Introduction

In 2008, when recession signs became evident also in Romania, all attention was directed to the banking system. Moreover, a heated debate took place on the terms of loans contracts and bank officers’ honesty from the pre-crisis period. Customers become increasingly suspicious of contract clauses and tried as much as possible to rekindle their relationship with the bank.

The main question raised was regarding the currency of the loans (consumer or mortgage backed). In Romania, it is obvious that the population preferred (and still prefer) the foreign currencies lending products. This is not a singular behavior; in Eastern Europe about 52% of loans and 40% of deposits were obtained in foreign currency, the euro being the preferred currency as it is showed in the Annual Report of European Central Bank (2007).

In Romania, the risk of foreign currency lending was a problem widely discussed even before the crisis. Since 2001 National Bank of Romania took measures to reduce the growing rhythm of foreign currency lending, using a wide range of instruments: prudential, of monetary policy and administration. But it is interesting to observe the evolution nationwide during the recession. Thus, it is extremely important to understand the economic situation and to analyze the banking sector evolutions between 2008-2010.

Macroeconomic Background

At the end of 2008, money market was affected by the global financial crisis and the reduction of the external financing forced the banks to rethink their strategies. Although the first half of the year was registered a rapid expansion of the credit for private sector, this decreased in intensity in the last quarter, reaching to 33.7% in December.

Fig. 1. Loans in Foreign and National Currency in Romania at April 2008(LFO-Loans in Foreign Currency, LRO-loans in RON)

After careful analyses of the international financial crisis conjuncture and also of the internal competition existing at the time, it can be said that the banking system during 2008 went from one extreme to another: from excess of liquidity to deficit, from excessive lending to significant restrain of the growth rate for credit and offers for deposits. In terms of credit growth rate, was found the reduction of the rhythm compared with 2007 but the deterioration of loan portfolio could not be avoided.

An analysis conducted by the National Bank of Romania (Annual Report 2008, pg27) revealed that for retail sector the preferred loans are those on long term, in foreign currency and for consumption. Also, in 2008 the new offered products had promotional interest rates, indicating a delay of the debt impact in a future period.

Reduced growth of household borrowing has become evident in the second quarter, reaching 63.3% compared to 70.9% in December 2007 (National Bank of Romania, Annual Report 2008, pg39). First half of the year was dominated by the combined effect of extending the action of stimulating factors of supply and demand of credit and the emergence of inhibitory influences: increasing interest rates for new loans, massive indebtedness of the population, increasing costs with mother banks, the transfer of some credits in other countries. The demand for loans has been severely affected by the growth of interest rates for new loans but also to those already contracted, by RON depreciation and uncertainties on the evolution of the exchange rate.

It was also registered a gradual decrease of the credit risk associated with substitution of RON loans with those in foreign currency. Growth rate of the denominated component in Swiss francs (both for consumption and for housing) decreased drastically; banks almost dropped entirely the lending in this currency. However, the balance of foreign currency loans had higher growth rates relative to RON, mainly due to RON depreciation.

In terms of guarantee deposits in the banking system, it was started a draft law so that the threshold was increased for retail sector to equivalent of 50,000 euro / depositor.

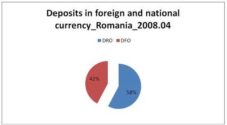

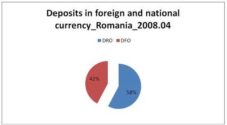

Fig. 2. Deposits in Foreign and National Currency in Romania at April 2008 (DRO-Deposits in RON, DFO-Deposits in Foreign Currency)

However, the propensity to save money had a decrees tendency, especially in the first half of 2008, given the high consumer preference and the high prices. Growth rate of deposits in lei reached a negative level in July 2008 reaching -0.6% despite the high interest rates existing in that period. The evolution of this rate registered a rebound later that year, under the influence of existing competition for resources between credit institutions.

The dynamic of total deposits in foreign currency was characterized by a relative stabilization in the first months of the year, but was subsequently recorded a decline. Thus, the overall growth rate of total deposits of the population had a downward trend during 2008, reaching 15.8% in December with over 20% lower than the value of the previous year.

The territorial banking sector was characterized by a downward trend of business expansion and number of employees, due to global crisis. According to National Bank of Romania Reports (2008) the developments in international markets have significant effects on the credit institutions in Romania, influencing the volume and structure of the resources. Deposits, although with small reductions, still are the main source of funding for banks in the Romanian system. The banking system remains well capitalized even if they felt, especially at the end of 2008, the effects of the international financial crisis.

