Introduction

Communication of an organization’s performance in its economic, social and environmental dimensions to the parties concerned is the principal function of the CSR (Corporate Social Responsibility) reporting process. In this way, an enterprise demonstrates effectiveness of its actions in the area of social responsibility management. Thus, CSR reporting should be part of the process of creating an organization’s strategy, implementation of its action plans (Krištofík, Lament, Musa 2016). Given the popularity of both sustainability and external reporting, it may come as no surprise that the conceptual joint venture of ‘sustainability reporting’ has become influential (Niemann, Hoppe 2017). Zyznarska-Dworczak concluded that the positive and normative theories in a complementary way enable a multifaceted analysis of factors impacting the corporate sustainability reporting development, and determining its scope and shape in the future.

In the past non-financial reporting was only a good practice of enterprises. To increase consistency and comparability of non-financial information shown in the territory of the European Union, some of the big units should prepare a statement on non-financial information containing information on environmental, social and labor issues, respect for human rights, counteracting corruption and bribery (Directive No. 2014/95/EU). This regulation concerns approximately 6,000 large entities functioning within the EU area, including more than 300 Polish entities based on the estimations of the Minister of Finances.

The first stage of research is based on the method of analysis and criticism of the literature. This stage is auxiliary and constitutes a starting point for further research. The quantitative methods are used to analyse the data. The study is based on historical data. The study uses statistical data published by: GRI Database, Fundacja Standardów Raportowania, Bibliotekę Raportów CSRinfo. Publications developed by these institutions are highly reliable, and thus the collected research material is credible. The analysis is designed to answer the following research questions:

- Has the implementation of Directive 2014/95/EU of the European Parliament and of the Council of October 22, 2014 in Polish balance sheet law affected the non-financial reporting of entities?

- What kind of standards are used according to the preparation of non-financial reports?

- What is the level of usage of GRI guidelines by polish enterprises?

The article will be divided into the following sections: introduction, review of the literature, legal aspects of non-financial reporting in Poland, standardization options, the practice of choosing standardization in Poland and conclusions.

Review of the literature

A sustainability report gives information about economic, environmental, social and governance performance. Other words, sustainability reporting is the practice of measuring, disclosing, and being accountable to internal and external stakeholders for the company’s ability to achieve sustainable development goals and manage impacts on society (Calabrese et. al. 2017). The Global Reporting Initiative (GRI), the most widely used of those frameworks, has produced several generations of guidelines (Simomons, Crittenden, Schlegelmilch 2018).

Non-financial reporting at the national level is being researched by many scientists. Caesaria and Basuki analyze the situation of Indonesia. They conclude that economics, environmental, and social aspects have positively significant influence on the companies’ market performance (Caesaria, Basuki 2017). Truant, Corazza and Scagnelli tested the relationship between large Italian organizations’ level of risk disclosure and other relevant variables. Woźniak and Pactwa compare the value of the revenues to the budgets of local government units (communes) from the operating fee paid by entrepreneurs and expenditures of these municipalities on environmental protection, as additional support by these entities in Poland.

Maj, Hawrysz and Bębenek verify whether selected variables: the size of the company, the issue of operating on foreign markets and financial performance influence the detail of disclosed non-financial information. Their analysis has shown that only in a few cases a statistically relevant dependency between analysed variables exists (see more Maj, Hawrysz, Bębenek 2018).

Nowadays, the topic of non-financial reporting is studied and described by many researchers and their conclusions are widely published, one of them is Magdalena Obłoza. The aim of her article was to assess the development of non-financial reporting in Poland before the entry into force in 2017 of the Directive 2014/95/EU . The analysis of non-financial companies’ reports led by the author which so far published the information and non-financial results freely let to define market trends and good reporting practices on the Polish market (Obłoza 2018).

The disclosure of non-financial information by stock-exchange-listed companies in Poland, in the light of the changes introduced by the Directive 2014/95/EU describe Szadziewska, Spigarska, Majerowska. Results of their research on non-financial reporting encompass the last reporting period prior to the introduction of the changes to the Act on Accounting. Their paper presents the results of an analysis of corporate non-financial disclosures in Poland within five sectors, i.e., food, paper and wood products (furniture), chemical, energy and construction.

Many researchers deal with the non-financial reporting and explore it from many points of view. But, there are no publications that present this area before and after the implementation of Directive 2014/95/EU, examining the use of national and international reporting standards in Poland.

