Introduction

In the context of the COVID-19 pandemic, the research is carried out with the purpose of capturing the influences of financing policy on the financial performance of companies in the most affected sector during the COVID-19 period, namely the pharmaceutical sector in Europe and the United States of America. In this context, close attention has been paid to the impact of sales on the financial performance of these companies. The paper provides complex and timely information for company managers, their shareholders, as well as potential investors concerned about the impact of financing policy on the companies’ financial performance.

The fundamental objective of the research is to analyze the influence of financing policy on the financial performance of companies in the pharmaceutical sector in Europe and the United States of America, over a period that includes the COVID-19 pandemic crisis in the year 2020. Building on the fundamental objective, the research encompasses several specific objectives to simultaneously investigate: the impact of indebtedness on financial performance, along with other indicators characterizing liquidity, taxation, dividend distribution policy and company size. To enhance the relevance of the results, given that the companies in the database are listed on international stock exchanges, the research employs not only financial performance indicators in accounting values (ROA and ROE), but also financial performance indicators expressed in market values (PER).

The research begins with an investigation of previous studies in the international specialized literature and is followed by an empirical analysis of the influence of financing policy on the financial performance of companies in the pharmaceutical sector in Europe and the United States of America. These two geographical areas were significantly involved in providing medications in the context of the COVID-19 pandemic. The research concludes with the presentation of statistical and economic results. The obtained results are interpreted in relation to the previously cited studies from the literature review, which formed the basis for the research hypotheses.

The impact of financing policy on the companies’ financial performance is widely analyzed in international scientific literature, and previous research results highlight positive or negative influences of the financing structure on financial performance. In this case, it is worthy of note that long-term indebtedness negatively affects return on assets (Nenu, Vintilă & Gherghina, 2018; Kao, Hodgkinson & Jaafar, 2019; Nazir, Azam & Khalid, 2021), as well as return on equity (Ting et al., 2020; Kao, Hodgkinson & Jaafar, 2019; Co, Uong & Nguyen, 2021), while price earnings ratio is positively influenced by the long-term indebtedness (Ting et al., 2020). Moreover, short-term indebtedness has a negative influence on return on assets (Nazir, Azam & Khalid, 2021; Nenu, Vintilă & Gherghina, 2018).

The empirical research is carried out on a database comprising 466 pharmaceutical companies in Europe and the United States of America, over a period of 10 years, specifically 2012-2021, amassing a total of 4660 statistical observations. The dependent variables used as a measure of companies’ financial performance are indicators expressed in both accounting values and market values. The main independent variables, also identified in previous studies, that form the basis for the research hypotheses, consist of indebtedness, liquidity, taxation, and asset tangibility. Control variables include indicators of company size, measured by turnover and market capitalization. To enhance the robustness of the research, along with the factorial variables taken from previous studies, there have been included in the empirical models other independent variables significantly impacting financial performance, from the financing policy perspective, measured by indicators such as Net Debt and Dividend Payout Ratio.

There were estimated unbalanced panel data multiple regression models, with no effects, with fixed effects and with random effects, using the EViews 12 software. For each dependent variable, two econometric models were used, each model being estimated without effects, with cross-section random effects, with cross-section fixed effects, and with both cross-section and period fixed effects. The empirical study results highlighted a positive or negative impact of the factorial variables on the companies’ financial performance, validating 7 out of the 10 proposed research hypotheses.

At the end of the paper, there is presented a summary of the most important results regarding the influence of financing policy on the financial performance of pharmaceutical companies in Europe and the United States of America. The empirical research results are being interpreted from both a statistical and an economic standpoint.

Literature Review

The impact of financing policy on the companies’ financial performance is widely analyzed in international scientific literature, and previous research results illustrate positive or negative influences of the financing structure on financial performance.

