Introduction

The CAPM model (Capital Asset Pricing Model) was built by William Sharpe in the 1960s, and the paper on that was published in the book entitled Portfolio Theory and Capital Markets in 1970. As the acknowledgement for his work, he received the Nobel Prize for Economics in 1990. The capital investment assessment model is in the very heart of corporate finance as an extremely important analytical means which precisely determines the ratio between risk and return on investment in equity and is based on the attitude that all investments in stocks are by their very nature risky investments, as given by Malinić (1999).

The standard CAPM model represents a very useful means for a simple and sufficiently reliable assessment of the acceptability of an investor’s investment in securities, i.e. the obtaining of investments from somebody else’s sources on the basis of the sale of financial instruments. Glova (2015) discussed that this model, which has already been considerably applied on developed capital markets, essentially serves to quantify the ratio between risk and return, concluded by Stahl (2016).

In order for the model to be applied in practice, a potential investor needs to have data about the beta coefficient for a company’s share, the expected rate of return on the market portfolio and the risk-free rate. The phenomenon of the CAPM model, mentioned by Brzaković (2013), is characterized by a small-scale applicability in SE European countries given the fact that the capital market of those countries is insufficiently developed. Despite that fact, due to the increasingly more intensive development of those markets, the CAPM model is becoming an increasingly more popular method for the assessment of the acceptability of an investor’s investment from within somebody else’s sources on the basis of the issuance of securities. Through this paper, the application of the expanded CAPM model with a country risk premium, which is characteristic of SE European countries, will be explained. These countries carry a greater risk in relation to highly-developed countries, and it is exactly for the reason of this fact that potential investors are interested in adding the country risk premium to the CAPM model, which encompasses market return. The assumption foreign investors start from when making a decision on investing in SE European countries is based on the existence of the risk specific factors of these countries. Therefore, in case the risk factors of those countries are growing, then the investor’s requested return will also be in an increase when making an investment decision as well. Given the uncertainty of the final outcome of investing in securities, investors endeavor to investigate country risks prior to making an investment decision. They will do that based on the reports of international consulting firms (rating agencies) and professional journals, concluded by Erb et al. (1996).

The aim of the research is deep understanding of the CAPM phenomenon with country’s risk premium, which foreign investors use when measure risk and yield, as a base for making the decision to invest into the JIA countries. These countries are, commonly, riskier than the highly-developed countries, which is causing investors demand on the higher investments yield rate, which will consider both market risk premium and country risk premium.

The symbiosis of theoretical and practical research will provide answers to many complex questions, such as: determination of the non-risky rate, beta-coefficient, as well as the market risk premium and country risk premium.

The authors will focus on the country risk, as additional or specific risk in each country of JIE, having in mind the uncertainty of the final decision to invest in these countries. Foreign investors are considering this reality, and therefore, they are looking for additional mitigation, in form of premium on-top-of market premium – called, country risk premium. The risk analysis of the country is derived from the complex risk rating, which is constituted of: economic, political and financial risk. The goal of the country risk assessment is a recommendation to the potential investors to be well-informed about the risk of their investments. The country risk can raise that high that investors from the developed countries can lose their stake which would lead to the property loses. Based on the actual and future country risk, foreign investors will rate these countries, and decide to invest in those countries which can ensure appropriate yield return, comparing to the estimated risk.

Country Risk

Country risk can be defined as a complex of the risks that may occur in the country of the issuer of securities due to an unfavorable current situation in its economy and society, and even more so due to a possibility of the occurrence of unexpected changes in the future in the economic, political, legal, and other subsystems of the big social system. Foreign investors’ interest in the analysis of country risk has to do with their endeavoring to ensure the safety of investment and a possibility for them to achieve a higher rate of return from investing in domestic production, concluded by Pampush (2018). Country Risk, defined by Bouchet, et all (2018), is “a set of interdependent macro-economic, financial, institutional, and sociopolitical factors, specific for a particular country in the global economy, which can negatively affect both domestic and foreign economic agents relating to savings, investment, and credit transactions.”

Ilić (2017) finds that by analyzing country risk, foreign investors endeavor to make an assessment of the economic and political potentials of the country to properly perform its obligations according to approved international loans (private and public) and the funds invested in financial instruments of less developed countries. After becoming aware of the fact that investing in a particular country is not risky, i.e. that there is no macro-risk of the country, the foreign investor will initiate an investigation into the cost-efficiency of investing in the project he is interested in, i.e. he will make an assessment of the micro-risk.

