Introduction

The agricultural activity, according to the Royal Spanish Academy “RAE” (2016) is “all that is related with the agriculture and cattle raising”. Going from this concept, it is recognized that the agricultural activities are the primary productive processes based on renewable natural resources: agriculture, cattle raising, forestry and aquaculture.

Now, the business environment is facing huge changes, which are promoted based on the globalization phenomenon; coupled to the economic, political and social crisis, which has been a hot topic the last years in Venezuela, it has directed the businessmen to the development of strategies oriented towards the permanence as a mechanism to guarantee the business impulse as a direct benefit to the partners, human capital, as well as the collectivity.

Hence, the importance of innovating with new technologies, as well as other alternative elements, in the search to offer products and services with broad advantages within the market, maintaining competitive prices without affecting quality. That is to say, to execute actions oriented to the optimal administration of resources with expectations of future benefits, aimed at making investment decisions that guarantee the sustainability and permanence in the long term of the company.

Therefore, in order to face this scenario, it is necessary to have human capital trained with the necessary competencies to develop each one of the activities related to their positions, facing the new demands of the market, consumer requirements and governmental actions; generating strategies framed within the paradigm associated with intelligent organizations focused on efficiency, effectiveness and effectiveness, which are ultimately translated into profitability indices for shareholders, guaranteeing their future permanence.

However, currently in Venezuela, there is a strange situation related to the marking of prices in the products and/or services offered by the various companies; this is based on the determination of real prices, which do not agree with the purchasing power of the final consumer, which decreases more and more; reason why the State has decided to develop control measures.

Based on this, and with the aim of controlling the situation described above, the national executive promulgated the Organic Law of Fair Prices according to Gaceta Official No. 40,340 of January 23, 2014; this is oriented to protect the consumer. Therefore, the prices on the products, as well as services are subject to strict compliance with the legal framework that conditions the businessmen to obtain a maximum percentage of profits.

In this sense, effective management could contribute to organizational profitability, favoring the determination of advantages in a competitive market by complying with the government-established adjustments that regulate production, as well as marketing in Venezuela, thus being able to obtain adequate profitability so that organizations can remain in the market.

It should be noted, the problem that Venezuelan organizations are going through which is the scarcity of resources, mainly the economic one; hence, when considering investment needs, financing must be carefully planned in order to present or execute plans or projects with an effective orientation. This seeks to promote equal levels of utility, as well as profitability in the activities developed.

On the other hand, SMEs in the agricultural context now face a great challenge, this is based on meeting the needs of both food and medicine for animals, which brings as a consequence the insufficiencies to supply the demanding market; due to the scarcity of imports, a perspective that obliges entrepreneurs dedicated to this context to apply market diversification in order to achieve optimal use of the resources available for a given moment.

Based on the previous approach, the situational analysis in SMEs of the agricultural context includes the need to have sufficient internal and external information to strengthen the financial analysis, in relation to productive capacity, as well as the flexibility to carry out preventive plans considering the economic / financial scenario.

In this sense, in a research study conducted by Socorro and Seijo (2016), it is established that companies, to make the selection of investments that generate profitability or become a reserve of the monetary value invested, make several considerations about the possible alternatives both short and long term, depending on the environment in which they operate.

These investments can come from different sources, depending on the company involved, which is why adaptive development based on strategic management is associated with the cost to be able to remain in the market, and thus obtain the planned profitability. Hence, the issue of strategy in the organization, in the opinion of Villasmil (2016), is based more specifically on its design within the strategic process that consists of taking into account the strengths, weaknesses, opportunities, threats, values and the inherent responsibilities of the situation. Within this framework, the strategies then allow to specify and execute the strategic projects.

That is how to achieve and realize each objective and each strategic project. In the same way, the author emphasizes the importance of the strategy to execute the action plans. The above coincides with Villasmil, Leal, Sierra and Márceles (2017), establishing that the strategic direction from the systemic perspective must consider the importance of the relationship between the organization of the environment in achieving the objectives since you cannot think in a strategy without analyzing the social, economic and political context in which the organization operates.