In accordance to reports provided by CBR (Central Banking Risks), in 2008 was registered a significant increase in the number of individual customers. At the end of the analyzed year, their number was 920,668 (an increase of 27% over the previous year). Loans for individuals increased to 76.7 billion lei in December 2008 of which 57.7% were denominated in euro, 26.5% lei and 15.3% in lei sweets francs. Only 0.5% of them were obtained in U.S. dollars.

The international financial crisis has deepened, lending fell down on global level and the authorized institutions in Romania had to intervene to maintain the stability of the banking system. There was no need to require grant of public funds for credit institutions as full responsibility returned to shareholders. Romanian banking system remained stable, with capitalization and solvency levels consistent with prudential standards.

2009 can be characterized by the variations in interest rates level, exchange rate, market value of land and buildings and the income reductions. Therefore, there has been registered a tightening of both supply and demand for loans and a deterioration of quality for banks credit portfolio.

The territorial situation show a reduction of banks activity, being closed almost 128 units, raising the unemployment and deteriorating consumer confidence. The annual dynamics of the loans for population extended the downward trend, being negative in late 2009, as it is showed by NBR’s Annual Report (2009, page 45). Decreased incomes, the uncertainty of job prospects and high interest rates have made the demand for loans to be significantly restricted. Also, the offer for loans suffered mainly because of tighter lending standards and terms, but reported a stimulating effect in the end of the year, when there were reduced the interest rates of loans in lei and euro, but especially by running the “first house program” (with special interest rates and reduction of taxes for those who buy there first house).

The growing rhythm of all loan categories declined, but the most affected were the consumer loans, with a reduced growth to -5.7% (influenced both by RON and foreign currency). Mortgages had a low annual growth of 27.8%, but remained positive and determined the growth of the percentage for this product in total share of population loans. The currency structure had no significant changes, the percentage of foreign currency in total share of population loans increased to 61.3%. The prudential effect was found mainly in short-term savings, less than two years, where growth in real terms was by 49.8%.

In 2009, according to CRB reports, the number of customers decreased. At the end of the analyzed period the number of debtors was 88,730, with 3.6% less than the same period from previous year. In the NBR’s Annual Report (2009) it is mentioned that the value of loans for individuals increased, but they were explained mainly because of the evolution of the exchange rate (from 76.722 billion lei in 2008 to 78798 billion lei in December 2009. In terms of currency structure, the situation was as follows: 60.4% in euro, 24% in USD, 15% in Swiss francs and only 0.4% in U.S. dollars, these percentages are compared to the previous year.

Global uncertainties have persisted in 2010 and the challenges for the banking stability in Romania, already known from previous years, as the quality of the loans portfolio and the high level of borrowing in foreign currency, continued to be the main discussed issues. From regulation point of view, the National Bank of Romania was involved in the drafting of Government Emergency Ordinance no.131/2010 concerning the Guarantee Fund of Deposit in the banking system that increases the provided coverage to 100,000 euro / depositor.

The financial results were affected by the crisis but temperate by the resize of the territorial networks that have grown substantial in the years before the crisis. In 2010 there were over 250 outlets closed and staff reduced proportionally.

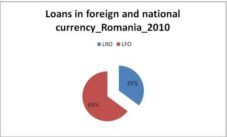

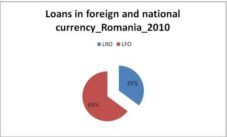

During 2010, the demand for loans in retail sector declined significantly, amid by the pessimism of the jobs prospects, while the banks offer reflected the prudential attitude of the credit institutions. Annual growth rate of the contracted consumer loans reached -10.8% (according to the Annual Report of National Bank of Romania, 2010, page 43). On the other hand, mortgage loans registered a slight dynamic, this trend being a result of the implementation of the “First House” Program (a project between Romanian Government and NBR, that offered smaller interest rates and tax cuts for customers that were buying their first home). The main component was the currency, the foreign currency loans registered a percentage of 64.8% and the share of mortgage loans in total loans recorded an upward trend.