Legal aspects of non-financial reporting in Poland

Worldwide trends of transparency caused the appearance in the polish economic share “the fashion” for widely understood reports in the area of CSR. This right practice is observed from many years. Legislative regulations occur as a secondary response to the expectations of business practice. Significant changes in Polish law are introduced by the Act of December 15, 2016 amending the Act of 29 September 1994 on accounting (Journal of Laws of 2016, item 1047). The basic aim of shown changes of the Accounting Act was the implementation of Directive 2014/95/EU of the European Parliament and of the Council of October 22, 2014 amending Directive 2013/34/EU regarding the disclosure of non-financial information and diversity information by certain large entities and groups (Journal of Laws of the EU L 330 from 2014, as amended). Previously, the units which prepare activity reports- based on Art. 49 par. 3 of the Accounting Act- were obliged to report minimum of information in the following system: financial and non-financial indicators, including information on environmental and employment issues, as well as additional explanations to amounts reported in the financial statements.

Though a new duty of expanded non-financial reporting includes public interest entities (concerns only a small group of entities) is an important moment of perceiving non-financial reporting of Polish entities. It informs that non-financial reporting should be developed by independent entities on a voluntary basis, taking into consideration market trends or codes of good practice.

As it was previously mentioned, new standards of non-financial reporting were imposed obligatorily on a small group of entities, both in the individual and consolidated reporting. The range of entities covered by extended reporting of non-financial information includes:

- banks, insurance companies, issuers,

- investment funds,

- pension funds,

- entities intending to apply or applying for admission to trading on one of the regulated markets of the EOG,

- issuers of securities admitted to trading in the alternative trading system,

- national payment institutions,

- electronic money institutions.

Moreover, in the next two financial years (i.e. in the financial year for which they prepare financial statements and in the year preceding this year) they will exceed the following values: 500 people – in the case of average annual employment in full-time equivalents and PLN 85 million – in the case of total assets balance sheet at the end of the financial year or PLN 170 million – in the case of net revenues from sales of goods and products for the financial year.

Consolidated statement about non-financial information- must prepare public trust entities which is the asset of dominant of a big group. Large entities include companies and capital groups with average annual employment of over 500 people (in full-time equivalents) and with a balance sheet total of more than EUR 20 million (approximately PLN 85 million) or net income of over EUR 40 million (approximately 170 PLN million). The size criterion must be met for at least two years in a row, i.e. in the financial year for which they prepare the financial statements and in the year preceding that year.

The legislator allows to choose a form of reporting. Being more precise, entities will be able to post required information- in the field of activity reports (as a declaration on non-financial information and then the rules apply as in the preparation of the activity report) or they will be able to prepare a separate report on non-financial information. In both cases, they include at least the following information:

- a brief description of the business model of the unit;

- key non-financial performance indicators connected with the entity’s operations;

- description of the policies used by the individual in relation to social, employment, environmental issues, respect for human rights and counteracting corruption, as well as a description of the results of these policies;

- description of due diligence procedures – if the entity uses them under the above policies;

- description of significant risks related to the entity’s activities which could have an effect on social, employee, environment, respect for human rights and anti-corruption, including risks related to the entity’s products or its relations with the external environment, including contractors, as well as a description managing these risks.

The assumption was taken that entities have a duty to use a rule “comply or explain”. It means that in case a particular entity doesn’t lead a policy in terms of one or more of the above issues, it is obliged to disclose this fact with the reasons. The deadline for preparation is no later than within 3 months from the balance sheet date. It should be underlined that neither the law, nor the EU regulations, specify according to what rules non- financial reporting should be made. That is why, the entity, while preparing a statement about non- financial information (or a separate statement about non- financial information), may use voluntary methods together with their own rules, national or international standards, norms or guidelines. However, in a statement (or report), the entity has information about the applied principles, standards, norms or guidelines. The next part will present selected reporting standards.

Standardization options

A legislator by imposing the obligation to prepare non-financial reports allows the entities to choose the way of preparing the report. Enterprises do not have a duty to use any of the formalized standards or guidelines. They are obliged only to refer to these issues assigned in the Directive and, as a consequence, the amended Accounting Act. The international business environment offers many standards, guidelines and reporting framework that entities may adopt when preparing a non-financial report:

- Global Reporting Initiative (GRI),

- Standard of Non-Financial Information (SIN)

- Communication on Progress (Global Compact),

- International Integrated Reporting Framework,

- Guidance on Corporate Responsibility Indicators in Annual Reports,

- KPIs for ESG,

- Model Guidance on Reporting ESG Information for Investors,

- Reporting framework in line with the UN Guiding Principles on Business and Human Rights,

- Carbon Disclosure Project,

- Greenhouse Gas Protocol Corporate Standard,

- Principles for Responsible Investment,

- OECD guidelines for multinational enterprises,

- PN-ISO 26000: 2012 regarding social responsibility,

- Eco-Management and Audit Scheme (EMAS),

- Tripartite declaration of principles for multinational enterprises and social policy (ILO) and others.

