance management. The advancement of AIS has not only facilitated the ascertainment of performance management but has also contributed to significant reduction in costs associated with running the organization (Munaf et al. 2019; Kowalik, 2020). In their study of the critical success factors of AIS on performance in Jordanian banks, Ali et al. 2016 assert that AIS success factors include information quality, service quality, system quality and data quality which support the organizational processes and enhance organizational performance.

The financial managers need the accounting and financial information generated by the AIS to evaluate their organization’s past and present performance in order to make plans of the organization’s future. Consequently, the performance of the organization is measured in terms of Return on Equity (ROE). ROE can be defined as a measure of financial performance determined by dividing net income by shareholders’ equity. It can be referred as the main determinant of the profitability of an organization in relation to stockholders’ equity (Fernando, 2021). ROE, in particular, provides useful information about how the firm is using debts to finance its activities in relation to equity, which helps the managers to make decision on how to correct the firm’s gearing position and performance. Performance management plays a crucial role in improving the overall value of the organization (Miller et al., 2001). Optimal use of AIS significantly helps in improving customer satisfaction which ultimately drives up the organizational success (Rom & Rohde, 2007). According to Grande, Estebanez & Colomina (2010), the organization’s external relationship with its various partners (and more so, its foreign customers), the exploitation of new business opportunities, and flow of information within itself and with external partners, has significantly changed the nature and operation of business today.

Hunton (2002) investigated the relationship between automated AIS and organizational effectiveness and found a strong correlation between AIS and organizational effectiveness. Several other studies over the recent past on the value of AIS in areas such as share price and earnings prediction and equity valuation have also showed a strong relationship between AIS and organizational effectiveness. These studies agree that automated AIS aids in decision making, which in turn enhances the organizational effectiveness (Laban et al. 2017). Knežević et al. (2012) emphasized that AIS is strongly correlated with organizational effectiveness because it is concerned with the measurement and quantification of business events in monetary form, processing of the accounting data, and preparation of the financial statements. Bhimani et al. (2019) opined that the main function of the AIS is to assign quantitative values for the past, present and future transactions. Typically, AIS released in form of periodic reports and special analyses provides the main source of information about the organization for important organizational decisions, including decisions on pricing, customer servicing, production mix, production capacities, inventory policy, labor negotiations, capital investments, and long-term decisions such as outsourcing and other strategies of international market penetration (Urquía et al., 2011).

Ahmad and Al-Shbiel (2019) researched the effects of AIS on the organizational performance in Jordanian SMEs. Their findings indicated that AIS has a significant and positive effect on organizational performance. Their study implied that firms that apply AIS in their operations are more likely to achieve a higher level of management performance when compared to firms that do not. An earlier study by Ameen, Ahmed and Abd Hafez (2018) discussed the importance of AIS; their findings indicated that organization performance is enhanced by an aspect of AIS, such as the organizational culture. Thus, organizations where the import of AIS is more likely to see a steady growth, attract new investors due to the transparency of the system, and build investor confidence, while also maintaining a high customer confidence in the products and services offered by the firm. This is also applicable to the banking sector, where for example, not having an open system can affect investor confidence, restrictions, and other instruments capable of affecting the future business operations of such a bank, not forgetting the hundreds (or thousands of staff) who may be affected by insolvency of such a bank.

As established in the literature, AIS play a crucial role in the production of accounting information that is accurate, informative, and timely to facilitate communication and effective decision making within the organization. Effective decision making is particularly important for organizations to help them adapt to the highly changing and competitive business environment today. Therefore, with the right AIS structure put into place, the organizational managers are at a better position to make informed decisions that will help their firms to survive the tough working business environment, and possibly compete more favorably and comparably in comparison to their peers who have not laid out such an AIS structure. What is missing from the literature is research on the application of AIS in the banking sector in Thailand. This research addresses this gap by analyzing the financial statements of Thailand banks to identify the application and effect of AIS on performance management and the overall growth of the Thai banking sector.

