Introduction

The relationship between economic growth and foreign direct investments is very interesting to analyze because these two variables in the economy could influence each other’s evolution. The attraction of the foreign direct invetment in a country generates advantages that could support the economic growth as new technologies, invested capital, employment opportunities for the labor force and trainings, new management perspectives, competitiveness in the market and development of the banking industry for financing investments. On the other side, a country with an economic growth increasing could offer a lot of opportunities for the foreign investors in terms of fiscal facilities, favorable economic environment, free access to information, employment, opening to trade.

The main objective of this research is to highlight the impact of the foreign direct investment on economic growth in case of 26 OECD countries from Europe, during the years 2000-2021. More than that, this study includes also in the analysis other variables with influence in the economic environment as net exports, imports, openess of the economy, unemployment rate and inflation rate, which are very important in the analysis of the economic growth evolution. The novelty of this study is sustained by the extended period of analysis which includes also the most recent last years, the health crisis impact from 2020 and also the recovery of the economies after that.

The empirical analysis is based on the Panel Least Squares regressions with fixed effects, Vector Autoregressive (VAR) model and VAR Granger causality test in order to establish the impact of the foreign direct investments on economic growth in the case of the selected coutries. The results of the research showed that the foreign direct investment has a positive impact on economic growth and there is a unidirectional causal relationship from foreign direct investment to ecobomic growth in the case of the selected group of OECD coutries.

In the literature review, the empirical evidence is diverse; some of the researchers highlighted a positive impact of the foreign direct investments on economic growth and a unidirectional or bidirectional causal relationship between these two variables as Ünsal (2017), Goyal and Rajput (2019), Gökçeli et al (2022), Ahmad et al (2018) and Saidi et al (2023). On the other hand, some of the researchers concluded a non-existent impact or relationship between foreign direct investment and economic growth as Gholipour et al (2014).

This paper includes in its structure the consistent literature review of the most recent papers that investigated the impact of the foreign direct investment on economic growth, the research methodology, the empirical evidence and concluding remarks with future directions.

Literature Review

In the international literature, the relationship between foreign direct investment and economic growth represents a topic of interest for researchers around the world. Our research comes with a current perspective of this relationship taking into account also the most recent years, so we highlight in the analysis at the end of the period the impact of the health crisis from 2020 and the recovery of the economic environment from 2021. In the following part will be presented the empirical results from the specialized literature obtained by researchers on different samples of countries and time periods of analysis.

A paper by Goyal and Rajput (2019) analyzed the causal relationship between economic growth, foreign direct investment and exports in a group of 30 OECD countries between the period 1984-2018. The study used the index of industrial production (IPI) to highlight growth, and the research results showed after the Johansen’s cointegration test a significant cointegration relationship between both IPI and FDI in 22 OECD countries and between IPI and exports in 23 OECD countries. The Granger causality testing between IPI and FDI showed both bilateral and unilateral relationships in OECD countries. Moreover, Gökçeli et al (2022) conducted a study in which the impact of foreign direct investment on economic growth and domestic investment in OECD countries was analyzed for the period 1990-2017. The empirical research is based on the method of fixed-effects and system generalized method of moments (GMM), and the econometric results have shown that foreign direct investments have a positive and significant impact on the economic growth of the host country.

Ünsal (2017) conducted a study in which he analyzed the effects of foreign direct investment on economic growth in Turkey compared to other OECD countries, during the period 1974-2015. For the analysis of panel data for OECD countries, the Fixed-Effects Regression with Driscoll-Kraay Standard Errors was used, which showed that foreign direct investment positively impacts economic growth in OECD countries. On the other hand, Gholipour et al (2014) analyzed the relationship between foreign direct investment in the real estate sector, economic growth, and property prices for a set of OECD countries, in the period 1995 – 2008. The empirical results using a panel cointegration technique have shown that foreign direct investment does not contribute to economic growth in the long or short term.

The relationship between foreign direct investment, governance quality, and economic growth was analyzed by Saidi et al (2023) for a group of 102 developing countries, the period of analysis being 1996-2014. The panel vector autoregressive model was used in the empirical study and highlighted that foreign direct investments have a significant positive impact on economic growth. Another paper by Pradhan et al (2019) studied the relationship between economic growth, foreign direct investment, and financial development for the G-20 group of countries over the period of analysis 1970-2016. A vector error correction model was used in the analysis, and the empirical results of this study revealed a cointegration relationship between the three variables included in the model – in the short term the links being non-uniform, but in the long term foreign direct investment and financial development are important in determining economic growth. Bajo-Rubio (2022) studied the long-term effects of foreign direct investment on gross domestic product growth in Spain over the period 1964-2013. The analysis used a production function that includes the stock of foreign capital, and also the Granger causality test which show that there is a positive effect of foreign capital on GDP growth, but this effect is more intense in the first years of the analysis.

