Introduction

Any nation follows a macroeconomic policy to achieve full employment, stabilise the price level, achieve economic growth, and stabilise the balance between payment and exchange rate. To do so, countries use the two complement macroeconomic tools; fiscal and monetary policies. Besides, the fiscal policy uses different instruments; taxes, expenditure, public debt and country’s budget to make the economy healthy. However, monetary policy instruments are open market operations, the discount rate and the reserve requirement.

There are contradicting arguments from monetarists and Keynesians on the impact of these macroeconomic policies on the economy. Monetarism is an economic theory which argues that the money supply is the most significant driver of economic growth. When the money supply increases, the households’ demand for goods and firms increases. To satisfy the existing demand, factories produce more which create new job opportunities and increase the income of the households. Hence, monetarists believe that monetary policy is more effective than fiscal policy (Khosravi & Karimi, 2010). Even though stimulus spending adds to the money supply, it results in a deficit, an external debt and a rise in the interest rate. Monetarists believe that central banks are more influential relative to the government in controlling the money supply. However, the Keynesian economists believe that the economy is best controlled by operating the demand for goods and services. They do believe that monetary policies take an enormous amount of time for the economic market to adjust. Generally, Keynesians believe in consumption, government expenditures and net exports to change the state of the economy (Lioudis, 2019).

Keeping the above contradicting arguments in mind, currently, issues related to the relative effectiveness of macroeconomic policies gained a great interest from researchers and decision-makers in both developing and developed countries but rarely in Ethiopia. Although there are studies regarding the impact or effect of monetary or fiscal policies on economic growth of Ethiopia, only one by Owoye & Olugbenga (1994) using VAR model is known to study the empirical research on the relative effectiveness of monetary and fiscal policies on economic growth in the case of selected African countries (including Ethiopia). However, it has a time and methodological gap. Similarly, there is only one study in the case of Ethiopia by Teweldebrehan (2010) using unrestricted vector autoregressions (VARs) framework. Similar to Owoye & Olugbenga (1994), it has the methodological limitation. Further, the researcher suggested that “further studies on this issue are required to make concrete policy recommendations as a single study based recommendation may not be appropriate” (Owoye & Olugbenga (1994), pp. 86). Therefore, this study was conducted to fill the above gaps.

Also, there has been contradicting empirical evidence on the relative effectiveness of monetary and fiscal policies on economic growth in a different part of the world (see empirical literature review part). Hence, based on the above contradicting theories, empirical findings, lack of recent and advanced methodologies and the presence of only one empirical finding in the case of Ethiopia which has doubtful findings, especially on the impact of fiscal policy, along with methodological limitation, the relative effectiveness of monetary and fiscal policies on the Ethiopian economy was conducted to partially fill the methodological gap and to confirm the previous study in the case of Ethiopia using Johansen Cointegration Approach for the time ranging from 1981 to 2008.

Literature Review

This section provides the literature which is relevant to the topic, specifically, the schools of thought on fiscal and monetary policies and structure of fiscal and monetary policies in Ethiopia. Besides, it has an empirical literature.

Schools of Thought on The Effectiveness of Fiscal and Monetary Policies

The Classical or Extreme Monetarists: According to classical economists, the LM curve is vertical. Under this model, the elasticity of demand for money is zero due to the unchanged demand for money when there is a change in the interest rate (Rebmann & Levacic, 1982). Considering the classical assumption of the labour market’s real wage adjustment, regardless the interest rate level, the demand for money is equal to the supply at some level of income when the demand for money is a function of income (Teweldebrehan, 2010). According to Hillier (1997), expansionary/contractionary fiscal policies affect only the push up/ down of the interest rate without affecting the income level. However, an increase/decrease in the money supply shifts the LM curve to the right/left, which increases/ decreases the level of income due to the fall/rise of interest rate which increases/decreases the level of private investment (Hiller, 1997).