It should be noted that for Gitman and Joehnk (2012), profitability is considered as the benefit in an investment, it is the reward obtained for investing. This represents the resource obtained once the investment made is recovered; hence, the importance of management, controlling the use of resources associated with the items to obtain an expected benefit.

In accordance with the above, Moreno, Parra, Villasmil, Hernández & Durán (2017), consider that, for this stage, the strategic actions in terms of investments come to be the set of interventions, assumed under a perspective of social profitability where the profits are measured according to the social welfare that emerges from a set of objectives, policies and values shared by the actors in a community of social interests. Therefore, the issue of investment is also an economic, social and financial issue.

That is why, profitability is measured by the cash flows obtained in the investment, considering that the set of expenditures (costs and expenses) does not exceed the investment made. However, both external and internal factors may affect it, among these are: scarcity, price controls, political events, quality of finished products, installed production capacity, level of economic resources, salary, culture and organizational climate among other elements.

Consequently, based on the unstructured interviews carried out by the researchers with the informant units within the SMEs of the context, it is presumed that the companies of the agricultural sector at the moment are facing economic and financial difficulties, before the imminent governmental measures, which continue to generate distortions in the cost structure and tax adjustments by the State; affecting the development and growth of organizations.

In a research study conducted by Gayle (1999), she points out that the situation posed directly affects profitability in SMEs in the agricultural context, due to the implementation of the Organic Fair Price Act in January 2014; where in article 32, “a maximum level of 30% is established in profits for marketing products and providing services”, which affects organizational profitability, generating consequences that affect the permanence of organizations in the market for not developing effective strategies to avoid bankruptcy and business failure and therefore the loss of capital invested. For this, it is necessary to understand what the Economic-Financial Profitability is for this research and how it is reflected or expressed in acts of benefit and utility for the organization.

This theoretical framework will favor the approach to the object from the plane of reality, and from there, there will be capacity for deconstruction – construction of the researched object, and thus be able to understand the logic of the implemented processes by the SMEs belonging to the eastern coast of Lake Maracaibo of Zulia State in Venezuela, representing the main motivation of the present study, given the current economic state in Venezuela, in the agricultural production process, in which costs are seen as a tool that disturbs the farmer, who has to confront new obstacles marked by political, environmental, social, financial crises, which require planning, controlling and making decisions to maintain or improve the profitability of the business.

Literature Review

Organizational profitability, an element of control to generate effective strategies towards development

The organizational profitability is based on the utilities or benefits generated during the economical exercise with the assets. The initial premise for all investors is that the company generates utilities, which is why the assets are determined with a primordial element for its gathering; however, having large volumes associated with the line does not guarantee effective levels of benefits; being the organizational profitability, an element of control and evaluation leading to generate effective strategies towards the development, growth, and strengthening of the entities, as well as in the investment of the partners.

In this sense, according to the criteria of the authors Bravo, Lambretón and Márquez (2013), they define profitability as the relationship between the benefits and the investment to obtain them. It provides a certain operation and the investment or effort that has been made; when it comes to financial performance; it is usually expressed in percentages, where the profitable condition is established as the capacity to generate income, that is, gain, profit, utility. Profitability is associated with making profits from an investment.

In turn, Martínez (2013), states, that profitability refers to the benefits obtained, which can be generated from an investment previously made. This is a vital concept for organizations, because it is related to the application of indicators, which are formulated to measure the ability of the entity to remunerate the amount of resources used in operations.

In addition, Villareal (2011), determines that profitability is the ability to generate profit; This is considered as the remuneration received for the money invested. In the financial world it is also known as dividends received for invested capital; profitability can be represented in relative form (percentage) or in absolute form (values) after the end of the fiscal year.