Research by Ahmad et al (2018) considered the causal relationships between foreign direct investment, economic growth, and exports in ASEAN5 countries, the period of analysis being 1981-2013. The results of the empirical research showed that there is a long-term bidirectional causal relationship between foreign direct investment and economic growth, and, in the long and short term, economic growth is supported by foreign direct investment and export. More than that, Long (2020) analyzed the impact of foreign direct investment, electricity consumption, and urbanization on economic growth in six ASEAN countries, applying the Bayesian approach over a period of analysis between the years 1980-2016. The research results showed that foreign direct investments have a moderately positive impact on economic growth in the case of the analyzed countries, a result obtained through Bayesian inference. Another study by Liu and Lee (2020) analyzed the impact of foreign direct investment on economic growth in China over the period 1981-2018. The empirical results based on the vector autoregressive (VAR) model and Granger causality testing revealed a positive impact of foreign direct investment on economic growth in China; in the short term the impact was insignificant, but in the long term a significant impact was visible.

Ali et al (2022) conducted a study related to India regarding the relationship between foreign direct investment and economic growth expressed by GDP, the period of analysis being 1991-2020. Following the cointegration tests and Vector Error Correction Model, the results showed that the two variables are cointegrated, so there is a long-run equilibrium between those, and the changes in foreign direct investments generate changes in GDP, but not vice versa. Another paper by Kumari et al (2023) considered the long-term relationship but also the causal relationship between foreign direct investment, economic growth and trade openness, in the case of India over the period 1985-2018. The results obtained from the Johansen cointegration test and VAR Granger causality test did not reveal a long-term relationship between the three variables, but a bidirectional causal relationship between foreign direct investment and economic growth was highlighted.

In the study by Mogota and Djekonbe (2022), the impact of foreign direct investment on economic growth through renewable energy consumption was analyzed using the method of fixed-effects, and system generalized method of moments (GMM) was used based on panel data extracted from 30 countries in Sub-Saharan Africa, the analysis period being 2017-2021. The research results revealed a double positive causality between economic growth and renewable energy consumption, so the study concludes that investment in renewable energy consumption supports economic growth. The causal relationship between foreign direct investment and economic growth for a group of 20 African countries was also studied by Wehncke et al (2023) over the period of analysis 2000-2018. The empirical research was based on the Autoregressive distributed lags and the error correction model, and the econometric results revealed a positive long-term cointegration relationship between economic growth and foreign direct investment. The study by Yimer (2023) analyzed the relationship between foreign direct investment and economic growth in African countries, which were classified as resource-rich or resource-limited countries. The empirical analysis was carried out for the period 2000-2017, and the results following the use of the System Generalized Method of Moments revealed that foreign direct investment has a positive and significant effect on economic growth in African countries with limited resources, while in the case of African countries with rich resources no effect of FDI on economic growth was found.

A different perspective of analysis is found in the study by Matekenya and Moyo (2023) which investigates the effect of foreign direct divestment on economic growth in South Africa, the period of analysis being 1991–2019. The empirical research

considered the non-linear autoregressive distributed lag technique, and the results showed that foreign direct divestment has considerable negative effects on economic growth and these negative effects of foreign direct divestment are greater than the positive effects that foreign direct investment inflows on economic growth.

In conclusion, the literature review shows that the empirical results are different depending on the group of countries analyzed, the type of economic development and the time period included in the analysis. The results obtained by some researchers highlighted a positive impact of foreign direct investment on economic growth or a presence of a causal relationship, but there was also some evidence related to a non-existent impact or relationship.

Research Methodology

The research methodology of the empirical analysis is based on the quantitative methods applied on the selected variables for the study as economic growth, foreign direct investments, net exports, imports, the openess of the economy, unemployment rate and inflation rate. First of all, the Levin, Lin and Chu (2002) unit root test was applied for each time series, this being the most recommended test for small to medium-sized panel data. The results showed that there is a presence of a stationarity at intercept level for all the variables included in the analysis, with an exception with stationarity at first difference with intercept in terms of net exports variable.

