Introduction

The banking sector of each country represents the most important channel for financing local economies. They are deeply linked via the payment systems, the inter-banking relationships as well as economic relationships and interests of the customers. The multiple crises context, starting with the global financial crisis (in 2008), the sovereign debt crisis, the pandemic crisis and continuing with the geopolitical situations have had a strong impact, transforming each banking sector and the banking system globally.

The paper focuses on the post-financial crisis framework and the context of the onset of the pandemic crisis. During the period 2013 – 2021, which is the time frame for the data used in the empirical study, monetary policy was accommodative, interest rates converged to “zero” and subsequently turned negative. Government deficits, countries’ indebtedness, and global debt[1] have increased significantly. Those disequilibria are at the global level and emphasized for long periods. The debt-oriented behavior of governments, companies, and individuals should be part of deeper analyses and research, as impacting the repayment capacity, the management of debt, the savings paradigm, the structure of the new economy, and the willingness to repay the future generations.

The contribution of this research to the literature is highlighted by studying the interrelationships between five key indicators for a country’s economy, the lending rate and a set of other four selected macroeconomic indicators: unemployment, inflation, capital adequacy ratio and bank assets to GDP. The relevance of the research is emphasized by the fact that the selected countries accounted for around 60% of global GDP in 2021. Countries with strong banking sectors and specific structures are included in the empirical study, such as the USA, China, the UK, Germany, and France.

The first two parts present the post-financial crisis and pandemic crisis contexts along with the interdependencies between the variables used in the research. The third part presents the empirical analysis based on the Panel Var methodology.

Part four contains the results of the research together with the authors’ interpretations of these results. The empirical study is connected to the developments and new geopolitical context post-2021.

The paper ends with the authors’ conclusions section.

Literature Review

Empirical research on the links between interest rates and inflation is abundant. The pandemic crisis that occurred during the period under review was another inflection point from the perspective of extending this research. According to INHOFFEN et.al. (2021), central banks around the world supported negative interest rates and facilitated quantitative easing, this led to rising asset prices but without real output growth, which subsequently caused the CPI inflation index to reach a record high in 2022 of 9.1%.

According to Urrehman Akhtar (2022), OECD (2021) CPI inflation is a considerable risk affecting real GDP, thus contributing to lower overall growth. Also IMF (2013), IMF (2021), and Asensio (2019) consider that quantitative easing, along with the accommodative policy spiral for the Covid-19 pandemic, along with negative interest rates have generated the spikes in inflation since Covid 19 pandemic.

According to Sam (2014), there is an inverse relationship between the federal funds rate, business confidence, and unemployment. Reduced business confidence and reduced federal funds rate contribute to higher unemployment rates.

Authors Alessandri and Nelson (2015) found that at the UK bank-level, although the return on bank assets is closely related to long-term rates rather than the average return on liabilities – there is a positive long-term link between the level and slope of the yield curve and bank profitability. According to Swamy’s (2014) research for the Indian banking system, the simulations for several banking groups reflect that 1% of capital growth can be covered by increasing lending spreads by 11.4 basis points, assuming no change in risk-weighted assets.

Bitar et al. (2018), Ding and Sickles (2018), and Ding and Sickles (2019) consider that bank capital is essential as it intervenes as a security component to absorb losses. In this way, setting the appropriate level of capital should be quite compelling to experts and regulators in the United States, because, from a certain perspective, a higher capital ratio holding enhances the potential for loss absorption by the bank. Holding too much capital also distorts economic expansion and increases bank risk.

Low unemployment rates before the global financial crisis as well as between the global and pandemic crises were impacted by declining productivity, according to Demertzis and Viegi (2021). Although the lack of real economic finance remains a key factor in low-interest rates, the decline in productivity is at odds with the technological progress recorded.

Across the European continent, lending capacity and capitalization are severely undermined by the effects of “zero” and negative interest rates impacting the stimulation of economic growth, Claessens et al (2018). Thus, low profitability will diminish banks’ ability to attract and mobilize capital, increasing their vulnerability to shocks, diminishing market confidence and undermining banks’ ability to support the real economy.

The US and EU financial markets are different in terms of funding: the US market relies heavily on retail investors and the equity fund market; in Europe, by comparison, most financing is channeled via traditional credit institutions, which have important implications for the way companies raise external finance, Yip and Bocken (2018), Hachenberg and Schiereck (2018), and Nitescu and Anghel (2023).

