Introduction

The global warming caused by greenhouse gas emissions (GHG) has been a political and business issue which has become more important in many countries (Bae, Lee & Psaron, 2013) facing a lot of challenges resulting from this matter. One of these countries is Indonesia. According to World Resources Institute (2016), Indonesia was the sixth largest emitter of carbon emissions which released up to 1.98 million tonnes of CO2 emissions every year based on its 2016 report. In 2017, Indonesia contributed 5,3% to the total global GHG in which Indonesia’s GHG per capita reached 10,5 tCO2e/cap compared to the average of G20 countries with 8,3 tCO2e/cap (Climate Transparency, 2017).

Indonesia had ratified the Kyoto Protocol on December 3rd, 2004 by the enactment of Law No. 17 Year 2004 to participate in the efforts to reduce global GHG emissions. As a follow-up action, the president issued a Presidential Decree No. 61 Year 2011 which stated Indonesia’s National Action Plan for Reducing GHG (RAN-GRK). In 2015, the Indonesian government submitted its post-2020 climate pledge known as Nationally Determined Contributions (NDCs) to the United Nations. In its NDCs, the Indonesian government promised to reduce the GHG emissions by 29% up to 41% in 2030. This pledge has been implemented through the national development plan 2015-2019 by determining several climate mitigation and adaptation targets, such as a moratorium for new forest concessions and peatlands, peatland restoration, renewable energy mix targets, social forestry, and degraded forest land rehabilitation (Chrysolite, Juliane, Chitra & Ge, 2017).

In the Indonesian National Action Plan for Reducing GHG (RAN-GRK), it was revealed that the industry sectors were the largest GHG emitters. The industry sectors or businesses undeniably had the biggest potential to increase the economy growth and became the development priorities in various provinces in Indonesia; however, the activities of the industries had the potential to release GHG emissions and contributed to the global warming and climate change (Utama, 2014). Therefore, the related companies must support the measures to reduce GHG emissions and cope with the global warning effects as part of their corporate social responsibility efforts known as carbon emission disclosure.

The main objective of applying the carbon emission disclosure is to reduce carbon emissions produced by industries as a part of the agreement within the Kyoto Protocol. Through the disclosure, each company can measure the amount of carbon emissions it produces, create a strategy to reduce it, record the results and report them to the company’s stakeholders (Dwijayanti, 2011). Carbon emission disclosure is a type of a climate change disclosure covering the GHG emissions intensity and energy use, corporate governance, and strategy in relation to dealing with climate change (Cotter & Najah, 2012). Carbon emission disclosure is also a form of contribution from the related parties to the environmental changes, particularly global warming (Akhiroh & Kiswanto, 2016).

To measure the implementation of the carbon emission disclosure, a non-profit organization based in England, called CDP, has issued a Carbon Disclosure Project (CDP) in the forms of information request sheets or questionnaires which have been submitted to the companies that need to be measured. CDP has functioned as the spearhead for the implementation of a global disclosure system which has been useful for investors, corporations, cities, states and regions to control their environmental effects. The CDP questionnaires were adopted and developed into a carbon emission disclosure checklist with 18 indicators by Bae et al. (2013) who used them to measure the carbon emission disclosure in Australian companies.

In Indonesia, the carbon emission disclosure is still a voluntary act. A voluntary disclosure is a provision of information voluntarily by a company beyond the mandatory requirements which exceeds the minimum requirements of the existing stock exchange regulations (Nuswandari, 2009). Thus, companies have a considerable discretion as to the amount of information they want to disclose. This creates variations of the carbon emission disclosure stated in the companies’ annual reports, and the carbon emission disclosure has been rarely implemented by companies involved in economic activities. The voluntary disclosure will urge the companies to consider the costs and benefits of the disclosure. For companies emitting GHG, the carbon emission disclosure can be advantageous to obtain legitimacy from the stakeholders and to avoid serious repercussions such as increased operating costs, reduced demands, reputational risks, legal proceedings, fines and penalties (Berthelot & Robert, 2011).

In the discussion on the carbon emission disclosure, there are some factors which can influence the extent of the disclosure. Several previous studies revealed the determinants of the carbon emission disclosure, including carbon emissions levels, the size of the firms, the type of industry, profitability, growth opportunities, legal systems, environmental performance, financial market pressure, economic pressure and other factors (Bae et al., 2103; Luo, Tang & Lan, 2013; Jannah & Muid, 2014; Kalu, Buang & Aliagha, 2016). Factors such as media exposure, environmental performance, and the company’s characteristics measured by its type of industry, its size, and its profitability are still interesting to be studied as an attempt to reconcile the conflicting results found among the researchers in the area.

Media exposure is one of the factors that can influence the coverage size of the carbon emission disclosure. The rapid advancement in information and technology has encouraged media to be a crucial part in the carbon emission disclosure. This media exposure compels the companies to publish their activities related to the protection of the environment to obtain positive responses from their stakeholders (Jannah & Muid, 2014). Companies which have more online media coverage from external parties tend to disclose their GHG emissions voluntarily because those companies have become more motivated in making a social and environmental disclosure (Majid & Ghozali, 2015). On the other hand, some researchers are of the opinion that the media presence does not always give the motivation for the companies to perform carbon emission disclosures in their annual reports (Pratiwi & Sari, 2016). In this case, companies have lacked explorations on the media visibility which is directly associated with the level of carbon emission disclosure due to the excessive anxiety or fear of the environmental control or retribution they will face if the information was disclosed openly in the media, especially for the companies which cannot control the environment optimally (Cahya, 2017).

Within the environmental management issue, the environmental performance becomes the determinant of the carbon emission disclosure. The environmental performance of a company is the result of the environmental management as an attempt to push the company to manage the environment. The Indonesian Ministry of Environment and Forestry has put some efforts to promote the management of the environment through the Program for Pollution Control, Evaluation and Rating (PROPER) which has been in effect since 1994. The objective of this environmental performance rating (PROPER) is to encourage the company to comply with the laws and regulations by means of giving reputation incentives and disincentives and by compelling the practice of a cleaner production. It is expected that the increase in the companies’ environmental performances can encourage the disclosure of environmental issues such as the carbon emission disclosure.

Most of the publicly listed companies in Indonesia which have high environmental performances tend to encourage the companies to disclose the GHG emissions so that the public can give them full support (Prafitri & Zulaikha, 2016). However, companies with high PROPER ratings have indirectly represented the companies’ commitment to cope with the climate change, and this has lowered the companies’ motivation to disclose their carbon emissions voluntarily (Jannah & Muid, 2014). Conversely, companies with low PROPER ratings incline to make efforts to obtain the public trust through their voluntary GHG emission disclosure (Majid & Ghozali, 2015).

In the implementation of the companies’ carbon emission disclosure, the characteristics of the companies’ can encourage the extent of the coverage and the companies’ motivation level in implementing the carbon emission disclosure. The characteristics of the companies can be measured from the type of industry, the company size, their profitability and leverage. The type of industry can be categorized into high profile industry and low profile industry which can be differentiated from the intensity of their operational activities that can affect the environment. The high profile industry type is more intensive in producing emissions which have negative effects on the environment, whereas the low profile industry includes companies which are not intensive in producing emissions (Bae et al., 2013). The high profile companies whose operational activities can have negative effects on the environment have the tendency to disclose more corporate social responsibility (CSR) information than the low profile companies (Wang, Song & Yao, 2013).