The Keynesian Economics: Unlike the monetarist, the Keynesians argue that relative to the monetary policies, fiscal policies are more effective in influencing the economy especially during the liquidity trap; a condition of low-interest rates and high saving rates, making monetary policy ineffective which can be represented by horizontal LM curve in the IS-LM model. When the interest rate is low, individuals expect that it will rise and hence no one will hold the bond fearing capital loss in the future. Hence, an increase in the money supply does not lead to buy bonds by individuals (Teweldebrehan, 2010). In Keynes’s words, ‘liquidity preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields a low rate of interest (Rebmann & Levacic,1982).

The neoclassical Economists: In addition to the relative effectiveness of the fiscal and monetary policy, the feasibility of the Keynesian macroeconomic policies is a big debate between the Keynesians and the neoclassical economists. The neoclassical economists criticise the Keynesians on the basis of the lags between changes in one variable which result in changes in another and that makesboth of them long and very imperfectly known. Given the complexities and uncertainties surrounding this study of how the economy works, the government is most unlikelyable to fine-tune the economy (Hillier, 1997). Further, Keynesians assume that the existence of government policy does not modify the behaviour of individual agents to alter the coefficients (parameters) of the structural equations constituting the model. According to this critique, macroeconomic models should incorporate rationally formed expectations of economic agents with future values of variables (Rebmann & Levacic, 1982). Expectations are rational when they are formed by using the model of the economy which is thought to explain its workings, The application of the rational expectations hypothesis to macroeconomics has been an essential development in the last few years. Models incorporating entirely rational expectations have been developed to show that both fiscal and monetary policies will have no impact on the variables at all if the government’s policy reaction to economic events is forecasted by the private sector (Rebmann & Levacic, 1982). Therefore, neoclassicals believe that: (a) fiscal policy is less important than monetary policy (b) due to insufficient knowledge of the dynamics of the economy, the implementation of both discretionary fiscal and monetary policies cannot succeed. (c) due to the rational expectations of the private sector, both fiscal and monetary policies have a limited impact on the real wage (Teweldebrehan, 2010).

Structure of Fiscal and Monetary Policies in Ethiopia

The federal government budget of Ethiopia is categorized in two parts (public revenue with grant and expenditure and net lending).

Fig. 1: Fiscal Policy Structure of Ethiopia

Source: Authors’ construction based on MoFED database

According to the Ministry of Finance and Economic Development (MoFED) of Ethiopia, there are three different sources of revenue. The first and the primary source of revenue is tax revenue (with a share of 84 % out of the total revenue with grant). The other source of revenue is non-tax revenue (with a share of 8.2 % out of the total revenue with grant). External grants are also one of the sources of revenue in Ethiopia even though its share is small (6.9 %) relative to other sources. Tax revenue in Ethiopia is divided into direct and indirect taxes. The direct taxes average share is 33 % from 2002 to 2012. Besides, the indirect taxes (67 %) have the lion’s share relative to the direct taxes as a source of tax revenue (Daba, 2014).

In Ethiopia, the principal objective of the monetary policy is to maintain price and exchange rate stability and support the rapid and sustainable economic growth of the country. Achieving price stability is a proxy for macroeconomic stability, which is vital for private sectors’ decisions in terms of investment, consumption, saving, international trade, reduction of unemployment and enhancing economic growth. Further, to be competitive in the international market, maintaining exchange rate stability is also a principal policy objective of NBE (NBE, 2009).

Currently, NBE is employing various monetary policy instruments. The policy instruments are similar in most cases to those in other economies elsewhere. These monetary policy instruments are Open Market Operation (OMO), standing central bank credit facility, reserve requirements, setting floor deposit rates, direct inter-bank borrowing or lending mechanism, credit control and moral suasion (NBE, 2001 & 2009).

Empirical Literature

Andersen & Jordan (1968), using OLS estimation technique for the case of the USA applying the quarterly data from 1952:Q1-1968:Q2, found that monetary policy is more effective (in terms of certainty and quickness) in determining the economic growth of the USA. Similarly, using the OLS estimation techniques for six industrialised countries, Batten & Hafer (1983) found that monetary policy is more effective on the economic growth of those countries.

