Introduction

In the conditions of crisis and post-crisis state of economies, the main directions in the development of the banking sector are achieving the strategic goals set, ensuring the growth of profitability and increasing the inflow of deposits. In a constantly changing economic environment, the attention of bank financial intermediaries should be focused on business processes that allow achieving primary goals. At the same time, the state regulator and the banking sector should aim to ensure the effectiveness of the implementation of measures with prior identification of financial risks and the following ways to respond to (influence) them. The detailed consideration of the organization of the state regulator and banks, in terms of making sound management decisions in conditions of endogenous and exogenous shocks and imbalances, becomes especially relevant, as these management decisions have direct and indirect impacts on the social and economic development sectors.

Authors such as Dyakonova, Kravchuk, Mordan and Onopriienko (2018) as well as Dzybliuk and Priydun (2008) investigate the problem of effective state regulation of the banking sector in terms of integrating the economy of the country into the world economy. They display all this in their works. Also, Popov (2000) has been researching the formation and development of a modern conceptual apparatus for state regulation, noting that banking is a rule-making and individual-authoritative activity of regulatory entities, aimed at streamlining the formation and operation of credit institutions, the banking sector in general, the formation and maintenance of sustainable law and order in the field of banking, as well as protecting the rights and legitimate interests of its participants and individuals. The disadvantage of this interpretation is that the author considers state regulation from the angle of legal mechanisms. He considers state regulation as a normative and individual-authoritative influence of specially authorized bodies on the banking sector in order to streamline the activities of its elements, protect people’s rights and legitimate interests of interacting with them, and form and maintain sustainable law and order in banking.

It should also be noted that in their works, Polykova and Moskovkina (1996) consider the concept of state regulation of banking and interpret its essence solely through the activities of the central bank. However, the problem of the impact of such regulation on the social and economic development of the state in constantly changing economies and financial risks has not received the necessary coverage in the economic literature yet. This has given the reason to consider the issue of state regulation of the banking sector not only in the context of individual methods and aspects of measuring financial risks, but also in the context of different groups of risks in the complex. This includes a comparison of: 1) capital calculated on the basis of the standard approach of Basel II and the structural model, 2) short-term liquidity and increased stable long-term financing in accordance with the requirements of Basel II. The use of the method of analogies allowed taking into account the results of international experiences in terms of implementing the structural model and applying it in the analysis of the Ukrainian banking sector as a whole.

The main part

As part of studying the possibilities of applying the structural model on real empirical data, the authors of this paper propose analyzing the results of the model as follows:

- In a situation of economic crisis, based on the influence of the state regulator, the financial performance of banks and the socio-economic development of the country;

- Using the financial performance of Ukrainian banks, in particular, to compare the amount of capital calculated on the basis of the standard approach of Basel II, the advanced approach of Basel II and the structural model. Thus, it will be possible to identify reliable banks with a state share, foreign banking groups and banks with private capital, as well as a group of banks for which it is necessary to take measures by the state regulator;

- Using the financial indicators of the banking sector such as capital and liquidity, which will illustrate the success of the structural model.

The first step in the study is to analyze the evolution of the basic concepts of state regulation of the banking sector.

As a result of analyzing different theoretical and methodological approaches in the economic literature, three groups of scientific concepts have been identified, the content of which differs depending on the presence (or absence) of relationships between banking and other sectors of the economy, and the degree of their impact on economic processes. However, together, they determine the development opportunities of these sectors under the combined influence of endogenous and exogenous factors.

Some authors have recognized the autonomous nature of state regulation of the banking sector and social and economic spheres. At the same time, the process of synergy between them is interpreted as the necessity to implement the intermediary function of banks, which is primarily the concentration of loan capital and its redistribution between economic activities. Self-sufficiency and the independence of these areas determine the random nature of the generation of possible effects (Chmutova, Vovk and Bezrodna, 2017).

The development of market relations in Ukraine is characterized by the weak development of the banking sector, credit and their role in the social and economic development. Currently, a set of scientific concepts that are based on the principle of “classical dichotomy” is being formed, such as the independent functioning of economic sectors and their institutional units, denying the significant impact of their synergy on each other and on the whole economy.