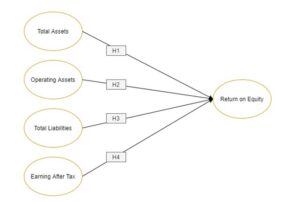

Conceptual Framework and Hypothesis Development

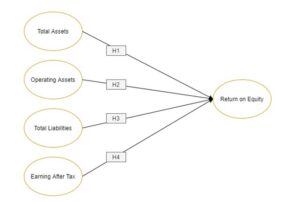

The purpose of this research is to investigate the effects of AIS on performance management on the banking sector in Thailand. Based on the literature review, the effects of the AIS will be explored using the banks’ financial statements, which represent the output of the AIS, such as total assets, working capital, operational assets, and earnings after tax. The performance management was evaluated using Return on Equity (ROE). Therefore, the research composed of four independent variables representing the AIS (total assets, operational assets, total liabilities and earning after-tax), and one dependent variable of Return on Equity (ROE). Figure 1 below shows the conceptual framework of the research.

Fig 1. Conceptual Framework

Based on the conceptual framework in figure 1, the following hypotheses were developed:

H1: There is a positive relationship between the results of Total Assets and the ROE

H2: There is a positive relationship between the results of the Operating Assets and the ROE

H3: There is a positive relationship between the results of Total Liabilities and the ROE

H4: There is a positive relationship between the results of Earnings after Tax and the ROE

Research Methods

The current research investigated the role of the AIS on the performance management in the banking sector in Thailand using content analysis. Newbold, Boyd-Barrett, and Van Den Bulck (2002) delineate three methods of selecting research populations for a content analysis. They include selecting media form, selecting study period and finally sampling the chosen media for relevant content analyzed. The research populations consisted of commercial banks in Thailand and their year–end financial statements from 2011-2019. Six major commercial banks were purposively selected from a list of the top ten banks in Thailand (Overview of Banks in Thailand, n.a.); they include: The Siam Commercial Bank Public Company Limited, Krung Thai Bank Public Company Limited, Bangkok Bank Public Company Limited, Bank of Ayudhya Public Company Limited, Thanachart Bank Public Company Limited, and Kasikorn Bank Public Company Limited. Financial statements of the banks were collected from their official respective websites (SCB Financial Information, 2021; KTB Financial Information, 2021; BB Financial Information, 2021; BoA Financial Information, 2021; T Bank Financial Information, 2021; K Bank Financial Information, 2021).

The researchers felt nine years was long enough to produce a pattern of measuring the AIS on performance management of the selected banks. Prasad (2008) defines content analysis as “the scientific study of content of communication” (p.174). The contents in this instance are the financial statements of the selected banks, which are released to the public to show the financial dealings of the bank in compliance with transparency and keeping in line with the best global practices that boost investor confidence in the sector.

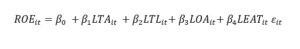

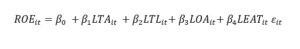

The data collected were coded using Microsoft Excel to identify the different variables as contained in the financial statement. The collected data were analyzed, and the panel data were used in testing the hypotheses. A diagnostic test of the data was conducted to evaluate the suitability of the data in conducting the study. The research applied the standard error approach using SPSS, which was considered appropriate because it takes care of the data, which have normality, heteroscedasticity, and autocorrelation issues. The major independent variable is the AIS which is represented by four proxies. These proxies are the Total Assets (TA), Operating Assets (OA), Total Liabilities (TL), and Earning after Tax (EAT). The multiple regression analysis under the robust standard error was used to test the effect of the independent variables on the dependent variable. The regression equation is presented below.

Where: = bank company; = time period; ROE = Return on Equity; LTA = log of Total of Assets; LTL = log of Total Liabilities; LOA = log of Operating Assets; LEAT = log of Earning after Tax; = the error term

Results

This section presents and discusses the results of the data analysis conducted using the data collected from six major commercial banks in Thailand. The independent variables considered for analysis of the research objectives included: the Total Assets (TA), Operating Assets (OA), Total Liabilities (TL), Earning after Tax (EAT) and Return on Equity as dependent variable. The six banks and the nine-year period of study from 2011-2019 resulted into a panel data consisting of 54 values for analysis. The findings of the data analysis are presented in the following section.

