Introduction

The primary goal of accounting standards is to improve the transparency and comparability of financial reports of firms since financial reports have critical economic consequences on the decision-making of stakeholders (De Jong et al., 2006; Zeff, 1978). Disclosure is an effective tool and the primary way to reach the primary goal of the accounting information system, which is to measure the results of economic events for businesses and communicate them to financial information users. In this regard, the more comprehensive and forward-thinking accounting information firms disclose better market work and development (Pavlopoulos et al., 2019; Ernst and Young, 2014).

Many financial instruments have become widely used in response to subsequent developments in financial markets. On the other hand, the financial crises raised important questions about the role of accounting standards in reporting on financial instruments (Ryan, 2012). As a result, governments worldwide have sought to develop financial instrument disclosure accounting rules to control the inclusion of a minimum level of financial instrument relevant facts in enterprises’ financial results (Tahat et al., 2016; Laux, 2012).

Since 1988, the IASB and the IASC have attempted to produce an adequate accounting standard for financial instruments (Chatham et al., 2010). In this regard, IASB issued IAS 32 “Financial Instruments: Disclosure and Presentation” & IAS 39 “Financial Instruments: Recognition and Measurement” to organize the presentation of financial instruments’ disclosures. However, in the latest decades, organizations’ strategies for measuring and managing risk deriving through financial instruments have changed. This has resulted in several initiatives from both the public and private sectors calling for reforms to the risk disclosure framework for fiscal instruments.

As a result, to increase transparency for financial report users and enable them to make more informed decisions about the risks posed by financial instruments, IASB determined that all fiscal instrument disclosure requirements should be consolidated in IFRS 7. As a result, beginning on January 1, 2007, financial instrument reporting was changed from IAS 32 to IFRS 7. As one of the primary purposes of IFRS 7, users will be able to examine not only the usefulness of fiscal instruments for organizations but also the type and scale of the risks involved in employing financial instruments, as well as how firms manage risks (Leote et al., 2020).

IFRS 7 focuses on improving financial report users’ comprehension of financial instruments as shown in the financial results or not, concerning the enterprise’s financial position and performance. Therefore, the purpose of this study is to measure the extent of compliance with the requirements of IFRS 7 by the Jordanian & Palestinian banks.

Furthermore, the paper aims to answer these questions:

- What is the extent of compliance with the requirements of IFRS 7 by Palestinian banks?

- What is the extent of compliance with the requirements of IFRS 7 by Jordanian banks?

- Is there a difference in the level of compliance with the requirements of IFRS 7 among Palestinian and Jordanian banks?

The successive developments in the global financial markets have led to the widespread use of financial instruments, as a result, this study gains its importance as it addresses information that must be included in financial reports about the value of fiscal instruments for performance and position for banks. It also discusses the extent & nature of risks related to the usage of financial instruments, as all users of financial reports can benefit from this information by using it to create a comprehensive picture of risks and returns. Besides, the results of this study will contribute by providing evidence for regulatory bodies about the extent of compliance with the requirements of IFRS 7, enabling them to take measures to improve the compliance level of banks. Furthermore, the significance of the paper stems from the importance of the sector in question, as the banking sector is currently regarded as the mainstay of the economy in all countries throughout the world.

Literature Review

A financial instrument is a contract that creates an asset for an entity and an obligation or ownership right instrument for another (Mirza et al., 2010). Financial instruments are classified by IAS 32 into two main categories: financial assets & liabilities. Financial instruments are a significant aspect of corporate transactions, which has prompted regulatory organizations to develop accounting standards that govern concerns relating to financial instruments including debt instruments, equity instruments, and derivatives. In this regard, the IASB, and previously IASC, issued four accounting standards regarding financial instruments—IAS 32, IAS 39, IFRS 7, & IFRS 9.

Financial instrument disclosures are often confidential and competitively sensitive, as well as time-consuming to create (Bamber and McMeeking, 2010). Therefore, several attempts by researchers before the implementation of the Accounting Regulations for Financial Instruments found that firms are often reluctant to disclose information regarding their financial instruments voluntarily (Tahat et al., 2016).

There has been a significant body of research that attempts to verify the extent of compliance with rules and standards connected to financial instruments in the wake of the increased regulation of such standards. As an illustration, Tahat et al (2016) presented Jordanian evidence to support the connection between IFRS 7 and financial instruments’ disclosure. The researchers found that the percentage of disclosure by Jordanian companies related to financial instruments amounted to 47% after the mandatory application of IFRS 7, compared to 30% for the disclosure level related to financial instruments before the mandatory application of the standard.