According to the research of Gao et al (2019) and Su et al (2020), in comparison with the European and American banking systems, the Chinese banking system has an open market entry for companies. There is also high competition among banks because depositors can search for high-yielding assets, comparing traditional banking with shadow banking and capital markets.

Also, according to the authors Stiglitz (2018), Borio et al. (2017), and Brunnermeier and Koby (2016), loosening monetary policy for a long period, with too low – interest rates, leads to a reduction in interest income which may prevent the transmission of monetary policy.

According to Oto (2023), the inflationary counter effect of the Covid 19 pandemic, attempted by the Fed, by raising interest rates on loans and driving down asset prices and thus long-term bond prices, led to the bankruptcy of three US banks in a very short period.

In terms of the relationship between bank risk and bank capital buffers, banks with higher capitalization follow financial market discipline and have greater power to withstand sudden shocks, and the higher the capital buffers are, the greater the confidence of shareholders to make investments, Abbas et.al (2021), Valencia and Bolaños (2018).

Methodology and Database

The study aims to structure answers to a complex question: do relevant macroeconomic and banking indicators, such as the unemployment rate, inflation, the capital adequacy ratio, and bank assets to GDP have a direct influence on the lending rate, or their influence is based on the relationships between variables in a given country?

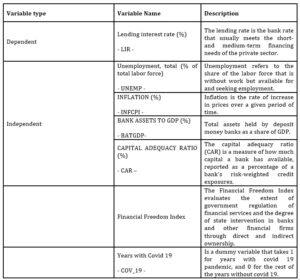

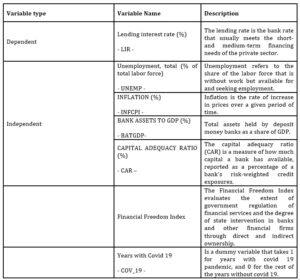

To build an adequate framework and a meaningful contribution, the study proposes three working hypotheses, formulated as questions, which include the five variables used and presented in table number 1:

- Which of the indicators analyzed influence the long-term interest rate on loans?

- How do the relationships between the selected indicators influence the evolution of the interest rate on loans granted?

- Which of the indicators included in the study do not have a statistically significant influence on the development of the lending rate?

The Vector Error Correction model (VECM model) allows us to explain the interdependencies between multiple time series, in the short term, as well as in the long term, between variables that are cointegrated.

To capture the impact of all the independent variables used on short, medium and long-term interest rates, considering that not all variables were stationary of order I(0), but also order I(1), we used the Autoregressive Distributed Lag model (ARDL model). To obtain the robustness of the results at different points in time throughout the period analyzed, we also used quantile regression together with the VECM and ARDL models.

The research design along with the annual series of data was used for each country analyzed. Other relevant research (Alessandri and Nelson (2015); Apriadi et.al. (2016); IMF (2013) and Swamy (2014)) used only Panel Var to capture the interdependencies and developments of the analyzed countries, under the impact of multiple crisis periods, in the short, medium and long term, but also to bring robustness to the results obtained.

30 countries having various banking systems were chosen to highlight the transformations, interdependencies and evolutions: Austria, Belgium, Bulgaria, Croatia, the Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden, China, the United Kingdom, the United States.

To capture the developments, impact, relationships and influences of selected macroeconomic indicators, also relevant for financial and banking activity, specific indicators were used: the share of banking assets in GDP, the capital adequacy ratio, the inflation rate and the unemployment rate, the financial freedom index and a dummy variable: Covid_19 related to the Covid-19 pandemic years.

The methodology used to verify the research hypotheses included 270 observations. Panel data methodology was used for the econometric analysis, based on EVIEWS 12 software. The data series that were included have an annual frequency.

The data were extracted from the World Bank and The Global Economy databases, with records for 8 years, from 2013 to 2021. From an economic perspective, the selected countries play an important role in the global economy, which was an important element for the selection.

Other relevant arguments for the sample of the countries are linked to ensuring comparable data between the chosen countries globally: countries in Eastern Europe, Western Europe, North America, and Asia. Among the countries in the chosen sample, we can highlight the countries with strong banking systems, the USA, China, Germany, France, the UK, whose banking systems are dominant globally.

