Introduction

In Europe, since the end of the 20th century, an increase of the importance of environmental protection in economic activity has been observed. This is due to the adoption and implementation of the sustainable development concept by the EU member states, including Poland, which assumes the preservation of the quality of the natural environment for the present and the future generations. As such, it is necessary to use its resources in a way that does not contribute to:

- an excessive use of the natural resources,

- an excessive contamination of the environment with pollutants and waste,

- degeneration of natural landscapes, ecosystems and biodiversity.

Enterprises are viewed as the main generators of the above-mentioned ecological threats. For this reason, while conducting a business activity, companies cannot afford to ignore the environmental protection rules. This necessitates access to relevant and credible information (Szadziewska, 2013, p. 106) that would allow:

- assessment and control of the impact of economic activity on the natural environment,

- functioning in accordance with the applicable environmental regulations, and thus – reduction of the risk of additional costs resulting from the sanctions imposed,

- rational management of the natural capital resources (through waste management, recycling, water, raw materials and energy saving processes),

- reducing the risk of ecological catastrophes,

- implementation of new technological solutions and innovations into production processes and reduction of the negative impact on the natural environment.

An important role in delivering the above-mentioned environmental information is played by the cost accounts recorded by businesses. As part of the information system, it should constitute an important tool in obtaining relevant and credible information, enabling economic entities to undertake activities aimed at prevention, reduction and repair of the damage done to the natural environment. In particular, cost accounting is meant to:

- identify, measure, record and analyse the costs related to the exploitation of and the changes to the environment;

- determine the tax burdens on the exploitation of the resources and the use of values of the natural environment, which is necessary to prepare mandatory reporting to external users;

- provide information enabling assessment and control of the rationality of the conducted business activity, from the perspective of its impact on natural environment.

In highly developed countries, the use of cost accounting as a source of environmental information has been the subject of many scientific studies since the end of the 20th century (e.g. Wendisch, Heupel, 2005; Bagliani, Martini, 2012; Doorasamy, Garbharran, 2015; Hörisch, 2015). In Poland, so far, little research in this area has been conducted (e.g. Stępień, 2004, 2005; Majchrzak, 2006; Hellich, Klonowska, 2007; Zubalewicz, 2008; Szadziewska, 2013). What is more, most of the projects implemented concerned the methods used for measurement of the environmental impact large enterprises exert as well as the inclusion of such information in external reporting. By contrast, the studies conducted so far overlook or present little information on the role of cost accounting as a measurement system and a source of information on the environmental costs in micro and small enterprises. Due to the significant number of these entities, however, in most market economies, their economic activity contributes to the environmental burden caused by pollutants. For this reason, these entities should have access to information on their impact on the natural environment, including information on the resulting environmental costs. Lack of access to this type of data prevents compliance with the applicable environmental regulations, including proper preparation of the environmental reports resultant from these regulations. Taking this into account, the aim of the article is to present the use of the cost accounting system as a tool for measuring environmental costs in the small manufacturing enterprise under examination. Based on literature overview, a review of the legal regulations and the case study, the following research questions have been formulated:

- What environmental costs are identified and recorded in the cost accounting system of a small manufacturing enterprise?

- Is the small manufacturing enterprise able to prepare valid environmental reporting based on the environmental information provided by the cost accounting system?

We believe our article extends the knowledge on the possibilities of using cost accounting to obtain reliable information on environmental costs in small businesses. The case study presented also allows the identification of the actions that can be taken by every small entity to record, group and control the costs of natural resource exploitation and pollution removal as well as the cost of the protective measures undertaken.

The remaining part of the article is organized as follows: the second section presents SMEs and the impact of their economic activity on the natural environment; the next section discusses the structure of the environmental costs arising in these entities, in the light of the legal regulations applicable in Poland; the forth section describes the role of cost accounting in the provision of information on environmental costs in a small manufacturing company (case study); while the last section presents the conclusions and the indications for future research.

