Introduction

Public-private partnership (PPP) is treated as a modern and innovative form of public investment implementation, although its origins date back to the turn of the 18th and 19th centuries. At that time, British landowners created road trusts, which took loans from private persons for road repairs, and the resulting liabilities were settled from fees for the use of infrastructure. (Yescombe 2008, 36).

In the last few decades, in many countries around the world, there has been a marked increase in the interest in cooperation within public-private partnerships. PPP is a form of cooperation widely used by public sector entities, including governments and municipalities (other local government units) in order to overcome the limitations of public resources (including financial limitations), and to use the opportunities and resources offered by private sector entities (Cabral et al. 2013; Mahoney et al. 2009).

According to the data of the European Investment Bank (EIB), almost 1,800 PPP projects have been recorded in Europe since 1990 for a total amount of EUR 368.3 billion, of which almost 61% were projects in the transport sector (European Investment Bank, 2022).

Despite its growing popularity, the current PPP market is developed in few European countries. The UK, Spain, Portugal, Greece, and Ireland remain the leaders, while other countries either have PPP policies in place, but relatively few projects (e.g., France, Germany), or turned out to be skeptical about both PPP policy and its implementation (e.g., Scandinavian countries). This means that even in the EU Member States, significant differences in the popularity of PPP undertakings can be found (Cepparulo, Eusepi, Giuriato, 2020).

In Great Britain, as one of the PPP leaders, a number of tasks incumbent on the public sector are delegated to private partners. The Private Finance Initiative effectively relieves the budgets of public sector entities (both at the central and local level) (Mühlenkamp H., 2011). According to the data of the International Monetary Fund, in the years 2000-2019 in the UK, the total value of investments in PPP projects exceeded USD 191 billion, which in turn accounted for nearly 14% of total investments of the government sector and almost 2.5% of total investments in private sector fixed assets (IMF Investment and Capital Stock Dataset 1960-2019).

Compared to the UK in Poland, PPP is still a not very popular form of cooperation; total investment in PPP projects is only 1.7% of total government investment and 0.4% of total private sector fixed asset investment.

Despite the initial distrust of PPP, it seemed that this form of financing would quickly become popular in Poland. It seems, however, that these optimistic expectations have not been met.

Hence, the main goal set by the author was to identify the main barriers to the development of PPP in Poland.

The specific objectives were also:

– analysis of PPP development in Poland

– identifying the main sectors in the implementation of PPP projects

– definition of future prospects.

To achieve the goal, the author conducted a pilot survey among people employed in public institutions who had already implemented at least one public-private project in the past, and also used the available statistics of the PPP Development Institute in Poland, data from the International Monetary Fund, the World Bank in total with available literature and legal acts.

The essence of PPP

There are different definitions of PPP in the literature available and there is not a recognized one.

As defined by the Organization for Economic Cooperation and Development (OECD): Public-Private Partnerships (PPPs) are long term contractual arrangements between the government and a private partner whereby the latter delivers and funds public services using a capital asset, sharing the associated risks (OECD 2012). In turn, the World Bank defines PPP as: a long-term contract between a private party and a government entity, for providing a public asset or service, in which the private party bears significant risk and management responsibility (PPP Reference Guide – IntroductionPPP Reference Guide – Introduction, World Bank 2017).

Korbus and Stravinsky call public-private partnership a new form of public tasks implementation and identify it with an efficient instrument for the public sector to fulfill the tasks entrusted to it in cooperation with a private entity (Korbus, Strawiński 2006, 23).

Brzozowska defines public-private partnership as cooperation between the public and private sectors, the purpose of which is to carry out tasks traditionally performed by the public sector (Brzozowska, 2010, 30). It also emphasizes that the parties have some benefits from collaborating in which they share tasks and risks, and that each partner is doing what they specialize in, which makes the collaboration more effective.

Kowalczuk defines PPP as an investment implemented under a long-term contract concluded between a public and private entity, which aims to create infrastructure elements for the provision of public services (Kowalczuk 2014, 9-10).

Liżewski describes public-private partnership as cooperation using the knowledge of the public sector and private capital to implement public investments. This cooperation is based on a long-term contract that defines the division of tasks and risks between investors. The author emphasizes that a private entity is required to partially or fully finance and implement the project as well as manage or maintain the resulting infrastructure in return for reaping specific benefits (Liżewski 2014).