Likewise, Chawdhury (1986b) found that monetary policy variables growth rate have a more significant and long-lasting impact on the real income of Korea than fiscal policies. However, Chawdhury (1986a) found the opposite result for the case of Bangladesh using the same estimation technique for the time between 1972- 1989. Surprisingly, Chowdhury (1988) found a mixed result for the case of six European countries using OLS estimation techniques and quarterly data from1966:Q1-1984:Q4. His finding implies that monetary policies are useful for Denmark, Norway and Sweden. However, fiscal policies are active for Belgium and Netherland and inconclusive for the case of Austria.

Kretzmer (1992) examined monetary versus fiscal policy and found new evidence on an old debate of the USA using the VAR model for the time from 1950:Q2-1979:Q4 and from 1962:Q2-1991: Q4. The study confirms that monetary policy is more effective than fiscal policy in determining the economy.

Owoye & Olugbenga (1994), using the VAR model, found a mixed result for ten African countries. Relative to fiscal policy, monetary policy is more useful for Ghana, Kenya, Morocco, Nigeria and South Africa. However, the reverse is true for Burundi, Ethiopia, Sierra Leone, Tanzania and Zambia. However, Olaloye & Ikhide 1995) found against Owoye & Olugbenga (1994) for Nigeria even though they used a different methodology and time scope. Similarly, Jayaraman (2002) found that fiscal policies are mostly effective for promoting the economic growth of four South Pacific Island countries (Fiji, Samoa, Tonga and Vanuatu). However, both fiscal and monetary policies have no impact on the economic growth for Samoa.

Using cointegration and error correction modelling techniques, Ajisafe & Folorunso (2002) found that the Nigerian economy is more profoundly affected by monetary policy than fiscal policies. A similar result was obtained by Ali et al. (2008) for four South Asian countries (Pakistan, India, Sri Lanka and Bangladesh), Rahman (2009) for Bangladesh, and Adefeso & Mobolaji (2010) for Nigeria even though they used different methodologies (ARDL, VAR and Error correction respectively) and different time frames.

The only known study of the case of Ethiopia is by Teweldebrehan (2010), using unrestricted vector autoregressions (VARs) for the time scope from 1971-2009. The study found that the monetary policy alone has a significantly positive impact on GDP growth in Ethiopia.

Likewise, Senbet (2011), Sanni et al. (2012) and Anna (2012) using Granger causality tests and VAR model, Error correction model, and cointegration and error correction approach respectively, found that the relatively monetary policy has a more powerful effect on the economic growth of the USA, Nigeria and Zimbabwe respectively.

Equally, Rakic & Radenovic (2013) and Havi & Enu (2014) investigated the relative effectiveness of monetary and fiscal policies in the cases of Serbia and Ghana using the ordinary least squares estimation technique. They found that monetary policy is more effective in stimulating economic growth compared to fiscal policy. Whereas, Cyrus & Elias (2014) found that fiscal policy has a significant positive impact on real output growth of Kenya for the period between1997-2010.

Finally, Hussain (2014) and Petrevski et al. (2016) got a mixed result for their studies using panel data for South Asian Association of Regional Cooperation and three South-Eastern European countries using VAR modelrespectively. Hence, monetary policy has been more active on GDP than fiscal policy in the case of Pakistan, Sri Lankaand Bulgaria. However, the fiscal policy contributes more potent than the monetary policy for Bangladesh, India, Nepal, Croatia and Macedonia.

Data Sources, Model Specification, and Methodology of the Study

In this section, the source of data, the model specification and the methodology of the study are presented. All the data are from the World Bank database.

Data Type, Source, and Data Analysis

In this study, secondary data were used for time series data running from 1981 to 2008 and due to the lack of data, it was analyzed only until 2008.

