Introduction

One of the primary objectives of developing countries like Nigeria is to achieve a sustainable rate of economic growth. Growth is the process by which economies accumulate larger quantities of capital equipment, push out the frontiers of technological knowledge and steadily become more productive. (Parkin, Powell, and Mathews, 2008). It is the continuous expansion of production possibility curves, leading to an increase in real gross domestic product, at a given period.

It should be noted that capital accumulation and technological improvements are boosters of economic growth. In Nigeria, like any other African country, the marginal propensity to save is low. To this effect, domestic saving is lower than the desired level of investment needed to increase growth rate to the level that it is capable of reducing poverty rate (Ajayi, 2006). Also, the level of technology is low in Nigeria, thereby resulting in retarded rate of economic growth.

In order to achieve a sustainable rate of economic growth, Nigeria like other developing countries needs to adopt and implement new technologies available in developed countries. Foreign direct investment can perform the role of bridging this gap because it facilitates technological diffusion. In this regard, Todaro and Smith (2003) argued that it is engaging in foreign direct investment that can help less developed countries to fill gaps between the domestically available supplies of savings, human capital skills, and technology. In view of this, successive Nigerian governments have recognised the importance of foreign direct investment in enhancing economic growth. Various strategies that involved incentive policies and regulatory measures were put in place to promote the inflow of foreign direct investment to Nigeria. Consequently, these efforts have brought about tremendous increase in the volume of foreign direct investment inflow to Nigeria.

In 2015, according to UNCTAD, the flow of foreign direct investment in Nigeria was US $588 million, this increased to US $2. 962.2 million in 2006 and increased further to US $5, 564.7 million in 2012. It has been observed that the growth rate of the economy has not increased in line with the increase in the flow of foreign direct investment. Many researchers have identified negative effects of foreign direct investment on economic growth in Nigeria (Akinlo, 2004; Olokoyo, 2012), despite the fact that a huge sum of the scarce resources of the country is being diverted to providing incentives in order to encourage these multinational companies.

Inward foreign direct investment has been known to promote economic growth as well as to transfer technology across countries. Consequently, many economies promote policies that encourage and support inward foreign direct investment. Researchers have been undertaking empirical study aimed at determining if the inward foreign direct investment does have the proclaimed effect on the economy. The results from the studies on the spill-over effects of foreign direct investment on economic growth are mixed. More recent studies suggested that the effect of foreign direct investment on the host country’s economy is not automatic: rather, it depends on the adequate presence of some environmental factors, for the existence of spill-over effect (Elboiash, 2015; Sghaier and Abida, 2013). This study contributes to this debate by presenting a deeper insight into the host country conditions that might affect the FDI –Growth nexus.

This raises the issue of what is known as the absorptive capacity of a country: that is, a country’s capacity or ability to absorb the benefits that foreign direct investment can offer. It is important to know that some studies such as Elboiash (2015) investigated the effect of absorptive capacity on foreign direct investment and economic growth in Africa, Asia, and Latin America; Polpat (2010) also investigated the effect of foreign direct investment on economic growth in 15 Asian countries and found that foreign direct investment affects growth only when a certain level of absorptive capacity is reached. While studies abound in developed countries as well as in emerging economies on the extent to which absorptive capacity has influenced foreign direct investment and economic growth, the issue of absorptive capacity so far has not received much attention in Nigeria. Some of the existing research studies in the area of foreign direct investment are very limited in their scope by examining only the impact of foreign direct investment either on economic growth (Ayanwale, 2007; Egwaikhide, 2012) or on the determinants of economic growth. Little attention has been placed on the study of the effect of absorptive capacity on the relationship between foreign direct investment and economic growth in Nigeria. This study is therefore contributing to knowledge by investigating the effect of absorptive capacity on the relationship between foreign direct investment and economic growth in Nigeria. To this effect, the objectives of this study are:

- To examine the effect of foreign direct investment on economic growth in Nigeria.

- To investigate the effect and extent of absorptive capacity on foreign direct investment and economic growth in Nigeria.