Bae et al. (2013) conducted a research on 100 Australian largest companies. The research showed that the type of industry which is more intensive in producing emission will disclose carbon emissions more extensively. Companies in the energy sector, transportation, materials and utilities which are more intensive in producing carbon emissions tend to disclose information related to environmental aspects compared with companies which do not produce carbon emissions intensively like the companies in the financial sector (Jannah & Muid, 2014). In contrast to the statement above, Cahya (2017) is of the opinion that companies producing carbon emissions intensively do not fully disclose their carbon emissions because the disclosure is still voluntary and this makes the companies incline to disclose their corporate social responsibility from other perspectives.

Subsequently, one of the characteristics of companies is their size. Large companies will actively involve in a voluntary carbon emission disclosure because they have a lot of resources to prepare a comprehensive disclosure (Bae et al., 2013). On the contrary, small companies tend to avoid this voluntary carbon emission disclosure because the quality of their human resources is not sufficient for implementing the disclosure, not to mention their lack of other resources (Majid & Ghozali, 2015). Larger companies are more transparent in disclosing the carbon emissions information, so that they can maintain their environmental legitimacy (Gonzáles-Gonzáles & Zamora-Ramírez, 2016). Kalu et al. (2016) conducted a research on Malaysian listed companies, and the results showed that the more awareness and education the public has on carbon emissions, the higher the public consideration will be on the corporates’ contribution towards the carbon emissions threats. Consequently, the public will put more social pressure on the companies which motivate them to increase their participation in carbon mitigation through a voluntary carbon emission disclosure. Contrary to the previous statement, the results of Cahya’s research (2017) on Indonesian sharia companies showed that the company size does not influence the extent of sharia social responsibility to disclose carbon emissions because large sharia companies still have not taken into consideration the positive effects of disclosing information for their companies, particularly the carbon emission disclosure.

In developing countries, financial resources play more significant roles in making decisions related to the companies’ carbon emission disclosure (Luo et al., 2013). A company’s profitability level is its financial resource which can indicate the company’s performance in taking some measures to reduce emissions and disclose the measures in its annual report. Companies with high profitability show that they can react to the environmental pressure effectively, and they are willing to solve problems promptly (Jannah & Muid, 2014). Conversely, profitability does not correspond with the carbon emission disclosure which is caused by irrelevant benefits and disclosure costs. When a company discloses its carbon emissions, but the disclosure creates problems for the stakeholders in understanding it, the disclosure gives little contributions to the company (Irwhantoko & Basuki, 2016). Companies with high profitability do not need to extend the scope of the disclosure related to their environment because they are afraid that the disclosure can disrupt the information about the companies’ financial achievements (Prafitri & Zulaikha, 2016).

Leverage is another characteristic of a company. A higher leverage level in a company can increase the creditors influence in applying pressure on the company. The higher the leverage level in a company is, the greater the creditors’ expectations will be on the company’s performance (Roberts, 1992). This shows that the credibility of GHG emissions has a directly proportional relationship with the company’s leverage level (Rankin, Windsor & Wahyuni, 2011). On the other hand, a higher liability level of a company than the company’s debt and expenses can place restrictions on its carbon emission disclosure. A high leverage level reduces the tendency for the company to conduct a social and environmental disclosure (Jannah & Muid, 2014). A company with a high leverage level will be very careful in reducing and disclosing expenses related to carbon emissions prevention actions (Luo et al., 2013). The higher the leverage level is, the more obvious it will be that the company tends to settle its liabilities rather than making a disclosure which can result in an increase in the company’s expenses (Majid & Ghozali, 2015).

Based on the reviews of previous research, it is found that there are some conflicting results. These different results motivate this present study to examine the relations between media exposure, environmental performance, and the characteristics of a company (e.g. the type of industry, the company size, profitability and leverage) and the carbon emission disclosure to obtain empirical evidence.

Through developing and testing the models, this present study can yield certain contributions. First, this study provides new empirical evidence for the relations between variables such as media exposure, environmental performance, and the characteristics of the company (e.g. the type of industry, the company size, profitability and leverage) and the carbon emission disclosure. Second, this present study can contribute to the development of green accounting, particularly, its application in Indonesia. Third, this study can enrich the existing empirical research on the carbon emission disclosure which is still rare in Indonesia.

Literature Review

The Influence of Media Exposure on Carbon Emission Disclosure

Based on the legitimacy theory, media has a role in increasing the pressures of the public demand on the companies. Media exposure has a major role in encouraging the companies to publish their activities, especially those related to the environmental aspects. When the media publish the information related to the companies’ activities which involve the environment, the information will become one of the considerations taken by the public in applying pressure on the companies to legitimize their activities by disclosing their carbon emissions.

Based on the stakeholder theory, media plays a role in compelling the companies to fulfill various social contracts with various stakeholders of the companies. Media exposure on the companies’ carbon emissions policies encourages the companies to make necessary measures related to the environment. Applying these measures to preserve the environment can help the companies obtain support from various parties.

The high intensity of media attention on a company can increase the company’s motivation to disclose information. The more intense the media attention on the company’s environmental policy is, the more extensive the carbon emission disclosure will be. This is in line with the results of research by Jannah & Muid (2014) and Kusumah, Manurung, Oktari & Husnatarina (2016) showing that media exposure has a positive influence on the carbon emission disclosure. Thus, it can be assumed that media exposure can affect the carbon emission disclosure positively.

The influence of Environmental Performance on Carbon Emission Disclosure

The legitimacy theory asserts that to obtain public legitimacy, companies must conduct an environmental preservation which can create harmony between the environment and the company. The companies’ efforts to bring this harmony are the results of their environmental preservation measures which can be reflected on their environmental performances. With a good environmental performance, a company can disclose more extensive carbon emissions information in an attempt to create harmony between the environment and the company.

A company with a high level of environmental performance can disclose the information on its carbon emissions to obtain legitimacy from the public in the surrounding areas. Thus, companies use their carbon emission disclosures as one of the means to obtain public legitimacy. In this case, the better the environmental performance of a company is, the better the company’s carbon emission disclosure will be. This is in line with the results of a research by Prafitri & Zulaikha (2016) and Dawkins & Fraas (2011). Prafitri & Zulaikha (2016) conducted a research on 298 listed companies in Indonesia and revealed that higher environmental performances can motivate the companies to disclose their GHG emissions including a carbon emission disclosure. Similarly, Dawkins & Fraas (2011), who studied companies within S&P 500, also showed that environmental performances influence the climate change disclosure positively. Accordingly, it can be assumed that environmental performances have a positive influence on the carbon emission disclosure.

The Influence of Type of Industry on Carbon Emission Disclosure

Corresponding to the legitimacy theory, companies operating in industries which intensively produce carbon emissions can receive greater demands from the public. The public demands that the companies make adjustments to their environmental management in terms of their activities that can potentially affect the environment. With this demand, the companies can take some measures towards the environmental restoration by decreasing their carbon emissions and publishing their carbon emission disclosure.

Business activities of a company involve various stakeholders. Each stakeholder will consider whether to support those business activities or not. Naturally, companies’ business activities influence the provision of the stakeholders’ interests. Each activity must yield an added value to the stakeholders. When a company conducts business activities which negatively affect the environment, the stakeholders can consider the measures taken by the company towards the environmental restoration. Hence, companies which are active in producing carbon emissions will publish their carbon emissions disclosures more extensively to obtain the support from the stakeholders who become more active in assessing the company.

