Introduction

Banking has become an intensely competitive industry, more so because of the frequent disruptions caused by technological advancements, making it incumbent upon banks to make all out efforts to retain existing customers (Clayton-Smith, 1996; Thomas, 2001; Wong & Wong, 2012). The general belief is that it is always less expensive to retain an existing customer than acquiring new customers (Stone, et al., 1996), though new customers too need to be acquired for sustaining growth. Efficient service and long-term relationships are recognized as the key essentials for continued growth. Not surprisingly, banks are placing considerable emphasis on finding ways of satisfying existing customers to a degree that ensures low switching by them to competing banks (Reichheld, 1996; Wong & Wong, 2012). Empirical evidence presented by Reichheld (1996) suggests that under certain conditions, the ability to retain customers can have a hugely positive impact on a bank’s profit.

In reality retaining existing customers is becoming increasingly difficult because digitalization of the banking industry has made it considerably easier for consumers to hunt for alternative suppliers of banking services. In fact digitalization has resulted in Non-Banking Financial Companies (NBFCs) to compete with banks in several areas, such as educational loans. Margins in the banking industry have been under pressure and entry of NBFCs in areas hitherto served by banks has made things even more difficult. The increasingly aggressive consumers are demanding more at lower costs, which means banks have to think more creatively and be more efficient to retain customers (Shankar, et al., 2003).

While enhanced customer satisfaction is certainly the best way of retaining customers, the need for erecting suitable and effective switching barriers cannot be ignored (Lee, et al., 2001; Ranaweera & Prabhu, 2003; Wong & Wong, 2012). The cost of switching does impact decisions of customers who are apparently dissatisfied with the service. Considering banking services are essentially a continuous purchasing setting, customer retention is not feasible without some switching barriers (Ranaweera & Prabhu, 2003; Wong & Wong, 2012).

Research gaps

Technological advancements are resulting in increasing proliferation of online banking and are forcing banks to rethink almost all components of their operations. While potential opportunities for enhancing customer satisfaction are growing, implying it should become easier to retain customers, it is also true that customers are finding it increasingly easier to switch to alternate service providers. In the increasingly complex scenario, new research gaps are emerging rapidly. Apparently there are three critical gaps in extant research that need to be addressed, particularly in the context of online banking:

- First, different dimensions and configurations of switching barriers used traditionally in retail banking(Tesfom & Birch, 2010; Valenzuela, 2010) need to be examined afresh in the context of the growing usage of online retail banking services.

- Secondly, the reasons for switching have been examined but why customers decide to stay after having considered switching has not been investigated adequately.

- Thirdly, it is acknowledged that heterogeneity of consumers implies varying behaviors (Dabholkar & Bagozzi, 2002; Meuter, et al., 2003; Wong & Wong, 2012) but how the age of a consumer’s relationship with a bank impacts efficacy of switching barriers has not been examined.

Research objectives

While this research attempts to fill the above gaps to a certain extent, there are two major objectives of this research work.

- First, why in certain cases some online banking customers decide to continue with the existing main bank after having considered a switch to another main bank is examined. The bank which respondents use most frequently is treated as the main bank.

- Secondly, how customers with different lengths of relationship with the banks view the switching barriers, i.e. do customers with long relationships think differently from those who have had the relationship for shorter periods when it comes to switching barriers? The age of the relationship is divided into two categories, short and long: short relationship age applies to a customer who has been with his or her main online bank for 4 years or less and a long relationship age means a customer who has been using his or her main online bank for more than 4 years.

The structure of this paper is as follows. The second section provides a review of existing literature on switching barriers and the third section explains the methodology, while the fourth section reports the findings. Conclusions are described in section five.

Theoretical Background

Definitions of switching barriers

Jones et al. (2000) define switching barrier as any factor which makes it more difficult or costly for consumers to change providers. A switching barrier has also been defined as the difficulty a customer faces when dissatisfaction with the existing provider leads to the decision to switch to another provider, which includes financial, social and psychological burden involved in switching to a new carrier (Fornell, 1992). Kim et al. (2003) found that the higher the switching barrier, the more a customer is forced to remain with the existing provider. A switching barrier is what discourages a customer from switching to an alternate service provider because of the cost and difficulties involved in doing so (Jones, et al., 2000). Factors that discourage customers from switching retail bank include search cost, transaction costs, learning costs, loyalty discounts and emotional costs (Pass, 2006; Pont & McQuilken, 2005; Sengupta, et al., 1997; Va´zquez-Carrasco & Foxall, 2006). Besides, there are factors related to uncertainties about the alternate service provider, real or those perceived by the customer, including the likelihood of any expected or unforeseeable adverse consequences of switching (Dowling & Staelin, 1994). Common used switching barriers are either rewarding or punitive or both in nature (Valenzuela, 2010). Most often banking companies erect rewarding as well as punitive barriers to retain existing customers (Valenzuela, 2010).

