Introduction

In the last 20 years, pet food and equipment market has continuously increased, with double-digit growth in some countries. Higher life standards and changed family structure with fewer members place pet care high on the priority list. According to GfK report from 2016, 56% of people live with a pet. The survey of over 27,000 people in 22 countries has shown that dogs are the most popular (33%), followed by cats (23%), fish (12%), and birds (6%). Croatia is following this trend, experiencing an increase in the pet population, as well as an increase in general awareness of their needs. The COVID 19 pandemic further pushed this trend (Rombach and Dean, 2021). People decide to get a pet for several reasons, such as love for animals, the need to spend time in nature, excess of free time, rehabilitation and stress relief purposes. The pet owners are becoming increasingly demanding regarding the pet food quality, and they are especially concerned with the pet food safety.

The pet food market is very concentrated, where 60% of the market share hold five leading producers. However, there are opportunities for innovative, high-quality producers to enter the market by offering different, customized pet food products. There is only one dry pet food facility in Croatia, with few more dogs’ raw food producers and more microbusiness providing some treats and equipment for pets. The import of pet food and equipment is very high. According to The Croatian Chamber of Economy (HGK, 2021), the deficit of the animal food market is EUR 129.4 million, and almost a half of that amount is related to the pet food. Accordingly, there is a huge potential for local companies to participate in this market. This study aims to explore the market potential and trends at Croatian pet food and equipment market. Moreover, the study analyses pet owners’ purchasing habits and expectations. The logistic regression analysis has been used to determine how various factors influence the decision to purchase local pet food products. The contribution of this study is twofold: it gives input to the entrepreneurs willing to invest in the pet food market and it also provides insight into pet owners’ purchasing habits and expectations.

Literature Review

Pet ownership has become very common in the modern society. Historically, pets were domesticated for use in hunting or keeping rodent populations down (Larson and Burger, 2013). However, today pets are treated as children, and many authors emphasize the “pet parenting” trend (Holbrook and Woodside, 2008; Banton et al., 2020). The market is continuously growing; each year people spend more on their pets, and the rate of pet ownership is also increasing. Pet food and equipment market is becoming very attractive to the investors and manufacturers. Moreover, pet food producers have been increasing their product range and developing higher value premium products to sell to pet owners.

Global Pet Food Industry

The global pet food industry is continuously growing to fulfil increasingly complex customers’ requirements, especially at the northern hemisphere. The European market is among market leaders, generating about 30% of global pet food, equipment, and related activities (Mordor Intelligence, 2018). According to Fortune, the global pet food market size was valued at USD 110.53 billion in 2021, and they expect it will expand to USD 163.70 billion by 2029 (FBI, 2022). Because of the COVID 19 pandemic, the global demand increased by 4.75% in 2020 as compared to 2019. The pandemic boosted a demand for pets, and consequently the pet food and equipment market. It is expected to continue in post pandemic. The increasing rate of pet ownership is anticipated to be one of the primary drivers of the pet food and equipment market (Yildiz, 2021). Other trends in the pet food market include: personalization of food products for pet animals (FBI, 2022) and innovative practices of pet food manufacturers (Yildiz, 2021). Regarding the form, the market is segmented into dry form, wet form, and snack and treats. Dry food is the most preferred and is expected to grow a compound annual growth rate (CAGR) of 5.3% during the 2021 – 2030 period (Bundele and Deshmukh, 2021). The supermarkets and hypermarkets are dominant retail channels for pet food sales, but future developments indicate significant growth in specialized pet shops segment (CAGR 5.1% according to Bundele and Deshmukh, 2021). Online channels are also expected to grow, encouraged by new purchasing habits during the pandemic and with more millennials participating in the market. Pet food market is very concentrated, with five leading producers holding more than 60% of the global market share (FBI, 2022). The two major players are Mars and Nestle.

The premium and super premium pet foods are rising due to the increased consciousness about the food safety (Vinassa et al., 2020; Kamleh et al., 2020). Previous studies have shown that pet owners’ awareness of pet food safety is low (Finley et al., 2006). Further, numerous studies have emphasized the risks of pet food contaminations (Hogan, 2012) and helped to increase the awareness about pet food safety standards. Today, pet food market in developed countries is strongly regulated developing towards superior quality and sustainability (Morais Viana et al., 2020). These developments are encouraging researchers to propose innovative approaches, such as upcycled pet foods (Yo et al., 2022).

