Introduction

Insurance companies are key financial intermediaries in the financial systems of modern developed market economies, but their significance in the financial systems of developing countries is slightly increasing. Insurance companies collect funds by selling insurance policies to investors, and direct the collected funds to the companies primarily by investing in different types of financial instruments. In this way, insurance companies encourage the transfer of funds from financially sufficient to financially deficient entities (Brealy, Myers & Marcus, 2004; Pilbeam, 2005). However, insurance companies can also invest their funds into investment properties to generate additional income and increase financial performance.

In the Croatian financial system, insurance companies are becoming increasingly important financial institutions. In the last ten years, the gross premium charged by insurance companies in Croatia increased from HRK 9,076,600 thousand in 2013 to HRK 11,698,341 thousand in 2021 (CFSSA, 2023). According to the Accounting Act in Croatia, insurance companies are public interest entities and are obliged to apply International Financial Reporting Standards (IFRS) for financial reporting purpose (Accounting Act, 2022). Insurance companies in Croatia primarily invest funds in financial instruments that were classified, recognized, and measured on the basis of International Accounting Standard 39 Financial Instruments: Recognition and Measurement by December 31, 2022 (IAS 39). From January 1, 2023, insurance companies in Croatia must apply the International Financial Reporting Standard 9 Financial Instruments (IFRS 9) for the classification, recognition, and measurement of financial instruments (Commission Regulation (EU) 2016/2067, 2016). In addition to investing in financial instruments, insurance companies in Croatia invest funds in investment properties to generate additional income (CFSSA, 2023). The accounting treatment of investment properties is defined within International Accounting Standard 40 Investment properties (IAS 40).

Insurance companies are highly regulated entities. All insurance companies that operate within the European Union must meet the requirements and criteria defined by the Solvency II legislative and regulatory framework which began to be adopted in 2009 (Directive 2009/138/EC). Although, Solvency II affects the structure of investments of insurance companies, this paper is mainly focused on the recognition, measurement, and disclosure of investment properties for financial reporting purposes based on IFRS.

The main purpose of this paper is to analyse whether investment properties significantly affect the financial position and performance of insurance companies in Croatia. The majority of insurance companies in Croatia (11 out of 15) recognized investment properties in their financial statements, which indicates the need to research their impact on the financial position and performance of these companies. Based on the analysed literature, research was conducted on the application and impact of the model of subsequent measurement of investment properties in general, however, investment properties of insurance companies were not investigated to such an extent. Therefore, there is a need to investigate the impact of investment properties within insurance companies. Furthermore, this paper aims to determine the extent to which a particular model of measurement of investment properties is applied in Croatian insurance companies. Finally, the paper also aims to determine whether there is a significant impact of income and expenses from investment properties on the financial performance of insurance companies in Croatia.

Theoretical Framework and Literature Review

Recognition and measurement of investment properties according to IAS 40

Insurance companies in Croatia recognize, measure, and disclose information regarding investment properties according to the requirements of IAS 40. Investment properties are defined as properties held by business entities in order to earn additional income in the form of rentals or capital appreciation or both (IAS 40, 2016, A1558). The purpose of these properties is not to use them in ordinary business activities and operations (such as the production or supply of goods or services or for administrative purposes), nor are these properties intended for sale in the ordinary course of business (IAS 40, 2016, A1558). Therefore, the accounting treatment of investment properties differs from those properties used in ordinary business activities and operations.

IAS 40 defines two basic criteria that must be met for recognition of investment properties in financial statements. According to IAS 40, investment property is recognised as an asset in the statement of financial position when (a) “it is probable that the future economic benefits that are associated with the investment property will flow to the entity” and (b) “the cost of the investment property can be measured reliably” (IAS 40, 2016, A1591). Furthermore, IAS 40 states that an investment property is derecognised (removed from the statement of financial position) “on disposal or when the investment property is permanently withdrawn from use and no future economic benefits are expected from its disposal” (IAS 40, 2016, A1598).

At initial recognition, an investment property is measured at cost which includes transaction costs. In the subsequent measurement of investment properties, IAS 40 defines two models of measurement of investment properties, namely: (a) cost model and (b) fair value model (IAS 40, 2016, A1593). The chosen model of subsequent measurement of investment properties should be applied to all entity’s investment properties. Also, the accounting policy of subsequent measurement of investment properties should be consistently applied from one period to another (IAS 40, 2016, A1593).