SMEs and the impact of their economic activity on the natural environment

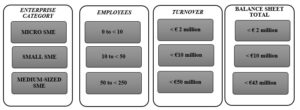

In the EU countries, SMEs (Small and medium-sized enterprises) are perceived as the source of economic growth and the driving force behind the development of European economy. It is indicated that SMEs play a key role in the creation of new jobs, production capacity improvement, reduction of poverty, and the increase of a given economy’s competitiveness (Sokołowska, 2013, p. 83; Shashi et al., 2018, p. 3679). According to the Annual Report on European SMEs 2018/2019, non-financial SMEs were responsible for generating 54.5% of GDP and employed 61.4% of the total workforce. In Poland, the companies classified within this group constitute the majority. In 2018, their share in the structure of all enterprises was 99.8%. These entities comprise micro, small and medium-sized companies. This division is presented in Figure 1, in accordance with the legal regulations regarding statistical data collection and the tax system in force in Poland.

Fig. 1: Definition of SMEs

Source: Developed based on the Act on the Law of Entrepreneurs of 6 March 2018

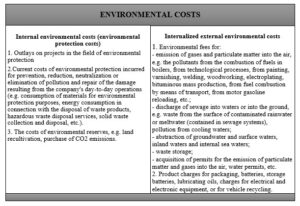

It needs to be noted that the classification presented in Figure 1 takes into account quantitative criteria. In order to classify an entity within a specific category, it must meet two conditions, in at least one of the last two financial years, i.e., the number of employees and the value of the sales revenues or the value of the balance sheet total. The division indicated is in line with the EU Commission Recommendation of 6 May 2003. It has been in force since the 1st of January 2005, in relation to all the measures, policies and programs in the EU. This classification was introduced to Polish legal regulations on January 1st, 2005. What is more, changes were made in the accounting regulations, as to include the concept of micro and small entities (see Figure 2).

Fig. 2: Definition of SMEs according to Accounting Act

Source: Developed based on the Accounting Act of 29 September 1994, as amended

The information presented in Figure 2 indicates that the same criterion was adopted in the Accounting Act with regard to the number of employees. There are differences, however, in the thresholds adopted for the value of the sales revenues and the value of the balance sheet total. As such, when conducting research, usually the number of employees is used for enterprise classification.

In Poland, non-financial SMEs play a significant role in the building of the Polish economy. Their share in the national GDP in 2017 was 49.1%. In these companies, however, the problems associated with natural environment exploitation and protection are not always noticed. This has been indicated in the research carried out in 2008 by the Environmental Partnership Foundation, which indicated that 68% of the companies surveyed believed that their activity had low impact on the natural environment (Zbaraszewski, 2010, p. 527). Another confirmation of SMEs’ low level of awareness of the environmental requirements is the research results presented in the publication “Report of small and medium-sized enterprises in the field of new innovative product development – pro-ecological solutions” (Raport SMEs, 2009). The results indicate that the companies surveyed do not have sufficient knowledge regarding the threats to the environment resulting from their activity, the possible ways of reducing their negative impact on the natural environment, nor on the legal requirements applicable in this area. Similar research results were obtained in 2014 by Kubicka and Kupczyk (2016), as part of a project titled “Green company – the key to enterprise competitiveness”. 52% of the micro and small companies surveyed (i.e., 26 entities) believed that they exerted no negative impact on the natural environment, while 48% admitted to minimal environmental impact of their business activity. What is more, the research carried out by Osiński et al. (2017) in 2014-2015 indicates not only the low ecological awareness on the part of the SMEs surveyed, but also incorrect reporting of their impact on the natural environment. Such situation in particular occurs in micro and small enterprises, which delay the implementation of the obligations resulting from environmental regulations or treat them as insignificant and fail to comply with them at all (see: Osiński et al., 2017, p. 105).

It needs to be noted that the economic activity conducted by entities has direct impact on the natural environment, causing its quality to deteriorate. This state of affairs has been affected not only by the large enterprises operating on the market, but also by the SMEs. As stated by Osiński et al. (2017, p. 97) in unit terms, the impact of a micro or small entity may be minor, but due to the cumulative effect, the total amount of the pollution generated by all companies in this group is of significant importance for the condition of the environment. This results from the fact that these units constitute the vast majority of enterprises in Poland. For this reason, it is important that these entities have access to information on the environmental aspects of their functioning that are associated with their negative impact on the natural environment. Such information includes data on the following in particular:

- water consumption,

- particulate emissions and greenhouse gas emissions,

- solid and liquid waste produced (including hazardous waste),

- the wastewater generated,

- recycling and recovery of waste.

The above-mentioned information groups facilitate SME enterprises in the fulfilment of their reporting obligations resulting from environmental regulations. They additionally constitute the basis for assessment of their impact on the natural environment and for undertaking the measures to protect it.