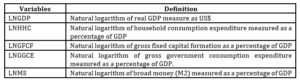

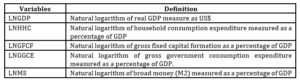

Table 1: Definitions and Measurement

Source: Authors’ construction

Model Specification, Estimation Technique, and Methodology

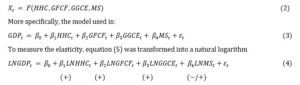

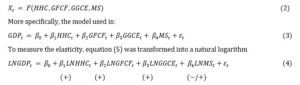

To test the relative effectiveness of monetary and fiscal policies on the Ethiopian economy, this study used the following model:

Based on the theoretical and empirical studies so far, the variables in the vector X are identified. Even though there are many fiscal and monetary policies, the two main variables were concluded; government expenditure and broad money supply., household consumption expenditure was also concluded (to capture consumption) and gross fixed capital formation to capture capital accumulation. Therefore, X is written as:

Where, β0 is an intercept term, and β1, β2, β3, and β4 are the long-run coefficients that will be estimated. The signs in the parenthesis are the expected hypothesised signs of the variables.

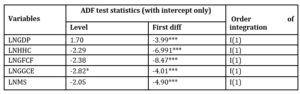

This study used the Johansen cointegration approach to analyse the relative effectiveness of fiscal and monetary policies on the economic growth of Ethiopia. Before estimation, different tasks should be conducted. Hence, the primary step in the time series analysis is testing for the stationarity status of all variables (see Table 2). To avoid spurious results, all variables should be stationary at the level of first difference. For the selected cases (Johansen cointegration), all variables should be I (1). Following the unit root test, the lag length determination and cointegration test are also the other prerequisites before estimation.

Testing the existence of a long-run relationship among the variables included in the model is the last step before estimating the model (equation 6). The two main approaches in the cointegration test are the Engle-Granger two-step approach and the Johansen maximum likelihood estimation procedure. Hence, this study used the latter due to the limitations of the Engle-Granger two-step approach. There are two test statistics for cointegration under the Johansen approach (for more details see Beyene & Kotosz, 2019). Finally, it is necessary to run diagnostic tests; serial correlation, heteroskedasticity, normality and stability tests to confirm the validity of the estimated results.

Results and Discussion

In this section, the unit root test using ADF, the lag length selection using all techniques, the cointegration test using trace statistics and maximum Eigen statistics, long-run and short-run dynamics using Johansen cointegration approach along with the theoretical and empirical support, and diagnostic tests are presented.

Unit Root Test and Lag Length Determination

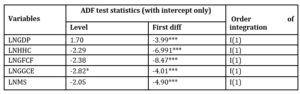

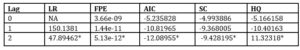

This studychecked the stationary behaviour of all the variables included in the model using the Augmented Dickey-Fuller (ADF) (see Table 2). Further, for the long-run and short-run estimation, all criteria determined two lag length for this model (see Table 3).

Table 2: Unit Root Test

Note *** Significant at 1% level * Significant at 10 % level

All the values in the table are t-statistics,

Source: Authors’ own construction from using EViews 10 result

Table 3: Lag Length Determination

Note: * Optimal lag length using LR, FPE, AIC, BIC, and HQ.

Source: Authors’ own construction from using EViews 10 result

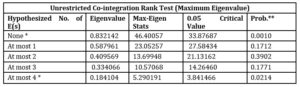

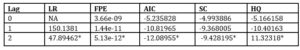

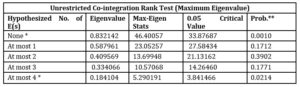

Number of Cointegration Vectors

The trace statistics and the maximum Eigenvalues in table 4 and 5 are the tests to examine the existence of a long-run relationship among the variables. The trace test statistics indicate the presence of two

cointegration equations at the 5 percent level of significance. However, Max-eigenvalue test indicates one cointegrating equation at the 0.05 level. Therefore, a high association between explanatory and dependent variables can be concluded (see Table 4 and 5).

Table 4: Trace Statistics

Note: Trace test indicates 2 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Table 5: Eigenvalue Statistics

Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**Kinnon-Haug-Michelis (1999) p-values

Source: Authors’ own construction from using EViews 10 result

The Long-Run and Short-Run Estimation Results

From Table 4 and 5, both trace test statistics and the Max-eigenvalue test confirmed the existence of a long-run equilibrium relationship between the variables used in this model. The Johansen long-run equation arranged to have a GDP on the left-hand side, is:

*** Significant at 1% level

The t-values of the estimated coefficients are presented in the parenthesis and all of them are significant. All the independent variables are positively and significantly affecting the Ethiopian economy. The rise in the household consumption level and capital accumulation by one percent results in increasing the GDP of Ethiopia by 2.67 and 0.82%, respectively. This result shows that the household consumption level of Ethiopia contributes the major part of the GDP. This is also consistent with the theoretical aspect of the aggregate demand function. Besides, capital formation is the second major contributor to the Ethiopian economy.