Under the cost model, investment property is subsequently measured at cost less accumulated depreciation and any accumulated impairment losses (IAS 40, 2016, A1596). Therefore, investment properties that are subsequently measured by the cost model are subject to depreciation over their useful life and an impairment test. Furthermore, by applying the cost model, income from investment properties mainly includes rental income, while expenses refer to depreciation costs, maintenance costs and impairment losses.

Under the fair value model, investment property is subsequently measured at its fair value. Gains and losses resulting from changes in the fair value of investment properties are recognized in profit or loss in the periods in which they arise (IAS 40, 2016, A1594). When the fair value model is applied, investment properties are not subject to depreciation or impairment testing. Application of the fair value model requires estimating the fair value of investment properties based on relevant market information including “rental income from current leases and other assumptions that market participants would use in pricing investment properties under current market conditions” (IAS 40, 2016, A1594). If the fair value cannot be measured reliably on an ongoing basis, then the cost model should be applied and the residual value of the investment property should be assumed to be zero (IAS 40, 2016, 1596). Also, in the case of applying the fair value model, income from investment properties includes rental income and unrealized gains resulting from an increase in the fair value of investment properties, while expenses refer to unrealized losses resulting from a decrease in the fair value of investment properties and maintenance costs.

Results of previous studies

Previous studies on investment properties mainly focused on the application of the measurement model and financial reporting of investment properties (Araujo, 2013; Chen, Lo, Tsang & Zhang, 2013; Prewysz-Kwinto & Voss, 2016; Taplin, Yuan & Brown, 2014; Crosby & Henneberry, 2016; Pavić, Mamić Sačer & Brozović, 2016; Wahyuni, Soepriyanto, Avianti & Naulibasa, 2019; Olante & Lassini, 2022) as well as on the practices and the reliability of investment property’s fair value estimates (Dietrich, Harris & Muller III, 2000; Nellessen & Zuelch, 2011; Jabar & Mohamed, 2015; Kulikova, Samitova & Aletkin, 2015; Ahmad & Aladwan, 2015; Chen, Lo, Tsang & Zhang, 2013; Nordlund, Lorentzon & Lind, 2021). There are also studies that investigated the determinants of the choice of accounting policy for investment properties’ subsequent measurement (Souza, Botinha, Silva & Lemes, 2015; Souza & Lemes, 2015; Alves, 2019).

Ahmad and Aldavan (2015) conducted a research study based on the sample of real estate companies listed in Amman stock exchange for the period from 2008 to 2011. The findings are that “the market values of the Jordanian real estate companies are associated with the use of fair value model of IAS 40”; “fair value accounting measurements are value relevant and serve the primary objectives of accounting information” (Ahmad and Aldavan, 2015). So and Smith (2009) investigated value-relevance of presenting changes of fair value of investment properties in the income statement since Hong Kong adopted IFRS in 2005. Therefore, “based on a sample of listed property companies in Hong Kong during 2004-2006, results of study show significantly higher market price reaction and returns association when changes in fair value of investment properties are presented in income statement”. It must be stated that, even though HKAS40 allows choice between cost and fair value model, all the companies in the initial sample adopted fair value model (So and Smith, 2009).

In Croatian quoted companies, research results show that there is a relatively small share of investment property in the structure of total assets, which is probably one of the reasons why related accounting estimates are brief and incomplete in notes to the financial statements. Results also stated that “companies that have higher share of investment property showed greater level of transparency by providing additional information” (Pavić, Mamić Sačer and Brozović, 2016). In their research among UK and German companies, Christensen and Nikolaev (2013) find that “for investment property, companies are equally likely to use historical cost and fair value accounting”. Findings from Chen, Lo, Tsang and Zhang (2020) showed that, in China, voluntary adoption of fair value reporting for investment property remains low. In Portugal (Araujo, 2013), find evidence that most of the Portuguese listed companies use cost model, while a small number of companies use the fair value when recognizing investment properties. Research results showed that, “slight correlation was found between the financial leverage ratio and the choice by the fair value model”, such as that “firms adopting the fair value are more leveraged as well as older companies are more willing to adopt the fair value model”. Prewysz-Kwinto and Voss (2016) analysed reporting on investment properties in the financial statements of the largest capital groups that are listed on the Warsaw Stock Exchange. Research results showed that “more than 50% of them hold investment property, while almost two thirds use the cost model. Based on the research on the sample of Russian banks, among those that have investment properties, 70% of them chose fair value model for investment property” (Kulikova, Samitova and Aletkin, 2015). According to Wahyuni, Soepriyanto, Avianti & Naulibasa (2019), Indonesian listed companies mostly use cost model, on average 86% of the companies in the sample chose cost model. According to their study, “institutional investors seem to be more confident in using fair value, since companies with high percentage of institutional investors have negative association with the cost model. Reason behind it might be that institutional investors have more resources to gather information and predict future earnings better” (Wahyuni, Soepriyanto, Avianti & Naulibasa (2019).

