Introduction

Currently, Portuguese companies are in a complex, dynamic and globalized context. It is essential to recognize strategic variables that influence and enhance growth in foreign markets and contribute to improving medium and long term performance. Thereby, analysing strategic variables, together with the knowledge of microeconomic reality, contributes to more aware and efficient measures taken by economic agents that meet the challenges of constant change, bolder competitors and demanding consumers.

Entrepreneurial orientation, as a strategic determinant, contributes to the strategic formulation of business management and economic policies, designed to increase business performance in foreign markets by adding value.

However, in practice, there are many companies that still do not acknowledge the real importance of entrepreneurial orientation, conditioning their development, expansion and survival. So, it is essential to carry out tests with the intent to identify and analyze key strategic variables and, eventually, establish a relationship between entrepreneurial orientation and business performance on the Portuguese footwear SME context.

This study aims at investigating the influence of entrepreneurial orientation in export performance in Portuguese SME of footwear. Few studies have been made in order to understand how to enhance exports, vital for the Portuguese recovery from economic and financial crisis. The importance that this industry has in the country’s development influenced our choice, since it has positively contributed to the stability of Portuguese trade balance.

Theoretical Framework

Entrepreneurial orientation

Entrepreneurial orientation emerged from entrepreneurship definition which suggests that a company’s entrepreneurial degree can be measured by how it takes risks, innovate and act proactively (Miller, 1983). Entrepreneurship is connected to new business and entrepreneurial orientation relates to the process of undertaking, namely, methods, practices and decision-making styles used to act entrepreneurially. Thus, the focus is not on the person but on the process of undertake (Wiklund, 2006).

Companies can be regarded as entrepreneurial entities and entrepreneurial behaviour can be part of its activities (Covin and Slevin, 1991). Entrepreneurial orientation emerges from a deliberate strategic choice, where new business opportunities can be successfully undertaken (Lumpkin and Dess, 1996). Thus, there is an entrepreneurial attitude mediating the vision and operations of an organization (Covin and Miles, 1999).

Several empirical studies indicate a positive correlation between entrepreneurial orientation and organizational growth (e.g. Miller, 1983; Covin and Slevin, 1991; Lumpkin and Dess, 1996; Wiklund, 2006; Davis, Bell, Payne and Kreiser, 2010; Frank, Kessler and Fink, 2010). Similarly, other studies also confirm that entrepreneurial orientation has a positive correlation with the export’s performance, enhancing business growth (e.g. Zahra and Garvis, 2000; Okpara, 2009).

The underlying theory of entrepreneurial orientation scale is based on the assumption that the entrepreneurial companies are different from the remaining (Kreiser et al, 2002), since such are likely to take more risks, act more proactively in seeking new businesses and opportunities (Khandwalla, 1977; Mintzberg, 1973).

Entrepreneurial orientation has been characterized by certain constructs that represent organization’s behaviour. Starting from the Miller (1983) definition, three dimensions were identified: innovation, proactiveness and risk-taking, which collectively increase companies’ capacity to recognize and exploit market opportunities well ahead of competitors (Zahra and Garvis, 2000). However, Lumpkin and Dess (1996) propose two more dimensions to characterize and distinguish entrepreneurial process: competitive aggressiveness and autonomy. In this study, only innovation, risk-taking and proactiveness will be considered, as they are the most consensual and used dimensions to measure entrepreneurial orientation (e.g. Covin and Miller, 2014; Covin and Slevin, 1989, 1991; Davis et al, 2010; Frank et al, 2010; Kreiser et al, 2002; Lisboa, Skarmeas and Lages, 2011; Miller, 1983; Okpara, 2009; Wiklund and Shepherd, 2005; Zahra and Covin, 1995; Zahra and Garvis, 2000).

Export performance

The development of exports is of great importance, both at macro and micro levels, contributing to the economic and social development of nations, helping the industry to improve and increase productivity and create jobs. At company level, through market diversification, exports provide opportunity to become less dependent on domestic market, gaining new customers, exploiting economies of scale and achieving lower production costs while producing more efficiently (Okpara, 2009).