For the previously mentioned authors, profitability is any action in which resources are mobilized to get results. Reason why, a yield is obtained based on the invested capital. It is a way to compare the medium used for a determined action, and the profitability that has been generated through the operations. Based on that, profitability is established as the derived utility in the activity, this being the determining criterion for shareholders for the taking of decisions.

In the SMEs of the agricultural context, profitability is oriented to determine the benefits generated to the partners. This being an index that measures the relationship between the profit or gain obtained against the investment or used to obtain it. Its establishment is oriented to its determination both under the economic and financial denomination; starting from the indicators to measure and their purpose.

Types of profitability

In modern organizations, the premises are designed to achieve organizational objectives, make profits and encourage development in profitability; as well as establishing the core activity to obtain indicators associated with each type; which are associated both with the origin and the magnitude established in the capital contributed by the partners that the organization owns. Regardless of the ratio to be analyzed, it is considered essential to evaluate the management strategies applied to maximize the benefit obtained.

In the same order, Baena (2010), states that the classification is established in the evaluation of business management. It defines the main aspects to consider, which are aimed at determining how partners participate in terms of structural capital and the internal capital of the company and, finally, the remuneration generated to investors based on the participation generated in each of them.

On the other hand, Besley and Brighman (2010), determine that to classify the organizational profitability the following criteria are established: a) its measurement on the contributions generated by all the capital b) the impact associated to the own capital and finally c) the proportion representative before the contributions of capital informed by the shareholders (which is formulated in percentages). In SMEs related to the agricultural context, the types of profitability are measured based on the results obtained when developing the fiscal year.

Where the financing, according to González & Pagliettini (2006), intervenes as a generator of value for the organizations by promoting more resources in order to execute the operations; but in turn, if the cost related to leverage is not controlled, the levels of both economic and financial profitability are reduced.

Economic Profitability: an indicator of effectiveness over the use of assets

When developing organizational operations, economic profitability is determined as an indicator associated with measuring the efficiency under which assets are used to generate profits. Enacting actions to contribute effectively to maximize organizational benefits and ensure a better scenario to execute the dividend policy determined by the board of directors.

For Ebrard and Brigham (2012), it is an indicator of organizational profitability in relation to the assets it has. It gives an idea of how efficient management is to use its assets to generate profits. The indicator is expressed as a percentage, and is sometimes referred to as return on investment. This ratio determines how much profit is generated for each monetary unit invested.

In the same order of ideas, for Court (2012), it represents the effective capacity established in any entity to guide a simple way associated with giving back the capital placed at their disposal (both their own and those of others); that is, it is the relationship between the benefit obtained before interest and taxes with the total assets. It allows analyzing the evolution related to the productivity generated by the total assets; therefore, it is the profit generated by the company with the available assets. Based on this, a higher return is related to a more productive asset.

For Baena (2010), economic profitability or economic performance is determined as an aspect aimed at evaluating the economic/financial management in organizations. It allows relating the generated result with what has been required to execute the business activity; in a broadly competitive context where strong intervening elements are presented.

While Besley and Brighman (2010), state that the return on investment also known as return on total assets measures the efficiency with which the organizational management is oriented to obtain utilities based on the assets available in the accounting records. The higher the return on the investment of the company, the better it will be. Based on the previous presentations, in relation to SMEs in the agricultural context, the economic profitability is determined as an associated ratio to establish the effectiveness under which the organizational assets allow planning, executing, lending, as well as assessing the various services; to effectively guarantee organizational operations, promote development, growth and sustainability. There is no established value as favorable for economic profitability.

Financial Profitability: an indicator of organizational results

Financial profitability is determined as an extension of the organizational results oriented to give back to the shareholders; it is a ratio used to evaluate the remuneration in the dividends for the owners. Reason why this one is related to the results obtained by an organization without intervening the leverage that generates the financing. Thus, the definition presented by Ebrard and Brigham (2012), who indicate that financial profitability is also known as a factor obtained by capital taxpayers; It is measured according to the determined net benefits; That is, the net profit obtained during a fiscal year, divided between own funds that are made up of capital and the company’s reserves by one hundred. Its result computes the magnitude in the organizational assets without financing to generate profits.