To identify the optimal analysis methodology, the characteristics of all variables analyzed were evaluated and tested. For obtaining relevant results, both economically and statistically, we chose to analyze the effect and the relationships implied on the dependent variable – the interest rate on loans, by the independent variables. The variables used in the analysis are presented in Table 1.

Table No.1 – Variables used in the analysis

Source: Authors’ own interpretation

Models Estimation

The degree of stationarity for each variable included in the model was tested and it was found that some of them are not stationary. As a result, for each variable, the first difference was applied to obtain stationarity, as well as the cointegration test to highlight the significance of the variables in the short, medium and long term, for every of the 30 surveyed countries, as well as globally.

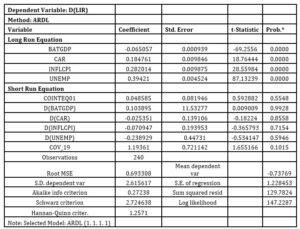

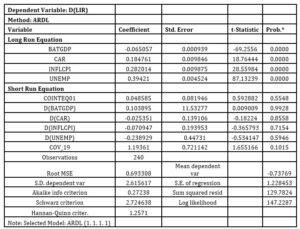

Table 2 – Autoregressive Distributed Lag (ARDL) Cointegration Test

Source: Authors’ own calculation based on World Bank and The Global Economy data.

Source: Authors’ own calculation based on World Bank and The Global Economy data.

Following the application of the cointegration test for the ARDL model in Table 2, we observe two completely different time horizons. Thus, if in the short term, all the variables included in the model are statistically insignificant but economically important, in the long term the situation changes and all the variables become statistically significant and not only economically significant.

According to the ARDL cointegration test, we can notice that, in the short run, several variables are statistically insignificant, all of them becoming significant in the long run. In the following countries analyzed (Bulgaria, Cyprus, Czech. Rep., Denmark, Estonia, Greece, Luxembourg, Malta, Poland, Romania, Sweden, the United Kingdom, and the United States), the variables BATGDP and CAR are statistically insignificant, finding them higher than the 5% threshold.

The long-run coefficients resulting from the ARDL cointegration test were based on the AIKAKE information criterion. Following this analysis, we can observe statistically significant relationships, both positive and negative for the 5% significance threshold, in Table 2. Thus, at a 1% increase in BATGDP, the dependent variable LIR will decrease by 0.065%. Also, at a 1% increase in CAR, LIR will increase by 0.185%. In the case of a 1% increase in inflation, the LIR will increase by 0.282%, and, in the case of a 1% increase in unemployment, the LIR will increase by 0.39%.

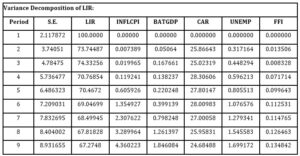

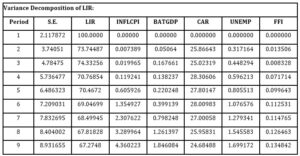

Variance decomposition (VDC) shows which of the independent variables is stronger in explaining the variability of the dependent variables over time. (VDC) determines also how much of the forecast error in the variance of each variable can be explained by exogenous shocks to the other variables.

Table 3 – Variance Decomposition

Source: Authors’ own calculation based on World Bank and The Global Economy data.

As shown in Table 3, on an average time interval of 3-5 years, we notice that the most pronounced impact on the dependent variable, interest rate on loans, are the variables: CAR (28.31%), UNEMP (0.596%) and BATGDP (0.138%), INFLCPI (0.12%). Also, over 5 years, the order of the variables with a more significant impact on the LIR is the same, being: CAR (27.80%), UNEMP (0.81%) and INFLCP (0.61%), BATGDP (0.22%), and also for the 8 years the variables are the same: CAR (24.68%), INFLCPI (4.36%), BATGDP (1.85%) and UNEMP (1.699%) with the most impact on lending rate.

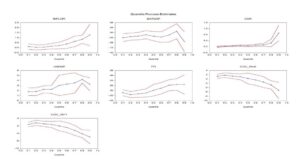

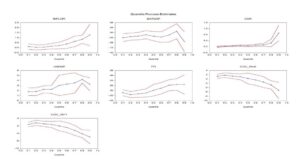

To analyze the impact and relationships between variables in the short, medium and long term, was used quantile regression. The results are presented in Figure 1.

Figure 1 – Quantile Process Estimates

Source: Authors’ own calculation based on World Bank and The Global Economy data.