In order to highlight the impact of the foreign direct investments on economic growth, according to Baltagi (2005), there will be cosidered the general form of panel data regression model without cross-sectional effects:

yit = α + X’it β + uit , i = 1,…,N, t = 1,…,T (1)

where yit represents the endogenous variable (economic growth), X’it represents the exogenous variable (foreign direct investments, net exports, imports, the openess of the economy, unemployment rate, inflation rate), α is the constant, uit represents the time-varying random component, i represents the cross-section dimension (the 26 OECD countries from the European region) and t represents the time period used in the analysis (the period between 2000 and 2021 years).

Also, cosidering Baltagi (2005), the models with a single type of effects (one-way error component regression model) will divide the initial errors in two components as uit= μi + υit, where μi represents the unobservable individual effect specific to each analyzed country, this being constant over time, and υit represents the true error of the regression that varies depending on i and t. So, in this context, there will be taken into account the general form of the fixed-effects model as follows:

yit = (α + μi )+ X’it β + υit, i = 1,…,N, t = 1,…,T (2)

In terms of the decision related to the most appropriate regression model between fixed and random effects models, there was used Hausman test. The null hypothesis of the Hausman test assumes that the model errors uit are not correlated with the explanatory variables xit (this being the same hypothesis as for the random effects models). The rejection of the null hypothesis of the Hausman test means that the fixed-effects model should be estimated, and the non-rejection means that a model with random effects should be estimated.

Afterwards, there will be estimated the Vector Autoregressive (VAR) model, considering yt the vector of studied variables and εt the vector of innovations, as follows:

yt = A1yt-1 +…+ Apyt-p + Bxt + εt (3)

In the end of the analysis there will be also tested the VAR Granger causality in order to establish the cauzal relationship between economic growth and foreign direct investments, according to Granger (1969):

- yt= α0 + α1 yt-1 +…+ αi yt-i + β1xt-1+…+ βixt-i+ εt (4)

- xt= α0 + α1 xt-1 +…+ αi xt-i + β1yt-1+…+ βiyt-i+ ut (5)

The null hypothesis of the Granger causality test considers that X does not Grangercause Y in the first case presented above, and alsoY does not Grager-cause X in the second case presented above. Rejecting the null hypothesis will mean that there is a causal relationship between the two variables included in the investigation – the relationship could be unidirectional or bidirectional, depending on the case.

Empirical Analysis

Sample selection and variables description

In order to analyze the impact of foreign direct investment on economic growth, we chose to study the OECD countries, so we chose a group of 26 OECD countries in Europe: Austria, Belgium, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland and United Kingdom.

The empirical research began by collecting data with annual frequency from the official website of the World Bank for the years of analysis 2000 – 2021 (22 years). The main variables used in the analysis are the real GDP growth rate (GDP_GRW) as an endogenous variable, and foreign direct investments (FDI) as an exogenous variable. The other exogenous control variables were selected according to the empirical research from the literature, and as we present in Table 1, all the data included in the analysis were extracted in percentage form.

Table 1. Presentation of the variables included in the analysis

Source: Authors’ own processing

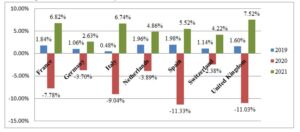

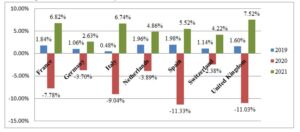

In Figure 1, there are presented 7 developed OECD countries from Europe in order to illustrate the evolution of the real economic growth rate over the years 2019-2021. We considered these three years from the perspective of the current context and chronological events in the economy. Thus, 2019 represents a year of normality before COVID-19, 2020 highlights the impact of the health crisis and 2021 shows the effect of the recovery of the economies of the analyzed countries.

Figura 1. Evolution of the real GDP growth rate during the years 2019-2021 in the case of OECD developed countries in Europe

Source: Authors’ own processing using the data available on the World Bank website

There is a considerable effect of the occurrence of the COVID-19 pandemic in 2020, because all countries registered a negative real GDP rate with a visible decline, the biggest decrease being registered by Spain (-11.33%) followed by the United Kingdom (-11.03%) and Italy (-9.04%). On the other hand, a recovery of all countries can be observed in 2021, and the greatest progress can be seen also in the countries mentioned previously which registered the greatest decreases in 2020: the United Kingdom (7.52%), France (6.82%), Italy (6.74%) and Spain (5.52%).