Taking into consideration the lack of strict legal regulations while so many opportunities, a good way out of the situation can be using one of the available norms, guidelines or standards. The report with usage of these standards makes a bigger trust. It can be also decided on indirect output: formally not reporting in any of the standards, rely on any of them, i.e. treat it as a support. There are many guidelines’ options but only some of them are widely enough to allow reporting all of the aspects which are directly shown in a law. It is worth presenting the following routes: Global Reporting Initiative (GRI G4 or GRI Standards), Non-Financial Information System (Standardy Informacji Niefinansowej SIN).

The majority of companies (N100 – 74 % – and G250 – 89 %) are using some kind of guidance or framework for GRI reporting (KPMG 2017). Global Reporting Initiative GRI is an independent international organization based in Amsterdam, the Netherlands. It was formed in Boston, USA by the Coalition for Environmentally Responsible Economies and Tellus Institute, with the support of the United Nations Environment Programme in 1997. It released a first version of the Sustainability Reporting Guidelines in 1999, the first full version in 2000. Since then they have been publishing further improved versions of standards. Currently the most important are: GRI 4 and GRI Standards. The Sustainability Reporting Standards are available as a free public good. Their usefulness is wide. Woźniak and Pactwa compare the value of the revenues to the budgets of local government units (communes) from the operating fee paid by entrepreneurs and expenditures of these municipalities on environmental protection, as additional support by these entities in Poland. They use Global Reporting Initiative (GRI) and GRI G4 Mining and Metals guidelines.

Against the common opinion and an overwhelming quantity of guidelines themselves, reporting with their usage does not have to be complicated at all (GRI 2016). Indicators and measures appointed on international forum allow the access to information and compare data in sustainability reports, providing stakeholders with more knowledge necessary to make informed decisions. That is why a document G4 was created. GRI guidelines are periodically reviewed to provide the best and most up-to-date guidance for sustainability reporting. The goal of G4, that is, the fourth edition of the guidelines, is simple: to provide help for organizations while preparing a report about a sustainable development which will consist of valuable information about the most important issue connected with sustainable development as well as ensuring that making such a report will become a standard practice.

The GRI Standards are the first global standards for sustainability reporting. They feature a modular, interrelated structure, and represent the global best practice for reporting on a range of economic, environmental and social impacts (GRI 2018). GRI Standards consist of:

- The 100 series of the GRI Standards include three universal Standards applicable for every organization preparing a sustainability report: Foundation – GRI 101, General Disclosers – GRI 102, Management Approach – GRI 103,

- 33 Topic-specific Standards arranged in a series: Economic – GRI 200, Environmental – 300) and Social – GRI 400.

An initial alternative can base on national standard – Non-Financial Information (SIN). They were created thanks to the Association of Stock Exchange Issuers and the Reporting Standards Foundation associated with it. Together with the environment of issuers involvement and widely understood participants of a market, the standard was created which is dedicated to be a competition for GRI according to the authors. It is addressed mainly to companies for which non-financial reporting is a novelty, and for which the law imposes new reporting obligations (Dymowski 2017). The advantage of this document is its simplicity. It does not enforce any obligatory guidelines, just proposes their very wide choice. Of course, the Non-Financial Information Standard (SIN) is a national standard and it is new. So, it does not offer as much prestige as reporting according to international guidelines developed by Global Reporting Initiative. Similarly, as in the case of GRI, its content is available for free. Each method and each tool has its strong and weak points. All of the people who are reporting should be conscious about one thing: no matter which standard or guideline they are using, it is necessary to include in the report all elements referred to in the directive.

The practice of choosing standardization in Poland

From the 1st January, 2017 in all of EU member countries new national regulations should have obliged implementing the Directive 2014/95/UE whose main assumption is to increase the transparency of social and environmental information in the area of corporate social responsibility and their coherence and comparability. The planned effect is to increase the degree of disclosure of information and non-financial data by some large entities and groups on all European markets. The new regulations covered around 300 entities in Poland.

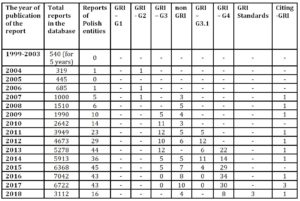

Table 1: Non-financial reporting in Poland in 2005-2018

Source: own study based on the CSRinfo Report register www.rejestrraportow.pl (accessed on 31.01.19.).