Bank financial intermediaries are the ones that stimulate the sale of accumulated goods through loans, the size of which at some point begins to exceed reasonable limits and repayment possibilities, exacerbating the problem of defaults and the crisis of commodity production (Mikhasyuk, Zaloga and Sukhai, 2010). However, in the authors’ opinion, not all ideas about the synergy of banking and other sectors of the economy have found their practical confirmation due to the underestimation of the ability of markets to self-development.

Later, a number of crises (the Great Depression of 1929–1933 and the Great Recession of 2007–2008) demonstrated the lack of validity of the conclusions made. In modern conditions, there are many examples of countries that have managed to ensure a sustainable interaction between institutional sectors and the whole economy not only through lending and investment operations, but also through other banking operations, regardless of any integration processes (Douglas, 2014; and Grydzhuk, 2017).

After the events of 2007-2008, more and more studies began to appear in the economic literature whose results indicate a gradual separation of cash capital flows from the flow of goods and services. This became the basis of the concept of separation of the financial (including banking) sector from social and economic processes. Thus, Menkhoff and Tolksdorf (2007) concluded that the growing diversity of banking instruments determined the quantitative and qualitative dominance of speculative elements over the mechanisms mediated by the functioning and development of the social and economic spheres. These authors came to the conclusion about self-sufficiency and the possibilities of the autonomous functioning of sectors, the synergy between which was episodic, not systemic. It is important to emphasize that they are unanimous in the fact that the closeness of the relationship between the subjects of synergy cannot be determined by any external forces (institutions), but is limited by the laws of the market. In the authors’ opinion, the current practice and specifics of synergy between the banking sector and the social and economic spheres in terms of the accumulation and mobilization of capital, risk assessment and management, as well as current regulatory standards indicate the existence of a range of links. They determine the interdependence of the subjects, their essential institutional nature and the ability to provide effects both for the subjects of economic sectors and for the macro-environment where the process of their synergy is taking place.

Some scientific concepts recognize the interdependence between the banking sector and the social and economic spheres, and the results of synergies between them may not always be positive due to a number of external conditions and factors, and therefore regulated (Fridman, 2017). First of all, it is noted that the strong interdependence between the banking sector and the social and economic spheres often cause a change in cyclical stages, which requires appropriate methods of government regulation to ensure the sustainable economic development.

Research Methodology

It is advisable to calculate the economic capital taking into account the aggregation of market and credit risks that affect the banking sector and the degree of confidence in the social and economic spheres as a consumer of various financial services. Taking their correlation into account allows obtaining a net position of a bank with a state share, a bank of foreign banking groups and a bank with private capital on risks. It is much lower than the estimates which were obtained from adopting the conservative principles of Basel III aggregation. Basel IV already exists, but since the banking sector is currently trying to implement Basel III, the authors consider that it is appropriate to conduct an assessment using Basel II. At the same time, a significant disadvantage of simply summing up financial and banking risks is ignoring the fundamental principle of risk management – diversification. Considering market and credit risks, general financial risk factors can be identified in operational risks, which will allow obtaining more realistic estimates of the aggregate financial risk.

Farrakhov (2012), a Professor in Basel University, also considered the factorial method of determining the amount of the aggregate financial risk, in particular, the aggregation of credit and market risk (stock, currency and interest rate risks), where he has showed that financial risk factors include the cumulative probability of default during the year (credit risk) and changes in market prices, market indices, exchange rates, and interest rates (market risk).

The disadvantage of the existing factor models is the approach regarding the choice of financial risk factors, as well as the rather narrow range of these risks (operational and business risks are not taken into account). It is also very difficult to assess the impact of selected financial risk factors on the expected income of the banking sector. At the same time, the impact of changes in financial risk factors on the change in the value of the portfolio is assessed. However, in this model, the authors will assess the impact of risks on the banking sector and determine its consequences to ensure social and economic development.