Aigner-Walder adds that the term PPP is used as a collective term for the various forms of cooperation between public authorities and private entities. The basic idea of the PPP concept is based on the cooperation of the public and private sectors aimed at combining the ways of thinking and acting as well as the use of available resources to lead the project in the most efficient and effective way for the mutual benefit of cooperating partners (Aigner-Walder 2018)

Kivlenc also points out that a public-private partnership needs to combine profit-based incentives (but not too much!) with regulatory controls and the possibility of extra state funding (but again not too much on either count). Public-private collaborations differ from those between private firms in a number of ways (Kivleńc et al. 2017).

Iosa & Martimort indicate that public-private partnerships (PPPs) are contractual arrangements between a public authority (which can be a local or a central government agency) and a private supplier for the delivery of some services, in which the latter takes responsibility for building or upgrading a piece of infrastructure that supports these services, makes arrangement towards the financing of the investment, and then manages and maintains this facility (Iossa & Martimort 2015).

It is also worth emphasizing that involving the private sector through a PPP is different from outright privatization in several important ways. This is especially important in the context of a policy of reluctance (society, government) or the impossibility of privatization (Fabre & Straub 2021).

Along with the dissemination of the assumptions of public-private partnership, more and more benefits related to the implementation of investments in this formula began to be noticed. The literature on the subject mainly emphasizes the financial aspect, as it has been proven that the costs incurred in public-private projects are lower compared to projects financed from public funds. This is related to the distribution of costs incurred for the implementation of the project, as well as their transfer to the public entity for subsequent maintenance and management.

It is not difficult to notice that the public sector derives more benefits from such cooperation, because without incurring high costs (apart from making own contribution), it gains modern infrastructure or services. Private entities, on the other hand, are driven primarily by the desire for profit, paying attention to the security and stability of cooperation with the public partner.

A characteristic feature of public-private partnership is the division of risks between the participants of the investment process – the public institution and the private partner. It is this element that makes PPP more attractive and effective by comparison to traditional forms of investment implementation. The allocation of risks should be based on the assumption that a given entity is responsible for the area of risks that it is able to manage more effectively, and that neither party can be assigned all identified risk areas. This breakdown is called the optimal level of risk. The occurrence of undesirable phenomena during the implementation of the project increases the investment costs, therefore the participants should make every effort to minimize the risks and costs, which will translate into a higher level of remuneration (McQuaid RW. 2000, Wall. Connolly 2009. 707–724, Zayyanu, Foziah 2018).

According to the above-mentioned definitions, an investment in the public-private partnership formula must meet the following criteria: 1) the parties’ cooperation must be governed by a public-private partnership agreement, which defines the division of tasks, responsibilities and risks, 2) parties to the contract must be units specified in the act on public-private partnership, 3) cooperation must be guided by the implementation of a public task, 4) the private entity is entitled to remuneration for the work performed, 5) the private entity is obliged to bear the costs and expenses for the implementation of the project or the obligations of third parties to do so, 5 ) the benefits for the public interest obtained under the public-private partnership must be higher than in the case of implementing the project in a different form, 6) the selection of the private partner must be made in accordance with the provisions of the Act, 7) establishing cooperation with information about the project should be announced in the Public Information Bulletin, the Official Journal of the European Union, the Public Procurement Bulletin and / or the European Journal of Public Procurement.

Özdoganm and Birgönül have listed critical success factors, i.e. determinants that favor the implementation of projects in the PPP formula, dividing them into four groups: 1) financial and commercial – demand for a given service, competences of the project team, profitability of the project, economic stability in the country, the prospect of attracting a foreigner capital, 2) political and legal – political stability in the country, experience of public authorities in the implementation of projects under public-private partnership, transparent procurement system, accessible legal regulations, 3) technical – the size of the project allowing for reliable technical control, innovation of implemented solutions, credibility and competences of the private partner, 4) social – acceptance of the project by the community, compliance of the project with ecological standards and respect for the natural environment, the price of future services (Özdoganm & Birgönül 2000).

Based on the above review, it can be seen that the success of PPP projects depends on many factors, e.g., the policy pursued by the central government which defines the place and role of the private sector in the economic system, the applicable legislation, although the initiative is equally important, willingness and experience of local governments. As a rule, countries with a developed market economy and with a significant share of the private sector in it more often decide to invest with the use of PPP.