In an interesting study (Ullah et al., 2020), there were analyzed the effects of the capital structure on the financial performance of 90 companies in the textile industry listed on the Pakistan Stock Exchange during the period 2008-2017. There was identified a negative influence of the debt-to-equity ratio on financial performance. Furthermore, there was a positive impact of sales’ growth on performance, while the company’s size negatively affected ROE. Another relevant approach (Ngo, Tram & Vu, 2020) investigated the impact of debts on the profitability of non-financial companies listed on the stock market in Vietnam. The research was carried out on a sample of 118 non-financial companies over a period of nine years, from 2009 to 2017. The research results highlighted that indebtedness had a statistically significant negative effect on corporate profitability, while the other variables positively influenced performance, apart from asset tangibility, which had both a positive and negative impact.

Ting et al. (2020) examined the impact indebtedness, alongside environmental, social, and governance initiatives, has on the financial performance of companies. The sample consisted of 4886 firms from emerging and developed markets, during the period 2014-2018. The results evidenced that long-term indebtedness positively influenced PER and Tobin’s Q and negatively impacted ROE. Company size had a negative impact on the dependent variables PER and Tobin’s Q, while company’s age negatively influenced Tobin’s Q. Another relevant study (Jawoeski & Czerwonka, 2018) investigated the influence of capital structure on the profitability of a sample of 372 companies listed on the Warsaw Stock Exchange during the period 1998-2016. Research results indicated a negative influence of total indebtedness and a positive influence of long-term indebtedness on company performance, while company size positively influenced profitability.

In the international specialized literature, another interesting approach (Nenu, Vintilă & Gherghina, 2018) focused on the impact of capital structure on the risk and financial performance of non-financial companies listed on the Bucharest Stock Exchange, during the period 2000-2016. The authors found out a positive influence of the current ratio and cash ratio, market capitalization and depreciation on financial performance, unlike company size, short-term and long-term indebtedness, effective tax rate and quick ratio which negatively influenced ROA. Habibniya et al. (2022) disclosed the importance of indebtedness as a funding source, with a significant impact on financial performance. The research was conducted on a sample of 72 companies from the telecommunications sector in the United States of America, during the period 2012-2020. The results showed that the total debt ratio negatively influenced ROA and positively impacted ROE. Meanwhile, company size, as a control variable, exerted a positive influence on ROA and an insignificant impact on ROE.

In a scientific paper (Kao, Hodgkinson & Jaafar, 2019), there were analyzed the effects of a company’s financial structure and its board of directors on the performance of enterprises listed in Taiwan during the period 1997-2015. It was observed that company size had a positive influence on accounting indicators and a negative impact on market indicators. Debt also showed a negative impact on the dependent variables ROA and ROE. Another recent and representative research study (Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021) investigated the factors determining the profitability of unlisted energy companies in four Central European countries: Hungary, Poland, Slovakia and the Czech Republic, over the period 2015-2019. For that purpose, there were noted negative influences of total indebtedness and long-term indebtedness on performance, as well as positive influences of short-term indebtedness on ROA. Additionally, it was highlighted that company size had a positive impact on ROA, profitability was negatively affected by asset tangibility, while liquidity had both positive and negative influences on financial performance.

The relationship between capital structure and company profitability was also studied by Perri and Cela (2022), who focused on a sample of 53 construction industry enterprises in Albania during the period 2016-2019. The study’s results highlighted the statistically insignificant influence of all the indicators of capital structure on ROA. However, there was only a positive and significant influence of the total debt to equity ratio on ROE. The impact of financing policy on the companies’ profitability was also investigated by Georgakopoulos et al. (2022) on a sample of 10 top enterprises from the energy sector, over an 11-year period, from 2009 to 2019. The analysis results highlighted positive influences of long-term indebtedness on profitability, but also a negative impact of company size on financial performance.