SMEs’ environmental costs in the light of the legal regulations applicable in Poland

At present, in Poland, enterprises are required to conduct their business activity in accordance with the principles of sustainable development, i.e., in a manner that maintains the quality of the natural environment for the present and the future generations. Such a state of affairs primarily has been influenced by an expansion of the existing legal regulations involving the implementation of:

- a country’s environmental policy that assumes undertaking activities to reduce the pressure on the natural environment;

- the priorities included in the Strategy for Energy Security and Environment – a perspective until 2020, such as: sustainable management of the environmental resources, providing the national economy with a safe and competitive energy supply as well as the improvement of the environment and its condition;

- the priorities adopted by the European Union related to the implementation of sustainable development, contained, inter alia, in such documents as: “Europe 2020 – A European Strategy for Smart, Sustainable and Inclusive Growth”, “Energy 2020 – A Strategy for Competitive, Sustainable and Secure Energy”, “EU Strategy for the Baltic Sea Region”, “Our Life Insurance, Our Natural Capital: An EU biodiversity strategy to 2020”.

A list of selected entrepreneurial obligations resulting from the introduced legal regulations is presented in Figure 3.

Fig. 3: Selected entrepreneurial obligations resulting from the legal regulations

Source: Own elaboration on the basis of the current legal regulations

The information contained in Figure 3 indicates that in their annual reports SMEs do not have to present any information on the impact of their activity on the natural environment nor on the protective measures taken in this area. This is in line with Directive 2014/95/EU, which assumes that individual Member States should not impose any additional administrative burdens on small and medium-sized enterprises. Nevertheless, entities in this group are obliged to prepare reports on environment exploitation, on the assessment of their impact on environment quality, and on their compliance with the principles of environmental protection. Therefore, in order to meet the requirements in this area, they should have access to information on the environmental costs incurred in the course of running business, including the costs associated with:

- acquisition of permits and authorizations for the release of substances or energy into the environment, if the environment exploitation exceeds the scope of general use;

- the fees incurred for environment exploitation (gas and particulate matter emission, sewage emission into waters and into the ground, water abstraction, dumping waste in landfills);

- recycling and achievement of an appropriate level of waste recovery;

- incurrence of administrative penalties (when exceeding or violating the conditions specified in the permit or in the case of a lack of permit);

- the measures taken to protect the natural environment, e.g., projects reducing or neutralizing particulate matter and gas pollution.

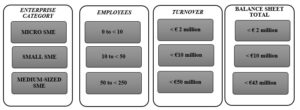

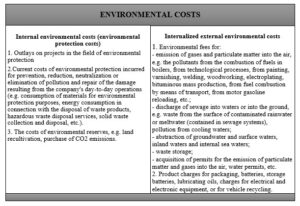

The structure of SMEs’ environmental costs is presented in Figure 4.

Fig.4: The structure of SMEs’ environmental costs

Fig.4: The structure of SMEs’ environmental costs

Source: Developed based on Szadziewska, 2013, pp. 337-361.

In addition to the environmental costs associated with air protection, sewage management and water protection as well as waste and packaging management, which are indicated in Figure 4, enterprises may incur costs associated with the development of their pro-ecological image. These costs include, in particular, the cost of environmental management system implementation and maintenance or the cost of reporting the socially responsible activities undertaken by companies in order to reduce their negative impact on the environment. It should be added, however, that the measurement of environmental costs is not an easy matter. This results from the complex nature of this category, consisting of a large number of elements. Identification and valuation of these costs is not an easy task. Currently, the solutions used in SME cost accounting do not allow discrete classification nor recording and accounting of the environmental costs arising in these companies.

Cost accounting as a source of information on environmental costs in a small manufacturing enterprise – Empirical Study

Compliance with the principles of environmental protection in business operations applies not only to large enterprises, but also to micro and small ones. These units are obliged to submit, to the relevant state-government and local-government bodies, reports on their impact on the natural environment and the protective measures taken in this respect. Nevertheless, as indicated by the research carried out by Osiński et al. (2017, p. 98), the majority of the SMEs surveyed (i.e., 63.6%) did not comply with the obligation to report the amount of gas and particulate matter emissions to the National Center for Emissions management (KOBiZE). Proper waste management was also problematic, in particular with regard to the hazardous waste that ended up in municipal landfills. What is more, the results obtained also indicated that environmental costs, in most of the entities surveyed, have been undervalued. This did not result from the entrepreneurs’ reluctance to incur these costs, but from the lack of awareness of the need to incur such costs (Grudzień et al., 2015, p. 306). For this reason, a need exists to establish the role of cost accounting as a source of information on the environmental costs arising in a small manufacturing enterprise.