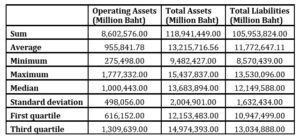

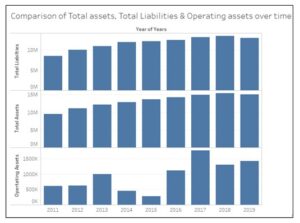

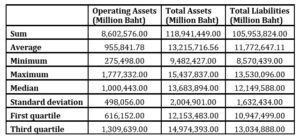

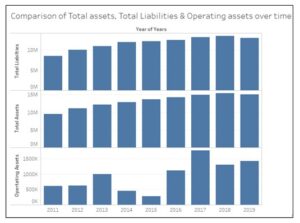

Before conducting the actual data analysis, it was critical to evaluate the data using descriptive statistics. The descriptive statistics was conducted using Tableau software and the results are presented in Table 1 and Figure 2 below.

Table 1: Summation of Operating Assets, Total Assets and Total Liabilities for the six banks

Figure 2: Comparison of Total Assets, Total Liabilities, and Operating Assets for the Six Banks

From Table 1, the descriptive statistics of the sum of the operating assets, total assets, and total liabilities of the 6 major commercial banks operating in Thailand is presented. The statistics presents the data from 2011 to 2019. The statics shows that the sums of the Total Assets (118,941,449) are higher than the Total Liabilities (105,953,824). Considering Figure 1, the comparison of the annual sum of the Total Assets, Operating Assets and Total Liabilities was made, it shows that over the years (2011-2019) the Total Assets and Total Liabilities have been experiencing an increasing trend. This is clear indication that the commercial banks considered have been experiencing increasing growth over time. This growth can, to a greater extent, be generalized to the entire banking sector in Thailand because the six purposively selected banks were among the top 10 banks in Thailand. However, it is critical to note that the sector experienced a decreasing trend for the year 2019, when compared to 2018, for both Total Assets and Total Liabilities. Total Operating Assets have been experiencing fluctuations over the years, with the least year being 2015 (275,495 million Baht) while the largest being 2017 (1,777,332 million Baht). However, Operating Assets has been experiencing an increasing trend over the years considered.

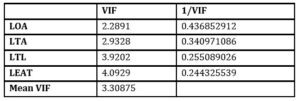

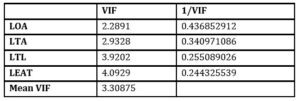

Before conducting the actual regression results, the diagnostic test of the data was conducted to evaluate the suitability of the data in conducting the study. The diagnostic tests conducted included the normality tests, multicollinearity test, the autocorrelation assumption, and the homoscedasticity test. The assumption of multicollinearity was evaluated using the Variance Factor Inflator (VIF) and the results of the tests are presented in the Table 2 below.

Table 2: VIF Test Results

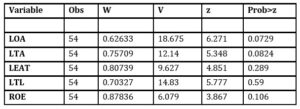

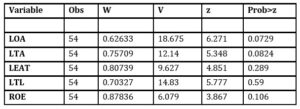

The VIF results show that the mean VIF is below 5, and the VIF values of each variable are below 5 as well. This shows that the assumption of no multicollinearity in the data was confirmed; hence, the data were not highly correlated with each other. The normality test was conducted using the Shapiro-Wilk W-test for normal data, and the results are presented in table 3. The column of interest is the probability value. If the value of the Shapiro-Wilk W-test is greater than 0.05, the data are normal. If it is below 0.05, the data significantly deviate from a normal distribution. From Table 3, all the variables probability values are greater than 0.05, which implies that the assumption that the data are normally distributed is true.

Table 3: Shapiro-Wilk Test

The assumption of autocorrelation was tested using the Wooldridge tests, while that of the homoscedasticity was tested using the Breusch-Pagan test. The output of the two tests showed that the assumption of both autocorrelation and homoscedasticity was violated. As a result, this analysis opted to use the robust standard error estimator, which takes care for the autocorrelation and homoscedasticity problem in data. The result of the regression analysis is presented in table 4 below.

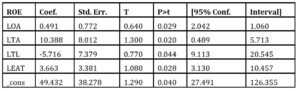

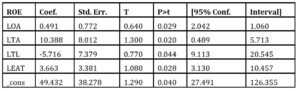

Table 4: Regression Results

NB: Prob > F = 0.0074, R-squared = 0.7672

The first result considered is the R-squared, which is 0.7672. This implies that 76.72% of the variation in performance management (ROE) is explained by the AIS application, which includes Total Assets, Operating Assets, Total Liabilities, and Earnings after Tax. The remaining 23.28% is explained by other factors not included in the model. The results also show that the overall regression model is statistically significant, F(4, 49) = 8.04, p = .0074, which is an indication that the overall model applied could significantly predict the dependent variable.