Court (2012), points out that financial profitability measures the organizational capacity to remunerate shareholders either by paying dividends or withholding profits to capitalize them with the consequent increase in equity; allowing the comparison from the perspective of the shareholder, returns on alternative investments, for which, factors such as risk and organizational liquidity are considered.

While Besley and Brighman (2010), indicate that their determination is oriented to establish the level at which the company obtains success in operations. Where the magnitude of the investment indicates better conditions to develop profitability; its analysis is established on two horizons: a) based on the result and b) on related investment. Therefore, it is known as profitability in both sales and leverage.

Once the formulated definitions have been analyzed, a point of convergence is established, stating that financial profitability is conceived as any action aimed at determining the return obtained by the owners or shareholders in the companies. This supposes the comparison between the income generated and the means used to get it. That is, it is an average obtained by the company through its activity, using its own funds.

In the SMEs of the agricultural context, financial profitability constitutes a vital indicator in financial control because it measures the net benefit (after deduction of financial expenses, taxes and general payroll), where this is considered as the one established as the benefit measure related to the shareholders which is evaluated to distribute dividends.

Methodology

The methodology, according to Arias (2016), is in charge of the principles and procedures, techniques and instruments of knowledge to describe the reality. Through it, the setup of a research issue can be created, as well as the reference frame, the hypothesis, collecting, coding, data analysis and interpretation, and finally use all of it to explain the issue set up by using the information collected.

The present study was developed under a type of descriptive research because its fundamental purpose is to observe and describe the elements, components and characteristics of the types of profitability in the SMEs of the agricultural context of Venezuela, understanding it as referred by Hernández, Fernández and Baptiste (2014), as those studies that aim to measure or collect independent or joint information on the concepts or variables to which it refers. Its goal is not confined to the collection of data, but to the prediction and identification of the relationships that exist between two or more variables.

In turn, the authors Palella and Martins (2012), describe it as the strategy to be carried out by the researcher to indicate the problem. Can be classified as experimental, non-experimental and bibliographic. They explain the non-experimental design as the one that is executed without manipulating the variables. The independent variables are not intentionally replaced. The facts are seen as they are shown in their real content, in a defined lapse and then analyzed. For this type of design, a specific context is not created, existing ones are observed. Given the explanation, the research is located within this design, as the variable is not intentionally manipulated; the information is collected as it happens, and then analyzed, without altering what is studied.

Continuing with the exhibition by Palella and Martins (2012), the transectional design is the one that collects the data in a single moment and in a single time. Its purpose is to detail the variables and analyze their incidence and interaction in a given time, without manipulating them. The present investigation will collect the data in a unique moment as explained by the author, which is why it is part of this design. On the other hand, Tamayo and Tamayo (2011), express that field design occurs when the data are collected directly from reality. Its main objective is to certify the true scenario where the data have been acquired, which facilitates verification. This design can present several groups, which are unique in each investigation, starting from common characteristics.

Based on the above definitions, it is pointed out that the design to be used in the development of this research is field, transectional, non-experimental, given that it will be carried out directly at the source where the events occur. The information will be collected in a single moment from the application of the structured questionnaire and the variables will not be manipulated. For data collection, a structured instrument designed with multiple choice questions was applied, whose response options are: always, almost always, sometimes, almost never, never; directed to the twenty-three (23) informants, managers and employees of the administration, accounting or finance departments of the SMEs of the agricultural context of the East Coast of Lake Maracaibo State of Zulia Venezuela.

Where for the authors Palella and Martins (2012), the population is the set of units from which information will be obtained. It can be defined as the finite or infinite set of elements pertinent to an investigation, demonstrating similar characteristics. In this regard, intentional sampling is established for purposes of this study; considering 5 SMEs of the agricultural context in the East Coast of Lake Maracaibo; which are attached to the Chamber of Industry and Commerce of Cabimas (CAICOC). In addition, its similarity in size, number of personnel, sales capacity, subscribed capital, among other aspects is considered.