From the economic perspective, we can conclude that pet food industry is relatively saturated. Leading producers hold the highest market shares and are not seriously threatened by new entrants (Phillips et al., 2014). They have large economies of scale and a consistent consumer base. Smaller producers usually focus on the niche markets, providing customized solutions and they are dealing with higher risk of new market entrants.

Croatian Pet Food Industry

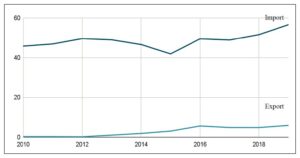

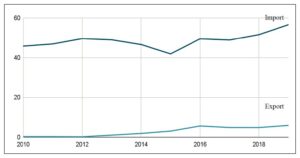

According to the data of the Eurostat (2022), in 2021, more than 70,136 tons of prepared pet food were imported to Croatia, worth nearly 66.66 million euro. Only 3.18 million euro were imported from extra EU countries. The imports increase significantly from one year to the next. For example, in 2020 Croatia imported 67,791 tons of prepared pet food worth 61.05 million euro. The pet food market is dealing with very large deficit (see Figure 1). The export for the last two years increased from 5.43 million euro in 2020 to the 7.01 million in 2021. The trend is presented in the Figure 1. The import of dog and cat food in Croatia grew from USD 42 million in 2010 to USD 57 million in 2019. This growth is expected to continue in the forthcoming years. The export has also increased, but on a much slower pace compared to import, consequently increasing trade deficit.

Fig 1. The import and export of pet food in Croatia in million USD (2010-2019)

Source: The Observatory of Economic Complexity (2021), URL: https://oec.world/en/

It is quite clear that Croatian entrepreneurs are missing an excellent opportunity. However, there are some positive examples. In 2019, the first plant for dry pet food was built in Virovitica. The investment was worth around 2 million euro, with around 0.7 million coming from EU funds. The data from Fininfo (2020) show that there are four registered companies for producing pet food, two for dry pet food and two for raw pet food. These are all small and medium enterprises. However, there are also many micro-entrepreneurs who provide pet treats, cosmetics, apparel, raw pet food. These entrepreneurs usually sell small quantities through special pet stores or online. On the other hand, retail of pet food and equipment is quite competitive and developed. The pet food and equipment are available to Croatian customers through all retail formats: specialized shops and supermarkets, grocery supermarkets and hypermarkets, chain shops, direct selling, department stores, and different online channels.

A literature review confirmed that the pet food market is undergoing changes in the pet owners’ buying habits who are becoming more focused on the quality and safety of the food they give their pets. On the other hand, the fact is that large manufacturers hold the majority of the market share with popular products of verified quality. A research question arises: What are the key factors that would encourage pet owners to purchase lesser-known local brands of pet food?

Analysis and Results

The research of pet food and equipment industry has been done in several ways. It started with the literature review related to this market, including statistic sources from Eurostat and Croatian national databases. Research also included interviews with key industry informants and market experts. The interviews were conducted to validate the questionnaire prepared for this research and to get deeper insight into market trends. In total, 25 informants participated in the interview. The second phase was a survey with 880 pet owners in Croatia, conducted using online survey platform. The data were collected from different pet owners’ groups, such as: veterinarian records, associations for animal protection, associations of pet breeders, online groups of pet owners. Data were collected from May 2020 till September 2020. Finally, data were analyzed using logistic regression analysis to determine the likelihood of buying local pet food products.

Sample and descriptive analysis

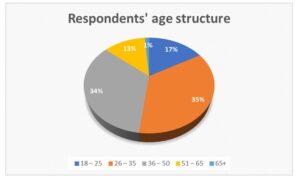

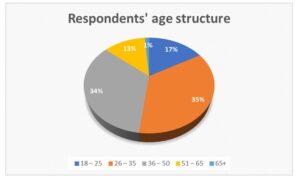

More than half of the participants were younger than 36, and only 13.8% were older than 50 (see Figure 2). In total, 76% of the respondents were female. Regarding the level of education, 52.7% of the respondents hold higher education diploma, 44.8% have completed high school, and 2.5% have completed primary school. With regard to the residence, 77.7% of the respondents live in urban areas, and 22.3% in rural areas.