Ahmed and Bhuyan (2020) analyzed the relationships between capital structure and financial performances for a sample of 91 companies from the services sector in Australia from 2009 to 2019. There was identified a positive influence of the current ratio and long-term indebtedness on both ROA and ROE. An interesting analysis (Agmas, 2020) was conducted in a study on a sample of 30 construction companies in Ethiopia over the period 2011-2015. The study results indicated a positive influence of long-term indebtedness on both ROA and ROE, and a negative impact of total indebtedness on financial performance.

The results of another research study (Lazăr & Istrate, 2018) highlighted the negative influence of taxation on the companies’ financial performance. The authors also integrated other independent variables, such as asset tangibility, leverage, and company size, which negatively impacted performance, in contrast to cash liquidity and sales growth, which positively influenced ROA. Another representative study (Co, Uong & Nguyen, 2021) focused on the relationship between capital structure and the profitability of rubber manufacturing companies listed on the Vietnam Stock Exchange during the period of 2015-2019. The research results indicated that the profitability of companies was positively influenced by total indebtedness, company size, revenue growth, but negatively impacted by long-term indebtedness. The impact of debt on financial performance was examined in a recent study (Nazir, Azam & Khalid, 2021), which investigated the relationships between indebtedness and financial performances of 30 companies from the automotive, cement and sugar sectors listed on the Pakistan Stock Exchange from 2013 to 2017. The results showed a negative impact of both short-term and long-term indebtedness on financial performance, while company size and sales growth had positive effects on the financial performance of the companies.

Based on the results of these previous studies, the following research hypotheses are considered:

H1: Long-term indebtedness negatively influences ROA (Nenu, Vintilă & Gherghina, 2018; Kao, Hodgkinson & Jaafar, 2019; Nazir, Azam & Khalid, 2021).

H2: Long-term indebtedness negatively influences ROE (Ting et al., 2020; Kao, Hodgkinson & Jaafar, 2019; Co, Uong & Nguyen, 2021).

H3: Long-term indebtedness positively influences PER (Ting et al., 2020).

H4: Short-term indebtedness negatively influences ROA (Nazir, Azam & Khalid, 2021; Nenu, Vintilă & Gherghina, 2018).

H5: Current ratio positively influences ROA (Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nenu, Vintilă & Gherghina, 2018).

H6: Current ratio positively influences ROE (Ahmed & Bhuyan, 2020).

H7: Effective tax rate negatively influences ROA (Lazăr & Istrate, 2018; Nenu, Vintilă & Gherghina, 2018).

H8: Asset tangibility negatively influences ROA (Lazăr & Istrate, 2018; Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021).

H9: Company size positively influences ROA (Jawoeski & Czerwonka, 2018; Nenu, Vintilă & Gherghina, 2018; Habibniya et al., 2022; Kao, Hodgkinson & Jaafar, 2019; Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nazir, Azam & Khalid, 2021).

H10: Company size positively influences ROE (Jawoeski & Czerwonka, 2018; Kao, Hodgkinson & Jaafar, 2019; Co, Uong & Nguyen, 2021).

These hypotheses will be further tested, within the quantitative models estimated for pharmaceutical companies, using the specified variables in Table 1.

Research Methodology

To highlight the impact of financing policy on the performance of pharmaceutical companies in Europe and the United States of America, several empirical models have been estimated, which integrate debt indicators along with indicators reflecting liquidity, taxation, dividend distribution policy and company size.

Database and Research Variables

The empirical research is carried out on a sample of 466 companies operating in the pharmaceutical industry in Europe and the United States of America, over a period of 10 years, from 2012 to 2021, amassing a total of 4660 statistical observations.

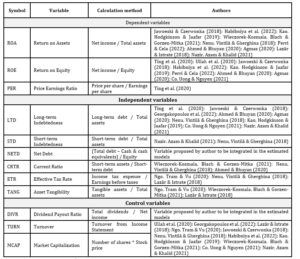

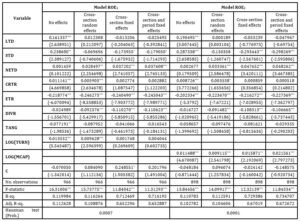

Table 1 presents the variables integrated into the models which analyze the impact of financing policy on the companies’ financial performance.