INFLCPI variable reflects an upward trend starting in quantile 10 with 0.11% to quantile 90 being 1.27%. The unemployment variable has a mixt trend starting from quantile 10 with 0.18% to quantile 80 (0.42%) being an upward trend and descent in the 90th quantile to (0.32%), becoming a downward trend. BATGDP variable has a mixt trend starting from quantile 10 with (-0.040%) to 80 quantile becoming (0.011%) and descending to (-0.071%) into 90 quantile. CAR over the period analyzed has an upward trend starting from 10 quantile being ( -0.01%) to 90 quantile becoming (0.9%).

Also taking into account the analysis of the periods related to the years with the Covid 19 pandemic, we can notice the increased impact of the analyzed variables on the dependent variable for all variables compared to the periods without these economic contexts.

Results and Discussions

An important role is played by the relationship between inflation, the interest rate on loans, and the level of bank assets. Thus, high lending rates to counteract inflation will contribute to the increase in the indebtedness of borrowers, but also to the fall in asset prices, especially long-term bonds, ultimately generating losses for banks with large volumes of long-term bonds. This is consistent with the theory and research by Oto (2023) that rising interest rates on loans have led to falling asset prices.

According to Hashima et al (2021), starting from lowering interest rates on loans can help companies in hiring more people which drives lowering the unemployment rate. As a result, the volume of credit granted to companies will increase.

The remaining independent variables have a smaller direct long-term impact. The impact on the interest rate on loans will be indirect, through the correlations between the independent variables analyzed, which provides the answer to Question 1. The relationship between inflation and the interest rate on loans is significant and mutual, a result which is reflected in particular in the medium and long term.

As for the answer to question 2, over a medium time horizon, bank assets to GDP and unemployment remain at a low level of direct significance on lending rates. This result highlights other indirect ways in which the interrelationships between these macroeconomic indicators could influence lending interest rates, namely tighter prudential supervision for both small and medium-sized banks, not just large banks, better and constantly improving regulation of the financial digitalization, and also increased confidence in the banking market, following the bank failures in the US, in 2023.

The answer to Question 3 is given by the indicators of unemployment and bank assets to GDP, which have a direct impact on the interest rate on loans, but are not significant statistically.

The result of the significant influence on the dependent variable given by the context of that variable itself can be interpreted through the lens of the accommodative monetary policies conducted by central banks during the period under analysis. The literature includes diverse views on the effects of “zero” interest rates and negative interest rates on investment, generating very low economic growth in Europe and globally, Demertzis and Viegi (2021). In addition, the use of monetary policy subsequently to stimulate the economy during the pandemic crisis led to higher inflation at the end of the period under review.

According to Sweet and Chapman (2023) and Thompson (2023), the Federal Reserve’s fight against inflation has played a key role in the banking turmoil. The Fed had raised its key interest rate by a quarter-point to the highest level in 16 years as part of that campaign, its tenth consecutive rate hike between 2022 – 2023. The Fed’s rapid rate hikes over the 2023 have started to slow the economy. As a consequence of high inflation, rising interest rates and a high proportion of uninsured deposits for business financing, three banks have failed[2].

The global financial crisis of 2008 and the succession of crises determined major transformations in the global banking system. Bank concentration increased, profitability levels decreased, and the adoption of sustainable banking became a global practice. The cooperation between the analyzed 30 countries may provide strategic support in balancing competitiveness, profitability and sustainability, for the benefit of all the stakeholders, in the long run. As for Istudor et al (2022), the financial and banking sector should act as the main driver of capital allocation for sustainable investments and digital technologies.

In terms of answering the fundamental question of this research, from a global perspective, the macroeconomic and banking indicators analyzed influence the interest rate for the long-term loans, for all countries included in this sample. These findings are also in line with the research of Christensen and Rudebusch (2019). However, this influence is not direct but is based on the interrelationships between these macroeconomic indicators and the accommodative monetary policies that have been conducted by central banks during the context of multiple crises. Facilitating the finding of alternative sources of oil supply as well as the implementation of measures to reduce countries’ dependence on a single source of imports, directing funds towards more efficient regulation of financial digitization, together with keeping the inflation rate as stable as possible by central banks, should be of concern for creating viable economic policy options, as reflected by Urrehman Akhtar (2022).

