Introduction

Globally, it is a known fact that for an organization to succeed in any commercial or economic activity, the key ingredient to achieve this success is the customer (Sedighimanesh, Sedighimanesh, & Ashghaei, 2017). The banking sector, which is regarded as one of the most essential and vital sectors of Nigeria’s economy, has garnered a great deal of attention in recent years. The Nigerian banking business is becoming increasingly competitive as a result of the introduction of globalization as well as new technologies. To be able to satisfy customers, it is essential that organisations develop strategies on how to attract customers as well as maintain them. In the research study by Aaltonen, Markowski & Kirchner (2012), they stated that creating an efficient marketing plan necessitates the gathering of useful data on customers, rivals, and markets, as well as the creative transformation of that data into useful and actionable information.

Ryding (2012) in his research study explained that every financial services organization must assess which banking channels are most appropriate and cost effective for its various customer segments in today’s existing competitive business environment. It must precisely predict which customers would accept the new technology adopted by the organisation or they remain extremely satisfied with their old technology. The banking industry is allocating a growing part of their Information technology budgets and resources to efforts known as Information (IT) transformation. Security, data management, and new customer interaction channels are all problems that come with these transformation projects (Vandyck, 2016).

The use of technology coupled with appropriate human resources has a way of increasing customers’ satisfaction (Jan & Abdullah, 2014). Organizations are now analyzing the internal environment and evaluating the roles and responsibilities of workers and management in order to provide the best quality services demanded by customers as Nigeria undergoes rapid change (Chun-Fang, 2016; Khan & Jabbar, 2018)

Customer satisfaction benefits the businesses as a whole. In a study by Worlu (2018), he explained that customer service practices that are properly implemented will allow the organisation to gain client loyalty as well as competitive advantage. This also allows businesses to respond to customer demands and comments quickly and efficiently. Furthermore, it will also give management clear visibility into which consumers are unsatisfied and why, as well as what measures have been taken or need to be taken, and what suitable replies must be delivered. In addition, it will facilitate the development of real and practical ideas for enhancing overall industry performance (Tavakoli, 2016; Lin & Liu, 2018). Customers and companies develop bonds based on trust, which is aimed at attaining overall beneficial outcomes. As a result, higher levels of trust and commitment are associated with stronger customer retention, which leads to increased organizational success (Vandyck, 2016).

Statement of Research Problem

The satisfaction of customers is critical to the survival of the business irrespective of the type of business they are involved in. The banking industry is in competition with itself. Several banks are looking for ways to adopt new technology to make their service more satisfactory. Technology was adopted by the banking industry to enhance their quality of service. Electronic banking (e-banking) was introduced as a result of technological change and this made banking easier and faster thereby eliminating unnecessary queuing in the bank and also provided other opportunities for customers by allowing them to withdraw cash 24/7 as long as they have a debit card, allowing customers to track their transactions, allowing them to transfer funds to a third-party account, etc. Even with the above stated benefits and opportunities, there are still some issues with technology with regard to customer satisfaction.

As a result of wanting to stay ahead of their competitors, banks tend to spend exorbitant amount of money on acquiring new technology. When rapid changes occur, some of the current employees are not skilled enough to equip such technology. Such inefficiency leads to systems’ redundancy. This goes to show that if employees are not well-skilled in handling technology, attending to customers might prove difficult, hence leading to customers’ dissatisfaction.

Over the years, complaints have been made with regards to the use of automated teller machines (ATMs). Such complaints include malfunctioning and slow response of the machine as well as network issues.

Therefore, the objective of this study is to identify the effects of these technological changes on the satisfaction of customers. The hypothesis of this study is in line with the objective and can be stated as:

H0: Technological change has no significant effect on customers’ satisfaction.

H1: Technological change has a significant effect on customers’ satisfaction.

Literature Review

Concept of Technological Change

Technological change is the application of innovative and rebranded technologies in an organisation (Karanja, 2015; Gruman & Saks, 2017). Also, according to Brauns (2015), technological change basically means establishing inventions and the adoption of the changes.

As technology advances, it appears to have more power over our lives. Technology is now widely accessible and actively promoted across our society. While technology makes life easier for people, it also produces problems in our society, such as the loss of common social habits. Modern societies, on the other hand, have acknowledged the value of intellectual technology, which is a sort of new knowledge that helps people achieve their goals or solve problems. Skills are crucial to a country’s ability to capitalize on new and emerging technology opportunities, and there is a significant disparity in capabilities between industrialized and developing countries.