Fig. 3. Loans in Foreign and National Currency in Romania in 2010 (LFO-Loans in Foreign Currency, LRO- Loans in RON)

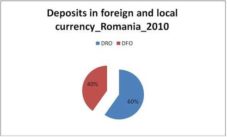

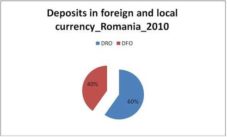

The population placements at banks continued to be low, showing the precautionary purposes of individuals, but recorded better values than in previous years. Investments with a maturity smaller than two years in total population deposits, reached in December 2010a share of 78.8%. The preferred currency for this product diminished, the dynamic of their balance being almost 3.0%.

Fig. 4. Deposits in Foreign and Local Currency in Romania in 2010 (DRO-Deposits in RON, DFO- Deposits in Foreign Currency)

The lending in foreign currency represented in 2010 a big problem both in stock and flow. The National Bank of Romania closely monitored the evolution of lending activity and took the necessary measures to ensure appropriate conditions of risk. On mortgage loans for retail sector, the main vulnerabilities are the higher share of these products in banks’ balance sheets and the risk of worsening the quality of these exposures.

In terms of number of branches and number of credit institutions per 100,000 inhabitants, Romania is placed below the European average. The concentration of the Romanian banking system remains moderate.

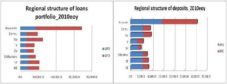

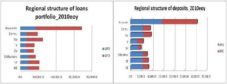

Fig. 5. Regional Structure of Loans and Deposits at the End of 2010

As you may see in the above figure, the territorial structure of the loans and deposits portfolio in Romania shows a clear preference of the population for loans in foreign currency (LFO) and for deposits in RON (DRO). At the end of 2010, most loans were obtained in Bucharest (Romania’s capital) followed by the North West Region. The same situation is kept in case of deposits portfolio structure but the preferred currency for these products is the local one.

Econometric Analysis

The popularity of foreign currency loans raises questions about the reasons for which people choose these products over those offered in local currency. It is important to determine whether demand or supply effects are those that favor foreign currency lending. On one hand there is the theory that banks promote foreign currency loans in order to have a better result for the external balance. On the other hand, increased demand for foreign currency loans can be explained by the high interest rates charged for products available in national currency and by the inflation volatility even higher than exchange rate fluctuations.

This paper proposes a regional perspective of potential factors that may influence the decision to contract foreign currency loans by the Romanian people. The chosen period of time for this analysis was July 2009-December 2010 so as to be seen the extent to which the crisis affects consumer behavior in terms of lending in foreign currency.

Regression Model

The period for the panel data has a monthly frequency and it starts with July 2009 until December 2010. The panel was build using data for all the 41 counties in Romania and the total number of observations in this model was 738 (Annex 1).

The variables that were used in this model:

LFO_: balance of loans in foreign currency in retail sector (in RON)

LRO_: balance of loans in local currency in retail sector (in RON)

DFO_: balance of deposits in foreign currency with maturity term and redeemable at notice (in RON)

DRO_: balance of deposits in local currency with maturity term and redeemable at notice (in RON)

SMN_: medium net wage (in RON)

The method that was used is the panel least squares and the obtained equation is the following one:

LOG(LFO_) = 2.50211 + 0.50746*LOG(LFO_(-1)) + 0.17965*LOG(LRO_(-2)) + 0.20290* LOG(DFO_(-1)) + 0.13742*LOG(DRO_(-15)) – 0.39059*LOG(SMN_(-4))

The Economic Explanations of the Model

As it can be seen in Annex 1, the econometric regression shows that there is a strong determination between the chosen variables and therefore a strong correlation among them, determined by the value of R-squared (84.8%). Also, the coefficients of the explanatory variables obtained in this model show a specific modification of the dependent variable.

LOG(LFO_)=2.50211+0.50746*LOG(LFO_(-1))+0.13742*LOG(DRO_(-15))+0.20290*

LOG(DFO_(-1)) +0.17965*LOG(LRO_(-2))-0.39059*LOG(SMN_(-4))

The loans in foreign currency have an inertial importance, showed by it’s coefficient of 0.507 (taking also into account the logarithmic data), mostly because they are provided from external sources of the mother banks. They are positive correlated with the expansion/contraction of the loans in RON (but less that foreign loans) and depend on the foreign currency deposits, but not so much because of the external sources. Also, they depend less and with big temporal adjustment on RON lending base.

Analyzing the results, it is observed that the average wage (SMN_) has a negative effect on lending in foreign currency. This could be explained by the fact that in Romania, an important volume of foreign currency loans is destined to be used for home construction/ acquisition. If we consider the sectors of home construction, many of houses are build by the householders (mostly in the rural area), for whom the percentage of the installment payments and self resources is very big. So, if the medium wage will increase, the people will not ask for additional loans but they will pay on installments, considering the stage of the constructions.