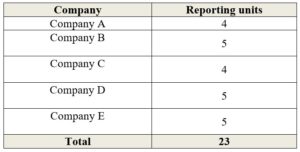

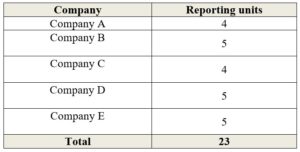

Chart 1: Sample representation of the reporting units

Source: Author creation (2018)

Results

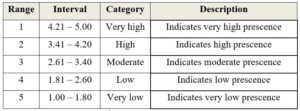

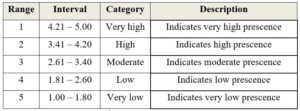

Next, we will proceed with the description as well as the discussion of the results obtained, after processing the information, once the instrument designed to collect the data is applied in order to be able to respond to the stated objective. Where descriptive statistics procedure selected by Microsoft Excel software was used, the calculations were made of measures of central tendency (average), dispersion measures (standard deviation), frequency values, both absolute and relative, determining the degree of presence presented by the indicators in the study variable (types of profitability). Where for the measurement of central tendency, a scale was designed for its interpretation, by means of a table of range, interval and category. Next, chart 2 is presented, which summarizes the quantitative and qualitative assessment determined in the results.

Chart 2: Analysis category to interpret the results

Source: Author creation (2018)

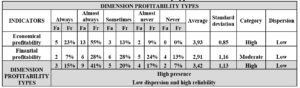

In relation to the objective of this research, which is aimed at describing the types of profitability in SMEs of the agricultural context of the East Coast of Lake Maracaibo, the following table 1 is presented, which shows the results obtained by the informants.

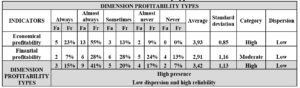

Table 1: Profitability types

Source: Author creation (2018).

Table 1 shows that the indicators that make up the dimension Profitability types present the following values of the frequencies according to the responses received; Regarding Economic Profitability, 55% of respondents (13 informants) said that this type of profitability is almost always considered, 23% (5 informants) believe that 13% (3 informants) always said, and the 9% (2 informants) almost never. While for financial profitability, 28% (6 informants) say that it is almost always considered, the same values say that sometimes, 24% (5 informants) almost never, 13% (4 respondents) never responded and only 7% (2 informants) thinks that always.

However, the behavior shown previously, when considering the average of its indicators, shows that 41% of the respondents (9 informants) state that the types of profitability are almost always considered, 20% (5 informants) indicated that sometimes the proposed indicators are considered, while 17% (4 informants) think that almost never; 15% (3 informants) always, and 7% (2 informants) consider that the indicators present in the proposed dimension are never considered.

According to these results, the dimension Profitability types are located in the category of High Presence with an average of 3.42 and a high degree of reliability, with a low dispersion value of 1.13, according to the pre-established scales. Likewise, the values of means and standard deviation are presented for each indicator, as well as their interpretation: for economic profitability, an average of 3.93 (high presence) and low deviation 0.87 (high reliability) is observed; and for financial profitability an average of 2.91 (moderate presence), low deviation 1.16 (high reliability).

At the same time, it is observed that the indicators are not considered equally by the interviewees; the economic profitability is almost always considered, while the financial profitability presents several alternative answers with a similar percentage of frequency.

However, when analyzing the economic profitability indicator, the results show a high presence, where Court (2012), indicates that when you have a high economic profitability, it means that the effective capacity established by the organization allows you to support the capital made available to you, that is, the relationship between profit before interest, taxes and total assets. This type of profitability allows the management of SMEs in the agricultural context to analyze the evolution of the benefits associated with the productivity of their assets.