Muller, Reidl and Sellhorn (2011) conducted a research study to investigate if the mandatory adoption of IAS 40 by real estate companies reduces information asymmetry among market participants. The study was conducted in the context of European real estate industry. Results stated that “mandatory adoption companies exhibit a larger decline in information asymmetry”, such as that they “continue to have higher information asymmetry than voluntary adoption companies”, since there was evidence that fair values reported by mandatory adoption firms are less reliable. Based on the sample from publicly listed companies in Malysia, the adoption of fair value of investment properties is not considered as value relevant, since disclosure of fair value didn’t influence investors in setting the share price of the companies (Jabar and Mohamed, 2021). Those results might be influenced by the high implementation cost of fair value and the lack of confidence amongst investors regarding the reliability of the fair value measurement. Research results also show that “different model of investment properties will significantly influence the decision of investors in setting the share price”. Research results showed that “unrealized gains and losses play a role in explaining stock prices for Jordanian companies, and also that the including them in earnings increases the incremental explanatory power of earnings” (Al-Kadash and Kasawneh: 2014).

According to a study among 96 randomly selected Chinese listed companies, half of them used fair value model and half of them used historical cost model. Research results showed that “companies that have an international influence in form such as listed on international stock exchange and/or with international operations are more likely to use fair value model. Also, companies with above average volatility in earnings are more likely to use fair value model” (Taplin, Yuan and Brown, 2014).

Chen, Lo, Tsang and Zhang (2020) analyzed whether Chinese companies use discretion in investment properties’ fair value in order to manage reported performance. Their results showed that fair value model is more often chosen for investment properties by the companies that have greater needs for accounting discretion. They find that “post-adoption fair-value-adopting companies engage in earnings smoothing using unrealized gains and losses from investment properties”, and also those companies are “more likely to meet or beat earnings benchmarks after adoption”. Dietrich, Harris and Muller (2000) find that “fair value estimates are considerably less biased and more accurate measures of selling price than respective historical cost amounts”, such as that “managers exercise discretion with annual revaluation increments to smooth the reported change in net assets, and boost reported property fair values prior to raising new debt”. Wahyuni, Soepriyanto, Avianti & Naulibasa (2019) find that “type of business and profitability have positive significant relationship with the decision to use cost model”, while “companies with high information asymmetry proxied by growth have negative association with cost model”. Based on the research results among listed companies in Portugal, Alves (2019) suggests that the “decision to use the fair value method seems to be guided mainly by the need to signal the financial health of a company, its additional borrowing capacity, and also to reduce information asymmetry between the company and outside investors”.

Al-Kadash and Khasawneh (2014), based on a research study among Jordanian listed companies that had investment in properties, find that the use of fair value accounting has a significant effect on the company’s reported financial performance, such as on EPS. Al-Yaseen and Al-Khadash (2011) conducted a research study on the sample of Jordanian insurance companies listed on Amman Stock Exchange. They find that income that is based on fair values reflects more income volatility than income that is based on historical-cost. Also, “income is more volatile with the recognition of unrealized fair value gains/losses on financial instruments, but not with the recognition of unrealized fair value gains/losses on investment property” (Al-Yaseen and Al-Khadash, 2011). Smit, van der Niet and Botha (2022) conducted a research study on companies listed on Johannesburg Stock Exchange in order to determine whether fair value adjustments to investment properties affect the profitability ratio. Research results showed that “50% to 70% of the sampled companies had profitability ratios impacted by the recognition of fair value adjustments”, in this study profitability ratios of sampled entities were sensitive to fair value adjustments posted through profit or loss accounts.