The more intensive a company’s contribution towards the increase of carbon emissions is, the more extensive its carbon emission disclosure will be. This is similar to the results of research by Bae et al. (2013), Jannah & Muid (2014), and Pratiwi & Sari (2016). Bae et al. (2013) which showed that the type of industry which intensively produces carbon emissions will disclose its carbon emissions extensively. Similarly, Jannah & Muid (2014) showed that the type of industry has a positive and significant influence on the carbon emission disclosure. A similar result was also found by Pratiwi & Sari (2016) who studied non-industrial companies which are listed in the Indonesian Stock Exchange. Therefore, it can be assumed that there is a positive correlation between the type of industry and the carbon emission disclosure.

The Influence of Companies’ Size on Carbon Emission Disclosure

The legitimacy theory and the stakeholder theory show that companies which have great resources can receive public attention and high demands for each of their business activities which are conducted to fulfil the interests of the stakeholders involved in those companies. Subsequently, companies with great resources are demanded to do extra measures towards the environmental restoration.

The company size can influence its ability to report its carbon emission disclosure with its resources. It is in line with the fact that the size of the company’s resources can affect its ability to conduct activities to mitigate carbon emissions. With great resources, a company can be more unimpeded in disclosing the mitigation activities. Studies done by Bae et al. (2013), Jannah & Muid (2014), Majid & Ghozali (2015), Gonzáles-Gonzáles & Zamora-Ramírez (2016), Kalu et al. (2016), and Hermawan, Aisyah, Gunardi & Putri (2018) showed that the company size has positive effects on the carbon emission disclosure. Thus, it can be assumed that the company size affects its carbon emission disclosure positively.

The Influence of Profitability on Carbon Emission Disclosure

Profitability reflects the ability of a company to fulfil the interests of its stakeholders from the financial aspect. A high level of profitability indicates that a company is able to give an added value to its shareholders and creditors. Based on the legitimacy theory and stakeholder theory, a company must be able to satisfy the public demands related to the environment and to other social contracts. With high profitability, a company is demanded to be capable of implementing the necessary measures to reduce the carbon emissions, in addition to increasing the interests of the shareholders and fulfilling various social contracts with them. Profitability can boost the company’s ability in increasing its carbon emission disclosure.

Studies on the relation between profitability and the carbon emission disclosure have been conducted by Bae et al. (2013), Luo et al. (2013), Gonzáles-Gonzáles & Zamora-Ramírez (2016), among others. all of them show that profitability has a positive and significant influence on the carbon emission disclosure. The better the company’s performance in making a profit is, the better the company’s contribution in reducing the carbon emissions will be, including making a carbon emission disclosure. Accordingly, it can be assumed that profitability affects the carbon emission disclosure positively.

The Influence of Leverage on Carbon Emission Disclosure

Based on the stakeholder theory, the management will increase value creation to minimize losses suffered by the stakeholders. In this case, the stakeholders who become the center of attention from the management are the ones who provide debt financing to the company. To minimize the losses suffered by these stakeholders, the company will put more efforts into reducing any disclosure which can worsen the company’s image. If the company’s image becomes worse in the public eye, the company will weigh the disclosures which are considered as ineffective in increasing the company’s image. Moreover, a high leverage level reduces the company’s ability to publish its non-financial disclosure.

A high leverage level can motivate the company to limit the level of its carbon emission disclosure to the public. A company with high leverage will prioritize the policy related to the fulfilment of the company’s liabilities rather than its efforts to reduce its carbon emissions. This puts a restriction on the company’s carbon emission disclosure. The results of studies conducted by Jannah & Muid (2014), Luo et al. (2013), and Majid & Ghozali (2015) share the same opinion that the leverage level has a negative effect on the carbon emission disclosure. Therefore, it can be assumed that leverage affects the carbon emission disclosure negatively.

Methodology

In this present study, the research objects focused on the level of the carbon emission disclosure published in the annual reports or sustainability reports of listed companies in the non-financial sectors which had joined PROPER over a four-year period from 2014 to 2017. These companies became the objects of research because the non-financial sector is closely related to the environmental issues, and the companies in this sector contribute to the increase of carbon emissions. The scope of this present study is constrained by variables influencing the carbon emission disclosure, namely media exposure, environmental performance, type of industry, company size, profitability and leverage.

This present study is a quantitative research using the multiple linear regression to analyze secondary data. To assess the carbon emission disclosure, secondary data were obtained from the companies’ annual reports uploaded to the official website of Jakarta Stock Exchange (JSX) and other additional reports taken from the official websites of the companies.

All the listed companies in the non-financial sector which had joined PROPER during 2014 – 2017 became the research population of this present study. The samples were taken by using the purposive sampling technique in which the samples were taken based on certain considerations or certain criteria. The criteria used in taking the samples were as follows: 1) A listed company in the non-financial sector which had joined PROPER from 2014 – 2017; 2) A listed company in the non-financial sector which had published its financial reports and annual reports consecutively from 2014 – 2017; 3) A listed company in the non-financial sector which has disclosed its carbon emissions implicitly and explicitly (covering at least one policy or one disclosure item which was related to carbon emissions or greenhouse gas emissions) in various published documents, such as annual reports, sustainability reports, and financial reports from 2014 – 2017; 4) A listed company in the non-financial sector which had made positive profits from 2014 – 2017.

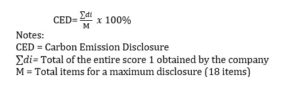

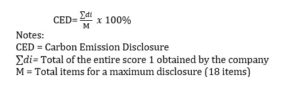

The Dependent Variable in this research is the Carbon emission disclosure., The checklist scoring is used to operationalize it. The scoring, which is developed by Bae et al. (2013), is based on the information request sheets distributed by CDP (Carbon Disclosure Project). The calculation of the carbon emission disclosure index in this present study was conducted by following these steps (Jannah & Muid, 2014): 1) Give a score to each disclosure item by using a dichotomous scale; 2) Each disclosure item in a report was worth 1 point and vice versa; 3) The total score for each disclosure item (carbon emission disclosure by a company) was calculated using this formula:

The Independent Variables in this study are Media Exposure; Enviromental Performance; Type of Industry; Company Size; Profitability and Leverage. Media Exposure was calculated by using a dummy variable in which score 1 was given to a company which had positive and negative news coverage from external parties or from internal parties with regard to the company’s efforts in dealing with carbon emissions. The news coverage here referred to the online media coverage. However, score 0 was given to companies which have received no publication on any types of media from external parties concerning the company’s efforts in handling its carbon emissions.

In the operational description, the environmental performance was measured by using the ranking scores as stated in the Program for Pollution Control, Evaluation and Rating (PROPER). The PROPER rating puts the companies in a gold rank, a green rank, a blue rank, a red rank and a black rank. In this present study, each rank was given a score from 5 to 1 respectively.

The type of industry was measured by using the ranking scores based on the ranking of three industrial sectors: Energy Sector: Mining and Energy Industry; . Industrial Processes and Product Use (IPPU) Sector: cement industry, steel, pulp and paper, textile, electronic and electrical appliances, petrochemicals, ceramics, food and beverage.; Agriculture, Forestry and Other Land Use (AFOLU) Sector: Agro-industry, plantation, livestock, forestry, property, real estate, building construction, pharmaceutical and cosmetic.which had been the biggest contributors to carbon emissions in Indonesia as revealed by the Indonesian Ministry of Industry (2013). Each listed company was classified into one of the sectors, and they were given scores 3 to 1 respectively.

The company size was measured by using the natural logarithm of total assets.