In this sense, exports is a more attractive way to enter international markets, especially for SMEs, in comparison with other alternatives, either joint ventures or setting up subsidiaries, which involve spending a large number of resources (e.g. Dhanaraj and Beamish, 2003; Piercy, Kaleka and Katsikeas, 1998), does not create high risk and commitment and allows greater flexibility in adjusting the volume of goods to different export markets (Lu and Beamish, 2002).

On one hand, a company’s export activity starts to fulfil certain goals, which may be economic (such as increasing profits and sales) and / or strategic (such as diversification of markets, gaining market share and increasing brand reputation) (Cavusgil and Zou, 1994).

On the other hand, the export motivation may result from proactive or reactive actions. The proactive actions are advantage of profit, introduction of a single product, technological advantage, and exclusive information, commitment of management, tax benefits and economies of scale. The reactive motivations are identifying competitive pressures, excess production capacity, sales decrease in domestic market, saturation of domestic market and proximity of customers and landing ports (Wood and Robertson, 1997).

Relations between constructs

The literature suggests that each dimension of entrepreneurial orientation has a positive influence on business performance (Wiklund and Shepherd, 2005), since it increases the engagement with innovation, which contributes, for example, to creating new products and services, seeking new opportunities and new markets (Miller 1983; Lumpkin and Dess, 1996). In this sense, innovative companies have an extraordinary performance and can even be seen as a country’s engine of economic growth (Schumpeter, 1934). Proactive companies can benefit from the advantages of being first-movers, achieving greater market share, charging higher prices and reaching the market before competition (Zahra and Covin, 1995). Thus, these companies can control the market by mastering distribution channels and building brand recognition. With respect to risk-taking, the connection to performance is less obvious, since there are projects that fail while others have long-term success (Wiklund and Shepherd, 2005). Hence, it is intended to confirm the existence of this relationship and test the following working hypotheses:

H1: Entrepreneurial orientation influences positively and significantly export performance.

H2. Innovation influences positively and significantly export performance.

H3. Proactiveness influences positively and significantly export performance.

H4. Risk-taking influences positively and significantly export performance.

Methodology

Sample

To test the hypothesis a sample of Portuguese footwear companies was used that met the following criteria: companies in which at least 50% of income comes from exports of gooemergeds, or companies in which at least 10% of income comes from exports of goods and the export value is higher than 150,000 Euros (INE, 2011).

For information regarding companies, the Associação Portuguesa dos Industriais de Calçado, Componentes, Artigos em Pele e seus Sucedâneos (APICCAPS) was contacted. We were provided with a database of 231 companies (company name, telephone contact, email, CAE, export markets, export intensity and capital origin) but only 167 companies fulfilled the parameters. All companies were contacted by APICCAPS and later by the authors, via e-mail and telephone, to ensure a higher rate of valid responses. The questionnaires began on April 22, 2014 and ended on July 22, 2014. After finishing the data collection period, 42 valid questionnaires were received, representing a 25% response rate. In this investigation, we use a Non-probability sampling since the respondents were chosen for being members of APICCAPS.

Measure instrument and data collection process

From Miller’s (1983) definition 3 dimensions were indentified for entrepreneurial orientation: innovation, proactiveness and risk-taking. Although the literature considers more dimensions, this literature review confirmed that these three dimensions are the most widely used in empirical research. Covin and Slevin (1989) scale assesses entrepreneurial orientation. Survey questions were based on a 5-point Likert scale, where 1 means “strongly disagree” and 5 “strongly agree”.

Okpara’s scale (2009) was used to assess export performance, comprising profitability indicators of sales growth, profit, activities, operations and performance in general. A five point Likert scale was used to measure each item, where 1 means “strongly disagree” and 5 “strongly agree”.

Data collection was implemented through online questionnaire in Limesurvey, version 1.91. To reduce misunderstandings, the questionnaire was validated by the research department of APICCAPS. The analysis unit used in this research was export venture.