Technology provides new options for dealing with humanitarian crises. Changing technology, on the other hand, has an impact on the contexts in which humanitarian work is carried out, alters people’s needs, and may even lead to a crisis. Technology has an amount of impact on the labour economy (Gruman & Saks, 2017). As a result of automation and digital advancements, labour demand is transitioning away from basic low and middle-level skills and toward higher-level and more advanced analytical, technical, and management capabilities (Baumruk, 2016). Even if huge variations in adoption still exist in different parts of the world, particularly in economies that are least developed, the invention and application of new technology has accelerated dramatically over the years. Rapid technological change has an influence on almost every sector of business, society, and culture (Kansal & Singh, 2016). This presents a tremendous potential for the 2030 Agenda and the Sustainable Development Goals to be realized.

Concept of Customers’ Satisfaction

According to Hansemark and Albinson (2004), satisfaction is exposed as a customer’s overall or principal attitude toward an individual or organisation that renders service, or can be seen as the gap between a customer’s expectation and sense of satisfaction with certain wants, needs, set of ambitions or goals. Customers, as the world knows, are a significant component if not the most significant in a company’s development, growth and survival. Therefore, it should not come as a shock that businesses with an intent to compete must provide their customers with well met wants and needs (Biesok & Wrobel, 2011). This satisfaction includes not only the feelings associated with the purchasing of an item, but also the environment prior to when the purchase was made and after. An organization must make its customers her priority, get closer to them and find out how best to grant their needs for the long term.

By listening to their consumers, satisfaction is one’s sensation of pleasure or unhappiness resulting from a service perceived performance (Kotler, 2000). Satisfaction is relative and may fluctuate depending on customers’ experiences and individual preference.

Technological Change and Customers’ Satisfaction

Technological change is referred to as increase in both effectiveness and efficiency processes resulting in a rise in output and it may also have association with employee outcomes. Technology determines the quality and quantity of how services are rendered in an organisation. Technological change is inevitable. It will affect the both internal and external environment of an organisation. Customer satisfaction is a key component of both for-profit or non-profit organisations (Ibidunni, Salau, Falola, Ayeni & Obunabor). Technology will increase customers’ satisfaction when technology is used for the organisation’s benefit and used alongside ethical values (Imran, Maqbool & Shafique, 2014). Technology will increase customers’ satisfaction. In today’s modern leading organisations, technology is a drive to accomplishing great results. So, for organisations that are lacking technological wise, they will have a limit to what and how they can produce or offer services.

Methodology

The study employed the use of causal-comparative research design. This design helped in stating out the causes of technological change as well as its effect on customers’ satisfaction. The information collected from respondents was gotten through the administering of 245 copies of structured questionnaire to the customers of zenith bank headquarters, Lagos, Nigeria. The simple random sampling technique was used because it helped the researcher obtain a sample population that perfectly represents the whole population in view. The respondents were chosen based on the study’s objective, which is to learn more about technological changes and how they affect customers’ satisfaction, and also their use of the banks’ e – services.

Validity and Reliability of Procedures

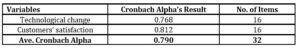

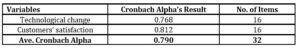

This research used the content validity which tests items fairly representative of the structure used for measurement. It looks for the quality of items in a research work, which can be viewed by supervisor and researcher in the field. Reliability describes how consistent a research instrument produces the same result over and over again after repeated trials and yields the same result. The reliability of the research was tested with the use of Cronbach’s Alpha test which ensured the test exceeds 0.7, is interpreted as a number of 0 to 1. In using the Cronbach’s alpha, it will test the internal consistency which explains the degree at which all items measure the same construct in the test.

Table 3.1: Result of Reliability Test

Method of Data Analysis

When the questionnaires are obtained, the interpretation of the data from the respondents is gathered together; this is done to ensure that the data is displayed in tables in a concise manner by inserting the data into the Social Sciences Statistical Package (SPSS). Regression analysis was used because it predicts the effect of one variable on another.

Data Presentation

To address the research objective, Tables 4.2 – 4.3 show the effect of technological change on customers’ satisfaction based on the Likert-scale presentation on the research instrument and their responses explain their attitudes.

Demographic Characteristics of Respondents

Table 4.1 depicts the demographic profile of the respondents. The first section shows the gender of the respondents from the study, 113 participants out of the respondents are males equivalent to 46.1%, while 132 participants are females equivalent to 53.9%. This information shows that the majority of the respondents in this study are females.