Table 2 shows the descriptive statistics related to all the variables included in the empirical analysis. The mean registered during the years 2000-2021 in terms of economic growth was 2.20%, and in terms of foreign direct investment was 6.03%. The maximum real growth rate was registered by Ireland (24.37%) in 2015 and the minimum one was registered by Lithuania (-14.84%) in 2009. Related to the foreign direct investments, the maximum and minimum records were in the case of Luxembourg with a minimum of -57.53% in 2007 and a maximum of 138.21% in 2020.

Table 2. Descriptive statistics

Source: Authors’ own processing using Eviews 10

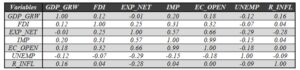

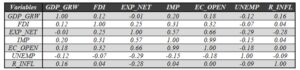

Table 3 provides the correlation matrix which includes all the variables used in the investigation in order to establish the interdependeces between the endogenous variable GDP_GRW and all the other exogenous variables.

Table 3. Correlation matrix

Source: Authors’ own processing using Eviews 10

Source: Authors’ own processing using Eviews 10

The values of the correlation coefficients do not show strong correlations with the endogenous variables, and regarding the exogenous variables the only strong correlations are present between net exports, imports and openess of the economy which will not be included together in the same regression equation.

Empirical Evidence

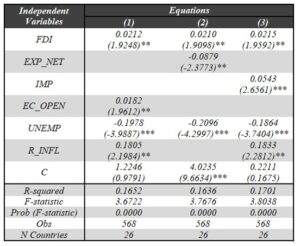

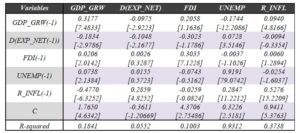

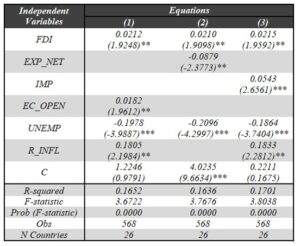

In the following section will be presented the quantitative analysis regarding the influence of foreign direct investment on economic growth in the case of the 26 selected OECD countries from Europe. The empirical evidence is based on three Panel Least Squares regressions with fixed effects which are displayed in Table 4.

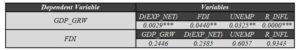

Table 4. Panel Least Squares regressions with fixed effects analysis

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%. Each variable is presented with the value of the associated coefficient and in parentheses with the t-statistic value.

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%. Each variable is presented with the value of the associated coefficient and in parentheses with the t-statistic value.

Table 4 reports the results of the regression analysis which shows that the three proposed models are statistically valid and all the variables included in the models are statistically significant

at a significance threshold of 5%. The results of the regressions prove that the foreign direct investment has a positive impact on economic growth, but not very strong, so at 1 pp increase in foreign direct investment, the economic growth will increase by 2%. The weak impact of the foreign direct investment can be explained by the fact that the selected group of countries includes a large number of developed countries. Thus, is the case of the developed countries, the foreign direct investment no longer has such a large impact on the country’s economic growth, being already balanced in terms of investments and opprotunities, compared to the emerging countries whose economic growth is greatly supported by foreign direct investments because they are unexploited territory with a lot of opprotunities. An important factor in economic growth seems to be the inflation rate which contributes to a positive impact in this case, but we should consider this increase of the economic growth an unsustainable artificial growth. Also, the empirical results showed that the openess of the economy and the imports positively contribute in economic growth, but the impact is weak. On the other hand, the net exports have a negative impact on economic growth and also the unemployment rate contributes to a decrease of the economic growth. Regarding the coefficients of determination, in the case of all the regressions, the R-squared values are between 0.16 and 0.17, which means that the variation of the economic growth is explained by the variation of the exogenous variables included in the models in proportion of 16-17%.

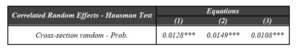

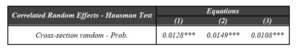

Table 5 shows the Hausman test results related to the three regressions previously presented. The null hypothesis of the Hausman test considers that the random effects model is the optimal one, so the rejection of the null hypothesis means that the fixed-effects model should be estimated.

Table 5. Hausman Test results related to the regression equations

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10%

As we can see in Table 5, all the probabilities are below the significance level of 5%, thus, the null hypothesis could be rejected. Therefore, in the case of the regression equations investigated in this research, the optimal models indicated by the Hausman test are the ones with fixed effects.