This finding indicates that IFRS 7 has indeed enhanced disclosures of financial instruments in a firm’s annual reports. In other developing countries, Sarea and Al Dalal (2015) investigated the extent of IFRS 7 compliance for companies listed on the Bahrain Bourse; they found that the amount of compliance differs across the sector, with the financial sector disclosing the greatest level of compliance and the insurance business disclosing the lowest. Besides, Iraqi banks comply with the IFRS 7 requirements at 82% (Mohsen et al., 2020). Zango et al (2015) also provide proof from Listed Banks in Nigeria, as they found non-compliance with IFRS 7 requirements for 2012 & 2013. In the context of banks, Amoako (2010) found a high degree of compliance with IFRS 7 requirements in listed banks in Ghana. Besides, Hossain and Sultana (2014) found that the degree of compliance with IFRS7 reached 61.36% of the Banks of Bangladesh.

Additionally, Leote et al (2020) state that there is a good level of compliance under IFRS 7 in the context of Euronext Lisbon stock (2015-2017). Additionally, Agyei-Mensah (2017) discovered that in Ghana the quality of IFRS 7 disclosures is 33% and the compliance level of IFRS 7 is 53% (2011-2013). This outcome necessitates an evaluation of how well companies listed on the Ghana Stock Exchange disclose risks. Agyei-Mensah (2017) also concludes that for the three years under IFRS 7, the average level of risk disclosure compliance in Botswana and Ghana was 63% and 53%, respectively. In the context of Canada, Mnif and Znazen (2020) found that IFRS 7 compliance by Canadian financial institutions reached 77%. These findings generally point to a high degree of adherence to the standards for financial instruments. Due to the global financial crisis’s negative impact on company performance generally, firms have grown more concerned about reporting information concerning financial instruments, as seen by the high degree of compliance (Leote et al., 2020).

Methods

Sample Selection

The study aims to compare and contrast the levels of IFRS 7 compliance between Jordanian and Palestinian banks. The banking sector is picked because it deals with financial instruments and their derivatives, which are most susceptible to financial hazards, and also deals with fair value. At the time of the study, the Jordanian-listed banks on the Amman Stock Exchange (13 banks) and the Palestinian-listed banks on the PEX (7 banks) make up the study sample (2014-2019).

Data Collection

The study depends on secondary data by using annual reports of the banks to collect the study data since they are considered the main source of data for stakeholders. Before collecting data, the researcher reviewed the literature related to IFRS 7 to develop an index that represents the requirements of this standard. This study depends on an index developed by Yamani and Hussainey (2021) and used by Yamani, Hussainey and Albitar (2021) to measure compliance with the requirements of IFRS 7. This index contains 77 items divided into three main groups; the significance of financial instruments, the extent & nature of risks related to financial instruments, and transfers of financial assets. Where “1” is assigned to the item that was disclosed and “0” otherwise.

Therefore, the extent of compliance with the requirements of IFRS 7 is measured by dividing the total point of disclosure of financial instruments that the bank has committed to by the maximum prescribed limit for disclosure of financial instruments following IFRS 7.

Results

Descriptive Statistics

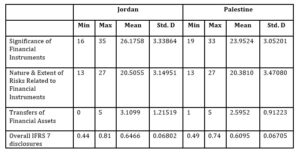

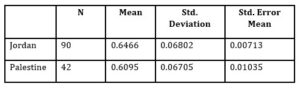

Table 1 presents the descriptive statistics for the IFRS 7 disclosures provided by the Palestinian sample of 42 bank observations and the Jordanian sample of 90 bank observations for the period 2014-2019.

Table 1: Descriptive Statistics of Jordanian and Palestinian Banks’ Observations

As shown in Table 1, the minimum percent of compliance with the IFRS 7 requirements by Jordanian listed banks is 44%, and the maximum percent of compliance with these requirements is 81%. On the other hand, the mean of compliance with the IFRS 7 requirements is 64.66% which indicates that Jordanian listed banks in general comply with the majority of the requirements of the IFRS 7. As shown in Table 1, the minimum percent of compliance with the requirements of IFRS 7 by Palestinian listed banks is 49%, and the maximum percent of compliance with these requirements is 74%. On the other hand, the mean of compliance with the IFRS 7 requirements is 60.95% which indicates the Palestinian listed banks in general comply with most of these requirements.