This paper consists of five sections inclusive of the introduction which is in the first section. The second section contains the literature review, while the third section presents the source of data, description of data, hypotheses of the study and the method of analysis. In the fourth section, the estimation procedures and empirical results were discussed. The fifth section contains the conclusion and policy implications of the study.

Theoretical and Empirical Review

Theoretical Review

Foreign direct investment affects growth directly and indirectly. It affects growth directly by augmenting domestic savings thereby leading to a higher level of capital formation. This accumulated capital can assist in the implementation of new technology in the production process, resulting in the stimulation of the productivity of domestic investment (Borensztein, Gregorio and Lee 1998). Also, foreign direct investment contributes to growth indirectly through its ability to transfer advanced technology from the industrialised countries to the developing countries. Findlay (1978) suggested that foreign direct investment increases the rate of technical progress in the host country through knowledge diffusion from the more advanced technology and management practices used by foreign firms to the domestic ones. This can result in positive externalities or efficiency spill-over which will end up in the efficient utilisation of resources and increase in factor productivity in local firms. This positive spill-over or externality provides non-diminishing returns to capital, thereby enhancing growth. It can occur through various channels.

Externality could be through linkage effect whereby a local firm improves its productivity by imitating the technology used by multinational affiliate corporation (MNC) in the local market. Gorg and Greenway (2002) suggested that when local firms imitate the technology employed by foreign firms, there will be a technological improvement for domestic firms. This is possible through indirect transfer, as they attempt to incorporate new inputs and foreign technologies in the production functions of the host country, hence, stimulating the productivity of domestic investment. Externality could also be through competitive effect when local firms either decide to use existing technology and resources in a more efficient manner or to search for more efficient technologies because the entry of a multinational corporation has increased competitive pressure in the local market. This rise in competition is advantageous because it can lead to the reallocation of resources to more productive activities. In addition, externality can occur through demonstration effect whereby an affiliate demonstrates new techniques to local workers who later join the employment of local firms or start their own firm.

Also, foreign direct investment contributes to growth indirectly through human capital development such as the provision of managerial skills, research and development (R & D). Romer (1990) suggested that human capital is an important input for innovation and increased productivity which will help host countries to develop their technologies and increase their ability to absorb technologies developed in other countries. Multinational corporations can positively affect a host country’s human capital development by providing training courses and financing R and D activities which will turn local workers from simple skilled workers to advanced technical and managerial skilled ones. The ultimate effect of this training is an increase in economic growth in the host country.

The theory that supports this process of transmission of foreign direct investment spill-over to growth is the endogenous growth theory. The Neoclassical growth model has no explanation for long term growth, due to absence of technological changes. It is assumed to be exogenously given at the same rate for all countries. The theory states that all economies will converge to zero and will eventually approach the same level of productivity. Consequently, the impact of foreign direct investment on growth is identical to that of domestic investment. However, endogenous growth theory assumes countries grow at different rates because they have different institutional frameworks and policies that affect the technical progress. In essence, endogenous growth theory provides an economic explanation for the disparity in productivity growth rates across different countries.

Empirical Review

In this sub-section, relevant empirical studies were reviewed in order to identify the existing gap which underscores the essence of this study.

Foreign Direct Investment and Economic Growth

Akinlo (2004) investigated the impact of foreign direct investment on economic growth in Nigeria from 1970-2001 by employing the Error Correction Model and found that private capital and lagged foreign capital have negative and statistically insignificant effect on economic growth. The author observed that the result supports the hypothesis that extractive FDI does not enhance economic growth as much as manufacturing FDI. Also, the empirical evidence showed that while export has a positive and statistically significant effect on growth, financial development has a significant negative effect on growth, which might be as a result of the high capital flight it generates.

Parviz (2011) investigated the effect of foreign direct investment on economic growth in Canada and also investigated the determinants of foreign direct investment in the country using annual data from 1976 to 2008. The result suggested that foreign direct investment has no significant impact on economic growth in Canada. According to the author, only total factor productivity and domestic investment growth determine economic growth in Canada. The study therefore, recommended that Canada should pursue foreign direct investment policies that target the manufacturing sector.