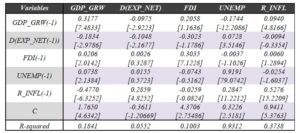

Table 6 provides the estimation of the Vector Autoregressive (VAR) model related with the variables of interest, economic growth, net exports, foreign direct investments, unemployment rate and inflation rate. For the estimation of the VAR model, we proceed the unit root tests in order to establish if the series are stationary at level or at the first difference. According to the Levin, Lin and Chu (2002) unit root test results, all the series are stationary at level, except the net exports which is stationary at first difference. In order to see the impact of the variables on economic growth, we considered one lag for the VAR model estimation.

Table 6. The estimation of Vector Autoregressive Model

Source: Authors’ own processing using Eviews 10 ( t-statistic for each coefficient is reported in parentheses)

The results of the VAR estimation showed that the foreign direct investment has a positive impact on the economic growth, in line with the previous empirical estimation, so the impact is weak (2%). Also, the results showed that the economic growth is mainly positively influenced by its own historical evolution with one year lag and also by the variation of the foreign direct investments. In this estimation, the inflation rate has a negative impact on the economic growth which is in line with the usual economic expectations.

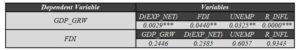

Table 7. VAR Granger Causality Test

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10

Source: Authors’ own processing using Eviews 10, P-value ***p<1%, **p<5%,*p<10

Table 7 presents the results of the VAR Granger causality test between the variables included in the VAR model. The results show that foreign direct investment Granger causes economic growth, but not vice versa, which means that between these two variables there is a unidirectional causality relationship from foreign direct investments to economic growth.

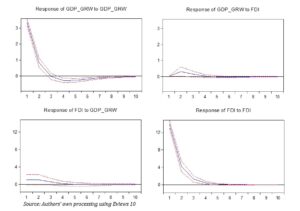

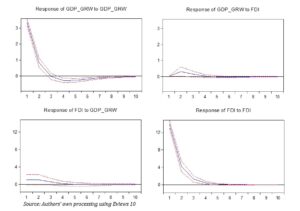

Figure 2 illustrates the representation of impulse response functions extracted from the VAR model related to the economic growth and foreign direct investment.

Figura 2. Impulse response function related to VAR model

Source: Authors’ own processing using Eviews 10

The impulse response graphs show how one of the variables acts on the impulse of the other variable, thus, we can observe that the economic growth has a positive response at the impulse from foreign direct investment and also the foreign direct investment has a positive response at the impulse from economic growth. We can conclude that the economic growth mainly reacts to its own historical evolution, but also to variations in foreign direct investment.

Concluding Remarks

This research investigates the impact of the foreign direct investments on economic growth in the case of 26 OECD countries from Europe, the period of analysis being 2000-2021 years. The results of the empirical research based on Panel Least Squares regressions with fixed effects, Vector Autoregressive (VAR) model and VAR Granger causality test highlighted that foreign direct investment has a positive impact on economic growth in the case of the selected OECD countries.

The evidence showed that the positive impact of the foreign direct investment is weak in both methodologies, Panel Least Squares and VAR, in presense of net exports, unemployment rate and inflation rate. The results of the VAR model showed that the economic growth has a positive reaction to its own historical evolution and to variations of the foreign direct investment. Also, the VAR Granger causality test highlighted a unidirectional causal relationship from foreign direct investment to economic growth, but not vice versa. The results of the current investigation are in line with the results from the literature review which presented a positive impact of the foreign direct investments on economic growth and at least a unidirectional relationship as in Ünsal (2017), Goyal and Rajput (2019), Gökçeli et al (2022), Ahmad et al (2018) and Saidi et al (2023). Regarding the weak impact of the foreign direct investment on economic growth, we consider that in the case of the group of 26 OECD countries included in the analysis, with a large number of developed countries with a balanced economy, the foreign direct investment may no longer have such a strong effect, as in the case of the emerging countries.

In conclusion, the foreign direct investment has a positive impact on economic growth and each country should attract foreign direct investments in order to benefit from the advantages brought by these investments. The foreign direct investments bring with them new technologies, invested capital, employment opportunities for the labor force and trainings, new management perspectives, competitiveness in the market and development of the banking industry for financing investments. The evidence of the research is useful for the macroeconomic policy makers in order to manage to attract foreign direct investment in the host countries that could develop and increase the economic growth. The results are useful also for the international investors who are interested in investing in OECD countries in Europe.