The second section of Table 4.1 shows the age range of the respondents that participated in this study: 51 participants out of the total respondents are between the ages of 21 – 30 years old with a percentage of 20.8%; 133 participants out of the total respondents are between the ages of 31-40 years old with a percentage of 54.3%; 55 participants out of the total respondents are between the ages of 41-50 years old with a percentage of 22.9%; and 5 participants out of the total respondents are 51 years and above with 2.0%.

The third section of Table 4.1 shows the marital status of the respondents that filled the questionnaire for this study: 72 of the respondents are single with 29.4%; 167 of the respondents are married with 68.2%; 5 of the respondents are divorced with 2.0% and 1 person chose the option of others which is 4%.

Table 4.1 Respondents’ Demographic Characteristics

Source: Field work, (2021)

The fourth section depicts the Highest level of Education of the respondents: 136 of the respondents are HND/BSc holders with 55.5%; 98 of the respondents are MSc/MBA holders with 40%; 7 are Doctorate degree holders with 2.9% and others are 4 with 1.6%.

The fifth section shows the Department of the respondents in their organisation: 61 respondents who filled the questionnaire are in the Business Development department with 24.9%; 63 respondents who filled the questionnaire are in the Operations and IT department with 25.7%; 82 respondents are in the Risk management department with 33.5%; 25 respondents are in the corporate development department with 10.2%; and others are 14 respondents with 5.7%.

The Sixth section shows the position of the respondents in their organisation: 16 of the respondents are Senior managers with 6.5% of the total respondents; 69 of the respondents are managers with 28.2%; and then the other employees are 101 having 41.2% of the respondents.

The seventh section shows the number of years the respondents have spent in their current organisation: 41 of the respondents have spent between 1-5 years having 16.7% of the respondents; 129 of the respondents have spent between 6-10 years having 52.7% of the respondents; and 19 of the respondents have spent above 16 years having 7.8% of the respondents.

The eight section shows the employment status: 72 of the respondents are Permanent staff having 29.4% of the respondents; and 173 of the respondents are Contract staff having 70.6% of the respondents.

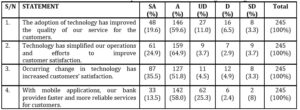

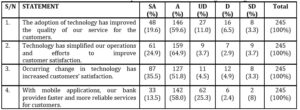

Table 4.2: Distribution of Respondents based on Technological Change

Source: Field work, (2021)

The frequency table above presents respondents’ responses when they were asked questions depicting technological change: 48 (19.6%) respondents strongly agree that the adoption of technology has improved the quality of our service for the customers; while 146 (59.6%) respondents agree; 27 (11.0%) respondents undecided; 16 (6.5%) respondents disagree; 8 (3.3%) respondents strongly disagree. 61 (24.9%) respondents strongly agree that technology has simplified our operations and efforts to improve customer satisfaction; 159(64.9%) respondents agree; 9(3.7%) respondents undecided; 7(2.9%) respondents disagree and 9(3.7%) strongly disagree. 87 (35.5%) respondents strongly agree that occurring change in technology has improved customers’ satisfaction; 127 (51.8%) respondents agree; 11 (4.5%) undecided; 12(4.9%) disagree and 8 (3.3%) strongly disagree. 33 (13.5%) respondents strongly agree that with mobile applications, the bank provides faster and more reliable services for customers; 142 (58.0%) agree; 62 (25.3%) undecided; 6 (2.4%) disagree; and 2 (8%) strongly disagree.

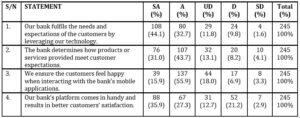

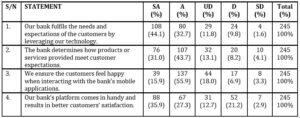

Table 4.3 Distribution of Respondents based on perceived Customers’ Satisfaction

Source: Field work, (2021)

The frequency table above presents respondents’ responses when they were asked questions on their perception of customers’ satisfaction; 80(32.7%) respondents strongly agree the bank fulfils the needs and expectations of the customers by leveraging our technology; while 29 (11.8%) respondents agree; 108(44.1%) undecided; 24 (9.8%) disagree; and 4 (1.6%) strongly disagree. In addition, 76(31.0%) respondents strongly agree that the bank determines how products or services provided meet customer expectations; while 107 (43.7%) respondents agree; 32(13.1%) undecided; 20 (8.2%) disagree; and 10 (4.1%) strongly disagree. Also, 39 (15.9%) respondents strongly agree that bankers ensure customers feel happy when interacting with the bank’s mobile applications; while 137 (55.9%) agree; 44(18.0%) undecided; 17 (6.9%) disagree; and 8 (3.3%) strongly disagree. Besides, 88(35.9%) respondents strongly agree that the bank’s platform comes in handy and results in better customers’ satisfaction; while 67(27.3%) agree; 31 (12.7%) undecided; 52 (21.2%) disagree; and 7(2.9%) respondents strongly disagree.