Methodology and Data

The initial goal of this study is to investigate and analyze whether investment properties and associated income and expenses affect the financial position and performance of insurance companies in Croatia. More specifically, this study aims to explore the impact of investment properties on the financial position and the impact of income and expenses from investment properties on the financial performance of insurance companies in Croatia. The initial goal of the study is elaborated through the following research questions:

- Is there a statistically significant interdependence among investment properties and the financial position in insurance companies in Croatia?

- Is there a statistically significant interdependence among income and expenses from investment properties and net profit or loss in insurance companies in Croatia?

- Is there a statistically significant interdependence among income and expenses from investment properties and the profitability in insurance companies in Croatia?

The stated research questions are the framework for setting the following research hypotheses:

H1: There is a statistically significant impact of investment properties on the financial position of insurance companies in Croatia.

H2: There is a statistically significant interdependence among income and expenses from investment properties and the net profit or loss of insurance companies in Croatia.

H3: There is a statistically significant interdependence among income and expenses from investment properties and the return on assets (ROA) of insurance companies in Croatia.

The research population consists of all insurance companies that operated in the Croatian insurance sector. The period of the research covers five consecutive years from 2017 to 2021. The research is carried out on 11 insurance companies that operated in the Croatian insurance sector during the research period and reported investment properties in their financial statements. During the research period, the total number of insurance companies fluctuated from 20 in 2017 to 18 in 2018, 16 in 2019 to 15 in 2020 and 2021.

The data required for the implementation of the research were collected from publicly available audited financial statements of insurance companies in Croatia. In order to answer the research questions and test the research hypotheses, the data were processed using correlation and regression analysis. The first hypothesis is tested (a) by calculating the percentage of the carrying amount of investment properties in the carrying amount of total assets and using the descriptive statistical methods (mean value, standard deviation, median, minimum and maximum value); (b) using the correlation analysis among the carrying amounts of investment properties and total assets and (c) using the simple linear regression model. The correlation analysis is based on the calculation of the Pearson correlation coefficient. In a simple linear regression model, total assets represent the dependent variable while the carrying amount of investment properties is defined as the independent variable. The second hypothesis is tested (a) using correlation analysis among income and expenses from investment properties and net profit or loss and (b) using the multiple linear regression model. In a multiple linear regression model, net profit or loss is the dependent variable while income and expenses from investment properties are the independent variables. Income from investment properties includes rental income, unrealised gains and gains on disposal, while expenses from investment properties include impairment losses, depreciation costs, maintenance costs and losses on disposal. The third hypothesis is tested (a) using correlation analysis among income and expenses from investment properties and the return of assets ratio (ROA) and (b) using the multiple linear regression model. In a multiple linear regression model, ROA is a dependent variable, while income and expenses from investment properties are the independent variables.

Findings and Discussion

Insurance companies invest their funds collected from premiums mainly in different types of financial instruments. In addition to financial instruments, insurance companies also invest their funds in properties in order to generate additional income either through rent or through an increase in the fair value of properties or both (IAS 40). This paper aims to identify and analyse the extent to which investment properties affect the financial position and performance of insurance companies in Croatia. Insurance companies in Croatia apply IFRS for the preparation of financial statements. So, the recognition and measurement of investment properties and corresponding income and expenses in insurance companies in Croatia are based on IAS 40.

The analysis of data collected from the financial statements of insurance companies from 2017 to 2021 found that the share of the carrying amount of investment properties in the total assets of insurance companies in Croatia has slightly decreased from 7,13% in 2017 to 5,67% in 2021. The share of the carrying amount of investment properties in the total assets in insurance companies in Croatia ranged from 7,13% in 2017 over 6,86% in 2018, 6,59% in 2019, 6,90% in 2020 to 5,67% in 2021. However, it is important to emphasize that the share of the carrying amount of investment properties in total assets is different among insurance companies in Croatia.

According to the notes to the financial statements of insurance companies in 2021, 6 insurance companies in Croatia (54,55%) apply the cost model and 5 insurance companies (45,45%) apply the fair value model. Insurance companies that apply the fair value model hold 56,17% of the total assets of insurance companies that have recognized investment properties in their financial statements, while insurance companies that apply the cost model hold 43,83%. Based on these results, it can be concluded that the cost model is applied to a slightly greater extent than the fair value model in insurance companies in Croatia. Compared to the results of a previous study on the application of the measurement models of investment properties in listed companies in Croatia (Pavić, Mamić Sačer & Brozović, 2016), although a greater number of both insurance companies and listed companies apply the cost model, the fair value model is applied to a greater extent in insurance companies compared to listed companies. These results are in line with the results of research conducted on listed companies in Portugal (Araujo, 2013), Brazil (de Souza, Botinha, Silva & Lemes, 2015), Indonesia (Wahyuni, Soepriyanto, Avianti & Naulibasa, 2019) and Poland (Prewysz-Kwinto & Voss, 2016), which also showed greater application of the cost model compared to the fair value model.