Rewarding switching barriers

Whatever a bank does to enhance the satisfaction of its customers can be viewed as a rewarding switching barrier (Berry & Parasuraman, 1991; Ranaweera & Prabhu, 2003; Tumball & Willson, 1989; Wong & Wong, 2012). Generally speaking, there are two main rewarding barriers to switching in the retail banking industry: good service recovery and high trust.

Service recovery

When customers are satisfied with the service they receive, particularly recovery after some incident that triggers dissatisfaction, their commitment to the service provider strengthens further (Colgate & Danaher, 2000; Gwinner, et al., 1998). While incidents that trigger dissatisfaction are often the reason why a customer thinks of switching, effective steps taken by a bank to redress the situation, commonly described as service recovery, can often result in the customer-bank relationship actually becoming stronger (Gronroos, 1988; Tesfom & Birch, 2010). After a complaint has been addressed effectively to the entire satisfaction of a customer, that customer is most likely to continue with the relationship, generally with reinforced commitment. Thus service recovery constitutes one of the most effective steps that banks can take on receipt of a complaint from a customer (Zemke, 1993).

Trust

When two parties are dealing with each other and have confidence in each other’s reliability and integrity it constitutes trust between the two (Morgan & Hunt, 1994). Besides integrity, reliability, i.e. the ability to deliver what is promised, is an essential ingredient of trust (Crosby, et al., 1990; Moorman, et al., 1992; Morgan & Hunt, 1994; Schurr & Ozanne, 1985). Consistent performance in respect of the promise is a prerequisite (Moorman, et al., 1992; Morgan & Hunt, 1994; Schurr & Ozanne, 1985). When the consumer has trust in the service provider, the relationship is strengthened since the risk perception and confidence lead to lower transaction costs for both. Naturally, trust encourages the buyer to stay with the same service provider (Ratnasingham, 1998).

Punitive switching barriers

Punitive switching barriers refer to the native reasons that remain in a relationship (Hirschman, 1970). Generally speaking, there are two main punitive barriers to switching in the retail banking industry: high switching costs and lack of alternative attractiveness.

Switching costs

There is a cost attached to not only the finding of an attractive alternative but also to termination of an existing relationship and it is these two costs that constitute what is defined or perceived as switching cost (Patterson & Smith, 2003). These two costs include time required for terminating the existing relationship and establishing a new relationship with a new service provider, besides monetary and psychological costs (Dick & Basu, 1994; Guiltinan, 1989; Jackson, 1985; Jones, et al., 2000; Kim, et al., 2003; Ping, 1993; Sengupta, et al., 1997). Quite often these costs are intimidating enough and even when customers are dissatisfied with service, they decide to continue with the same service provider (Beerli, et al., 2004; Burnham, et al., 2003; Caruana, 2004; Gronhaug & Gilly, 1991). Besides the cost in terms of time and money generally there is a feeling of uncertainty and apprehension which translates into psychological discomfort (Dowling & Staelin, 1994). Correlation between real and perceived switching costs and customer loyalty has been examined extensively in extant research (Lee, et al., 2001; Ping, 1993; Ranaweera & Prabhu, 2003; Wong & Wong, 2012) and most researchers have found that high switching costs often make customers “loyal”, largely because the consumer feels dependent upon the service provider (Morgan & Hunt, 1994; Wong & Wong, 2012).

Lack of alternative attractiveness

It is a given that switching service provider is possible only when an acceptable alternate provider is available (Jones, et al., 2000). When there are viable alternatives available in the market, customers feel sort of encouragement to switch suppliers (Patterson & Smith, 2003). When feasible alternatives are not available, the probability of switching automatically decreases and conversely, adequate availability of alternatives increases the probability of switching (Bendapudi & Berry, 1997; Jones, et al., 2000; Sharma & Patterson, 2000). Hirschman (1970) also found that customer loyalty is boosted when options of alternative suppliers are limited.