Periods of zero and negative interest rates have not helped to increase savings and stimulate investment. In addition, the monetary policies used subsequently, together with government liquidity support programs during the pandemic crisis, led to higher inflation at the end of the period under review, which is in line with other research by Asensio (2019) and Demertzis and Viegi (2021). The fight against inflation led to a rapid increase in interest rates several times during 2022, resulting in a slowdown in economic growth and the failure of three banking institutions in the US.

Sustainable investment and more robust regulation of new digital technologies are also in line with Jacobs (2023) and can help mitigate financial risk and increase the profitability of the banking sector, impacting economies, embedding innovation, supporting job creation and acting as a key catalyst for the transition to a sustainable economy.

Regulatory dynamics adapted to the context of multiple crises together with the implementation of sustainability objectives and the transition to a “green economy” along with the development of a policy mix (monetary, economic, fiscal) adapted to each country, also according to Nitescu and Anghel (2023), are essential objectives for financial and banking systems. It is very important to focus on countercyclical policies so that the economy and the financial banking system of the country concerned can contribute to the adequate accommodation of transitory phenomena and the absorption of shocks.

In the economic and financial structure of each country, to minimize constraints it is necessary to develop new financial instruments to support production, exports, sustainable development programs and digital technologies.

Conclusions

The period selected for the empirical study (2013 – 2021) incorporates the effects of the financial crisis, the changes in the regulatory framework, a new macro approach from the regulatory and supervision perspectives, and a new approach brought by the pandemic crisis.

Almost every industrialized country, as per the selected sample, registered strong negative consequences, both for the economy and banking sector, many years after the financial crises. The interdependences and linkages between the macro indicators and banking indicators should be deeply analyzed and considered for the policy mix. Calibration of the instruments as well as cooperation between authorities and countries add significant value.

During the financial crisis, the banking sector was part of the problem, contributing significantly to risk amplification, while during the pandemic, banking was part of the solution, backed by stronger and better cooperation of the relevant authorities. New “antibodies”, new instruments and know-how to manage an unafavorable financial context were in place, during the pandemic, compared to the global financial crisis time.

The results of the study, also supported by the researchers Borio et.al (2017) and Hashima et.al (2021), indicate that monetary policy, together with policymakers, plays a key role in influencing and shaping interest rates, inflation, unemployment and asset quality, for all categories of banks in all the countries analyzed. Thus, in the wake of the panic created by the collapse of the three US banks, the return to tighter regulatory oversight, including higher capital ratios, stricter stress tests and/or faster recognition of losses by all small and medium-sized banks was part of the solution, to avoid the amplification of other risks.

The research also reflects the important role of the unemployment variable, interlinked with all other indicators, for every analyzed country, which is in line with Sam (2014). Policies related to sustainable employment stimulation require special attention in the policy mix. Thus, the design of new jobs, the development of specific skills, the continuous training of the workforce in line with economic dynamics and the retraining of a large part of the workforce have a significant impact on supporting the transition to a green and sustainable economy in the medium and long term.

The transformation of international banking is linked with the transformation of the global economy. The multiple crises’ context influenced the financial governance, at the global level as well as the funding of the economies.

References

- Abbas, F., Masood, O., Ali, S., and Rizwan, S. (2021), ‘ How do capital ratios affect bank risk-taking: New evidence from the United States’, Sage Open, 11(1), https://doi.org/10.1177/2158244020979678 .

- Alessandri, P and Nelson, B. (2015), ‘Simple banking: profitability and the yield curve’, Journal of Money Credit and Banking, vol 47, no 1, pp 143–75.

- Apriadi, I., Sembel, R., Santosa, P. W., and Firdaus, M. (2016), ‘Banking fragility in Indonesia: A panel vector autoregression approach’, International Journal of Applied Business and Economic Research, 14(14), 1193-1224.

- Asensio, A. (2019), ‘Endogenous interest rate with accommodative money supply and liquidity preference’, HAL SHS – Human and Social Science, [Online], [Retrieved February 5 2023], https://halshs.archives-ouvertes.fr/halshs-01231469 .

- Bitar, M., Pukthuanthong, K., and Walker, T. (2018), ‘The effect of capital ratios on the risk, efficiency and profitability of banks: Evidence from OECD countries’, Journal of International Financial Markets, Institutions and Money, 53, 227–262.

- Borio, C., Gambacorta, L. and Hofmann, B. (2017), ‘The influence of monetary policy on bank profitability’, International finance, 20(1), 48-63, https://doi.org/10.1111/infi.12104 .