To address the research hypothesis, Tables 4.4 – 4.6 shows that technological change has an effect on customers’ satisfaction.

H0: Technological change has no significant effect on customers’ satisfaction

H1: Technological change has a significant effect on customers’ satisfaction

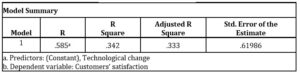

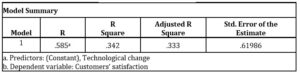

Table 4.4 Model Summary

Source: Field work, (2021)

Interpretation of results: Table 4.10 shows that (R) in the model summary table indicates a .585 relationship of Technological change on customers’ satisfaction which depicts a strong relationship. The table shows the results that revealed the degree to which the variance in customers’ satisfaction is explained by technological change. This is represented by R square which equals .342

and is expressed as 34.2%. This shows that technological change only accounts for 34.2% of customers’ satisfaction in the organisation, while the standard error estimate is .61986 which signifies error term. Hence, other factors not stated in this study explain 65.8% (i.e., 100%-34.2%) of the variance in customers’ satisfaction.

Decision: Therefore, it can be concluded that technological change has an effect on customers’ satisfaction.

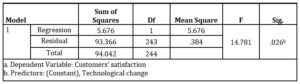

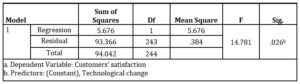

Table 4.5: ANOVAa

Decision Rule: Null hypothesis should be rejected when the significance value is below 0.05.

Null hypothesis should be rejected when the significance value is less than 0.05.

Interpretation of Result: The ANOVA table shows that the F value is 14.781 at .026ᵇ significance level. This means that technological change has significant influence on customers’ satisfaction in the organisation.

Decision: The Null hypothesis is therefore rejected because the significance is below 0.05. Therefore, there is a significant effect of technological change on customers’ satisfaction.

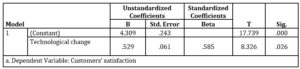

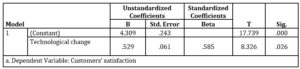

Table 4.6 Coefficientsa

Source: Field work, (2021)

Interpretation of Result: The table above shows that technological change has significant effect on customers’ satisfaction (β=.529; t= 8.326; p <0.05). The constant B= 4.309 is the intercept in the regression equation. This means that when technological change is at point 0, customers’ satisfaction is 4.309. B value for technological change is 0.529 which indicates the slope of the regression equation. This implies that a unit increase in technological change will foster increased customers’ satisfaction by 52.9%.

Decision: Since the significant level of the model is less than 0.05, the null hypothesis is rejected while the alternative hypothesis is accepted. Therefore, technological change has a significant effect on customers’ satisfaction.

Conclusion and Recommendation

This study has revealed the several advantages of delivering value to customers through the use of technology. Every firm in the present day makes use of one technological facility or the other to ensure that their consumers receive high-quality and timely services.

The findings show that technological change plays a significant role in whether or not a customer is satisfied. The result indicates a technological change is critical to the performance of Zenith bank especially with regards to customers’ satisfaction. This suggests that the technological change promotes flexibility, creates an opportunity for the selected bank to develop new and innovative ideas and improved the whole banking process. The findings also revealed that technological change has an amount of effect on customers’ satisfaction. H0 was rejected while the H1 was accepted. This means technological changes have stimulated employees (i.e., bankers) to perform well in their daily business operations and it has improved their service quality to their customers. This supports Kwizera’s (2019) assertion that “almost every firm in the modern environment relies on technology at every level of its activities,” and that “employee performance is critical for organisational effectiveness in an increasingly competitive environment” (Aryee, 2014).

According to the findings, despite all of the benefits of technology, the banking industry still has some work to do in terms of customer service. The following recommendations were derived:

- As the world is evolving, Zenith bank should consider the adoption of technology in its operations for it will allow them to retain their position and the best bank in Nigeria.

- Proper legislation must be put in place with regards to technological change. If an organisation is not equipped to introduce a particular technology into their operations, legislations should be put in place to restrict these organisations until they are fit to proceed.

- The bank should improve their Internet services to maintain customer loyalty.