Analogously, the discussion of the result for the financial profitability indicator shows a moderate presence where Baena (2010), Contreras (2006), point out that this type of profitability is determined based on the company’s financial structure, relating the economic results including financial expenses with the company’s own resources. In this sense, SMEs in the agricultural context measure in this way the organizational capacity to remunerate shareholders by paying dividends or withholding profits to capitalize them with the purpose of being reinvested for the operations of the organization.

On the other hand, in relation to these results, the dimension profitability types are located in the category of high presence in the theoretical reference expressed by Baena (2010), when it indicates that it is a classification established when performing the evaluation of managerial management. In the SMEs of the agricultural context, it is established that the main aspects to be considered are aimed at determining how the contribution of the partners and the internal investment represented in their assets participate, and the effect on the participation of both the investments and the contributions of the partners to produce economic benefits in the organization; in this way, we can make decisions regarding strategic management.

Conclusion

After the confrontation with the postulates that served as the theoretical foundation, the following conclusions are presented, in which the main ideas of each emerged finding are gathered in relation to the behavior of the SMEs of the agricultural context in Venezuela, where the types of profitability generated by the study population were described, showing as a result that economic profitability is mostly considered in relation to financial profitability, evidencing that the effect that the assets of the company have to generate economic benefit is taken into account, relegating to the effect that can have the contributions of investors.

In this sense, the management of these organizations must have the capacity to evaluate the influence of the investment in assets with the generation of profits, as well as the contributions made by the partners that contribute to regenerating economic resources. While it is true, that agricultural companies in the world are of great importance, it is necessary to recognize that they need special attention in all aspects; that is, they require multidisciplinary support that contributes to their permanence and growth in the world. Due to that, these companies are the basis for human existence. Moreover, from an administrative point of view, it is highly recommended to apply the tools of the Financial Administration.

Managers must evaluate in their decision-making process what type of profitability is the most appropriate in the company, as well as determine the influence of cost management on the economic and financial aspect of SMEs. The objective of profit maximization is the alternative to achieve, in the first place, survival in an environment of broad competitiveness, and, secondly, the economic development of the Company.

It is clear and demonstrated that, in Venezuelan government policy, the Government of the Bolivarian Republic of Venezuela (GBRV) maintains an almost monopoly of foreign exchange, food imports, raw materials, essential agricultural inputs and the distribution / allocation of those goods. The low availability of foreign currency has limited meat imports, which were 47% of general consumption in 2008, and have fallen to 4% in 2017.

This is stated by the United States Department of Agriculture (USDA), when it states that: The Venezuelan agricultural industry is unable to respond and compensate for this drop in imports and, due to this, the availability of beef and the level of consumption have decreased by 70% in the last eight years, from 24 kg per capita in 2011 to 7 kg in 2018, for which it is estimated, however, will probably fall in the 2018-2019 business year.

For all the above, and due to the importance of agricultural companies in the world, it is necessary to recognize that they need special attention in all aspects, that is, they require multidisciplinary support that contributes to their permanence and growth in the world, because these companies are the basis for human existence. Likewise, it is important to note that the current economic crisis in Venezuela continually challenges and decreases the availability of these important services. In addition, production problems are aggravated by the shortage of vaccines and medicines to control serious animal diseases, such as foot-and-mouth disease, brucellosis and tuberculosis, which leads to reduced margins and reduced profitability.

Finally, these agro industries must initiate the approach with both public and private financial institutions with which they have no relations in order to be able to evaluate the most advantageous credit conditions with preferential rates to qualify for a loan at the required time, minimizing the effects of the lack of liquidity, guaranteeing the invigoration of the economy through investment.

(adsbygoogle = window.adsbygoogle || []).push({});

References

- Arias, F. (2016), The research project: Introduction to scientific research. 7th Edition. 2016 Ediciones El Pasillo, 2011, C.A. Publisher: Episteme. Caracas Venezuela. 147 p.

- Baena, D. (2010), Financial analysis: Financial approach and projections. Publisher: Ecoe Editions. Colombia.