Hassen and Anis (2012) examined the effect of foreign direct investment on economic growth in Tunisia from 1975 to 2009 by employing co-integration analysis on time series data from 1975-2009. In the model, the study included foreign direct investment relative to GDP, human capital proxied by school enrolment rate at the secondary level, OPEN as the ratio of exports plus imports to GDP; and financial development as endogenous variables. The result suggested that foreign direct investment plays an important role in boosting long-term economic growth in Tunisia. Also, human capital and financial development have positive effects on economic growth but openness has a negative impact on economic growth.

Olokoyo (2012) evaluated the effects of foreign direct investment on the development of the Nigerian economy by employing time series data over the period 1970 -2007. The result showed that foreign direct investment has no positive impact on the Nigerian economy and recommended that a policy that would focus on the enhancement of the productive base of the economy should be encouraged instead of encouraging more foreign direct investment.

Egwaikhide (2012) investigated the relationship between foreign direct investment and economic growth in Nigeria between 1980-2009 through the application of Johansen co- integration technique and Vector Error Correction Methodology in which foreign direct investment was disaggregated into various sectors of the economy. The result suggested that only telecommunication sector had a positive and significant effect on economic growth.

Ugwuegbe, Okore and John (2013) assessed the empirical relationship between foreign direct investment and economic growth in Nigeria by using a time series data from 1981 to 2009. Gross fixed capital formation, interest rate and exchange rate were added as control variables. The result of the OLS technique indicated that foreign direct investment has a positive but insignificant impact on economic growth in Nigeria and that domestic investment has a positive and significant impact on economic growth.

Alege and Ogundipe (2014) examined the relationship between foreign direct investment and economic growth in ECOWAS sub-region for the period 1970-2011 by employing Generalised Methods of Moment technique of estimation (GMM). The report suggested a negative and insignificant relationship between foreign direct investment and economic growth in ECOWAS sub-region despite enhanced human capital, trade openness and sound governance in the Sub-region. The study recommended that because foreign direct investment inflows into ECOWAS countries are resource-seeking, excessive openness in the extractive industries should be curtailed. Also, the government should implement policies that encourage foreign direct investment inflows into heavy labour industries like manufacturing and telecommunication.

Saibu and Keke (2014) investigated the effect of foreign private investment on economic growth using time series data from Nigeria. The paper employed co-integration and error correction mechanism (ECM) or technique. The study revealed that there was a substantial feedback of 116 percent and 78 percent from previous disequilibra between long run economic growth and foreign private investment respectively. The finding also showed that a large proportion of capital inflow was not productively invested but a relatively small proportion (22 percent) of net capital inflows invested contributed significantly to economic growth in Nigeria.

Rahman (2015) examined the impact of foreign direct investment on the economic growth of Bangladesh using a time series data from 1999 to 2013 by employing the multiple regression technique of analysis. The result of the empirical analysis showed a negative relationship between foreign direct investment and economic growth. The study therefore recommended that the government of Bangladesh should focus on reforms and policies that will make foreign direct investment more beneficial.

Adigwe, Ezeagba and Francis (2015) examined the relationship between foreign direct investment, exchange rate and gross domestic product using time series data on Nigeria from 2008 to 2013. Pearson correlation technique of estimation was employed. The result showed that there is a significant relationship between foreign direct investment, exchange rate and economic growth.

Ogbokor (2016) investigated the effect of foreign direct investment on economic growth in Namibia by using annual data set that span from 1990-2014 and employed co-integration technique. The result showed that there is a positive relationship between the explanatory variables and real gross domestic product, but foreign direct investment contributed more towards innovations in economic growth compared to openness and real foreign exchange rate.

Munyanyi (2017) investigated the relationship between foreign direct investment and economic growth in Zimbabwe using a time series data that span from 1975-2007 by employing an Autoregressive Distributed Lag (ARDL) co-integration technique. The result showed that foreign direct investment has a positive effect on economic growth. The study recommended that a stable economic and investment environment such as improving infrastructure should be created to ensure sustainable economic growth.