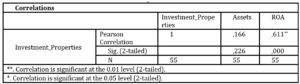

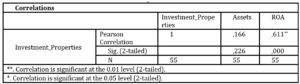

The paper investigates the impact of the carrying amount of investment properties on the financial position. For this purpose, the interdependence among the carrying amount of investment properties and total assets is evaluated using correlation and simple linear regression analysis. The results of the correlation are presented in Table 1.

Table 1. Correlation among the carrying amount of investment properties, total assets and ROA in insurance companies in Croatia

Source: Authors’ calculation

Source: Authors’ calculation

Correlation results show a weak, statistically insignificant, correlation among the carrying amount of investment properties and total assets and a medium-strong, statistically significant, correlation among the carrying amount of investment properties and ROA. In accordance with these results, the carrying amount of investment properties does not significantly affect the total assets, but it does affect the ROA of insurance companies in Croatia. The interdependence among investment properties and total assets is also examined using a simple linear regression model in which total assets is the dependent variable, and investment properties is the independent variable. The quality measures of the regression model are presented in Table 2 and the regression results are shown in Table 3.

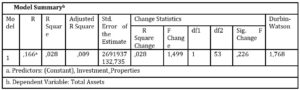

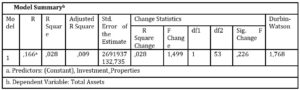

Table 2. Measures of quality of the regression model on the interdependence among the investment properties and total assets in insurance companies in Croatia

Source: Authors’ calculation

Source: Authors’ calculation

The regression model is not suitable for assessing the interdependence among investment properties and total assets since R square is 2,8% and the model is not statistically significant.

Table 3. Regression model on the interdependence among the investment properties and total assets in insurance companies in Croatia

Source: Authors’ calculation

Source: Authors’ calculation

The regression results show that investment properties are not a significant variable in the model and therefore cannot significantly affect the total assets in insurance companies in Croatia. The results of the descriptive statistical methods, correlation and regression, do not provide evidence of a significant interdependence among the carrying amount of investment properties and total assets, so the first hypothesis (H1) is not accepted.

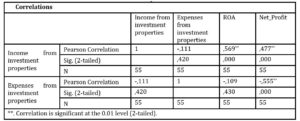

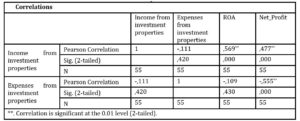

In order to examine the impact of income and expenses from investment properties on financial performance, correlation and regression analysis is used. The results of the correlation among income and expenses from investment properties and net profit and among income and expenses from investment and ROA of insurance companies in Croatia are presented in Table 4.

Table 4. Correlation among income and expenses from investment properties, net profit and ROA in insurance companies in Croatia

Source: Authors’ calculation

Source: Authors’ calculation

The correlation results suggest a statistically significant positive medium strong correlation among (a) income from investment properties and net profit and among (b) income from investment properties and ROA, and a statistically significant negative medium strong correlation among expenses from investment properties and net profit. According to these results, income from investment properties affects net profit and ROA while expenses only affect net profit.

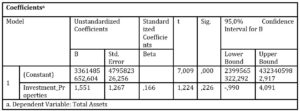

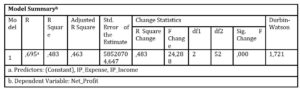

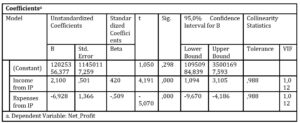

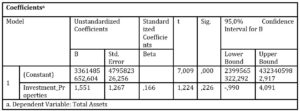

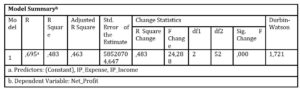

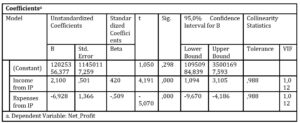

The impact of income and expenses from investment properties on net profit is also analysed using a multiple regression model. Measures of model quality are presented in Table 5 while the regression results are presented in Table 6.