Experiences – PPP in Poland

The Polish legislator did not regulate the public-private partnership until 2005, but during its validity (2005-2009) no project in this formula was implemented. The Act was amended and published on December 19, 2008. According to the adopted definition, public-private partnership consists in the joint implementation of a project based on the division of tasks and risks between the public entity and the private partner (Act of December 19, 2008 on public-private partnership; Journal of Laws 2009 No. 19 item 100, as amended). Pursuant to the Act, the private partner undertakes to perform the task for which it will receive remuneration and to incur the necessary costs, and the obligation of the public entity is to cooperate and make its own contribution.

In Poland, public-private partnership functions, in addition to the Act of December 19, 2008, on the basis of the Act of October 21, 2016 on concession contracts for construction works or services (Announcement of the Marshal of the Sejm of the Republic of Poland of March 1, 2021 on the publication of the consolidated text of the Act, Journal of Laws 2021, item 541) and the Act of September 11, 2019 – Public Procurement Law (Announcement of the Speaker of the Sejm of the Republic of Poland of May 18, 2021 on the publication of the uniform text of the Act, Journal of Laws of 2019, No. 2021 item 1129).

The value of the Polish PPP market, calculated by the cumulative value of completed and ongoing projects (at the beginning of January 2022), amounts to approximately PLN 8.6 billion (less than EUR 2 billion). The highest-value contracts were concluded in 2013 and their value amounted to approximately PLN 2.1 billion. The largest undertaking of this period was the construction and management of the waste management system in Poznań (PLN 782.8 million). The average value of contracts concluded in 2009-2020 was PLN 54 million.

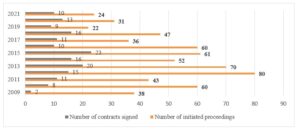

It should be noted that the ratio of initiated procedures to procedures with a signed contract remains at a relatively low level. Over the last 13 years, from the beginning of 2009 to the end of 2021, a total of 624 PPP proceedings were initiated in Poland; at the same time, the number of signed PPP contracts was 164 (this number includes contracts in progress and completed contracts in total), which makes it effective 26.3%. The quoted data on the number of decisions initiated and concluded contracts, broken down by year, are presented in Figure 1.

In regional terms, there are significant discrepancies in the number of investments – on the eastern wall, as well as in the Kujawsko-Pomorskie, Lubuskie, Opolskie and Świętokrzyskie voivodeships, they are single projects, while where there are large urban centers, developed industry, fast economic development, PPP becomes more practiced. The undisputed leader is the Mazowieckie Voivodeship, which has so far undertaken the implementation of 34 projects. A relatively small number of projects concerns the following voivodships: Lubelskie, Lubuskie, Kujawsko-Pomorskie, Świętokrzyskie, Podkarpackie. Eastern voivodeships are constantly developing economically, as evidenced by, inter alia, the growing GDP generated by these areas, and also receive significant EU funds as part of programs compensating the differentiation of regions for new investments, and yet they do not benefit from PPP.

Fig. 1. The number of initiated proceedings and the number of signed

PPP contracts in 2009-2021

Source: Author’s calculations based on: Raport rynku PPP 2009-2020, Ministerstwo Funduszy i Polityki Regionalnej, Warszawa 2021, s. 4, Raport rynku PPP 2009-2021, Ministerstwo Funduszy i Polityki Regionalnej, Warszawa 2021, s. 3, Raport rynku PPP 2009-2020, Ministerstwo Funduszy i Polityki Regionalnej, Warszawa 2021, s. 4, Raport rynku PPP 2009-IQ2022, Ministerstwo Funduszy i Polityki Regionalnej, Warszawa 2022, s. 3

Figure 2 shows the distribution of completed and implemented public-private projects as at the end of 2021, broken down by individual voivodeships.

Fig. 2. Number of signed PPP contracts in Poland by individual voivodeships

Source: Author’s calculations based on: Bazy zawartych umów PPP, https://www.ppp.gov.pl/baza-zawartych-umow-ppp/ (access: 20.03.2022).