In the investigation of country risk, foreign investors are specially interested in obtaining the answer to the question: Will the issuer of the bonds or shares (with the seat or residence in a less developed country):

- be able to settle the obligations according to the performed issuance? It is not about a lack of willingness, but rather about the objective incapability of the enterprise to perform its international obligation. Such a situation may occur if unexpected changes in the macroeconomic ambience generate a lower growth rate, a fall in exports and a reduction in the foreign-exchange inflow. At the enterprise level, the negative effects of economic-systemic changes are manifested in a fall in liquidity, i.e. a diminished capability of settling mature short-term liabilities including also the obligations from the issuance of securities (transfer risk), and

- be prevented, though no fault of his own, from performing the obligation of paying out the interest, the principal amount and the dividend? Due to the deterioration of the results of the economic relationships of the country with foreign countries, the government undertakes restrictive measures in disposing with the foreign-exchange funds. As a consequence of the implementation of those measures, the possibilities of the repatriation of a part of the profit which belongs to foreign investors are reduced. It may also happen that the enterprise has sufficient funds (in its foreign-exchange account) to settle the mature obligations, but it is not going to be able to do so since there is a decision of the government preventing it from doing so (sovereign risk).

OECD (2018) has developed “National Risk Assessments” (NRA) as good practice in country risk management, and used a policy tool to identify and analyze a range of events that could cause significant disruption at a national scale.

Country Risk Premium

An analysis of a country risk premium is reduced to the assessment of the two kinds of uncertainty in the relationships between foreign investors and their respective partners from SE European countries. Namely, a country risk premium can be decomposed into two components (economic and political) resulting from economic movements and possible changes in the political systems of those countries in the future. These two components are interrelated on a cause-effect-dependence basis, due to which fact they cannot be observed in isolation from one another. A country sending the world a picture of itself as an economically risky country simultaneously confirms the economic inefficiency of the state in leading both its macroeconomic and its overall policies, which cannot exert an influence on the political state of the matters in its society, either. The conditionality and interdependence of economic and political risks also corresponds, as noticed by Damodaran (2019) to the relationship between the economic and political independences of the country. Economic sovereignty is the fundamental sovereignty from which political independence is also derived. This does not negate the relative self-reliance of political independence, nor that of the political system, in relation to the economic system. Although it is derived from economic sovereignty, political independence is the first, inevitable condition for the achievement of economic independence.

Fig. 1: A list of factors for assessment of a country risk premium (authors)

Figure 1 shows the conditionality of the country risk premium by economic and political risks. Economic factors (the GDP growth rate, the rate of inflation, the unemployment rate, etc.) have an impact on the assessment of economic risk, whereas political factors (the stability of the Government, wars, the behavior of citizens as consumers, and so forth) have an impact on the assessment of political risk. Claude et al. (2019) discuss that together, economic and political risks, determine the amount of the requested capital risk premium demanded by potential investors when making their decision on investing in the securities of those countries. In case these risks are growing, the country risk premium requested by foreign investors as a compensation for their investments is also growing. On the contrary, if these risks are falling, the country risk premium is falling, too.

Differently from the majority of the agencies that perform the measurement of country risk by including both economic and political risks, however, the leading organization for country risk assessment PRS Group (Political Risk Services), as concluded by Bodie, et al. (2009) makes an assessment of the so-called combined country risk. Apart from political and economic risks, country risk is also constituted by financial risk. It is a market, i.e. macroeconomic risk indicating a possibility of the appearance of recession in the economy. Combined risk is determined on a scale from 0 (the riskiest countries or the countries with a very high risk, such as less developed countries) to 100 (the least risky or the countries with a very low risk, such as developed market economies).