Relationship between switching barriers and relationship age

In this context, one factor that has not been examined adequately is the relationship age, i.e. the duration for which the customer has had a relationship with the current service provider. Like all other relationships, customers’ switching barriers also evolve over time. In fact a positive correlation between the market value of a firm and the average age of its relationships with its customers has been reported in prior research (Galbreath, 2002) since the relationship age has a positive effect on corporate reputation (Bartikowski, et al., 2011) and profitability also (Reinartz & Kumar, 2003). As the age of a relationship increases, the effectiveness of switching barriers is enhanced since the trust the customers have in the relationship grows with passage of time and accumulation of experience (Palmatier, et al., 2006). Besides, customers are often able to gain more benefits from the same relationship as the relationship matures, which implies lower risk perceptions and a higher sense of security (Dagger & O’Brien, 2010).

Methods

Selection of industry

The context of this empirical research was online retail banking industry in Hong Kong. Banking, per se, constitutes a continuous purchasing setting where customer satisfaction and switching barriers have high impact on customer retention (Ranaweera & Prabhu, 2003). Continuous purchasing setting is qualitatively different from normal purchasing where a customer has the discretion of sourcing from different suppliers at its own discretion. The relationship between a bank and its customers is generally of a long-term nature. Switching a bank is not an easy decision, more so in case of online banking, because switching requires considerable time, money and effort (Ranaweera & Prabhu, 2003; Wong & Wong, 2012). Therefore, switching decision is often considered and reconsidered even after a decision has been made in principle.

Target population and criteria of sample

Online banking services are used by retail as well as business customers. The target population of this research only included retail customers. The sample for this empirical research was selected on the basis of four specific criteria. The four criteria are that a user must (1) be above 18 years of age, (2) have carried out at least one online banking transaction with his or her main online bank in the preceding month, (3) have registered at least one complaint with his or her main online bank in the preceding 12 months, and (4) have decided to continue with his or her existing main online bank after having thought of switching.

Measurements

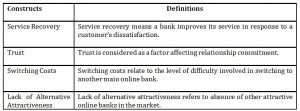

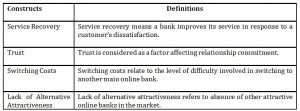

Dimensions of switching barriers used in online banking have not been examined exhaustively. Therefore, dimensions of barriers used in the traditional retail banking were used. These barriers can apparently be applied to online banking services too since in the context of switching barriers, the traditional banking services and online banking services are quite similar. Four switching barrier constructs, namely, service recovery, trust, switching costs and lack of alternative attractiveness, which have been validated in the past, are used in this research. Each construct comprises of three items, measured on seven-point Likert-type scale with anchors “1 = strongly disagree” and “7 = strongly agree”. Definitions of these four constructs are as listed in Table 1. The items in the constructs are listed in Appendix 1. While service recovery and trust are rewarding switching barriers, switching costs and lack of alternative attractiveness are the punitive switching barriers. Demographic information collected was (i) gender, (ii) age, (iii) education and (iv) relationship age.

Table 1: Definitions of Constructs

Questionnaire design

The questionnaire prepared on the basis of the constructs and the items was tested by obtaining opinions of others, such as some online banking professionals in Hong Kong (Converse & Presser, 1986), in order to identify any bias, besides any additional item that may help answer the research objectives. As is routine in research, appropriateness and suitability of the structure, as well as comprehensibility of the questionnaire was examined by a pilot study. Five lecturers teaching marketing, five managers of three local banks, and twenty online retail banking users were consulted. This resulted in rephrasing of some of the questions.

Data collection

Data collection was by way of a questionnaire survey. A few students of marketing were recruited for holding personal interviews with respondents selected from among shoppers coming out of three large shopping malls (Times Square, Langham Place and New Town Plaza) in Hong Kong. The screening process was used for selecting suitable candidates who met the three specific criteria described earlier. Once the potential respondents and interviewees were selected, their consent was sought and obtained for voluntary participation.