Research Questions and Methodology

Analysis of the publications presenting the results of research on environmental cost accounting in SMEs allows a conclusion that a research gap exists concerning the functioning of environmental cost accounting in Polish small and medium-sized enterprises. Assuming that the issues addressed in the work deserve researchers’ interest, the approach prevalent in the literature should be adopted, according to which qualitative research is recommended when the object, the subject or the phenomenon examined has not been covered by research or when only a few of such studies have been conducted (Creswell 2009). It is all the more justified, as a belief function in the literature that the existing research on accounting relies overly on quantitative survey methods, which may distort the correct image of the reality under examination (Van Helden, 2016). Case studies based on observation may be the answer. This call conforms to the general interest in qualitative research in the field of accounting, for better understanding of individual accounting practices aggregated into group behaviors (Hall 2016; Ryan 2002).

For these reasons, the qualitative research strategy was selected for the study. According to Creswell (2009), in a qualitative study, researchers formulate and seek answers to research questions, as opposed to hypotheses. Taking the above and the importance of the available previously cited studies into account, as well as bearing in mind the purpose of the work, the authors formulated the following research questions:

RQ1: What environmental costs are identified and recorded in the cost accounting system of a small manufacturing enterprise?

RQ2: Is the small manufacturing enterprise able to prepare valid environmental reporting based on the environmental information provided by the cost accounting system?

Qualitative research requires multiple sources of data and data triangulation, to increase the credibility of the study, whereas any finding or conclusion drawn from the case study may be more convincing and accurate, if it is based on several different sources of information (Yin, 2014). The case study method was selected as the research approach in this study. Selection of the case was related to participant observation on the part of one of the Authors of this work.

The primary source of evidence was the audited entity’s documentation. The following documents were analyzed, with regard to the criteria described further:

- the entity’s corporate documents, including: the partnership agreement, copy of the register of entrepreneurs of the National Court Register, copy of the data from the National Official Register of Business Entities REGON;

- the accounting policy, understood as a document defining the accounting principles and the internal regulations shaping the entity’s economy;

- annual financial statements;

- environmental reports.

The second source of evidence entailed participatory observation, since one of the Authors participated in activities related to environmental cost accounting implementation and co-created the environmental reporting system in the entity surveyed. The observation was intended to verify how the procedures and the methods implemented as part of cost accounting and environmental reporting are carried out.

The Research Procedure

The case studied was assessed according to the criteria defined with consideration of the available publications on the functioning of environmental cost accounting in enterprises (Dyduch 2016, Ferens 2016, Wendisch, Heupel 2005, Balicka 2016).

The case assessment criteria have been divided into 3 groups associated with the main areas of analysis, that are:

C1 – the manner in which the entity operates,

C2 – environmental cost accounting,

C3 – environmental reporting.

The first group of criteria refers to the organizational and the functional aspects of the entity surveyed and consists of the following sub-criteria:

C1.1 – the formal aspects of running a business,

C1.2 – the subject of activity,

C1.3 – the principles of economic records,

C1.4 – the cost accounting principles.

Assessment of these criteria was focused on the issues that are significant from the perspective of the research question verification process, which mainly concerned accounting and cost accounting issues.

Within the C2 group, the following criteria have been defined:

C2.1 – measurement and recording of the quantity and the quality of the water collected;

C2.2 – measurement and recording of the amount and the type of the gases or the particulate matter introduced into the air;

C2.3 – measurement and recording of the amount and the type of the liquid and solid waste released into water or soil;

C2.4 – measurement and recording of the amount and the type of the liquid and solid waste stored independently;

C2.5 – measurement and recording of the amount and the type of the liquid and solid waste designated for disposal or treatment;

C2.6 – data records containing information on environment exploitation and the amount of the fees due;

C2.7 – valuation and recording of the fees payable for environment exploitation;

C2.8 – recognition of the environment-related costs, in accordance with function-related taxonomy:

- the cost of environment exploitation,

- prevention costs,

- the cost of pollution reduction,

- restitution costs,

- the cost of environmental management system.