Interest in the PPP formula may also be influenced by the size and level of urbanization of urban centers and tourist attractiveness. Cities such as Warsaw, Tricity, Poznań, Kraków or Wrocław decide to use PPP not only to improve the quality of life of residents by insulating buildings, replacing street lamps with LED, or providing running water and sewage, but also to improve the quality of public transport ( e.g. construction / extension of tram networks, construction of ecological bus shelters), improvement of the functioning quality of road users (e.g. construction of underground or multi-storey car parks, extension of bicycle paths, introduction of a city bike), and to highlight the most attractive points in the city and celebrate historical events (e.g. . production of a film about Solidarity, expansion of the Old Town in Gdańsk). In Silesia – due to economic and environmental conditions – initiatives are primarily undertaken to improve air quality and expand road infrastructure.

The structure of the size, expressed in the unit value of the implemented projects, is dominated by micro-scale projects – with a value below PLN 5 million. Such projects account for over 44.8% of all investments. The largest projects (worth PLN 500 million) are just 4 projects. Their total value amounts to PLN 3.2 billion, i.e., approximately 37.2% of the value of the entire PPP market in Poland.

Over the years 2009-2021, most public-private projects were implemented in the following sectors: energy efficiency (25 projects), sport and tourism, transport infrastructure (24 projects each) and water and sewage management (22 projects). In terms of value, the sectors dominate: waste management (28.2%), telecommunications (19.2%) and transport infrastructure (19.1%).

Study Results

The author conducted a survey in the period of December 2020 – October 2021.

The group of respondents consisted of 35 people representing public institutions participating in the implementation of public-private projects. Most often they were employees of municipal offices or communes filled in the departments of public procurement, investment or economic development. The respondents performed functions at various levels – some of them were operational members of PPP teams, others were specialists and inspectors in individual departments of public units, while the rest performed managerial functions as coordinators, department heads, directors or deputies of local authorities, etc.

The greatest number of return questionnaires was received from the Wielkopolskie and Mazowieckie voivodships – 6 each.

Almost 2/3 of the projects on which the respondents based their experiences and views were implemented under the Act on Public-Private Partnership, the remaining – under the Act on concession for construction works or services.

Among the research group, the largest group were small projects, i.e., with a value between PLN 5 and 40 million. Only a few projects were implemented with the participation of EU funds. More than half of the projects were consulted with employees of advisory offices.

When asked about the reasons for choosing the PPP method for the implementation of a municipal investment, participants of the survey indicated mainly: 1) financial aspects – related to limited funds for investments, transfer of some costs to the private partner, no impact on the level of public debt of the public entity, distribution of costs incurred into debts period, diversification of debt capital, generating additional revenues to the entity’s budget, 2) competence aspects – related to the lack of skills and experience on the part of the public partner to build and manage projects and the private partner’s contribution of innovative know-how, 3) organizational aspects – related to division of risks, staff shortages on the part of the public partner, imposing this form of investment implementation by city authorities, demonstrating that PPP will be the optimal formula, process transparency and 4) quality / efficiency aspects – related to the high quality of products delivered by the private sector, the speed and timeliness of investment implementation and the sustainability of the project.

Almost 58% of the respondents agreed with the statement that the PPP procedure is overly formalized and complicated. The remaining percentage of participants expressed the opposite opinion (28.5%), and over 13% did not have an opinion on this subject. Complicated legal regulations were recognized by the respondents as one of the most important factors hampering the development of partnership in Poland. At the same time, the respondents were not able to clearly assess whether the current regulations encourage private entrepreneurs to take initiatives in the PPP formula – 31.4% of all respondents indicated both that the regulations encourage private partners to cooperate with the public sector and that they do not encourage them.

The complexity of the process as well as the limited substantive knowledge of public officials in the field of PPP may be indicated by the need to use the services of consulting offices. Almost 52% of the respondents indicated that they used the services of external companies in the preparation of the required documentation. In addition, the publicly available Database of PPP Agreements provides information on external consultancy, which shows that at least 75 out of 165 investments were needed for such a need (45.5%).

Public entities positively assess cooperation with private partners – 54.5% assess it “rather positively”, and 36.4% “definitely positive”. The assessments were motivated, among others, by: trouble-free work organization, professionalism, timeliness of work, commitment, good communication, extensive knowledge, implementation of interesting ideas and solutions and the ability to resolve conflicts.

Despite the undeniable positive aspects of cooperation, certain difficulties also arose during the implementation of the projects. According to the respondents, the biggest problem is the legal aspects (42.4%), failure to meet the deadlines specified in the work schedule (39.4%) and exceeding the project budget (33.3%).

In the further part of the questionnaire, the respondents were asked to indicate factors which, in their opinion, inhibit the development of public-private partnership in Poland.