- Brunnermeier, M.K. and Koby, Y. (2016), ‘The reversal interest rate: the effective lower bound of monetary policy’, American Economic Review, [Online], [Retrieved February 18 2023], https://markus.scholar.princeton.edu/publications/reversal-interest-rate-effective-lower-bound-monetary-policy .

- Claessens, S., Coleman, N. and Donnelly, M. (2018), ‘ “Low-For-Long” interest rates and banks’ interest margins and profitability: Cross-country evidence’, Journal of Financial Intermediation, 35, 1-16., http://doi.org/10.1016/j.jfi.2017.05.004 .

- Demertzis, M., and Viegi, N. (2021), ‘Low interest rates in Europe and the US: one trend, two stories’, Policy Contribution, 7, 1-19.

- Ding, D., and Sickles, R. C. (2019), ‘Capital regulation, efficiency, and risk taking: A spatial panel analysis of US banks’, Academic Press, 405–466, https://doi.org/10.1016/B978-0-12-815859-3.00013-5 .

- Ding, D., and Sickles, R. C. (2018), ‘Frontier efficiency, capital structure, and portfolio risk: An empirical analysis of US banks’, BRQ Business Research Quarterly, 21(4), 262–277 .

- Eurostat, (2023), ‘Annual inflation more than tripled in the EU in 2022’, [Online], [Retrieved May 21 2023], https://ec.europa.eu/eurostat/web/products-eurostat-news/w/ddn-20230309-2 .

- Gao, H., Ru, H., Townsend, R. and Yang, X. (2019), ‘The rise of bank competition: Evidence from banking deregulation in Gao’, National Bureau of Economic Research, [Online], [Retrieved May 22 2023], https://www.nber.org/papers/w25795, https://doi.org/10.3386/w25795 .

- Hachenberg, B., and Schiereck, D. (2018), ‘Are green bonds priced differently from conventional bonds? ’ Journal of Asset Management, 19 (6), 371–383, https://doi.org/10.1057/s41260-018-0088-5 .

- Hashima, A., Rambeli,N., Norasibah, A. and Hashim, E. (2021), ‘The dynamic relationship between unemployment, inflation, interest rate and economic growth’, International Journal of Innovation, Creativity and Chang, 8( 7), 89-94.

- IMF, (2021), ‘Understanding the Rise in Long-Term Rates’, [Online], [Retrieved May 23 2023], https://blogs.imf.org/2021/04/22/understanding-the-rise-in-us-long-term-rates/ .

- IMF, (2013), ‘Assessing the Determinants of Interest Rate Transmission Through Conditional Impulse Response Functions’, [Online], [Retrieved May 28 2023], https://www.imf.org/external/pubs/ft/wp/2013/wp1323.pdf .

- INHOFFEN, J., PEKANOV, A. and Url, T. (2021), ‘Low for Long: Side Effects of Negative Interest Rates’, Monetary Dialogue Papers, [Online], [Retrieved January 26 2023] https://www.europarl.europa.eu/cmsdata/235693/02.DIW_formatted.pdf .

- Istudor, N., Nitescu, D. C., Dumitru, V. F., and Anghel, C. (2022), ‘Banking, Competitiveness and Sustainability: The Perspective of the Three Global Actors: US, China, Europe’, Journal of Competitiveness, 14(3), 59–75, https://doi.org/10.7441/joc.2022.03.04 .

- Izzeldin, M., Muradoğlu, Y. G., Pappas, V., Petropoulou, A., and Sivaprasad, S. (2023), ‘The impact of the Russian-Ukrainian war on global financial markets’, International Review of Financial Analysis, 87, 102598, https://doi.org/10.1016/j.irfa.2023.102598I .

- Jacobs, J. (2023), ‘Silicon Valley Bank and the double-edged sword of digital efficiency’, Official Monetary and Financial Institutions Forum, [ Online], [Retrieved March 10 2022], https://www.omfif.org/2023/04/silicon-valley-bank-and-the-double-edged-sword-of-digital-efficiency/ .

- Kammer, A., Azour, J., Selassie, A. A., Goldfajn, I., and Rhee, C. (2022), ‘How war in Ukraine is reverberating across world’s regions’, Washington: IMF, [Online], [Retrieved March, 15 , 2022], https://joserobertoafonso.com.br/wp-content/uploads/2022/03/How-War-in-Ukraine-Is-Reverberating-Across-Worlds-Regions-%E2%80%93-IMF-Blog.pdf .