The criteria in this group can be treated as features of environmental cost accounting, while the assessment made according to these criteria was focused on verifying whether cost accounting exhibited these features after the implementation process and whether cost accounting exhibited these features during the study. As such, owing to these criteria, it was possible to verify RQ1.

Group C3, related to environmental reporting, mainly consisted of sub-criteria representing various types of environmental reports produced by SMEs.

These criteria, supplemented with criteria related to the method of report development, were intended to help verify RQ2. The criteria structure was as follows:

C3.1 – organization of environmental reporting;

C3.2 – the environmental reporting process;

C3.3 – the information base for environmental reporting;

C3.4 – summary of information regarding environment exploitation and the amount of the fees due;

C3.5 – report on packaged products, on packaging and packaging waste management;

C3.6 – the VOC (Volatile Organic Compound) balance – a report on the compliance with the emission standards for greenhouse gasses and other substances released into the air by entities exploiting the environment;

C3.7 – data summary on the types and the amounts of waste, the methods of waste management and the installations and devices used for recovery and disposal of waste;

C3.8 – report on the weight of manufactured, imported, exported packaging;

C3.9 – report on the amount of the product fee due.

Case Study Findings

The results obtained via the case study analysis, based on the criteria mentioned previously, are as follows:

C1.1 – the enterprise is a legal person, a limited liability company established under the Polish law. The company’s share capital was provided by private entities. The company is classified as a small enterprise, as per the criteria specified in the Accounting Act. The average annual number of job positions in the company is 36, 7 of which are administration and accounting positions. The balance sheet total for 2019 was approximately PLN 8 million, while the sales revenues were approximately PLN 12 million.

C1.2 – the company conducts business activity entailing the processing of waterfowl feathers, resulting in the production of down and feathers that are used as filling in the textile industry – quilt, pillow and clothing filling. For this reason, the company has been classified within the manufacturing industry, with the business activity code of the Polish classification PKD 13, 92, Z, i.e., PRODUCTION OF FINISHED TEXTILE PRODUCTS. The production process with the greatest impact on the environment is the feather washing, as it requires consumption of large amounts of water. Other processes, such as sorting and dedusting, show lower environmental impact.

C1.3 – the company keeps accounting books in accordance with the Polish Accounting Act.

C1.4 – the company’s cost account is characterized by the following features:

- records of the cost of basic production activity are kept based on the types of activity;

- the type-based system of costs is consistent with the range of costs in a comparative profit and loss account;

- product calculation is carried out in accordance with the division method;

- the types of activity costs, in addition to the standard overheads, include the accounts used in product calculation – direct costs, indirect production costs and purchase costs.

C2.1 – the company measures its water consumption for production purposes and separately for non-production purposes. An internal record of this consumption is kept for control and resource management purposes.

C2.2 – the company does not measure its gas or particulate matter emission into the air. In the company’s opinion, such a measurement is not justified, due to the low level of emission.

C2.3 – the company does not measure the amount, nor the type, of the liquid and solid waste discharged into water or soil, since none of its waste is treated in such way.

C2.4 – the company does not measure, nor record, the amount and the type of the liquid and solid waste stored on its own, due to the small amount. Work is currently underway to implement independent treatment of solid waste. Successful implementation of such a process will result in the necessity to keep such records.

C2.5 – the company measures the level of both the liquid waste (post-production water) and the solid waste. An internal record of the amount of waste is kept for control and management purposes. Liquid waste (sewage) is discharged into the municipal sewage system. Solid waste is transferred to entities authorized to dispose it.

C2.6 –the company has been recording information on environment exploitation and the amount of the fees due. Appropriate registers are kept for this purpose.

C2.7 – the entity measures and records the fees due for environment exploitation. The accounting policy incorporates the development of an information subsystem for environmental accounting, through the following:

- definition of the current set of environmental reports that the entity should prepare; this list constitutes part of the document development and circulation regulations, as an attachment to the accounting policy,

- formulation of the scope of the environmental reporting obligations assigned to specific positions in the administration and accounting department; description of these obligations is included in the accounting policy, in the part defining the personnel structure of the administration and accounting department,

- indication of the allocation rules for selected environmental costs; this information is included in the accounting policy, in the section describing the principles for calculation of the costs of manufacturing.