Also, it must be said that in Romania the vast majority of people get their income in local currency and exchange rate fluctuations (especially in terms of the ratio € / EUR) is the main concern of those who take foreign currency loans. Most unperformed loans were based on inability of the debtors to pay the rates in foreign currency considering the trend of depreciation of the domestic currency. Moreover, in 2008-2010 the National Bank of Romania communicated strong messages to the population through its representatives (NBR’s governor Mugur Isarescu and consultant Adrian Vasilescu) with clear suggestions of borrow in the currency in which the income is obtained so as to be avoided if possible, the default situations.

The variables in deposits category (in RON and foreign currency) have a positive influence on the foreign currency loans. According to the analysis above, in 2010 the share of loans secured by mortgage is superior to other types of loans. On the other hand, commercial banks offer these products by asking for advance from borrower. Therefore, saving decision may be based on the intention of contracting a loan. Thus, it is considered that for deposits in RON is necessary longer term savings in order to offset exchange rate fluctuations or inflation.

Also, the annual NBR reports have shown that the main source of financing of the commercial banks is the amounts deposited by clients. Here so that the positive effect of the two variable coefficients supports the published results of the National Bank of Romania.

In the analysis was considered the variable on domestic currency loans in order to identify the possible influences on the endogen variable. Note that the influence is positive, which may indicate a level of welfare of the population so that the demand for loans is trending upward. The lending in RON is a positive sign for the general economic situation given the restrictive conditions in recent years by banks for these products.

Final Remarks

The global financial crisis affected the population in the sense that the loans are now perceived as riskier. Even so, the foreign currency loans are still preferred by the householders and in 2010 in Romania almost 65% of population considered euro loans more attractive. The main question of this work-paper was if the banks influenced the customers to take out foreign currency or they demand them. Another question was if the global crises can change the borrowing plans. The results suggest that the causes are on both sides of the demand and supply. The truth is that the borrowing conditions are friendlier for foreign currency loans compared with the local currency ones. On the other hand, population asks for this kind of loans due to the favorable interest rate.

Also, the Stability Report issued by National bank of Romania in September 2012, showed that a large share of debt in foreign currencies enhances the vulnerability of the indebtedness rate. Real estate and consumer loans secured with mortgages are granted in an overwhelming proportion in foreign currencies. The flow of newly awarded credit by banks is still predominant in foreign currencies and the “First House” program made a notable contribution to such trend also in 2012.

The NBR report states that the prospects are favorable to continuing the process of saving and the factors pleading in that direction are the persistence of the precaution motivation given the reverberations of the financial crisis, harshening of banks lending standards and the public’s expectations regarding an improvement of the financial situation offset by the still high unemployment rate.

ANNEX 1: Econometric Results of the Panel Analysis

References

Beckmann, E., Scheiber, T. & Stix, H. (2011). “How the Crisis Affected Foreign Currency Borrowing in CESEE: Microeconomic Evidence and Policy Implications,” OeNB;

Publisher – Google Scholar

European Central Bank (2007, 2008, 2009, 2010). Annual Reports [Online], [August 2012],http://www.ecb.int/pub/annual/html/index.en.html

Publisher

Galiani, S., Lamarche, C., Porto, A. & Sosa-Escudero, W. (2005). “Persistence and Regional Disparities in Unemployment,” Regional Science and Urban Economics 35, 375-394;

Publisher – Google Scholar

Lee, C. C. & Chang, C. P. (2008). “Unemployment Hysteresis in OECD Countries: Centurial Time Series Evidence with Structural Breaks,” Economic Modeling 25, 312—325;

Publisher – Google Scholar

Mills, E. S. & Nijkamp, P. (1987). “Advances in Urban Economics,” Handbooks in Economics, Vol.2: Urban Economics;

Publisher – Google Scholar

National Bank of Romania (2008, 2009, 2010). Annual Reports [Online], [August 2012], http://www.bnro.ro/Publicatii-periodice-204.aspx

Publisher

Pissarides, C. A. (2000). “Equilibrium Unemployment Theory,” MIT Press;

Publisher – Google Scholar

Roehner , B. M. (1995). ‘Theory of Markets, Trade and Space-time Patterns of Price Fluctuations,’ Ed. Springer-Verlag;

Google Scholar