Table 1. Variables used in the empirical research

Source: author’s own processing

The variables used in estimating the quantitative models were established based on previous studies, as defined in the 10 research hypotheses. In addition to the variables derived from the literature review, two other factorial variables were proposed and used, considered to have a significant impact on the financial performance from the financing policy perspective: Net Debt and Dividend Payout Ratio.

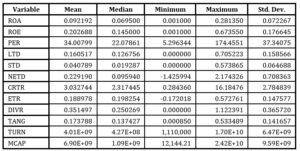

Descriptive Statistics and Correlation Analysis

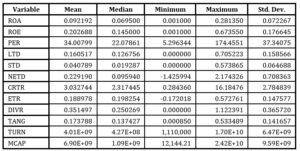

The descriptive statistics of the variables included in the empirical models are presented in Table 2. It is noteworthy that there is an average dividend payout ratio of 35.15%, which suggests an average net income reinvestment rate of 64.85%, indicating a good policy of financing companies from their own funding sources.

Table 2. Descriptive statistics

Source: author’s own computation

Source: author’s own computation

It can be observed that the average long-term indebtedness (16.05%) is higher than the average short-term indebtedness (4.08%) and there are also companies that do not fund themselves through either long-term or short-term debt. Furthermore, there is an average net debt of 22.92%, highlighting the ratio between total debt, which is not covered by cash & cash equivalents, and equity.

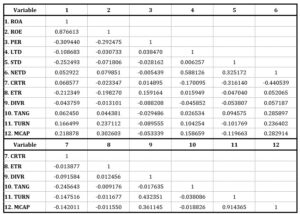

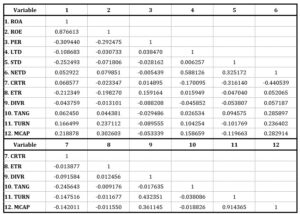

To determine the strength of the relationship between variables, a correlation matrix was developed and is presented in Table 3.

Table 3. Correlation matrix

Source: author’s own computation

Source: author’s own computation

In Table 3, positive and strong correlations can be observed between the dependent variables ROA and ROE, as well as between the control variables turnover and market capitalization. To avoid the multicollinearity phenomenon, independent variables with strong correlation coefficients have been included in different regression models as measures of company size.

Empirical Analysis and Results

Empirical Analysis

In this research, to investigate the 466 companies from the pharmaceutical sector in Europe and the United States of America, over the period 2012-2021, there were estimated unbalanced panel data multiple regression models, without effects, with fixed effects and with random effects, using the EViews 12 software.

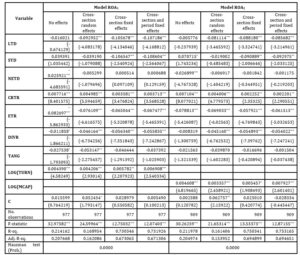

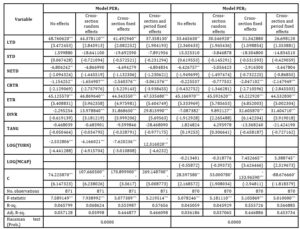

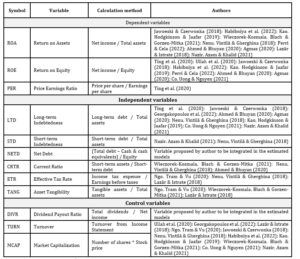

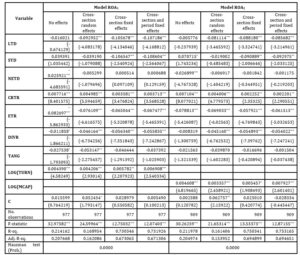

For each dependent variable, respectively ROA (Table 4), ROE (Table 5) and PER (Table 6), two econometric models were used, each model being estimated without effects, with cross-section random effects, with cross-section fixed effects, and with both cross-section and period fixed effects.