The results also showed that Total Assets (LTA) have a positive and significant influence on the return on equity (P>t (0.020) < 0.05), since the p-value is less than 0.05. This confirms hypothesis one (H1) that there is a positive relationship between the results of AIS application (Total Assets) and the Performance Management (ROE). The coefficient of LOA is 10.388, which implies that a one unit increase in total assets would result in 10.388 units increase in return on equity (ROE) and vice-versa.

The results show that the Operating Assets (LOA) have a positive and significant influence on the return on equity (P>t (0.029) < 0.05), since the p-value is less than 0.05. This confirms hypothesis two (H2) that there is a positive relationship between the results of AIS application (operating assets) and the Performance Management (ROE). The coefficient of LOA is 0.491, which implies that a one unit increase in operating assets would result in 0.491 units increase in return on equity (ROE) and vice-versa.

The results also showed that Total Liabilities (LTL) have a negative and significant influence on the return on equity (P>t (0.044) < 0.05), since the p-value is less than 0.05. This confirms hypothesis three (H3) that there is a negative relationship between the results of AIS application (Total Liabilities) and the Performance Management (ROE). The coefficient of LOA is -5.716, which implies that a one unit decrease in total liabilities would result in 5.716 units increase in return on equity (ROE) and vice-versa.

The results also showed that Earnings After Tax (EAT) have a positive and significant influence on the return on equity (P>t (0.028) < 0.05), since the p-value is less than 0.05. This confirms hypothesis four (H4) that there is a positive relationship between the results of AIS application (Earnings After Tax) and the Performance Management (ROE). The coefficient of LEAT is 3.663, which implies that a one unit increase in earnings after tax would result in 3.663 units increase in return on equity (ROE) and vice-versa.

Discussions

The findings of this study indicated there is a positive and significant relationship between Total Assets, Operating Assets and Earnings After Tax, which is a representation of the application of the AIS with the Management Performance. This confirmed the hypothesis of this research. The specific results that Total Assets (LTA) has a positive and significant influence on the Return on Equity is in line with the findings of Ali, Bakar & Omar (2016) who investigated the effect of the AIS on the organizational performance as well as the moderating effect of organizational culture which indicated that AIS has a significant effect on the organizational performance.

Similarly, the findings of this paper indicated that there is a positive relationship between the results of AIS application (Earning after Tax) and the Performance Management (ROE). This corroborates the findings of Ahmad and Al-Shbiel (2019) who investigated the effects of AIS on the organizational performance in Jordanian SMEs. Their findings indicated that AIS has a significant and positive effect on organizational performance. Their study had an implication that firms that use AIS have a higher likeliness to achieve a higher level of management performance as compared to the firms that do not. A study carried out by Ameen et al., 2018 on the impact of the management accounting and how it could be implemented on the organization culture had similar results. Their findings indicated that organization performance is enhanced by an aspect of AIS such as the organizational culture.

The findings are also in concurrence with the postulations of the Resource-Based View (RVB) theory that the performance of businesses is influenced by the resources at their disposal (Barney, 1991; Liang, You & Liu, 2010; Wernerfelt, 1984). The findings show that the applications of AIS present in financial statements such as Total Assets, Operating Assets, Earning after Tax, and Return on Equity have a positive and significant relationship with Organizational Performance that supports the theory. Higher resources like total assets, operating assets and earnings after tax gives an organization a competitive edge. This edge over others helps them attract new investment, recruit the best people and enable the business to diversify its investment and build a healthy financial future.. Similarly, it is indicative that a lower or negative Total Liability for the firm also gives it a competitive advantage; the organization can have more resources that it can hedge its growth on, unlike in situations where resources are diverted to service liabilities to the organization.

It is also important to note that the findings of this research match that of Paiva and Carvalho (2018) who investigated the accounting and management practices. Their findings indicated that AIS enhances the management performance, which is in line with this study. These findings could also be important in providing guidelines to researchers in the future who may be interested in understanding the variable dynamics of AIS on performance management in Thailand or other parts of the world. The study can also be beneficial to banks and other business entities in Thailand in their business decisions enhancements based on the availability of more data to guide management decisions with implications for investors, staff, and customers, as well as being applied in developing policies focused on enhancing management performance.