The authors of this paper have considered the dynamics of financial risk factors and volumes of relevant portfolios exposed to this risk from 2015 to 2019 for banks with state share, banks of foreign banking groups and banks with private capital: the return on loans (including the cost of provisions) of individuals and legal entities, the banking sector, the value of deposits of individuals and legal entities, the profitability of the market portfolio of securities, as well as the share of administrative and economic costs in the assets of the banking sector.

To compare this, the results of a stress test are presented, conducted by one of the Ukrainian banks to assess the real financial condition of the banking sector in June 2018. The stress test showed that about one third of state-owned banks, banks of foreign banking groups and banks with private capital did not pass it, and therefore could not comply with NBU standards. So, in the authors’ opinion, this information can be useful for the social and economic sectors in the process of choosing the bank for placing funds, as well as for the state regulator in terms of introducing precautionary measures to address possible future financial problems in the banking sector.

The total losses in the case of implementing the scenario laid down in the studied bank would amount to 5.2% of the GDP or 50.7% of the capital of banks of foreign banking groups and banks with private capital, which on the first of January, 2020 was amounted to UAH 2,439 billion. As a result, in most banks of foreign banking groups and banks with private capital, the level of capital adequacy will reach below the minimum set mark of 10%, and in 80% of them – and will be below 2%.

When the calculations of the structural model are used, the total losses of the banking sector will be 71.7% (with a confidence level of 99%), which exceeds the National Ukrainian bank estimated by 40%. At the same time, about 60% of banks of foreign banking groups and banks with private capital will not be able to keep the level of capital adequacy above the regulatory value. In the authors’ opinion, the stress test confirms the urgency of increasing the capital adequacy of state-owned banks, banks of foreign banking groups and banks with private capital of Ukraine, which, in the face of negative systemic changes, will have to resist the declining quality and volatility of the banking sector profitability.

Without taking preventive measures, the average capital adequacy ratio of banks with a state share, banks of foreign banking groups and banks with private capital of Ukraine will decrease more than 2 times and will exceed the permissible limits. Therefore, in the authors’ opinion, the state regulator should require the banking sector to change the internal procedures for assessing capital adequacy and conduct stress testing of its portfolios in terms of realizing all financial risks, as well as to form a system of VaR-limits not only by types of risks and operations.

Results of the research

This section presents which assessment of the total financial risk of banks with a state share, banks of foreign banking groups and banks with private capital will be received if the structural model is applied to the empirical indicators of their activities. It is also necessary to determine how this assessment will differ from the values of regulatory capital, which is assessed using the recommended approaches of the Basel Committee on Banking Supervision.

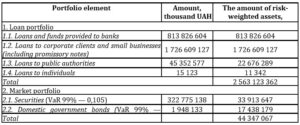

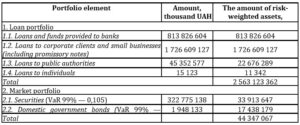

According to the standard approach, the amount of credit risk is calculated as 8% of the amount of risk-weighted assets. Such assets are calculated as the product of the volume of the asset by the risk ratio, which depends on the external credit rating. Ratings, which are used at the sub-portfolio level of the loan portfolio, are presented in table 1.

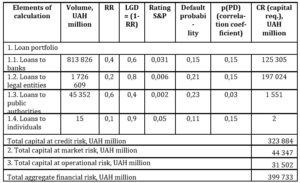

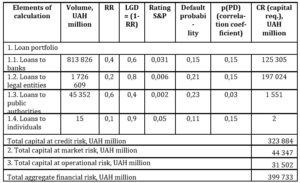

The amount of market risk is calculated as the product of VaR 99% return and the size of the risk position for the relevant portfolio (securities portfolio and currency position). The operational risk has been calculated in accordance with the basic indicative approach of Basel II. According to this approach, the operational risk is 15% of the average annual gross income of the banking sector for the last five years. The amount of operational risk under the basic indicative approach is 3,253,965 thousand UAH. The total aggregate financial risk, in accordance with the standard approach of Basel II, is 8% * (2,563,123,362 + 12.5 * 3,253,965 + 12.5 * 44,347,067) = 252,650,900.96 thousand UAH.

