Introduction

Entities can use several methods or tactics to manage the perceptions of users using the various tools available, undermining the transparency and credibility of the disclosed information (Diouf & Boiral 2017). The literature refers to these processes as impression management (IM).

There are different perspectives on IM in accounting. This paper attempts to summarize this concept from the diverse literature found on this topic in accounting (Beattie and Jones 1999; Godfrey et al. 2003; Clatworthy & Jones 2006; Merkl-Davies & Brennan 2007, 2011; Merkl-Davies et al. 2011). As a result of these views and researchers, IM can be described as management’s strategic role in selecting and manipulating information through different mechanisms. The information can be graphically displayed or described in text form, to influence and, thus, distort the perceptions of the users about the managers or organizations. Some of the aspects under consideration may include managers’ characteristics and entities’ accountability, as well as historical performance and perspectives.

Thus, IM strategies may affect the information provided by entities, influencing stakeholders’ decisions. Stakeholders must therefore distinguish between reliable and misleading information. Different strategies can be used to perform IM (Sandberg & Holmlund 2015). Merkl-Davies and Brennan (2007) divide these strategies into two major analysis areas: concealment and attribution.

Since IM strategies can influence a variety of human actions, Merkl-Davies and Brennan (2011) suggest that this topic encompasses a wide range of topics and subjects. In addition to accounting, it is a popular topic in other fields, such as social and human sciences, anthropology, communication, law, linguistics, management (including marketing and labour relations), sociology, and medical sciences (psychology and sports).

As a significant contribution to the accounting literature, Merkl-Davies and Brennan’s (2007) research has already established a significant position in this field. Later, other more specific literature reviews were performed, such as Beattie and Jones’ (2008) work on graphs.

Nevertheless, those works need to be updated to identify how the latest developments in accounting have been incorporated, such as non-financial reporting and the use of emerging technologies. From a multidisciplinary perspective of analysis, it can also be interesting to assess how matters traditionally covered in areas other than accounting have been incorporated into this field. Accordingly, the following research question was developed: Has the accounting literature on impression management been evolving and incorporating topics that are traditionally outside the scope of accounting?

To this purpose, and as an excerpt from major research on this theme published in a book chapter by Albuquerque et al. (2023) providing an overview of the literature on this subject since the seminal papers from the new research found in 2023, this paper proposes the use of IM strategies with possible implications, direct or indirect, in the accounting area. As a result, this paper presents an evolutionary analysis of the literature. As a source of information, Scopus papers published by 27 August 2022 are selected. As a complementary tool, textual analysis is used to assess the information gathered.

Providing a synthesis of the papers related to this subject, including its evolutive analysis and future avenues for research, this paper contributes to the literature on this topic by providing an outline of the investigations on this topic. However, this study does not seek to provide specific outputs or compare findings from papers from a critical perspective. Instead, the paper aims to summarize existing research and identify traditional and novel themes proposed by their authors. It also identifies their topics and their contributions to the study.

This paper offers a global update on this work, despite proposing a different perspective. In addition, its relevance is also justified by the changes in accounting, as it has been influenced by a variety of factors, such as regulatory changes, stakeholder needs, and technological advances.

Regarding its practical and social implications, the relevance of this topic is justified by its potential impact on the entities’ financial and non-financial reporting, which can be avoided by gaining a better understanding of the sources, tactics, and patterns of IM strategies entities may use. This can be beneficial to a variety of stakeholders, including capital providers and other decision-makers. In addition, standard-setting bodies, auditors, governments, and supervisory agencies are responsible for ensuring the quality of information provided by entities.

This paper is divided into four sections in addition to the Introduction. The second section discusses the sources and methods used in this study. In the third section, the papers selected for the literature review analysis are summarized. A critical assessment of the findings is provided in the fourth section. As a final section, the fifth provides the main conclusions and recommendations for future research.

Material And Methods

This paper uses Scopus data from papers collected by 27 August 2022 to generate its findings. The papers were not restricted in terms of release dates and, therefore, the analysis covers seminal papers as well as the most recent research, providing an evolutionary analysis of this field of literature. In the abstracts of the papers selected, the term “impression management” was used as a keyword. Additionally, only papers published in English-language journals were considered and, lastly, only articles in the “Business, Accounting and Management Area” were considered. After identifying the journals considered by Scopus to be within the accounting area, a secondary filter was applied to exclude papers that covered general IM research. 117 papers were collected for assessment at the end of this process.

A list of the papers assessed is included in the appendix to this study.

An analysis of the abstract of the papers collected is also performed using a textual analysis tool (the {L}exos), as a complementary analysis in the third subsection. Some of the most frequent words are meaningless for research purposes, as is usual in these processes. Consequently, these words must be classified as “stop words” and removed from the analysis. {L}exos is not automatically able to identify those words. Users must identify them. The decision to exclude them must therefore be made based on a judgment. In this study, common abbreviations such as articles, adverbs (mostly conjunctive adverbs), determiners, numbers, prepositions, pronouns, verbs “to be” and “to have” in their different forms, and modal verbs were excluded. In contrast, some adjectives and some adverbs were kept since they could express different feelings of students regarding the topics on non-financial information. Furthermore, the expression “impression management” was also eliminated since it comprises key search terms.