= Ln(Total Assets)

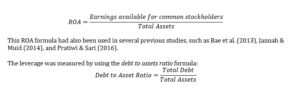

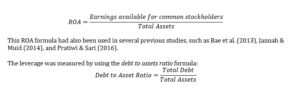

The level of profitability in this present study was measured by using the ROA formula as stated in Gitman & Zutter (2013, p. 81):

This formula had also been used in studies by Jannah & Muid (2014).

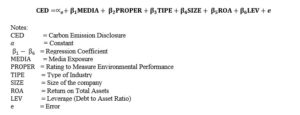

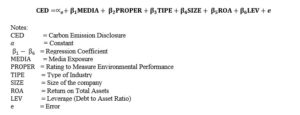

The multiple linear regression analysis was done to measure the degree of influence from the factors which affected the carbon emission disclosure (CED). The multiple linear regression model was conveyed in the following equation:

Results and Discussion

Seventy-four (74) companies from the non-financial sector became the research population in this present study. From the population, 21 companies were selected as the samples by using the purposive sampling technique with several criteria. Thus, the total number of observations were 84 throughout a period of four years from 2014 – 2017.

The Results of Hypothesis Testing

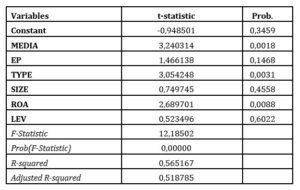

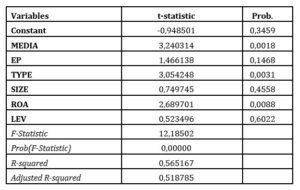

After all the data were assessed using the classical assumption test and the regression model evaluation, the next step was to test the multiple linear regression model on Eviews 10. The significant t-test results can be seen in Table 1 below.

Table 1: Results of Statistical Tests

Source: Output Eviews 10

The results of the multiple linear regression and significant t-test for each independent variable are explained briefly as follows:

First Hypothesis

The table above shows that media exposure (MEDIA) has a positive and significant influence on the carbon emission disclosure. This can be seen from the t-value of 3,240314 > 1,992 ttabel with a p-value below 0,05, which is at 0,0018. Hence, the hypothesis which is stating that media exposure has a positive influence on the carbon emission disclosure is accepted.

Second Hypothesis

The environmental performance variable has a p-value of 0,1468 which is higher than 0,05, and the t-value stands positively at 1,466138. This means that the environmental performance variable has no significant influence on the carbon emission disclosure. Thus, the hypothesis which is stating that the environmental performance has a positive influence on the carbon emission disclosure is not accepted.

Third Hypothesis

The type of industry variable has a positive and significant influence on the carbon emission disclosure. This can be seen from the t-value of 3,054248 which is higher than ttabel of 1,992, and the p-value stands at 0,0031. Therefore, the third hypothesis stating that the type of industry variable has a positive and significant influence on the carbon emission disclosure is accepted.

Fourth Hypothesis

The company size variable does not affect the carbon emission disclosure. This can be seen from the t-value of 0,749745 which is lower than ttabel, of 1,992 with a p-value of 0,4558. This proves that the company size has no positive and significant influence on the carbon emission disclosure. Consequently, Hypothesis 4 stating that the company size has a positive influence on the carbon emission disclosure is not accepted.

Fifth Hypothesis

The profitability variable measured by ROA shows a positive influence on the carbon emission disclosure. This is because the p-value of 0,0088 stands below 0,05 with a t-value of 2,689701 > 1,992 ttabel. Therefore, the fifth hypothesis stating that profitability has a positive influence on the carbon emission disclosure is accepted.

Sixth Hypothesis

The leverage variable measured by DAR has no significant influence on the carbon emission disclosure. This variable has a p-value of 0,6022 with a positive t-value of 0,523496. As a result, the sixth hypothesis stating that the leverage variable has a negative influence on the carbon emission disclosure is not accepted.

Based on the test results above, the regression model equation in this present study shows that the independent variables simultaneously have a significant influence on the dependent variables. This is proven from the probability F-value which is below the significant level of 0,05.

Coefficient of Determination

Based on the table above, the coefficient of the determination value can be seen from the adjusted r-square value of 0,518785 (51,88%). This value means that the independent variables used in the multiple linear regression model has 51,88% influence in explaining the dependent variables. The percentage is more than 50%; thus, it can be indicated that the independent variables in this present study have strong relations with the companies’ carbon emission disclosure. In other words, these independent variables have the ability to explain factors which can influence the carbon emission disclosure.

Discussion

The Influence of Media Exposure on Carbon Emission Disclosure

Media exposure (MEDIA) has a positive and significant influence on the carbon emission disclosure. This can be seen from the t-value of 3,240314 > 1,992 ttabel with a p-value of 0,0018 which is below 0,05. Thus, the first hypothesis stating that media exposure has a positive influence on the carbon emission disclosure is accepted.

This result is in line with those of Jannah & Muid (2014) and Majid & Ghozali (2015) which showed a positive relation between media exposure and the carbon emission disclosure. Jannah & Muid (2014) studied the non-financial companies listed in Jakarta Stock Exchange from 2010 – 2012. During that period, it is found that media can motivate the companies to disclose their carbon emissions. However, these results are in contradiction to those of Pratiwi & Sari (2016) in which media exposure does not always motivate companies to publish their carbon emission disclosure in their annual reports.

Companies which have a continuous coverage from external media tend to publish their carbon emission disclosure more extensively. For example, PT Bukit Asam (Persero), Tbk is one of the state-owned enterprises (SOEs) which often receives media coverage with regard to the company’s policy in reducing carbon emissions. During the period of research (2014 – 2017), PT Bukit Asam (Persero), Tbk always received news coverage from external media related to its carbon emissions. Because of this considerable media exposure, PT Bukit Asam (Persero), Tbk published an extensive carbon emission disclosure which covered 94, 44% (17 items) from the total of 18 disclosure items. PT Bukit Asam (Persero), Tbk published a comprehensive carbon emission disclosure in its sustainability report which started from the company’s experience in implementing a carbon emission disclosure to its development and the results of its efforts to mitigate its carbon emissions.

The directly proportional relationship between media exposure and the carbon emission disclosure was also proven from the companies which did not get media exposure during the research period. For example, PT Asahimas Flat Glass, Tbk which did not receive media exposure from 2014 – 2017 published only 22,22% to 22,78% from the total of 18 carbon emission disclosure items. The extent of the carbon emission disclosure published by PT Asahimas Flat Glass, Tbk was not as extensive as those published by companies which constantly received media exposure. In other words, the less frequent the companies receive media exposure, the more restricted their carbon emission disclosures will be.

The results of this present study are in line with the legitimacy theory and the stakeholder theory which are applied in this present study. For example, PT Astra Agro Lestari, Tbk was one of the companies which received news coverage from external media regarding its policy in reducing the carbon emissions level. As a crude palm oil (CPO) producer, PT Astra Agro Lestari, Tbk published 77,78% to 83,3% of its carbon emission disclosure in its efforts to obtain public legitimacy amid negative issues attacking palm oil producing companies. Not only did PT Astra Agro Lestari, Tbk contribute in the efforts to reduce carbon emissions nationally, but it also gained support from its stakeholders in running its business activities.

The rapid advancement of information and technology has encouraged companies to be more active in responding to the media exposure. Various media have also become more active in criticizing the policies and issues striking the companies. By doing this, media can motivate companies to extend their carbon emission disclosures in order to build and maintain their images in front of the public who has become more aware of the companies’ activities. It seems that the more frequent media exposure a company receives, the more extensive its carbon emission disclosure will be. Based on the theories, statistic test results and facts, it can be concluded that media exposure has a positive and significant influence on the carbon emission disclosure. Hence, the fourth hypothesis is accepted.