CAPM Model in SE European Countries

In the realistic reality of SE European countries, foreign capital (obtained through the issuance of bonds and stocks) has a predominant participation in the total investments. The base equation of the CAPM model does not encompass country risk, due to which fact it could not be used to calculate the expected return from investing in SE European countries. This equation is based on the assumption that the expected return based on investing in equity (a dividend), i.e. the cost of equity, includes: the risk-free rate and the share risk premium, i.e. share risk (a risk premium on a share). (Damodaran, 2005). In order to calculate the expected return from foreign investors’ investment, however, it is necessary that the equation of the general CAPM model should be modified. The CAPM model with a country risk premium is based on using data (data about the expected market return and country risk) from a SE European country (the issuer), except for data about the risk-free rate (the data of the investor country). (Petrović, 2017) Investors expect higher returns from investment in the securities of SE European countries, which also causes an increase in the price of the costs of capital on growing markets. The difference in return which reflects country risk is referred to as a country risk premium. If the discount rate of the base equation of the CAPM is increased by the amount of the country risk premium of the investment host (a SE European country), the pure CAPM model will transform into the CAMP model with a country risk premium, as defined by Petrović (2017):

Rj = Rf + (Rm – Rf) β + CR (1)

Rj–the expected average (annual) rate of return on investment in a share of one enterprise

Rf–the expected average (annual) risk-free interest rate of return

Rm–the expected average (annual) rate of market return on the market portfolio of the shares traded in one country (the market index)

(Rm– Rf) –the expected rate of a market risk premium on investment in the market portfolio of shares

β –the beta coefficient for a share of one enterprise, which measures the sensitivity of return on the company’s share in relation to the overall return on the market (Brzaković, 2007)

(Rm – Rf) β – the expected average (annual) rate of market return above the risk-free rate, on investment in a share of one enterprise

CR – a country risk premium.

This equation of the domestic CAPM model can be used to assess the costs of the capital of emerging markets only if the country is well integrated into the global (world) market system. In that case, the risk-free rate is calculated in the following manner:

Risk-free rate of the SEE country = Risk-free rate of the USA + (Inflation rate of the SEE country – Inflation rate of the USA) (2)

After that, the market risk premium of capital is then estimated and added to the risk-free rate. The market risk premium reflects the global risk premium, not the domestic risk premium. The global market risk premium is calculated on the basis of the MSCI (Morgan Stanley Capital International) index. The beta for SE European countries is also calculated based on the global market index (MSCI). These data ensure the comparability of the CAPM model between SE European countries since they are based on the unique methodology for the calculation of a market risk premium and a beta, as mentioned by Brilli, et al. (2009.)

CAPM of SEE countries = Risk-free rate of SEE countries + (Market risk premium global) βglobal+ CR. (3)

If, just for a moment, we exempt the risk-free rate from the equation of CAPM with a country risk premium, the residual part of the right-hand side of the equation represents the risk premium of capital or a premium for capital risk (Rp). Damodaran (2019) argued that is the investor’s compensation for the total investment risks expressed by the sum of inter-conditioned premiums:

-the risk premiums of a share or the premiums of the market risk of a share (Rm– Rf) β. It also incorporates the risk premium of the market portfolio or the premium of the market risk of the market portfolio of shares, and country risk premium or a premium for the risk of the country.

A capital risk premium represents the fundamental basis in the assessment of returns and risks by both individual and institutional investors. Data about the capital risk premium achieved in the past period are most frequently used for this assessment. The assessment of the capital risk premium in the future of a country based on a historical capital risk premium depends on the assessment period, the amount of the risk-free rate and the returns that have been achieved in the prior period.

Country Risk Premium in SE European Countries

In facing risks of investing in developmental projects and securities of SE European countries, foreign investors perform a complex of risk management activities. At the same time, one should bear in mind the fact that the standard CAPM model does not provide us with precise and objective results when investing in SE European countries. A modification of the standard CAPM model needs to be made by the amount of the country risk premium so as to enable foreign investors to realistically assess their investments and also to enable the countries receiving capital to more successfully perceive the necessary changes in the investment ambience. The following countries are included in the paper within the framework of the research study on the country risk premiums of SE European countries, namely: Serbia, Bosnia and Herzegovina, Bulgaria, Greece, Macedonia, Croatia, and Montenegro. The specificity of the application of the CAPM model with a country risk premium is in the inclusion of extra return due to different kinds of risks in SE European countries.