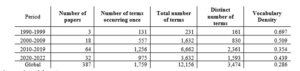

In addition to a global overview, some analysis breaks down the papers into four distinct periods: 1990-99 (the first paper found is from 1991), from 2000 to 2009, from 2010 to 2019, and from 2020 to 2022. The first two periods include the seminal papers in the various investigation lines on the IM strategies, followed by the consolidation period. Although it was shorter than its predecessors, the last period was specifically selected to identify trends in IM strategies in accounting. Therefore, some analysis should consider this element.

A summary of the textual characteristics from the selected papers can be found in Table 1.

Table 1: Summary of the textual characteristics of papers selected by period

Source: Own elaboration

A review of the papers selected is presented in the following subsection.

Literature Review Analysis

As an auxiliary tool to identify the most frequent words included in the abstracts of selected papers, Figure 1 to 5 present two distinct interactions of [L]exos that produced word clouds (whole period and by period).

For the whole period, Figure 1 indicates the most common words.

Figure 1. Word clouds (for the whole period)

Source: Own elaboration

According to Figure 1, there are several terms emerging that are associated with non-financial information, such as “sustainability”, “environmental”, “social” and “nature”, in addition to traditional ways of reporting that are evidenced by the word “financial”, which are associated with non-financial information. “Report”, “reporting”, and “annual” are all words associated with both.

A focus of analysis within the companies’ reporting can be seen in the following terms: “graphs,” “narratives,” “tone,” “textual,” and “discourses” (despite some not being evidenced in the figure above), with a predominant concentration on the second group (accounting narratives). “Earnings” and/or “performance” indicate the common variable assessed by the authors to justify the use of IM strategies. Finally, the identification of words such as “listed” and “public” in the sample suggests that this type of entity is the most common.

Figure 2 shows the most common words for the period from 1990 to 1999.

Figure 2. Word clouds (from 1990 to 1999)

Source: Own elaboration

It is particularly pertinent to highlight the absence of a non-financial information assessment for this specific period in Figure 2.

The three seminal papers collected during this period indicate a diversified focus with the words “accounting” and “explanations” (Aerts, 1994), “public”, “accounting” (also), and “profession” (Neu, 1991), and “graphs” or “graphs”, “per cent” and “distortion” (Beattie and Jones, 1999).

Figure 3 shows, in turn, the most frequent words for the period from 2000 to 2009.

Figure 3. Word clouds (from 2000 to 2009)

Source: Own elaboration

During the period summarized in Figure 3, the increasing number of papers indicated two major lines of investigation related to the use of graphical analysis and accounting narratives.

The main source of information continues to be financial information. In addition, more diversified information appears, such as “prospectuses”, “CEOs” and “managers”. Additionally, the use of theories supported by “legitimacy” theory, as well as the use of different IM strategies, has been demonstrated, for instance, by “selectivity”.

Finally, new terms such as “climate”, “ethics”, and “water” indicate that these themes are emerging.

For the period from 2010 to 2019, Figure 4 provides the same analysis.

Figure 4. Word clouds (from 2010 to 2019)

Source: Own elaboration

Compared to the previous period, Figure 4 shows an increased usage of words like “voluntary”, “social”, “environmental”, “sustainability”, “integrated”, and “biodiversity”, indicating strength in the use of those themes.

Further, most papers from this period are also focused on accounting “narratives”, “tone”, “rhetoric”, “content”, and “disclosures” instead of using graphics for assessing IM strategies. A variety of new information is also evident, such as “press”, “releases”, “media”, and “visual”.

As a final observation, the words “audit”, “external”, “auditors”, and “risk” suggest an increased evaluation of these aspects of IM.

From 2020 onwards, Figure 5 concludes the proposed analysis using {L}exos by presenting the most frequent words for this period.

Figure 5. Word clouds (from 2020 to 2022)

Source: Own elaboration

Based on figure 5, which summarizes the latest period, previous findings are consistent with those pertaining to information types, including financial as well as non-financial content. As evidenced by words such as “sustainability”, “CSR”, “social”, “gender”, “nature”, “power”, and “SASRS”, the authors also use new sources, and pieces of data, as evidenced by words like “call” or “calls”, “non GAAP”, and “SEC”.

In addition, assurance and audit remain relevant in literature as well, as can be seen from words such as “assurance” and “audit”.

Finally, new topics emerge, such as “users” and “stakeholders”, suggesting a broader range of perspectives for analysis.

A more critical discussion of the findings is presented in the next section.