Figure 2: Respondents’ age structure

Source: Author’s own work.

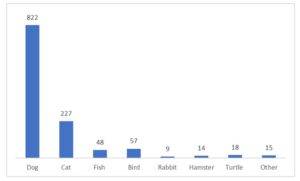

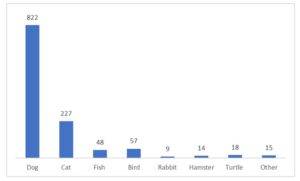

Regarding the pet ownership, most of the respondents (59.9%) own one pet, and 40.1% own multiple pets (21% two pets, 13.5% three to five pets, and 5.6% more than five pets). The structure based on the type of pet is shown in Figure 3.

Fig 3. The structure of the respondents according to type of the pet they own

Source: Author’s own work.

The following questions were based on the purchasing behavior of pet owners. They usually buy pet food and equipment in specialized stores or supermarkets (38.8%), then in the specialized store or supermarket and occasionally online (25.5%), half time in the specialized store or supermarket and half time online (17.8%), and mostly online (17.9%). Regarding the spending per month, there are 21.4% who spend 25 or less euro, 23.9% who spend 26 – 40 euro, 29.5% who spend 41 – 70 euro, and 25.2% those who spend more than 71 euro.

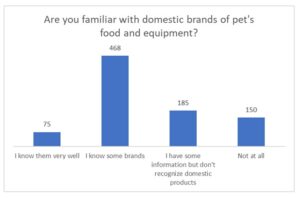

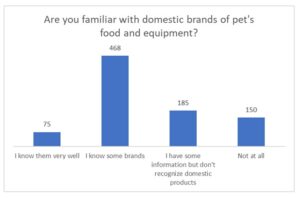

Most of the respondents buy more foreign than domestic products for their pets (40.6%), while 25% buy only foreign products. This is not surprising, since local production is very limited. However, 30% of the respondents buy the same share of domestic and foreign products. Considering the familiarity with local brands of pet food and equipment, more than 38% of the respondents don’t recognize domestic pet food products. More than 90% of the respondents claim that their purchasing decision is based on the quality of the product, and only 8.8% of them said that price is more important.

Fig 4. The structure of the respondents according to their familiarity with local brands

Source: Author’s own work.

Logistic Regression Analysis

Logistic regression analysis was performed to ascertain the effects of different variables on the likelihood of buying local pet food products with higher price and similar quality as the foreign brand. Two control variables were age and level of education (1=EQF 1-4; 2= EQF 5-6; 3=EQF 7-8). Based on the literature review and interviews with market experts, the following independent variables were included in the model: level of expenses for pets’ food per month (expressed as a value in Euro), familiarity with local brands (not familiar at all, have some information but don’t recognize local brands, I know some brands, I know them all), availability of the local brands (range 1-5, 1=not available, 5= available), number of pets owned (0=one, 1=multiple), purchasing channel (1=specialized store; 2=specialized store and occasionally online; 3=same share of store and online purchase; 4=mostly online); preference for the premium brand (expressed as the percentage of product price they are willing to pay for premium brand).

All assumptions for the logistic regression have been checked before the analysis. The response variable is binary (Yes or No); all VIF values were below 1,8; Cook’s distance calculations indicate there were no outliers in the dataset; linearity between continuous independent variables and the logit transformations of the dependent variable has been confirmed. The JASP and Excel have been used for calculations.

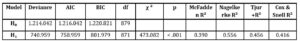

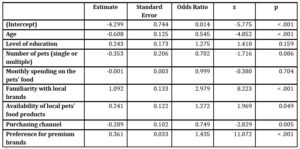

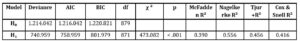

Table 1: Model Summary – Would you buy domestic product with higher price and similar quality as the foreign brand? (0 = No; 1 = Yes)

Source: Author’s own work.