Independent Samples T-Test

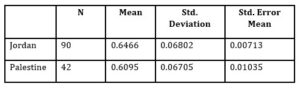

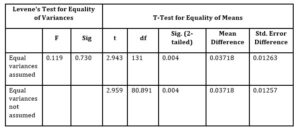

As shown in Table 2, when comparing the mean compliance with IFRS 7 for both Jordanian and Palestinian banks, it finds that, on average, Jordanian banks comply with the IFRS7 requirements more than Palestinian banks. However, to check if there is a statistical difference between the level of compliance with the IFRS 7 between Jordanian & Palestinian banks, Independent Samples T-Test will be used.

Table 2: Group Statistics

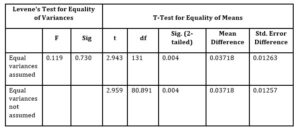

It is recognized that the Independent Samples T-Test is used to compare means across two independent samples with equal variances (Rasch et al., 2007; Fradette et al., 2003). The study uses the Independent Samples T-Test to present the statistical differences between Jordanian & Palestinian banks regarding compliance with the IFRS 7 requirements. Table 3 shows the results.

Table 3: Independent Samples T-Test

It is clear from the results that the value of (F) = .119 and its significance level is 0.730; this value is greater than 0.05, which indicates that it is not significant (and this means that there is homogeneity between the variance of the two groups). Therefore, it prompts to read the findings of the (t) test corresponding to the phrase “equal variances assumed”; from these results it notes that the calculated t-test value = 2.943, degrees of freedom df = 131, and the Sig value (2-tailed) = 0.004. Since the Sig. value (2-tailed) in the table (0.004) is less than the value of 0.05, then there are statistically significant differences between the extent level of compliance with the IFRS 7 requirements between Jordanian & Palestinian banks in favor of Jordanian banks, due to their obtaining larger arithmetic mean = 0.6466. This result may be since Jordanian banks in general are subject to several larger supervisory bodies compared to Palestinian banks that require and regulate compliance with accounting standards such as the Basel Committee, the Central Bank of Jordan, the Amman Stock Exchange, and the Securities Commission, which is reflected in the bank’s commitment to the requirements of international accounting standards.

Conclusion

Banks’ strategies for monitoring and assessing risk emerging through financial instruments have changed in recent years. As a result, stockholders have increased their demand for details on the importance of financial instruments to banks’ financial results, as well as information on the scope and nature of risks associated with the use of fiscal instruments and how banks manage these risks. As a result, these developments and justifications are seen as an introduction to IFRS 7. The purpose of this study is to determine how well Jordanian banks listed on the Amman Stock Exchange & Palestinian banks listed on the PEX comply with the criteria of IFRS 7 for the fiscal years 2014-2019. Therefore, the study is limited to the banking sector and the study results can’t be generalized to other sectors.

Using SPSS software, the findings show that the mean of compliance with the IFRS 7 requirements by Jordanian banks is 0.6466 and by Palestinian banks is 0.6095; these results indicate that there is a high compliance level. Banks are subject to several laws and legislations, which puts pressure on them to abide by and apply international accounting standards, which creates a high commitment for the study sample concerning compliance with the requirements of IFRS 7. Furthermore, the findings show a statistical difference in the extent of compliance with the IFRS 7 requirements between Jordanian & Palestinian banks.

Based on these findings, it is better for the management of the Amman Stock Exchange and the PEX to obligate companies to fully disclose the requirements of IFRS 7 as it is considered one of the most important corporate disclosures confirmed by international standards and to raise the level of compliance of Palestinian and Jordanian banks by disclosing the financial instruments included in their financial reports to full compliance with the application of the standard by 100%. On the other hand, the study suggests more future research in this field such as studying the reasons for none of the complete compliance with all the requirements of IFRS7 by Palestinian and Jordanian banks, and re- examination of the compliance with the requirements of IFRS 7 for entities other than banks.

References

- Agyei-Mensah, B. K. (2017) ‘Does the Corruption Perception Level of a Country Affect Listed Firms’ IFRS 7 Risk Disclosure Compliance? ’ Corporate Governance: The International Journal of Business in Society.

- Agyei-Mensah, B. K. (2017) ‘The Relationship Between Corporate Governance Mechanisms and IFRS 7 Compliance: Evidence from an Emerging Market,’ Corporate Governance: The International Journal of Business in Society.

- Amoako, G. K. (2010) ‘Compliance with International Financial Reporting Standard 7 (IFRS 7): A Study of Listed Banks in Ghana,’ (Doctoral dissertation, University of Cape Coast).