Results and analysis

Reliability Analysis

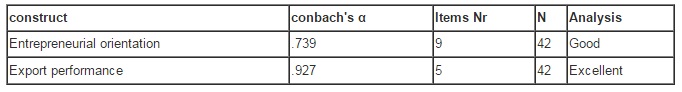

In order to verify the reliability of the overall variables, we estimated the stability and internal consistency through Cronbach’s alpha (α). In general, an instrument or test is classified with appropriate reliability when α is higher or equal to 0.70 (Nunnally, 1978). However, in some research scenarios in social sciences an α of 0.60 is considered acceptable, as long as the results are interpreted with caution and the context is taken into account (DeVellis, 2012). For the present study, we used the scale proposed by Pestana and Gageiro (2008).

The result of 0.932 achieved for all of the variables is considered excellent, confirming the sample’s internal consistency. An internal consistency test was also conducted for all variables in each construct to assess their reliability (table 1).

Table 1: Internal consistency test by construct (Cronbach’s Alpha)

We found that export performance has excellent consistency and that entrepreneurial orientation presents good reliability.

Exploratory factor analysis

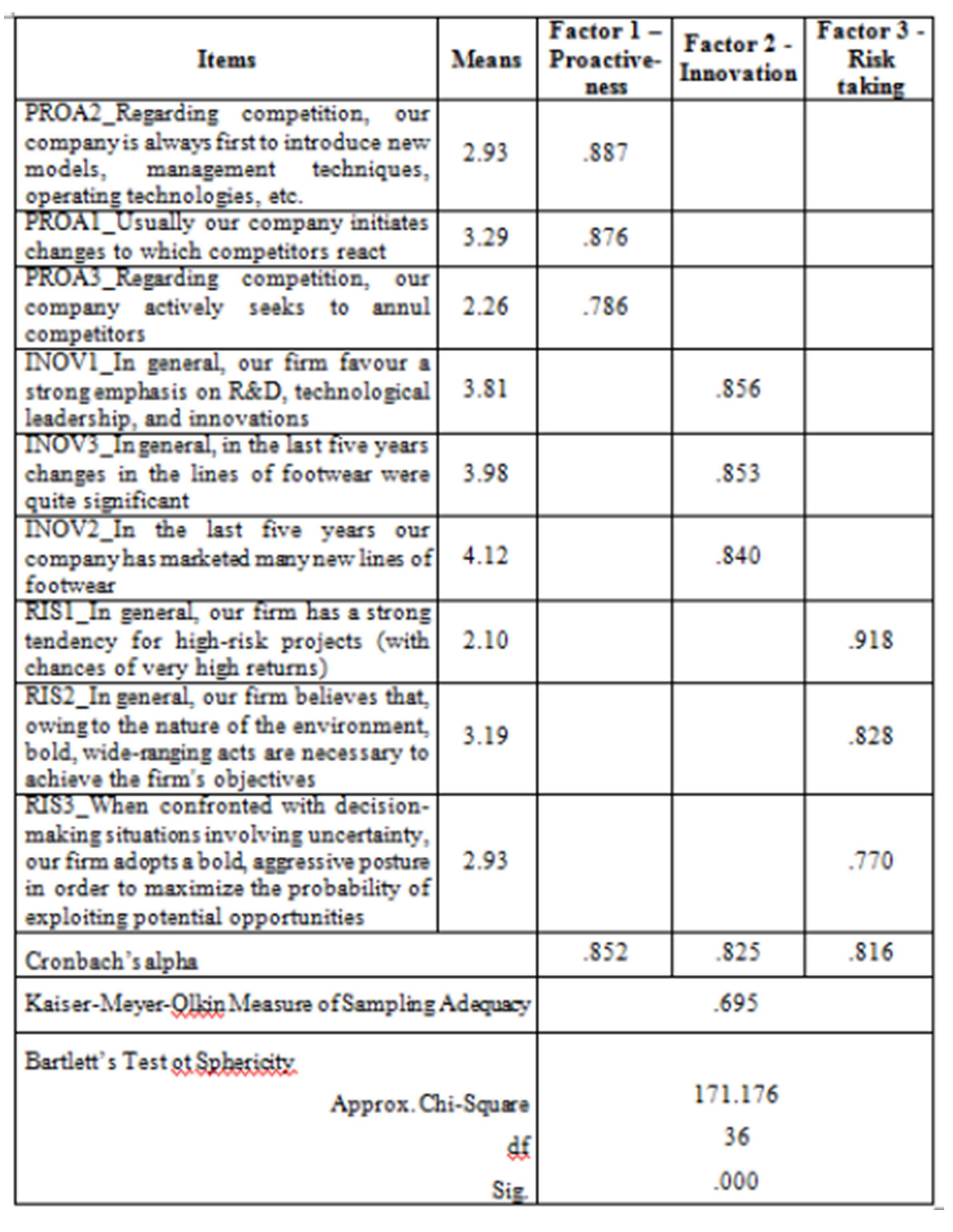

We performed a factor analysis, with Varimax rotation, of entrepreneurial orientation construct items that comprise the scale, with the purpose of finding a solution that was more easily interpretable. Three factors were extracted and there was no need to delete items.

Thus, we obtained a scale composed of 9 items, distributed over three factors that explain 77.09% of total variance, with 35.52% of variance explained by the first factor, Proactiveness, 27.48% for the second factor, Innovation, and 14.09% by the third factor, Risk taking. Analyzing the internal consistency of the three factors, we found that Cronbach’s Alphas have a very good internal consistency. KMO test indicates that there is a reasonable correlation between the variables (0.695) (table 2).

Table 2: Entrepreneurial orientation correlation matrix of factor analysis

Bartlett’s sphericity test registered a value of x2(36, N=42) =171.176, p<0.05, therefore it is confirmed that x2>x0.952, so the null hypothesis is rejected, i.e. the variables are correlated.