Absorptive Capacity, Foreign Direct investment and Economic Growth

Shahrivar and Jajri (2012) investigated if foreign direct investment alone affects economic growth or with the interaction of human capital by using data from 8 East Asian countries from 1980-2009. In finding out the effect of absorptive capacity on the relationship between foreign direct investment and economic growth, the study interacted foreign direct investment and human capital. The result indicated that the interaction term of human capital and foreign direct investment has a significant positive effect on productivity growth and technological progress but the effect on productivity growth is greater than that of technological progress.

Sghaier and Abida (2013) investigated the effect of financial development on the relationship between foreign direct investment and economic growth in a panel of four countries of North Africa over the period 1980-2011 by employing Generalised Methods of Moments (GMM). The result suggested that foreign direct investment has a positive and significant effect on growth in all countries. Also, when foreign direct investment interacted with financial development, the coefficient of interaction showed that the effect of foreign direct investment depends on the absorptive capacity of host countries, with particular reference to the development of a domestic financial system. The policy implication is that financial sector should be developed to maximise the benefits of the presence of foreign direct investment.

Jude and Levieuge (2015) examined the role of institutional quality on foreign direct investment and economic growth by employing a Panel Smooth Regression model on a large sample of developing countries. The result showed that foreign direct investment will have a positive effect on growth only when a threshold level of institutional quality is reached. The paper recommended that in order to benefit from foreign direct investment, institutional reforms should precede foreign direct investment attraction policies.

Loukil (2016) investigated the role of innovation in the relationship between foreign direct investment and economic growth in developing countries by estimating a panel threshold model for 54 developing countries during the period 1980-2009. The result showed that there is no positive relationship between foreign direct investment and innovation. The study concluded that it is not enough for government to attract foreign direct investment but efforts should be geared towards supporting domestic firms to build up absorptive capacity that would enhance the process of innovation in order to enjoy the benefits of foreign direct investment.

Hayat (2017) investigated the impact of institutional quality through the channel of foreign direct investment on economic growth by using a dynamic panel dataset consisting of 104 countries by employing GMM technique of estimation. The result showed that in countries that possess well developed institutional quality, the rate of economic growth will be high but in those with lower institutional quality, the rate of economic growth will be low.

Data, Model Specification and Methodology

Nature and Source of Data

The data used in this study are secondary and all of them were obtained from the world development indicator 2016, on the WDI CD ROM.

Statement of Hypotheses

In order to realise the major objectives of the study, the following hypotheses were formulated in null form:

- Ho: There is no significant effect of foreign direct investment on economic growth without conditioning on absorptive capacity in Nigeria.

- Ho: There is no significant effect of absorptive capacity on foreign direct investment and economic growth in Nigeria.

Data Analysis Technique

The study tested the research hypotheses using the Ordinary Least Square (OLS) method. Hence, the multiple regression technique was used to estimate the parameters. This is because this technique helped in minimising the error term with a view to finding the regression equation that explains the data. This is preferred because of its unbiasedness, consistency, minimum variance, efficiency and simplicity properties. The statistical test of parameter estimates was conducted using their standard error, t-test, F-test, R2, Ȓ2. The economic criteria showed whether the coefficients of the variable conformed to the economic a priori expectations while the statistical criteria test was used to access the significance of the overall regression.

Model Specification

Two models were constructed in testing the research hypotheses. The models were based on endogenous growth theory which stipulates that apart from the factors of production, there are some other factors that determine growth. These factors are determined by the total factor productivity (TFP) which in turn is determined by the technical progress. It should be noted that there are some environmental conditions that enhance the level of technological progress in an economy and these are the absorptive capacity factors like human capital, financial development, infrastructure trade openness and domestic investment that are included in the model .These models were adapted from the work of Polpat (2010). However, this study expanded the scope of Polpat`s work by including infrastructure and domestic investment as absorptive capacity factors. These models are stated below:

Model 1:

GrY = βo + β1FDI + β2GFCF + β3HCAP + β4INFR + β5FDEV + β6OPEN + ε1 (1)

Where:

GrY: Growth rate of GDP per capita

FDI: Inflow of FDI as share of GDP

GFCF: Gross Fixed Capital Formation (proxy for domestic investment)

HCAP: Human capital (proxied by primary, secondary and tertiary enrolments)

INFR: Infrastructure (proxied by electricity consumption)

FDEV: Financial development (proxied by credit to private sector)

OPEN: Total external trade as a proportion of GDP (proxy for trade)

βo: Constant term

ε1: Error term

β1, β2, β3, β4, β5, β6 are the coefficients of independent variables.