Discussion

A key objective of this paper was to assess how the literature on impression management in accounting has evolved and incorporated trending topics as well as discussions traditionally outside of accounting. As a result of the previous findings, the traditional topics that emerged from 1990 appear to be consolidating. Nonetheless, new avenues of investigation have emerged from 2010 onwards, especially since 2015, proposing diverse sources, contents, and types of analyses where IM strategies may appear, such as:

- from a more diversified set of information about entities that can be used to promote favourable viewpoints and interpretations, possibly influencing auditors’ judgments (Andon & Free 2014), and photographs can also be used to illustrate corporate social responsibility (Chong et al. 2019);

- including innovative methods of releasing information to stakeholders, such as the use of IM strategies in their messages on social media, such as Twitter (Yang & Liu, 2017);

- investigating IM strategies from different perspectives, such as Cardoso et al.’s (2018) stakeholder perspective;

- assessing other influences within the entity other than those by managers, such as the impact of the audit committee on mitigation strategies (Al-Sayani et al., 2020);

- exploring innovative content other than traditional ones in accounting, including gender disclosures (Houssain et al., 2020), carbon emissions (Pitrakkos & Maroun 2020), water (Fialho et al., 2020) as well as child labour and unsustainable farming practices (Perkiss et al., 2021);

- from different sources of analysis that can be used, besides the companies’ financial and integrated reporting, such as audit proposals presented by audit firms to their clients, which can be used as marketing tools to balance potentially conflicting values of professionalism (Chang and Stone, 2021);

- by examining the dynamics of charismatic historic leaders from different perspectives, such as Kumarasinghe and Samkin’s (2020) qualitative research, identifying the techniques they used to convey their leadership, as well as finding similarities between them and contemporary leaders, as well as the research by Parker and Warren (2017) that assessed the accountant’s professional role, identity, values, and image in the face of professional stereotypes;

- by using innovative techniques such as eye tracking experiments proposed by Cho et al. (2020), users’ perspectives are assessed to determine the impact of information. In addition to machine learning, Corazza et al. (2020) propose using more traditional textual analysis tools in conjunction with machine learning.

Thus, this paper demonstrates that seminal papers primarily analysed graphs and messages to manipulate or obfuscate information provided to stakeholders about the entities’ performance. Initial papers focused on mandatory (financial) information, but soon expanded to assess voluntary (non-financial) reports, enriching the sources of analysis, tools and techniques, as well as the topics being addressed.

IM strategy conclusions, limitations, and future avenues for future research are presented in the next section.

Conclusion

This paper shows that this theme remains relevant as long as it can be assessed and adapted considering the trending topics in accounting, even though different IM strategies and investigation lines have been covered in accounting literature since the seminal research of the last decade of the 20th century. As an example of a topic that can be inserted into traditional IM research, the gender-related disclosure analysis emerges as a promising innovation.

According to recent research, non-financial reporting, social media, technological advancements, and innovative information management systems can be used as sources of future research on this topic. It may also be possible to develop different methods and techniques for assessing the use or the impact of IM strategies by entities using new technological tools such as big data analysis, machine learning, and artificial intelligence.

This paper focuses on accounting papers with IM explicitly mentioned in their abstracts, which is its main limitation. IM research has also been associated with a wide range of topics within various social and human sciences, as observed when gathering and reviewing the papers for the literature review. Accounting research can benefit greatly from the inputs found in those papers, and researchers should take note of them. A review of papers published in journals with a traditional background on innovative research, such as Critical Perspectives on Accounting, might also be helpful (see, for example, Jeacle’s (2008) study on the accounting stereotype).

Without presenting specific results, this paper summarizes the themes and characteristics of the papers selected for its scope. Although this is a research-oriented publication, it is useful to a wide range of audiences, which includes researchers, regulators, standard-setting bodies, users, auditors, and other stakeholders who are interested in learning about and identifying different sources and methods of IM strategies for entities.

Acknowledgment

The authors extend sincere gratitude to

- The Instituto Politécnico de Lisboa (IPL/2022/REPUKRAINE_ISCAL) for the valuable support.

References

- Aerts, W. (1994), ‘On the use of accounting logic as an explanatory category in narrative accounting disclosures’, Accounting, Organizations and Society, 19 (4-5), 337–353.

- Albuquerque, F., Stoltzemburg, V., and Cariano, A. (2023). Impression Management in Accounting: Evolution and Trends. In Concepts, Cases, and Regulations in Financial Fraud and Corruption (pp. 184-217). IGI Global.

- Beattie, V. and Jones, M. (2008), ‘Corporate reporting using graphs: A review and synthesis’, Journal of Accounting Literature, 27, 71–110.

- Beattie, V and Jones, M. (1999), ‘Australian financial graphs: An empirical study’, Abacus, 35 (1), 46–76.

- Cardoso, R., Leite, R. and Aquino, A. (2018), ‘The effect of cognitive reflection on the efficacy of impression management: An experimental analysis with financial analysts’, Accounting, Auditing and Accountability Journal, 31 (6), 1668–1690.