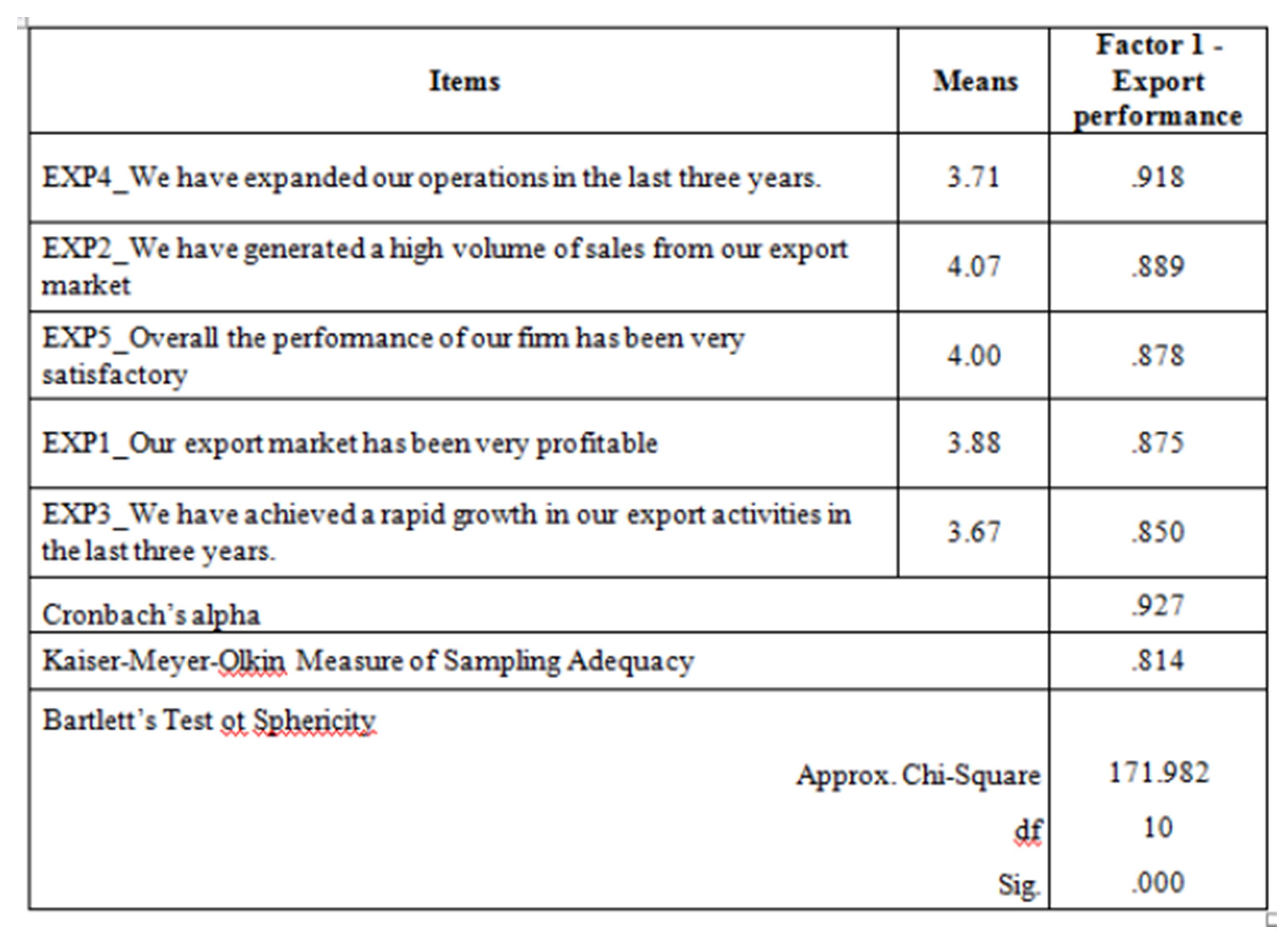

Lastly, in the factor analysis, with Varimax rotation, of export performance construct we got a scale with one factor and there was no need to delete items. A scale with 5 items was obtained, which explained 77.9% of total variance (table 3).

Table 3: Export performance correlation matrix of factor analysis

The internal consistency is excellent (α=0.927). KMO test points to a good correlation between the variables (0.814). Bartlett’s sphericity test registered a value of x2(10, N=42) =171.982, p<0.05, therefore it is confirmed thatx2> x0.952, so the null hypothesis is rejected and the variables are correlated.

Multiple linear regression

In linear regression, the coefficient of determination R2 measures the proportion of total variability that can be explained by regression (0≤R ≤1), measuring the effect of independent variables on dependent variable (Marôco, 2011).

We carried out a multiple linear regression analysis linking variables of the studied constructs. The coefficient of determination R2 measures the proportion of total variability that can be explained by regression, while the ANOVA regression provides information about levels of variability within a regression model, this forms a basis for tests of significance and allows to test the hypotheses: H0: ρ2=0 vs. H1: ρ2≠0 (table 4).

Table 4: Summary and ANOVA regression

The previous table presents for model 1 a value of F=5.091, with ρ-value=0.005 (Sig.), so H0 is rejected in favour of H1. Model 2 presents a value of F=3.262, with ρ-value=0.078 (Sig.), so H0 is rejected in favour of H2. For model 3, we have obtained a value of F=10.715, with ρ value=0.002 (Sig.), so H0 is rejected in favour of H3, while model 4 presents a value of F=0.001, with ρ-value=0.978 (Sig.), so H0 is not rejected in favour of H4. Thus, H1, H2 and H3 are supported, H4 being unsupported.

A mere comparison of the regression coefficients is not valid to evaluate the importance of each independent variable, since these variables have different magnitudes. Thus, it is essential to use standard variables, known as Beta (β) coefficients, in the models adjustment so that the independent variables can be compared (table 5).

Table 5: Estimates of β coefficients in the regression models

By analyzing the standardized Beta coefficients it is confirmed which variables have higher contribution to exports performance. From the entrepreneurial orientation perspective, Innovation (β=0.460) and Proactiveness (β=0.275) are the ones that have higher contributions to explain exports performance.

Conclusion

The Portuguese footwear industry faces considerable challenges, not only regarding international markets crisis, but also consumption patterns. The reduction of shoe design lifecycles has consequences on offer. On one hand, products have to be adapted to different segments with specific needs and tastes (custom design, new models in small series, etc.), on the other hand, manufacture processes must be increasingly flexible, adopt just-in-time production, invest in branding, qualified personnel, technology and innovation.

In recent decades, this industry has been under enormous pressure from large international brands. Although few in number some companies risked launching their own brand into the market. Entrepreneurial orientation is crucial in this process, by allowing companies to permanently evolve, follow the needs and market trends, in order to achieve superior exports performance in foreign markets.