Table 4. Econometric results for ROA models

Source: author’s own computation. Significance level: *p<10%; **p<5%; ***p<1%. t-Statistic values are displayed in brackets.

Source: author’s own computation. Significance level: *p<10%; **p<5%; ***p<1%. t-Statistic values are displayed in brackets.

To determine which model is better, the Hausman test was conducted, indicating that the models with fixed effects are more appropriate. Additionally, the Variance Inflation Factors test was used to determine the existence of multicollinearity among the factors, which reveals that multicollinearity was not present in any of the models.

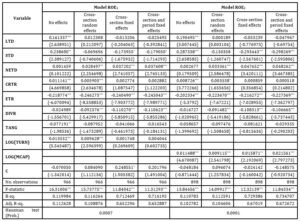

Table 5. Econometric results for ROE models

Source: author’s own computation. Significance level: *p<10%; **p<5%; ***p<1%. t-Statistic values are displayed in brackets.

Source: author’s own computation. Significance level: *p<10%; **p<5%; ***p<1%. t-Statistic values are displayed in brackets.

The empirical results highlight both positive and negative influences on the financial performance of pharmaceutical companies, represented by ROA (Table 4), ROE (Table 5), and PER (Table 6). These influences are generated both by the independent variables and the control variables.

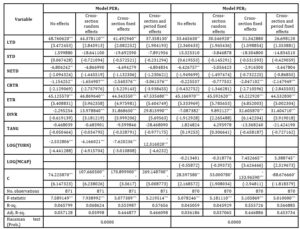

Table 6. Econometric results for PER models

Source: author’s own computation. Significance level: *p<10%; **p<5%; ***p<1%. t-Statistic values are displayed in brackets.

Using econometric tests to select the most relevant empirical model, it was found that models with cross-section and period fixed effects are the most significant to analyze the influence of financing policy on the company’s financial performance. Therefore, the results interpretation will exclusively focus on the models with cross-section and period fixed effects.

Empirical Results

Regarding long-term indebtedness, it can be observed a negative influence on return on assets, confirmed in both ROA models with cross-section and period fixed effects, at a significance level of 1%. This indicates that less indebted companies will incur lower interest expenses, leading to an increase in net income and, consequently, an increase in return on assets. Therefore, hypothesis 1 is accepted (Nenu, Vintilă & Gherghina, 2018; Kao, Hodgkinson & Jaafar, 2019; Nazir, Azam & Khalid, 2021). Long-term indebtedness does not influence return on equity, as evidenced in the ROE models with cross-section and period fixed effects. Consequently, hypothesis 2 is rejected. Conversely, long-term indebtedness positively influences PER, which leads to the validation of hypothesis 3 (Ting et al., 2020).

Short-term indebtedness negatively influences return on assets and return on equity, but is insignificant in the case of PER models. This means that as short-term indebtedness increases, net income decreases due to rising interest expenses, causing a reduction in ROA and ROE. Therefore, hypothesis 4 is accepted (Nazir, Azam & Khalid, 2021; Nenu, Vintilă & Gherghina, 2018). The impact of financing policy on the company’s financial performance was also analyzed using independent variable Net Debt, which positively impacts ROE, at a significance level of 1%.

It is observed that the current ratio has a positive impact on return on assets, is statistically insignificant in the ROE models, and negatively influences the price earnings ratio. Therefore, as the current ratio increases, driven by a decrease in current liabilities, interest expenses will decrease and net income will increase, positively impacting ROA and negatively impacting PER. These results validate hypothesis 5 (Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nenu, Vintilă & Gherghina, 2018) and reject hypothesis 6.