Conclusion

This study adopted content analysis design to study the effects of AIS on performance on six Thailand banks using their year-end financial statement from each of the banks as the tool to be analyzed. One of the advantages of content analysis study is the inability of the researcher to introduce bias into the study once the parameters to be analyzed have been set. In this instance where the AIS of the selected banks were measured using the official bank financial statements, the qualitative characteristics require that the indicators used need to be seen to be fair and not favoring any bank over others. The long-term study also meant that data selected cannot be altered to make one bank appear healthier than others, rather, the study reported and analyzed what is available, verifiable, and replicable by other researchers. The findings from the research revealed that Total Assets, Operating Assets, and Earnings after Tax have a positive and significant effect on the Return on Equity.

Subsequently, Total Liabilities were found to have a negative and significant relationship with Return on Equity. Generally, the study found that AIS has a significant and positive effect on the performance management and recommends that AIS should be considered a critical aspect if the growth in performance management and long-term viability of the business entity is a priority. The significance of this study has further highlighted the benefits of the application of AIS to businesses, and how they can be used to show the financial position of an organization. The financial position is important to stakeholders; it shows the true position of the firm, its long-term viability, and the possibility to attract new investors to the sector. The availability, processing, and transmission of these sets of information would be excoriating to obtain without AIS.

Future Studies and Limitations

Future research can investigate the application of AIS to other sectors in Thailand such as telecommunication, energy, tourism etc. to understand the position of the sectors and how they contribute to the GDP of Thailand. A limitation of this study was in the reductive nature of content analysis. Thus, because content analysis focuses only on specific aspects of the financial statement as defined from the coding schema, other important information will be neglected if they are not part of the variables being analyzed. This can be addressed by survey research designs in future studies or creating more variables and hypotheses that address other issues capable of showing the extent of relationships between variables under study.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Ahmad, M. A. and Al-Shbiel, S. O. (2019) “The effect of accounting information system on organizational performance in Jordanian industrial SMEs: The mediating role of knowledge management,” International journal of business and social science, 10(3).

- Ahmed, M. F., Ameen, A. M. and Abd Hafez, M. A. (2018) “The impact of management accounting and how it can be implemented into the organizational culture,” Dutch journal of finance and management, 2(1).

- Al-Dalaien, B. O. A. and Dalayeen, B. O. A. (2018) “Investigating the Impact of Accounting Information System on the Profitability of Jordanian Banks,” Research Journal of Finance and Accounting, 9(18), pp. 110–118.

- Al-Delawi, A.S., Ramo, W.M. (2020) The impact of accounting information system on performance management. Polish Journal of Management Studies, 21 (2), 36-48.

- Al-Hiyari, A. et al. (2013) “Factors that Affect Accounting Information System Implementation and Accounting Information Quality: A Survey in University Utara Malaysia,” American Journal of Economics, 3(1), pp. 27–31.

- Ali, B. J. A., Bakar, R. and Wan Omar, W. A. (2016) “The Critical Success Factors of Accounting Information System (AIS) and its Impact on Organisational Performance of Jordanian Commercial Banks,” International Journal of Economics, Commerce and Management, 4(4), pp. 658–677.

- ALshbiel, S. O. and Al-Awaqleh, Q. A. (2011) “Factors Affecting the Applicability of the Computerized Accounting System,” International Research Journal of Finance and Economics, (64), pp. 36–53.

- Azmi, F. and Sri, M. (2015) “Factors that affect accounting information system success and its implication on accounting information quality,” Asian Journal Of Information Technology, 14(5), pp. 154–161.

- Barney, J. (1991) “Firm resources and sustained competitive advantage,” Journal of management, 17(1), pp. 99–120.

- BB Financial Information (no date) Bangkok Bank Public Company Limited. Available at: https://www.bangkokbank.com/en/Investor-Relations/Financial-Information.

- Bhimani, A. et al. (2019) Management and Cost Accounting. 7th ed. London, England: Pearson Education.

- BoA Financial Information (no date) Bank of Ayudhya Public Company Limited. Available at: https://www.krungsri.com/en/investor-relations/financial-information.