As future directions, the investigation will continue also with the other two regions with OECD countries, North & South America and Asia-Pacific, in order to establish the impact of the foreign direct investment on economic growth taking into account the region of the countries. More than that, we propose to continue the research extending the analysis period to see the effects of the Russian-Ukrainian war, in order to highlight all the effects of the shocks in the world economy in the recent years.

References

- Ahmad, F., Draz, M., & Su-Chang, Y. (2018). Causality nexus of exports, FDI and economic growth of the ASEAN5 economies: evidence from panel data analysis. The Journal of International Trade and Economic Development, 27, 685-700.

- Ali, N., Aarif, M., & Ansari, S. (2022). An Empirical Analysis of Foreign Direct Investment and Economic Growth in India. Empirical Economics Letters, 21, 483-495.

- Bajo-Rubio, O. (2022). The role of foreign direct investment in growth: Spain, 1964-2013. Applied Economic Analysis, 30, 263-276.

- Baltagi, B. H. (2005). Econometric analysis of panel data, 3rd edition. West Sussex, John Wiley & Sons Ltd.

- Gholipour, H., Usama, A.-m., & Mohammed, A. (2014). Foreign investments in real estate, economic growth and property prices: evidence from OECD countries. Journal of Economic Policy Reform, 1-13.

- Gökçeli, E., Fidrmuc, J., & Ghosh, S. (2022). Effect of foreign direct investment on economic growth and domestic investment: evidence from OECD countries. European Journal of Business Science and Technology, 8, 190-216.

- Goyal, A., & Rajput, N. (2019). Causal Relationship between Foreign Direct Investment, Growth and Exports: An Anecdote from Oecd Countries. International Journal of Recent Technology and Engineering, 8, 6584-6593.

- Granger, C. (1969). Investigating causal relations by econometric models and cross-spectral methods. The Econometric Society, 37, 424-438.

- Kumari, R., Shabbir, M., Saleem, S., Khan, G., Abbasi, B., & Lopez, L. (2023). An empirical analysis among foreign direct investment, trade openness and economic growth: evidence from the Indian economy. South Asian Journal of Business Studies, 12 (1), 127-149.

- Levin, A., Lin, C.-F., & Chu, C.-S. (2002). Unit root tests in panel data: asymptotic and finite-sample properties. Journal of Econometrics, 108, 1-24.

- Liu, P., & Lee, H.-S. (2020). Foreign direct investment (FDI) and economic growth in China: vector autoregressive (VAR) analysis. SHS Web of Conferences, 80, 01002, pp. 1-8.

- Long, N. (2020). Do Foreign Direct Investment, Energy Consumption and Urbanization Enhance Economic Growth in Six ASEAN Countries? Journal of Asian Finance, Economics and Business, 7, 33-42.

- Matekenya, W., & Moyo, C. (2023). Foreign divestment, economic growth and development in South Africa: an empirical analysis. Journal of Chinese Economic and Foreign Trade Studies, 16, 4-21.

- Mogota, A., & Djekonbe, D. (2022). Renewable Energy and Economic Growth: The Role of Foreign Direct Investment in Sub-Saharan Africa. The Economic Research Guardian, 12 (2).

- Pradhan, R., Arvin, M., Bahmani, S., & Hall, J. (2019). Attaining economic growth through financial development and foreign direct investment. Journal of Economic Studies, 46, 1201-1223.

- Saidi, Y., Ochi, A., & Maktouf, S. (2023). FDI inflows, economic growth, and governance quality trilogy in developing countries: A panel VAR analysis. Bulletin of Economic Research, 75 (2), 426-449.

- Ünsal, M. (2017). FDI and Economic Growth: Comparative Analyses between Turkey and the other OECD Countries. Journal of Current Researches on Business and Economics, 7, 207-216.

- Wang, X., Xu, Z., Qin, Y., & Skare, M. (2022). Foreign direct investment and economic growth: a dynamic study of measurement approaches and results. Economic Research, 35, 1011-1034.

- Wehncke, F., Godfrey, M., & Makoni, P. (2023). Economic Growth, Foreign Direct Investments and Official Development Assistance Nexus: Panel ARDL Approach. MDPI Economies, 11, 1-15.

- Yimer, A. (2023). When does FDI make a difference for growth? A comparative analysis of resource-rich and resource-scarce African economies. Internation Finance, 26 (1), 82-110.