Table 5. Measures of quality of the regression model on the interdependence among income and expenses from investment properties and net profit of insurance companies in Croatia

Source: Authors’ calculation

Source: Authors’ calculation

According to the model quality measures, this model can be considered adequate because it is statistically significant and there are no serious problems with autocorrelation.

Table 6. Regression model on the interdependence among the income and expenses from investment properties and net profit in insurance companies in Croatia

Source: Authors’ calculation

Regression results indicate that both variables (income and expenses from investment properties) are statistically significant in the model, which means that income and expenses from investment properties affect the net profit of insurance companies in Croatia. In particular, investment income has a positive effect on net profit, while expenses have a negative effect on net profit. The tolerance and VIF values suggest that the model has no serious collinearity problems. A more detailed regression analysis suggests that income and expenses seriously affect net profit in those insurance companies that have applied the fair value model in the measurement of investment properties. These results are in line with the results of previous studies conducted on listed companies in China (Taplin, Yuan & Brown, 2014) and Jordan (Ahmad & Aladwan, 2015). The correlation and regression results provide sufficient evidence in support of the second hypothesis (H2), so the second hypothesis is accepted.

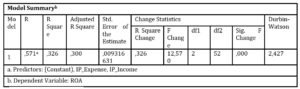

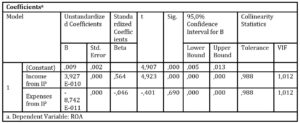

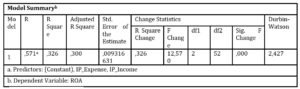

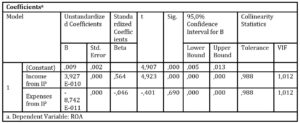

Furthermore, the paper assesses the impact of income and expenses from investment properties on ROA using a multiple linear regression model. The measures of model quality are presented in Table 7 and the regression results in Table 8.

Table 7. Measures of quality of the regression model on the interdependence of income and expenses from investment properties and ROA of insurance companies in Croatia

Source: Authors’ calculation

Source: Authors’ calculation

According to the value of R square and adjusted R square, the model can be considered appropriate. Furthermore, the model is statistically significant and the value of Durbin-Watson test is still at an acceptable level, which means that the model does not have substantial problems with autocorrelation.

Table 8. Regression model on the interdependence of income and expenses from investment properties and ROA of insurance companies in Croatia

Source: Authors’ calculation

The regression results show that the variable “income from investment properties” is statistically significant in the regression model, while the variable “expenses from investment properties” is not statistically significant. The model has no substantial problems with collinearity. The regression results suggest that income from investment properties positively affects ROA, while expenses from investment properties do not significantly affect ROA. A more detailed regression analysis suggests that income from investment properties seriously affects ROA in those insurance companies that have applied the fair value model in measuring investment properties. Based on the correlation and regression results, the third hypothesis (H3) cannot be fully accepted since a statistically significant interdependence among income from investment properties and ROA is confirmed, but not among expenses from investment properties and ROA.

The study reveals that investment properties do not have a significant effect on the financial position of insurance companies, while income and expenses from investment properties have a significant effect on net profit. Furthermore, income from investment properties has a significant effect on ROA. The impact of income and expenses from investment properties on net profit and the impact of income from investment properties on ROA are more pronounced with those insurance companies that applied the fair value model in measuring investment properties. The study suggests that managers in insurance companies in Croatia can affect the financial performance with investment properties, particularly if they apply the fair value model. However, the study has some limitations. The study covers the period from 2017 to 2021 and includes the period of the COVID-19 pandemic. The impact of the COVID-19 pandemic on the financial position and performance of insurance companies is not assessed. Furthermore, the study did not separately analyse life insurance and non-life insurance companies. These limitations must be considered when interpreting the results of the study.

Future research on this topic will focus on a longer period and will analyse the impact of investment properties on the financial position and performance separately for life insurance and non-life insurance companies. Also, future research will try to identify the impact of the COVID-19 pandemic on the financial position and performance of insurance companies in Croatia.

Conclusion

Insurance companies are large investors in financial instruments and an important financial intermediary in the financial markets. In addition to investing in financial instruments, insurance companies also invest in properties, so investment properties can represent a significant item in their financial statements. This study aims to identify and analyse the impact of recognition and measurement of investment properties on the financial position and performance of insurance companies in Croatia. The research refers to the period from 2017 to 2021 and includes 11 insurance companies in Croatia that operated during the research period and recognized investment properties in their financial statements. The methods used in the study are descriptive statistical methods, correlation and regression analysis.