Model 2:

GrY = βo + β7FDI*INFR + β8FDI*GFCF + β9FDI*HCAP + β10FDI*FDEV + β11FDI*OPEN + ε2 (2)

Where:

FDI*INFR: Interaction term between foreign direct investment and infrastructure

FDI*GFCF: Interaction term between foreign direct investment and domestic investment.

FDI*HCAP: Interaction term between foreign direct investment and human capital

FDI*FDEV: Interaction term between foreign direct investment and financial development

FDI*OPEN: Interaction term between foreign direct investment and openness

βo: Constant term

ε2: Error term

β7, β8, β9, β10, β11 are the coefficients of independent variables.

β7, β8, β9, β10, β11 are the coefficients of interaction between FDI and infrastructure, domestic investment; human capital, financial development and openness respectively. These coefficients of interaction can take any sign depending on the level of absorptive capacity in Nigeria. When the interactive terms are positive, it implies there is a positive multiplicative effect of FDI and the variables. Therefore, Nigeria has sufficient absorptive capacity. However, if the interactive terms are negative, it suggests that she does not have sufficient absorptive capacities and that the two variables involved do not support each other in promoting economic growth in Nigeria.

Estimation and Discussion of Results

Estimation of Objective One

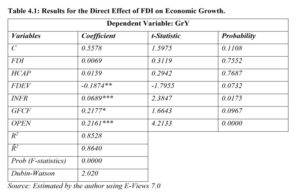

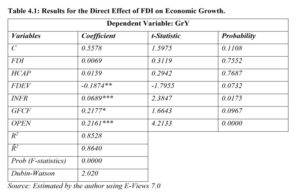

Note: *** Significant at 1 percent, **Significant at 5 percent, *Significant at 10 percent.

In testing the accuracy and reliability of the estimates obtained from model one, diagnostic tests were conducted. The result showed that R square which determined the explanatory power of the model is 85.25 percent, implying that 85.28 percent of the total variation in economic growth was explained by the included variables. Also, the F-stat probability result (0.0000) showed that the result is statistically significant at 1 percent. DW statistic is 2.02 thereby suggesting absence of autocorrelation.

Table 4.1 reveals the effects of foreign direct investment (FDI) on economic growth. The coefficient of foreign direct investment (0.0069) is positive but insignificant. Also, the effect of human capital (HCAP) on economic growth (GrY) is positive but insignificant. It shows that both foreign direct investment and human capital do not have significant effect on economic growth in Nigeria during the period. These results are inconsistent with some studies in the FDI-growth literature such as Sghaier and Abida (2013). The implication is that neither foreign direct investment (FDI) nor human capital (HCAP) can individually affect economic growth.

However, the result reveals that infrastructure (INFR), domestic investment (GFCF) and openness (OPEN) have positive and significant relationship with economic growth in Nigeria, but financial development (FDEV) has an inverse relationship at 10 percent level of significance with economic growth. This implies that financial development does not support economic growth, rather, it has a negative effect on economic growth.

Estimation of Objective Two

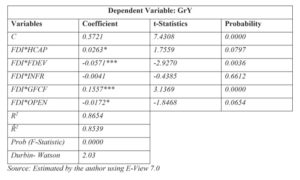

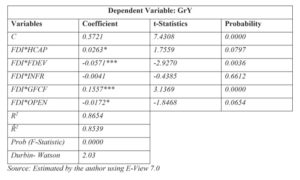

Table 4.2: Results of the Effect and Extent of Absorptive Capacity on the Relationship between FDI and Economic Growth.