Analyzing the influence that entrepreneurial orientation has on export performance of SME was the main purpose of this study. Therefore, an empirical research study was conducted, using proceedings and statistical techniques, based on a sample of 42 companies. It is important to refer to the fact that companies evaluated constructs in comparison to their main competitors and export markets, so results should be interpreted based on these aspects.

According to the results, entrepreneurial orientation contributes to exports performance, with particular emphasis on innovation and proactiveness. Companies are able to analyze and discuss market trends and new product development, among others.

However, this industry has yet a long and hard way to go. The industrial structure has a high number of family businesses, weak competitiveness mainly due to deficit in management skills and is overly concentrated in Europe as export market destination.

Theoretical and practical implications

From this study emerge important contributions to theory and practice, results are relevant to researchers, business managers, public and government entities, since this study links the theory of entrepreneurial orientation to export performance, by incorporating them into strategic determinants analysis. The obtained results are a contribution to clarify the influence of entrepreneurial orientation on the company’s exports performance. Additionally, the study contributes to developing concepts as well as to defining scales. The use of constructs “entrepreneurial orientation” and “export performance” allowed measurement through common and identifiable characteristics between organizations.

Innovation can occur throughout a new product line process, advertisement or technological advances (Lumpkin and Dess, 1996). There are several ways to identify a company’s innovation degree, such as financial resources volume invested in innovation, human resources allocated to innovation activities, the number of new products or services launched on the market or change frequency in product lines or services (Covin and Slevin, 1989). Proactiveness can be critical to entrepreneurial orientation, as it emerges from a long-term perspective, which is accompanied by innovation activities or new businesses (Lumpkin and Dess, 1996). This study confirms that these two dimensions are preponderant for exports performance.

Lastly, this study makes an important contribution to the theory of strategic management, by presenting entrepreneurial orientation as a strategic determinant that contributes to the clarification of export performance.

Research limitations

As in any research work, methodology, procedures adopted, analysis and empirical study interpretation always present alternatives and limitations.

The main limitation of this study is related to the sample size, since it was difficult to find companies willing to collaborate in this type of research.

Furthermore, a five points Likert scale was used to measure the constructs. Most responses were based on the subjective judgment of respondents. Although literature identifies the advantages of subjective measures to evaluate exports performance, it is recognized that some answers may not represent the reality of business performance in foreign markets.

The fact that the research does not consider the effect of control variables such as size, age, location and the target market of the respondents can be seen as a limitation.

Future lines of research

Wherever scientific research is developed, which adopts specific type of approach, it leaves open field so that the same topic can be addressed by other perspectives, using different techniques or adding new knowledge.

This study incorporated a set of constructs for which there was a need to define measures and scales. In future work, we suggest that the model be used in a sample with a higher number of observations to confirm these results.

Finally, we suggest pursuing with the investigation of strategic management in Portugal, focusing on other sectors of national economy, so in the future one can make a comparison with similar studies, allowing new factors that enhance the emergence of exports performance.

(adsbygoogle = window.adsbygoogle || []).push({});

References

1. Cavusgil, T. and Zou, S. (1994), ‘Marketing strategy-performance relationship: an investigation of the empirical link in export market ventures‘, Journal of Marketing, 58 (1), 1–21.

Publisher – Google Scholar

2. Covin, J. and Miles, M. (1999), ‘Corporate entrepreneurship and the pursuit of competitive advantage’, Entrepreneurship: Theory and Practice, 23 (3), 47–63. Available at: http://ecite.utas.edu.au/68600/1/Corporate Entrepreneurship and the pursuit of competitive advantage.pdf [Accessed November 3, 2013].

3. Covin, J. and Miller, D. (2014), ‘International Entrepreneurial Orientation: Conceptual Considerations, Research Themes, Measurement Issues, and Future Research Directions‘, Entrepreneurship Theory and Practice, 38 (1), 11–44.

Publisher – Google Scholar

4. Covin, J. and Slevin, D. (1991), ‘A conceptual model of entrepreneurship as firm behavior’, Entrepreneurship: Theory and Practice, 16, 7–25.

Google Scholar

5. Covin, J. and Slevin, D. (1989), ‘Strategic management of small firms in hostile and benign environments’, Strategic Management Journal, 10 (1), 75–87.