The logistic regression model was statistically significant, χ ² (871) = 473.082, p < .001. The model correctly classified 80% of the cases (Sensitivity 0.794; Specificity 0.804). McFadden’s R² was 0.390, which indicates a good model fit.

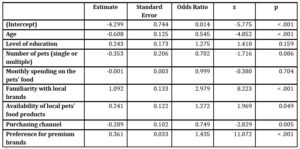

Age, familiarity with the local brands, availability of the local pet food products, purchasing channel, and preference for the premium brands were all significant predictor variables (p<0.05). Level of education, number of pets, and monthly spending on pets’ food were not statistically significant. The findings suggest that older pet owners are related to an increased probability of buying foreign pet food products. One of the reasons could be the fact that older population often buys pet food products through online channel where foreign brands are mostly represented. The results should be interpreted considering the smaller share of older population in the sample (about 14% older than 50). Familiarity with local brands, availability of the local pet food products, and preference for premium brands are related to an increased probability of buying local pet food products. The results indicate that marketing activities are very important to attract pet owners. Regarding the purchasing channel, pet owners who use online channels are 75% more likely to buy foreign pet food product instead of local one. Local producers are very often using Facebook webpages or their own webpages for online shopping, that might be hard to find for pet owners who are not very familiar with local pet food market.

Table 2: Coefficients

Note: Willingness to buy domestic product with higher price and similar quality as the foreign brand ‘Yes’ coded as 1.

Source: Author’s own work.

Discussion and conclusion

The pet food and equipment market is evolving, not only in size, but also in diversity and innovativeness. Customers are becoming conscious about the food they give to their pets, especially with “pet parenting” trend. Even though the pet food market is very concentrated and saturated with global brands, there is opportunity for local producers to find different market niches for ever more demanding pet owners. The pet food market in Croatia is significantly increasing in the last ten years, especially after the pandemic. This is the opportunity for local producers to find specific market niche and to offer innovative and exciting products to local and regional customers. The regional market focus is suggested, due to the fact that the global market is dominated by few large producers. Also, Croatian exchange in this segment is mainly related to the EU market.

The pet owners are very conscious about the food they give to their pets, and the food composition is their primary concern (91.6% of the respondents put quality in the first place when deciding on the product for their pet). This is in line with previous studies that highlighted the importance of food composition and quality for pet owners (Banton et al., 2021). In Croatia, most consumers still believe more in popular foreign brands. Therefore, local producers have to promote their products and emphasize their quality. It is encouraging for the local producers that pet owners are willing to buy local products, even if they cost more than foreign ones. Most of them are willing to pay up to 10% more for local product of similar quality. A study from Italy (Vinassa, 2020) also has found that quality and presence of “natural” ingredients in pet food are the most important for pet food owners. Accordingly, new local producers should create innovative products with natural ingredients aimed at premium pet food buyers to succeed in the market.

The results from logistic regression revealed that the younger population is more likely to buy local pet food products. The younger generation is better integrated into social networks through which small local producers often advertise and sell their products. On the other hand, the older population usually buys from the websites of large retailers that carry popular foreign brands. There is an opportunity for local producers to join the large retailers’ network and to make their products available to the larger population. Local pet food producers should also invest in marketing activities to make their products available to the wider population, to inform local pet owners about their products and their features, and to stress out the quality of the product since all three factors have been shown to significantly influence the decision to buy local products.

This study is the first phase of larger research, and is limited to Croatian pet food buyers. The study provides first insights into Croatian pet food and equipment market, since to the author’s best knowledge there is no previous research in this area. The study can be further developed using inferential statistics to discover how different pet owner groups perceive Croatian market, and to determine their buying intentions. Moreover, the research should be expanded to other markets to compare results and provide more detailed insights into new market possibilities.

References

- Banton, S, Baynham, A, Pezzali, JG, von Massow, M and Shoveller, AK. (2021) ‘Grains on the brain: A survey of dog owner purchasing habits related to grain-free dry dog foods’, PLoS ONE, 16 (5), e0250806.

- Bundele, J and Deshmukh, R. (2021) Pet Food Market 2021 – 2030, Allied Analytics LLP, US.