The respondents stated that the biggest obstacle was: 1) lack of experience in the implementation of public-private projects – such an answer appeared 18 times, which is more than half of all indications. Complex legal regulations are another significant barrier – this answer was repeated 15 times, which accounts for 41.7% of all indications. 34% of the respondents considered that the problem related to the lack of state support was significant, and 31.4% indicated that there is a concern about ensuring the sustainability of investments, including the risk of excessive workload. As part of other barriers mentioned by the respondents, the lack of appropriate action disseminating the PPP idea, the lack of appropriate financial instruments, the lack of exemplary projects, excessive risk mitigation or instability resulting from the term of office of the authorities, were indicated.

According to the respondents, the ways to eliminate the above-mentioned barriers and improve the functioning of the public-private partnership mechanism in Poland are: 1) conducting a thorough information and promotion campaign, including workshops and training, 2) increasing the catalog of forms of state support, 3 legal changes, e.g. more accessible and transparent legislation, 4) increasing the availability of financial instruments (e.g. bank guarantees, state guarantees, preferential loans), 5) making the conditions for exiting the contract more flexible in the case of difficult situations of the private partner, 6) presentation of model projects and development of good practices , 7) increasing the catalog of incentives for private entrepreneurs, 8) creating a common and effective system of universal advisory services for public institutions in the field of PPP.

Conclusion

It has been shown that public-private partnership is most often chosen as a method of performing public tasks due to, inter alia:

– limited resources of public institutions for investments,

– the distribution of costs over time and their distribution among project participants

– no impact on the level of debt of the public entity,

– lack of skills and experience (staff) on the part of the public partner to build and manage projects, innovative know-how provided by the private partner,

– risk sharing, high quality of products provided by the private sector,

– durability of the project.

The respondents pointed to:

– the need for promotion and education on the benefits of PPP,

– increasing the catalog of forms of state support,

– introducing financial instruments, developing good practices and model projects, and, importantly, changing the legal provisions into more accessible ones,

– unambiguous and transparent, and the introduction of a universal advisory system for public institutions. It is also necessary to disseminate this idea – especially in small communes, with smaller projects and in various sectors.

In the context of the conducted research, the main barriers to the development of PPPs were:

¬ lack of sufficient knowledge and experience of public authorities to carry out this type of investment, hence the concerns at the stage of initiating the procedure and preparing the project;

¬no incentives or stimulation from the government;

– complicated provisions in the legislation.

References

- Aigner-Walder B. 2018. Public Private Partnership. In: Akademie für Raumforschung und Landesplanung (Ed.): Handwörterbuch der Stadt- und Raumentwicklung, Hannover, 1821-1827, http://nbn-resolving.de/urn:nbn:de:0156-55991691

- Bazy zawartych umów PPP, https://www.ppp.gov.pl/baza-zawartych-umow-ppp/ (Access: 20.03.2022)

- Brzozowska K. 2010. Partnerstwo publiczno-prywatne w Europie, cele, uwarunkowania, efekty, CeDeWu, Warszawa, 30.

- Cabral S, Lazzarini SG, Azevedo PF. 2013. Private entrepreneurs in public services: A longitudinal study of outsourcing and statization in prisons. Strategic Entrep. J. 7(1), 6–25

- Cepparulo A., Eusepi G., Giuriato L. 2020. Public finances and Public Private Partnerships in the European Union, MPRA Paper No. 103918 (https://mpra.ub.uni-muenchen.de/103918/)

- European Investment Bank, 2022, https://data.eib.org/epec/ (access: 11.02.2022)

- Fabre A., Straub S. 2021, The Impact of Public-Private Partnerships (PPPs) in Infrastructure, Health and Education, Warking Papers no 986. September 2021

- https://ppp.worldbank.org/public-private-partnership/about-us/about-public-private-partnerships (Access: 01.03.2022)

- IMF Investment and Capital Stock Dataset, 1960-2019https://infrastructuregovern.imf.org › Knowledge-Hub, version: May 2021 ((access: 22.02.2022)

- Iossa, E., & Martimort, D. (2015). The Simple Microeconomics of Public-Private Partnerships. Journal of Public Economic Theory, 17 (1), 4–48. doi: 10.1111/jpet.12114

- Kaletnik G., Lutkovska S. 2021. European Journal of Sustainable Development(2021), 10, 1, 81-89 doi:10.14207/ejsd.2021.v10n1p81

- Kivleniece, I., Cabral, S., Lazzarini, S., Quélin, B.V. 2017. Public-private Collaboration: A Review and Avenues for Further Research’, in Mesquita, L.F., Ragozzino, R. and Reuer, J.J. (eds.), Collaborative Strategy: Critical Issues for Alliances and Networks, Cheltenham: Edward Elgar, 224-233.