- Bamber, M. and McMeeking, K. (2010), ‘An Examination of Voluntary Financial Instruments Disclosures in Excess of Mandatory Requirements by UK FTSE 100 Non‐Financial Firms,’Journal of Applied Accounting Research.

- Chatham, M. D., Larson, R. K. and Vietze, A. (2010), ‘Issues Affecting the Development of an International Accounting Standard on Financial Instruments, ‘ Advances in Accounting, 26(1), 97-107.

- De Jong, A., Rosellón, M. and Verwijmeren, P. (2006), ‘The Economic Consequences of IFRS: The Impact of IAS 32 on Preference Shares in the Netherlands, ‘ Accounting in Europe, 3(1), 169-185.

- Ernst and Young ( 2014), ‘Integrated Reporting, Elevating Value.’

- Fradette, K., Keselman, H. J., Lix, L., Algina, J. and Wilcox, R. (2003), ‘Conventional and Robust Paired and Independent Samples T-Tests: Type I Error and Power Rates, ‘ Journal of Modern Applied Statistical Methods, 2(2), 22.

- Hossain, I. and Sultana, N. (2014), ‘Regulatory Compliance of IFRS# 7 of the Banks’ Disclosures: A Case Study on the Nationalized Commercial Banks of Bangladesh,’ Banglavision, 13(1), 186-201.

- Laux, C. (2012) ‘Financial Instruments, Financial Reporting, and Financial Stability,’ Accounting and business research, 42(3), 239-260.

- Leote, F., Pereira, C., Brites, R. and Godinho, T. (2020), ‘ Financial Instruments’ Disclosure in Compliance with IFRS7: The Portuguese Companies, ‘ International Journal of Accounting, Finance and Risk Management, 5(1), 52-61.

- Mirza, A. A., Orrell, M. and Holt, G. (2010). Wiley IFRS: practical implementation guide and workbook. John Wiley & Sons.

- Mnif, Y. and Znazen, O. (2020), ‘Corporate Governance and Compliance with IFRS 7: The Case of Financial Institutions Listed in Canada, ‘Managerial Auditing Journal, 35(3), 448-474.

- Mohsen, M. D. K., Kandouri, E. M. and Jawad, K. K. (2020), ‘The Extent of Application of International Standard No. (7)(Financial Instruments: Disclosures) In Iraqi Banks, ‘ Journal of Administration and Economics, (125).

- Pavlopoulos, A., Magnis, C. and Iatridis, G. E. (2019), ‘Integrated Reporting: An Accounting Disclosure Tool for High Quality Financial Reporting, ‘ Research in International Business and Finance, 49, 13-40.

- Rasch, D., Teuscher, F. and Guiard, V. (2007), ‘How Robust are Tests for Two Independent Samples? ‘ Journal of Statistical Planning and Inference, 137(8), 2706–2720.

- Ryan, S. G. (2012) ‘Financial Reporting for Financial Instruments,’ Foundations and Trends® in Accounting, 6(3–4), 187-354.

- Sarea, A. M. and Al Dalal, Z. A. (2015), ‘The Level of Compliance with International Financial Reporting Standards (IFRS 7): Evidence from Bahrain Bourse,’ World Journal of Entrepreneurship, Management and Sustainable Development.

- Tahat, Y. A., Dunne, T., Fifield, S. and Power, D. M. (2016), ‘The Impact of IFRS 7 on the Significance of Financial Instruments Disclosure: Evidence from Jordan, ‘Accounting Research Journal.

- Yamani, A. and Hussainey, K. (2021), ‘Compliance with IFRS 7 by Financial Institutions: Evidence from GCC, ‘ International Journal of Disclosure and Governance, 18(1), 42-57.

- Yamani, A., Hussainey, K. and Albitar, K. (2021), ‘Does Governance Affect Compliance with IFRS 7? ‘Journal of Risk and Financial Management, 14(6), 239.

- Zango, A. G., Kamardin, H. and Ishak, R. (2015), ‘Risk Management Committee Effectiveness and International Financial Reporting Standards 7 (IFRS7) Compliance by Listed Banks in Nigeria, ‘International Journal of Advanced Research, 3(6), 160-165.

- Zeff, S. A. (1978) ‘The Impact of Accounting Reports on Decision Making may be the most Challenging Accounting Issue of the 1970,’Journal of Accountancy (pre-1986), 146(000006), 56.