When it comes to the target variables, the one percent rise in the government expenditure leads to 0.41% increment in the GDP of Ethiopia. Similarly, the one percent increment in the broad money increases the GDP of Ethiopia by 0.39%. The difference between the coefficient of the fiscal and monetary policies is almost insignificant. Generally, this study can conclude that both fiscal and monetary policies equally contribute to the economy of Ethiopia (likeWaud, 1974 & Jawaid et al. 2010). Besides, this result is consistent with that of (Chowdhury, 1986a; Chowdhury, 1988; Owoye & Olugbenga, 1994; Olaloye & Ikhide, 1995; Jayaraman, 2002 and Cyrus & Elias, 2014). Specifically, this study supports the positive impact of monetary policies on the economic growth; however, it does not support the insignificant impact of the fiscal policy in the study of Teweldebrehan (2010) in the case of Ethiopia.

The short-run equation relates the difference of the dependent variables with the difference of the independent variables and the error term in the lagged periods. Since all results of lag length determination say that the lag length is two. As a result, the short-run estimation has two periods of the lagged difference term for all the variables of the model, which capture the short-run change in the corresponding level. However, the error correction term (ECM) capture the long-run impact.

Table 6: Short-run Estimation Result of D(LNGDP)

*** Significant at 1% level

Source: Authors’ own construction from using EViews 10 result

In the model, the explanatory variables included together explain around 84% of the systematic variation in GDP during the studied period. The F-value of 6.16 is significant at 1% level of significance. Besides, the Durbin-Watson result (2.02) shows the absence of serial correlation of the residuals in the system. Further, a one-year lag difference in household consumption expenditure, gross fixed capital formation, government expenditure and the broad money supply are negatively and significantly affecting the economy of Ethiopia.

One of the possible reasons is that the Ethiopian government has been using these expenditures excessively which led to increased taxes and/or borrowing to finance the government expenditures and this may affect the Ethiopian economy adversely. Also, in the short run, the money supply results in an inflationary pressure and hence, all the household consumption, private investment and the economy will reduce.

The error correction term (ECM (-1)) coefficient is negative and significant as expected, which imply that there is a reasonable adjustment process towards the long-run steady state. This guarantees that although the actual GDP may temporarily deviate from its long-run equilibrium value, it would gradually converge to its equilibrium. The coefficient of the error correction term of -0.73 shows that about 73% of the deviation of the actual GDP from its equilibrium value is eliminated every year, hence, the full adjustment would require more than one year.

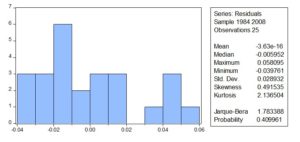

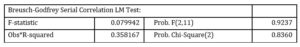

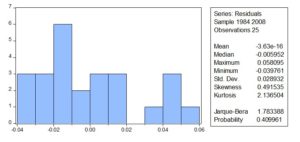

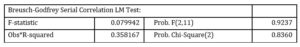

Finally, the diagnostic tests such as the normality, serial-correlation, heteroskedasticity and stability tests have been conducted. Hence, the estimated residuals did not provide any significant evidence of non-normality, serial-correlation, heteroskedasticity or non-stability condition in the error term (see Annex1).