- Cho, C., Hageman, A. and Jérôme, T. (2017), ‘Eye-tracking experiments in social and environmental accounting research’ Social and Environmental Accountability Journal, 37 (3), 155–173.

- Clatworthy, M., and Jones, M. (2006), ‘Differential patterns of textual characteristics and company performance in the chairman’s statement’ Accounting, Auditing and Accountability Journal, 19 (4), 493–511.

- Corazza, L., Truant, E., Scagnelli, S. and Mio, C. (2020), ‘Sustainability reporting after the costa concordia disaster: A multi-theory study on legitimacy, impression management and image restoration’ Accounting, Auditing and Accountability Journal, 33 (8), 1909–1941.

- Diouf, D. and Boiral, O. (2017), ‘The quality of sustainability reports and impression management: A stakeholder perspective’ Accounting, Auditing and Accountability Journal, 30 (3), 643–667.

- Godfrey, J., Mather, P. and Ramsay, A. (2003), ‘Earnings and impression management in financial reports: The case of CEO changes’ Abacus, 39 (1), 95–123.

- Hossain, D., Alam, M., Mazumder, M. and Amin, A. (2020), ‘Gender-related discourses in corporate annual reports: an exploratory study on the Bangladeshi companies’ Journal of Accounting and Organizational Change, 17 (3), 394–415.

- Jeacle, I. (2008), ‘Beyond the boring grey: The construction of the colourful accountant’ Critical Perspectives on Accounting, 19 (8), 1296–1320.

- Merkl-Davies, D. and Brennan, N. (2007), ‘Discretionary disclosure strategies in corporate narratives: incremental information or impression management?’ Journal of Accounting Literature, 27, 116–196.

- Merkl-Davies, D. and Brennan, N. (2011), ‘A conceptual framework of impression management: New insights from psychology, sociology and critical perspectives’ Accounting and Business Research, 41 (5), 415–437.

- Merkl-Davies, D., Brennan, N. and McLeay, S. (2011), ‘Impression management and retrospective sense-making in corporate narratives: A social psychology perspective’ Accounting, Auditing and Accountability Journal, 24 (3), 315-344.

- Neu, D. (1991), ‘Trust, impression management and the public accounting profession’ Critical Perspectives on Accounting, 2 (3), 295–313.

- Sandberg, M. and Holmlund, M. (2015), ‘Impression management tactics in sustainability reporting’ Social Responsibility Journal, 11 (4), 677–689.

APPENDIX: Complete list of the papers collected

- Abdelrehim, N., Maltby, J., & Toms, S. (2015). Narrative reporting and crises: British petroleum and shell, 1950–1958. Accounting History, 20(2), 138-157.

- Abeysekera, I. (2020). Intangibles disclosure on entrepreneurial small businesses’ websites to influence stakeholders’ impressions. Australian Accounting Review, 30(1), 22-32.

- Abou-El-Sood, H., & El-Sayed, D. (2022). Abnormal disclosure tone, earnings management and earnings quality. Journal of Applied Accounting Research, 23(2), 402-433.

- Abraham, S., & Bamber, M. (2017). The Q&A: Under surveillance. Accounting, Organizations and Society, 58, 15-31.

- Adler, R., Mansi, M., Pandey, R., & Stringer, C. (2017). United nations decade on biodiversity: A study of the reporting practices of the australian mining industry. Accounting, Auditing and Accountability Journal, 30(8), 1711-1745.

- Aerts, W. (1994). On the use of accounting logic as an explanatory category in narrative accounting disclosures. Accounting, Organizations and Society, 19(4-5), 337-353.

- Aerts, W. (2005). Picking up the pieces: Impression management in the retrospective attributional framing of accounting outcomes. Accounting, Organizations and Society, 30(6), 493-517.

- Aerts, W., & Cheng, P. (2011). Causal disclosures on earnings and earnings management in an IPO setting. Journal of Accounting and Public Policy, 30(5), 431-459.

- Aerts, W., & Yan, B. (2017). Rhetorical impression management in the letter to shareholders and institutional setting: A metadiscourse perspective. Accounting, Auditing and Accountability Journal, 30(2), 404-432.

- Ahmad, N. N. N., & Hossain, D. M. (2019). Exploring the meaning of climate change discourses: an impression management exercise?. Accounting Research Journal, 32(2), 113-128.

- Al-Sayani, Y. M., Mohamad Nor, M. N., & Amran, N. A. (2020). The influence of audit committee characteristics on impression management in chairman statement: Evidence from malaysia. Cogent Business and Management, 7(1)

- Andon, P., & Free, C. (2014). Media coverage of accounting: The NRL salary cap crisis. Accounting, Auditing and Accountability Journal, 27(1), 15-47.

- Barkemeyer, R., Comyns, B., Figge, F., & Napolitano, G. (2014). CEO statements in sustainability reports: Substantive information or background noise? Accounting Forum, 38(4), 241-257.

- Beattie, V., & Jones, M.J. (1999). Australian financial graphs: An empirical study. Abacus, 35(1), 46-76.