Results

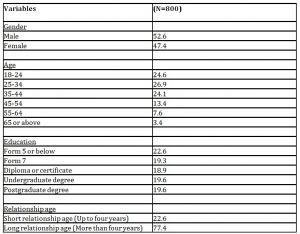

Respondent characteristics

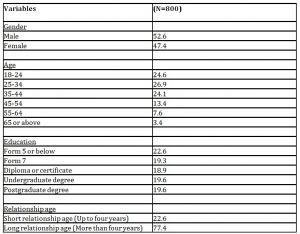

The respondent characteristics are shown in Table 2. Of the 800 responses received for the survey, 52.6% of respondents were male and 47.4% of respondents were female. For the age distribution, each of the age groups of 18-24 (24.6%), 25-34 (26.9%) and 35-44 (24.1%) accounted for about a fourth of the sample size. For the respondents’ education levels, about 39.2% of the respondents held undergraduate or postgraduate degrees and 41.9% had less than a certificate or diploma. For relationship age, an overwhelming majority (77.4%) was of those who said they had relationship with their main online banks more than four years and the rest (22.6%) only had relationship with their main online banks up to four years.

Table 2: Analysis of Respondents Characteristics

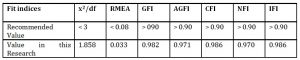

Measurement model analysis

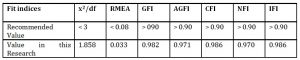

AMOS21 was used for confirmatory factor analysis (CFA) and the results confirm suitability of the four-factor structure comprising service recovery, trust,

switching costs and lack of alternative attractiveness for measuring effectiveness of switching barriers. Model fit indices are as shown in Table 3. All model fit indices have acceptable values (Hair, et al., 1988).

Table 3: Summary of Model Fit Indices

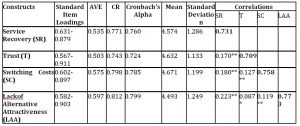

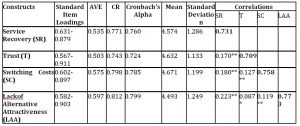

Reliability, validity, descriptive statistics and correlation coefficients

Reliability and validity of the constructs is shown in Table 4, which included standard item loading, average variance extracted (AVE), construct reliability (CR) and Cronbach’s Alpha (Anderson & Gerbing, 1988). All standard item loadings were found to be larger than 0.5, which confirms acceptable construct validity (Cheung, et al., 2000). As AVE values are all >0.5 and all values of CR and Cronbach’s alpha are above 0.700 for each scale, all the four scales stood the test of reliability and convergent validity (Nunnally, 1978).

Table 4: Item Loadings and Validities

Notes:

- ** mean that correlation is significant at the 0.01 level (2-tailed) and * means that correlation is significant at the 0.05 level (2-tailed).

- Square root of AVE (shown in bold diagonal correlation matrix)

Measurements on the constructs were taken by a three-item seven-point Likert-type scale. Average score on the three items was treated as the mean score. Mean scores of service recovery, trust, switching costs and lack of alternative attractiveness are 4.574, 4.632, 4.671 and 4.493 respectively. Since all mean scores are higher than the central point of 4, both rewarding and punitive switching barriers were obviously perceived to be too high by the overall respondents. Correlations among the four constructs were found to be significantly positive (p<0.01 and p<0.05). All square roots of AVE values (shown in bold diagonal correlation matrix) are larger than the off-diagonal elements in the corresponding rows and columns, implying good discriminant validity (Fornell & Larcker, 1981).

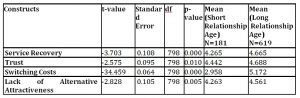

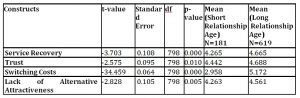

Switching Barriers by Relationship Age

The 800 respondents who returned valid questionnaires were divided into two segments: relationships age of up to four years (short relationship age) and relationships that were older than four years (long relationship age). Differences between perceptions of short relationship age and long relationship age were tested for all the four constructs by independent-samples t-tests (Table 5). It is clear that perceptions of users having short and long-term relationships with their respective main online banks are different for all the four constructs (p<0.01), implying that the two segments view switching barriers differently. The overall results indicate that those with longer relationships with their main online banks find it more difficult to switch to another online bank than those with shorter relationships.

Table 5: Switching Barriers by Relationship Age

Conclusions

This research examined efficacy of switching barriers in the context of the online retail banking industry in Hong Kong. This research is among the first research works that has attempted to correlate the duration of relationship with the existing main online bank to perceptions of switching barriers.