Publisher – Google Scholar

6. Davis, JL., Bell, RG., Payne, GT. and Kreiser, PM. (2010), ‘Entrepreneurial Orientation and Firm Performance: The Moderating Role of Managerial Power‘, American Journal of Business, 25 (2), 41–54.

Publisher – Google Scholar

7. DeVellis, RF. (2012) Scale Development – Theory and Applications, 3a ed., SAGE Publications, Inc.

Google Scholar

8. Dhanaraj, C. and Beamish, PW. (2003), ‘A Resource-Based Approach to the Study of Export Performance?, Journal of Small Business Management, 41 (3), 242–261.

Publisher – Google Scholar

9. Frank, H., Kessler, A. and Fink, M. (2010), ‘Entrepreneurial orientation and business performance-a replication study’, Schmalenbach Business Review, (April), 175–199.

Google Scholar

10. Khandwalla, PN. (1977), ‘Some top management styles, their context and performance’, Organization and Administrative Sciences, 7 (4), 21–51.

11. Kreiser, P., Marino, L. and Weaver, K. (2002), ‘Assessing the psychometric properties of the entrepreneurial orientation scale: A multi-country analysis’, Entrepreneurship Theory and Practice, (1989), 71–95.

12. Lisboa, A., Skarmeas, D. and Lages, C. (2011), ‘Entrepreneurial orientation, exploitative and explorative capabilities, and performance outcomes in export markets: A resource-based approach‘, Industrial Marketing Management, 40 (8), 1274–1284.

Publisher – Google Scholar

13. Lu, JW. and Beamish, PW. (2002), ‘The Internationalization and Growth of SMEs’, ASAC 2002, 86–96.

14. Lumpkin, G. and Dess, G. (1996), ‘Clarifying the entrepreneurial orientation construct and linking it to performance’, Academy of management Review, 21 (1), 135–172.

Google Scholar

15. Marôco, J. (2011) Análise estatística com o SPSS Statistics, 5a ed., ReportNumber, Lda.

16. Miller, D. (1983), ‘The correlates of entrepreneurship in three types of firms‘, Management science, 29 (7), 770–791.

Publisher – Google Scholar

17. Mintzberg, H. (1973), ‘Strategy-making in three modes‘, California Management Review, 16 (2), 44–53.

Publisher – Google Scholar

18. Nunnally, JC. (1978) Psychometric theory, McGraw-Hill.

19. Okpara, J. (2009), ‘Entrepreneurial orientation and export performance: evidence from an emerging economy’, Int. Rev. Bus. Res. Papers, 5 (6), 195–211.

Google Scholar

20. Pestana, MH. and Gageiro, JN. (2008) Análise de Dados para Ciências Sociais – A complementaridade do SPSS, 5a ed., Edições Silabo.

21. Piercy, N., Kaleka, A. and Katsikeas, C. (1998), ‘Sources of competitive advantage in high performing exporting companies’, Journal of World Business, 33 (4), 378–393.

22. Schumpeter, JA. (1934) The Theory of Economic Development, Transaction Publishers.

23. Wiklund, J. (2006), ‘The sustainability of the entrepreneurial orientation–performance relationship’, Entrepreneurship and the growth of firms, 141–155.

Google Scholar

24. Wiklund, J. and Shepherd, D. (2005), ‘Entrepreneurial orientation and small business performance: a configurational approach‘, Journal of Business Venturing, 20 (1), 71–91.

Publisher – Google Scholar

25. Wood, VR. and Robertson, KR. (1997), ‘Strategic orientation and export success: an empirical study‘, International Marketing Review, 4 (6), 424–444.

Publisher – Google Scholar

26. Zahra, S. and Covin, JG. (1995), ‘Contextual influences on the corporate entrepreneurship-performance relationship: A longitudinal analysis‘, Journal of Business Venturing, 10 (1), 43–58.

Publisher – Google Scholar

27. Zahra, S. and Garvis, D. (2000), ‘International corporate entrepreneurship and firm performance: The moderating effect of international environmental hostility‘, Journal of Business Venturing, 15, 469–492.

Publisher – Google Scholar