The Influence of Environmental Performance on Carbon Emission Disclosure

The environmental performance variable has a p-value of 0,1468 which is higher than 0,05, and it has a positive t-value of 1,466138. This means that the environmental performance variable has no significant influence on the carbon emission disclosure. For this reason, H2 stating that the environmental performance has a positive influence on the carbon emission disclosure is not accepted.

This result is conflicting with that of Prafitri & Zulaikha (2016) who are of the opinion that the environmental performance has a positive influence on greenhouse gas emissions (including the carbon emissions). The research by Prafitri & Zulaikha (2016) shows that the disclosure has been in line with the companies’ commitment towards the environment to obtain legitimacy and support from their stakeholders.

On the other hand, the test results in this present study confirm some previous studies such as those of Jannah & Muid (2014), Majid & Ghozali (2015), Akhiroh & Kiswanto (2016), and Cahya (2017). Furthermore, the publication of high PROPER rating has indirectly represented the companies’ commitment to cope with climate change problems (Jannah & Muid, 2014); thus, the increase in PROPER rating does not correspond with the companies’ motivation to publish their carbon emission disclosures.

In this present study, there are some reasons (or facts) why the environmental performance has no influence on the carbon emission disclosure. First, companies with high PROPER rating lack the motivation to publish their carbon emission disclosures. They are more motivated to disclose their other environmental responsibilities in their annual reports. For example, PT Indofood CBP Sukses Makmur, Tbk received green PROPER rating in 2016, but its carbon emission disclosure only reached 22,22%. In its annual report, PT Indofood CBP Sukses Makmur, Tbk was more inclined to disclose its social responsibilities within the farmers’ social welfare and the environment domain rather than to disclose its carbon emissions. With high PROPER rating, the company’s motivation to extend its carbon emission disclosure was still less than expected although the company itself has been promoting the efforts to create an alternative energy conversion which was environmentally friendly in which the program implied an effort to reduce the company’s carbon emissions.

Second, although companies already have good environmental performances, they still lack the motivation to disclose their carbon emissions because they think they have fulfilled some of the rating criteria in PROPER. In green rating criteria, companies think that if they can fulfil the air pollution and clean production aspects in PROPER, these two aspects can be considered as the alternatives in their efforts to reduce their carbon emissions. In the air pollution aspect, the companies which have air pollution emissions below 50% of the air pollution control standards have met one of the criteria in green PROPER rating. Within the clean production aspect, the green rating criteria include the application and conversion of efficient and environmentally friendly energy. Consequently, companies with green PROPER rating feel that it is unnecessary for them to extend carbon emission disclosures because the companies have already passed the evaluation criteria concerning air pollution and clean production which are two important aspects in the carbon emission disclosure. Statistically, the environmental performance variable with other independent variables can simultaneouly have a significant influence on the carbon emission disclosure (the dependent variable) as revealed in the significant F-test value of this present study. For example, PT Indofood Sukses Makmur, Tbk has a green PROPER rating, and this company is aware that it does not belong to the type of industry which is more intensive in producing carbon emissions; therefore, PT Indofood Sukses Makmur, Tbk becomes less motivated in publishing its carbon emission disclosure. Based on the statistic test results and facts found in this presen study, it can be concluded that the second hypothesis is not accepted. In other words, this present study states that the environmental performace has no significant influence on the carbon emission disclosure.

The influence of Type of Industry on Carbon Emission Disclosure

The type of industry variable has a positive and significant influence on the carbon emission disclosure. This can be seen from the t-value of 3,054248 which is higher than ttabel of 1,992, and the p-value stands at 0,0031. Therefore, H3 stating that the type of industry variable has a positive and significant influence on the carbon emission disclosure is accepted

The observation in this present study applies to the three sectors of industry which include carbon emission contributors from the Ministry of Industry, and it is in line with previous studies by Bae et al. (2013), Jannah & Muid (2014), and Pratiwi & Sari (2016). In general, these three previous studies are of the opinion that the type of industry which intensively produces carbon emissions tend to publish the carbon emission disclosure more extensively.

The results of this present study show a positive and significant relation between the type of industry and the carbon emission disclosure. Out of eight companies in the energy sector, three companies had scored more than 90% of the total carbon emission disclosure items. They are PT Indocement Tunggal Prakarsa, Tbk, PT Bukit Asam (Persero), Tbk, and PT Semen Indonesia, Tbk, all of which operate in the mineral mining industry which contributes rather enormously to the carbon emissions increase in Indonesia. However, the three companies had made some efforts to mitigate carbon emissions by applying various policies and reporting the progress of their efforts publicly through their sustainability reports uploaded on their official websites. This confirms the legitimacy theory and the stakeholder theory in which companies must focus not only on the financial aspects, but also on the environmental aspects, particularly in the environment where the companies conduct their business activities.

The more intensive the companies produce carbon emissions, the bigger their efforts in publishing carbon emission disclosures will be. This has been done by PT Semen Indonesia, Tbk. In order to reach the target of reducing its carbon emissions, PT Semen Indonesia, Tbk has applied a lot of measures, such as cooperating with Japanese companies in developing an environmentally friendly technology, implementing a pollution prevention program, environmental conversion, greenhouse program and using biomass fuel in its plant in Tuban. All of the programs and their progress have been reported in a comprehensive carbon emission disclosure covering every segment of the company. This carbon emission disclosure of PT Semen Indonesia, Tbk is published in its annual report and sustainability report.

On the other hand, companies which are not intensive in producing carbon emissions only reveal a small number of items from the total carbon emission disclosure items. For example, PT Kalbe Farma, Tbk operating in pharmaceutical industry did not publish a carbon emission disclosure extensively although the company had been aware of the on-going climate change and carbon emissions issues. Nevertheless, PT Kalbe Farma, Tbk only revealed its general strategies on reducing carbon emissions. Therefore, based on the statistic test results and described facts, it can be concluded that the third hypothesis stating that the type of industry has a positive and significant influence on the carbon emission disclosure is accepted.

The Influence of the Company Size on Carbon Emission Disclosure

The company size variable does not affect the carbon emission disclosure. This can be seen from the t-value of 0,749745 which is lower than ttabel, of 1,992 with a p-value of 0,4558. This proves that the company size has no positive and significant influence on the carbon emission disclosure. Consequently, H4 stating that the company size has a positive influence on the carbon emission disclosure is not accepted.

The results of this present study are not in line with several previous studies such as those conducted by Jannah & Muid (2014), Majid & Ghozali (2015), Bae et al. (2013), Luo et al. (2013), Kalu et al. (2016), and Gonzáles-Gonzáles & Zamora-Ramírez (2016), all of which state that the company size has a directly proportional and significant relationship with the carbon emission disclosure. Jannah & Muid (2014) are of the opinion that the company size has a positive and significant influence on the carbon emission disclosure. Majid & Ghozali (2015) further explained that big companies are confident in publishing carbon emission disclosures because they have the necessary human resources which are highly capable in publishing the disclosure.

Based on the statistic test results, the direction of the relationship between the company size and the carbon emission disclosure is the same as that of H4. However, the influence of the company size on the carbon emission disclosure is not significant yet. One of the reasons for this phenomenon is the presence of big companies which have not published their carbon emission disclosures optimally. For example, PT Indofood Sukses Makmur, Tbk which had a total asset of Rp 91.381.526.000.000,- in 2015 revealed only 22,2% (4 items) from the total of 18 carbon emission disclosure items. This implied that the company’s resources have not been used optimally to decrease carbon emissions. The extent of the company’s resources is reflected on the company’s total asset value which has been obtained from various contracts made to increase the fixed assets. However, the fixed assets have been used to develop plantation crops which are valuable for PT Indofood Sukses Makmur, Tbk to increase the abilities of its business segments.