Discussion of Results

In the banking industry, customers often consider switching to alternative banks but eventually decide to continue with the existing bank. While reasons for switching banks have been researched quite extensively, why some customers give up the thought of switching after having seriously considered switching do not appear to have been examined adequately. Validity of the four-factor structure used for measuring perceptions of switching barriers, internal consistency and reliability are confirmed by the confirmatory factor analysis.

The sample of this research included customers having short relationships (up to four years) as well as customers having long relationships (more than four years) with their respective main online banks. The results of independent-samples t-tests show that these two segments of customers clearly have different perceptions of switching barriers. Specifically, those with longer relationships generally find it more difficult to switch to another bank than those with shorter relationships. Consequently, it is suggested that banks should develop various strategies to improve service recovery, to enhance customer trust, to increase customers’ switching costs, and to improve overall attractiveness in order to retain existing customer. The rationale of these suggestions is that the increase of relationship age will also increase the customers’ switching barriers.

Limitations and Future Research

Whatever methodology a research work uses cannot be true or false; it can only be more or less useful (Silverman, 1994). However, all research works face limitations of one kind or another and that applies to this research work also. There are two limitations and suggestions for future research in this research. First, generalizability of the conclusions of this research to a broader range of businesses should be attempted. Instead of focusing only on online banking, it may be desirable that future research may examine and test the four identified factors in other settings such as e-commerce space and other online services like travel related services. Secondly, grouping of the respondents into those with shorter and longer relationship seems too broad and generic in nature. Future research may compare if there are significant differences in the perceptions of switching barriers in terms of customers’ sophistication level of banking service usage in both segments of short and long-term relationships as sophistication level of banking service usage may also impact perceptions and decisions related to switching.

References

- Anderson , J. C. & Gerbing, D. W., 1988. Structural equation modelling in practice: a review and recommended two step approach. Psychological Bulletin, 103(3), pp. 411-423.

- Bartikowski, B., Walsh, G. & Beatty, S. E., 2011. Culture and age as moderators in the corporate reputation and loyalty relationship. Journal of Business Besearch, Volume 64, pp. 966-972.

- Beerli, A., Martin, J. & Quintana, A., 2004. A model of customer loyalty in the retail banking market. European Journal of Marketing, 38(1/2), pp. 253-75.

- Bendapudi, N. & Berry, L., 1997. Customers’ motivations for maintaining relationships with service providers. Journal of Retailing, 71(3), pp. 223-47.

- Berry, L. L. & Parasuraman, A., 1991. Marketing service: competing through Quality. New York: The Free Press.

- Burnham, T., Frels, J. & Mahajan, V., 2003. Consumer switching costs: a typology, antecedents, and consequences. Journal of the Academy of Marketing Science, 31(2), pp. 109-26.

- Caruana, A., 2004. The impact of switching costs on customer loyalty: a study among corporate customers of mobile telephony. Journal of Targeting, Measuring and Analysis for Marketing, 12(3), pp. 256-68.

- Cheung, W., Chang, M. & Lai, V., 2000. Prediction of Internet and world wide web usage at work: a test of an extended triandis model. Decision Support Systems, 30(1), p. 83–100.

- Clayton-Smith, D., 1996. Do it all’s loyalty programme and its impact on customer retention. Managing Service Quality, 6(5), pp. 33-37.

- Colgate, M. & Danaher, P., 2000. Implementing a customer relationship strategy: the asymmetric impact of poor versus excellent execution. Journal of Academy of Marketing Science, 28(3), pp. 375-87.

- Colgate, M. & Lang, B., 2001. Switching barriers in consumer markets: an investigation of the financial services industry. The Journal of Consumer Marketing, 18(4/5), pp. 332-47.

- Converse, J. M. & Presser, S., 1986. Survey Questions: Handcrafting the Standardized Questionnaire, Series: Quantitative Applications in the Social Sciences. London: Sage Publications.

- Crosby, L. A., Evans, K. R. & Cowles, D., 1990. Relationship quality in services selling: an interpersonal influence perspective. Journal of Marketing, 54(July), pp. 68-81.

- Dabholkar, P. & Bagozzi, R. P., 2002. An attitudinal model of technology-based self-service: moderating effects of consumer traits and situational factors. Journal of the Academy of Marketing Science, 30(3), pp. 184-202.