C2.8 – recognition of environmental costs, based on the systematics of a given function within the entity surveyed, entails the following:

- the cost of environment exploitation – recognized separately, via analytics especially-developed within the cost group, divided by the type of activity; this applies to the following costs:

charges for electricity consumption, the costs of water acquisition and treatment, consumption of materials for environmental protection purposes, the energy consumption associated with waste product disposal, waste treatment services, solid waste collection and disposal services, sewage services,

- prevention costs – not specifically included, fall within the scope of indirect production costs (depreciation of the fixed assets involved in pollution prevention, pollution monitoring costs) or overhead costs (resource efficiency training),

- pollution reduction costs – currently they are not recognized separately, because the entity has been including these costs within the costs of environment exploitation, due to their low level; since the company is working on the development of its own water treatment and recycling installation and a solid waste composting installation, the need for separate recognition of these costs will emerge in the future,

- restitution costs – none,

- the cost of the environmental management system – none.

C3.1 – environmental reporting organization has been defined in the accounting policy and is applied in accordance with the procedures established,

C3.2 – the environmental reporting process, verified for the period covered by the study (2019), should be considered correct, which in turn results in the fulfillment of the reporting obligations,

C3.3 – the environmental reporting information base has been defined in the accounting policy, as presented in the criteria C2.7 and C2.8; it should be noted that it was used during the period considered,

C3.4 – the information on environment exploitation and the amount of the fees payable was compiled in a timely and complete manner,

C3.5 – the report on the products in packaging, the packaging and the packaging waste management was prepared in a timely and complete manner,

C3.6 – not applicable,

C3.7 – the list of data on the types and the amounts of waste, the methods of waste management and the installations and devices for recovery and disposal of waste was not created on the basis of the entity’s assessment that there was no such obligation,

C3.8 – not applicable,

C3.9 – the report on the amount of the product fee due was prepared in a timely and complete manner.

Discussion

The case study shows that the entity has not developed any special subsystem of environmental cost accounting. This conclusion is not surprising, as most studies on environmental cost accounting in SMEs show that such entities rarely develop a separate system for recognition of environmental costs (for example: {}). Meanwhile, it has been acknowledged that proper direction for cost accounting development entails the implementation of special procedures and methods for valuation and recognition of environmental costs ({}). Environmental cost accounting is a cost accounting system oriented at proper allocation. It is based on a systematic cause and effect analysis. It allows the linkage of the production costs associated with emission, removal and disposal of waste and sewage with the factors that cause these costs. In traditional cost accounting systems, which the Authors have dealt with in this study, these costs are treated as other indirect costs and are allocated to the cost carriers, without any clear relation. This results in the inability to properly identify and control environmental costs, as there is no appropriate cost allocation to cost centers. Proper allocation of environmental costs to their centers can help reduce these costs ({} Ansari et al. 1997).

Referring to the case study, it should be recognized that the separation of an environmental cost account in the entity examined would significantly contribute to the improvement of the entire cost accounting system. The condition for this entails the implementation of procedures, in accordance with an appropriate pattern. An example of the structure of such a system is shown in Figure 5.

Fig. 5: Conceptual structure of cost accounting in an SME

Source: Own elaboration based by Letmathe, Doost 2000

The account presented valuates the outlays, the processes and the products, in accordance with their actual costs. This procedure creates a decision-oriented information base for the environmental management system and for the planning, control and supervision of material and energy cost flows.

As a result, integration of environmental aspects into all areas of planning occurs. Apart from that, relevant environmental data improve the understanding of business processes. This is particularly important in the face of the steadily growing importance of environmental costs for enterprise operation. Knowledge of the real costs of environment exploitation is a necessary condition for the change, often necessary, in the way of doing business, including a change in the unit’s attitude towards environmental protection.

To achieve this, modification of the existing cost accounting is needed. It should be emphasized that the entity surveyed has the potential for such a change, but it depends on adequate determination on the part of the management staff. Such determination will only emerge when the benefits of additional information outweigh the costs of making the change.

Construction of an environmental cost account, in accordance with the concept proposed, assumes:

- valuation and recording of material and energy costs, along with the related environmental costs – for this purpose, it is necessary to identify and properly describe the significant costs of environment exploitation or the costs of the impact on the environment;

- it is crucial to identify which material and energy costs have significant environmental impact;

- the relevant material and energy costs to be increased by environmental costs can be determined with the real (actual) or standard cost model;

- to calculate environmental costs, it is necessary to register the consumption of materials and energy, in terms of quantity and value;

- by linking the relevant material cost streams with the related environmental costs, the actual cost of material and energy consumption is obtained.