PT Indofood Sukses Makmur, Tbk also puts a lot of efforts to mitigate the risks of global warming and climate change which can endanger its business segments. The company’s mitigation acts include maintaining the inventory level of raw materials, building good partnerships with the suppliers, establishing contingency plans to anticipate disasters and ensuring the provision of sufficient insurance protection against financial losses. However, these mitigation measures have a less impact on the extensive carbon emission disclosure because the mitigation efforts have not been focused on the measures which can potentially reduce the company’s carbon emissions. Big companies with great resources have not been aware of the importance of reducing carbon emissions with more focused and continuous actions. Consequently, the company size as reflected in its resources has no influence on the extent of the carbon emission disclosure published by the company.

In addition to the policies implemented by a company, the characteristics of the company also influence the company size which has no influence on the carbon emission disclosure. This present study also showed that several big companies are not actually the largest carbon emitters. This is because the company’s characteristics such as the type of industry and the company size simultaneouly have a significant influence on the carbon emission disclosure. For example, PT Indofood Sukses Makmur, Tbk is a big company with big total assets. Nevertheless, the company does not belong to the type of industry which produces the largest carbon emissions. Because of this, the company feels unnecessary to publish an extensive carbon emission disclosure. Thus, the company’s total assets can be used for a more strategic policy.

To extend its carbon emission disclosure, a company must have a higher awareness of reducing carbon emissions by using the company’s available resources which have not been focused on implementing a carbon emission policy comprehensively. Because the carbon emission disclosure is still voluntary, most of the companies still focus on their financial performances. In fact, a carbon emission disclosure not only contributes to the environment, but it can also be published as a value added statement which is not included in the financial statements as stated in the Indonesia Financial Accounting Standard or PSAK No.1 (Ikatan Akuntan Indonesia, 2009).

In this present study, although the direction of the relationship between the company size and the carbon emission disclosure is the same as that of Hypothesis No. 4, the results from the sample companies still make the influence insignificant. Thus, it can be concluded, in this present study, that the company size variable does not affect the carbon emission disclosure.

The Influence of Profitability on Carbon Emission Disclosure

The profitability variable measured by ROA shows a positive influence on the carbon emission disclosure. This is because the p-value of 0,0088 stands below 0,05 with a t-value of 2,689701 > 1,992 ttabel. Therefore, H5 stating that profitability has a positive influence on the carbon emission disclosure is accepted. The results of this present study confirm the results of previous studies by Bae et al. (2013), Gonzáles-Gonzáles & Zamora-Ramírez (2016), and Cahya (2017). These studies showed that the increase in profitability will encourage the company to publish a more extensive carbon emission disclosure. On the other hand, some other previous studies such as Pratiwi dan Sari (2016) and Irwhantoko & Basuki (2016) showed different results. Both studies show that the increase in profitability has no significant influence on the carbon emission disclosure. In other words, profitability does not affect the extent of the carbon emission disclosure.

This present study used ROA to demonstrate how a company with a good profitability can publish a carbon emission disclosure optimally. For example, PT Unilever Indonesia, Tbk had ROA of 41,50% in 2014, and its carbon emission disclosure reached 83,33% or 15 disclosure items (from the total of 18 carbon emission disclosure items). By directly proportional relationship similar to that of PT Unilever Indonesia, Tbk, the carbon emission disclosure of PT Asahimas Flat Glass, Tbk experienced reduction and became less extensive because its ROA value decreased drastically to 0,62% in 2017. Smaller ROA values encourage the decrease in the carbon emission disclosure.

Companies with high ROA values can implement many policies which can reduce carbon emissions. This effort can bring many benefits which can increase the reputation of the company. One of the companies which has already been aware of the benefits of the carbon emission disclosure is PT Semen Indonesia, Tbk which has been using the carbon emission disclosure as a strategy of energy transformation. This energy transformation is implemented by using rice husk and cocopeat biomass as an alternative fuel which creates energy as a source of efficiency for the company by obtaining certified emission reduction (CER). By using the alternative energy, the company has shown its commitment in managing energy, reducing carbon emissions and increasing economic values.

Companies with high profitability tend to be active in disclosing their carbon emissions. By disclosing their carbon emissions, the companies hope they will receive positive viewpoints from their stakeholders, and these viewpoints are expected to be able to support their financial performances which had already been reported to the public. Companies with high profitability can make use of this profitability to implement beneficial policies outside the financial aspect. It is expected that the carbon emission disclosure can bring relevant benefits to the companies’ reputation because by disclosing their carbon emissions, companies can gain public trust which can support the their operational activities which eventually increases the companies’ images.

The considerable cost for the carbon emission disclosure corresponds with the benefits which are received by the companies from these disclosures. The companies can focus on their social responsibilities for the environmental, social, cultural and economic aspects. The companies’ ability to make profits can influence the extent of their carbon emission disclosures. The higher a company’s profitability is, the higher the company’s awareness is in disclosing its carbon emissions which can support the results of its financial performance. Based on the statistic test results and facts found in the present study, it can be concluded that profitability has a positive and significant influence on the carbon emission disclosure.

The Influence of Leverage on Carbon Emission Disclosure

The leverage variable measured by DAR has no significant influence on the carbon emission disclosure. This variable has a p-value of 0,6022 with a positive t-value of 0,523496. As a result, H6 stating that the leverage variable has a negative influence on the carbon emission disclosure is not accepted.

The results of this present study are different from those of the previous studies. For example, Jannah & Muid (2014) are of the opinion that leverage has a negative and significant influence on the carbon emission disclosure. Companies with high debt financing tend to restrict their carbon emission disclosures and focus on settling the liabilities to the creditors or other financiers.

The direction of the relationship between leverage and the carbon emission disclosure shows a different direction from that of the formulated hypothesis. There are facts demonstrating how leverage has a positive but insignificant influence on the carbon emission disclosure. For example, PT Unilever Indonesia, Tbk had a high leverage level of 71,91% in 2016, but the company’s carbon emission disclosure was valued only at 77,78%. Although PT Unilever Indonesia, Tbk is aware that it should pay close attention to its expenses and discard any costs which do not add value to the consumers, the company still publishes its carbon emission disclosure extensively. Furthermore, the company still pays attention to the non-financial aspects which also influence the company’s good reputation. This implies that the company intends to fulfil various social contracts even though it has high leverage. However, the reduction of the company’s carbon emissions has not been directed optimally. This supports the claim that leverage has a positive relationship with the carbon emission disclosure although it is not significant yet. Another example of companies with high leverage and restricted carbon emission disclosures is PT Indofood Sukses Makmur, Tbk which had a leverage of 53,30% in 2015, but the company’s carbon emission disclosure was valued only at 22,22%.

Moreover, the leverage level during the period of research tends to be high because of several factors, one of which is the increase in the long-term liability. This happened with PT Phapros, Tbk whose DAR was increased from 29,57% to 40,35% in 2017. The surge was caused by an increase in the liability value of 81,67% from 2016 which was mainly caused by the increase in the long-term liability from Rp 215.020.000.000,- in 2016 to Rp 289.820.000.000,- or 287,47% increase in 2017. Furthermore, medium term-notes revenues which were realized in 2017 also contributed to the increase along with an increase in long-term bank loans to Rp 9.320.000.000,- or 19,59% which were used to fund investments. The increase in the leverage level was also triggered by an increase in the current value of post-employment benefits which rose 20,14% from 2016 and reached Rp 80.510.000.000,-. The considerable increase in the liability value did not correspond with the increase in the total asset value which only rose 33,13% from 2016. Moreover, the increase in the liability value was not intended for purposes outside the company’s carbon emissions policies.