- Beattie, V., & Jones, M.J. (2000a). Changing graph use in corporate annual reports: a time‐series analysis. Contemporary Accounting Research, 17(2), 213-226.

- Beattie, V., & Jones, M.J. (2000b). Impression management: the case of inter-country financial graphs. Journal of International Accounting, Auditing and Taxation, 9(2), 159-183.

- Beattie, V., & Jones, M.J. (2002). Measurement Distortion of Graphs in Corporate Reports: An Experimental Study. Accounting, Auditing and Accountability Journal, 15.

- Beattie, V., & Jones, M.J. (2008). Corporate reporting using graphs: A review and synthesis. Journal of Accounting Literature, 27, 71-110.

- Brennan, N.M., Daly, C. A., & Harrington, C. S. (2010). Rhetoric, argument and impression management in hostile takeover defence documents. British Accounting Review, 42(4), 253-268.

- Brennan, N.M., Guillamon-Saorin, E., & Pierce, A. (2009). Impression management: Developing and illustrating a scheme of analysis for narrative disclosures – A methodological note. Accounting, Auditing and Accountability Journal, 22(5), 789-832.

- Brivot, M., Cho, C. H., & Kuhn, J. R. (2015). Marketing or parrhesia: A longitudinal study of AICPA’s shifting languages in times of turbulence. Critical Perspectives on Accounting, 31, 23-43.

- Bujaki, M., & McConomy, B. (2012). Metaphor in nortel’s letters to shareholders 1997-2006. Accounting, Auditing and Accountability Journal, 25(7), 1113-1139.

- Cardoso, R. L., Leite, R. O., & Aquino, A. C. B. (2018). The effect of cognitive reflection on the efficacy of impression management: An experimental analysis with financial analysts. Accounting, Auditing and Accountability Journal, 31(6), 1668-1690.

- Chang, Y-T., & Stone, D.N. (2021). Impression management in public sector audit proposals: Language and fees. European Accounting Review.

- Cho, C.H., Hageman, A.M., & Jérôme, T. (2017). Eye-tracking experiments in social and environmental accounting research. Social and Environmental Accountability Journal, 37(3), 155-173.

- Cho, C.H., Michelon, G., & Patten, D.M. (2012). Enhancement and obfuscation through the use of graphs in sustainability reports: An international comparison. Sustainability Accounting, Management and Policy Journal, 3(1), 74-88.

- Cho, C.H., Roberts, R.W., & Patten, D. M. (2010). The language of US corporate environmental disclosure. Accounting, Organizations and Society, 35(4), 431-443.

- Chong, S., & Rahman, A. (2020). Web-based impression management? salient features for CSR disclosure prominence. Sustainability Accounting, Management and Policy Journal, 11(1), 99-136.

- Clatworthy, M., & Jones, M.J. (2003). Financial reporting of good news and bad news: Evidence from accounting narratives. Accounting and Business Research, 33(3), 171-185.

- Clatworthy, M., & Jones, M.J. (2006). Differential patterns of textual characteristics and company performance in the chairman’s statement. Accounting, Auditing and Accountability Journal, 19(4), 493-511.

- Compernolle, T. (2018). Communication of the external auditor with the audit committee: Managing impressions to deal with multiple accountability relationships. Accounting, Auditing and Accountability Journal, 31(3), 900-924.

- Conway, S. L., O’Keefe, P. A., & Hrasky, S. (2015). Legitimacy, accountability and impression management in NGOs: The indian ocean tsunami. Accounting, Auditing and Accountability Journal, 28(7), 1075-1098.

- Cooper, S., & Slack, R. (2015). Reporting practice, impression management and company performance: A longitudinal and comparative analysis of water leakage disclosure. Accounting and Business Research, 45(6-7), 801-840.

- Corazza, L., Truant, E., Scagnelli, S. D., & Mio, C. (2020). Sustainability reporting after the costa concordia disaster: A multi-theory study on legitimacy, impression management and image restoration. Accounting, Auditing and Accountability Journal, 33(8), 1909-1941.

- Corrigan, L.T. and Rixon, D. (2017), “A dramaturgical accounting of cooperative performance indicators”, Qualitative Research in Accounting & Management, Vol. 14 No. 1, pp. 60-80.

- Courtois, C., & Gendron, Y. (2020). The show must go on! legitimization processes surrounding certified fraud examiners’ claim to expertise. European Accounting Review, 29(3), 437-465.

- Davison, J. (2015). Visualising accounting: An interdisciplinary review and synthesis. Accounting and Business Research, 45(2), 121-165.

- Demaline, C. (2019). Disclosure characteristics of firms being investigated by the SEC. The Journal of Corporate, Accounting and Finance, 30, 11-24.

- Demaline, C. (2020). Disclosure readability of firms investigated for books-and-records infractions: An impression management perspective. Journal of Financial Reporting and Accounting, 18(1), 131-145.