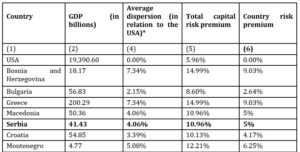

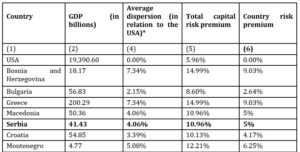

Table 1: The calculation of the country risk premium, 2019

Source: independent calculation of the authors based on publicly available indicators

Based on the above table, the USA is the best-ranked country with the GDP of 19,390.60 bilions, with the smallest capital risk premium in the amount of 5.96% and the country risk premium equaling 0. Due to this fact, the risk premiums of all the other countries are ranked based on the difference between the rating of the best-ranked state (the USA) and the rating of the state of its seat. That is presented in the following equation:

Country risk premium = Capital risk premium of the SEE country – Capital risk premium of the USA (4)

The biggest country risk premium is that of Greece and Bosnia and Herzegovina, which is 9.03%. Serbia and Macedonia have the country risk premium of 5%. The smallest country risk premium is that of Bulgaria, which is 2.64%.

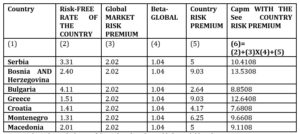

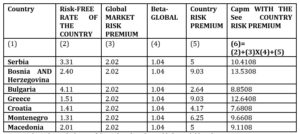

Table 2: The risk-free rate of the SE European countries, 2019

Source: *The Trading Economics https://tradingeconomics.com/country-list/inflation-rate?continent=Europe accessed: 08.05.2019

- which served as a basis for independent calculation of the authors

Table 2 provides a review of the calculation of the risk-free rates of the SE European countries. In order to calculate the risk-free rate of the SE European countries, the USA’s risk-free rate (the long-term bonds of the Government) was taken so as to make the risk-free rates comparable, starting from the assumption that each of these countries has different methodologies for the calculation of risk-free rates. The same rate is adjusted by the differences between the inflation rates of the SE European countries and the USA. The highest risk-free rate is that of Bulgaria, which is 4.11%, and the lowest risk-free rate is that of Montenegro, being 1.31%. Serbia’s risk-free rate is 3.31%.

The following table accounts for the CAPM model with a country risk premium. The global beta is

expressed based on the beta MSCI WORLD index, which is 1.04%. A market risk premium is expressed based on the market risk premium of the MSCI WORLD index, being 2.02%. With the help of the formula for the calculation of the CAPM model in the SE European countries, the CAPM model with the country risk premium of these countries is obtained.

Table 3: The CAPM model with the SE European country risk premium, 2019.

Source: independent calculation of the authors based on publicly available indicators

Table 3 is the illustration of the comparative overview of different countries. Bosnia and Herzegovina has the highest expected rate of return on investing in the SE European countries, with the rate of 13.53%, which also has the biggest country risk premium (9.03%). The second-ranked is Greece, with the expected return rate of 12.64%, whereas Serbia ranks the third, with the expected return rate of 10.41%. Croatia has the lowest expected return rate and the lowest risk, amounting to 7.68%.

Given the fact that the return rates vary between these countries, the riskiest countries also carry with themselves bigger returns when foreign investors make investments, i.e. their risk premium representing the extra return requested by investors so that they could transfer their money from the investment free of risk into the SE European countries is bigger. We should also have in mind the fact that a certain number of foreign investors will not be ready to accept these risks exactly because of their aversion to risk and that because of that only a smaller number of these investors will be ready to invest their money. Van Horne C. J, (1992) stated that the ultimate goal of risk management is the minimization of a potential damage (which would occur by investing in securities) to an acceptable minimum of “the costs of risk”. For the reason of the said, when investing, the foreign investor endeavors to realistically assess the investment climate in SE European countries. From the aspect of SE European countries, however, the foreign capital inflow represents an important assumption for their further development since those funds would be invested in developmental projects of different segments of the economy, which would contribute to their further growth and progress.

Conclusion

The CAPM model represents a very significant analytical means in investment decision-making when potential foreign investors are making a decision on investing in securities, namely; primarily thinking of stocks. Within the framework of the paper, a modification of the CAPM model was made in that the model was expanded by the addition of the country risk premium to it for the reason of the fact that SE European countries are characterized by a larger number of risks in relation to highly developed countries. Because of that, when they are making a decision on investing in these countries, potential investors request that, apart from a market risk premium, their return should also include a country risk premium, which together make a capital risk premium.