- de Larosiere, J., (2022), ‘Putting an end to the reign of financial illusion’, Editions Odile Jacob, [Online], [Retrieved January, 15 , 2024], https://www.odilejacob.com/catalogue/sciences-humaines/economie-et-finance/putting-an-end-to-the-reign-of-financial-illusion-for-real-growth_9782415003784.php

- NITESCU, D. C., and ANGHEL, C. (2023), ‘IMPACT OF MACROECONOMIC AND BANKING INDICATORS ON LENDING RATES-A Global PERSPECTIVE’, Romanian Journal of Economic Forecasting, 26(1), 64.

- OECD, (2021), ‘Strengthening the recovery: Need for speed’, Economic Outlook Interim Report, [Online], [Retrieved May 25 2023], https://www.oecd-ilibrary.org/economics/oecd-economic-outlook/volume-2020/issue-2_34bfd999-en .

- Oto, M. (2023), ‘Bank Failures 2023 and The Dangers Still Lurking Beneath the Surface’, Swan Global Investments, [Online], [Retrieved June 3 2022], https://www.swanglobalinvestments.com/bank-failures-2023-danger-beneath-surface/ .

- Sam, K.A. (2014), ‘Federal funds rate and unemployment relationship: does business confidence matter?’, Journal of Student Research, [Online], [Retrieved February 10 2023], https://minds.wisconsin.edu/handle/1793/77330 .

- Stiglitz, J. (2018), ‘The theory of credit and macroeconomic stability’, Economic theory and policy amidst global discontent, 127-183, https://doi.org/10.3386/w22837 .

- Su, C. W., Qin, M., Rizvi, S. K., and Umar, M. (2020), ‘Bank competition in China: A blessing or a curse for financial system?’ Economic Research, 34 (1), 1244–1264. https://doi.org/10.1080/1331677x.2020.1820361 .

- Swamy, V. (2014), ‘Modelling the Impact of New Capital Regulations on Bank Profitability’, SSRN – Elsevier, [Online], [Retrieved September 4 , 2014], https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2491397 .

- SWEET, K. and CHAPMAN, M. (2023), ‘The banking crisis isn’t over. But how bad will it get?’, The Associated Press [Online], [Retrieved May 27 2023], https://apnews.com/article/pacwest-deposits-fed-regional-banks-e08b80e8f9f321c881a8b946172b1cdb .

- The Global Economy, (2023)’, ‘Global Economic Data’ [Online], [Retrieved February 142023], https://www.theglobaleconomy.com/download-data.php .

- Thompson, M. (2023), ‘Global banking crisis: What just happened?’ [Online], [Retrieved May 28 2023], https://www.cnn.com/2023/03/17/business/global-banking-crisis-explained/index.html .

- Urrehman Akhtar, A. (2022), ‘The interrelationship between interest rate, inflation, and Economic growth-A comparison between Germany and France’, [Online], [Retrieved June 29 2022], https://www.theseus.fi/bitstream/handle/10024/755335/Atiq%20Urrehman%20Akhtar.pdf?sequence=2&isAllowed=y

- Valencia, O. C., and Bolaños, A. O. (2018), ‘Bank capital buffers around the world: Cyclical patterns and the effect of market power’, Journal of Financial Stability, 38, 119–131, https://doi.org/10.1016/j.jfs.2018.02.004 .

- World Bank, (2023), ‘ Global Financial Development’, [Online], [Retrieved February 18 2023], https://databank.worldbank.org/source/global-financial-development .

- Yip, A. W. and Bocken, N. M. (2018), ‘Sustainable Business Model Archetypes for the Banking Industry’, Journal of Cleaner Production, 174, 150–169, https://doi.org/10.1016/j.jclepro.2017.10.190 .

[1] According to Jacques de Larosiere, based on the figures from the Institute of International Finance, the global debt, at the end of 2021, has exceeded 300 trillion dollars; an absolute record in peacetime, representing 360 % of the world’s GDP; the world GDP registered around 85 trillion dollars; in 1970s global debt amounted to 100% of world GDP, in 2020 it represented 250 %, an increase of 2.5 times in 50 years.

[2] These three banks are: Sillicon Valey Bank, Signature Bank and First Republic Bank.