- Eurostat (2022) EU trade since 2002 by CPA 2.1. [Online] Eurostat. [20 August 2022]. Available: https://ec.europa.eu/eurostat/databrowser/view/DS-059268/default/table?lang=en

- (March 2022) Pet Food Market 2021 – 2028. [Online] Fortune Business Insights. [20 August 2022]. Available: https://www.fortunebusinessinsights.com/industry-reports/pet-food-market-100554

- (2020) Fininfo database [Online]. El Koncept d.o.o. [16 August 2022]. Available: https://www.fininfo.hr/

- Finley, R, Reid-Smith, R, Weese, JS and Angulo, FJ. (2006) ‘Human Health Implications of Salmonella – Contaminated Natural Pet Treats and Raw Pet Food,’ Clinical Infectious Diseases. 42, 686-691.

- GfK (24 May 2016) GfK Survey: 61% of Canadians Own a Pet. [Online] GfK. [16 August 2022]. Available: https://www.gfk.com/en-us/press/61-of-canadians-own-a-pet-gfk-survey

- HGK (17 November 2021) Izvoz poljoprivrednih i prehrambenih proizvoda u 2021. narastao za gotovo 15 posto, ali prati ga i rast deficit [Online]. The Croatian Chamber of Economy. [23 September 2022]. Available: https://www.hgk.hr/izvoz-poljoprivrednih-i-prehrambenih-proizvoda-u-2021-narastao-za-gotovo-15-posto-ali-prati-ga-i-rast-deficita

- Hogan, L. (2012) Pet food safety in Australia: Economic assessment of policy options, Research report 12.8, Australia: Department of Agriculture, Fisheries and Forestry.

- Holbrok, MB and Woodside, AG. (2008) ‘Animal companions, consumption experiences, and the marketing of pets: Transcending boundaries in the animal-human distinction’ Journal of Business Research. 61, 377 – 381.

- Kamleh, M, Khosa, DK, Verbrugghe, A and Dewey, CE. (2020) ‘E.Stone, A cross-sectional study of pet owners’ attitudes and intentions towards nutritional guidance received from veterinarians’, Veterinary Record, 187 (12), 123.

- Larson, G. and Burger, J. (2013) ‘A population genetics view of animal domestication,’ Trends in Genetics. 29, 194-203.

- Morais Viana, L, Gonçalves Mothé, MC and Gonçalves Mothé, MM. (2020) ‘Natural food for domestic animals: A national and international technological review’ Research in Veterinary Science. 130, 11 – 18.

- Mordor Inteligence (2019) Europe Pet Food Market – Analysis of growth, trends, and forecast (2019-2024), [Online] Mordor Inteligence. [15 September 2022]. Available: https://www.mordorintelligence.com

- OEC (2021) The database of OEC [Online], The Observatory of Economic Complexity. Available: https://oec.world/en/

- Phillips, JC, Carrigan, S, Ortega, K, Santamaria, M, Tamayo, F and Thistle, C. (2014) ‘An Analysis of the Pet Food and Pet Treats Industry’ Selected paper at the Meeting of the Western Extension and Research Activity no. 72 for Agribusiness Competitiveness, June 30 – July 1, Santa Clara, California, 1-21.

- Rombach, M and Dean, DL. (2021) ‘Just Love Me, Feed Me, Never Leave Me: Understanding Pet Food Anxiety, Feeding and Shopping Behavior of US Pet Owners in Covidian Times’, Animals. 11, 1-18.

- Vinassa,M, Vergnano, D, Valle, E, Girbaldi, M, Nery, J, Prola, L, Bergero, D and Schiavone, A.(2020) ‘Profiling Italian cat and dog owners’ perceptions of pet food quality traits’, Veterinary Research. 131 (16), 1 – 10.

- Ye, H, Bhatt, S, Deutsch, J and Suri, R. (2022), ‘Is there a market for upcycled pet food?’ Journal of Cleaner Production, 343, 130960.

- Yildiz, D. (8 December 2021) Global Pet Food Market and Trends. [Online]. Feed Additive: International Magazine for Animal Feed & Additives Industry. [15 August 2022] Available: https://www.feedandadditive.com/global-pet-food-market-and-trends/.