Additionally, effective tax rate exerts a negative influence on both return on assets and return on equity, while PER is positively influenced by ETR. Therefore, hypothesis 7 is accepted (Lazăr & Istrate, 2018; Nenu, Vintilă & Gherghina, 2018). Regarding the dividend payout ratio, it negatively influences return on assets and return on equity, while positively impacting the price earnings ratio. It’s worth noting that the asset tangibility variable is statistically insignificant in all models estimated with cross-section and period fixed effects, leading to the rejection of hypothesis 8.

Turnover and market capitalization, representing indicators for company size, highlight a positive impact on return on assets, at a significance level of 1%, while return on equity is positively influenced only by market capitalization, with turnover being statistically insignificant. Thus, there are validated hypothesis 9 (Jawoeski & Czerwonka, 2018; Nenu, Vintilă & Gherghina, 2018; Habibniya et al., 2022; Kao, Hodgkinson & Jaafar, 2019; Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nazir, Azam & Khalid, 2021) and hypothesis 10 (Jawoeski & Czerwonka, 2018; Kao, Hodgkinson & Jaafar, 2019; Co, Uong & Nguyen, 2021). Additionally, the empirical study results indicate the negative impact of turnover and the positive impact of market capitalization on PER.

In conclusion, within the empirical research regarding the impact of financing policy on the financial performance of companies in the pharmaceutical sector in Europe and in the United States of America, over a period of 10 years, specifically from 2012 to 2021, 7 hypotheses were confirmed from the 10 hypotheses formulated based on previous studies.

Conclusions

To highlight the influence of financing policy on the financial performance of companies, the research was conducted on a database consisting of 466 non-financial companies in the pharmaceutical industry in Europe and the United States of America, over a period of 10 years, from 2012 to 2021, encompassing a total of 4660 statistical observations used in the estimated empirical models.

To select the most relevant independent variables regarding company financing policy, there were investigated studies from the international specialized literature on this subject. Additionally, for enhancing the robustness of the research, other independent variables with significant impact on financial performance from the perspective of financing policy, measured by indicators such as Net Debt and Dividend Payout Ratio, were included in the econometric models. For each dependent variable, two empirical models were used. Each econometric model was estimated without effects, with cross-section random effects, with cross-section fixed effects, and with both cross-section and period fixed effects.

The research results illustrated a positive or negative impact of the factorial variables on the financial performance of companies, validating 7 out of the 10 proposed research hypotheses. It was observed that factors such as current ratio (Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nenu, Vintilă & Gherghina, 2018), turnover (Jawoeski & Czerwonka, 2018; Nenu, Vintilă & Gherghina, 2018; Habibniya et al., 2022; Kao, Hodgkinson & Jaafar, 2019; Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nazir, Azam & Khalid, 2021) and market capitalization (Jawoeski & Czerwonka, 2018; Nenu, Vintilă & Gherghina, 2018; Habibniya et al., 2022; Kao, Hodgkinson & Jaafar, 2019; Wieczorek-Kosmala, Błach & Gorzen-Mitka, 2021; Nazir, Azam & Khalid, 2021) have a positive influence on Return on Assets. Conversely, the following independent variables have a negative influence on ROA: long-term indebtedness (Nenu, Vintilă & Gherghina, 2018; Kao, Hodgkinson & Jaafar, 2019; Nazir, Azam & Khalid, 2021), short-term indebtedness (Nazir, Azam & Khalid, 2021; Nenu, Vintilă & Gherghina, 2018), effective tax rate (Lazăr & Istrate, 2018; Nenu, Vintilă & Gherghina, 2018) and dividend payout ratio.

Additionally, it was noted that Return on Equity is positively influenced by a series of factors, such as net debt and market capitalization (Jawoeski & Czerwonka, 2018; Kao, Hodgkinson & Jaafar, 2019; Co, Uong & Nguyen, 2021), but negatively affected by short-term indebtedness, effective tax rate and dividend payout ratio.