In Poland, only after the year 2000 occurred the phenomenon of social reporting which is directly connected with the next stage of economic development that takes into account the social responsibility of business. CSRinfo’s analysis shows a growth in interest in publishing non-financial reports in the last several years. The first reports registered in the Polish CSRinfo database appeared in 2005 (Table 1) – “Corporate Social Responsibility of BANK BPH SA Report for 2004”. The number of reports registered in the database is systematically growing. Most reports were registered in 2015 – 55. The leading industries in the field of non-financial reporting are: the first place is occupied by energy – 57, in the second place there are banks with 46 reports, in the third place the food industry 38 (as of 04.02.19 r.). The data show that a quality of non- financial reporting is growing because of standards used as well as a growing experience of those who are reporting and consolidation of the reporting process in companies.

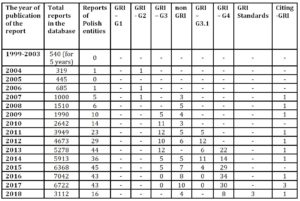

First reports in GRI database appeared in 1999, the first Polish report was provided in 2004 (see Table 2), it was-“British American Tobacco Poland Social Report 2003/2004” and it was developed taking into consideration GRI – G2. Data analysis published by this organization shows a growth of non- financial reporting in Poland. The biggest number of reports from Poland that is registered in the database was in 2015 – 45. Poland is not a leader in this ranking, the number of polish reports published on GRI sites did not exceed 1% in any year. It does not mean that enterprises do not use standards offered by this organization. In years 2013-2017 GRI – G4 was used most often.

Table 2: Non-financial reports of Polish entities re-identified in the GRI database

Source: own study based on GRI Database http://database.globalreporting.org/search/ (accessed on 31.01.19.).

As it was mentioned previously, around 300 entities were to be under an obligation of Directive 2014/95/UE. In a base of non-financial reports of Standards of Reports Foundation (FSR)/ 167 non-financial reports were collected for 2017 published by companies listed on the Warsaw Stock Exchange which are subject to the obligation resulting from the amendment to the Act on Public Procurement and Directive 2014/95/EU, which is about half of those expected. This amount of data allows formulating conclusions from the first year of validity of new regulations. Most entities prepared non-financial reports according to the guidelines of GRI standards. Among them, 46 chose GRI – 4, and 13 GRI Standards. Some of them chose the GRI option plus other indicators, including their own indicators, industry supplements, IPIECA Voluntary Guidance on Sustainability Reporting, UN Global Compact. The national guidelines for the Non-Financial Information System (SIN) have been selected by 27 companies. What is more, 4 decided to accept the guidelines for both SIN and GRI. 40 entities chose their own guidelines using SIN, GRI or PN-ISO 26000. One entity pointed to NaDiVeG (Law on Sustainable Development and Improvement of Diversity). 41 entities did not indicate the rules that were followed (which as it was written previously is not necessary, the law only imposes a description of specific areas). 8 entities were included in the consolidated report of the capital group. All of the three databases show the increase in non- financial reporting in Poland. The first of them, CSRinfo indicates a local growth of non- financial reports since 2005- historical perspective. The second one, GRI database allows expanding an international perspective including ex-post analysis since 1999. It offers a quantitative reference to the total number of reporting in particular years. The third register of Reporting Standards Foundation gives a wide field to research in the area of national reporting since 2017, that is from the moment of obligatory reports for some entities. The collected data allow formulating answers to the research questions set out in the introduction.

Questions from the introduction should be verified positively. The year 2018 was crucial for non-financial reporting in Poland. For last year just over 300 reports occurred (according to CSRinfo database). The same quantity should have been published during the year 2018 in conjunction with the duty of reporting imposed in the amended Accounting Act adapting the requirements of Directive 2014/09/EU to Polish regulations. In the FSR database, there are 167 for 2017 and published in the period from February to April 2018. Quantitative growth is therefore significant. Non-financial reporting up till 2017 was not obligatory, there were no formal standards. But, from what the data show, Polish entities used international standards mainly for GRI when reporting on a voluntary basis. Currently, the National Standard for Non-Financial Information (SIN) has become equally popular. The use of various reporting standards offered by GRI both before the introduction of legal obligation and after is at a high level. Until 2012, it was GRI – G3, after this year GRI – G4 is most often used.

Conclusion

Being a socially responsible entity is a sign of prestige. Enterprises also know that it pays to present as socially responsible. An essential tool in this process became social reports. First reports of this kind of Polish entities appeared in around 2004 and their quantity has been systematically growing from year to year. The reporting period for 2017 turned out to be a breakthrough. Before the EU Directive 2014/95 / EU appeared, in some countries there was already an obligation to report non-financial data (MR 2017), in Poland it was only an element of good practice. The changes in this area was brought about by the Act of December 15, 2016 amending the Act of 29 September 1994 on accounting (Journal of Laws of 2016, item 1047). Currently, about 300 entities are subject to obligatory preparation of non-financial reports.