- Besley, S. and Brighman, E. (2010), Fundamentals of financial administration. 14th Edition. Publisher: Cengage Learning. Mexico.

- Bravo, M.; Lambretón, V. and Marquez, H. (2013), Introduction to Finance. Publisher: Pearson Education.

- Contreras, I. (2006), Analysis of the economic profitability (ROI) and financial (ROE) in commercial companies and in inflationary context. In Management Vision. Magazine of the Center for Research and Business Development, Year 5, No. 1, January-June, University of Los Andes, Mérida, pp. 13-28.

- Court, E. (2012), Corporate Finance. 2nd Edition. Editorial Cengage Learning. Argentina.

- Department of Agriculture of the United States (2018), Look at the agricultural sector of Venezuela in this 2018 by the USDA. Marketing & Economy Section – Business. Consulted: January 2019. Online: Available: https://avicultura.info/mirada-del-sector-agropecuario-de-venezuela-in-este-2018-por-el-usda/.

- Ehrhardt, M. & Brigham, E. (2012), Corporate Finance. Publisher: Cengage Learning. Mexico.

- Gayle, L. (1999), Accounting and cost management (6th ed.). Mexico: McGraw-Hill.

- González, M. and Pagliettini, L. (2006), Agricultural costs and their applications (3rd reimpr.) University of Buenos Aires. Argentina: Editorial Faculty of Agronomy.

- Gitman, L. and Joehnk, M. (2012), Fundamentals of Investments. Publisher: Pearson Education. Mexico.

- Hernández, R., Fernandez, C., and Baptiste, M. (2014), Research Methodology. Sixth edition. Editorial Mc Graw Hill, Mexico.

- Hurtado, J. (2012), Research Methodology. Guide for the holistic understanding of science. Fourth Edition Sypal. Caracas.

- Martínez, E. (2013), Strategy and agricultural administration. Argentina: Editorial Troquel S.A.

- Moreno, Z., Parra, M., Villasmil, M., Hernandez, B., and Durán, S. (2017), Importance of Strategic Thinking and Strategic Actions to promote social entrepreneurship in Venezuelan universities. Online: Espacios Magazine. Caracas. Venezuela. Vol. 38 (45). Consulted: 07/2018. Available: http://www.revistaespacios.com/a17v38n45/17384504.html.

- Organic Law of Fair Prices. Official Gazette No. 40,340. Published on January 23, 2014. Caracas-Venezuela.

- Palella, S. and Martins, F. (2012), Methodology of quantitative research. FEDUPEL. Caracas Venezuela.

- Royal Spanish Academy. (2016), Dictionary of the Spanish Language. Online: Available: http://www.rae.es/. Consulted: March 2018.

- Socorro, C. and Seijo, C. (2016), Social responsibility: an investment initiative in private companies. Online: Coeptum Magazine. ISSN: 1856-9706. Vol. 8. (1). May 2016 – October 2016. Consulted: 09/2018. Available: https://es.calameo.com/books/00557333894e8b4f49819.

- Tamayo and Tamayo, M. (2011), The process of scientific research. Fifth edition. Editorial Limusa. Mexico.

- Villareal, J. (2011), Financial Administration II. Available: Online: http://www.eumed.net/libros-gratis/2008b/418/. Consulted: 12/2018.

- Villasmil, M. (2016), Strategic vision of corporate social responsibility. Online. Free Opinion Magazine, Vol. 18. Pp. 95-107. Barranquilla Colombia. Consulted: 02 / 2018.Available: http: //www.unilibrebaq.edu.co/ojsinvestigacion/index.php/dictamenlibre/article/view/717/649.

- Villasmil, M.; Leal, O.; Sierra, G. and Márceles, V. (2017), Strategic management approaches to promote tax arbitration in local governments of Zulia State, Venezuela. Espacios Magazine. Vol. 38 (Nº 41) Year 2017. Pág.14.Caracas. Venezuela. Consulted: 06 / 2018.Available: http://www.revistaespacios.com/a17v38n41/17384114.html.