- Dagger, T. S. & O’Brien, T. K., 2010. Does experience matter? differences in relationship benefits, satisfaction, trust, commitment and loyalty for novice and experienced service users. European Journal of Marketing , 44(9/10), pp. 1528-1552.

- Dick, A. S. & Basu, K., 1994. Customer loyalty: toward an integrated conceptual framework. Journal of the Academy of Marketing Science, 22(2), pp. 99-113.

- Dowling, G. & Staelin, R., 1994. A model of perceived risk and intended risk-handling activity. Journal of Consumer Research, 21(1), pp. 119-134.

- Fornell, C., 1992. A national customer satisfaction barometer: the Swedish experience. Journal of Marketing, Volume 56, pp. 6-21.

- Fornell, C. & Larcker, D. F., 1981. Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), pp. 39-50..

- Galbreath, J., 2002. Success in the relationship age: building quality relationship assets for market value creation. The TQM Magazine, 14(1), pp. 8-24.

- Gronhaug, K. & Gilly, M. C., 1991. A transaction cost approach to customer dissatisfaction and complaint actions. Journal of Economic Psychology, Volume 12, pp. 165-183.

- Gronroos, C., 1988. Service quality: the six criteria of good perceived service quality. Review of Business, 9(3), pp. 10-13.

- Guiltinan, J. P., 1989. A classification of switching costs with implications for relationship marketing. In: T. L. Childers, R. P. Bagozzi & J. P. Peter, eds. AMA Winter Educators’ Conference: Marketing Theory and Practice. Chicago: American Marketing Association, pp. 216-220.

- Gwinner, K. R., Gremler, D. D. & Bitner, M. J., 1998. Relational benefits in services industries: the customer’s perspective. Journal of the Academy of Marketing Science, 26(2), pp. 104-114.

- Hair, J., Anderson, R., Tatham, R. & Black, W., 1988. Multivariate Data Analysis. Engleweed Cliffs, NJ: Prentice-Hall.

- Hirschman, A. O., 1970. Exit, Voice and Loyalty Responses to Declines in Firms, Organizations and States. Cambridge, MA: Harvard University Press.

- Jackson, B., 1985. Winning and Keeping Industrial Customers: The Dynamics of Customer Relationships. Lexington: MA: Lexington Books.

- Jones, M., Mothersbaugh, D. & Beatty, S., 2000. Switching barriers and repurchase intentions in services. Journal of Retailing, 76(2), pp. 259-74.

- Julander, C. & Soderberg, R., 2003. Effects of switching barriers on satisfaction, repurchase intentions and attitudinal loyalty. Working Paper Series in Business Administration, 1-22.

- Kim, M., Kliger, D. & Vale, B., 2003. Estimating switching costs: the case of banking. Journal of Financial Intermediation, 12(1), pp. 25-56.

- Lee, J., Lee, J. & Feick, L., 2001. The impact of switching costs on the customer satisfaction-loyalty link: mobile phone service in France. Journal of Services Marketing, 15(1), pp. 35-48.

- Meuter, M. L., Ostrom, A. L., Bitner, M. J. & Roundtree, R., 2003. The influence of technology anxiety on consumer use and experiences with self-service technologies. Journal of Business Research, 56(11), pp. 899-907.

- Moorman, C., Zaltman, G. & Deshpande, R., 1992. Relationships between providers and users of marketing research: the dynamics of trust within and between organizations. Journal of Marketing Research, 29(3), pp. 314-329.

- Morgan, R. M. & Hunt, S. D., 1994. The commitment-trust theory of relationship marketing. Journal of Marketing, 58(3), pp. 20-38.

- Nunnally, N. Y., 1978. Psychometric Methods. New York: McGraw-Hill.

- Palmatier, R. W., Dant, R. P. & Grewal, D., 2006. Factors Influencing the effectiveness of relationship marketing: a meta-analysis. Journal of Marketing, 70(October), p. 136–153.

- Pass, M. W., 2006. Western US college students: banking preferences and marketplace performance. Journal of Financial Services Marketing, 11(1), pp. 49-63.

- Patterson, P. & Smith, T., 2003. A cross cultural study of switching barriers and propensity to stay with service providers. Journal of Retailing, Volume 79, pp. 107-20.