Conclusion

This study aimed at examining the relative effectiveness of fiscal and monetary policies on the Ethiopian economy using the time series data from 1981 to 2008 using the Johansen cointegration approach. This framework does not allow the analysis of the reverse effects. It focused only on the policies’ impacts on the economic performance. The study showed that both monetary and fiscal policies affect the Ethiopian economy positively and significantly. However, relative to monetary policies, the fiscal policies are more important even though their impact is not much higher compared to that of the monetary policy. Finally, it recommends that even though fiscal policy is good for the economy of Ethiopia, it will have a budgetary deficit, inflation and indebtedness. Even though there are different options of revenue (tax) to finance state expenditure, the tax bases in Ethiopia are limited to enhance the revenue and to finance for public expenditures. Also, theoretically, government expenditure leads to demand-pull inflation. Further, relative to fiscal policy, monetary policy is useful in achieving other objectives of the National Bank such as maintenance of price stability, equilibrium in the balance of payment, attainment of full employment and stability in the exchange rate. Therefore, it is better to focus on both policies equally to achieve macroeconomic goals.

Acknowledgements

This research was supported by the project nr. EFOP-3.6.2-16- 2017-00007, titled Aspects on the development of intelligent, sustainable and inclusive society: social, technological, innovation networks in employment and digital economy. The project has been supported by the European Union, co-financed by the European Social Fund and the budget of Hungary. The contents of the paper are the sole responsibility of the authors and can under no circumstances be regarded as reflecting the position of the European Union.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Adefeso, H. A. and Mobolaji, H. (2010) ‘The Fiscal-monetary Policy and Economic Growth in Nigeria: Further Empirical Evidence,’ Pakistan Journal of Social Sciences, 7(2), 137-142.

- Ajisafe, R. A. and Folorunso, B. A. (2002), ‘The Relative Effectiveness of Fiscal and Monetary Policy in Macroeconomic Management in Nigeria,’ The African Economic and Business Review, 3(1), 23-40.

- Ali, S., Irum, S. and Ali, A. (2008), ‘Whether Fiscal Stance or Monetary Policy is Effective for Economic Growth in Case of South Asian Countries,’ The Pakistan Development Review, 47(4), 791-799.

- Andersen, L. C. and Jordan, J. (1968) Monetary and Fiscal Actions: A Test of Their-Relative Importance in Economic Stabilization, Federal Reserve Bank of St. Louis Review, 11-24.

- Anna, C. (2012) ‘The Relative Effectiveness of Monetary and Fiscal Policies on Economic Activity in Zimbabwe: An Error Correction Approach,’ International Journal of Management Sciences and Business Research, 1(5), 1-35.

- Batten, D. and Hafer, R. W. (1983) The Relative Impact of Monetary and Fiscal Actions on Economic Activity: A Cross-Country Comparison, Federal Reserve Bank of St. Louis Review, 65(1): 5-12.

- Beyene, S. D. and Kotosz, B. (2019) ‘The Determinants of External Indebtedness of Ethiopia,’ Udvari B. and Voszka É. (eds), Proceedings of the 3rd Central European PhD Workshop on Economic Policy and Crisis Management, University of Szeged, Doctoral School in Economics, Szeged, 90-107.

- Chowdhury, A. R. (1986a) ‘Monetary and Fiscal Impacts on Economic Activities in Bangladesh: A Note,’ The Bangladesh Development Studies, 14(2), 101-106.

- Chowdhury, A. R. (1986b) ‘Monetary Policy, Fiscal Policy, and Aggregate Economic Activity in Korea,’ Asian Economies, 58, 47-57

- Chowdhury, A. (1988) ‘Monetary Policy, Fiscal Policy and Aggregate Economic Activity: Some Further Evidence,’ Applied Economics, 20(1), 63-71.

- Cyrus, M. and Elias, K. (2014) ‘Monetary and Fiscal Policy Shocks and Economic Growth in Kenya: VAR Econometric Approach,’ Journal of World Economic Research, 3(6), 95-108.

- Daba, D. (2014) ‘Tax Reforms and Tax Revenues Performance in Ethiopia,’ Journal of Economics and Sustainable Development, 5(13), 11-20.

- Havi, E. D. K. and Enu, P. (2014), ‘The Effect of Fiscal Policy and Monetary Policy on Ghana’s Economic Growth: Which Policy Is More Potent?’ International Journal of Empirical Finance, 3(2), 61-75.