According to the advanced approach, capital requirements are calculated based on the probability of counterparty default, which in its turn depends on the rating and conditions of Basel II:

Table 1: Calculation of risk-weighted assets according to the standard approach (as of 01.01.2020)

The calculation of risk-weighted assets according to the advanced approach is presented in table 2.

Table 2: Calculation of risk-weighted assets according to the advanced approach (as of 01.01.2020)

The results shown by the application of the structural model to the empirical data of the banking sector are considered. The authors of this paper have identified the following risk factors for the purposes of this experiment:

- Profitability less the provisioning rate for portfolios:

– Loans and advances to state-owned banks, banks of foreign banking groups and banks with private capital;

– Loans to the non-financial corporations sector (corporate clients and small businesses);

– Loans to government agencies;

– Loans to the social sector (individuals).

- Yield of the securities portfolio, exchange rate fluctuations.

- Specific weight per unit of assets of administrative and other expenses.

- Specific weight per unit of assets of commissions and other income/expenses.

- The cost of involved resources.

Multiplying the obtained value by ROA and the size of assets (ROA * Assets = profit), the size of the total financial risk of the banking sector is obtained- 520 343 644 thousand UAH. It is also necessary to consider the business risk factor, which shows the impact of deviations in the size of assets on the profits of the banking sector.

The business risk has been calculated according to the data obtained as the product of VaR 99% relative deviation of the amount of assets for 5 years of observations (value 2.93), multiplied by the current amount of profit, 15 948 415 thousand UAH (as of 01.01.2020). Thus, the business risk in the proposed model is 46 739 997 thousand UAH. As a result, the total financial risk of the banking sector is equal to 520 343 644 + 46739997 = 567 107 540 thousand UAH.

Therefore, the total financial risk, calculated in three ways, is as follows:

- According to the standard approach of Basel II – 280 899 095 thousand UAH.

- On the advanced approach of Basel II – 399 733 270 thousand UAH.

- According to the structural model – 567 107 540 thousand UAH (business risk 46 739 997 thousand UAH, other risks – 520 343 644 thousand UAH).

Conclusion

The presented model has been tested on the basis of empirical data of banks with state share, banks of foreign banking groups and banks with private capital. The results of the calculations show that the structural model gives more conservative estimates of the capital needed to cover the financial risks of the banking sector, compared with stress testing data. The amount of aggregate financial risk, calculated according to the structural model, significantly exceeds similar values for the Basel II approaches used to calculate regulatory capital (compared to the standard approach, it is 2 times higher, and compared to the advanced – 1.4 times higher); however, this is sufficient to meet the requirements of Basel III. This is due to the inclusion of a business risk component that is not taken into account in the calculation of the Basel models. The Basel Committee on Banking Supervision recommends taking it into account in the internal capital adequacy assessment procedures of the banking sector.

Thus, the authors have built a model that takes into account various factors of financial risks and their integral impact on the financial performance of the banking sector, which will allow banks to assess the capital needed to cover financial risks on time, and keep liquidity at the level of Basel II. Considering the state regulator, it will take measures to minimize risks on time, and, as a consequence, to minimize losses of the social and economic spheres. Also, the application of the structural model justifies itself and shows qualitatively correct and interpreted results for the purposes of the financial risk management of the banking sector. That is why banks use this model to assess capital as one of the ways to forecast the required capital to cover possible financial risks.

References

- CHMUTOVA, I., VOVK, V., BEZRODNA, O. (2017), ‘Analytical tools to implement integrated bank financial management technologies’, Economic Annals–ХХІ, 163, 1-2(1), 95–99.

- DOUGLAS, J.E. (2014) Some Key Principles of Bank Liquidity Regulation, Economic Studies at Brookings.

- D’YAKONOVA, I. I., KRAVCHUK, G. V., MORDAN, Yy. Yu., ONOPRIIENKO, Yu. Yu. (2018), ‘Studing the components of the Bank’s financial management system: a categorical and structural analysis of the objective field of financial management of the bank’, Financial and credit activity: problems of theory and practice, 4, 27.