Similarly, it was found that Price Earnings Ratio is positively influenced by long-term indebtedness (Ting et al., 2020), effective tax rate, dividend payout ratio and market capitalization. However, it is negatively influenced by the current ratio and turnover.

In conclusion, the empirical research results are relevant both statistically and economically, providing information regarding the impact of the financing policy on the financial performance of companies. This information is crucial for the decision-making process at the company level and is also valuable for shareholders and potential investors.

References

- Agmas, F., 2020. Impacts of capital structure: profitability of construction companies in Ethiopia. Journal of Financial Management of Property and Construction, 25(3), pp. 371-386.

- Ahmed, R. & Bhuyan, R., 2020. Capital Structure and Firm Performance in Australian Service Sector Firms: A Panel Data Analysis. Journal of Risk and Financial Management, 13(9), pp. 1-16.

- Co, H., Uong, T. & Nguyen, C., 2021. The Impact of Capital Structure on Firm’s Profitability: A Case Study of the Rubber Industry in Vietnam. Journal of Asian Finance, Economics and Business, 8(7), pp. 469-476.

- Georgakopoulos, G., Toudas, K., Poutos, E. & Kounadeas, T., 2022. Capital Structure, Corporate Governance, Equity Ownership and Their Impact on Firms’ Profitability and Effectiveness in the Energy Sector. Energies, 15(10), pp. 1-10.

- Habibniya, H., Dsouza, S., Rabbani, M.R., Nawaz, N. & Demiraj, R., 2022. Impact of Capital Structure on Profitability: Panel Data. Evidence of the Telecom Industry in the United States. Risks, 10(8), pp. 1-19.

- Jawoeski, J. & Czerwonka, L., 2018. Impact of capital structure on enterprise’s profitability: Evidence from Warsaw Stock Exchange. London, International Institute of Social and Economic Sciences, pp. 90-100.

- Kao, M., Hodgkinson, L. & Jaafar, A., 2019. Ownership structure, board of directors and firm performance: evidence from Taiwan. Corporate Governance, 19(1), pp. 189-216.

- Lazăr, S. & Istrate, C., 2018. Corporate tax-mix and firm performance. A comprehensive assessment for Romanian listed companies. Economic Research-Ekonomska Istraživanja, 31(1), pp. 1258-1272.

- Nazir, A., Azam, M. & Khalid, M., 2021. Debt financing and firm performance: empirical evidence from the Pakistan Stock Exchange. Asian Journal of Accounting Research, 6(3), pp. 324-334.

- Nenu, E., Vintilă, G. & Gherghina, Ș., 2018. The Impact of Capital Structure on Risk and Firm Performance: Empirical Evidence for the Bucharest Stock Exchange Listed Companies. International Journal of Financial Studies, 6(2), pp. 1-29.

- Ngo, V., Tram, T. & Vu, B., 2020. The Impact of Debt on Corporate Profitability: Evidence from Vietnam. Journal of Asian Finance, Economics and Business, 7(11), pp. 835-842.

- Perri, R. & Cela, S., 2022. The Impact of the Capital Structure on the Performance of Companies – Evidence from Albania. Universal Journal of Accounting and Finance, 10(1), pp. 10-16.

- Ting, I., Azizan, N., Bhaskaran, R. & Sukumaran, S., 2020. Corporate Social Performance and Firm Performance: Comparative Study among Developed and Emerging Market Firms. Sustainability, 12(1), pp. 1-21.

- Ullah, A., Pinglu, C., Ullah, S., Zaman, M. & Hashmi, S.H., 2020. The nexus between capital structure, firm-specific factors, macroeconomic factors and financial performance in the textile sector of Pakistan. Heliyon, 6(8), pp. 1-10.

- Wieczorek-Kosmala, M., Błach, J. & Gorzen-Mitka, I., 2021. Does Capital Structure Drive Profitability in the Energy Sector?. Energies, 14(16), pp. 1-15.