- Hillier, B. (1997) The Macroeconomic Debate: Models of the Closed and Open

Economy, Oxford: Blackwell.

- Hussain, M. N. (2014) ‘Empirical Econometric Analysis of Relationship between Fiscal Monetary Policies and Output on SAARC Countries,’ The Journal of Developing Areas, 48(4), 209-224.

- Jawaid, S. T., Arif, I. and Naeemullah, S. M. (2010), ‘Comparative Analysis of Monetary and Fiscal Policy: A Case Study of Pakistan,’ NICE Research Journal, 3, 58-67.

- Jayaraman, T. K. (2002) ‘Efficacy of Fiscal and Monetary Policies in the South Pacific Island Countries: Some Empirical Evidence,’ The Indian Economic Journal, 49(1), 63- 72.

- Khosravi, A. and Karimi, M. S. (2010), ‘To Investigate the Relationship between Monetary, Fiscal Policy and Economic Growth in Iran: Autoregressive Distributed Lag Approach to Cointegration,’ American Journal of Applied Sciences, 7(3), 420-424.

- Kretzmer, P. (1992) ‘Monetary vs. Fiscal Policy: New Evidence on an Old Debate. Federal Reserve Bank of Kansas City,’ Economic Review, 77(2), 21-30.

- Lioudis, N.K. (2019). “Keynesian and Monetarist economics: How do they differ?’ Investopedia [Online], [Retrieved June 25, 2019], https://www.investopedia.com/ask/answers/012615/what-difference-between-keynesian-economics-and-monetarist-economics.asp

- NBE (2001/2009). National Bank of Ethiopia Monetary Policy Framework, Economic Research and Monetary Policy Process, NBE, Addis Ababa,

- Olaloye, A. O. and Ikhide, S. I. (1995), ‘Economic Sustainability and the Role of Fiscal and Monetary Policies in a Depressed Economy: The Case Study of Nigeria,’ Sustainable Development, 3(2), 89-100.

- Owoye, O. and Olugbenga, O. A. (1994), ‘The Relative Importance of Monetary and Fiscal Policies in Selected African Countries,’ Applied Economics, 26(11), 1083-1091.

- Petrevski, G., Bogoev, J. and Tevdovski, D. (2016), ‘Fiscal and Monetary Policy Effects in three South Eastern European Economies,’ Empirical Economics, 50(2), 415-441.

- Rahman, H. (2009) ‘Relative Effectiveness of Monetary and Fiscal Policies on Output Growth in Bangladesh: A VAR Approach,’ Bangladesh Journal of Political Economy, 22(1&2), 419-440.

- Rakić, B. and Rađenović, T. (2013), ‘The Effectiveness of Monetary and Fiscal Policy in Serbia,’ Industrija, 41 (2), 103-122.

- Rebmann, A. and Levacic, R. (1982) Macroeconomics: An Introduction to Keynesian-Neoclassical Controversies, 2nd ed., London: Macmillan.

- Sanni, M. R., Amusa, N. A., and Agbeyangi, B. (2012), ‘Potency of Monetary and Fiscal Policy Instruments on Economic Activities of Nigeria,’ Journal of African

Macroeconomic Review, 3(1), 161-176.

- Senbet, D. (2011) ‘The Relative Impact of Fiscal versus Monetary Actions on Output: A VAR Approach,’ Business and Economic Journal, 25, 1-11.

- Teweldebrehan, T. (2010). Relative Effectiveness of Monetary and Fiscal Policies on Economic growth in Ethiopia. Vector Autoregression approach. A thesis submitted to the School of Graduate Studies of Addis Ababa University in partial fulfilment of the requirements for the Degree of Master of Science in Economics (Economic Policy Analysis) in the School of Economics, Ethiopia, Addis Ababa.

- Waud, R. N. (1974) ‘Monetary and Fiscal Effects on Economic Activity: Reduced Form Examination of Their Relative Importance,’ The Review of Economics and Statistics, 56(2), 177-187.

Annex 1: Diagnostic Tests

Fig. 2: Normality test

Table 7: Autocorrelation test

Table 8: Heteroskedasticity test

Fig. 3: Stability test