- Chaiyasoonthorn, W., Khalid, B. and Chaveesuk, S. (2019) “Success of smart cities development with community’s acceptance of new technologies: Thailand perspective,” in Proceedings of the 9th International Conference on Information Communication and Management – ICICM 2019. New York, New York, USA: ACM Press.

- Chaveesuk, S., Khalid, B. and Chaiyasoonthorn, W. (2020) “Understanding stakeholders needs for using blockchain based smart contracts in construction industry of Thailand: Extended TAM framework,” in 2020 13th International Conference on Human System Interaction (HSI). IEEE.

- Cragg, P., Caldeira, M. and Ward, J. (2011) “Organizational information systems competences in small and medium-sized enterprises,” Information & management, 48(8), pp. 353–363.

- Davoren, J. (2019) The Three Fundamental Roles of Information Systems in Business, Chron. Available at: https://smallbusiness.chron.com/three-fundamental-roles-information-systems-business-23681.html.

- “Determinants of behavior intention of AIS based information technology acceptance” (2016) Imperial Journal of Interdisciplinary Research, 2(8), pp. 125–138.

- Fernando, J. (2021) How return on equity (ROE) works, com. Available at: https://www.investopedia.com/terms/r/returnonequity.asp (Accessed: January 18, 2021).

- Ganyam, A. I. and Ivungu, J. A. (2019) “Effect of Accounting Information System on Financial Performance of Firms: A review of Literature,” IOSR Journal of Business and Management (IOSR-JBM), 21(5), pp. 39–49.

- Ginevičius, R., Nazarko, J., Gedvilaitė, D., Dacko-Pikiewicz, Z. (2021) “Quantifying the economic development dynamics of a country based on the Lorenz curve” E a M: Ekonomie a Management, 24(1), pp. 55-65.

- Hall, M. (2008) “The effect of comprehensive performance measurement systems on role clarity, psychological empowerment and managerial performance,” Accounting, organizations and society, 33(2–3), pp. 141–163.

- Hunton, J. E. (2002) “Blending information and communication technology with accounting research,” Accounting horizons, 16(1), pp. 55–67.

- KBank Financial Information (no date) Kasikorn Bank Public Company Limited. Available at: https://kasikornbank.com/en/IR/FinanInfoReports/Pages/financial-reports.aspx.

- Knezevic, S., Stankovic, A. and Tepavac, R. (2012) “Accounting information system as a platform for business and financial decision-making in the company,” Management Journal of Sustainable Business and Management Solutions in Emerging Economies, 17(65), pp. 63–70.

- Komala, A. R. (2012) “The influence of the accounting managers’ knowledge and the top managements’ support on the accounting information system and its impact on the quality of accounting information: A case of zakat institutions in Bandung,” Journal of Global Management, 4, pp. 53–73.

- Kot, S., Haque, A. and Baloch, A. (2020) “Supply Chain Management in SMEs: Global Perspective,” Montenegrin Journal of Economics, 16(1), pp. 87–104.

- Kowalik, K. (2020). The role of safety in service quality in the opinion of traditional and digital customers of postal service. Production Engineering Archives, 26(1), pp. 1-4.

- KTB Financial Information (no date) Krungthai Bank Public Company Limited. Available at: https://krungthai.com/en/investor-relations/financial-information/annual-report.

- Ladan Shagari, S., Abdullah, A. and Mat Saat, R. (2017) “Accounting information systems effectiveness: Evidence from the Nigerian banking sector,” Interdisciplinary Journal of Information Knowledge and Management, 12, pp. 309–335.

- Li, M. and Richard Ye, L. (1999) “Information technology and firm performance: Linking with environmental, strategic and managerial contexts,” Information & management, 35(1), pp. 43–51.

- Liang, T., You, J. and Liu, C. (2010) “A resource‐based perspective on information technology and firm performance: a meta analysis,” Industrial management + data systems, 110(8), pp. 1138–1158.

- Miller, A., Boehlje, M. and Dobbins, C. (2001) “Key Financial Performance Measures for Farm General Managers,” in. Lafayette, Indiana: Purdue Extension, p. 5.

- Mou, J., Shin, H. and Cohen, J. (2017) “Understanding trust and perceived usefulness in the consumer acceptance of an eservice: a longitudinal investigation,” Behavior and Information Technology, 6, pp. 125–129.