Based on literature analysis as well as information from three databases: CSRinfo, GRI Database and Reporting Standards Foundation, the research questions that were formulated in the introduction were verified . The growth of non- financial reporting can be confirmed after introduction of the provisions of Directive 2014/95 / EU. It does not impose the structure of this report but indicates minimal information content. The national Non-Financial Information Standard (SIN) or international GRI standards guide the construction of the report.

References

- Anam, L., Kacprzak, J., (2017) ‘Raportowanie niefinansowe. Poradnik dla raportujących’ Ministerstwo Rozowju (MR).

- Blasco, J. L., King, A., (2017) ‘The road ahead. KPMG Survey of Corporate Responsibility Reporting 2017’ KPMG International

- Caesaria, A. F., Basuki, B., (2017) ‘The study of sustainability report disclosure aspects and their impact on the companies’ performance’ SHS Web of Conferences 34, DOI: 10.1051/ shsconf/ 73408001.

- Calabrese, A., Costa, R., Ghiron, N., et al. (2017) ‘Materiality Analysis in Sustainability Reporting: A Method for Making it Work in Practice’ European Journal Of Sustainable Development, Vol. 6 (3), 439-447, Doi: 10.14207/ejsd.2017.v6n3p439.

- Dymowski, J., (2017) ‘Jak wybrać standard raportowania?’ Parkiet, https://www.parkiet.com.

- Dyrektywa Parlamentu Europejskiego i Rady nr 2014/95/UE z dnia 22 października 2014 r. zmieniająca dyrektywę 2013/34/UE w odniesieniu do ujawniania informacji niefinansowych i informacji dotyczących różnorodności przez niektóre duże jednostki oraz grupy z dnia 22 października 2014 r . (Dz.Urz.UE.L Nr 330, str. 1).

- Kristofik, P., Lament, M., Musa, H., (2016) ‘The reporting of non-financial information and the rationale for its standardization’ Ekonomie a management, Vol. 19 (2), 157-175, DOI: 10.15240/tul/001/2016-2-011.

- Maj, J., Hawrysz, L., Bębenek, P., (2018) ‘Determinants of corporate social responsibility disclosure in polish organisations’ International Journal of Contemporary Management 17 (1), 197–215, Doi:10.4467/24498939IJCM.18.011.8390.

- Niemann, L., Hoppe, T. (2017) ‘Sustainability reporting by local governments: a magic tool? Lessons on use and usefulness from European pioneers’ Public Management Review, https://doi.org/10.1080/14719037.2017.1293149.

- Obłoza, M., (2018) ‘Development of non-financial reporting in Poland before the implementation of Directive 2014/95/EU’ Marketing i rynek, Vol 11, 322-336.

- Simmons, J.M., Crittenden, V.L., Schlegelmilch, B.B., (2018) ‘The Global Reporting Initiative: do application levels matter?’ Social Responsibility Journal, Vol. 14 (3), 527-541 DOI: 10.1108/SRJ-12-2016-0218

- Szadziewska, A., Spigarska, E., Majerowska, E., (2018) ‘The disclosure of non-financial information by stock-exchange-listed companies in Poland, in the light of the changes introduced by the Directive 2014/95/EU’ Zeszyty Teoretyczne Rachunkowości, 99 (155), 65−95.

- Truant, E., Corazza, L., Scagnelli, S. D., (2017) ‘Sustainability and Risk Disclosure: An Exploratory Study on Sustainability Reports’ Sustainability, Vol. 9 (4).

- Ustawa z dnia 15 grudnia 2016 r. o zmianie w Ustawie z dnia 29 września 1994 r. o rachunkowości (Dz. U. z 2016 r. poz. 1047).

- Wozniak, J., Pactwa, K., (2017) ‘Environmental Activity of Mining Industry Leaders in Poland in Line with the Principles of Sustainable Development’ Sustainability, Vol. 9 (11).

- Zyznarska-Dworczak, B., (2018) ‘Accounting theories towards non-financial reporting’ Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach, Vol. 356, 157-169.

17.www.database.globalreporting.org/search/(access dates: 20.01.19.-10.02.19.).

www.rejestrraportow.pl/ (access dates: 20.01.19.-10.02.19.).

www.standardy.org.pl/ /(access dates: 20.01.19.-10.02.19.