- The bank should consistently ensure that the customers feel happy when interacting with the bank’s mobile applications and offer to customers a service that meets their expectations.

- Finally, to maintain bank sustainability, bank executives should employ a variety of tactics such as: technology adoption and application, training and learning, participative leadership styles’ adoption, effective communication, use of change champions, and cost minimization.

Acknowledgement

Great attitude goes to the management of Covenant University especially Covenant University Centre for Research, Innovation and Development (CUCRID), for funding this Journal publication.

References

- Aaltonen, P.G., Markowski, E.P. and Kirchner, T. A. (2012), ‘Technology satisfaction and effects on overall customer satisfactionin the banking industry’. European Journal of Business Research, 12(2), 1-14.

- Aryee, S., Chen, Z. H. and Budhwar, P. S. (2014), ‘Exchange fairness and employee performance: an examination of the relationship between organisational politics and procedural justice’. Organisational Behavior and Human Decision Processes, 94(1), 1-14.

- Brauns, M. (2015) ‘The management of change in a changing environment- To change or not to change?’ Corporate Board: Role Duties & Composition,11(3), 37-42.

- Biesok, G. and Wrobel, J. W. (2011), Marketing and logistics problems in the management of organisation,Prentice-Hall, New Jersey.

- Chun-Fang, C. (2016) ‘Perceived organisational change in the hotel industry: An implication of change schema’. International Journal of Hospitality Management, 29(2), 157–167.

- Gruman, J. A. and Saks, A. M. (2017),‘Performance management and employee engagement’. Human Resource Management Review, 21(2), 123-136.

- Hansemark, O. C. and Albinson, M. (2004), ‘Customer satisfaction and retention: theexperience if individual with employees’. Managing service quality, 14(1), 40-53.

- Ibidunni, A. S., Salau, O. P. Falola, H. O. Ayeni, A. W. and Obunabor, F. I. (2017), ‘Total quality management and performance of telecommunication firms’. International Business Management, 11(2), 293-298.

- Imran, M., Maqbool, N., and Shafique, H.(2014), ‘Impact of technological advancement on employee performance in banking sector’. International Journal of Human Resource Studies, 4(1), 57-70

- Jan, M. T. and Abdullah, K. (2014), ‘The impact of technology CSTs on customer satisfaction and the role of trust’. International Journal of Bank Marketing, 32(5), 420-447.

- Kansal, K.K. and Singh, A. (2016),‘Impact of organisation change on employees’ performance inMaruti Suzuki’. International Journal of Research in IT and Management (IJRIM), 6(11), 16-21.

- Karanja, A. W. (2015) ‘Organisational change and employee performance: A case on the postal corporation of Kenya’. Human Resource Management Review7(11), 72-81.

- Khan,M.M. and Jabbar, M. (2018), ‘Determinants of employees’ performance in corporate sector: Case of an emerging market’. Business and Management Research,2(3), 25-32.

- Kotler, P. (2000) Marketing management, Prentice-Hall, New Jersey.

- Kwizera, M., Osunsan, O. K. Irau, F. Wandiba, A. Abiria, P. and Bayo, I. (2019), ‘Effect of organisational change on employee performance among selected commercial banks in Bujumbura, Burundi’. Eastern African Scholars Journal of Economics, Business and Management, 2(4), 225-234.

- Lin, W. and Liu, Y. (2018),‘Successor characteristics, organisational slack, and change in thedegree of firm internationalization’. International Business Review, 21(1), 89-101.

- Ogbari, M. and. Tairat, B. T. (2015), ‘Strategic imperatives of total quality management and customer satisfaction in organisational sustainability’. International Journal of Academic Research in Business and Social Sciences, 5(4), 1-22.

- Ryding, D. (2010) ‘The impact of new technologies on customer satisfaction and business to business customer relationship: Evidence from the soft drinks industry’. Journal of retailing and consumer services, 17(2), 224-228.

- Sedighimanesh, M., Sedighimanesh, A. &Ashghaei, N. (2017), ‘The impact of self-service technology on customer satisfaction of online stores’. International Journal of Scientific & Technology Research, 6(7), 172-178.

- Tavakoli, M. (2016) ‘A positive approach to stress, resistance, and organisational change’. Social and Behavioral Sciences, 5(34), 1794-1798.

- Vandyck, R. (2016) ‘The impact of technology on customer satisfaction at social security and national insurance trust’. [Masters thesis, Kwame Nkrumah University of Science & Technology, Kumasi, Ghana].

- New Jersey service for competitive business advantage’. International Journal of e-Business Management, 2(3), 25-34.