PT Semen Baturaja, Tbk faced the same thing as it experienced an increase in leverage from 9,76% in 2015 to 28,56% in 2016. This surge was caused by retention receivables which reached 1030%. The retention receivables were incurred from the purchase of machinery equipment from Tianjin Cement Industry Design and Research Institute, the retention of civil construction work Phase I on DDK Joint Operation, and the retention of civil construction work Phase II plus the mechanical and electrical installation from Waskita. All of the retention receivables were intended for the Construction Project of Baturaja II Plant.

The decrease of leverage is caused by funding which is used to support various company’s interests in increasing the company’s operations. The companies tend not to apply an optimum strategy to attract the stakeholders’ attention (Ghozali & Chariri, 2007). This discourages the companies to publish their carbon emission disclosure. This is why the leverage level does not influence the extent of the companies’ carbon emission disclosure. Based on the statistic test results and facts found in this present study, it can be concluded that leverage has no significant influence on the carbon emission disclosure.

Conclusion

Based on the discussion above, it can be concluded that there are three independent variables which have influenced and have the same direction of relationships with the research hypotheses. The variables are as follows: Media exposure which was measured by dummy variables to see how news coverage from external media can influence the companies’ carbon emission disclosure. The results show that media exposure has a positive and significant influence on the carbon emission disclosure. In other words, the more frequent news coverage from external media concerning the companies’ policy on carbon emissions is, the more extensive their carbon emission disclosures will be. The type of industry was measured by using the scoring based on the sector division of carbon emissions contributors from the Ministry of Industry. The more intensive an industry is in producing carbon emissions, the more extensive its carbon emission disclosure will be. The results showed that the type of industry has a positive and significant influence on the carbon emission disclosure. Profitability was measured by the companies’ Return on Asset (ROA) values. The results showed that the company’s profitability has a positive and significant influence on the carbon emission disclosure. Companies with good profitability will publish their carbon emission disclosures decently. The disclosure of carbon emission will become the center of attention from the companies because they are starting to realize the benefits they will have from it.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Akhiroh, T., & Kiswanto, K. (2016). The determinant of carbon emission disclosures. AccountingAnalysis Journal, 5(4), 326-336.

- Angelia, D., & Suryaningsih, R. (2015). The effect of environmental performance and corporate social responsibility disclosure towards financial performance: Case study to manufacture, infrastructure, and service companies that listed at Indonesia Stock Exchange. Procedia – Social and Behavioral Sciences, 211, 348–355.

- Anggraeni, D. Y. (2015). Pengungkapan emisi gas rumah kaca, kinerja lingkungan, dan nilai perusahaan. Jurnal Akuntansi dan Keuangan Indonesia, 12(2), 188-209.

- Berthelot, S., & Robert, A. (2011). Climate change disclosure: An examination of Canadian oil and gas firms. Issues in Social and Environmental Accounting, 5(1/2), 106-123.

- Bae Choi, B., Lee, D., & Psaron, J. (2013). An analysis of Australian company carbon emission disclosures. Pacific Accounting Review, 25(1), 58-79.

- Burhany, D. I., & Nurniah, N. (2018). Akuntansi manajemen lingkungan, alat bantu untuk

- meningkatkan kinerja lingkungan dalam pembangunan berkelanjutan. Jurnal Ekonomi dan Keuangan, 17(3), 279-298.

- Cahya, B. T. (2017). Carbon emission disclosure: Ditinjau dari media exposure, kinerja lingkungan dan karakteristik perusahaan go public berbasis syariah di Indonesia. Nizham: Journal of Islamic Studies, 4(2), 170-188.

- (2018). Carbon disclosure project. Retrieved March 9, 2018, from https://www.cdp.net/en/info/about-us.

- Christiningrum, R. (2018, February). Dampak pelarangan ekspor sawit ke Uni Eropa. BuletinAPBN: Pusat Kajian Anggaran Badan Keahlian DPR RI. 2(3): 3-8. Retrieved April 4, 2018, from https://berkas.dpr.go.id/puskajianggaran/buletin-apbn/public-file/buletin-apbn-public-50.pdf.

- Chrysolite, H., Juliane R., Chitra, J., & Ge, M. (2017, October 04). Evaluating Indonesia’s progresson its climate commitments. World Resources Institute. Retrieved March 28, 2018, from http://www.wri.org/blog/2017/10/evaluating-indonesias-progress-its-climate-commitments.

- Climate Transparency 2017. (2017). Brown to green: The G20 transition to a low-carbon

- Retrieved March 28, 2018, from http://www.climate-transparency.org/wp content/uploads/2017/07/B2G2017-Indonesia.pdf.

- Cotter, J., & Najah, M. M. (2012). Institutional investor influence on global climate change disclosure practices. Australian Journal of Management, 37(2), 169-187.

- Dawkins, C., & Frass, J. W. (2011). Coming clean: The impact of environmental performance and visibility on corporate climate change disclosure. Journal of Business Ethics, 100(2), 303-322.

- Deegan, C., Rankin, M., & Tobin, J. (2002). An examination of the corporate social and environmental disclosures of BHP from 1983-1997: A test of legitimacy theory. Accounting, Auditing, & AccountabilityJournal, 15(3), 312-343.

- Dwijayanti, S. P. F. (2011). Manfaat penerapan carbon accounting di Indonesia. Jurnal Akuntansi Kontemporer, 3(1), 79-92.

- Freeman, R.E., & McVea, J. (2001). A stakeholder approach to strategic management. SSRN Electronic Journal.

- Friedman, A.L., & Miles, S. (2006). Stakeholders: Theory and practice. Oxford: Oxford University Press.

- Ghozali, I., & Chariri, A. (2007). Teori akuntansi. Semarang: Badan Penerbit Universitas Diponegoro.

- Ghozali, I., & Ratmono, D. (2013). Analisis multivariat dan ekonometrika: Teori, konsep, dan aplikasi dengan EViews 8. Semarang: Badan Penerbit Universitas Diponegoro.

- Gitman, L. J., & Zutter, C. J. (2013). Principles of managerial finance (13th ed.). Boston: Prentice Hall.

- Gonzáles-Gonzáles, J., & Zamora-Ramírez, C. (2016). Voluntary carbon disclosure by Spanish companies: An empirical analysis. International Journal of Climate Change Strategies and Management, 8(1), 57-79.

- Gujarati, N. D. (2003). Basic econometrics (4th ed.). Boston: McGraw-Hill.

- Hermawan, A., Aisyah, I. S., Gunardi, A., & Putri, W. Y. (2018). Going green: Determinants of carbon emission disclosure in manufacturing companies in Indonesia. International Journal of Energy Economics and Policy, 8(1), 55-61.

- Ikatan Akuntan Indonesia. (2009, June). Pernyataan standar akuntansi keuangan (PSAK) nomor 1 (Revisi 2009). Retrieved April 1, 2018, from https://staff.blog.ui.ac.id/martani/files/2011/04/EDPSAK-1.pdf.

- Iqbal, M. (2015). Regresi Data Panel (2): Tahap analisis. Retrieved April 12, 2018, fromhttps://dosen.perbanas.id/regresi-data-panel-2-tahap-analisis/.