The case study leads to a conclusion that in the entity examined it would be relatively easy to modify the cost accounting applied, as to fit the form of the concept presented. This is evidenced by a fairly extensive set of procedures and methods used by the entity to handle the environmental costs associated with environmentally harmful production. A subjective but clear conclusion from the study is the observation that the entity stopped halfway in the cost accounting modification for the needs of handling the environment-related areas of accounting.

Conclusion, Contributions, Limitations, And Future Research

The study confirmed that the cost accounting maintained in a small enterprise does not provide full record nor control of the environmental costs. These results are consistent with previous studies carried out in Poland (Grudzień et al., 2015; Osiński et al., 2017).

Although the entity fulfills the minimum obligations in terms of both the record keeping and the environmental reporting, it should be recognized that the lack of an environmental cost subsystem, within the structure of the cost account used, generates a significant risk in this area.

The lack of cost account solutions, applied in the field of classification and environmental cost recording (quantitative and valuable), hinders the correct fulfillment of the environmental obligations imposed on SMEs by the legal regulations. In particular, it may refer to the requirement of conducting business in accordance with the principles of sustainable development (e.g., taking actions aimed at reducing the negative impact of business activity on the natural environment).

When answering RQ1, it should be stated that only the environmental costs that are significant for the level of the product manufacturing cost valuation are isolated and recognized. The costs that are less important from this perspective, on the other hand, are ignored and fall within the scope of normal operating costs. This can be considered a system dysfunction, since the costs not currently recognized as product manufacturing costs can also be of significant importance in terms of control and management. This state of affairs can be improved by modifying the cost account in accordance with the concept presented in the previous part of the work.

When answering RQ2, it should be noted that based on the environmental information provided by the cost accounting system, the company surveyed is able to prepare environmental reporting to the minimum extent required by law. There is no doubt that the cost accounting modification recommended would have positive impact on the environmental reporting process – by potentially extending the scope of the data reported. More importantly, cost accounting modification would allow the development of internal environmental reports and environmental reporting for management purposes. Currently, such reporting does not exist in the entity surveyed, whereas the use of internal reporting could significantly support management processes (Petcharat, Mula 2012).

Our research contributes to the extension of knowledge on the role cost accounting in a small manufacturing enterprise plays in the acquisition of environmental information. As a consequence of the case study method, the main limitation of our article, however, is the inability to apply our conclusions to other companies. For this reason, a need exists for further research to determine how SMEs obtain the information they need to develop environmental reporting.

Notes

(Raport SMEs, 2009) The data were collected during the implementation and after the completion of a project titled “Wdrożenie Systemów Zarządzania Środowiskiem w MŚP (Implementation of Environmental Management Systems in SMEs)”. A total of 66 production companies participated in the study (Osiński et al., 2017, p. 99

Natural Environment

The data were collected during the implementation and after the completion of a project titled “Wdrożenie Systemów Zarządzania Środowiskiem w MŚP (Implementation of Environmental Management Systems in SMEs)”. A total of 66 production companies participated in the study (Osiński et al., 2017, p. 99

(adsbygoogle = window.adsbygoogle || []).push({});

References

- ‘Annual Report on European SMEs 2018/2019. Research & Development and Innovation by SMEs’. (2019). [Online], Luxembourg: Publications Office of the European Union, [Retrieved May 20, 2020], https://op.europa.eu/en/publication-detail/-/publication/cadb8188-35b4-11ea-ba6e-01aa75ed71a1/language-en

- Bagliani M., Martini F. (2012), ‘A joint implementation of ecological footprint methodology and cost accounting techniques for measuring environmental pressures at the company level’, Ecological Indicators, 16, 148–156.

- Doorasamy M., Garbharran H. L. (2015), ‘Assessing the Use of Environmental Management Accounting as a Tool to Calculate Environmental Costs and Their Impact on a Company’s Environmental Performance’, International Journal of Management Research and Business Strategy, 4(1), 35-52.