- Ping, R., 1993. The effects of satisfaction and structural constraints on retailer exiting, voice, loyalty, opportunism, and neglece. Journal of Retailing, 69(3), pp. 320-52.

- Pont, M. & McQuilken, L., 2005. An empirical investigation of customer satisfaction and loyalty across two divergent bank segments. Journal of Financial Services Marketing, 9(4), pp. 344-359.

- Ranaweera, C. & Prabhu, J., 2003. The influence of satisfaction, trust, and switching barriers on customer retention in a continuous purchasing setting. International Journal of Service Industry Management, 14(3/4), pp. 374-95.

- Ratnasingham, P., 1998. The importance of trust in electronic commerce. Internet Research: Electronic Networking Applications and Policy, 8(4), pp. 313-321.

- Reichheld, F. F., 1996. The loyalty effect: the hidden force behind growth, profits, and lasting value. Boston: MA: Harvard Business School Press.

- Reinartz, W. J. & Kumar, V., 2003. The impact of customer relationship characteristics on profitable lifetime duration. Journal of Marketing, 67(1), pp. 77-99.

- Schurr, P. H. & Ozanne, J. L., 1985. Influences on exchange processes: buyers’ toughness. Journal of Consumer Research, Volume 11, pp. 939-953.

- Sengupta, S., Krapfel, R. E. & Pusateri, M. A., 1997. Switching costs in key account relationships. Journal of Personal Selling & Sales Management, 17(4), pp. 9-16.

- Shankar, V., Smith, A. K. & Rangaswamy, A., 2003. Customer satisfaction and loyalty in online and offline environments. International Journal of Research in Marketing, 20(2), pp. 153-175.

- Sharma, N. & Patterson, P., 2000. Switching costs in key account relationships. International Journal of Service Industry Management, 11(5), pp. 470-90.

- Silverman, D., 1994. Interpreting Qualitative Data. London: Sage.

- Stone, M., Neil, W. & Muriel, W., 1996. Managing the change from marketing planning to customer relationship management. Long Range Planning, 29(5), pp. 675-683.

- Tesfom, G. & Birch, N. J., 2010. Do switching barriers in the retail banking industry influence bank customers in different age groups differently?. Journal of Service Marketing, 25(5), pp. 371-380.

- Thomas, J. S., 2001. A methodology for linking customer acquisition to customer retention. Journal of Marketing Research, 38(2), pp. 262-268.

- Tumball, L. & Willson, D., 1989. Developing and protecting profitable customer relationships. Industrial Marketing Management, Volume 18, pp. 233-8.

- Va´zquez-Carrasco, R. & Foxall, G. R., 2006. Positive vs negative switching barriers: the influence oositive vs negative switching barriers: the influence of service consumers’ need for variety. Journal of Consumer Behavior, 5(4), pp. 367-379.

- Valenzuela, F., 2010. Switching barriers used to retain retail banking customers: some empirical evidence from a South American country. Management Research Review, 33(7), pp. 749-766.

- Wong, C. B. & Wong, K. L., 2012. The moderating effect of switching barriers: online stock and derivatives trading. GSTF Business Review, 2(2), pp. 245-251.

- Zemke, R., 1993. The art of service recovery: fixing broken customers and keeping them on your side. In: E. Scheuing & W. Christopher, eds. The Service Quality Handbook. New York: American Management Association, pp. 463-476.

Appendix

Appendix 1: Measurement items and Definition of Constructs

Service Recovery (Adapted from Tesfom and Birch (2011))

- My complaint was addressed by my main online bank.

- I was satisfied with the way my main online bank responded to my complaint.

- My main online bank made adequate efforts to resolve my complaint.

Trust (Adapted from Morgan and Hunt (1994))

- I can trust my main online bank completely.

- My main online bank meets my expectations.

- My main online bank has high integrity.

Switching Costs (Adapted from Julander and Solander (2003))

- It would cost me a lot of time or effort to switch to another main online bank.

- It is risky to change my main online bank as the new bank may not give good services.

- Considering everything the cost to stop using my main online bank and start up with a new bank would be high.

Lack of Alternative Attractiveness (Adapted from Colgate and Lang (2001))

- All online banking service providers are the same.

- I am not sure what kind of services I shall get if I choose another main online bank.

- Other online banks do not offer better service.