- Irwhantoko, I., & Basuki, B. (2016). Carbon emission disclosure: Studi pada perusahaan manufaktur Indonesia. Jurnal Akuntansi dan Keuangan, 18(2), 92-104.

- Jannah, R., & Muid, Dul. (2014). Analisis faktor-faktor yang mempengaruhi carbon emission disclosure pada perusahaan di Indonesia: Studi empiris pada perusahaan yang terdaftar di Bursa Efek Indonesia periode 2010-2012). Diponegoro Journal of Accounting, 3(2), 1-11.

- com. (2017). Sektor energi & industri diandalkan dalam mereduksi emisi karbon. Retrieved May 26, 2018, from http://kabar24.bisnis.com/read/20171122/19/711599/sektor-energiindustri-diandalkan-dalam-mereduksi-emisi-karbon.

- Kalu, J. U., Buang, A., & Aliagha, G. U. (2016). Determinants of voluntary carbon disclosure incorporate real estate sector of Malaysia. Journal of Environmental Management, 182, 519-524.

- Kementerian Lingkungan Hidup dan Kehutanan. (2017). Strategi implementasi NDC. Retrieved April 4, 2018, from http://ditjenppi.menlhk.go.id/

- Kementerian Perindustrian Republik Indonesia. (2013). Kebijakan dan perkembangan pelaksanaan program penurunan emisi gas rumah kaca (GRK) sektor industri. Retrieved April 4, 2018 from http://iesr.or.id/wp-content/uploads/Kebijakan-dan-Program-Penurunan-Emisi-GRK_IESR.pdf.

- Kusumah, W. R., Manurung, D. T. H., Oktari, S. D., & Husnatarina, F. (2016, September).

- Analysis of factors affecting carbon emission disclosure: An empirical study at companies registered with sustainability reporting award 2015. Paper presented at the 8th Widyatama International Seminar on Sustainability, 203-207.

- Luo, L., Tang, Q., & Lan, Yi-Chen. (2013). Comparison of propensity for carbon disclosure between developing and developed countries. Accounting Research Journal, 26(1), 6-34.

- Majid, R. A., & Ghozali, I. (2015). Analisis faktor-faktor yang mempengaruhi pengungkapan emisi gas rumah kaca pada perusahaan di Indonesia. Diponegoro Journal of Accounting, 4(4), 111.

- Marlin, S. (2017). Analisis pengungkapan emisi karbon pada PT Perusahaan Gas Negara (PGN) Tbk dan PT Astra Agro Lestari Tbk tahun 2013-2015. Jurnal Akuntansi, 5(1).

- Nur, M., & Priantinah, D. (2012). Analisis faktor-faktor yang mempengaruhi pengungkapan corporate social responsibility di Indonesia: Studi empiris pada perusahaan berkategori high profile yang listing di Bursa Efek Indonesia. Jurnal Nominal, 1(1), 22-34.

- Nuswandari, C. (2009). Pengaruh corporate governance perception index terhadap kinerjaperusahaan pada perusahaan yang terdaftar di Bursa Efek Jakarta. Jurnal Bisnis dan Ekonomi, 16(2), 70-84

- O’Donovan, G. (2002). Environmental disclosures in the annual report: Extending the applicability and predictive power of legitimacy theory. Accounting, Auditing, & Accountability, 15(3), 344 371.

- Paramasivan, C., & Subramanian, T. (2009). Financial management. New Delhi: New Age International Publishers.

- Prafitri, A., & Zulaikha, Z. (2016). Analisis pengungkapan emisi gas rumah kaca. Jurnal Akuntansi & Auditing, 13(2), 155-175

- Pratiwi, P. C., & Sari, V. F. (2016). Pengaruh tipe industri, media exposure, dan profitabilitas terhadap carbon emission disclosure. Jurnal Wahana Riset Akuntansi, 4(2), 829-844

- Program Penilaian Peringkat Kinerja Perusahaan dalam Pengelolaan Lingkungan Hidup (PROPER). Retrieved March 13, 2018, from http://www.menlh.go.id/proper.

- Publikasi PROPER 2014. Retrieved March 9, 2018, from http://proper.menlhk.go.id/portal/pubpdf/Publikasi%20PROPER%202014.pdf.

- Publikasi PROPER 2015. Retrieved March 9, 2018, fromhttp://proper.menlh.go.id/portal/filebox/160322160528MEKANISME%20PROPER%202016.pd.

- Publikasi PROPER 2016. Retrieved March 9, 2018, fromhttp://proper.menlh.go.id/portal/filebox/161208060605Lampiran%20III%20SK%20PEringkat%2 PROPER%202016.pdf.

- Purwanto, A. T. (2003). Pengukuran kinerja lingkungan. Retrieved March 27, 2018, from http://andietri.tripod.com/jurnal/Pengukuran_KL_k.PDF.

- Pusat Data dan Teknologi Informasi Kementerian ESDM. (2016). Data inventory emisi GRK sector

- Retrieved March 28, 2018, from https://www.esdm.go.id/assets/media/content/content-data inventory-emisi-grk-sektor-energi-.pdf.

- Rankin, M., Windsor, C., & Wahyuni, D. (2011). An investigation of voluntary corporate greenhouse gas emissions reporting in a market governance system: Australian evidence. Accounting, Auditing, & Accountability Journal, 24(8), 1037-1070.

- Roberts, R. W. (1992). Determinants of corporate social responsibility disclosure: An application of stakeholder theory. Accounting, Organizations, and Society, 17(6), 595-612.

- Sholikhah, F. S. (2016). Strategi media relations PT Telekomunikasi Indonesia, Tbk untuk meningkatkan citra perusahaan. Jurnal Komunikator, 8(2), 93-112.

- Slamet S, L. (2006). Potensi dan dampak polusi udara dari sektor penerbangan. Berita Dirgantara, 7(2), 31-36.

- Subramanyam, K. R., & Wild, J. J. (2009). Financial statement analysis (10th ed.). New York: McGraw-Hill/Irwin.

- Suratno, I. B., & Mutmainah, S. (2006). Pengaruh environmental performance terhadap environmental disclosure dan economic performance: Studi empiris pada perusahaan manufaktur

- yang terdaftar di Bursa Efek Jakarta periode 2001 – 2004. Paper presented at Simposium Nasional Akuntansi IX, Padang.

- Telkom Indonesia. (2016). Kinerja kuartal I-2016 Telkom: Kinerja keuangan memuaskan dengan pertumbuhan double digit pada pendapatan, EBITDA dan laba bersih. Retrieved March 29, 2018, from http://www.telkom.co.id/kinerja-kuartal-i2016-telkom-kinerja-keuangan-memuaskan denganpertumbuhan-double-digit-pada-pendapatan-ebitda-danlaba-bersih.html.

- Utama, M. (2014). Kebijakan pasca ratifikasi Protokol Tokyo pengurangan dampak emisi rumah kaca dalam mengatasi global warming. Majalah Ilmiah Swiwijaya, 19(11), 26-34.

- Wang, J., Song, L., & Yao, S. (2013). The determinants of corporate social responsibility disclosure: Evidence from China. The Journal of Applied Business Research, 29(6), 1833-1848.

- Winarno, W. W. (2015). Analisis ekonometrika dan statistik dengan Eviews. Yogyakarta: UPP STIM YKPN.

- World Resources Institute. (2016, May). Top 10 emiters in 2012. In Maps & Data. Retrieved March 28, 2018, from http://www.wri.org/resources/charts-graphs/top-10-emitters-2012.