- ‘Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups’. (2014). [Online], European Parliament, Council of the European Union, [Retrived April 25, 2020], http://www.przepisy.gofin.pl/przepisy,4,42,42,2885,,20141115,dyrektywa-parlamentu-europejskiego-i-rady-201495ue-z-dnia.html

- Grudzień Ł., Osiński F., Jasarevic S. (2015), Analysis of the Environmental Costs in Manufacturing Companies in the SME Sector in Poland, Advances in Manufacturing Hamrol A., Ciszak O., Legutko S., Jurczyk M. (ed), 301-310.

- Hellich E., Klonowska, M. (2007), Wyniki wywiadu na temat rachunku kosztów ochrony środowiska, Zarządzanie kosztami jakości, logistyki, innowacji, ochrony środowiska a rachunkowość finansowa, Karmańska A. (ed), Difin, Warszawa.

- Hörisch J., Johnson M. P., Schaltegger S. (2015), ‘Implementation of Sustainability Management and Company Size: A Knowledge-Based View’, Business Strategy and the Environment, 24, 765-779.

- Kubicka J., Kupczyk T. (2016), ‘Wpływ mikro i małych przedsiębiorstw na środowisko naturalne i ich działania na rzecz zrównoważonego rozwoju’, Research Papers of Wroclaw University of Economics, XXX (417), 95-104.

- Majchrzak I. (2006), Koszty ochrony środowiska a rachunek kosztów przedsiębiorstw energetycznych, a doctoral thesis, duplicated material, Szczecin.

- Osiński F., Grudzień Ł., Hamrol A. (2017), ‘Analiza wpływu sektora MŚP na poziom zanieczyszczenia środowiska naturalnego w Polsce, Modern Management Review’, XXII (24), 97-107.

- Raport SMEs (2009), ‘Potencjał małych i średnich przedsiębiorstw w dziedzinie kreowania nowych produktów innowacyjnych – rozwiązania proekologiczne’. (2009). [Online], PSDB, [Retrived April 15, 2020], https://poig.parp.gov.pl/index/more/8866

- Shashi, Roberto Cerchione, Piera Centobelli, Amir Shabani (2018), ‘Sustainability orientation, supply chain integration, and SMEs performance: a causal analysis’, Benchmarking: An International Journal 25(9), 3679-3701.

- Sokołowska A. (2013), Społeczna odpowiedzialność małego przedsiębiorstwa. Identyfikacja, ocena, kierunki doskonalenia, Wydawnictwo Uniwersytetu Ekonomicznego we Wrocławiu, Wrocław.

- Stępień M. (2004), Ochrona środowiska w sprawozdaniu finansowym w aspekcie zarządzania przedsiębiorstwem, Rachunkowość a zintegrowane zarządzanie przedsiębiorstwem, Nowak E., Kaszuba-Perz A. (ed.), Wyższa Szkoła Informatyki i Zarządzania w Rzeszowie, Rzeszów.

- Stępień M. (2005), ‘Rola rachunkowości w ochronie środowiska w opinii praktyków – wyniki badań ankietowych’ Zeszyty Naukowe Akademii Ekonomicznej w Krakowie, 674, 45-60, Economic University in Cracow, Cracow

- Szadziewska A. (2013), Sprawozdawcze i zarządcze aspekty rachunkowości środowiskowej, Wydawnictwo Uniwersytetu Gdańskiego, Gdańsk.

- Wendisch N., Heupel T. (2005), ‘Implementing Environmental Cost Accounting in Small and Medium-Sized Companies’, Implementing Environmental Management Accounting: Status and Challenges, Rikhardsson P. M., Bennett M., Bouma J. J., Schaltegger S. (ed.), Springer, 193-2015.

- ‘The Accounting Act of September 29’ (1994), as amended, [Online], [Retrived April 20, 2020], http://www.przepisy.gofin.pl/przepisy,2,16,43,568,,20201201,ustawa-z-dnia-29091994-r-o-rachunkowosci1.html

- ‘Act on the freedom of economic activity of 2 July 2004’ (2004), as amended, [Online], [Retrived April 21, 2020], https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20041731807

- Zbaraszewski W. (2010), ‘Świadomość ekologiczna małych i średnich przedsiębiorstw w Polsce’, Ekonomiczne Problemy Usług, 51, 525-531.

- Zubalewicz A. (2008), Rachunek kosztów ekologicznych w przedsiębiorstwie e, a doctoral thesis, duplicated material, Economic University in Cracow, Cracow-Białystok.