The goal of the management of the risk of investing in the securities of SE European countries with the help of the CAPM model with a country risk premium is to achieve a profit and increase foreign investors’ assets, or at least to preserve the existent assets. The paper explains country risk and the factors that exert an influence on it (both economic and political); however, the authors have also indicated the fact that the inclusion of the assessment of financial risk, too, apart from the assessment of economic and political risks, in the country risk premium would be a desirable option.

When making an investment decision, potential investors first identify risks and measure the exposure to them. At the same time, they should always have in mind the fact that they must incessantly perform the monitoring of these risks due to the instability of the situation in SE European countries so that they could finally make a decision on the cost-efficiency of their investment in these countries. The CAPM model with a country risk premium in SE European countries consists of a risk-free rate, a market risk premium and a country risk premium. In the practical part of the paper, the ranking of these countries was performed when making a decision on investing in SE European countries based on the data of Moody`s agency in relation to the USA, the risk-free rate and the market risk premium in the end, the beta and the country risk premium. In that manner, potential investors carry out an assessment of capital investments while making investment decisions.

The expanded CAPM model with a country risk premium, however, has its shortcomings. Namely, the unique risk of a SE European country is extremely difficult to calculate since it includes a complex of risks (economic, political, financial) difficult to express. Besides, there are still different perceptions of the determination of the unique risk-free rate, the beta coefficient and the market risk premium. The best solution, however, is to express these coefficients on the basis of unique measures so that the CAPM model’s calculation methodologies for each country could be comparable. Based on these assessments, foreign investors make an investment decision which they find appropriate, aware of the fact that a bigger risk represents a real challenge and a possibility for them to earn more. As is presented in the paper, the expected return on investment and risk are interconnected and for that very reason, in spite of the limitations, the CAPM model with a country risk premium represents the unavoidable basis which is founded on the attitude that the application of risk leads to a change in the market risk premium and the country risk premium in a way implying that the premium compensates for the risk incurred. For the reason of all of the foregoing, this model is a very useful means for a simple and sufficiently reliable assessment of the acceptability of investors’ investment in securities in SE European countries.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Bodie, Z, Kane, A, & Marcus, J. A. (2009) Osnovi investicija, Data Status, Beograd.

- Bouchet, M, Fishkin, C, Goguel A. (2018) Managing Country Risk in an Age of Globalization, Springer International Publishing, Palgrave Macmillan.

- Brzaković, T. (2013) Strateški finansijski menadžment, Akademija za diplomatiju i bezbednost, Beograd.

- Brzaković, T. (2007) Tržište kapitala- teorija i praksa, Čugura Print, Beograd.

- Brili, R., Majers, S., & Markus, A. (2009) Osnovi korporativnih finansija, Mate, Zagreb.

- Claude B. Erb, Campbell R. Harvey, Tadas E. Viskanta (2019) ’Political Risk, Economics Risk and Financial Risk’, Financial Analyst Journal, pp. 29-46.

- Damodaran (2005) Korporativne finansije, Modus, Podgorica.

- Damodaran, A. (2019) Equity Risk Premium (ERP): Determinants, Estimation and Implications – The 2019 Edition, Stern School of Business, New York.

- Glova (2015) ‘Time-Varying CAPM and its Applicability in Cost of Equity Determination’, Procedia Economics and Finance, pp. 60-67.

- Ilić, M. (2017). Osnove ekonomije, finansija i računovodstva. Visoka škola strukovnih studija za informacione tehnologije, ITS – Beograd, Beograd.

- Malinić, D. (1999) Politika dobiti korporativnog preduzeća. Čigoja Štampa, Beograd.

- National Risk Assessments – A Cross Country Perspective, OECD Publishing, Year: 2018.

- Pampush F. (2018) Contry Risk Premiums & Cost of Equity, Concentric Energy Advisors, Oglethorpe University, Georgia.

- Petrović, D. (2017) ‘Savremeni izazovi u primeni modifikovanog modela CAPM sa premijom rizika zemlje u rastućim ekonomijama’, Škola biznisa, (1), pp 51-69.

- Stahl R., Gabler V. (2016) Capital Asset Pricing Model und Alternativkalküle: Analyse in der Unternehmensbewertung mit empirischem Bezug auf die DAX-Werte, Springer-Gabler, Germany, Wiesbaden.

- Van Horn, C. J. (1992) Financial Management and Policy, Prentice-Hall International Editions, United States.