- Korbus B. P., Strawiński M., Partnerstwo publiczno-prywatne. Nowa forma realizacji zadań publicznych, Wydawnictwo Prawnicze LexisNexis, Warszawa 2006, s. 23

- Kowalczuk E., Księgowanie umów partnerstwa publiczno-prywatnego, Finanse Publiczne, 2014, nr 6, s. 9-10.

- Liżewski M., Nowa definicja partnerstwa publiczno-prywatnego, Gazeta Samorządu i Administracji, 2014,

nr 13-14.

- Mahoney JT, McGahan AM, Pitelis CN. 2009. The interdependence of private and public interests. Organ. Sci. 20(6):1034–1052

- McQuaid RW. 2000. The theory of partnerships – why have partnerships. In: Osborne SP, editor. Managing publicprivate partnerships for public services: an international perspective. London: Routledge. 9–35

- Mühlenkamp H. 2011. Ökonomische Analyse von Public Private Partnerships PPP als Instrument zur Steigerung der Effizienz der Wahrnehmung öffentlicher Aufgaben oder als Weg Umgehung von Budgetbeschränkungen?

- Obwieszczenie Marszałka Sejmu Rzeczypospolitej Polskiej z dnia 18 maja 2021 r. w sprawie ogłoszenia jednolitego tekstu ustawy – Prawo zamówień publicznych Dz. U. 2021 poz. 1129

- Obwieszczenie Marszałka Sejmu Rzeczypospolitej Polskiej z dnia 1 marca 2021 r. w sprawie ogłoszenia jednolitego tekstu ustawy – Prawo zamówień publicznych, Dz.U. 2021 poz. 541

- OECD 2012. Recommendation of the Council on Principles for Public Governance of Public-Private Partnerships, May 2012

- Özdoganm I. D., Birgönül M. T. 2000. A decision support framework for project sponsors in the planning stage of build-operate-transfer (BOT) projects, Construction Management and Economics, No.18.

- PPP Reference Guide – Introduction. 2017. World Bank, PPPReferenceGuideVersion31 (worldbank.org) (Access: 12.12.2021)

- Raport rynku PPP 2009-IQ2022, Ministerstwo Funduszy i Polityki Regionalnej, 2022, Warszawa, 3 (Raport-z-rynku-PPP-I-kw-2022_4.pdf) (Access: 30.06.2022)

- Raport rynku PPP 2009-2021, Ministerstwo Funduszy i Polityki Regionalnej, 2021. Warszawa, 3 (https://www.ppp.gov.pl/media/system/slowniki/Raport-z-rynku-PPP-I-kw-2021_22.pdf) (Access: 12.02.2022)

- Raport rynku PPP 2009-2020, Ministerstwo Funduszy i Polityki Regionalnej, Warszawa 2020, 4 (https://www.ppp.gov.pl/media/system/slowniki/Raport-z-rynku-PPP-2020-01-29-_1.pdf) (Access: 25.04.2021)

- Quelin B.V, Cabral S, Lazzarini S, Kivleniece I. 2019. The Private Scope In Public‐Private Collaborations: An Institutional And Capability‐Based Perspective, Organization Science 30(4):831-846. https://doi.org/10.1287/orsc.2018.1251

- Ustawa z dnia 19 grudnia 2008 r. o partnerstwie publiczno-prywatnym, Dz. U. 2009 Nr 19 poz. 100 z późn. zm.

- Yescombe E. R. 2008. Partnerstwo publiczno-prywatne. Zasady wdrażania i finansowania, Wolters Kluwer, Warszawa, 36

- Wall A, Connolly C. 2009. The private finance initiative. Public Manag Rev. 11(5), 707–724

- Zayyanu M. Foziah J. 2018. Critical success factors of public–private partnership projects: a comparative analysis of the housing sector between Malaysia and Nigeria, International Journal of Construction Management, DOI: 10.1080/15623599.2017.1423163