Note: *** Significant at 1 percent, ** Significant at 5 percent, *Significant at 10 percent.

Table 4.2 shows the estimated results obtained when absorptive capacity was considered. In testing the accuracy and reliability of the estimates obtained from the model, diagnostic test was conducted. The result showed that R square which determined the explanatory power of the model is 86.54 percent implying that 86.54 percent of the total variation in economic growth was explained by the included variables. Also, the F-stat probability result (0.0000) showed that the result is statistically significant at 1 percent. DW statistic is 2.03, thereby suggesting absence of autocorrelation.

As shown in Table 4.2, the coefficient of interaction between foreign direct investment and human capital (FDI*HCAP) is significant and positive. The implication of this is that human capital supports foreign direct investment in promoting economic growth. This observation reflects what is known as innovation. This is because initially, the coefficient of foreign direct investment (FDI) was insignificant though positive and that of human capital (HCAP) was also insignificant though positive, but due to training, imitation, human capital has improved and the coefficient of interaction is now positive and significant. These variables did not affect growth by themselves, they affected growth through the interaction terms. The result is consistent with the idea that the flow of advanced technology brought along by foreign direct investment can increase growth rate of the host economy only by interacting with the country’s absorptive capacity. The result is consistent with that of Borensztein et al. which suggested that the interaction of foreign direct investment and human capital has a positive effect on economic growth.

As shown in Table 4.2, the estimated coefficient of interaction between foreign direct investment and financial development (FDI*FDEV) as well as the coefficient of interaction between foreign direct investment and openness (FDI*OPEN) are both negative and statistically significant. This implies that neither financial development nor openness supports foreign direct investment in promoting economic growth. Also in Table 4.2, the estimated coefficient of interaction between foreign direct investment and domestic investment (FDI*GFCF) is positive and statistically significant at 1 percent. The interaction term is positive because domestic investment supports foreign direct investment in promoting economic growth. Lastly, the coefficient of interaction between foreign direct investment and infrastructure (FDI*INFR) is negative and statistically insignificant. The implication of this result is that foreign direct investment (FDI) and infrastructure (INFR) do not support each other in promoting economic growth in Nigeria. The insignificance of the interaction term between foreign direct investment and infrastructure indicates the insufficient level of infrastructure, thereby hindering Nigeria from absorbing benefits from foreign direct investment.

Policy Implication and Conclusion

The empirical study revealed the fact that in Nigeria, foreign direct investment alone cannot promote economic growth, it has to be supported by sufficient absorptive capacity. Also, domestic investment promotes economic growth in Nigeria. Openness, Infrastructure and Financial development are not sufficiently developed to bring about spill-over effect from foreign direct investment in Nigeria. Only human capital and domestic investment supports foreign direct investment in promoting growth in Nigeria This result suggests that Nigeria does not have sufficient absorptive capacity to translate foreign direct spill-over to growth.

The policy implication of the results obtained from this empirical study is that instead of wasting the scarce resources available in Nigeria, on the provision of incentives to encourage foreign direct investment in the country, the government should try as much as possible to develop these absorptive capacity factors which include Openness, Infrastructure and Financial development. Also, efforts should be made at providing adequate facilities to encourage more entrepreneurs so as to increase domestic investment in order to bring about the desired level of economic growth in Nigeria. Finally, policies should be directed towards the provision of adequate training facilities in order to enhance the development of human capital.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Adigwe, PK., Ezeagba, C. and Francis, P. (2015), ‘Effect of foreign direct investment on Nigerian economic growth,’ European Journal of Research and Reflection in Management Sciences 3(5), 28-34.

- Ajayi, S. I. (2006), The determinants of foreign direct investment in Africa: A survey of the evidence, Foreign direct investment in Sub-Saharan Africa: Origins, targets and potentials, Ajayi S. (ed), AERC, Nairobi.

- Akinlo A. E. (2004), ‘Foreign direct investment and growth in Nigeria: An empirical investigation,’ Journal of Policy Modeling 26, 627-639.