- Dhanani, A., & Kennedy, D. (2022). Envisioning legitimacy: Visual dimensions of NGO annual reports. Accounting, Auditing and Accountability Journal.

- Dilla W.N., Janvrin D.J. (2010). Voluntary Disclosure in Annual Reports: The Association between Magnitude and Direction of Change in Corporate Financial Performance and Graph Use. Accounting Horizons, 24 (2), 257–278.

- Diouf, D., & Boiral, O. (2017). The quality of sustainability reports and impression management: A stakeholder perspective. Accounting, Auditing and Accountability Journal, 30(3), 643-667.

- Dunne, N. J., Brennan, N. M., & Kirwan, C. E. (2021). Impression management and big four auditors: Scrutiny at a public inquiry. Accounting, Organizations and Society, 88.

- Eberhartinger E., Genest N., Lee S. (2020). Financial statement users’ judgment and disaggregated tax disclosure. Journal of International Accounting, Auditing and Taxation, 41.

- Edgar, V. C., Beck, M., & Brennan, N. M. (2018). Impression management in annual report narratives: The case of the UK private finance initiative. Accounting, Auditing and Accountability Journal, 31(6), 1566-1592.

- El-Sayed, D., Adel, E., Elmougy, O., Fawzy, N., Hatem, N., & Elhakey, F. (2021). The influence of narrative disclosure readability, information ordering and graphical representations on non-professional investors’ judgment: Evidence from an emerging market. Journal of Applied Accounting Research, 22(1), 138-167.

- Enache, L., Fogel-Yaari, H., & Li, H. (2022). Signalling long-term focus through textual emphasis on innovation: Are firms putting their money where their mouth is? Accounting and Finance.

- Evans, L., & Pierpoint, J. (2015). Framing the magdalen: Sentimental narratives and impression management in charity annual reporting. Accounting and Business Research, 45(6-7), 661-690.

- Falschlunger, L. M., Eisl, C., Losbichler, H., & Greil, A. M. (2015). Impression management in annual reports of the largest european companies: A longitudinal study on graphical representations. Journal of Applied Accounting Research, 16(3), 383-399.

- Feng, S., & Gao, L. S. (2020). The verbal tone in mandatory environmental disclosures: Evidence from changes in disclosures following SEC guidance. Social and Environmental Accountability Journal, 40(2), 116-139.

- Fialho, A., Morais, A., & Costa, R. P. (2020). Impression management strategies and water disclosures – the case of CDP A-list. Meditari Accountancy Research, 29(3), 568-585.

- Fisher, R., van Staden, C.J., & Richards, G. (2020). Watch that tone: An investigation of the use and stylistic consequences of tone in corporate accountability disclosures. Accounting, Auditing and Accountability Journal, 33(1), 77-105.

- García Osma, B., & Guillamón-Saorín, E. (2011). Corporate governance and impression management in annual results press releases. Accounting, Organizations and Society, 36(4-5), 187-208.

- Godfrey, J., Mather, P., & Ramsay, A. (2003). Earnings and impression management in financial reports: The case of CEO changes. Abacus, 39(1), 95-123.

- Guillamon-Saorin, E., Osma, B. G., & Jones, M.J. (2012). Opportunistic disclosure in press release headlines. Accounting and Business Research, 42(2), 143-168.

- Hadro D., Klimczak K.M., Pauka M. (2017). Impression Management in Letters to Shareholders: Evidence from Poland. Accounting in Europe, 14(3), 305-330.

- Haji A.A., Hossain D.M. (2016). Exploring the implications of integrated reporting on organisational reporting practice: Evidence from highly regarded integrated reporters. Qualitative Research in Accounting and Management, 13(4), 415-444.

- Hamza, S., & Jarboui, A. (2022). CSR or social impression management? tone management in CSR reports. Journal of Financial Reporting and Accounting, 20(3-4), 599-617.

- Henry, E., Hu, N., & Jiang, X. (2020). Relative emphasis on non-GAAP earnings in conference calls: Determinants and market reaction. European Accounting Review, 29(1), 169-197.

- Higgins, C., & Walker, R. (2012). Ethos, logos, pathos: Strategies of persuasion in social/environmental reports. Accounting Forum, 36(3), 194-208.

- Higginson, N., Simmons, C., & Warsame, H. (2006). Environmental disclosure and legitimation in the annual report – evidence from the joint solutions project. Journal of Applied Accounting Research, 8(2), 3-23.

- Holm, C., & Zaman, M. (2012). Regulating audit quality: Restoring trust and legitimacy. Accounting Forum, 36(1), 51-61.

- Hossain D.M., Alam M.S., Mazumder M.M.M., Amin A. (2020). Gender-related discourses in corporate annual reports: an exploratory study on the Bangladeshi companies. Journal of Accounting and Organizational Change, 17(3), 394-415.

- Hrasky, S., & Jones, M.J. (2016). Lake pedder: Accounting, environmental decision-making, nature and impression management. Accounting Forum, 40(4), 285-299.