- DZYBLIUK, O.,PRIYDUN, L. (2008),‘Development of banking sector during integration economic Ukraine in word household in liberalization international capital movements’, World finance, 2.

- FARRAKHO, V. (2012),‘Assessment of the financial stability of credit institutions based on the analysis of published statements in US GAAP and IFRS’, Risk management in credit organization, 4.

- Financial and Economic Security and Accounting and Analytical Support in Business, East West Association for Advanced Studies and Higher Education GmbH, Vienna, 2016.

- FRIDMAN, M. (2017) Capitalism and freedom, Kyiv.

- GRYDZHUK, D. (2018), ‘Application of new approaches in assessment and management go efficiency in modern Banking business’, Journal of Academy of Business and Economic, 1, 13–30.

- GRYDZHUK, D. (2017), ‘Modern tendencies of the Ukrainian banking system development’, Business Perspectives. Banks and Bank Systems, 12, 105-113.

- International Convergence of Capital; Measurement and Capital Standards. A Revised Framework. Basel Committee on Banking Supervision, June 2004. Implementation of Basel II: Practical Consideraions. Basel Committee on Banking Supervision, July 2004. Quantitative Impact Study 3. Basel Committee on Banking Supervision, May 2003.

- IVASIV, I., KLAAS, J. A., MAVLINA, A. G. (2016), ‘Zoning Regional Banking Sector as a Factor of Its Financial Stability’, Journal of Economics and Economic Education Research, 17, Special Issue, 80–85.

- KOVALENKO, Yu. M. (2012), ‘Formation of a complementary models of the economy`s financial sector’, Bulletin of the National Bank of Ukraine, 7, 42 – 47.

- KOVALENKO, Yu. M. (2014), ‘Research toolkit for transformations in financial activities’, Actual Problems of Economics, № 4 (154), 51–58.

- KWILINSKI, A., RUZHYTSKYI, I., PATLACHUK, V., PATLACHUK, O., KAMINSKA, B. (2019), ‘Environmental taxes as a condition of business responsibility in the conditions of sustainable development.’, Journal of Legal, Ethical and Regulatory Issues, 22 (Special Issue), 2.

- LA PORTA, R., LOPEZ-DE-SILANES, F., SHLEIFER, A. (2016), ‘Government Ownership of Banks’, The Journal of Finance, 1, 265–301.

- MARHASOVA, V., KOVALENKO, Yu., BERESLAVSKA, O., MURAVSKYI, O., FEDYSHYN, M., KOLESNIK, O. (2020). Instruments of monetary-and-credit policy in terms of economic instability. International Journal of Management, 11 (5), 43-53.

- MENKHOFF, L., TOLKSDORF, N. (2007) Financial market drift: decoupling of the financial sector from the real economy, N.Y.

- MIKHASYUK, I., ZALOGA, Z., SUKHAI, O. (2010) State regulation of the economy in the context of globalization, Lviv.

- NWAKANMA, P. C., NNAMDI, I. S., OMOJEFE, G. O. (2014), ‘Bank credits to the private sector: Potency and relevance in Nigeria’s economic growth process’, Accounting and Finance Research, 3 (2), 23–35.

- POPOV, E. (2000) Legal mechanism of state regulation of banking, Moscow.

- POLYKOVA, V., MOSKOVKINA, L. (1996) Structure and functions central banks.

- RIKARDO, C. (2013) Customs encyclopedia, Vol. 2.

- ROMANENKO, Y. O. (2016), ‘Place and role of communication in public policy’, Actual Problems of Economics, 176 (2), 25-26.

- SHVETS, N., TKACHUK, I. (2017), ‘Estimation of the trends of banking system of Ukraine development at the present stage’, Innovative solutions in modern science, 1 (10), 11–19.

- ZABOLOTNA, N. (2017), ‘The problem of monetization of Ukraines economy’, Development strategy of science and education, 159–163.