- Alege, PO and Ogundipe, A. (2014), ‘Foreign direct investment and economic growth in ECOWAS: A system GMM approach,’ Covenant Journal of Business and Social Science, (JBSS), 15(1).

- Borensztein, E., De Gregorio, J. and Lee, J-W. (1998), ‘How does foreign direct investment affect economic growth?’ Journal of International Economics 45, 115-135.

- Egwaikhide, C H. (2012), ‘The impact of foreign direct investment on Nigerian economic growth: Evidence from Johansen Cointegration approach,’ International Journal of Business and Social Sciences 3(6).

- Elboiash, H. (2015), ‘The effect of FDI on economic growth and the importance of host country characteristics,’ Journal of Economics and International Finance.

- Findlay, R. (1978), ‘Relative backwardness, direct foreign investment and the transfer of technology: A simple dynamic model,’ Quarterly Journal of Economics 92, 1-16.

- Gorg, H. and Greenway, D. (2002), ‘Much ado about nothing? Do domestic firms really benefit from foreign direct investment?’ World Bank Research Observer 19(2), 171-197.

- Hassen, S. and Anis, O. (2012), ‘Foreign direct investment and economic growth: An approach in terms of co-integration for the case of Tunisia,’ Journal of Applied Finance and Banking 2(4), 193-207.

- Hayat, A. (2017). Institutional framework and economic growth. IES Working Paper: 9/2017. Institute of Economic Studies, Faculty of Social Sciences, Charles University in Prague.

- Jude, C. and Levieuge, G. (2015), ‘Growth effects of foreign direct investment in developing economies: The role of institutional quality’ Documents De Travail N0. 559, annual INFER conference held in Orlcans.

- Loukil, (2016), ‘Foreign direct investment and technological innovation in developing countries’ Journal of Business and Economics, 1(2), 31-40.

- Munyanyi, M.E. (2017), ‘Foreign direct investment and economic growth nexus in Zimbabwe: A co-integration approach’ MPRA Paper N0. 77946.

- Ogbokor, CA. (2016), ‘Econometric analysis of the impact of foreign direct investment on economic growth in Namibia: Evidence from annual data,’ International Journal of Economics and finance studies, 8(2), 205-218.

- Olokoyo, F. O. (2012), ‘Foreign direct investment and economic growth: A case of Nigeria,’ BVIMSR’s Journal of Management Research, 4(1), 1-29.

- Parviz, A. (2011), ‘Economic growth determinants and foreign direct investment causality in Canada,’ International Journal of Business and Social Science, 2(11).

- Parkin, M., Powell, M. and Matthews, K. (2008). Economics 7th Edition United Kingdom; Pearson Education Limited.

- Polpat, K. (2010), ‘Foreign direct investment and economic growth: A comparative study among East Asian countries,’ Applied Economics Journal. Centre for Applied Economics Research ISSN 0858-9291.

- Rahman, A. (2015), ‘Impact of foreign direct investment on economic growth: Empirical evidence from Bangladesh’ International Journal of Economics and Finance, 7(2), 178-185.

- Romer, P.M. (1990), ‘Endogenous technological change,’ The Journal of Political Economy 98(5), 71-102.

- Saibu, O. and Keke, N. (2014), ‘Real output effects of foreign direct investment in Nigeria’ Journal of Behavioural Economics, Finance, Entrepreneurship, Accounting and Transport, 2(1), 1-4.

- Sghaier, I. M. and Abida, Z. (2013), ‘Foreign direct investment, financial development and economic growth: Empirical evidence from North African countries,’ Journal of International and Global Economic Studies, 6(1), 1-13.

- Shahrivar, RB. and Jajri, I. (2012), ‘Investigating the interaction between FDI and human capital on productivity growth,’ Research Journal of International Studies 40(1), 15-25.

- Todaro M P and Smith, S. (2003) Economic Development. Pearson Education.

- Ugwuegbe S., Okore, A. and John, O. (2013), ‘The impact of foreign direct investment on the

- Nigerian economy,’ European Journal of Business Management 5(2), 25-33. ISSN 2222 1905.