- Jeacle, I. (2008). Beyond the boring grey: The construction of the colourful accountant. Critical Perspectives on Accounting, 19(8), 1296-1320.

- Jeacle, I. (2014). “And the BAFTA goes to […]”: The assurance role of the auditor in the film awards ceremony. Accounting, Auditing and Accountability Journal, 27(5), 778-808.

- Jeacle, I., & Carter, C. (2012). Fashioning the popular masses: Accounting as mediator between creativity and control. Accounting, Auditing and Accountability Journal, 25(4), 719-751.

- Jones, M.J. (2011). The nature, use and impression management of graphs in social and environmental accounting. Accounting Forum, 35(2), 75-89.

- Jones, M.J., Melis, A., Gaia, S., & Aresu, S. (2018). Does graphical reporting improve risk disclosure? evidence from european banks. Journal of Applied Accounting Research, 19(1), 161-180.

- Jugnandan S., Willows G.D. (2022). “It’s a long story…” – impression management in South African corporate reporting. Accounting Research Journal, 35(5), 581-597.

- Kayed, S., & Meqbel, R. (2022). Earnings management and tone management: Evidence from FTSE 350 companies. Journal of Financial Reporting and Accounting.

- Khanna, K., & Irvine, H. (2018). Communicating the impact of the global financial crisis in annual reports: A study of australian NGOs. Australian Accounting Review, 28(1), 109-126.

- Kumarasinghe, S., & Samkin, G. (2020). Impression management and ancient ceylonese rulers. Accounting History, 25(1), 5-26.

- Lau, C. M., & Martin-Sardesai, A. V. (2012). The role of organisational concern for workplace fairness in the choice of a performance measurement system. British Accounting Review, 44(3), 157-172.

- Leung, S., Parker, L.D., & Courtis, J. (2015). Impression management through minimal narrative disclosure in annual reports. British Accounting Review, 47(3), 275-289.

- Leventis, S., & Weetman, P. (2004). Impression management: Dual language reporting and voluntary disclosure. Accounting Forum, 28(3), 307-328.

- Li, Z., & Haque, S. (2019). Corporate social responsibility employment narratives: A linguistic analysis. Accounting, Auditing and Accountability Journal, 32(6), 1690-1713.

- Martins, A., Gomes, D., Oliveira, L., & Ribeiro, J.L. (2019). Telling a success story through the president’s letter. Qualitative Research in Accounting & Management.

- Mather, P., & Ramsay, A. (2007). Do board characteristics influence impression management through graph selectivity around CEO changes? Australian Accounting Review, 17(42), 84-95.

- Mather, P., Ramsay, A., & Steen, A. (2000). The use and representational faithfulness of graphs in Australian IPO prospectuses. Accounting, Auditing & Accountability Journal, 13(1), 65-83.

- McNally, M. -., & Maroun, W. (2018). It is not always bad news: Illustrating the potential of integrated reporting using a case study in the eco-tourism industry. Accounting, Auditing and Accountability Journal, 31(5), 1319-1348.

- Melloni, G., Caglio, A., & Perego, P. (2017). Saying more with less? disclosure conciseness, completeness and balance in integrated reports. Journal of Accounting and Public Policy, 36(3), 220-238.

- Merkl-Davies, D.M., & Brennan, N.M. (2007). Discretionary disclosure strategies in corporate narratives: incremental information or impression management?. Journal of accounting literature, 27, 116-196.

- Merkl-Davies, D.M., & Brennan, N.M. (2011). A conceptual framework of impression management: New insights from psychology, sociology and critical perspectives. Accounting and Business Research, 41(5), 415-437.

- Merkl-Davies, D.M., Brennan, N.M., & McLeay, S. J. (2011). Impression management and retrospective sense-making in corporate narratives: A social psychology perspective. Accounting, Auditing and Accountability Journal, 24(3), 315-344.

- Miles, S., & Ringham, K. (2020). The boundary of sustainability reporting: Evidence from the FTSE100. Accounting, Auditing and Accountability Journal, 33(2), 357-390.

- Moreno, A., Jones, M.J., & Quinn, M. (2019). A longitudinal study of the textual characteristics in the chairman’s statements of guinness: An impression management perspective. Accounting, Auditing and Accountability Journal, 32(6), 1714-1741.

- Moussa, T., Kotb, A., & Helfaya, A. (2021). An empirical investigation of U.K. environmental targets disclosure: The role of environmental governance and performance. European Accounting Review.

- Nègre, E., Verdier, M. -., Cho, C. H., & Patten, D. M. (2017). Disclosure strategies and investor reactions to downsizing announcements: A legitimacy perspective. Journal of Accounting and Public Policy, 36(3), 239-257.

- Neu, D. (1991). Trust, impression management and the public accounting profession. Critical Perspectives on Accounting, 2(3), 295-313.