The study revealed that investment properties do not significantly affect the financial position of insurance companies in Croatia, but have a statistically significant medium-strong impact on profitability. Furthermore, the study showed that the cost model is applied to a slightly greater extent than the fair value model, but insurance companies that apply the fair value model hold more than half of the total assets of insurance companies that have recognized investment properties in their financial statements. The study also pointed out that income and expenses from investment properties significantly affect the net profit of insurance companies, while only income from investment properties has a significant impact on ROA. The results of the study suggest that managers in insurance companies in Croatia can manage financial performance with investment properties but cannot significantly affect the financial position. However, when interpreting the results of the study, the limitations of the study should be considered.

References

- Accounting Act. Official Gazette, 78/2015, 134/2015, 120/2016, 116/2018, 42/2020, 47/2020, 144/2022.

- Alhaj Ahmad, F. B. and Aladwan, M.S. (2015) ‘The Effect of Fair Value Accounting on Jordanian Investment Properties. An Empirical Study on Jordanian Listed Real Estate Companies‘, International Journal of Financial Research, 6(4), 99-113. doi: https://doi.org/10.5430/ijfr.v6n4p99

- Al-Khadash, H.A. and Khasawneh, A.Y. (2014) ‘The effects of the fair value Option under IAS 40 on the volatility of earnings‘, Journal of Applied Finance and Banking, 4(5), 95 – 113.

- Alves, S. (2019) ‘Accounting for Investment Property: Determinants of Accounting Policy Choice by Portuguese Listed Firms‘, International Journal of Accounting and Taxation, 7(2), 1-10.

- Al‐Yaseen, B.S. and Al‐Khadash,. H.A. (2011) ‘Risk relevance of fair value income measures under IAS 39 and IAS 40‘, Journal of Accounting in Emerging Economies, 1(1), 9-32.

- Araújo, C.S.C (2013) ‘Financial reporting about investment properties: Evidence from Portuguese listed companies‘, Working paper No. 974. Retrieved from: https://run.unl.pt/bitstream/10362/9806/1/Araujo.C_2013.pdf.

- Brealy, R.A., Myers, S.C. and Marcus, A.J. (2004) Fundamentals of corporate finance. New York, NY: McGraw-Hill/Irwin.

- Chen C., Lo, K., Tsang, D. and Zhang, J. (2020) ‘Understanding accounting discretion in China: An analysis of fair value reporting for investment property‘ Journal of Accounting and Public Policy, 39(4), doi: https://doi.org/10.1016/j.jaccpubpol.2020.106766

- Christensen, H.B. and Nikolaev, V.V. (2013) ‘Does Fair Value Accounting for Non-Financial Assets Pass the Market Test? Review of Accounting Studies‘, Forthcoming, Available at SSRN: https://ssrn.com/abstract=1269515 or http://dx.doi.org/10.2139/ssrn.1269515

- Croatian Financial Services Supervisory Agency (CFSSA). 2023. Društva za osiguranje i društva za reosiguranje. Retrieved from: https://www.hanfa.hr/publikacije/statistika/#section2

- Crosby, N. and Henneberry, J. (2016) ‘Financialisation, the valuation of investment property and the urban built environment in the UK‘, Urban Studies, 53 (7). pp. 1421-1441. ISSN 1360-063X doi: https://doi.org/10.1177/0042098015583229

- de Souza, F.E.A and Lemes, S. (2016) ‘Comparability of accounting choices in subsequent measurement of fixed assets, intangible assets, and investment property in South American companies‘, Revista Contabilidade & Finanças, 27, 169-184.

- de Souza, F.E.A., Botinha, R.A., Silva,P.R. and Lemes, S. (2015) ‘Comparability of Accounting Choices in Future Valuation of Investment Properties: An Analysis of Brazilian and Portuguese Listed Companies‘, Revista Contabilidade & Finanças, 26(68), 154–166. doi: https://doi.org/10.1590/1808-057×201500580

- Dietrich, J.R. Harris, M.S. and Muller III, K.A. (2000). ‘The reliability of investment property fair value estimates‘, Journal of Accounting and Economics, 30(2), 125-158.

- Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II). Official Journal of the European Union, L 335/1. Retrieved from: ELI: http://data.europa.eu/eli/dir/2009/138/oj

- International Accounting Standard 39 Financial instruments: Recognition and measurement (IAS 39). (2018). IFRS Foundation. Retrieved from: https://www.frc.org.uk/getattachment/e8d66d2b-2d27-4c2b-adf3-c0b2f6a2795c/2017-01-IAS-39-Blue-book_CR.pdf

- International Accounting Standard 40 Investment properties (IAS 40). IFRS Foundation. Retrieved from: https://www.ifrs.org/issued-standards/list-of-standards/ias-40-investment-property.html/content/dam/ifrs/publications/html-standards/english/2023/issued/ias40/.

- International Financial Reporting Standard 9 Financial instruments (IFRS 9). (2023). IFRS Foundation. Retrieved from: https://www.ifrs.org/issued-standards/list-of-standards/ifrs-9-financial-instruments.html/content/dam/ifrs/publications/html-standards/english/2023/issued/ifrs9/

- Jabar, J.A. and Mohamed, A. (2015) ‘The practices of fair value reporting on investment property in Malaysia‘, International Conference on Accounting Studies (ICAS) 2015 17-20 August 2015, Johor Bahru, Johor, Malaysia, available at: https://repo.uum.edu.my/id/eprint/17548/1/017-ICAS2015%2017-23.pdf

- Kulikova, L. I., Samitova, A. R., and Aletkin, P. A. (2015) ‘Investment property measurement at fair value in the financial statements‘, Mediterranean Journal of Social Sciences, 6(1 S3), 401-405

- Muller III, K.A., Riedl, E.J. and Sellhorn, T. (2011) ‘Mandatory fair value accounting and information asymmetry: Evidence from the European real estate industry‘, Management Science, 57(6), 1138-1153.

- Nellessen, T. and Zuelch, H. (2011) ‘The reliability of investment property fair values under IFRS‘, Journal of Property Investment & Finance, 29 (1), 59-73. https://doi.org/10.1108/14635781111100209

- Nordlund, B., Lorentzon, J. and Lind, H. (2022) ‘Practice Briefing: A note on auditing fair value of investment properties‘, Journal of Property Investment & Finance, 40(1), 108-115.

- Olante, M.E. and Lassini, U. (2022) ‘Investment property: Fair value or cost model? Recent evidence from the application of IAS 40 in Europe‘, Advances in accounting, 56, 100568.

- Pavić, I., Mamić Sačer, I. and Brozović, M. (2016) ‘Do Croatian Quoted Companies Satisfy IFRS Disclosure Requirements of Accounting Estimates for Investment Property? ‘ Procedia Economics and Finance, 39(2016), 389-398. doi: https://doi.org/10.1016/S2212-5671(16)30340-9

- Pilbeam, K. (2005) Finance and financial markets. Houndmills, Basingstoke, Hampshire: Palgrave Macmillan.

- Prewysz Kwinto, P. and Voss, G. (2016) ‘Investment Property in the Financial Statements of Capital Groups Listed on the Warsaw Stock Exchange‘, European Journal of Economics and Business Studies, 2(1), 230-237. doi: https://doi.org/10.26417/ejes.v4i1.p229-236

- Smit, A. van der Niet, B. and Botha, M. (2022) ‘Evaluating The Effect of Fair Value Adjustments to Investment Property Based on Profitability Ratios‘, Journal of Accounting and Investment, 23(2), 330-347.

- So, S.. and Smith, M. (2009) ‘Value‐relevance of presenting changes in fair value of investment properties in the income statement: Evidence from Hong Kong‘, Accounting and Business Research, 39(2), 103-118. doi: https://doi.org/10.1080/00014788.2009.9663352

- Taplin, R., Yuan, W. and Brown, A. (2014) ‘The Use of Fair Value and Historical Cost Accounting for Investment Properties in China‘, The Australasian Accounting Business and Finance Journal, 8(1), 101-113. doi: http://dx.doi.org/10.14453/aabfj.v8i1.6

- Wahyuni, E. T., Soepriyanto, G., Avianti, I., & Naulibasa, W. P. (2019). Why companies choose the cost model over fair value for investment property? Exploratory study on Indonesian listed companies. International Journal of Business and Society, 20(1), 161-176. Retrieved from: http://www.ijbs.unimas.my/images/repository/pdf/Vol20-no1-paper10.pdf.