- Muangmee, C.; Kot, S.; Meekaewkunchorn, N.; Kassakorn, N.; Khalid, B. (2021) “Factors determining the behavioral intention of using food delivery apps during COVID-19 pandemics,” Journal of theoretical and applied electronic commerce research, 16(5), pp. 1297–1310.

- Munaf, M. B., Faris, M. F. and Akbay, C. (2019) “Factors affecting of using accounting information system (AIS) on the firm’s productivity: A case study Erbil, Iraq,” International journal of business and social science, 10(11).

- Nasri, W. and Charfeddine, L. (2012) “Factors affecting the adoption of Internet banking in Tunisia: An integration theory of acceptance model and theory of planned behavior,” The Journal of High Technology Management Research, 23(1), pp. 1–14.

- Newbold, C., Boyd-Barrett, O. and Van Den Bulck, H. (2002) The media book. London: Arnold (Hodder Headline).

- Paiva, I. and Carvalho, L. (2018) “Accounting and management practices in the third sector in Angola,” Economics & Sociology, 11(3), pp. 28–42.

- Pignataro, P. (2017) “Financial Statements,” in The Technical Interview Guide to Investment Banking. Nashville, TN: John Wiley & Sons.

- Prasad, B. (2008) Content Analysis: a method of social science research. Edited by D. K. L. Das. New Delhi: Rawal Publications.

- Ravichandran, T. et al. (2009) “Diversification and firm performance: Exploring the moderating effects of information technology spending,” Journal of management information systems : JMIS, 25(4), pp. 205–240.

- Ray, Muhanna and Barney (2005) “Information technology and the performance of the customer service process: A resource-based analysis,” MIS quarterly: management information systems, 29(4), p. 625.

- Rom, A. and Rohde, C. (2007) “Management accounting and integrated information systems: A literature review,” International journal of accounting information systems, 8(1), pp. 40–68.

- Saithong-in, S., Phornlaphatrachakorn, K. and Raksong, S. (2019) “The relationship between management accounting information system capability and firm success: Evidence from beverage businesses in Thailand,” Journal of Accountancy and Management, 11(1), pp. 76–90.

- Samsudeen, N. and Aliyar, S. (2015) “Evaluating the intention to use accounting information systems by small and medium sized entrepreneurs,” Research Journal of Finance and Accounting, 6(22), pp. 38–48.

- SCB Financial Information (no date) The Siam Commercial Bank Public Company Limited. Available at: https://www.scb.co.th/en/investor-relations/financial-information.html.

- Schwalbe, K. (2006) Introduction to Project Management: Course technology, Thomson Learning. Boston, Massachussetts, USA: Inc. Cengage Learning, Inc.

- Szczepańska-Woszczyna, K. (2018) “Strategy, Corporate Culture, Structure and Operational Processes as the Context for the Innovativeness of an Organization” Foundations of Management, 10(1), pp. 33-44.

- Sori, Z. M. (2009) “Accounting Information Systems (AIS) and Knowledge Management: A Case Study,” American Journal of Scientific Research, 4(1), pp. 36–44.

- Swanepoel, M.J. (2019). Management accounting research: Guidelines for using a hybrid of the grounded theory and case study approaches. Polish Journal of Management Studies, 19(1), 433-444.

- TBank Financial Information (no date) Thanachart Capital Public Company Limited. Available at: http://investor.thanachart.co.th/financials.html.

- Tilahun, M. (2019) “A review on determinants of accounting information system adoption,” Science journal of business and management, 7(1), p. 17.

- Urquía Grande, E., Pérez Estébanez, R. and Muñoz Colomina, C. (2011) “The impact of Accounting Information Systems (AIS) on performance measures: empirical evidence in Spanish SMEs,” The International journal of digital accounting research, 11.

- Veeken, H. J. M. and Wouters, M. J. F. (2002) “Using accounting information systems by operations managers in a project company,” Management accounting research, 13(3), pp. 345–370.

- Wang, E. T. G., Tai, J. C. F. and Wei, H.-L. (2006) “A virtual integration theory of improved supply-chain performance,” Journal of management information systems: JMIS, 23(2), pp. 41–64.

- Wernerfelt, B. (1984) “A resource-based view of the firm,” Strategic management journal, 5(2), pp. 171–180.

- Zhou, L. (2010) “The research on issue and countermeasures of accounting information of SMES,” International journal of business and management, 5(3).