- Nyagadza, B., Kadembo, E.M., & Makasi, A. (2020). Exploring internal stakeholders’ emotional attachment & corporate brand perceptions through corporate storytelling for branding. Cogent Business and Management, 7(1)

- Ogden, S., & Clarke, J. (2005). Customer disclosures, impression management and the construction of legitimacy: Corporate reports in the UK privatised water industry. Accounting, Auditing & Accountability Journal, 18(3), 313-345.

- Parker, L.D. (2016). From scientific to activity based office management: a mirage of change. Journal of Accounting & Organizational Change, 12 (2), 177-202.

- Parker, L.D., & Schmitz, J. (2022). The reinvented accounting firm office: Impression management for efficiency, client relations and cost control. Accounting, Organizations and Society, 98

- Parker, L.D., & Warren, S. (2017). The presentation of the self and professional identity: Countering the accountant’s stereotype. Accounting, Auditing and Accountability Journal, 30(8), 1895-1924.

- Perkiss, S., Bernardi, C., Dumay, J., & Haslam, J. (2021). A sticky chocolate problem: Impression management and counter accounts in the shaping of corporate image. Critical Perspectives on Accounting, 81

- Pitrakkos, P., & Maroun, W. (2020). Evaluating the quality of carbon disclosures. Sustainability Accounting, Management and Policy Journal, 11(3), 553-589.

- Riley, T.J., & Luippold, B.L. (2015). Managing investors’ perception through strategic word choices in financial narratives. Journal of Corporate Accounting & Finance, 26(5), 57-62.

- Sahyoun, N., & Magnan, M. (2020). The association between voluntary disclosure in audit committee reports and banks’ earnings management. Managerial Auditing Journal, 35(6), 795-817.

- Samkin, G., & Schneider, A. (2010). Accountability, narrative reporting and legitimation: The case of a new zealand public benefit entity. Accounting, Auditing and Accountability Journal, 23(2), 256-289.

- Schleicher, T. (2012). When is good news really good news? Accounting and Business Research, 42(5), 547-573.

- Schleicher, T., & Walker, M. (2010). Bias in the tone of forward-looking narratives. Accounting and Business Research, 40(4), 371-390.

- Shafer, W.E. (2009). Ethical climate, organizational-professional conflict and organizational commitment: A study of chinese auditors. Accounting, Auditing and Accountability Journal, 22(7), 1087-1110.

- Sheldon, M.D., & Jenkins, J.G. (2020). The influence of firm performance and (level of) assurance on the believability of management’s environmental report. Accounting, Auditing and Accountability Journal, 33(3), 501-528.

- Solomon, J.F., Solomon, A., Joseph, N.L., & Norton, S.D. (2013). Impression management, myth creation and fabrication in private social and environmental reporting: Insights from erving goffman. Accounting, Organizations and Society, 38(3), 195-213.

- Soobaroyen, T., & Mahadeo, J.D. (2016). Community disclosures in a developing country: Insights from a neo-pluralist perspective. Accounting, Auditing and Accountability Journal, 29(3), 452-482.

- Susilo, Y., Asnawi, M., & Wijaya, A. (2021). The effect of supervisor’s authority on auditor’s response. Accounting, 7(5), 1139-1146.

- Sydserff, R., & Weetman, P. (2002). Developments in content analysis: A transitivity index and DICTION scores. Accounting, Auditing & Accountability Journal, 15(4), 523-545.

- Tauringana, V., & Mangena, M. (2014). Board structure and supplementary commentary on the primary financial statements. Journal of Applied Accounting Research, 15(3), 273-290.

- Usmani, M., Davison, J., & Napier, C.J. (2020). The production of stand-alone sustainability reports: Visual impression management, legitimacy and “functional stupidity”. Accounting Forum, 44(4), 315-343.

- Westermann, K.D., Cohen, J., & Trompeter, G. (2019). PCAOB inspections: Public accounting firms on “trial”. Contemporary Accounting Research, 36(2), 694-731.

- Yang, J.H., & Liu, S. (2017). Accounting narratives and impression management on social media. Accounting and Business Research, 47(6), 673-694.

- Yekini, L.S., Wisniewski, T.P., & Millo, Y. (2016). Market reaction to the positiveness of annual report narratives. British Accounting Review, 48(4), 415-430.

- Zeng, X., Momin, M., & Nurunnabi, M. (2022). Photo disclosure in human rights issues by fortune companies: An impression management perspective. Sustainability Accounting, Management and Policy Journal, 13(3), 568-599.

- Zhang, S., & Aerts, W. (2015). Management’s performance justification and failure to meet earnings thresholds. Accounting and Business Research, 45(6-7), 841-868.

- Zhang, Z., & Chen, H. (2020). Media coverage and impression management in corporate social responsibility reports: Evidence from china. Sustainability Accounting, Management and Policy Journal, 11(5), 863-886.

- Zhao, L., & Atkins, J. (2021). Assessing the emancipatory nature of chinese extinction accounting. Social and Environmental Accountability Journal, 41(1-2), 8-36.